Table of Contents

- a. Key Points

- b. Demand

- c. Profits & Margins

- d. Balance Sheet

- e. Guidance & Valuation

- f. Call & Release

- g. Take

a. Key Points

- Wonderfully durable financial performance.

- Positive commentary on ad demand headwinds from the trade war.

- Remains #1 in streaming.

- Cloud remains supply constrained.

b. Demand

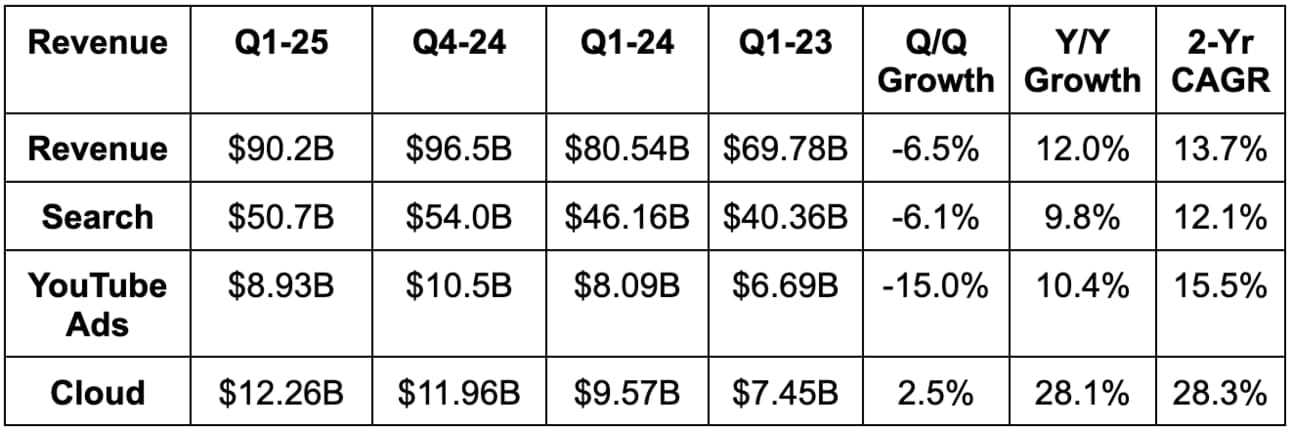

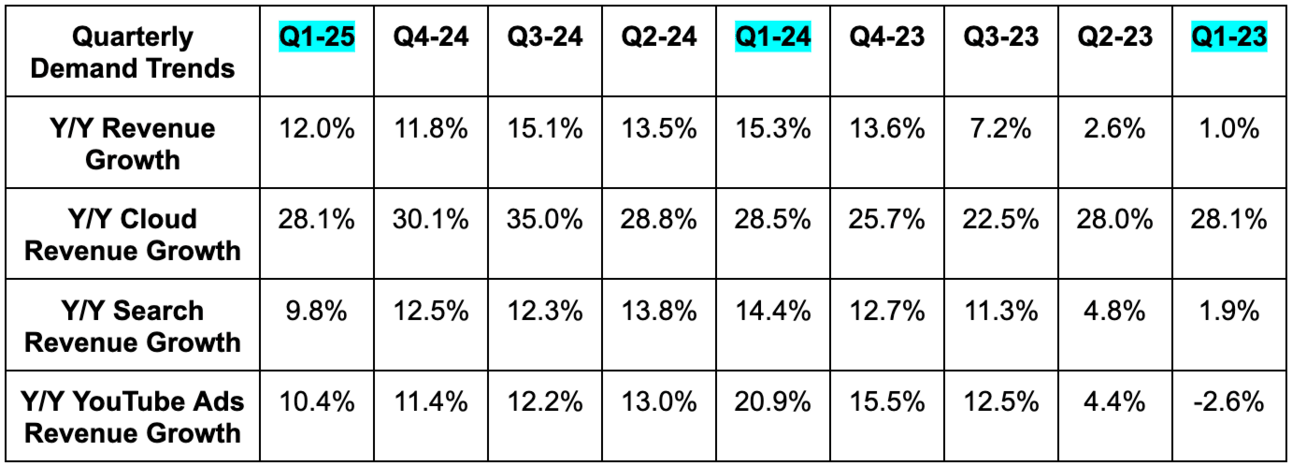

- Beat revenue estimates by 1.2%.

