I will post a complete earnings review on Mercado Libre tomorrow. It will cover the shareholder letter, presentation, conference call, other notes and my take on the quarter.

The detailed Alphabet Earnings Review in section two of this article is for paid readers. It provides an intricate overview of its quarterly financials, balance sheet, conference call and my take on the results. Upgrade below to see that and so much more content. Read the newsletter that Fortune 500 executives are reading.

In case you missed it:

- Meta Earnings Review.

- PayPal Earnings Review.

- Tesla Earnings Review.

- SoFi Earnings Review.

- Netflix Earnings Review.

- Taiwan Semi Earnings Review.

- My current portfolio & performance vs. the S&P 500.

- About 30 more earnings reviews are coming this season.

1. Mercado Libre Brief Earnings Snapshot

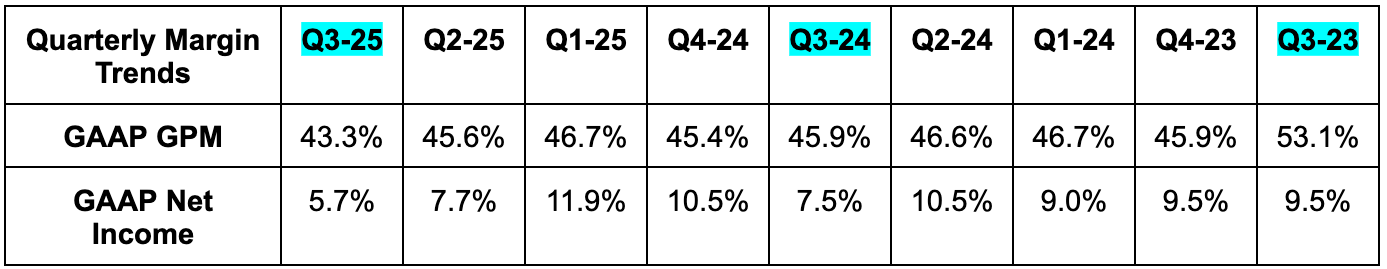

For now, I wanted to provide the financial overview. Some of the margin numbers don’t look good due to items such as foreign exchange. Other factors influencing profitability were broadly known and covered in the newsletter. They include credit portfolio growth, logistics network expansion and merchant fee reductions. Leadership is not currently focused on margins. They’re looking to fortify market share, grab more land, extend their competitive lead, and optimize for margins down the road. They know that’s the way to deliver maximum long-term shareholder value, as it's the same playbook they've frequently run throughout the decades. As I’ll get into tomorrow, I support these decisions despite the near-term pressures.

