Table of Contents

- 1. Chipotle (CMG) — Brief Earnings Snapshot

- 2. Alphabet (GOOGL) — Detailed Earnings Review

- 3. Tesla (TSLA) — Detailed Earnings Review

I was planning on publishing the full Chipotle review on Saturday. Given the underwhelming comparable store guidance and the volatile stock reaction, I will be moving that article to tomorrow. I’ll also include ServiceNow coverage in that piece. I’m not happy with the Chipotle forecast revision, but I should reserve judgement until I read everything. For now, here’s part one of that review and full, detailed reviews of Alphabet and Tesla quarters.

1. Chipotle (CMG) — Brief Earnings Snapshot

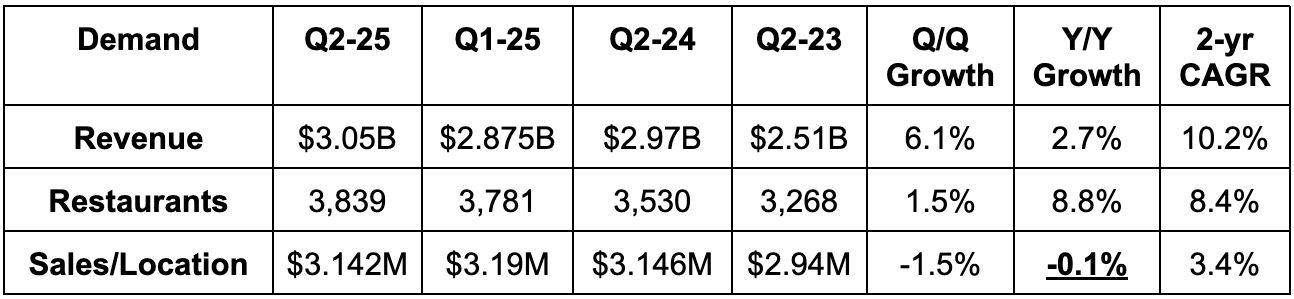

a. Demand

- Missed revenue estimates by 2.1%.

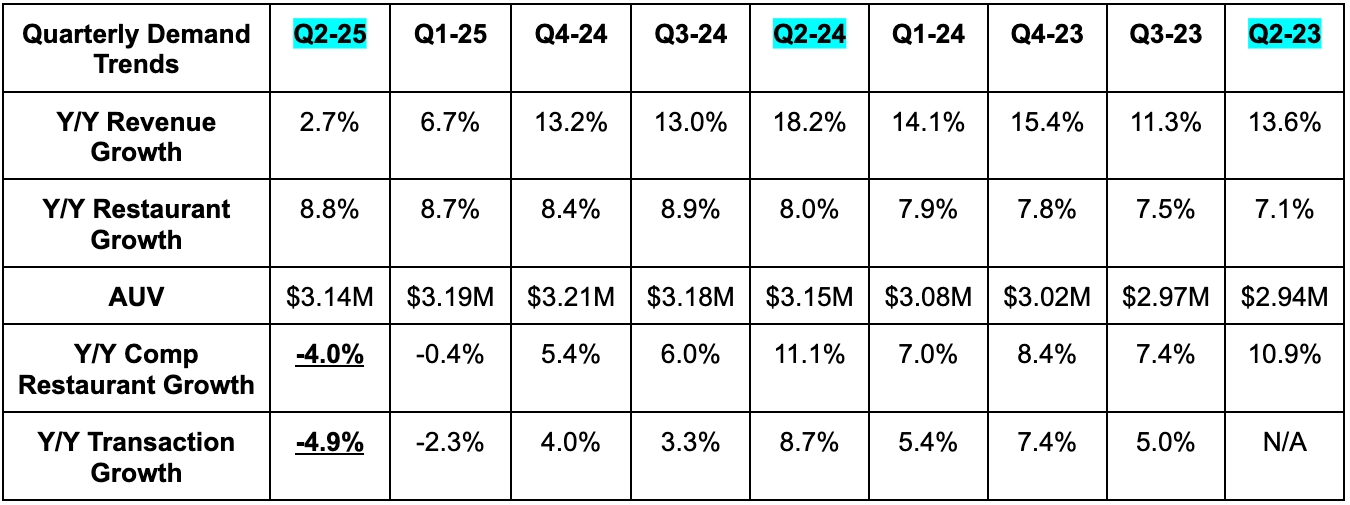

- Missed -3% comparable restaurant sales growth estimates with -4% growth.

- Missed average unit volume (AUV) estimates by 1.6%.

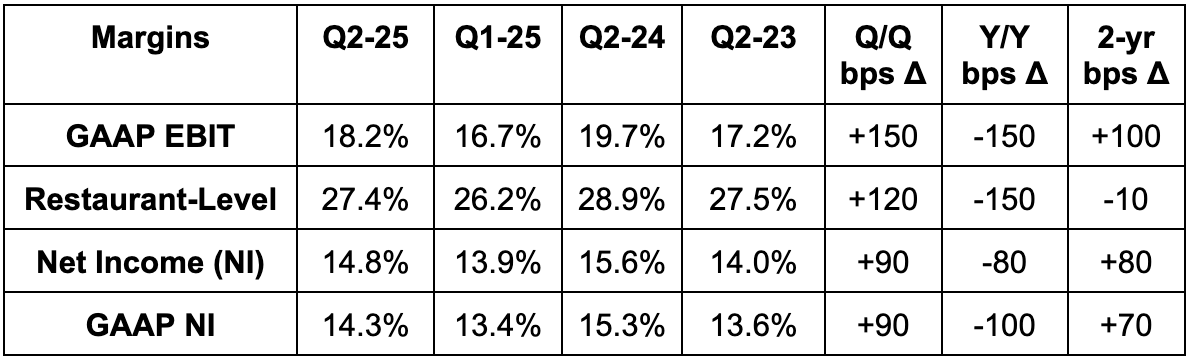

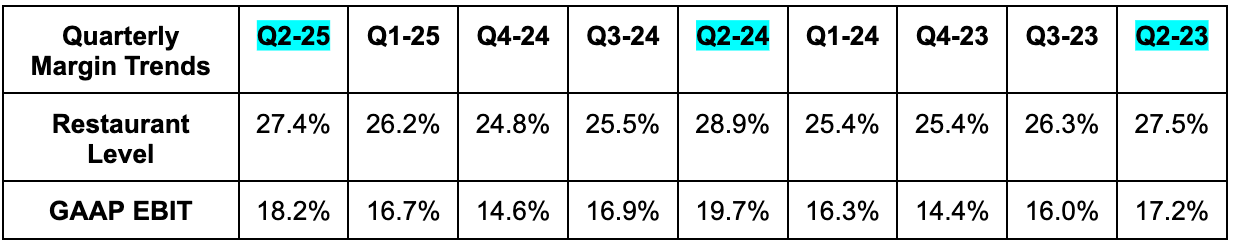

b. Profits & margins

- Missed EBIT estimates by 1.8%.

- Beat 27.1% restaurant-level margin estimates by 30 basis points (bps; 1 basis point = 0.01%).

- Met $0.32 GAAP EPS estimates.

c. Balance Sheet

- $844M in cash & equivalents.

- $518M in long-term investments.

- Share count fell by 2.2% Y/Y.

d. Guidance & Valuation

- Chipotle again lowered its comparable restaurant sales growth guidance from low single digits to 0%. It was low-to-mid-single digits entering 2025. Not good.

- Reiterated expectations calling for 330 new stores in 2025.