- Search revenue beat estimates by 0.8%.

- Cloud revenue beat estimate by 0.7%.

- YouTube slightly beat revenue estimates.

c. Profits & Margins

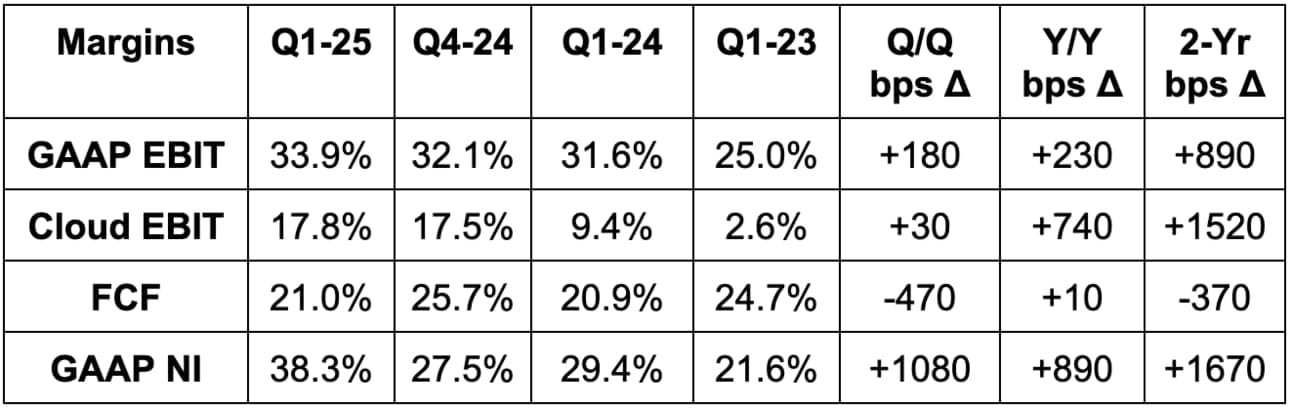

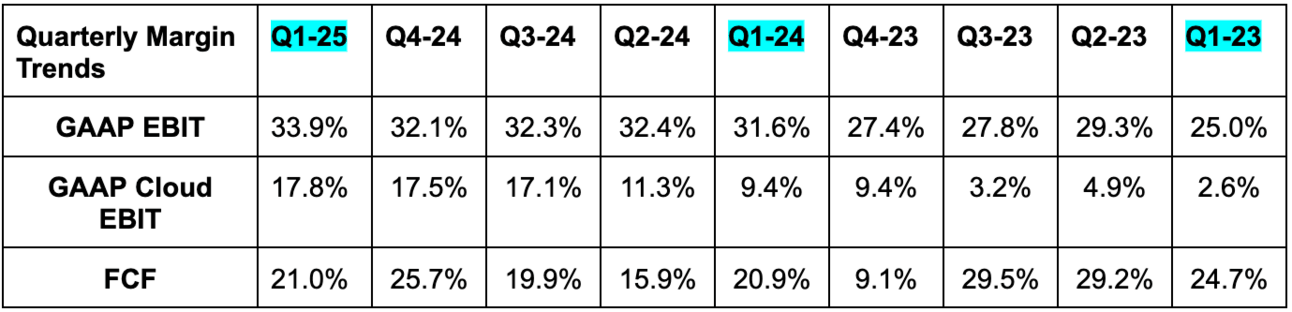

- Beat EBIT estimate by 6.4%.

- EBIT rose by 20% Y/Y; OpEx rose by 9% Y/Y; R&D rose by 14% Y/Y – led by ramping depreciation expenses via all of the 2023 and 2024 CapEx growth.

- G&A rose by 17% Y/Y, with higher legal expenses materially adding to the cost line.

- Beat $2.01 EPS estimates by $0.80 or by $0.18 excluding equity gains. Mark-to-market equity gains added $0.62 to this quarter’s EPS. Excluding this help, EPS grew by 16% Y/Y.

- This is why I like when firms offer non-GAAP EPS alongside GAAP.

