The full Amazon review is in section 2 of this article and is for paid readers. Upgrade below to read.

1. Mercado Libre Q3 2025 Earnings Snapshot

a. Mercado Libre 101

MELI is the e-commerce and logistics king of most of Latin America. It has a thriving marketplace and fulfillment business, with support for 3rd-party merchants. It also features a rapidly growing financial services suite and payments platform, entertainment offerings through partnerships, a quickly expanding ads business and a loyalty program called MELI+. That's where it laces a plethora of product utility into one unique consumer bundle. The business model resembles Amazon without cloud computing and with financial services. Here are the names of its various products:

- The e-commerce marketplace is called Mercado Marketplace.

- Logistics/Shipping is called Mercado Envios. Mercado Envios Full is its full-service logistics business for merchants. It handles all inbound and outbound activity, packaging and returns. It’s similar to Supply Chain by Amazon.

- The financial services business is called Mercado Pago, with its credit business called Mercado Crédito.

- MercadoShops is its white label store builder for other merchants to create a site fully integrated into the MercadoLibre platform.

- Mercado Play is its entertainment business, with key partnerships with Disney leaned on to fill out the library.

- Mercado Coin is its stablecoin. This can be used to shop on its site with exclusive perks for using it.

b. Key Points

- Several items weighed on margins as expected.

- Fantastic quarter for customer growth and engagement.

- Volatile macro in Argentina held back results.

- Credit health was again strong amid rapid origination growth.