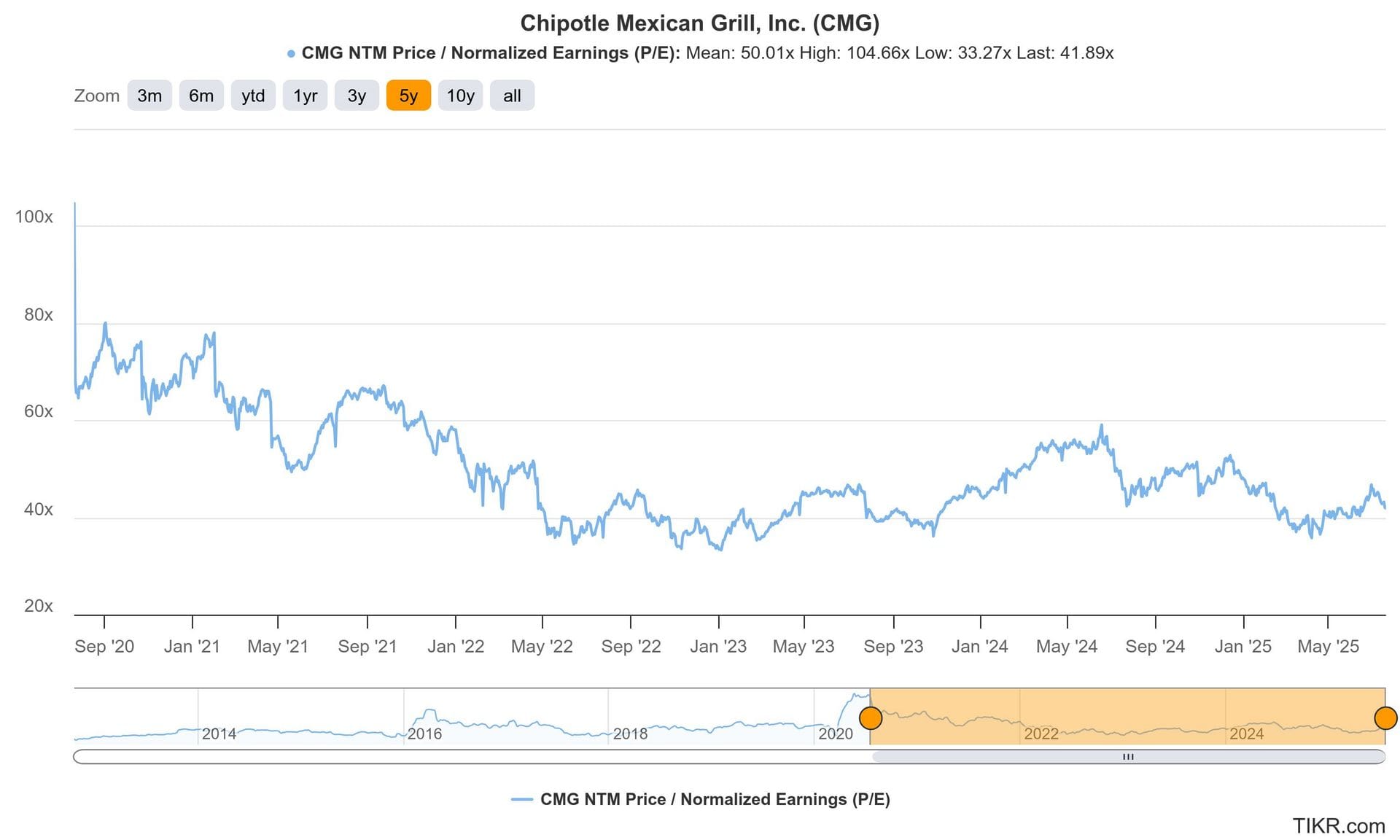

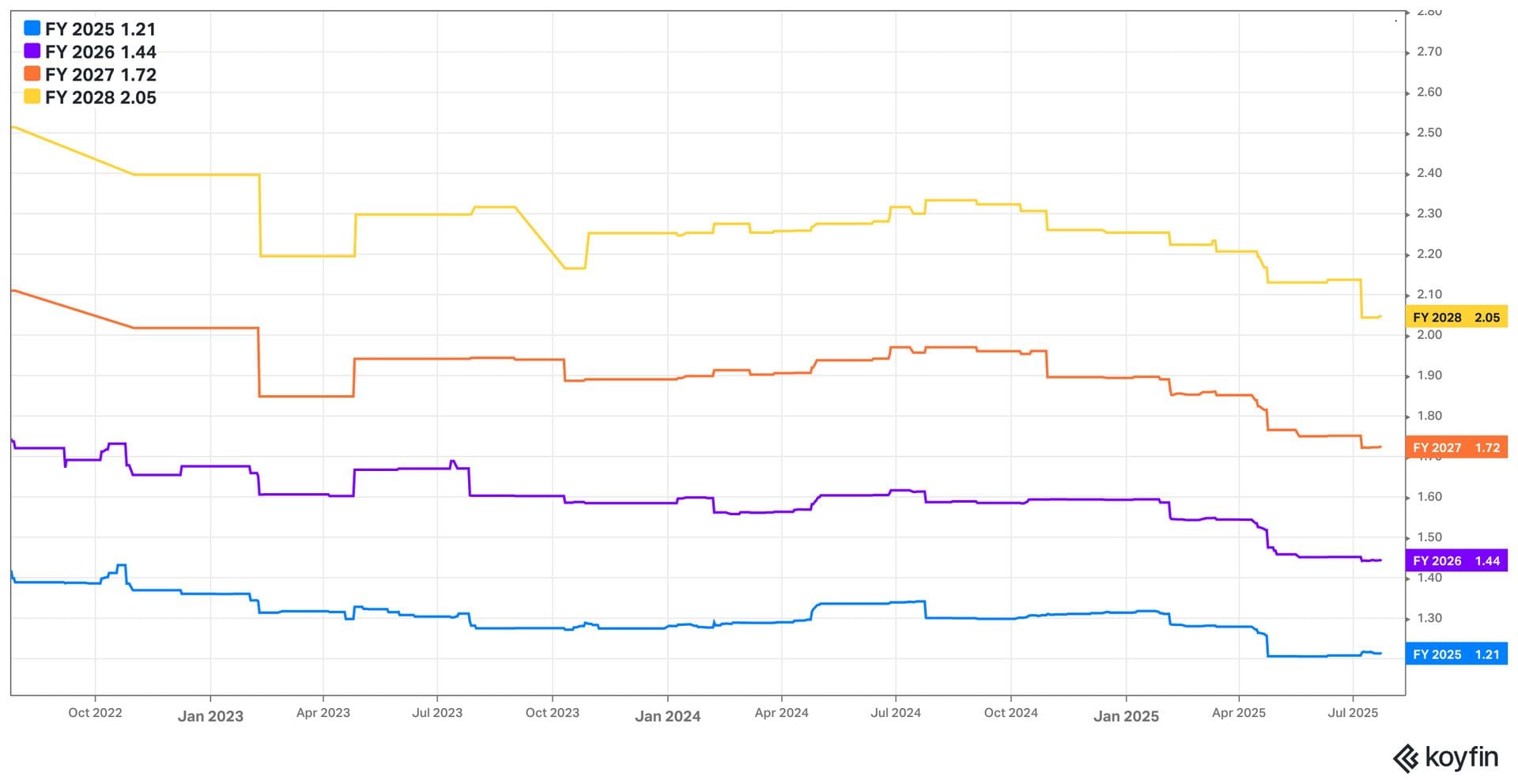

Chipotle trades for 42x forward earnings. For now, EPS is expected to rise by 8% Y/Y this year and by 18% Y/Y next year. Despite meeting expectations on EPS, I think the demand guidance and EBIT miss could lead to modest negative estimate revisions.

2. Alphabet (GOOGL) — Detailed Earnings Review

As a reminder, this company’s Gmail product flags messages that use its name too many times as automatic spam. For that reason, I will frequently refer to them as “Search King,” “Mega-Cap,” “Titan” etc.

a. Key Points

- Accelerating search growth.

- Fantastic large deal volume for the cloud business.

- YouTube is dominating streaming.