- Beat free cash flow (FCF) estimates by 1%.

d. Balance Sheet

- $95B in cash & equivalents; $51B in non-marketable securities.

- $10.9B in debt.

- 1.9% Y/Y share dilution. Announced a new $70B buyback program (3.5% of the market cap).

- Spent $17.2B in CapEx for the quarter.

e. Guidance & Valuation

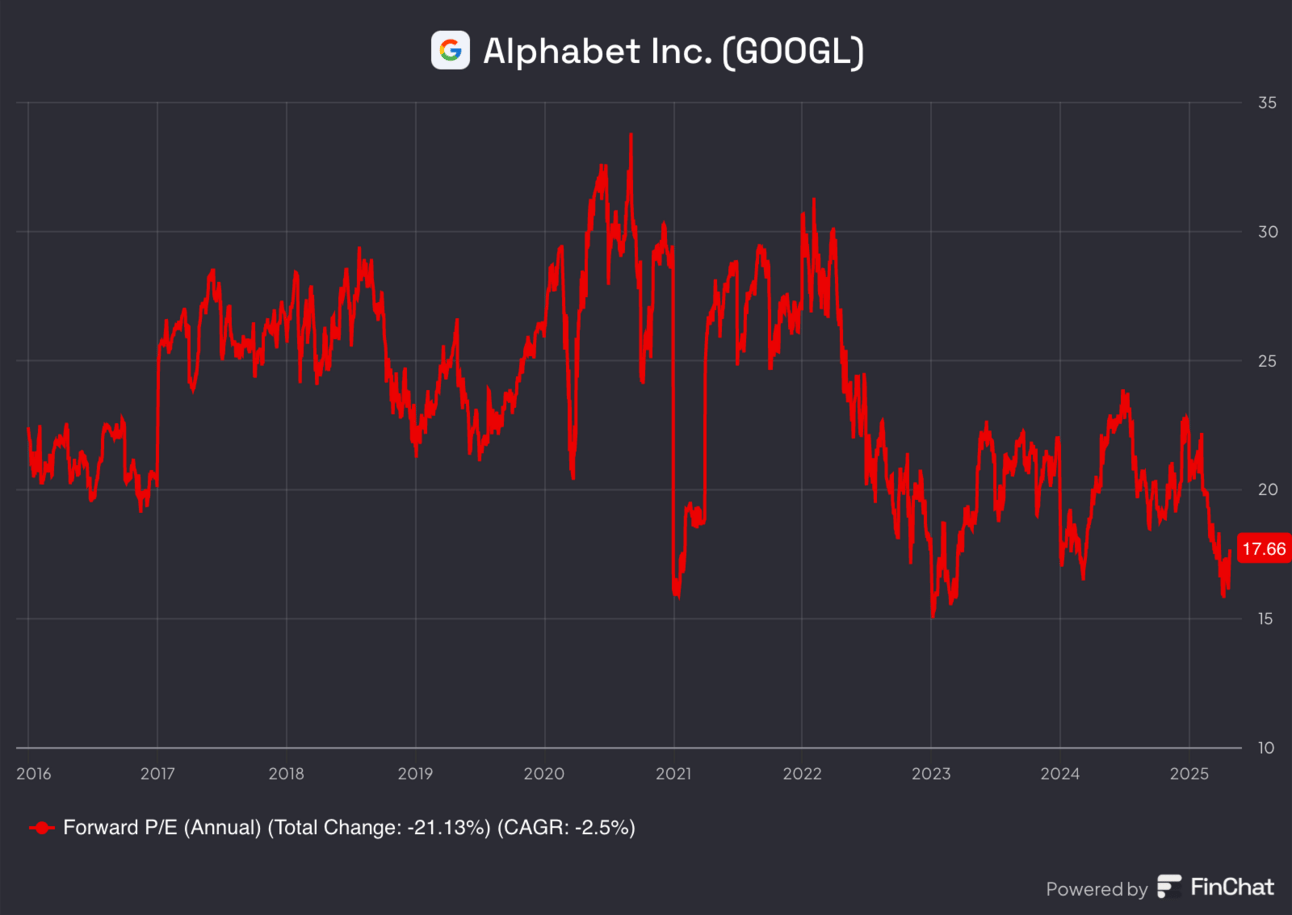