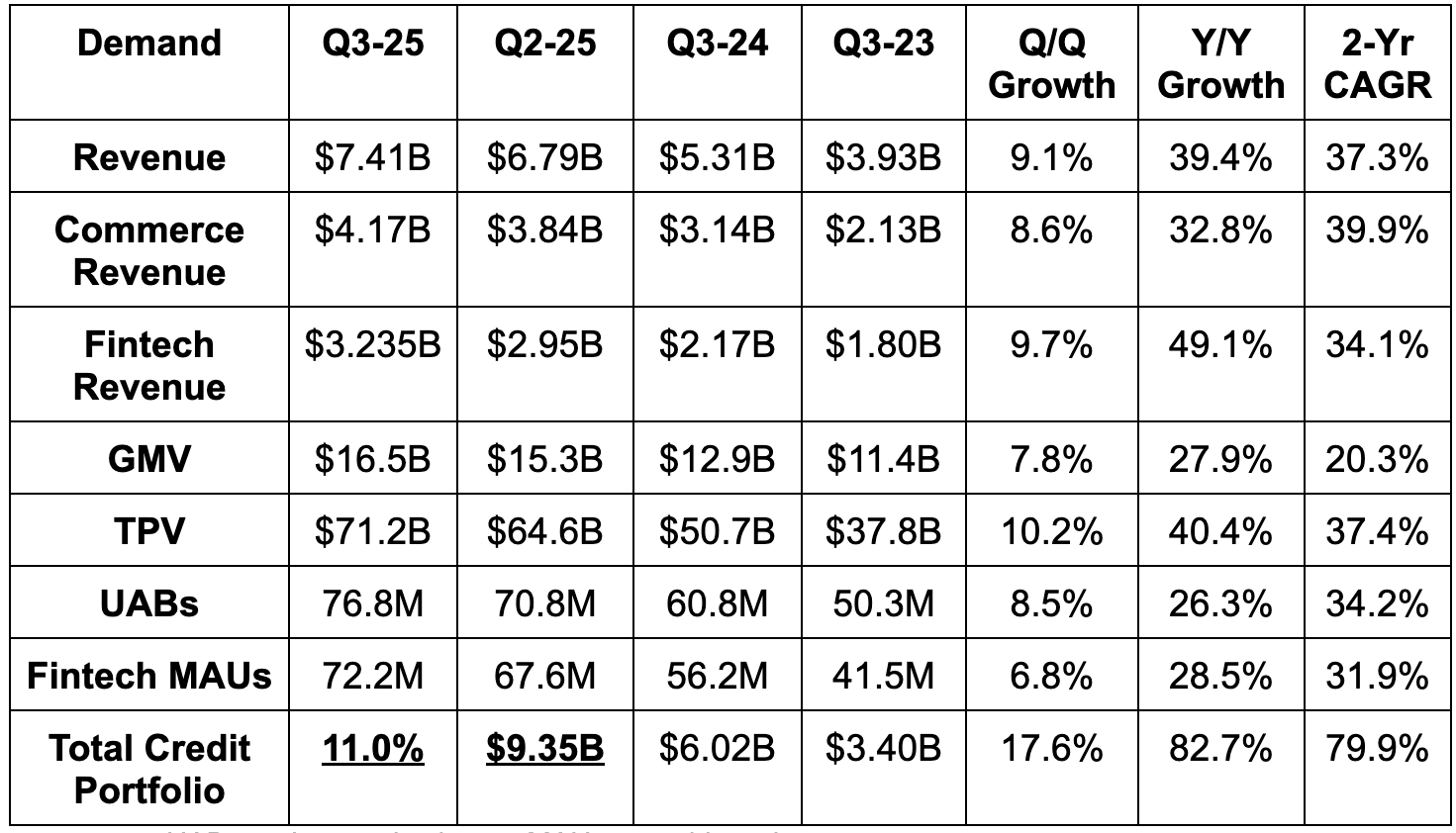

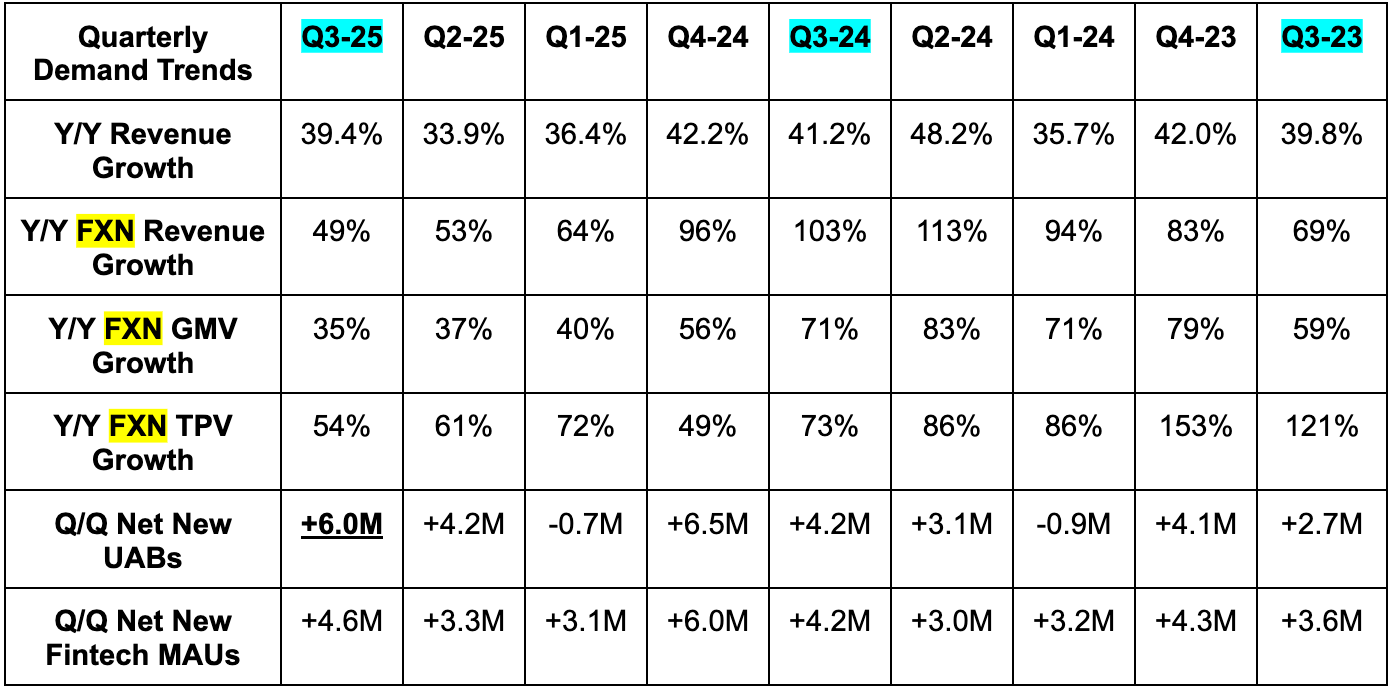

c. Demand

- Beat revenue estimates by 2.8%.

- Commerce revenue beat estimates by 3.2%.

- Fintech revenue beat estimates by 2.4%.

- Beat gross merchandise volume (GMV) estimates by 1.9%.

- Met foreign exchange neutral (FXN) GMV revenue growth estimates.