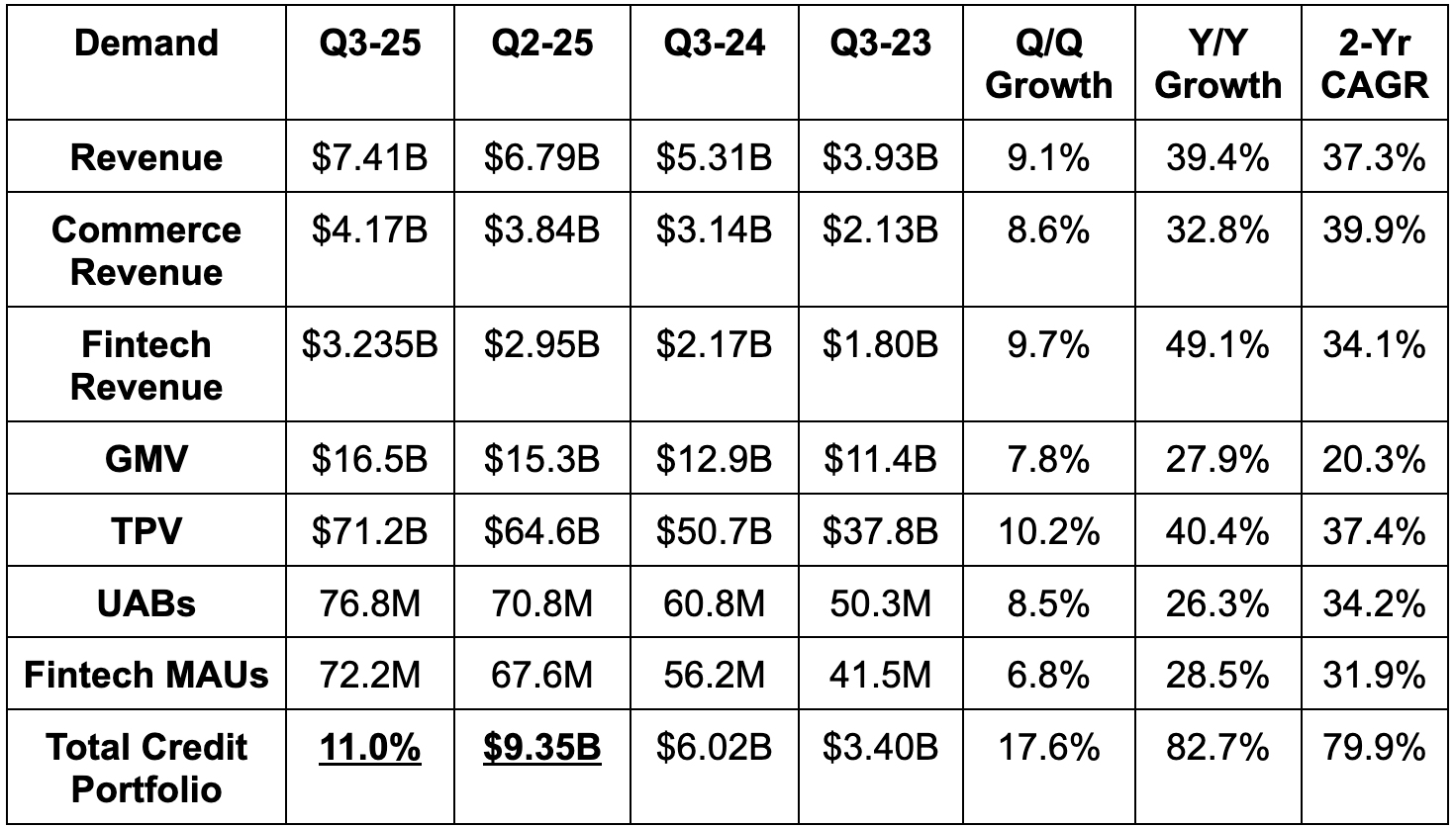

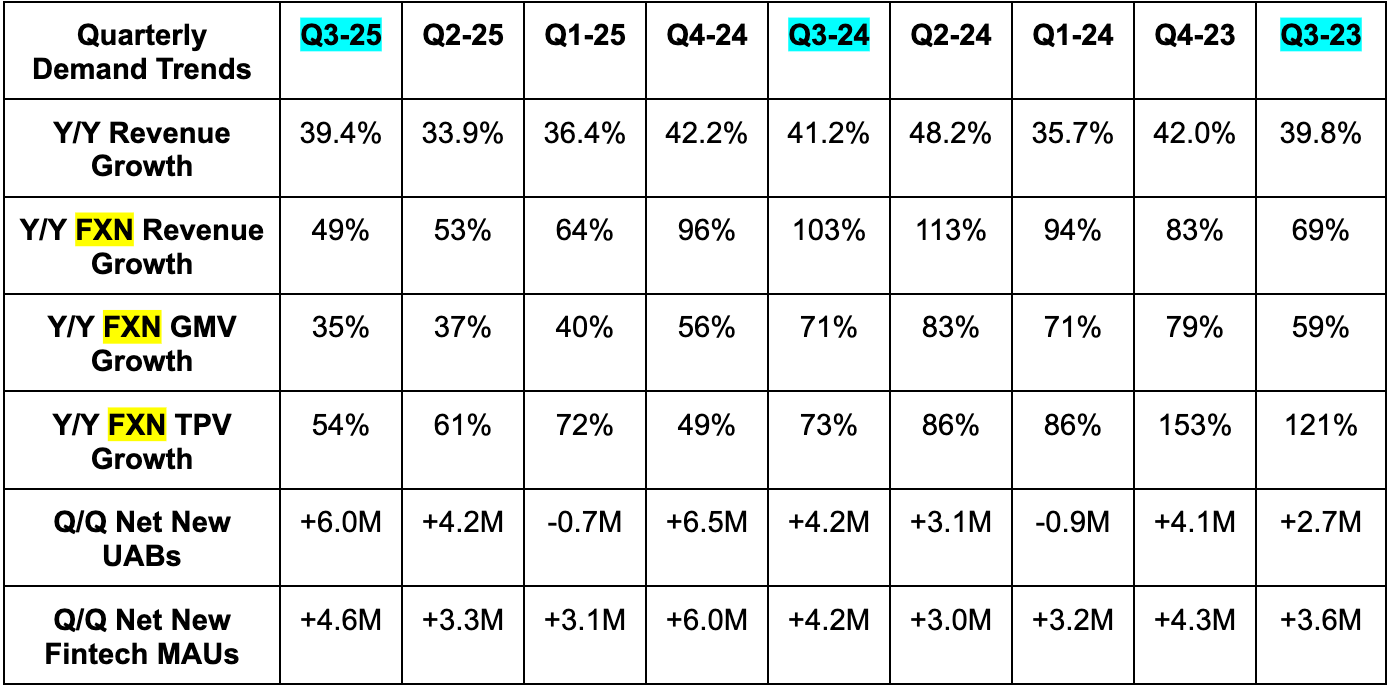

a. Demand

- Beat revenue estimates by 2.8%.

- Beat gross merchandise volume (GMV) estimates by 1.9%.

- Met foreign exchange neutral (FXN) GMV revenue growth estimates.

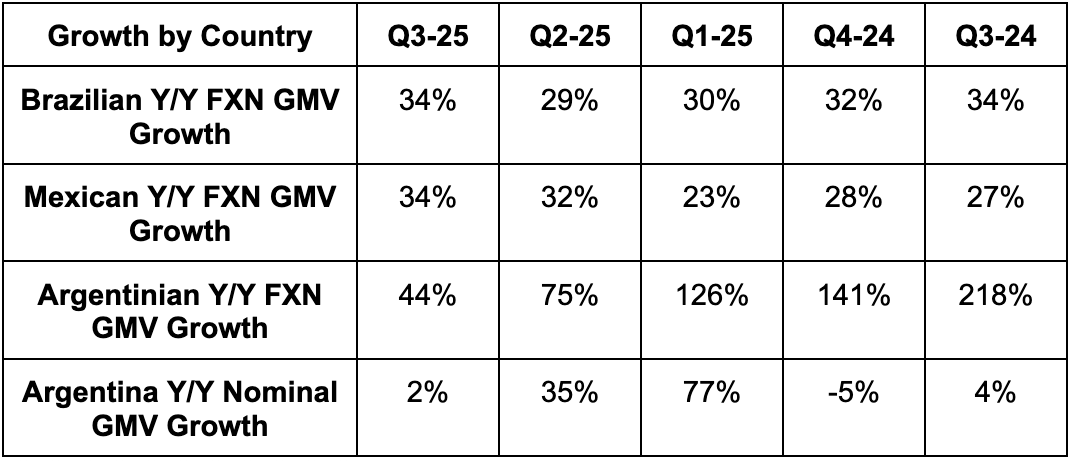

- 34% FXN Brazil GMV growth beat 30% growth estimates.

- 44% FXN Argentina GMV growth missed 65% growth estimates.

- 34% FXN Mexico GMV growth beat 28% growth estimates.

- Beat total payment volume (TPV) estimates by 2%.

- Beat unique active buyer (UAB) estimates by 3.6%.

- The credit portfolio is $11B in size vs. $10.1B expected.