- Raised capital expenditure (CapEx) guidance for 2025.

b. Demand

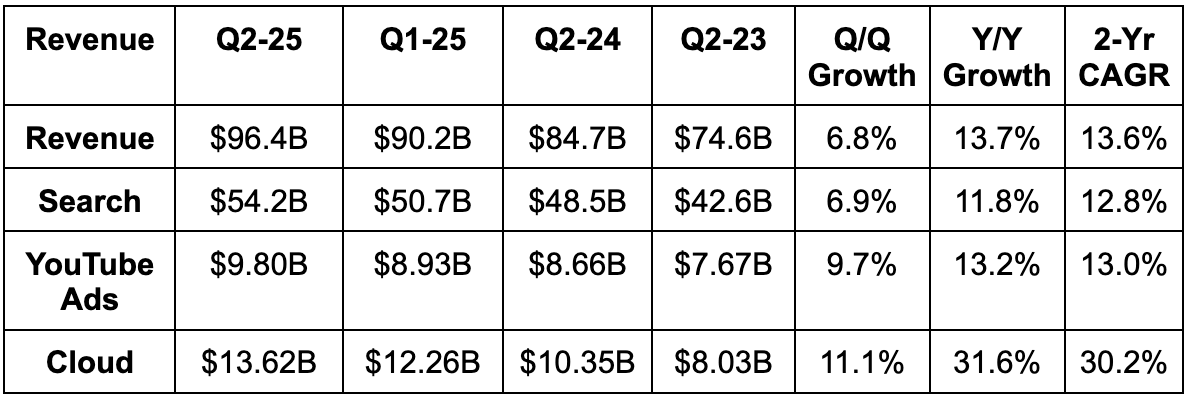

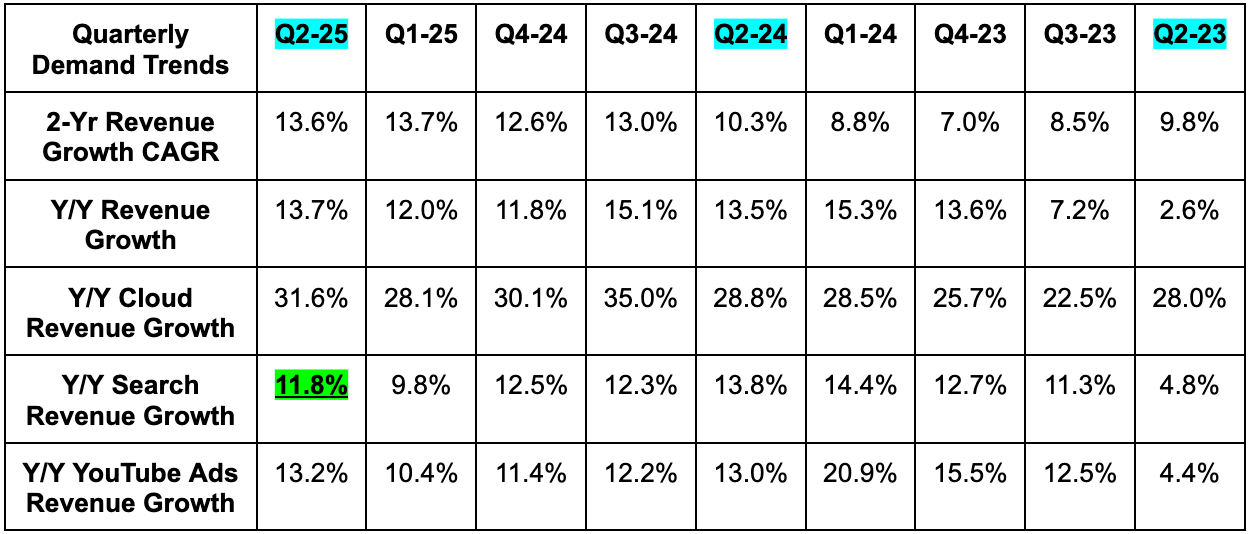

- Beat revenue estimates by 2.6%.

- Revenue growth on a foreign exchange neutral (FXN) basis was 13% Y/Y.

- Cloud revenue beat estimates by 3.7%.

- Search revenue beat estimates by 2.5%.

- The acceleration in Y/Y search growth was well in excess of the easier Y/Y comp help.

- YouTube revenue beat estimates by 2.5%.

- Subscription, platforms and devices revenue rose 20% Y/Y to $11.2B. Google One subscription momentum was strong and new Gemini Pro and Ultra subscriptions are already materially contributing.

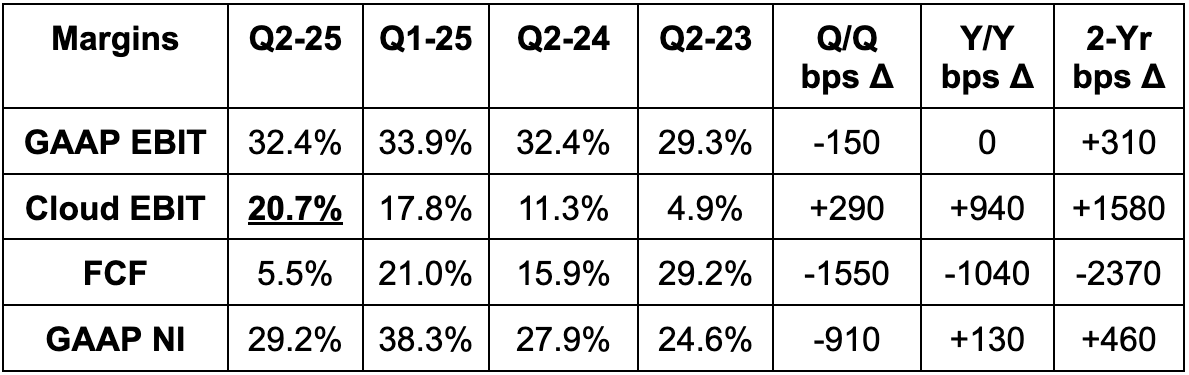

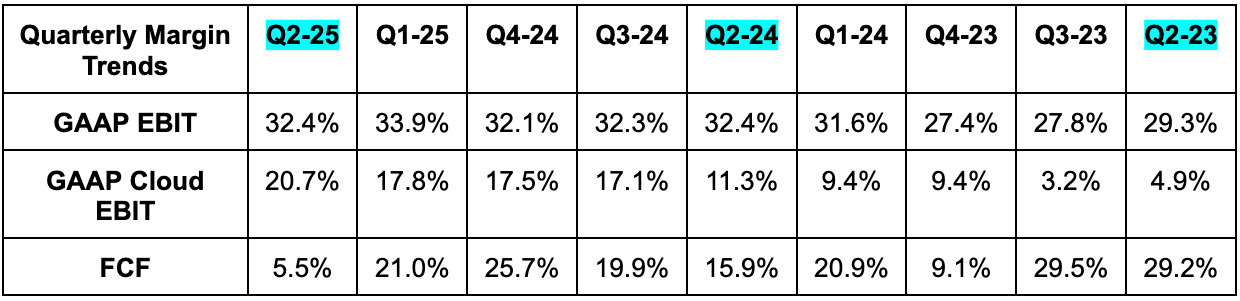

c. Profits & Margins

- Beat $2.18 EPS estimate by $0.13.

- EPS rose by 22% Y/Y despite a $1.4B legal charge. EPS growth would have been 29% Y/Y without this, although legal charges are a common part of this business.

- Beat EBIT estimates by 0.8%.

- EBIT margin would have been 33.9% without legal charges, representing 150 bps of Y/Y leverage.

- Sharply missed FCF estimates.

Quarterly CapEx is very lumpy and heavily influenced by available infrastructure capacity during a 90-day period. I think it’s especially important to focus on annual FCF generation at this point, which will still be greatly impacted by ramping CapEx. This CapEx is in response to strong demand signals for Google Cloud (GCP) and is something I strongly support. They should be sacrificing near-term profitability to greatly raise the revenue and profit ceilings in the years to come. And they are.

Hefty CapEx over the last several quarters is also now contributing to faster depreciation cost growth. For review, spending CapEx dollars counts immediately against FCF. In this case, those dollars create tangible assets, which have finite useful lives. As we work through these useful lives, the value of the assets are reduced to reflect the aging. That impacts EBIT and net income in the table below. Depreciation rose by 35% Y/Y. A lot of that cost is incurred in the cloud business, which is why it’s so encouraging to see the EBIT margin sharply expand despite this item. The depreciation headwind will not halt the fantastic margin trajectory this is on.

d. Balance Sheet

- $95B in cash & equivalents.

- $24B in debt.

- Added $12.5B in senior unsecured notes in May.

- Share count fell 2.4% Y/Y.