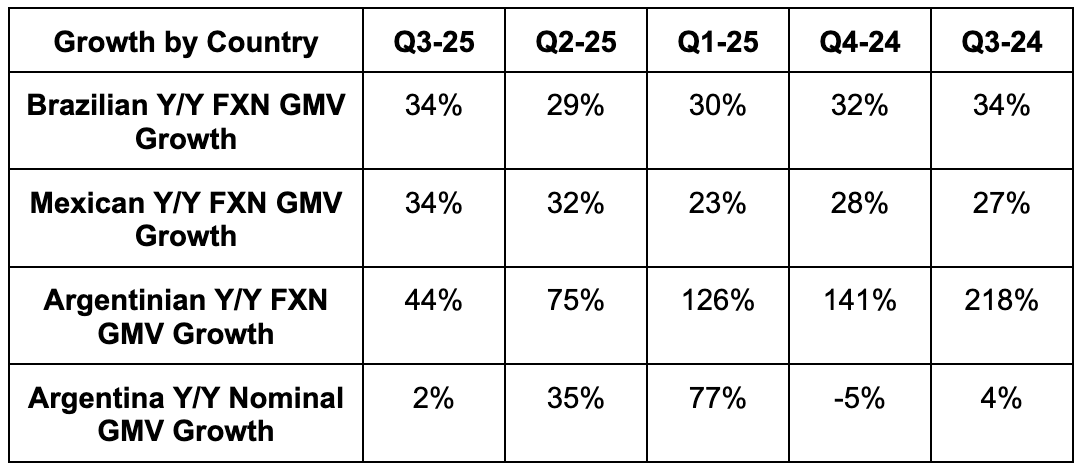

- 34% FXN GMV growth in Brazil beat 30% growth estimates.

- 44% FXN GMV growth in Argentina missed 65% growth estimates. Slower inflation weighed on nominal growth and was a source of slower FXN growth. Real growth (ex-inflation) remained strong.

- 34% FXN GMV growth in Mexico beat 28% growth estimates.

- Beat total payment volume (TPV) estimates by 2%.

- Beat unique active buyer (UAB) estimates by 3.6%.

- The credit portfolio is $11B in size vs. $10.1B expected.

By market, Brazil revenue beat estimates by 7.8% and grew by 38% Y/Y. That’s a meaningful 13-point acceleration vs. last quarter. FX helped, but I was still encouraged to see its largest source of outperformance come from Brazil. That’s the market where competitive concerns from players like Amazon and Shopee have been the most pronounced lately. MELI's initiatives (covered later in the piece) are working to drive demand. Argentina revenue missed estimates by 10% and Mexico revenue beat estimates by 6.4%.

The sequential acceleration seen below was helped by easier Y/Y comps, but that comp also includes lower shipping and merchant fees compared to last year. That makes the acceleration a lot more notable.

