Table of Contents

- 1. Brief Earnings Snapshots — Apple, Airbnb & Duol …

- 2. Microsoft (MSFT) – Detailed Earnings Review

- 2. Amazon (AMZN) – Earnings Review

1. Brief Earnings Snapshots — Apple, Airbnb & Duolingo

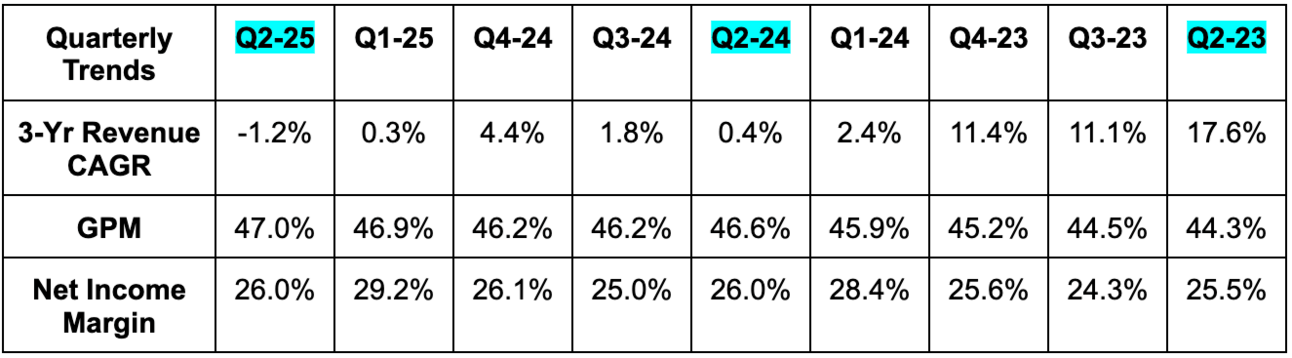

The detailed earnings reviews for all are coming soon. For Apple and Airbnb, revenue/profit is highly seasonal and Q/Q comps shouldn’t be focused on.

a. Apple (AAPL)

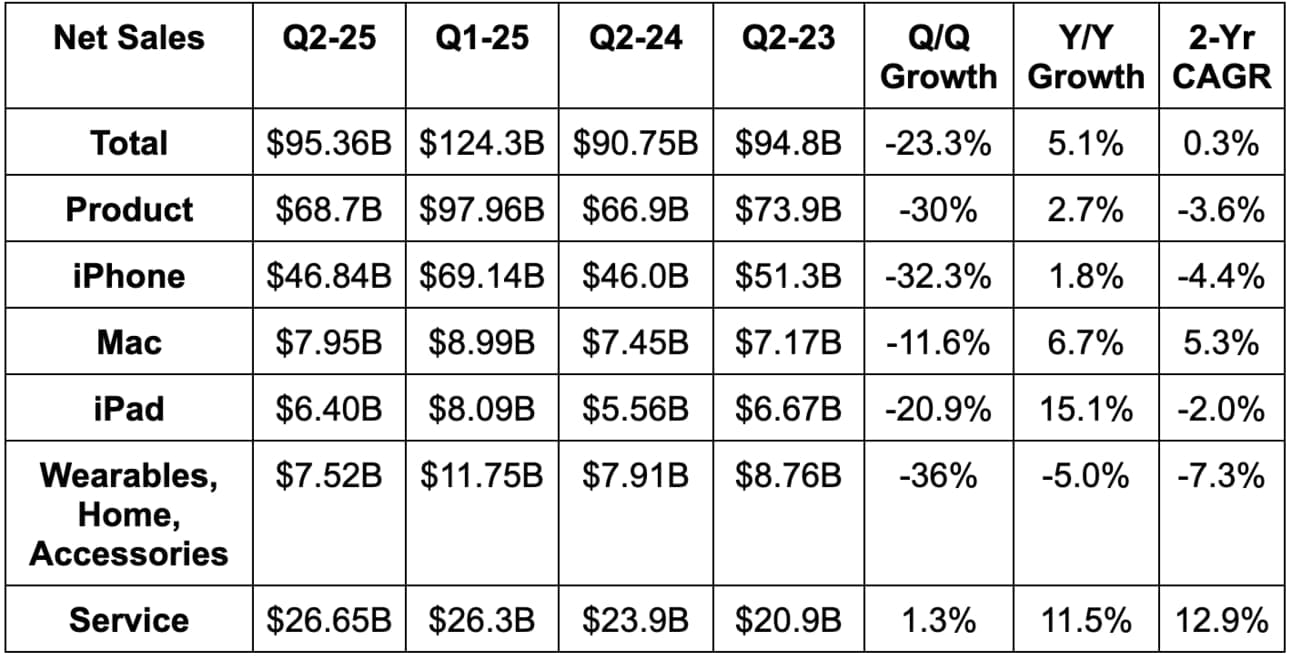

Demand vs. Expectations:

- Beat revenue estimates by 0.8%. It guided to low-to-mid single-digit revenue growth. 5.1% Y/Y growth is a beat.