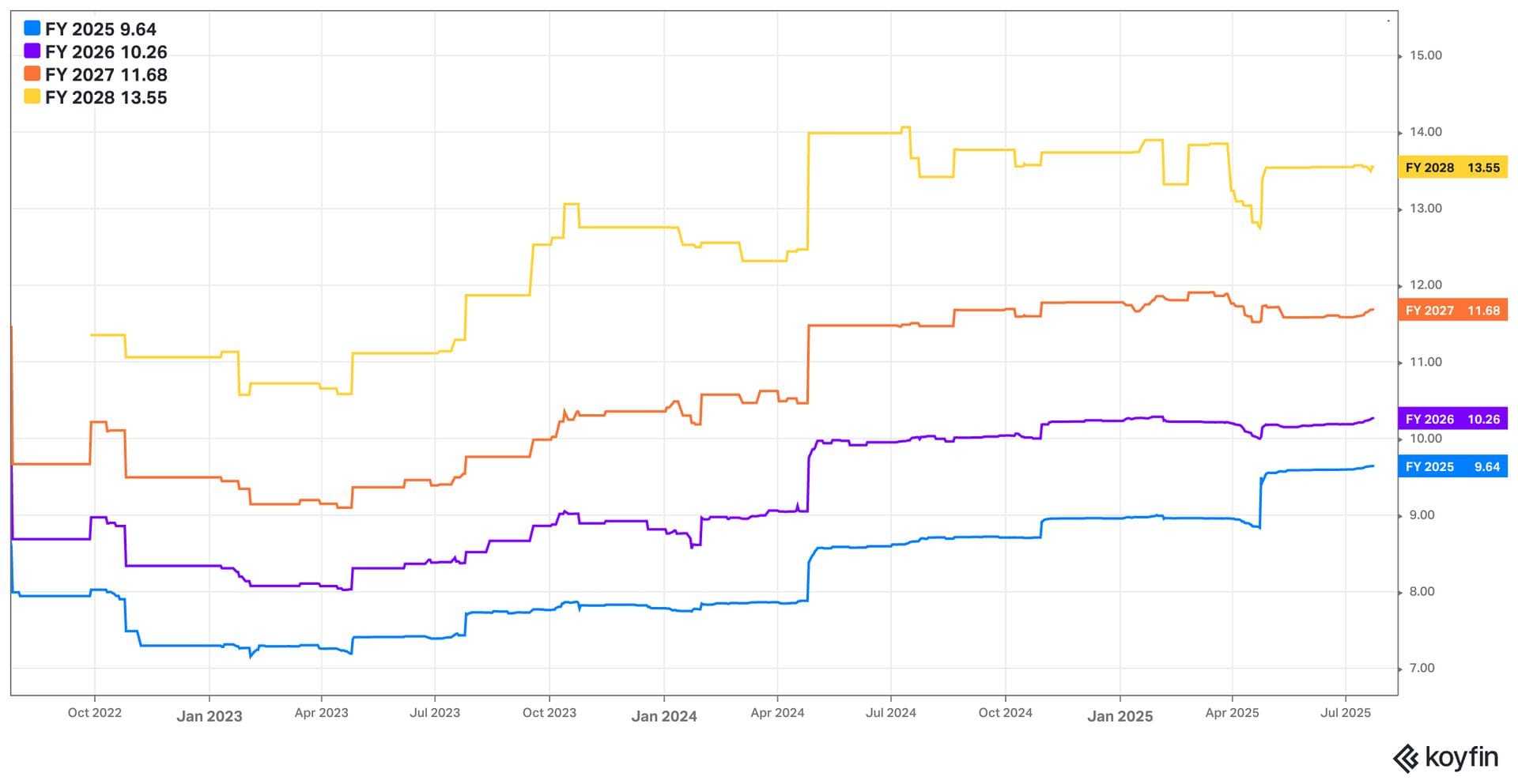

e. Guidance & Valuation

Annual CapEx guidance was raised from $75B to $85B. As I discussed in the profit section, this is to meet near-term demand. Two-thirds of the spend is earmarked for servers and other infrastructure to service clear demand signals. Momentum in the cloud business is historically strong at the moment, and not investing to take advantage of that would be short-sighted. I am happy to accept lower 2025-2026 FCF generation for years of margin-accretive scaling without capacity bottlenecks. They think CapEx will again rise Y/Y in 2026.

The mega cap trades for 20x forward EPS. That could fall by a turn or two following this strong report and upward estimate revisions. I realize CapEx guidance was raised, but that will immediately impact free cash flow, not net income. It will begin impacting net income when those dollars start contributing to depreciation expenses later on.

f. Call & Release

Full-Stack AI:

As he usually does, Sundar walked us through the firm’s progress, updates and traction within the three layers of the AI opportunity. For review, those layers are:

- Infrastructure

- Research teams & models

- Distributed products

The mega-cap is unmatched in its broad involvement in all three of these layers. It has a world-class network of datacenters, with what it views as superior compute efficiency. It pairs this with its high-quality tensor processing units (TPUs) being used by leading AI research labs like Physical Intelligence.

- As a reminder, TPUs are similar to GPUs in that they’re used for high-performance compute and AI. On the other hand, TPUs are custom built and for more specific use cases. They are not general purpose like GPUs.

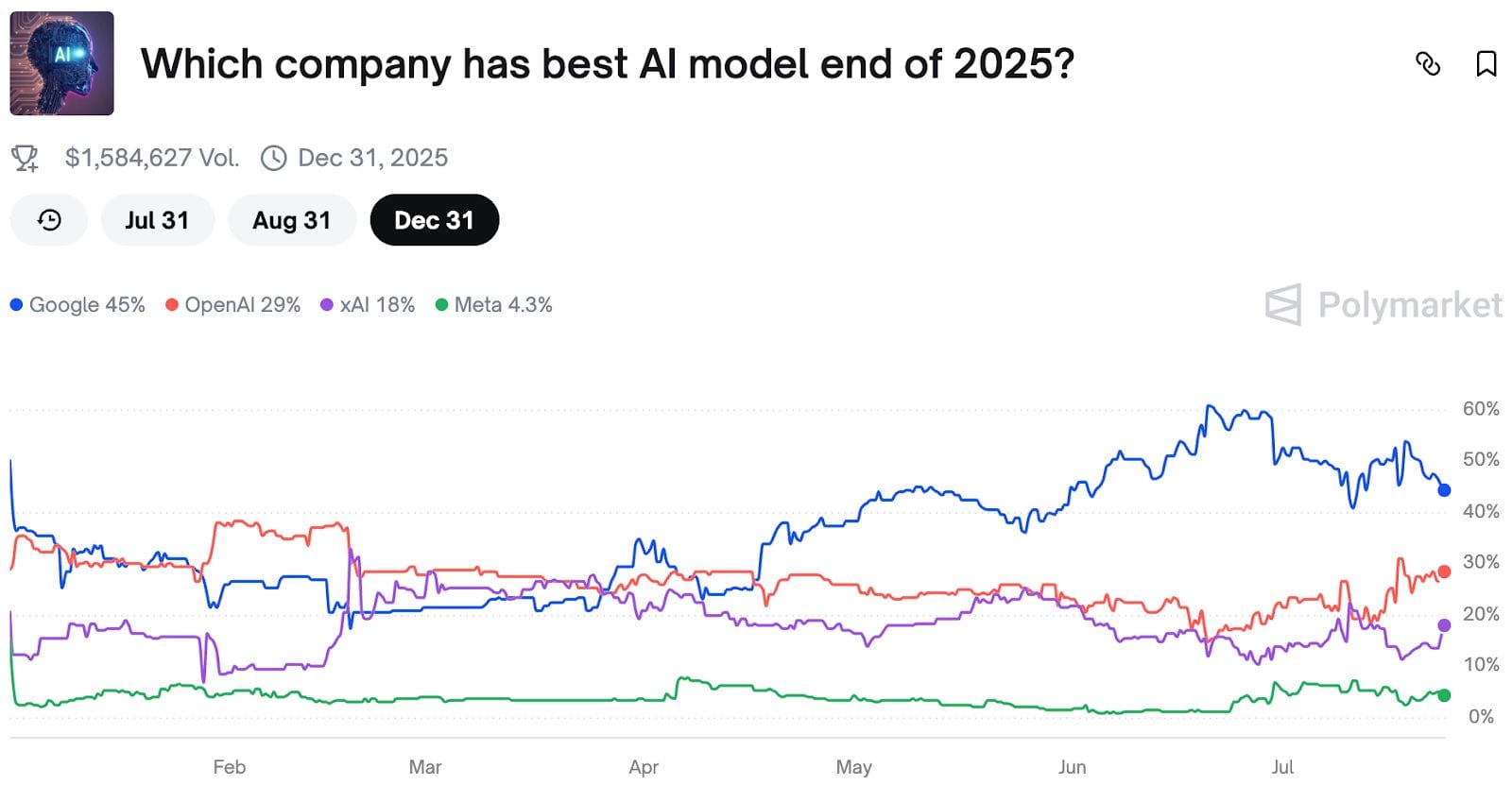

It then boasts an elite AI research team in Deep Mind, with those people having access to all the compute and data they need. That’s the luxury of enjoying distribution to 2 billion people across 7 total products. It provides unmatched multi-modal context to season its Gemini models, iterate more effectively and stay at the front of the pack. This is probably why Gemini is considered the best in the world, while being immensely popular among developers and overall users. For evidence, Gemini has grown developer users from 4.4M to 9.0M in just 6 months and overall monthly active users crossed 450M vs. 400M a handful of weeks ago. Gemini’s user engagement also rose 50% Q/Q.