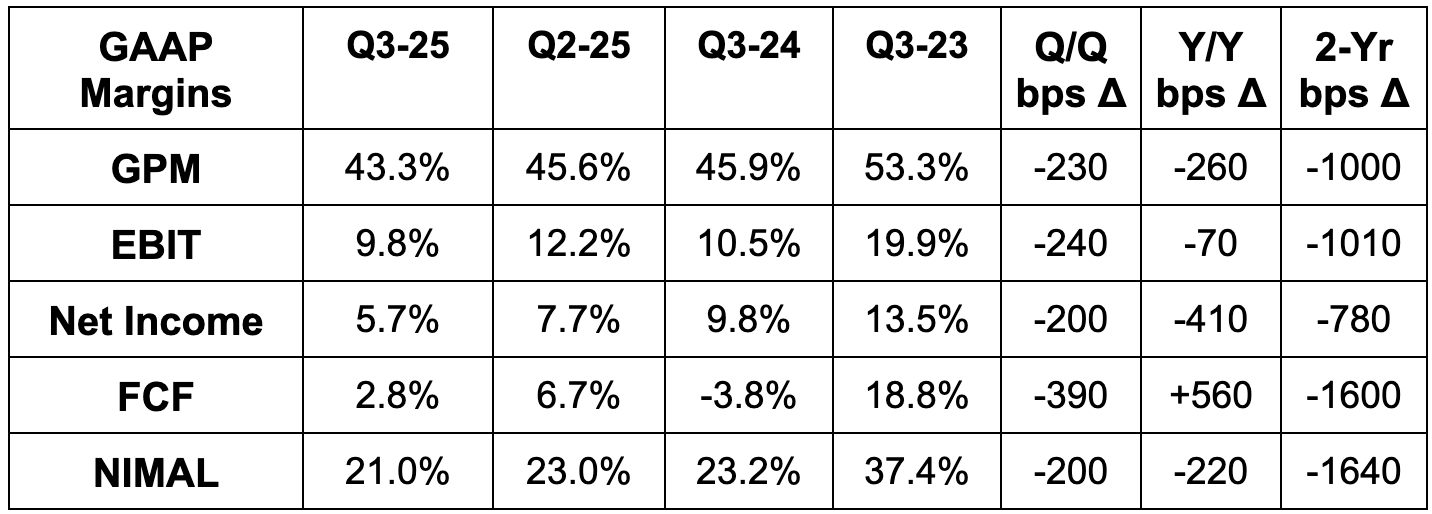

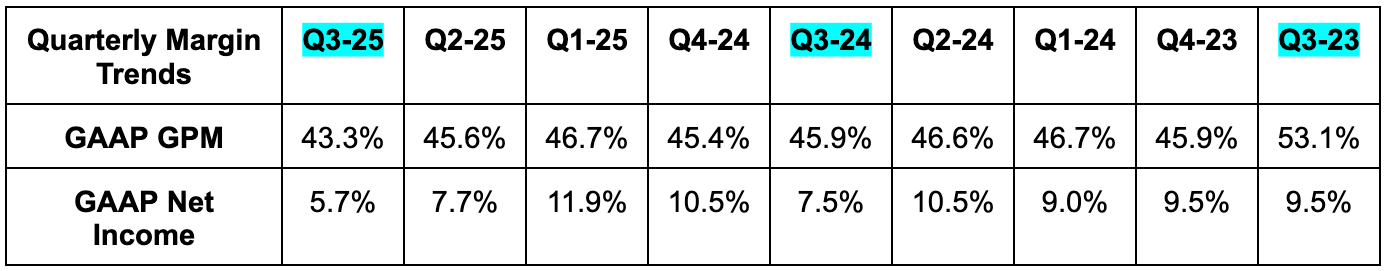

d. Profits & Margins

- Missed 45% GPM estimates by 170 basis points (bps; 1 basis point = 0.01%).

- Missed EBIT estimates by 4.7%.

- Marketing spend is probably going to stay right around 11% of revenue.

- Missed $9.69 EPS estimates by $1.37.

- Sharply missed FCF estimates by $1.1B.

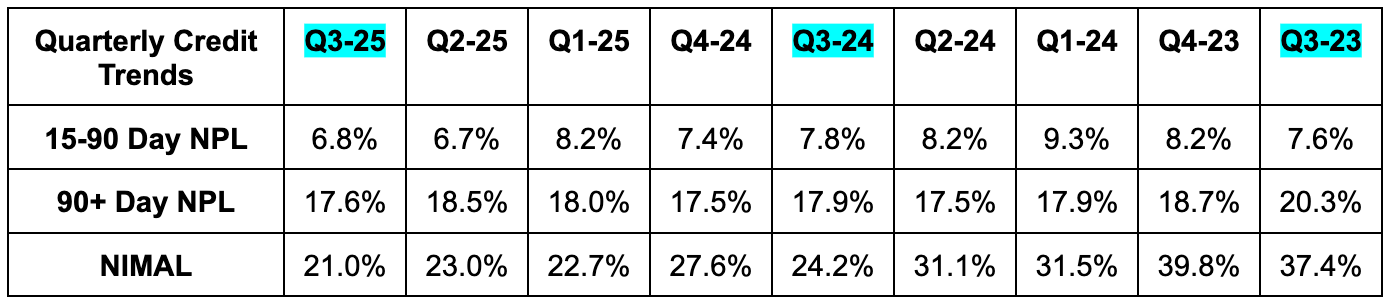

- Missed 22% net interest margin after losses (NIMAL) estimate by 100 bps.