- Beat product revenue estimates by 1.3%.

- iPhone beat by 2.2%; Mac beat by 2.2%; iPad beat by 4%; wearables, home and accessories missed by 6.6%.

- Missed services revenue estimate slightly.

- China revenue missed by 5%.

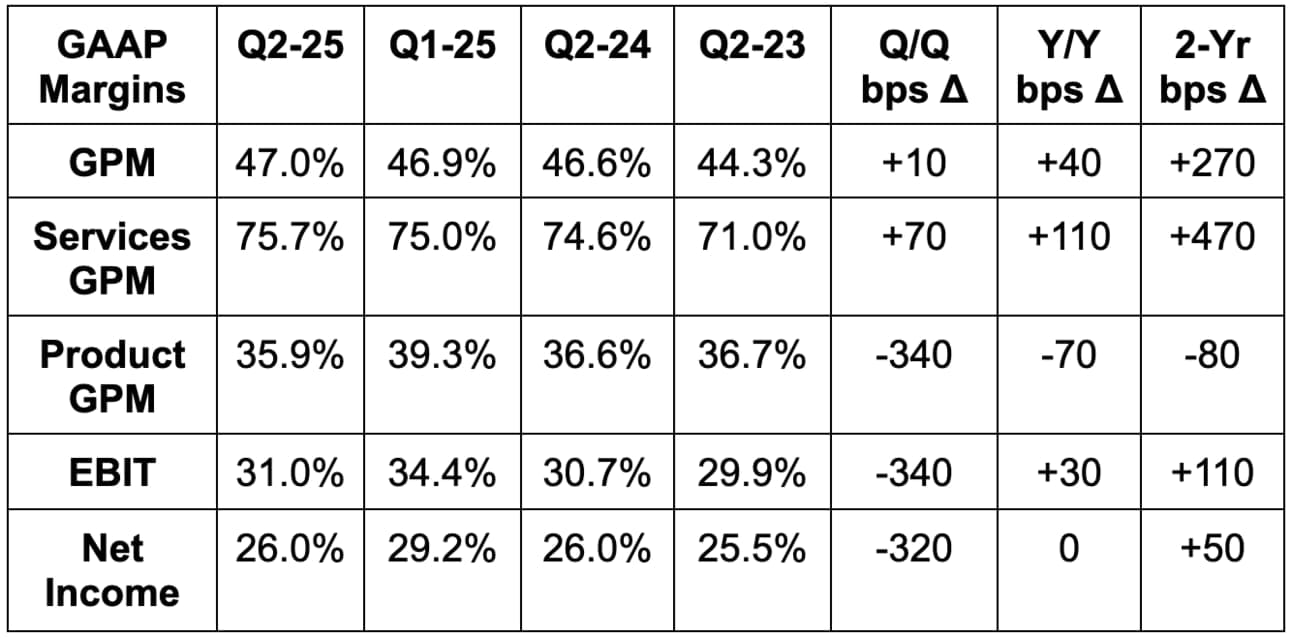

Profitability vs. Expectations:

- Met 47% GPM estimates.

- Met EBIT estimates.

- Beat $1.62 EPS estimates by $0.03.

- Missed FCF estimates by 21%.

Balance Sheet:

- $48B in cash & short-term marketable securities.

- $84B in long-term marketable securities.

- $92B in total debt.

- Share count fell by 2.7% Y/Y. Announced a new $100B buyback worth about 3% of its gigantic market cap.

Guidance & Valuation:

Low-to-mid single-digit revenue guidance for next quarter. If we assume that means 3% Y/Y growth, it missed estimates by 5.6%. 46% GPM guidance missed 46.7% estimates. EBIT missed estimates by 11%.