- All of those market share charts I shared during the quarter showing Gemini gaining great momentum vs. the field were clearly accurate.

One more note on the product layer. Aside from using existing tools like Maps and YouTube to better train its models, they’re also using great models and talent to develop entirely new AI use cases. And when you can insert those into already ubiquitous offerings, traction gets far more likely. Perhaps unsurprisingly, the firm now processes 980 trillion input tokens per month vs. 480 trillion just a couple months ago.

So, to summarize it has all of the foundational infrastructure needed to power AI, top-notch researchers with access to all needed assets, as well as globally served products to create larger sums of better data and unlock faster improvement than anyone else. That’s a good spot to be in and is why I’ve been so adamant about this firm’s positioning in AI being far, far better than most think.

- It just released a smaller, faster Gemini workhorse model called Gemini 2.5 Flash-lite.

- Its Veo3 video generation model was called a “viral hit.” With this product and other tools like Flow (its AI filmmaking product), 70M videos have been created since May.

- Google Vids (another product for short form video creation help) crossed 1M MAUs.

- As an important aside, attracting 9M developers inherently means more work will focus on improving Gemini performance and efficiency. Another luxury of being the scaled full-stack leader.

- They continue to be confident in Gemini and AI search needing to be two different products. The use cases for both are somewhat different according to them. I think they’d be better together, but I’m sure the team is looking at internal KPIs telling them to keep them apart. Their data is better than my opinion.

Search:

All AI product innovation in search is going well. AI Overviews have 2B MAUs (vs. 1.5B earlier in the quarter) and AI Mode is rapidly expanding. While this is nice, it’s somewhat seamless to grow users for these products when people are already coming to this behemoth for search. And because of that, I’m far more encouraged about the 10% engagement uplift that AI Overviews are delivering. That’s more meaningful for gauging success here and the 10% boost merely grows over time.

Leadership talked about AI greatly expanding query use cases and the overall market. I’ve long argued that the “market share gaining” ChatGPT is enjoying is really just them creating brand new market share within search, rather than taking Alphabet’s demand. This is partially why things like 70% Y/Y Lens growth have been incremental to the mega cap’s business, rather than cannibalistic. Circle to Search has been the same, with the product enjoying its fastest adoption among younger users.

Considering the 10% AI search engagement boost paired with ChatGPT having far lower than 10% overall search market share, I’m confident in calling AI a net tailwind for the search king’s business. This doesn’t even consider the fact that 3rd-party data we’ve shared since April clearly points to Gemini accelerating user growth and winning some of that newly created market share from ChatGPT.

- AI Mode is up to 100M MAUs as it continues to roll out to users.

- Added the ability for gamers to use AI overviews without leaving a page.

- Broadly debuted virtual try-on tools for shopping search use cases. Early results were called “extremely positive.”

More on Search:

There has been a budding debate on the firm’s search growth quality. Some have pointed to slowing click growth and overall revenue expansion being powered by monetization as a red flag. I just don’t agree. AI overviews, Gemini and AI Mode are exceptional at efficiently matching users to interesting links more accurately and quickly than traditional search. Folks no longer need to click into 6 different websites to find what they’re looking for. AI gets them there more quickly, which the team explicitly mentioned on the call. The search segment is comping over a period when AI was a far smaller part of the business. That is a large click headwind, and yet growth accelerated from 2% Y/Y last quarter to 4% Y/Y this quarter (despite AI traction building). On the other hand, more targeted links are innately more valuable than links in traditional search. That’s why pricing growth has been so strong. Ad buyers wouldn’t be paying these rates if returns didn’t justify doing so… yet they are. So while some view growth contribution shifting to click pricing over click volume, I view that as an inevitable byproduct of Google’s evolution.

YouTube:

YouTube Shorts monetization is now on par with the rest of YouTube. That’s so important. As that content form grows as a proportion of overall YouTube watch hours, proper monetization will become increasingly paramount for the growth engine marching on. That proper monetization is now happening as growth for Shorts remains expeditious. Daily watches crossed 200M during the quarter vs. 70M about 18 months ago. They just added new AI creator tools for shorts to keep this engine humming.

In streaming, YouTube is separating itself from the pack. While Netflix market share has stagnated, YouTube keeps taking a larger piece of the pie. It claimed 12.8% of total market share in June vs. 9.9% Y/Y. No other competitor came remotely close to matching this success. Thriving.

- Launched the Creator Partnership Hub to match brands with content creators for ad campaigns.

- Added Veo3 to Shorts editing.

- McDonald’s is using YouTube Shorts to 3.3x view rate for an ad campaign.

Cloud:

Like YouTube, the cloud business is absolutely rocking. $250M deals doubled Y/Y, while $1M deals signed year-to-date have already surpassed all of 2024. Customers rose 28% Q/Q with LVMH, Salesforce and others joining the roster, while the backlog grew by 38% Y/Y to set the table for more flourishing. Leadership is adamant that its “leading performance and cost efficiency” in general cloud use cases, AI training and inference are why things are going so well. Hard to argue with that.

- A new “anywhere cache” product lowers cloud latency by 70%. Its new “rapid storage” product improves latency by another 500% vs. “leading hyperscalers.”

- Its agent development kit (ADK; open-source tools for building agents) has 4M downloads in a little over a quarter.

- Debuted AgentSpace, which is a managed product for helping companies identify needed data to plug into AI agents. Agentspace has already sold 1M subscriptions before its full debut.

- Target is now using the cloud offering to improve its security posture.

- BBVA is using Gemini and GCP to save an employee 3 hours per week via task automation.

Waymo:

Waymo launched teen accounts in Phoenix and Atlanta while growing its coverage area in Austin and California markets. They’re very pleased with momentum and discussed allocating more “other bets” budget to this business.

Network Business:

The ad network business (ad marketplace that matches buyers and sellers) continues to shrink Y/Y. The firm is prioritizing its own ad properties over trying to be a conduit. Why do I bring this up? This segment is the source of significant ad-tech anti-trust drama currently unfolding. And? The firm already doesn’t care about making this core to its focus or operations. If regulators want to force them to sell it, it will be very hard to notice any impact in its financial statements.

More on Advertising:

- New AI Max tools for search campaigns are delivering a 14% boost to ad conversions.

- Smart bidding (update to expressed bidding strategies and processes) is boosting conversions by 19%.

- Etsy’s Depop used a demand generation campaign in YouTube shorts to raise click through rate by 100%.

- Advertisers using its AI-powered asset generation tools rose 50% Y/Y.

Other Notes:

- New PayPal partnership including more cloud usage from that payments giant and more PayPal availability across Alphabet’s products.

- They’re not concerned about Meta’s recent AI hiring spree.

g. Take

Great quarter. The stock can shrug off these results all it wants to, but I’m exceedingly pleased. When the biggest disappointment in a report is a FCF miss because they need to spend more to meet better-than-expected demand, you know things went well. Sacrificing near-term cash flow generation to capture the once-in-a-generation opportunity it’s poised to win is the correct decision. The search business is showing no signs of being disrupted, YouTube is firing on all cylinders, Cloud is clicking, Waymo is rapidly expanding and the full-stack AI approach is working. I continue to believe sentiment for this name is divorced from reality. In my mind, that reality includes Alphabet being a clear AI leader for a very long time… and it’s still the cheapest mega-cap tech name.