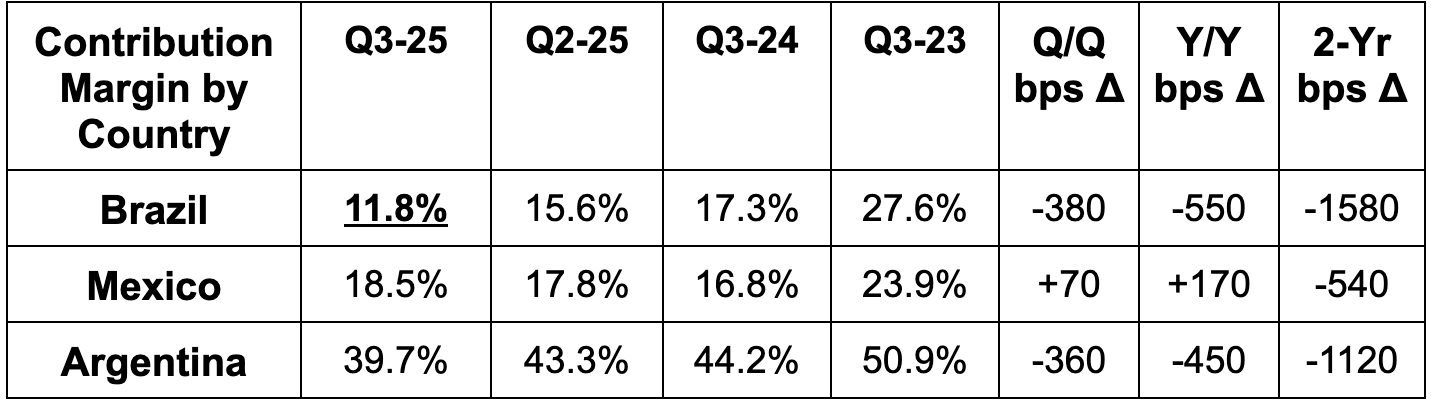

- For contribution margin:

- The 11.8% Brazilian margin missed 14.3% estimates.

- The 39.7% Argentinian margin missed 43.7% estimates.

- The 18.5% Mexican margin beat 17.2% margin estimates.

So much to discuss for margins. There were a ton of moving pieces that we covered throughout the quarter and had material impacts. It’s accelerating operating expenses (OpEx) across a few categories to extend its competitive edge and capture what is still a massive future opportunity. Examples include its lowered free shipping minimums in Brazil, which had a full quarter impact for Q3 compared to just a 1 month impact last Q. Other examples are its reduced Brazilian merchant fees, investments to grow 1st-party assortment in categories like grocery, more marketing and higher credit provisions stemming from overall portfolio expansion. That last factor is why FCF missed by such a wide margin. The credit book was nearly $1B larger than expected and originations count towards cash burn. That credit item is easing in terms of Y/Y margin headwind, but was expected to ease a lot more than it did.

The impact on contribution margin (especially in Brazil) is a lot more pronounced than the EBIT impact. And that’s actually very encouraging. The costs described above are all contribution profit drains right now. But? If they can deliver material boosts to revenue generation, it means added fixed cost leverage in areas like G&A that helps buffer the EBIT margin contraction. The fact that this is playing out is direct evidence that the growth investments are yielding real revenue gains. Immediately. It’s also how EBIT still managed to grow 30% Y/Y despite all of these large incremental costs. Not only are the investments a continuation of proven things that have worked for long-term profitability, but they’re occurring while MELI still delivers great near-term profit growth. That makes the strategy very easy for me to support. Time and time again, they’ve shown an ability to allocate capital in a way that fosters rapid market share gains. And they've turned those improvements into great returns. This should be more of the same, with plenty of data later in this piece supporting that opinion.

For Argentinian contribution margin, macro pressures led to rising funding costs and a 450 bps Y/Y headwind for that metric. It would have been flat without this factor. For net interest margin after losses (NIMAL), the note on higher Argentinian funding costs led to that decline and miss. Credit quality is stable or improving.

Net income growth of 6% Y/Y vs. 30% EBIT growth was related to two things. First, its tax bill rose 75% Y/Y to 34% of EBIT vs. 24% of EBIT Y/Y. Second, foreign exchange losses more than doubled Y/Y to $102M. Because Argentina is in hyperinflation according to GAAP accounting, negatively fluctuating asset valuations held in Argentine pesos count directly against net income. With a stable Y/Y tax rate and FX losses, net income would have grown by about 37% Y/Y.

And finally, there’s an added challenge for 2-year margin comparisons. MELI made a series of reporting charges during 2024. Mercado Pago’s interest income/expense was moved above the EBIT line. Mercado Envios changed to reporting gross revenue, rather than deducting shipping costs and reporting net revenue. This represents about a roughly 2-point margin headwind vs. 2023 comparisons.

e. Balance Sheet

- $6.3B in cash & equivalents.

- $1.3B in long-term investments.

- Flat share count Y/Y.

f. Guidance & Valuation

It doesn't offer guidance aside from saying "the best is yet to come" every quarter.