As of right now, Apple trades for 29x forward EPS and likely closer to 30x following this report. EPS is expected to compound at a nearly 9% clip for the next two years.

b. Airbnb (ABNB)

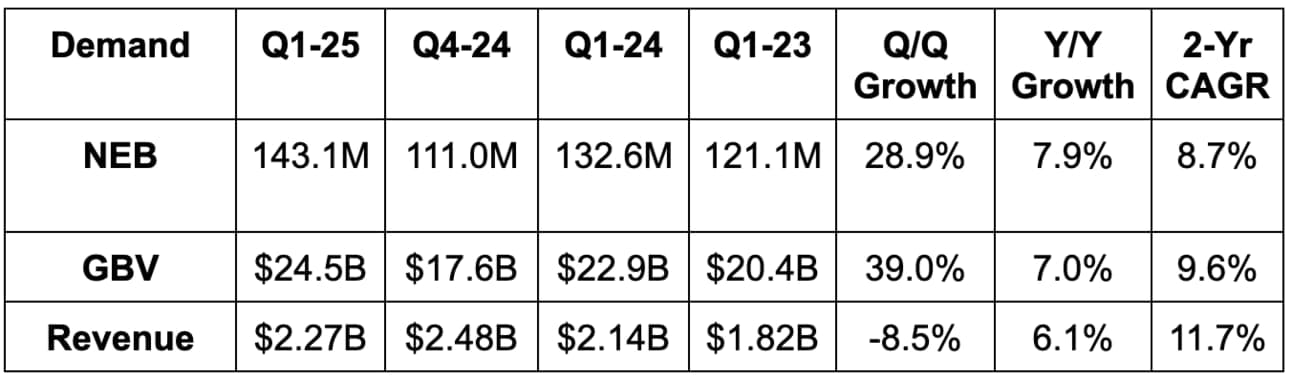

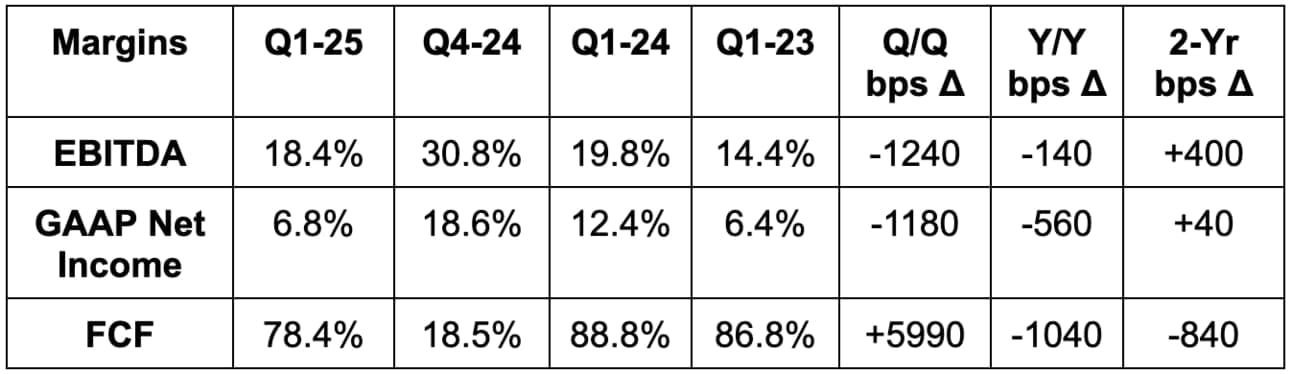

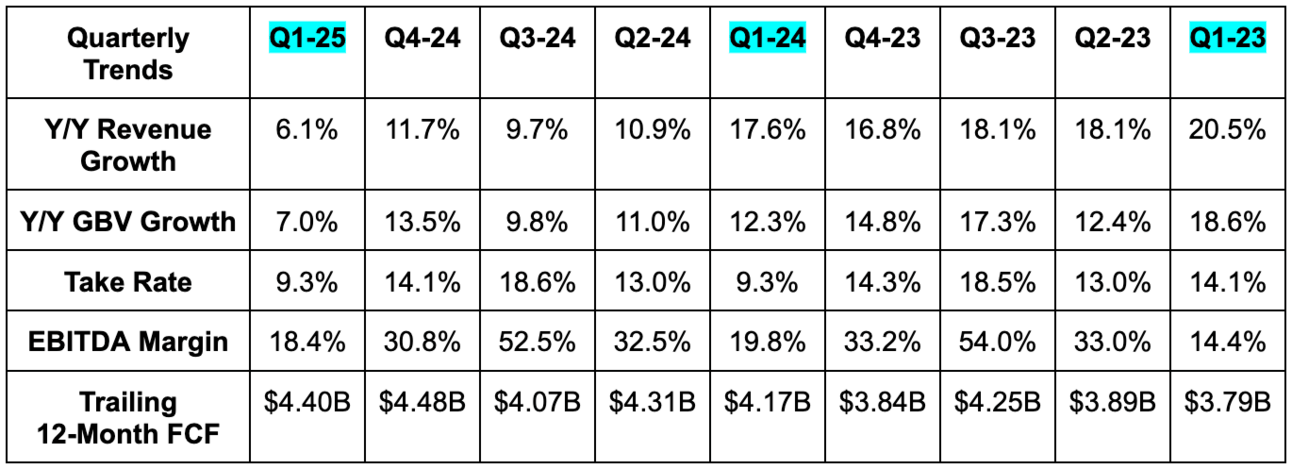

Demand vs. Expectations:

- Slightly beat revenue estimates by 0.4% & beat guidance by 0.9%.

- 8% Y/Y foreign exchange neutral (FXN) growth met guidance.

- Missed 9.5% Y/Y nights and experience booked (NEB) guidance with 8% Y/Y growth. NEB missed estimates slightly.

- Slightly beat Gross Booking Value (GBV) estimates.

Profitability vs. Expectations:

- Beat EBITDA estimates by 15.5%.

- Beat FCF estimates by 20%.

- Met $0.24 GAAP EPS estimates.

Balance Sheet:

- $11.5B in cash & equivalents.

- $2B in current debt.

- Share count fell by 2.5% Y/Y/

Guidance & Valuation:

- Slightly missed Q2 revenue estimates.

- Flat to down Q2 Y/Y EBITDA margins are in-line to slightly better than estimates. Consensus was looking for a little more than a point of Y/Y margin contraction.

- Reiterated annual EBITDA margin guidance of 34.5%.