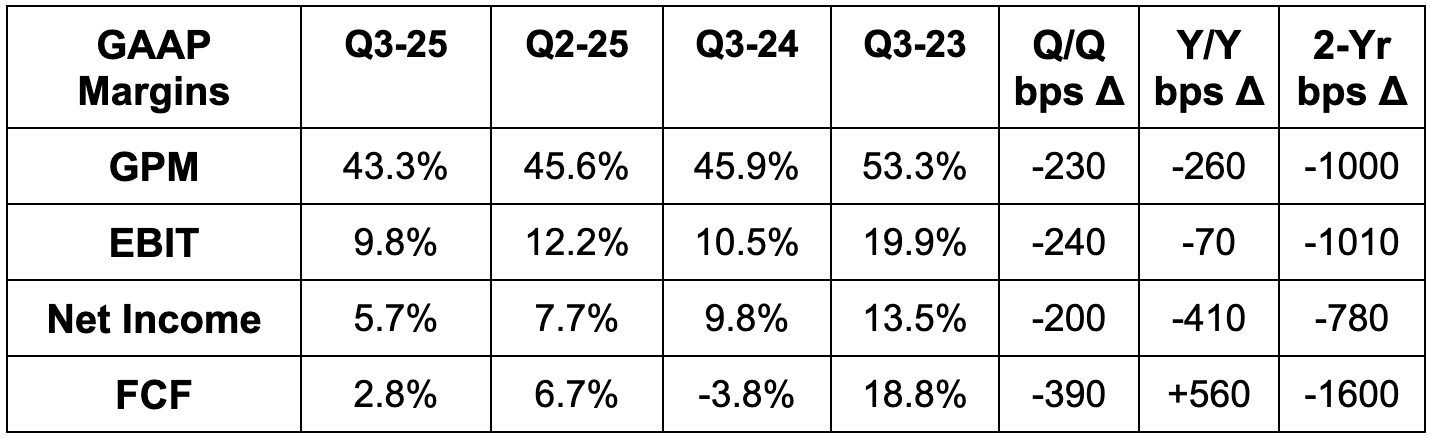

b. Profits, Margins & Credit Health

- Missed 45% GPM estimates by 170 basis points (bps; 1 basis point = 0.01%).

- Missed EBIT estimates by 4.7%.

- Missed $9.69 EPS estimates by $1.37.

- Sharply missed FCF estimates by $1.1B. This was largely related to its credit portfolio being $900M larger than expected. Those originations, with their front-loaded provisions, technically count towards cash burn despite fueling future profitable growth.

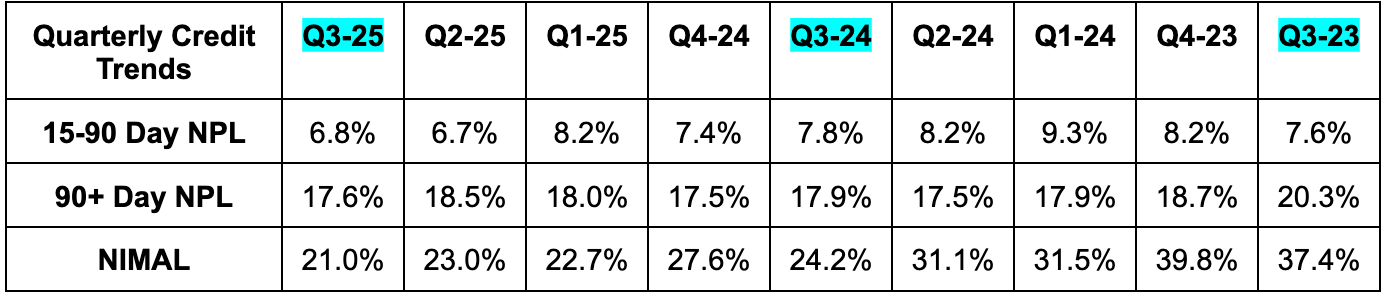

- Missed 22% net interest margin after losses (NIMAL) estimates by 100 bps.

- Note that continued mix-shift from personal loans to credit cards weighs on NIMAL. Accelerating originations also weighs on NIMAL in the near term.

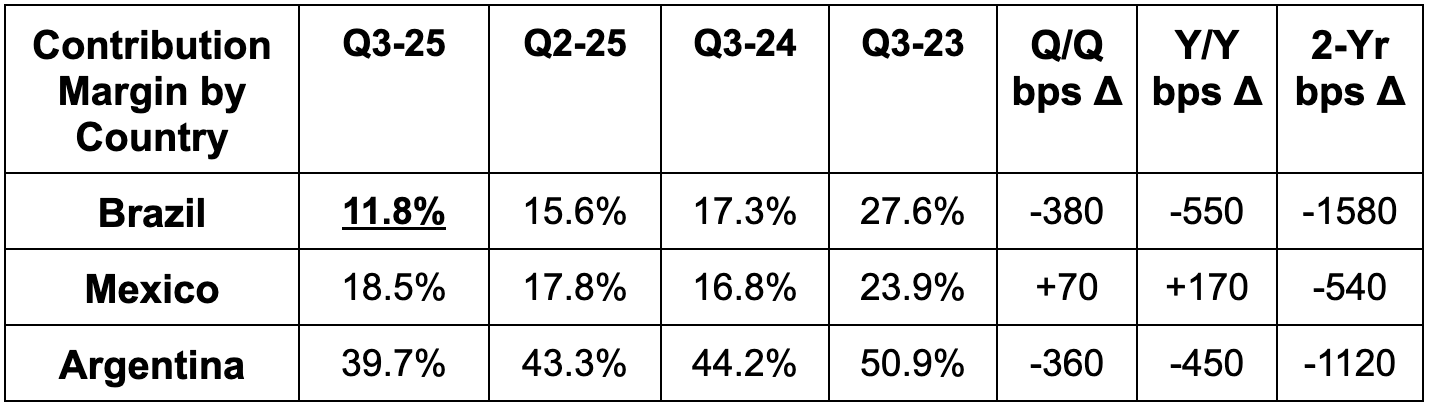

Aggressive growth investments in Brazil can be most clearly seen in the second margin chart below.

c. Balance Sheet

- $6.3B in cash & equivalents.