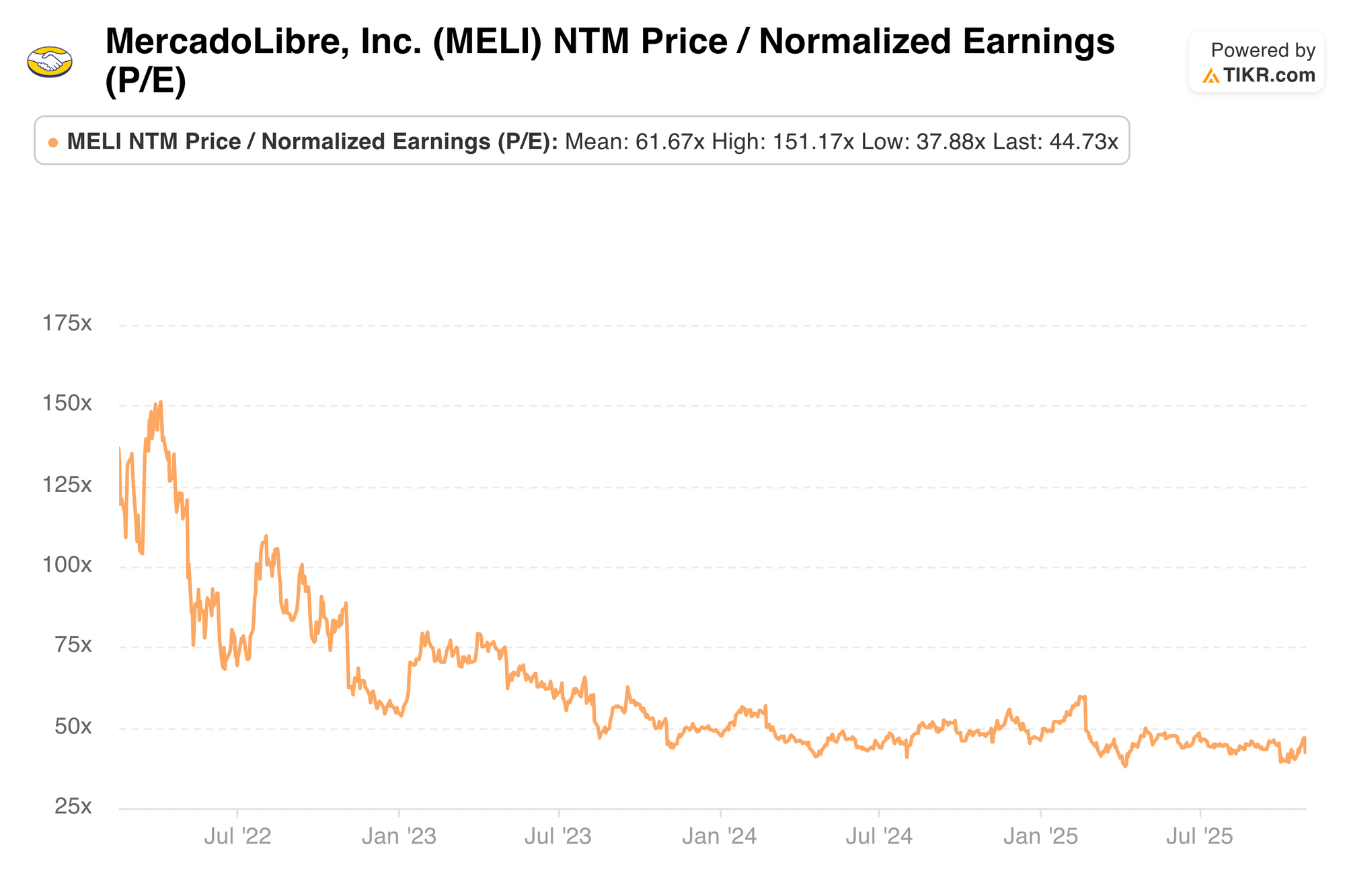

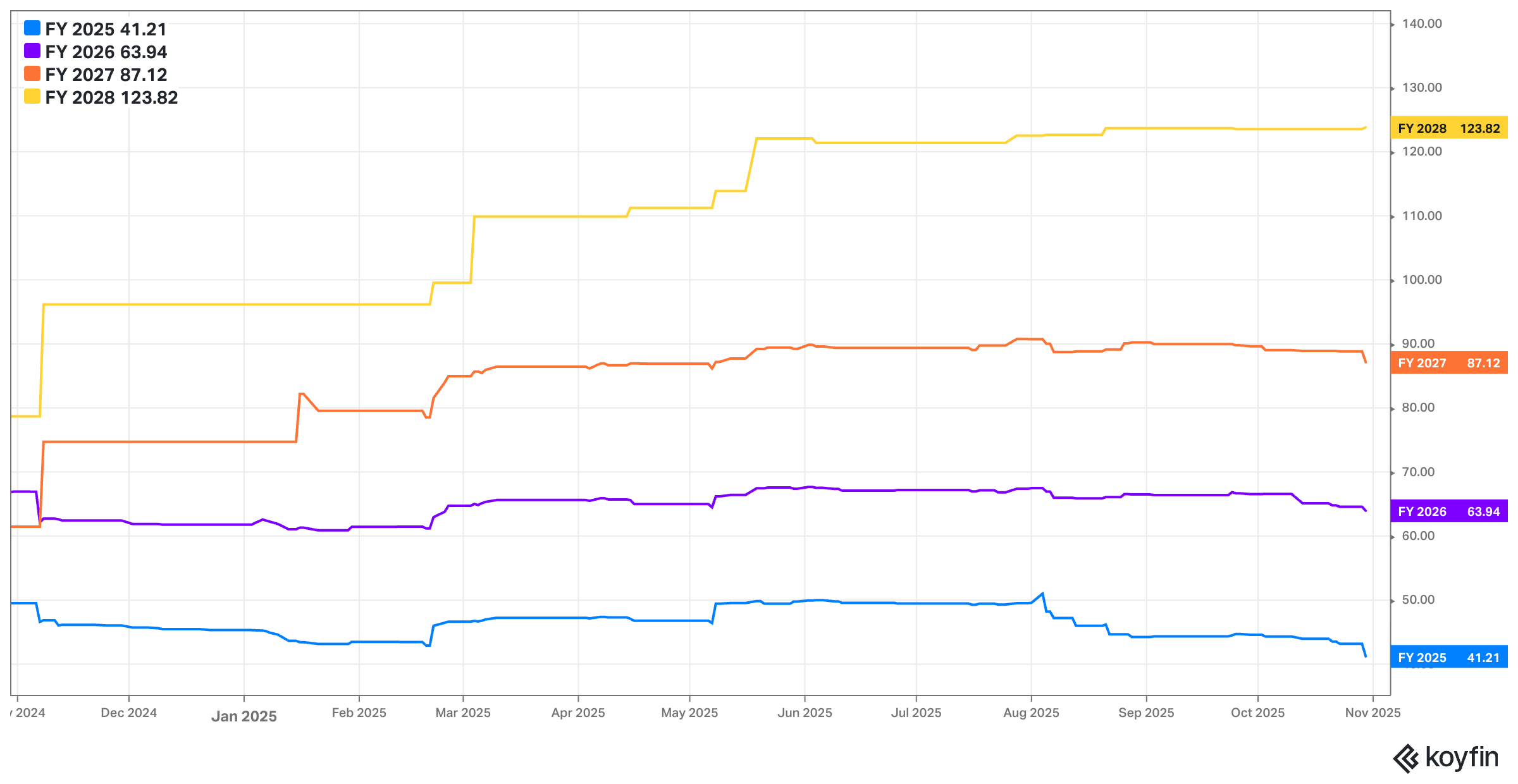

MELI trades for 45x forward EPS. EPS is expected to compound at a 46% clip in 2026 and 2027 after just 9% growth this year.

g. Call & Release

Credit Health:

Credit growth is so elevated because credit health is so strong. Their ability to use extensive customer commerce data to know borrowers better and more effectively underwrite is working well. Again, the NIMAL decline was related to Argentina macro, with a mix shift from personal loans to credit cards providing the rest of the decline. I repeat... credit quality is stable or improving. First time payment defaults set yet another record low in Brazil and improved in Mexico. These cohorts are clearly showing signs of future profitability, with around half of its Brazilian credit book now delivering a positive NIMAL. Mexico is earlier on in its journey but is showing the same pattern. As the book scales, the front-loaded provisioning will become a less intense part of the overall business because new credit will shrink as a portion of the book. That means the margin drag will keep easing.

- Credit quality in Mexico remains very good since re-accelerating originations a few quarters ago following a preemptive pullback.

Commerce Segment:

This category is showing the most obvious signs of aforementioned growth investments working. The lowered free shipping threshold in Brazil led to its fastest rate of buyer growth in 4+ years. The rate was faster than the pandemic peak. Items sold growth in Brazil and overall both improved accordingly. Their “market share gains accelerated” while customer delight reached new heights. Businesses also responded positively. Merchants with sales between R$19-79 (lowered free shipping threshold from R$79 to R$19) rose by more than 10% Y/Y; new listings within that price range rose by 200% Y/Y. All of this assortment delivered record conversion and retention rates. Lower fees… fueling more customer value... which powers more customer engagement… which motivates more assortment… which generates even more engagement.