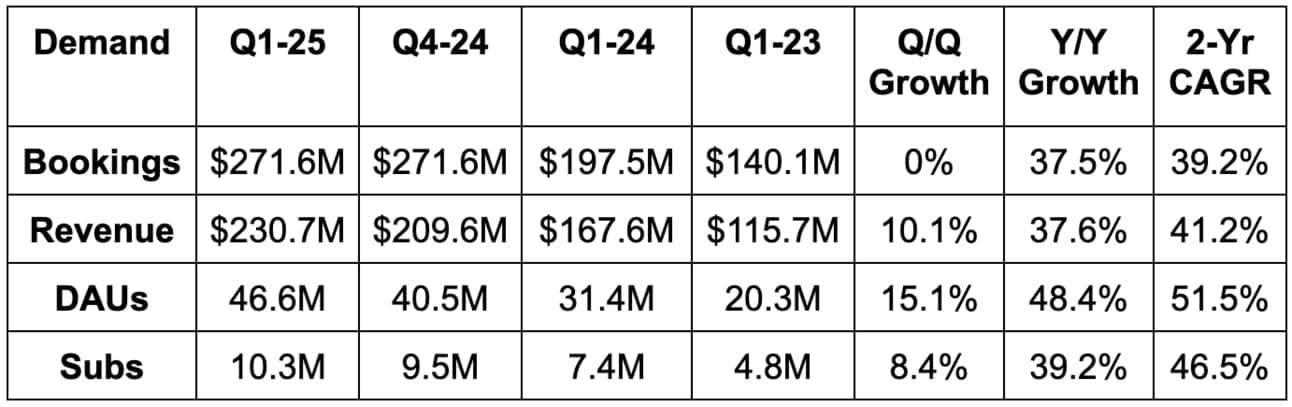

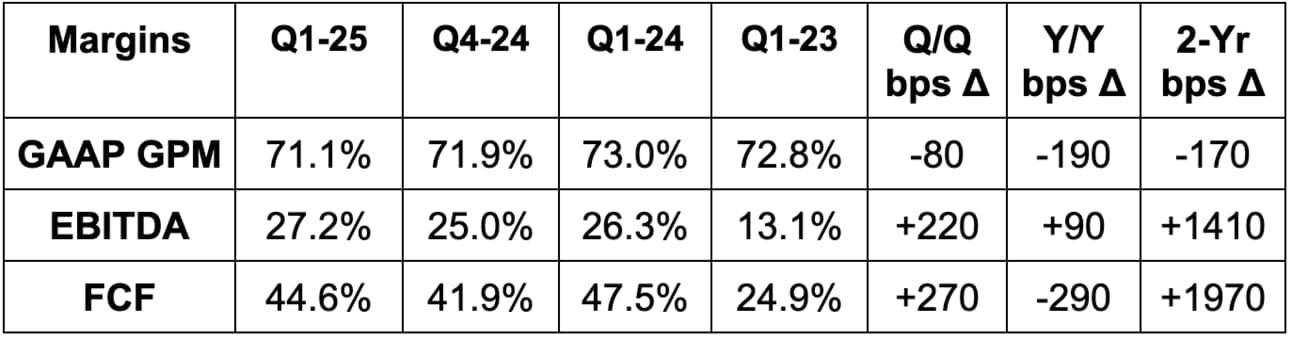

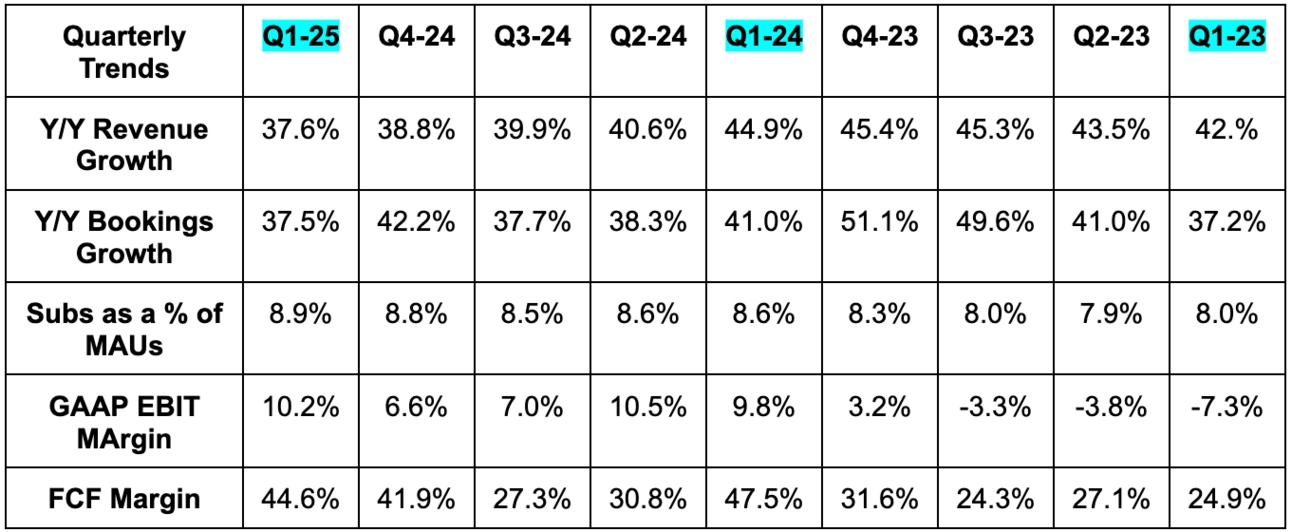

c. Duolingo (DUOL)

What an excellent quarter this was. I can’t wait to write the review. Spoiler alert — it will be positive.

Demand vs. Expectations:

- Beat bookings guide by 7.1%.

- Beat revenue estimates by 3.4% & beat guidance by 3.9%.

Profit vs. Expectations:

- Beat EBITDA estimates by 11.3% & beat guidance by 13.1%.

- Beat GAAP EBIT estimates by 16%.

- Beat $0.52 GAAP EPS estimates by $0.05.

- Beat GPM estimate by 60 bps.

Balance Sheet:

- $1B in cash & equivalents.

- No debt.

- Stock comp +24% Y/Y. Reiterated 1% shareholder dilution for 2025.

Guidance & Valuation:

- Raised annual bookings guidance by 2.3%

- Raised annual revenue guidance by 2.1%, which beat by 1.5%.

- Raised annual EBITDA guidance by 4%, which beat by 2.6%.

- The Q2 beats were a bit larger than the annual raises across the board.

Duolingo trades for 50x forward FCF and likely a few turns lower following this report. FCF is expected to compound at a 39% clip over the next two years. Those growth estimates will be revised higher.