3. Tesla (TSLA) — Detailed Earnings Review

a. key points

- Challenged auto business.

- Tariffs and the new federal budget add to headwinds.

- The mass-market model was delayed a quarter.

- Optimus timelines were also pushed back.

- Great energy gross margin performance.

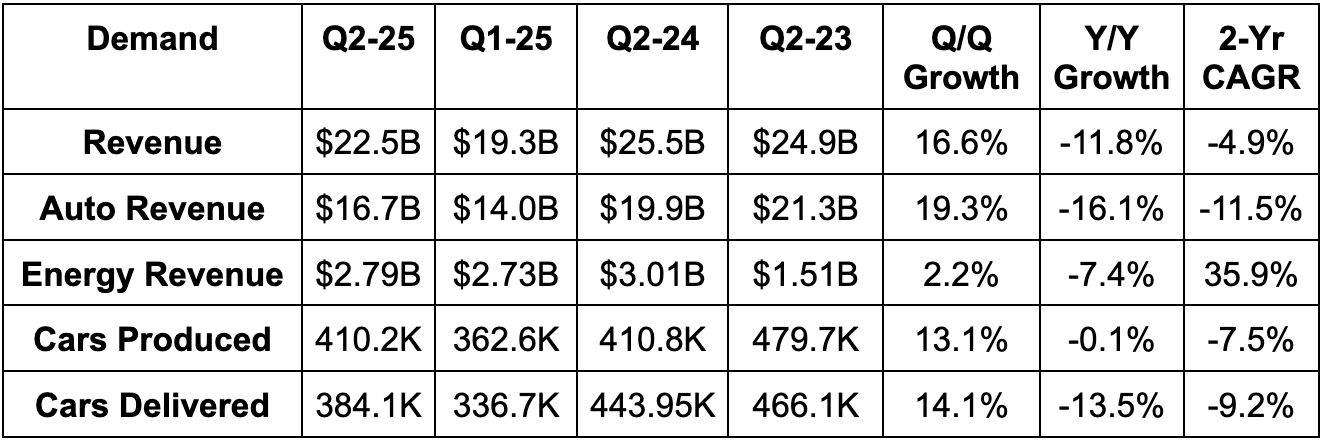

b. demand

- Slightly beat revenue estimates.

- Auto revenue beat estimates by 3.2%.

- Energy storage and generation (energy revenue) missed estimates by 18%. This is highly influenced by timing of deployments on a quarterly basis. I don’t think this is concerning unless it becomes a multi-quarter theme.

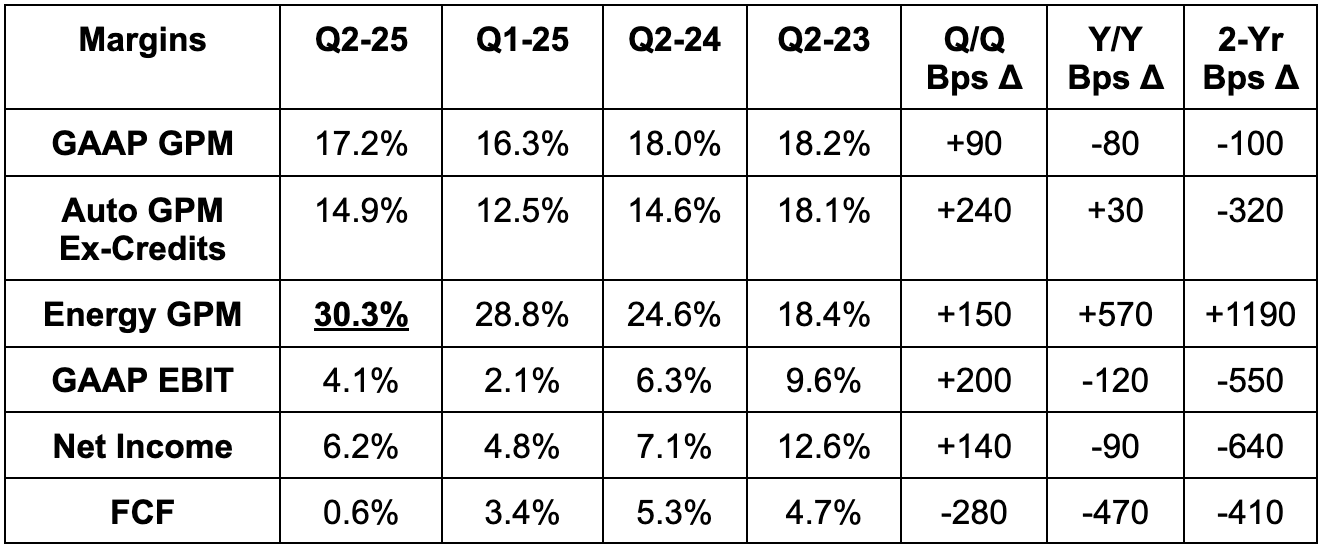

c. Profits & Margins

- Beat 16.5% GPM estimates by 70 bps.

- Beat 13.3% auto GPM ex-credit estimates by 170 bps.

- Beat 24.5% energy GPM estimates by 580 bps.

- Missed EBIT estimate by 10.5%.

- Missed $0.44 EPS estimates by $0.04. Some outlets had consensus estimates at $0.40. If we use that number, it met estimates.

- EPS fell by 23% Y/Y.

- Sharply missed FCF estimate.

Lower restructuring charges and lower cost per vehicle due to raw material leverage helped margins. This leverage was despite $300M in added costs from tariffs this quarter. That impact will grow next quarter.

d. Balance Sheet

- $36.7B in cash, equivalents & investments.

- $7B in debt.

- Share count rose by 1% Y/Y.

e. Guidance & Valuation

We got the same vague guidance we’ve grown used to receiving. Geopolitics are preventing a formal deliveries guide. Interestingly, while Alphabet raised its CapEx guide, Tesla lowered theirs from $10B+ to $9B. Other abstract notes on 2026 expectations are included throughout this piece.

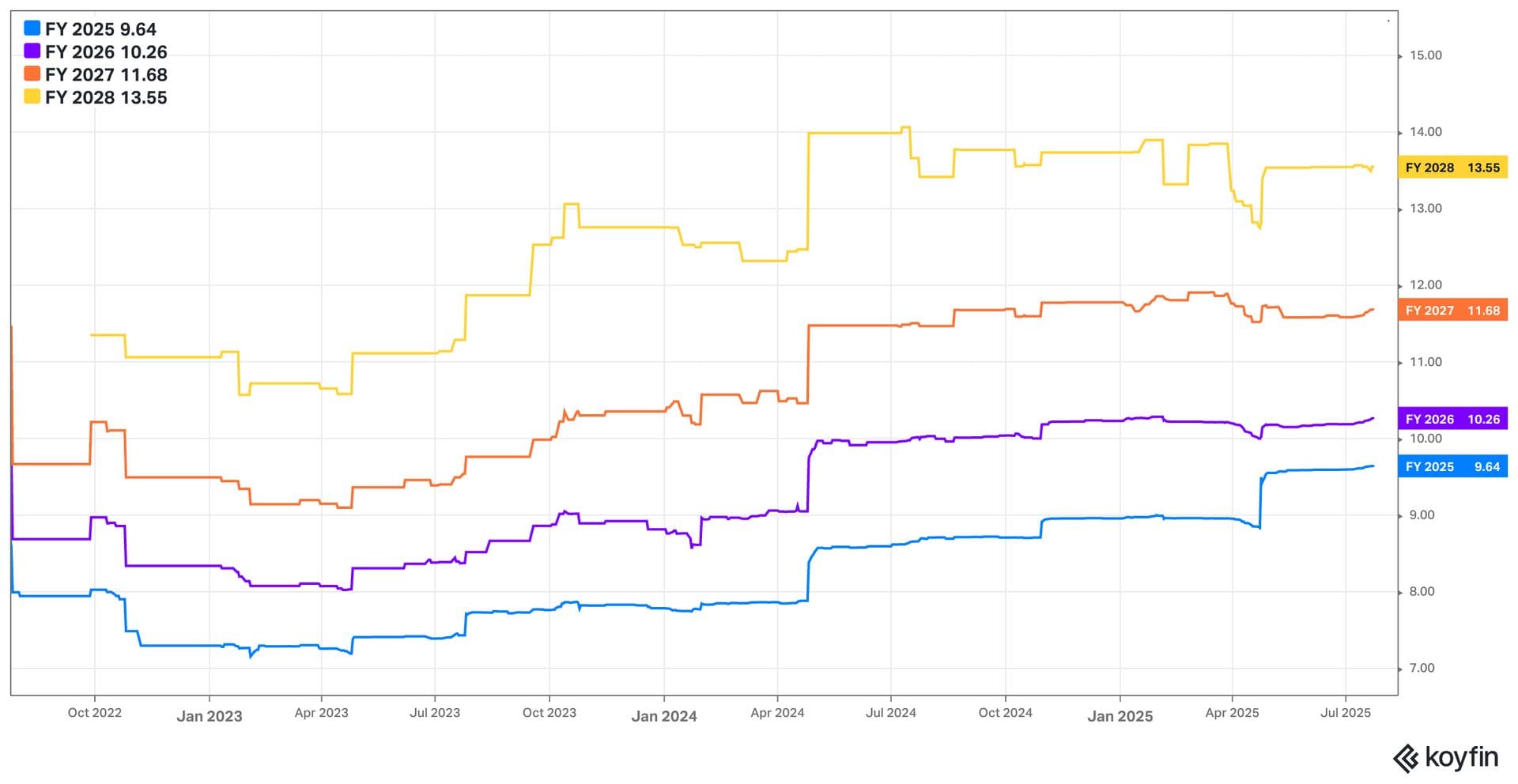

Tesla trades for a whopping 173x forward EPS. EPS is expected to fall by 26% this year and grow by 54% next year.

f. Call & Release

Robotaxi:

- Robotaxi refers to any Tesla vehicle that can offer autonomous paid rides. All newer models can be “Robotaxis.”

- Cybercab is Tesla’s planned dedicated model for offering commercial fleets of paid rides.

Per the team, the robotaxi launch in Austin occurred with no major safety incidents. It plans to keep expanding the coverage network there “in excess of what competitors are doing.” From there, San Francisco is likely the next expansion city, with parts of Arizona, Nevada and Florida planned for this year – “pending regulator approval.” Musk was careful to offer that disclaimer several times as he walked through launch timelines. He thinks they’ll have 50% U.S. population coverage for Robotaxi by 2026. And while that’s very exciting, Musk would be the first to tell you he’s generally wrong on timing. He’s great at delivering disruptive hardware. But not great at telling us when that will be.

As a relevant aside, as tax credit eliminations and tariffs raise costs for consumers, they’re excited about the prospect of Tesla owners adding their cars to robotaxi fleets (they think next year). That can help mightily in creating extra income to make this purchase more doable.

- Musk reiterated Cybercab cost expectations. He thinks it’s highly likely that the car will get to under $0.30 per mile.

- Cybercab is on track for scaled production next year.

- Launched its taxi app in Austin.

More on Full Self Driving (FSD):

In Europe, they think lack of supervised FSD is holding back demand. While that could be the case, I would think that impact is modest; alternatives in the market also don’t have it. They’re confident in getting EU supervised FSD approval and also confident that regulators will continue to be difficult and slow. They’re hoping to secure needed permission this year, and it’s a similar story for China.

In the USA, since lowering the FSD subscription cost, adoption rates have risen by 25 points. This was called a “promising trend” and I’d strongly agree. The true prize, however, is unsupervised FSD. Musk sees this perhaps becoming available for “personal usage” by the end of the year “in certain geographies.”

- Tesla will also soon loosen intervention requirements for its autopilot product in the USA.

- With robotaxi launched in Austin, they’re shifting some focus back to autopilot improvements.

- They think autonomous car deliveries will become the default in Austin and San Francisco by the end of 2025.

- Unsurprisingly, Tesla continued to praise its vision-only approach vs. the LIDAR approach used by most others. They think this will allow them to be first to actually autonomous driving and will allow them to expand robotaxi coverage networks faster than others.

Demand Context & Debate:

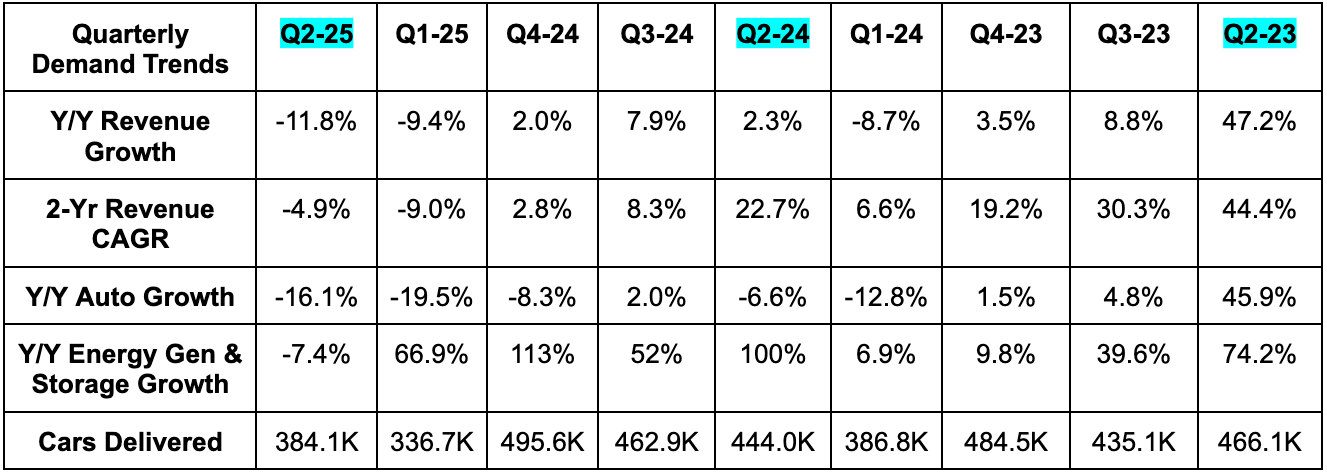

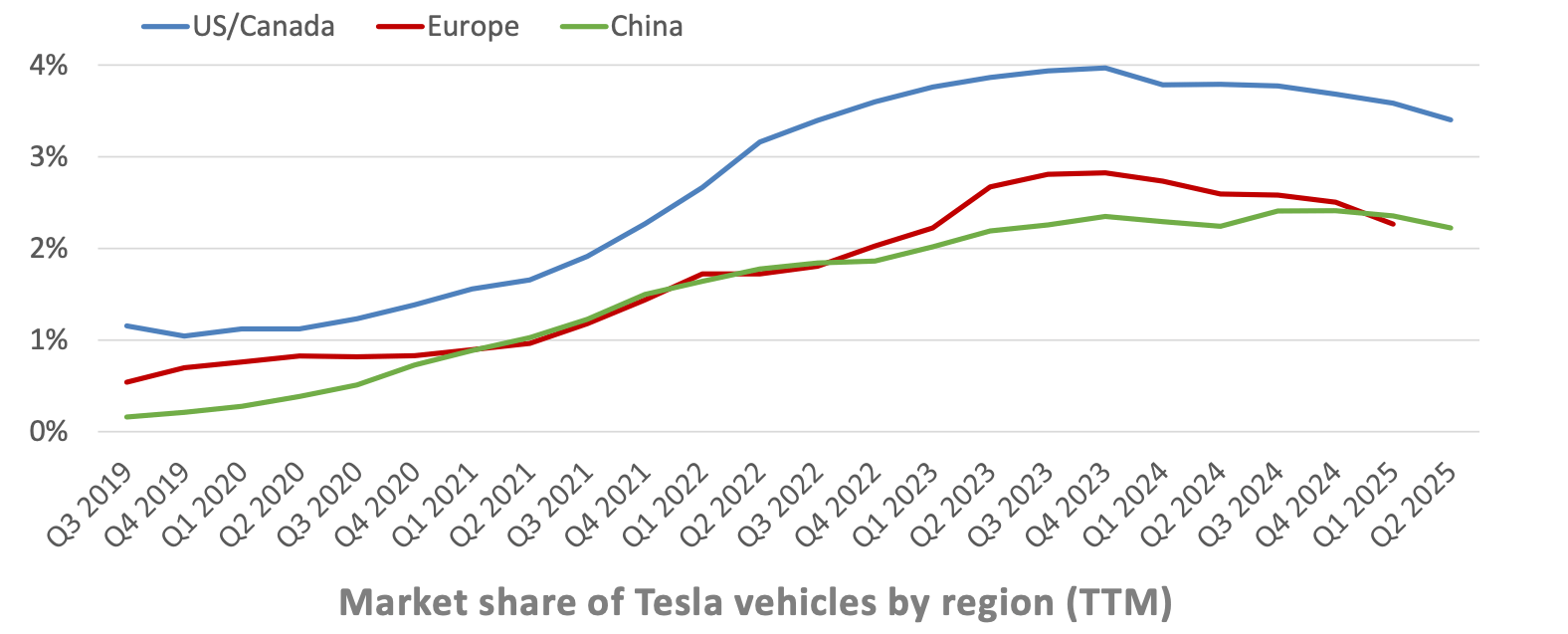

Despite increasingly easy comps and three 2024 rate cuts, Tesla is struggling to find any revenue growth. And we cannot blame that on macro when market share is also declining in all of its markets. Other automakers deal with the same exogenous headwinds, yet competitors like Rivian and Lucid are finding positive revenue growth. While the margin profiles for those companies stink vs. this one, Tesla has been the leader in this space for a long time. Leaders generally don’t deliver back-to-back quarters of negative 2-year revenue growth while their competitors enjoy expansion.

Is this because others suddenly have better cars than Tesla? I don’t think so. The Model Y is fantastic. Is this because Musk has become so polarizing in the world of politics? Maybe. Is this because his focus has perhaps strayed to other things like the America Party, xAI and building diners? Maybe. Whatever it is, the trends you see below must sharply improve in the future for this to keep earning the sky-high multiple it enjoys.

Optimus and robotaxi could easily both still be years away from carrying this financial engine. The auto business needs to perform better, and there are some reasons to believe that could happen. Test drives rose 20% Q/Q in North America, which is very encouraging. Potential FSD launches internationally could help, and so could its affordable 2026 model as well as the refreshed Model Y. We shall see if all of that can make market share look better in the coming quarters. That’s the metric that isolates Tesla’s relative performance vs. the field and eliminates macro-related noise. Focus on market share.

Model Y:

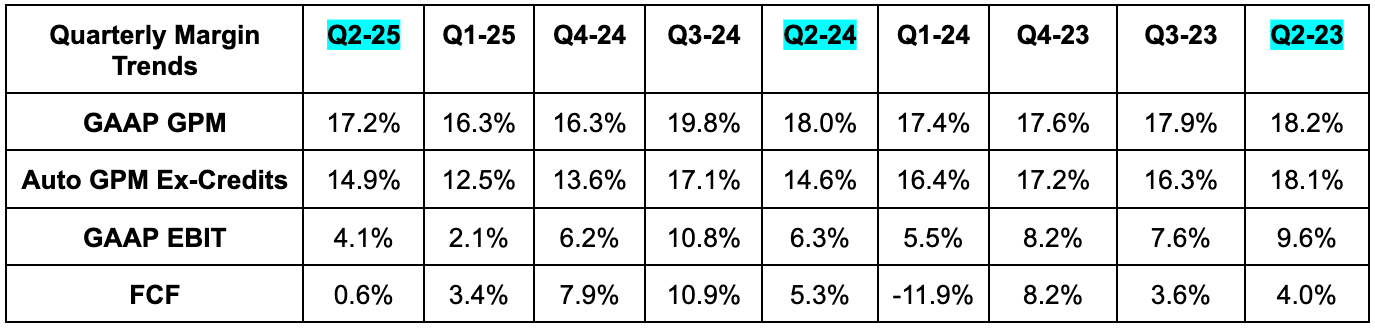

Model Y was the top-selling car in Turkey, the Netherlands, Switzerland and a few other places. They’ve begun ramping production of the refreshed Model Y across all associated factories, and enjoyed a Q/Q uptick in average selling price (ASP) as a result. That’s why auto gross margin expanded materially. Good to see. I’m tempted to say that should continue, considering updates to every model and its production lines are now complete, but there are other confounding variables like tariffs to consider, which are raising input costs.

Affordable Mass-Market Model & the New Federal Budget (“Big Beautiful Bill” (BBB)):

Production of the rumored affordable model has begun. This will reduce rare earth material usage in the motor and attempt to lower existing model costs elsewhere as well. As a reminder, this car will not use Tesla’s next-generation, out-of-box manufacturing technique. This is the bridge between its other models and getting to that point.

Removal of the $7,500 EV tax credit as part of the new federal budget has changed the ramp schedule for this car. Tesla switched some focus to building and delivering as many existing model units as possible before those credits go away during Q4. As a result, scaling production of the mass-market model will now happen during Q4 rather than Q3.

“We're in this weird transition period where we'll lose a lot of EV incentives in The U.S… So, does that mean we could have a few rough quarters? Yeah. We probably could have a few rough quarters. I'm not saying we will, but we could in Q4, Q1 and Q2 (2026)... By the end of next year, I think I'd be surprised if Tesla's economics are not very compelling.”

CEO Elon Musk

How BBB & Tariffs are Impacting the Energy Business:

The new federal budget and tariffs will also impact its energy business. They expect impacts on demand and margins, but think those impacts will be manageable. As leadership rightfully said, AI is creating an explosion in energy demand, with Tesla’s generation and storage business fantastically positioned to satiate that craving. They think their energy products are inevitable and don’t think the affordability hit from new policy will halt the traction. Again… it may slow things down a bit… but they expect this specific growth engine to keep revving.

“Overall, we're forecasting a very strong second half of the year as we increase deployments.”

VP of Energy & Charging Michael Snyder

More on the Energy Business:

Tesla sees its energy storage business as vital for helping the USA’s energy grid. Again, AI means massive spikes to energy consumption. Its batteries can double the grid’s efficiency (energy actually used divided by energy produced) to greatly bolster available capacity without doubling power plants. That is by far the most efficient way to satisfy rising energy needs, which should be a structural tailwind that supports this business through tariffs.

- Megapack deployments from Shanghai have begun.

- Deployment headwinds included shifting to powerwall deployments that come at lower volume but higher margin.

Optimus:

The team spoke about design flaws for Optimus versions 1 and 2. While that’s not overly concerning for a brand new product, it’s a surprise. Last quarter, we were told Optimus version 2 would be sold to the public, but that no longer seems to be the case. Musk sees version 3 as the model that will eventually reach commercial scale. Prototypes will be made this year and production will grow next year. While there were supposed to be thousands of these robots doing useful tasks this year, it now sounds like that has been delayed to next year. Still, Musk reiterated plans for 1M robots by 2030. Again… His timelines are generally a bit off, so take that with a grain of salt. Still, if (key word if) he’s close to right about the multi-trillion dollar opportunity this product represents, being a year or two late probably won’t matter much.

More Notes:

- Added a 16,000 H200 GPU Gigafactory in Texas to expand access to compute. They have the equivalent of 67,000 H100 GPUs in capacity vs. about 600,000 for Meta.

- Its lithium refining and cathode production plant will begin production on schedule this year.

- Supercharges rose 18% Y/Y.

- It’s using AI to handle customer service inquiries.

g. Take

Bulls, I get it. You’re all focused on the promise that Optimus and Robotaxi can provide. And while Musk is often overzealous in his forecasts, you don’t need him to be right for those products to deliver strong financial upside. My issue is that the core business is mightily struggling beyond macroeconomic headwinds. And it’s struggling while the forward multiple approaches 200x.

In my mind, two things are true. First, Tesla is an iconic company. It has done more to advance the global EV industry than any other firm on the planet by far. It builds fantastic hardware and drives American innovation. I would love for this company to keep succeeding, but I have no interest in investing in it. This leads me to point #2. Investors are being asked to pay a sky-high multiple for financial performance that has now been bad for two years. They’re being asked to bank on future products making the current struggles meaningless and I’m just not willing to make that bet. This remains firmly in my too hard pile. I don’t think it’s worth the headache, but fully understand why some disagree.

Not a great quarter.