While MELI makes this formula look easy, it isn’t. It’s actually quite hard to execute. The firm's ability is the byproduct of its world-class fulfillment network and cost efficiency work. Along these lines, unit shipping costs fell 8% Q/Q in Brazil thanks to better usage of its slow shipping network. They're getting better at batching orders, using excess capacity and shrinking deadweight loss within this part of the logistics footprint. As a result, Brazilian shipments rose by 28% Q/Q with zero impact on customer service... and again... while Brazilian unit costs fell.

The trend in Mexico is similar. The same cost fell 12% Y/Y while on-time deliveries set a new record.

- There’s plenty of margin improvement and scaling left to do with its existing slow shipping network in every market.

- In Argentina, 2025 is shaping up to be a record year for new customer growth. Same and next day delivery rose 7 points as a percent of total before they opened the new center in Buenos Aires.

- Added drop-shipping options from China in Argentina to support more assortment growth.

- Items sold growth in Argentina was 34% Y/Y despite worsening macro there during the quarter.

- As covered recently, it added a new assortment partnership with Casas Bahia to boost its market share in bulky home items and electronics.

Marketing:

Part of the added growth spending includes efforts in social media marketing. As leadership told us, Latin Americans spend more time on those services than a typical human. As a result, they’ve increased focus and grown affiliates by 4x Y/Y. Beyond this, brand campaigns across its core markets and Chile led to “record brand preference scores.”

Advertising Business:

The newer Mercado Ads platform is performing well. Off-platform relationships with companies like Google are allowing MELI to provide far more ad inventory to its customers. Partnerships with Roku and HBO will build on that trend and should help display & video ad revenue maintain nearly 100% growth. For now, overall FXN ad growth accelerated from 59% Y/Y last quarter to 63% Y/Y this quarter.

Loyalty Program:

MELI added a new shipping benefit for MELI+ members in Brazil. Those members used to be the only people able to access free shipping below R$79. That went away with the lowered minimum, so MELI added a different perk. Now, it lets members tap into this cheaper free shipping option with the same or next day MELI network, compared to the slower network for non-members. In other news, it launched a new Meli+ “super bundle,” with Disney+, Netflix, HBO Max, Apple TV and all of its existing perks in one package. Finally, it announced partnerships with McDonald’s, Petrobras and others. Now MELI+ members using a MELI credit card with those merchants will get unique cash-back rewards. They’re confident in the consumer subscription remaining the most compelling in the market and have plenty of ideas on how to further boost value.

Fintech:

Fintech net Promoter score (NPS) in Brazil set new highs. Leadership believes they have the highest NPS in the nation, but that’s based on “internal data” so it’s hard to verify. Regardless, the experience they’re delivering is resonating. Looking ahead, creating more primary banking relationships (PBRs) is key. It raises retention, credit quality and overall engagement. The push is going well, as the proportion of members using MELI for primary banking in Brazil rose by 11 points Y/Y. The credit card is a big piece of this strategy. It drives usage frequency and lifetime value gains in Brazil, and they want to match that in Argentina as well. Mercado Pago is already ubiquitous there thanks to QR payments and its savings account. They have more pre-card launch traction there than they did in Brazil or Mexico and I'm optimistic that Argentina will look just like those other two (or better).

Acquiring TPV:

Acquiring TPV refers to the piece of MercadoPago that lets merchants seamlessly tap into these easier payment options, augmenting conversion rates (through software and point of sale hardware). Acquiring TPV happens whenever MercadoPago is used as the main payment facilitator/processor on the marketplace or on a merchant’s own site (“off-platform” acquiring TPV). They’re taking market share “across all markets” thanks to popular credit, bank service and solutions like point of sale software and sales data analytics.

- Brazil is where competition is the most fierce, yet FXN Acquiring TPV grew by 28% Y/Y. Growth has been slowing across the sector while MELI accelerated there. Since they revamped go-to-market in that nation, results have been great.

- Mexico crossed 1 million active point of sale devices.

- Argentina Acquiring TPV rose by 53% Y/Y thanks to online payment resilience. In-store is weakening there a bit alongside macro.

Other Countries:

- Growth in Chile accelerated 10 points from last quarter. It also enjoyed 75% Y/Y fintech user growth there. They were notably excited about progress there.

- Growth also accelerated in Colombia for a 3rd straight quarter.