- $1.3B in long-term investments.

- Flat share count Y/Y.

- $9.9B in total debt.

d. Guidance & Valuation

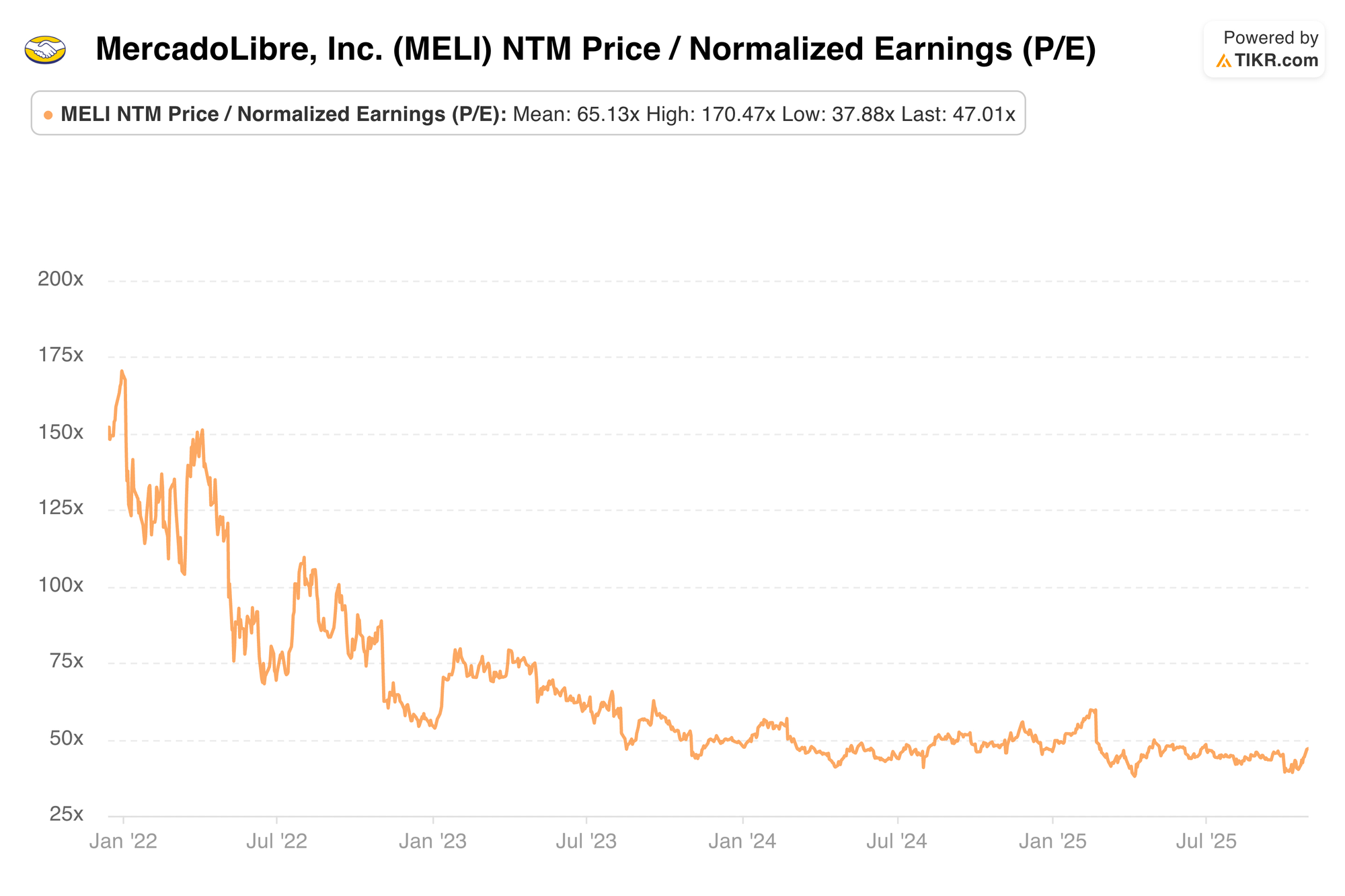

MELI trades for 47x forward EPS. EPS is expected to grow by 15% Y/Y this year. That will likely fall materially following this report. EPS is then expected to compound at a 43% clip over the following two years.