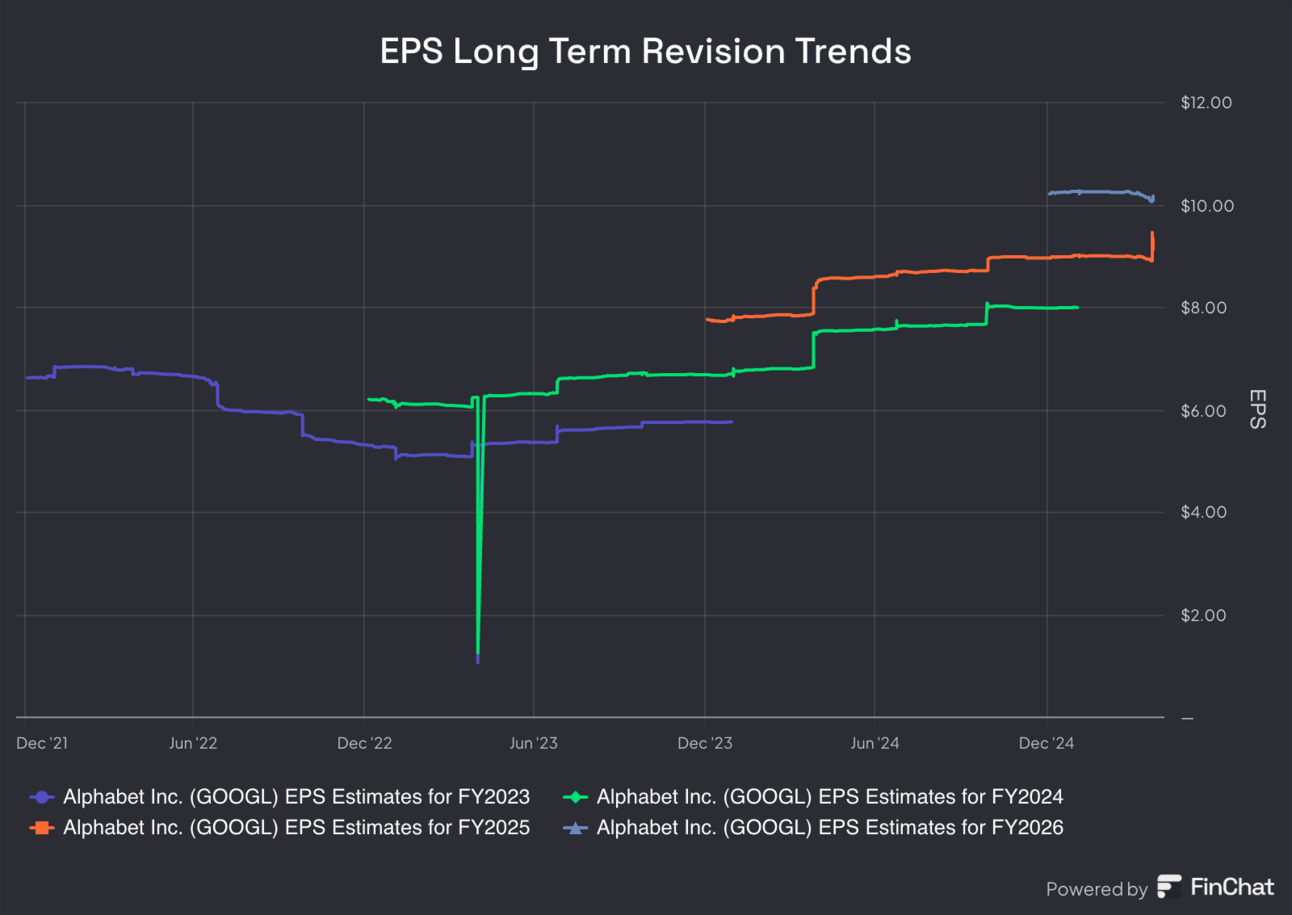

Alphabet reiterated its $75B CapEx guidance for the year. It continued to guide to accelerating depreciation expenses due to all of this CapEx growth. EPS is expected to grow by 16% this year and by 9% next year. EBIT is expected to compound at a 13% clip for the next two years.

f. Call & Release

Full-Stack AI: