In case you missed it:

- Meta & Robinhood Earnings Reviews.

- Alphabet & Tesla Earnings Reviews.

- SoFi & PayPal Earnings Reviews.

- Chipotle Earnings Review.

- ServiceNow Earnings Review.

- Netflix & Taiwan Semi Earnings Reviews (from two weeks ago).

- Portfolio Earnings Season Preview.

- Updated Holdings & Performance as of Today.

Table of Contents

- 1. Apple (AAPL) — Brief Earnings Snapshot

- 2. Microsoft (MSFT) — Detailed Earnings Review

- 3. Amazon (AMZN) — Detailed Earnings Review

1. Apple (AAPL) — Brief Earnings Snapshot

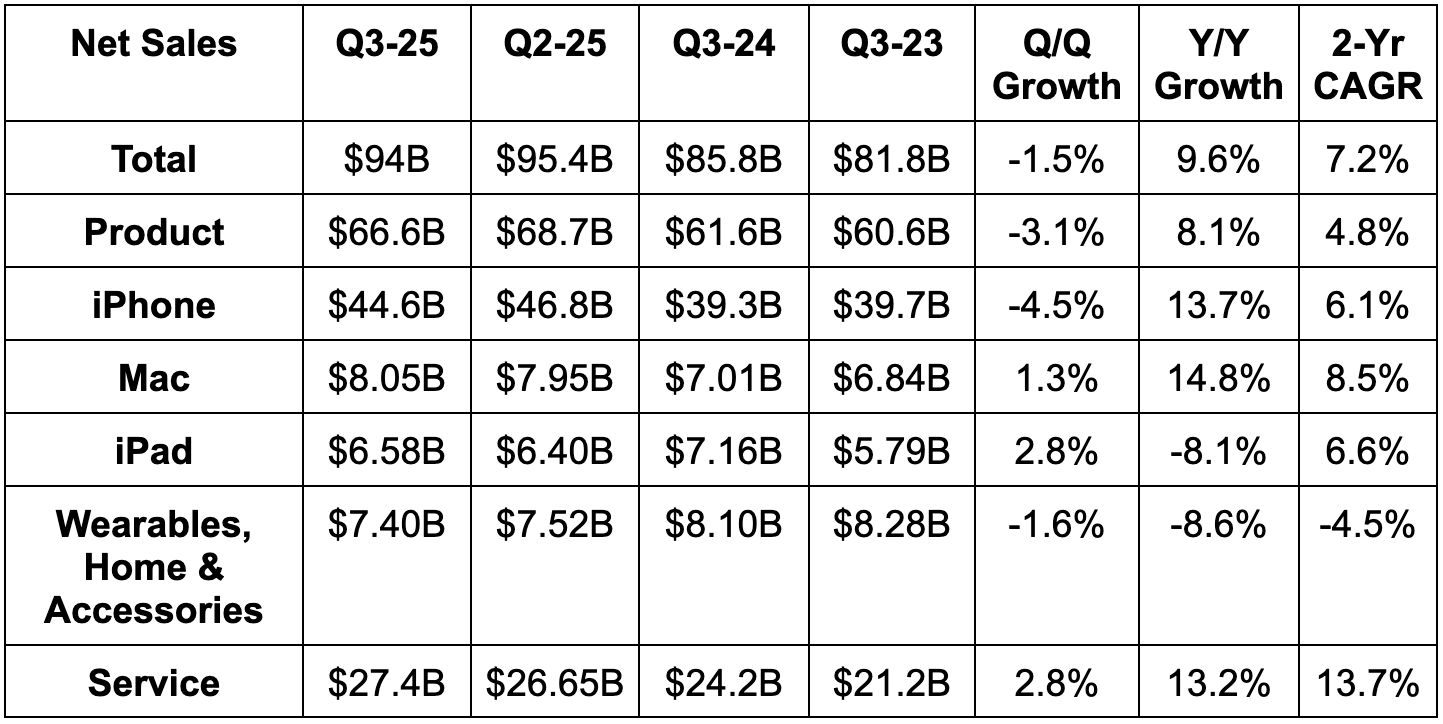

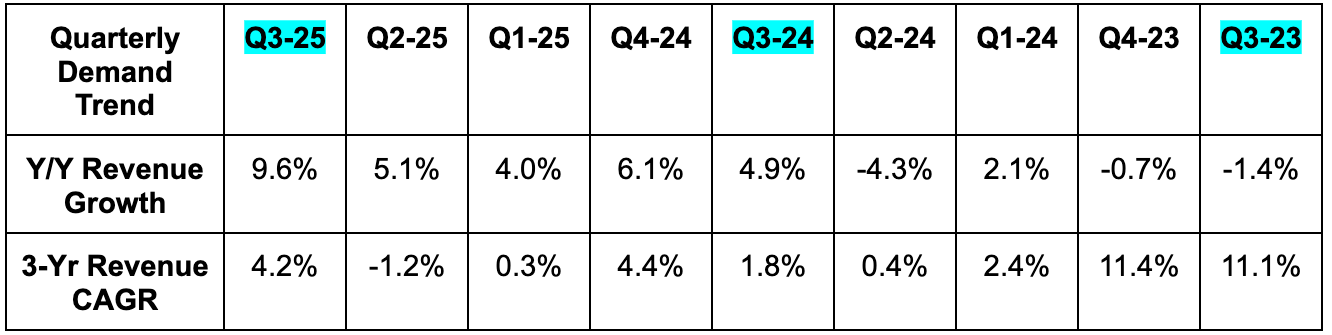

a. Demand

- Beat revenue estimates by 5.5% & beat guidance.

- Beat product revenue estimates by 6.1%.

- iPhone beat estimates by 11%

- Mac beat estimates by 10%.

- iPad missed estimates by 7%.

- Wearables, Home and Accessories missed estimates by 5%.

- China revenue was 1.2% ahead of expectations.

- Beat services revenue estimates by 2%.

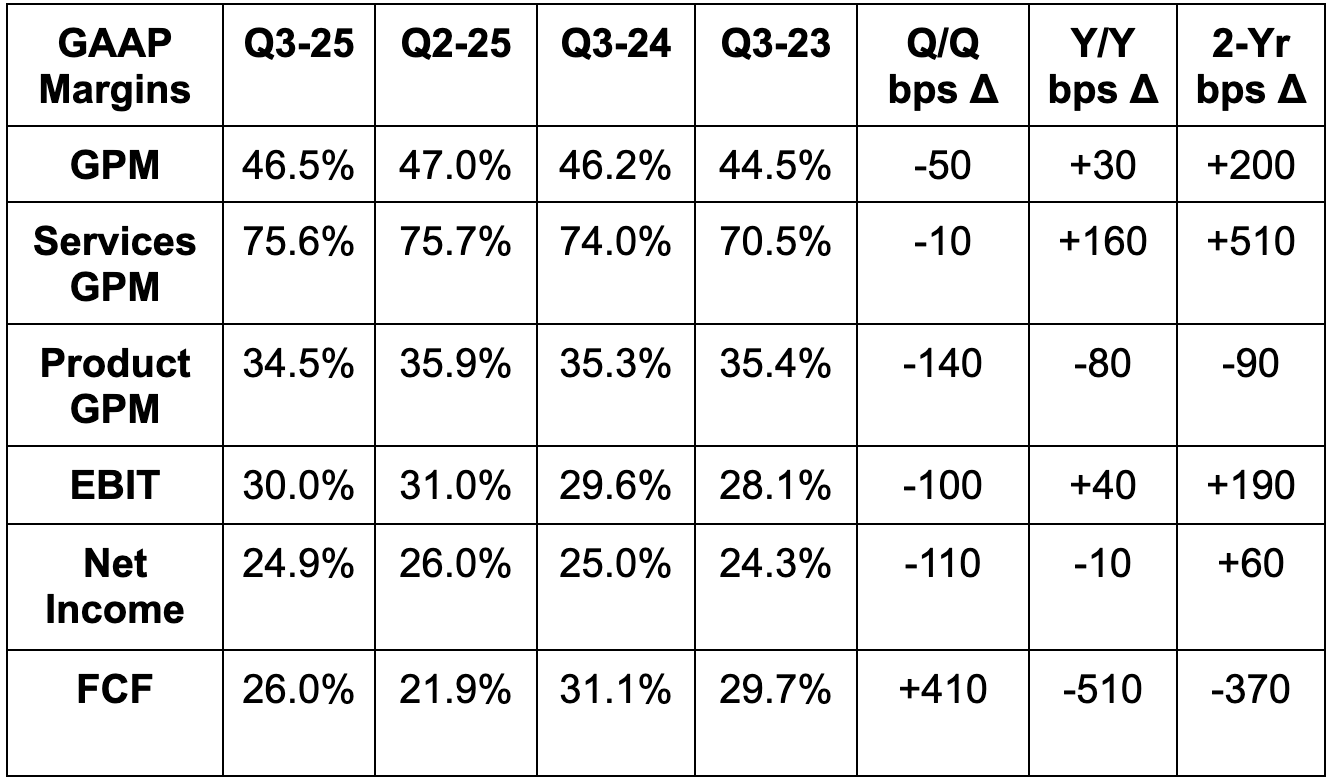

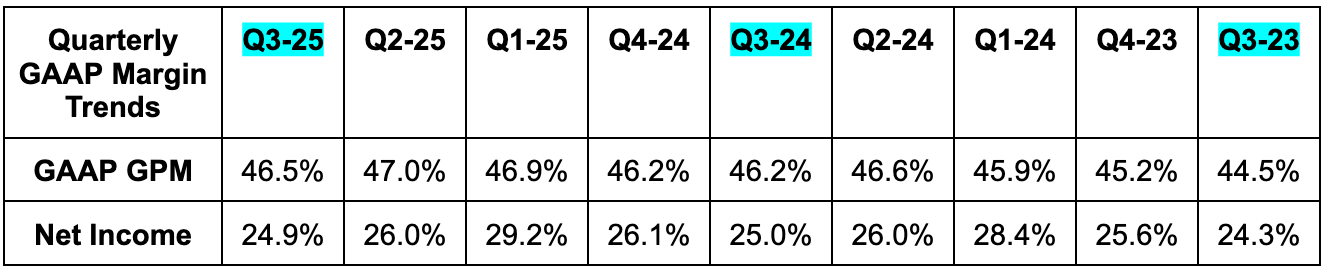

b. Profits

- Beat 46% GPM estimates & beat 46% guidance by 50 basis points (bps; 1 basis point = 0.01%) each.

- Beat EBIT estimates by 9.7% & beat guidance by ~10%.

- Beat $1.43 EPS estimates by $0.14.

- Beat free cash flow (FCF) estimate by 6.7%.

c. Balance Sheet

- $56B in cash & equivalents.

- $78B in non-current marketable securities.

- $92B in total debt.

- Share count fell by 2.6% Y/Y.

d. Guidance & Valuation

- Low-to-mid single digit revenue growth guidance was roughly in line with 3% growth estimates.

- 46% GPM guidance was also in line with estimates.

- Assuming their revenue growth guidance means 3% Y/Y, EBIT guidance was very slightly ahead of estimates.

- If we make the same assumption about their revenue growth guidance, EPS guidance is roughly in line with $1.66 estimates.

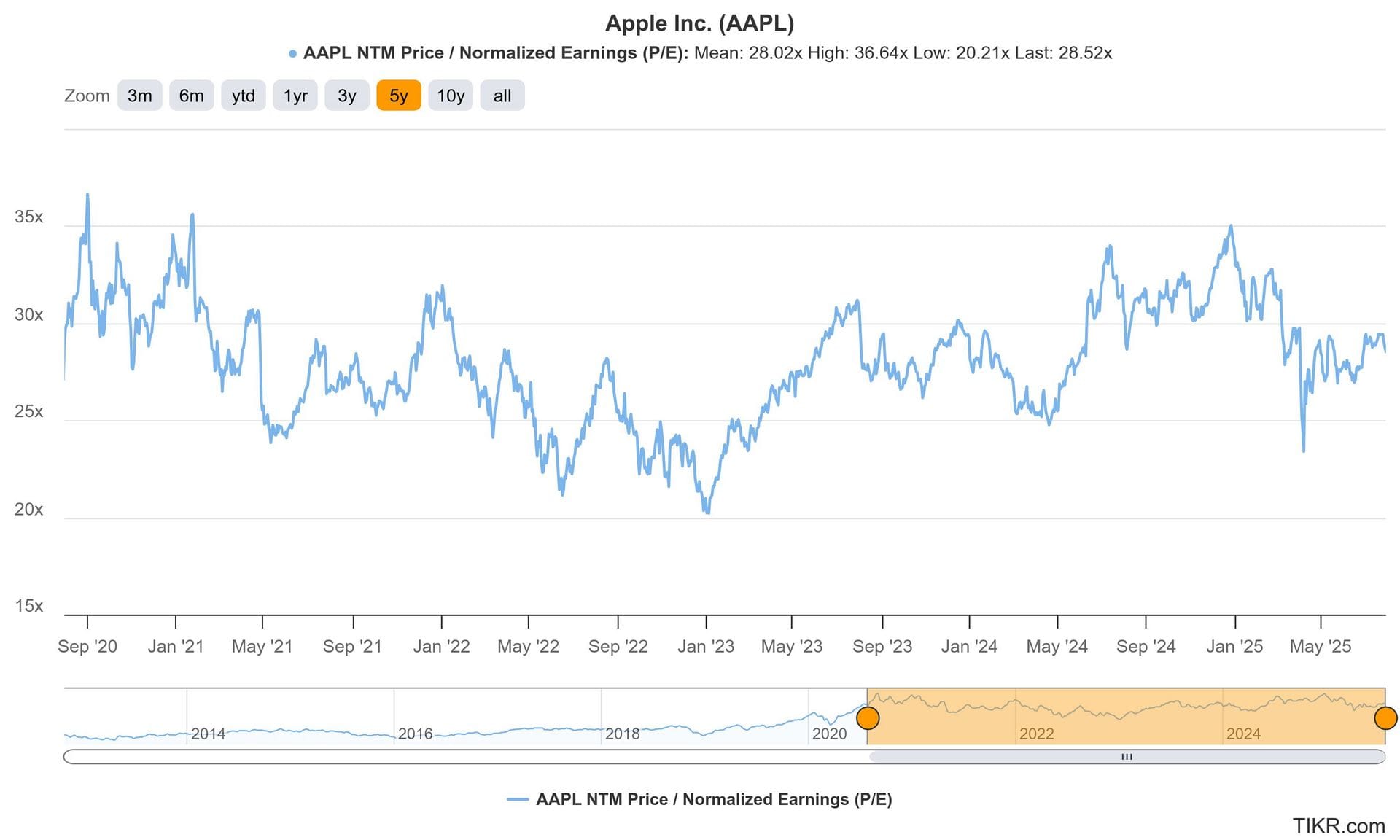

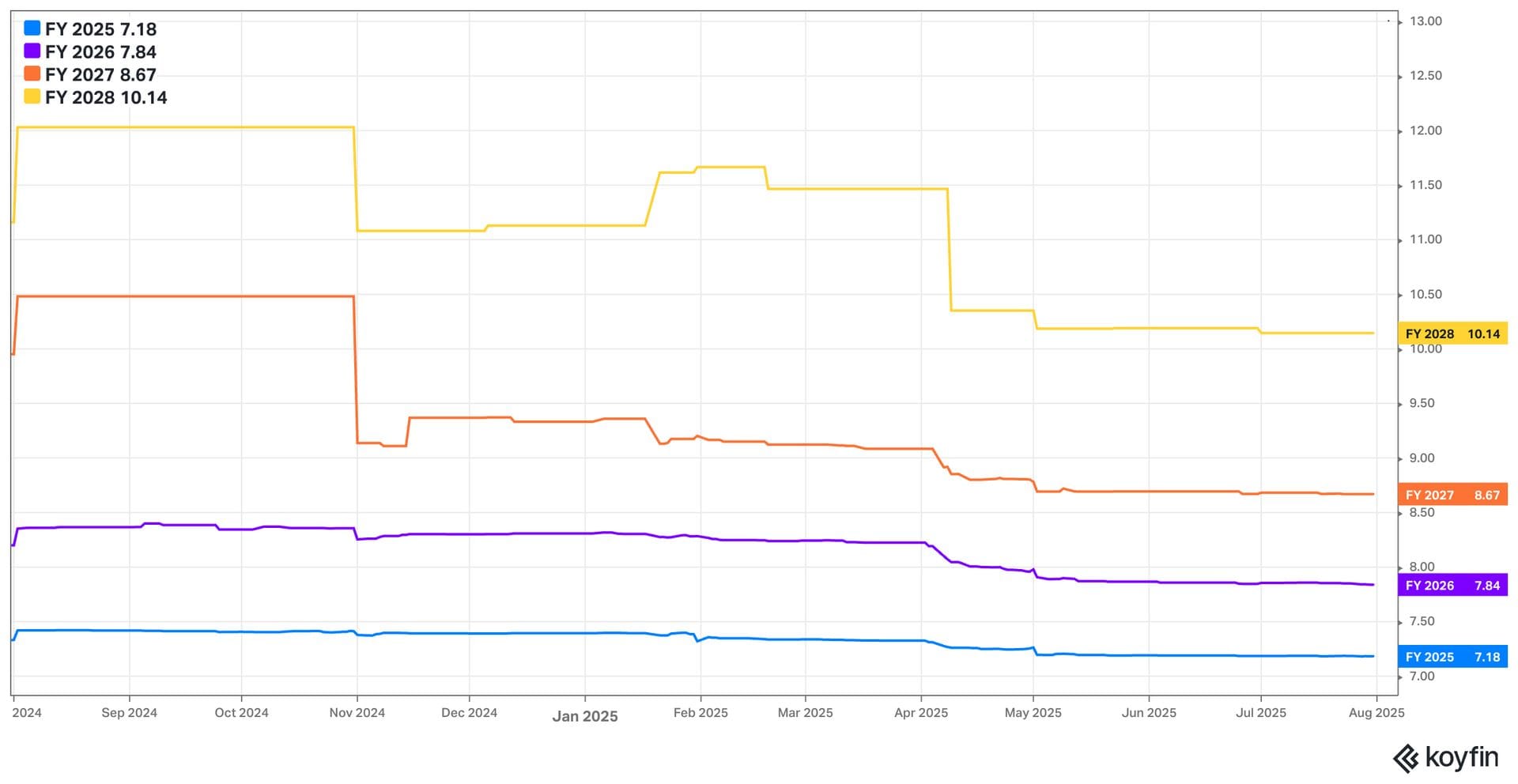

Apple trades for 29x forward EPS. EPS is expected to grow by 6% this year and by 9% next year. Estimates should rise a bit following the report.

I will have the rest of the review published on Saturday. This looks like Apple’s best quarter in over a year just based on the numbers. I need to read the transcript before I comment more.

2. Microsoft (MSFT) — Detailed Earnings Review

a. Key Points

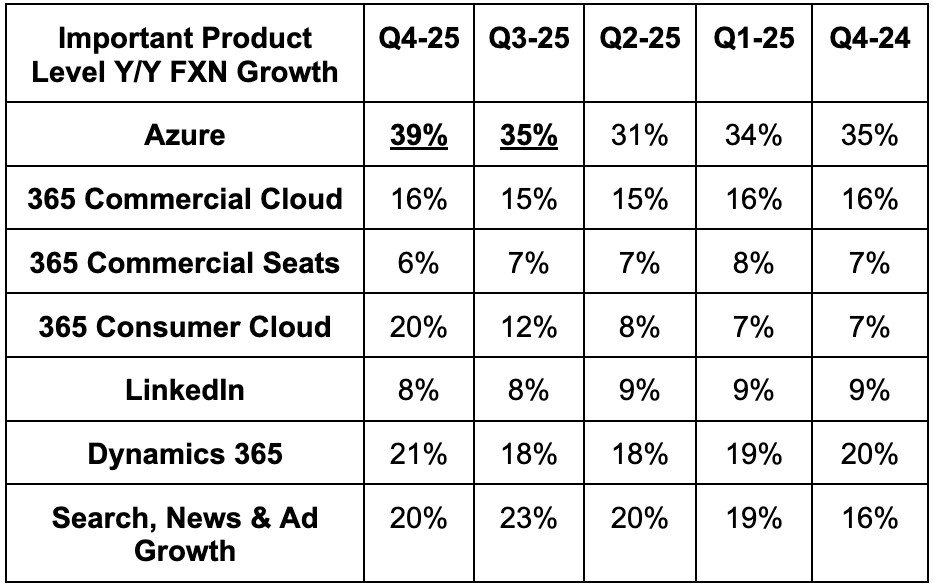

- Great Azure performance — especially for non-AI workloads.

- Continued rapid uptake of data products.

- Record quarter for commercial bookings.

- The CapEx spending spree will continue next quarter and is tied to near-term demand signals.

b. Demand

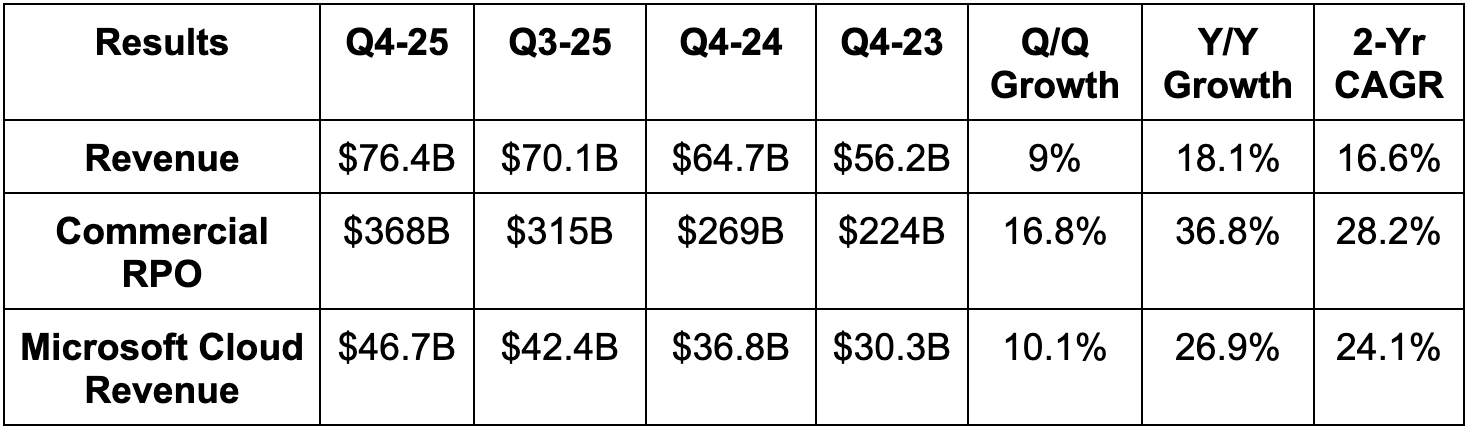

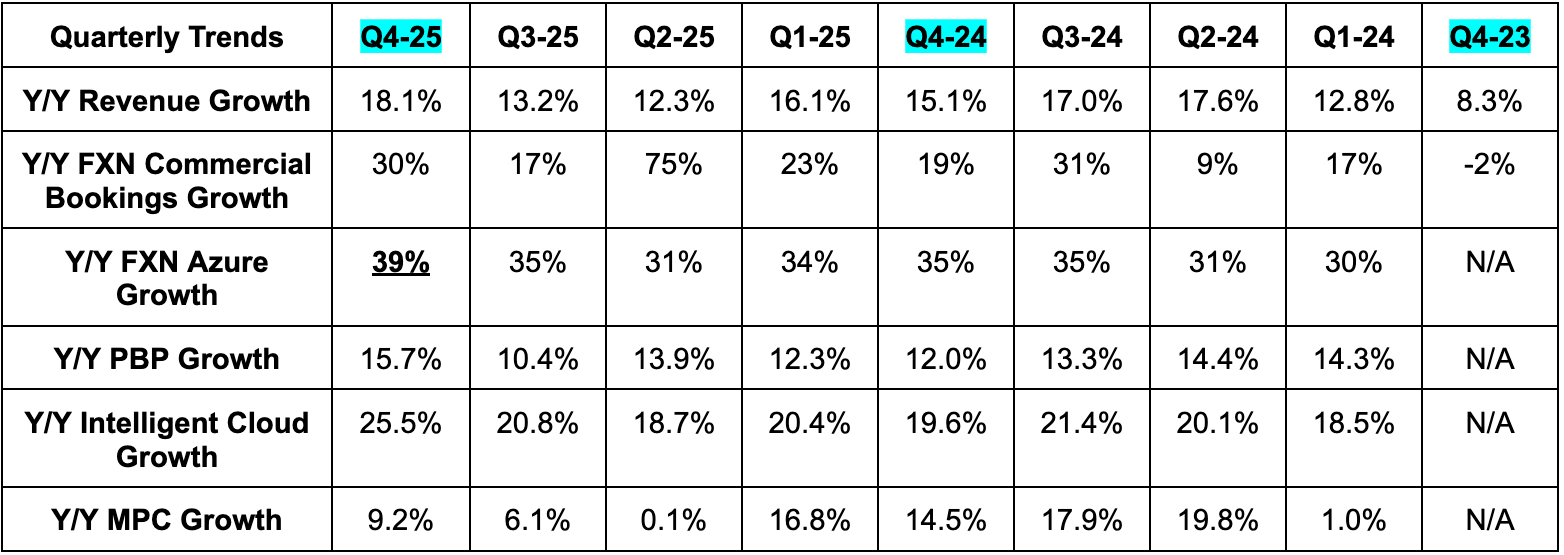

- Beat revenue estimates by 3.4% & beat guidance by 3.7%.

- Foreign exchange was as expected and did not contribute to the beat.

- Productivity & Business Processes (PBP) FX neutral (FXN) growth was 13% vs. 11.5% guidance and 15% estimates.

- Microsoft Consumer Cloud revenue beat internal expectations and Commercial Cloud trends were called “stable.”

- Intelligent Cloud FXN growth was 22% Y/Y vs. 21% growth expected.

- More personal compute FXN growth was 7% Y/Y vs. 3% growth expected.

- Beat 34.5% foreign exchange neutral (FXN) Azure growth estimates & guidance by 4.5 points each.

- Commercial bookings rose 37% Y/Y (30% FXN) and beat internal expectations. This was helped by great large deal momentum for Azure.

c. Profits & Margins

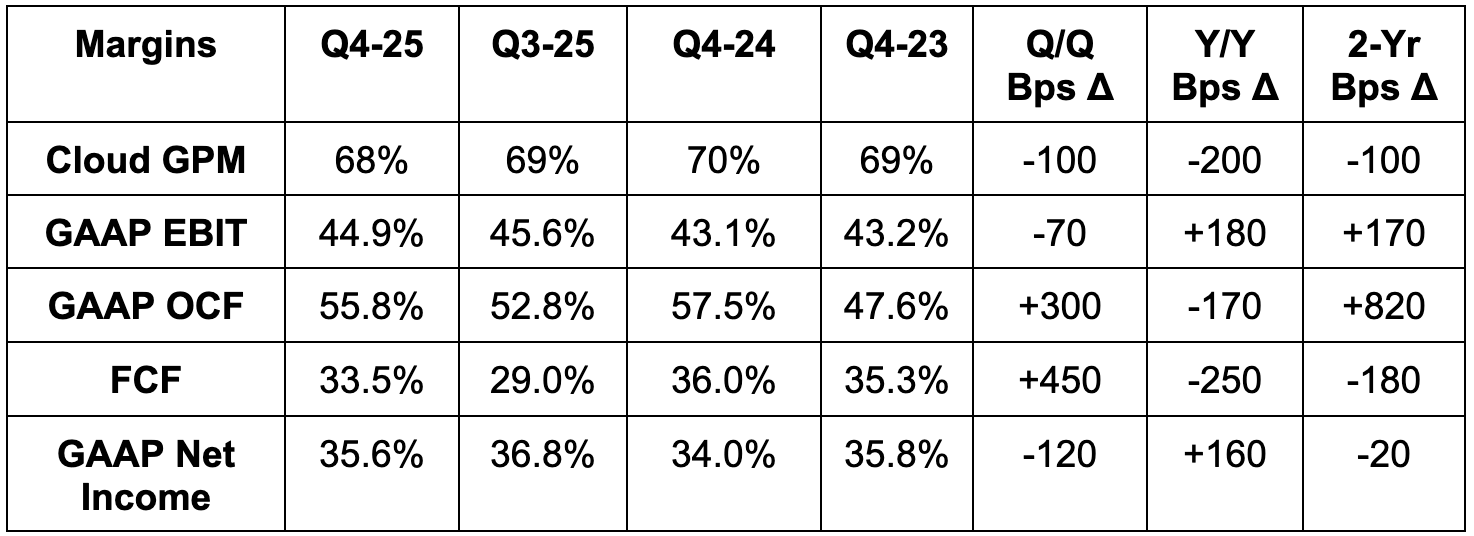

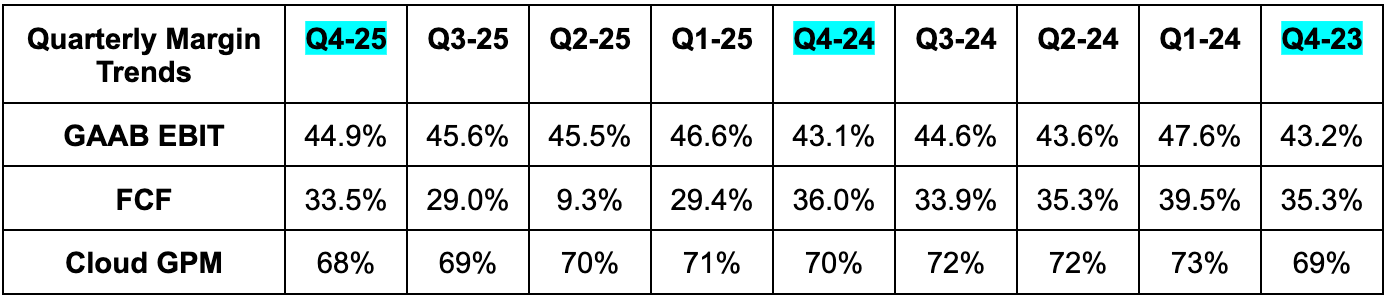

- Beat EBIT estimates by 6.8% & beat guidance by 7.3%.

- OpEx rose by 6% Y/Y. The EBIT beat was powered by revenue outperformance and cost controls.

- Beat $3.37 GAAP EPS estimates by $0.28.

- EPS rose by 24% Y/Y.

- Beat FCF estimates by 21%.

- Microsoft Cloud GPM fell 2 points Y/Y due to Azure infrastructure buildouts, though this was offset by some Azure efficiency gain.

d. Balance Sheet

- $94B in cash & equivalents.

- $40B in debt.

- Slight Y/Y share count reduction.

- 11% Y/Y dividend growth.

e. Guidance & Valuation

- Q1 revenue guidance beat estimates by 1.4%.

- Q1 EBIT guidance beat estimates by 3.5%.

- Q1 cloud GPM is expected to fall to 67% due to more infrastructure spending.

They also see more than $30B in Q1 CapEx. 50% of this is tied to short-lived assets like servers to meet near-term demand signals. Customer interest continues to soar, and they need to spend to meet their $368B backlog. The spending is “highly correlated” with revenue opportunities in the coming quarters, which greatly diminishes the risk of poor ROI and wasted money altogether. While they thought they’d alleviate supply constraints by this June, that has now been pushed back to December, as they continue to have a hard time keeping up with demand. That’s good news for the demand runway.

For the full year, they expect 10%+ revenue and EBIT growth, as well as stable Y/Y operating margins. This led to revenue and EBIT estimates for next year modestly rising.

- Growth during the first half of FY 2026 will be higher than the second half due to timing of capacity coming online.

f. Call & Release

Azure and AI:

Azure took market share during every single quarter over its past fiscal year. Leadership pounded their chests about being better than the competition in terms of getting compute capacity online, and these growth rates support that opinion. They added 2 full gigawatts of compute over the last 12 months and now have 70 cloud regions, which leads the pack. All of these regions are equipped with liquid cooling capacity and are “AI-first.” There was a bit of concern about Microsoft losing some OpenAI business to Google Cloud during the quarter. It is very hard to notice any of that weakness in its 39% Y/Y growth rate at massive scale.

The company continues to obsessively work on software-driven optimizations for all of the chips and data centers they’ve acquired. That work delivered 90% gains in token capacity per GPU Y/Y, and the trend of improvement has a long runway remaining. It’s these software-based optimizations that MSFT specializes in and will foster the compellingly lofty ROI all of this spending is expected to deliver.

While execution here was certainly fantastic, the large outperformance for Azure actually came from its core infrastructure business; AI performance was in-line with lofty expectations. Pace of migrations again accelerated Q/Q as Microsoft distances itself from an underwhelming non-AI cloud quarter two periods ago. That weakness was a byproduct of shifting too much focus to the AI opportunity, and clearly it has effectively balanced priorities since then. Nestle migrated 1.2 petabytes of data to Azure with “no business disruptions,” which marks one of the largest migrations it has ever done with no transitional headache.

“We're still not anywhere close to the finish line, if at best, maybe in the middle innings of that.”

CEO Satya Nadella

- This quarter, Microsoft debuted its Sovereign Cloud, which it views as the “most comprehensive” product of its kind in the market.

- In the intersection of cloud and quantum computing, it introduced the “world’s first operational Level 2 Quantum Computer” during the quarter.

AI Apps:

As a reminder, Copilot is Microsoft’s GenAI assistant that it’s rapidly infusing into most of its apps. It crossed 100M monthly active users during the quarter while the firm now has 800M users of one of its AI products (including Copilot).

The large Microsoft 365 Copilot update went live this quarter. This consolidates AI use cases for 365 across search, collaborative notebooks and agents too. Changes led to a record quarter for 365 seat additions, with customers like Barclays adding 100,000 employees to their license (vs. 15,000 originally). UBS added 55,000 seats and Wells Fargo, Pfizer and a few others purchased 25,000+. All of this innovation-led momentum is keeping Copilot adoption of 365 (across consumer and commercial) “faster than any other Microsoft 365 suite, while usage and retention keep rising week after week.

For industry-specific news, its Dragon Copilot for health care customers grew “physician-patient encounters” by 7x Y/Y, with 1,000 Mercy Health System physicians now using this product to automate tedious work. Usage has already delivered 100,000 of time savings across these doctors and will expand deployment to all 5,000 of their providers this year.

- Its Researcher and Analyst reasoning agents have 10,000s of users.

- Added real-time notes translation for Teams.

- Dynamics 365 took market share.

- They think AI monetization will be powerful and similar to other types of software. This will include tiers for various levels of service and consumption needed to build products that run on Azure workloads. They’re already starting to build real momentum here.

The Intersection of AI and Data:

- PostgreSQL (standard query language) Definition: open-sourced relational database that primarily handles structured data and deployment.

- CosmosDB: this is its Not Only SQL (NoSQL) database product. NoSQL is perfect for handling unstructured data, which is vital for GenAI. It’s a great document-oriented addition to PostgreSQL’s more statically organized rows and columns of data.

- Microsoft Fabric: its overarching data analytics, engineering, warehousing, real-time analytics and Business Intelligence (PowerBI) platform. This is where data warehousing, Power Business Intelligence (aggregates and displays data from various sources to accelerate learning), and its overall data analytics businesses preside.

- Fabric offers seamless integrations with its other database and querying tools to provide flexible access to context-rich, relevant data to power its core functions. Fabric can efficiently replicate (or “mirror”) these databases into its data lake (OneLake). This is done without hefty onboarding work.

- ChatGPT uses PostgreSQL integration with Fabric to store query history and chats for each user.

Fabric enjoyed more fantastic growth, as revenue rose by 55% Y/Y and it crossed 25,000 total customers. That means 4,000 Q/Q net new customers, which is above 3,000 last quarter and 2,000 the quarter before. This remains the fastest revenue ramp out of any data product in company history. Whether it’s the real-time intelligence tools, which already has a 40%+ customer adoption rate within a year of launching, its multi-cloud data lake functionality or all of the other utility offered here, Fabric is prospering.

- In terms of partner database integrations, customer usage of Databricks and Snowflake through Azure continued to accelerate for another quarter.

More generally speaking, leadership thinks its suite of data products is perfect for something called context engineering. This means plugging the right data, with the optimal format into the right problem to collect “intelligence to actually deliver results.” Context engineering is vital for extracting value from models, apps and agents and Microsoft, with its diverse array of data services, is poised to offer this service at scale.

Azure & Developers:

Azure AI Foundry is Microsoft’s cloud-native platform for experimenting with, creating and deploying complex AI agents. It offers a full suite of tools to build, manage, optimize and deploy AI apps and agents. And in a world where model choice is top-of-mind, Foundry enables these developers to run training and inference through “many more models than any other hyperscaler.” This helped support 7x Y/Y Foundry token processing (benchmark for traffic and usage) growth.

All of these models specialize in somewhat different things, while developers all have their preferences. Considering this, it’s easy to see why Foundry allowing builders to seamlessly use all of them in one environment is so compelling. They added 15 new OpenAI models in the last year and will soon add Black Forest Labs and Mistral AI models as well. All in all, 80% of the Fortune 500 now uses Foundry. I realize Microsoft’s enterprise software ubiquity makes cross-selling new products a lot easier, but this is still very impressive to me.

For Azure AI Foundry Agent Service specifically, growth remains rapid. They added 4,000 customers Q/Q to reach 14,000 total in just 7 months since the launch. Nasdaq is using it to automate 25% of board meeting prep and 80% of the Fortune.

- Customers created 3M agents with Copilot Studio during the quarter. This is Microsoft’s secure developer environment to create custom AI agents on top of existing apps and models. It offers no-code tools to make this highly accessible.

Moving onto Github (its developer platform). GitHub Copilot grew customers by 75% Q/Q, while its new Agent mode and coding agents enjoyed “great momentum.” AI is bending the growth curve upward for this product as a “surge in vibe coding, coding review and coding agents” usage continues. Its overarching integration developer environment (IDE) is also performing very well.

Security:

- Debuted data lake functionality for its security information and event management (SIEM) product. This ingests security data for a consolidated picture of hygiene and vulnerabilities. They have access to 350 data integration partners for this tool.

- Microsoft Defender is now securing 2M AI apps.

- Microsoft Purview (a tool for unifying systems and data in one place for data loss risk management) is now being used by 75% of Microsoft 365 Copilot customers.

- It has 1.5M total security customers and “continues to take share across all major categories.”

Other Products:

- LinkedIn enjoyed 30% comment growth and 20% video upload growth on a Y/Y basis.

- It was the top gaming publisher for Xbox and Playstation. Call of Duty has “never been stronger” and Minecraft enjoyed “record monthly active usage and revenue.” The successful Minecraft movie is helping to drive interest.

g. Take

Excellent quarter. Azure was remarkably strong and the full-year guidance was also quite impressive. Microsoft continues to effectively bundle more and more solutions in its massive enterprise software suite and enjoy immediate adoption whenever it does. The hefty CapEx is entirely warranted based on near-term demand signals and every piece of this business looks to be full speed ahead. More fantastic execution from this elite team and company. Enough said.

3. Amazon (AMZN) — Detailed Earnings Review

a. Key Points

- AWS capacity constraints remain material and a growth headwind.

- More fulfillment network improvements drove continued Y/Y operating leverage.

- Kuiper has already signed several large contracts before commercial availability next year (maybe late this year).

- Tariffs haven’t impacted the business yet but they baked a headwind into Q3 guidance regardless.

b. Demand

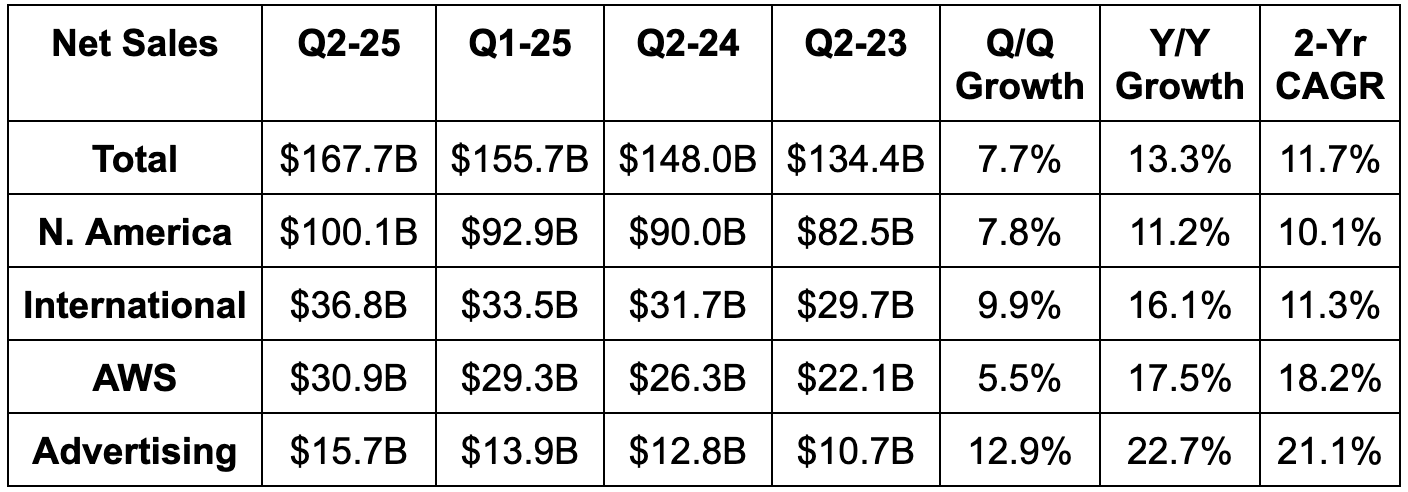

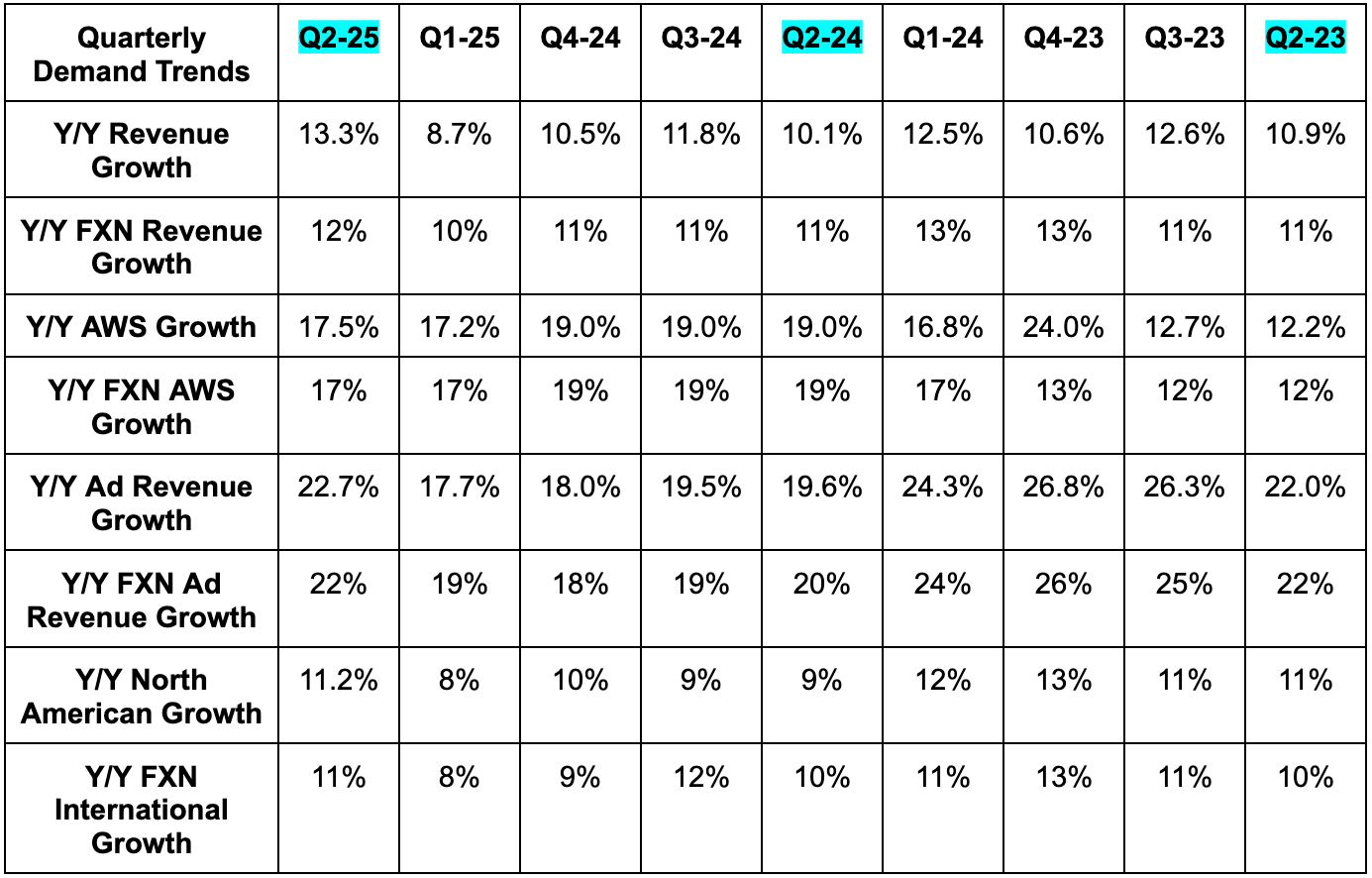

- Beat revenue estimates by 3.4% & beat guidance by 3.8%.

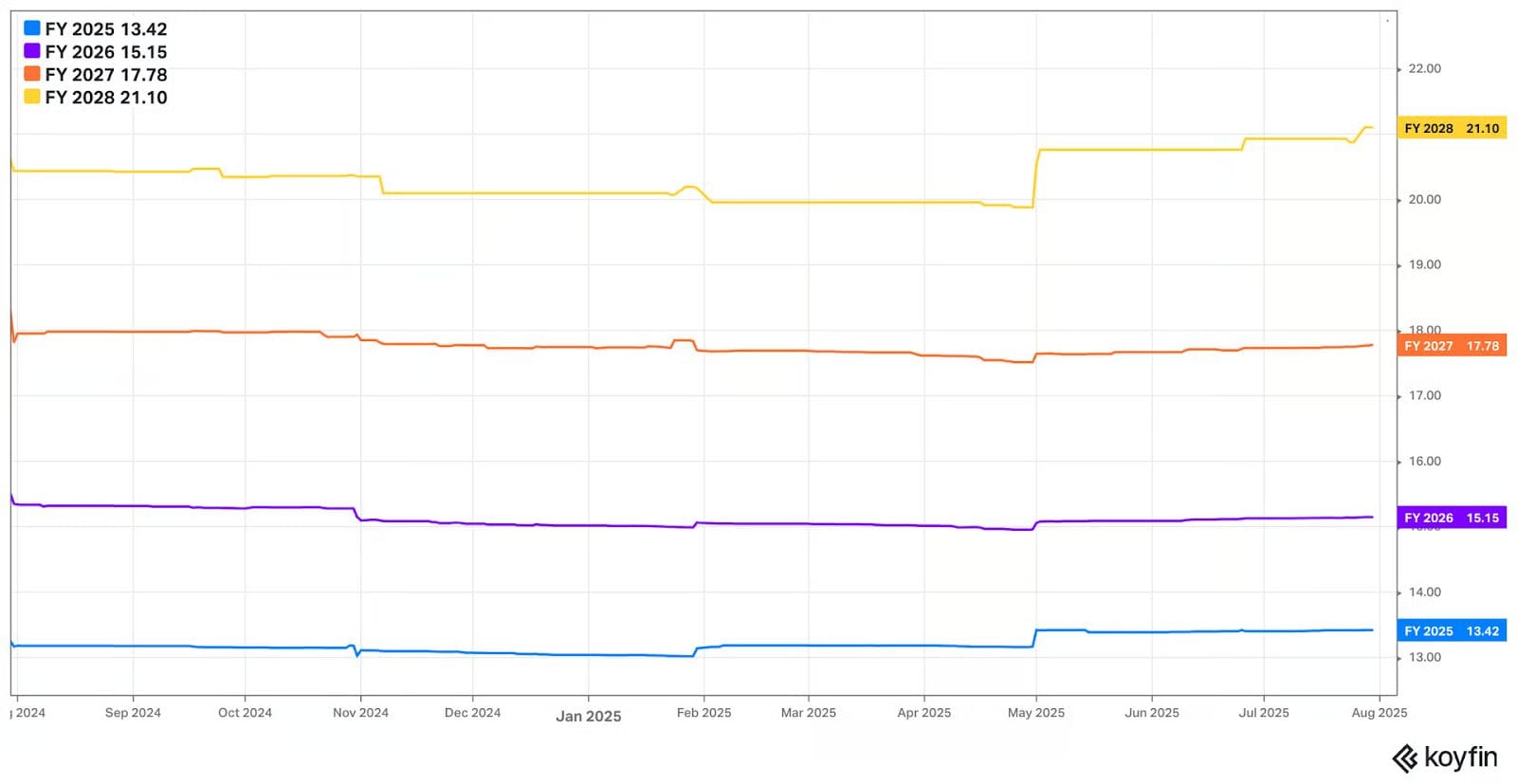

- Its 11.7% 2-yr revenue compounded annual growth rate (CAGR) compares to 8.7% Q/Q & 12.2% 2 Qs ago.

- FX was a $1.5B tailwind vs. a $100M assumed in the guide. Without this help, revenue would have beaten estimates by 2.5%.

- Slightly beat AWS estimates and met FXN AWS growth estimates.

- Beat ad revenue estimates by 4.7% and beat 17% FXN growth estimates by a comfortable 5 points.

- Beat North American revenue estimates by 2.8%.

- Beat International revenue estimates by 7.6% & beat 7% FXN growth estimates by a comfortable 4 points.

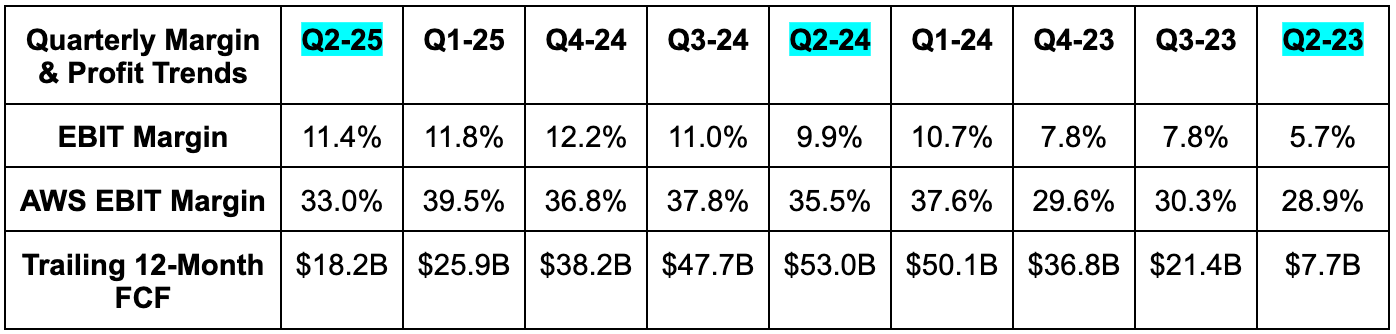

c. Profits & Margins

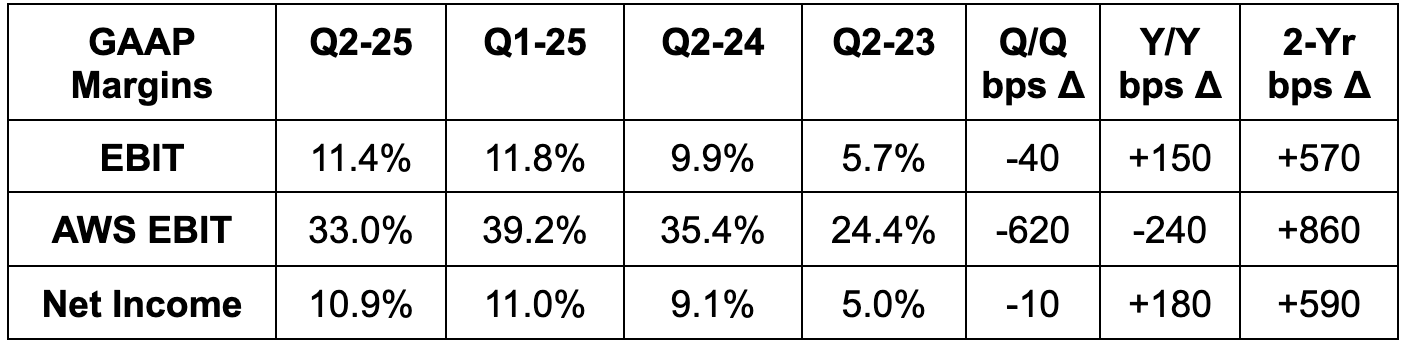

- Beat 50.5% GPM estimates by 130 basis points (bps; 1 basis point = 0.01%).

- Beat EBIT estimates by 12% & beat guidance by 26%.

- North American EBIT beat by 34%.

- International EBIT beat $770M estimates by about $700M.

- International EBIT margin soared from 0.9% to 4.1% Y/Y. This was thanks to improvements across established and expansion markets.

- AWS missed EBIT estimates by 6.7%.

- AWS EBIT margin declines Q/Q as expected. This is highly influenced by timing of capacity coming online from quarter to quarter. Furthermore, seasonal increases in stock compensation also led to a Q/Q decline. Without that rise in comp, the margin would have been 36.1%.

- Beat $1.33 GAAP EPS estimates by $0.35.

- Missed operating cash flow (OCF) estimates by 9%.

- CapEx was 24% higher than expected.

d. Balance Sheet

- $92B in cash & equivalents.

- $51B in debt.

- 0.9% Y/Y share dilution.

e. Guidance & Valuation

- Q3 revenue guidance beat by 2%.

- Q3 EBIT guidance missed by 7.5%.

Full-year CapEx commentary implies a roughly $117B guide. This is 11% above expectations and is to meet near-term demand signals.

f. Call & Release

Improving the Fulfillment Network:

Amazon continued to work hard on the three factors that influence its marketplace’s success: selection, prices and speed of delivery. All three of these variables are greatly supported by continued improvements in its logistics network productivity. It remains hard at work on fulfillment localization and upgrades to demand forecasting algorithms. Quarter after quarter, it keeps consistently improving its inbound and outbound inventory networks and getting better at knowing where to place goods, when to pack them and how to best move them to the final destination. Specifically, outbound shipping costs rose 6% Y/Y, which is far slower than 12% Y/Y unit growth. It boosted the share of orders moving straight to the final address (with no extra stops) by 40%+ Y/Y and lowered miles traveled per package by 12%. Touches per package also fell 15% Y/Y and it increased goods per single package as it leveled up in terms of combining orders. Finally, an upgrade to its demand forecasting improved regional placement efficacy by another 20% during the quarter – with many more upgrades on the way. All of this lowers costs, which unlocks more improvement across selection, pricing and delivery… and there’s more.

Robotics will be another massive lever to pull, as it just deployed its millionth unit across its network and unveiled automated package sorting. It also premiered “DeepFleet,” which is a new model to uncover the optimal path of movement throughout fulfillment centers and reduce clutter. This is already improving its robot efficiency by 10%.

How Fulfillment Network Improvements Help the Marketplace:

Now onto how all of this is actually helping the business. Starting with selection, lower cost means Amazon can offer items with lower price tags and profitably deliver them. That’s how everyday essentials have soared to 33% of total orders. It’s also how the company can rationally feature perishable groceries for its consumers. During the quarter, Amazon started recommending perishables when customers select same-day delivery for certain goods. This is driving great cross-selling activity, as 75% of these customers are brand new to the perishables category on Amazon and 20% of them are turning into repeat buyers. The other big news here was re-adding Nike to the marketplace, along with several other brands like Away and Marc Jacobs Fragrances. And generally speaking, in-stock rates rose as it got more surgical with inventory routing.

On pricing, simply put, lower costs for Amazon allow it to pass some savings onto customers and stand out from the pack. Thanks to this and massive economies of scale (so more fixed cost leverage), Profitero named Amazon as the lowest-price U.S. retailer for the 8th straight year.

And finally, localization of shipments and fewer miles to fulfill naturally leads to economically providing faster delivery times. They set a new quarterly record for same-day deliveries and grew same-and-next-day deliveries (SNDD) by 30% Y/Y. All of this progress also enables unmatched geographic range for rapid delivery. This quarter, Amazon announced SNDD for 4,000 smaller cities and rural towns in the USA. In the places where this is already live, as you’d expect, shopper frequency has materially risen.

Service keeps getting better. Margins keep expanding. Market share keeps rising. The business keeps executing.

- Prime Day was its largest event ever. I would hope so, considering it was 4 days while previous events were 2 days.

Tariffs:

They remain highly uncertain about the impact of tariffs. They’ve now worked through the inventory stock-piling that took them through June, so the impact of prolonged import taxes will more materially hit the business going forward. None of this uncertainty led to actual weakness in their business or rising prices for consumers, but it continues to bake that same possibility into forward guidance just like it did in Q2. They love to sandbag on forecasts, and I think this tariff item is giving them the perfect opportunity to do just that.

Amazon’s 3rd-party seller diversity, scale and logistics network all put it in a better place to weather this storm than virtually any competitor. But? It has not had to weather anything yet.

“In the first half, we just haven't seen diminished demand and we haven't seen any kind of broad scale price increases. And, you know, so that that could change in the second half. There are a lot of things that we don't know, but that's what we've seen so far.”

CEO Andy Jassy

AWS Results & Demand:

Some analysts wanted faster AWS growth. While results were slightly above sell-side expectations, the great Azure quarter for Microsoft led to some buy-side expectations rising to nearly 20% Y/Y growth. They didn’t get there, but thankfully, the reasoning isn’t concerning to me.

Amazon remains highly supply constrained (especially with energy) and unable to fulfill all of its demand. That constraint is now set to last for a couple more quarters than previously expected as they struggle to keep up with buyer interest. That’s why their order backlog rose by a whopping 25% Y/Y. That’s the best forward-looking indicator for demand and shows you what this business would look like if it weren’t temporarily unable to find more capacity. It shows you where AWS is heading.

I’d much rather have this AWS performance (which again, really wasn’t terrible) be supply-driven rather than demand-driven. At the same time, I do find this very modestly underwhelming AWS quarter to be on the leadership team. Azure has simply been better at finding more capacity to bring online than Amazon. That (and their smaller revenue base) have allowed them to deliver the kind of acceleration that I want to see in AWS. Leadership strongly teased that an acceleration was coming, but wouldn’t explicitly say it on the call. The great news is that AWS’s value proposition is more than capable of delivering the acceleration and I’m highly confident that it will come over the next string of quarters. They view their product breadth and security as much better than anyone else. I think product breadth is debatable, but I do think it’s pretty clear that AWS security is better.

So two things are true here. First, the lack of acceleration for AWS was from a somewhat encouraging source. But secondly, I still want leadership to move with greater sense of urgency in adding capacity. Make it happen. The demand is there.

- The AI portion of AWS continues to grow at a triple-digit Y/Y clip.

- Wins this quarter included Pepsi, Airbnb, the London Stock Exchange, Nissan, GitLab, SAP, Warner Brothers etc.

- Added new AI Availability Zones in Saudi Arabia and Korea.

- Added availability for Nvidia Grace-Blackwell superchip instances (virtual servers to build apps and models).

- Added Oracle Database availability.

- Launched Amazon Simple Storage Service (S3) Vectors which lower vector querying and storing costs by as much as 90%.

AWS Hardware:

Amazon’s custom high-performance training chip (Trainium Two) is performing well. It is securing larger and larger deals, and is the “backbone for Anthropic’s newest Claude models.” Interestingly, this continues to lead competition in terms of inference price performance by 30%-40% for certain workloads. Models are trained once and periodically updated. Most of the future demand will come from post-training inference, which needs to be constant. Once we get to that point in the AI transformation, Amazon thinks attention will shift and it will benefit.

AWS, AI Models & Tools:

- Bedrock Definition: Amazon’s fully managed environment for using a giant roster of foundational models to build applications. It offers the latest and greatest products to various partners and its own foundational model too.

- SageMaker Definition: Allows developers to build and configure custom models on top of Bedrock for more granular and company-specific needs. It’s essentially a full-service environment for developers to build with all needed tools in one place. They’re free to experiment and deploy in a safe, secure environment. Jassy calls this the “go-to service for AI model builders to manage their data, build and deploy.”

Amazon launched Bedrock AgentCore, providing guardrails for intuitive, seamless and scalable deployment of complex agents. Its ability to offer integrations from the lion’s share of software providers means these agents built on AWS can access needed context from all over the digital economy. In turn, that unlocks more multi-step, complicated tasks for developers to concoct. AgentCore provides all tools needed to power synchronous and asynchronous agents, with ample memory, access to model context protocol products, observability help and an automated web browser.

It also launched Stands Agents as an open-source library of tools to further support agent building.

Amazon Nova, its foundational model, is surprisingly the 2nd most popular model on Bedrock. Developers are flocking to what AMZN views as superior customization flexibility. Builders can easily add their own work and data to the models to make them more relevant for a given task or enterprise.

- Launched Nova Act as its foundational model specifically for agent creation.

- Expanding its speech translation model called Nova Sonic to 4 other languages.

- Claude 4 from Anthropic is the fastest-growing Bedrock model to date.

AI Products:

Amazon is using AI to make core cloud migrations easier. This quarter, it announced AWS transform as a new agent to cut on-premise migrations from years to months. With it, it can move VMWare customers to AWS 80x faster and lower operating costs for .net apps by 40%+.

Kiro is its new Integration Developer Environment (IDE) that provides a low-stakes environment and interface for building and iterating on agentic workflows. This racked up 100,000 users in the first 5 days of limited preview and momentum kept building from there. It offers natural language (vibe) coding, but really stands out in its ability to turn more conversations into functioning apps. With it, it’s easy to create, add to and edit full templates (or specs) for an app. This makes it more capable of actually moving from vibe coding to creating usable products. It also has a built-in reviewer to point out any coding bugs as they surface.

“It's still very early for Kiro, but it seems clear we're onto something customers love, and Kiro has a chance to transform how developers build software.”

CEO Andy Jassy

- Alexa+ is enjoying high ratings and ramping usage early on. Amazon sees an opportunity to add more subscription tiers for this product down the road for more monetizing.

- Launched the ability to turn product summaries into audio clips and AI-powered product listing enhancements.

Project Kuiper (Low Orbit Satellites):

Kuiper just completed its third successful launch. It isn’t commercially available just yet, but is already racking up some “impressive enterprise and government customers who have signed agreements.” They see the offering being superior to Starlink and see a great opportunity to undercut that future competitor too. That would be a highly compelling recipe for success. Separately, AWS is a perfect Kuiper complement. As Jassy puts it, customers want to use all of this connectivity and data in their cloud-native work. Doing so with one vendor (Amazon) instead of two (Starlink + a public cloud vendor) is easier.

Advertising:

For review, Amazon and Roku signed a new partnership this quarter. This provides Amazon and Roku with exclusive access to each other's audience data. Roku’s authenticated user data paired with Amazon’s gigantic supply of first party data is meant to offer advertisers great scale and more precise targeting. This is boosting reach by 40% and lowering instances of too much ad frequency by 30%. Importantly, Roku will continue to work with other partners like The Trade Desk to place their demand with its own inventory. Furthermore, Amazon also inked a partnership for its DSP to gain access to Disney’s inventory across its various streaming services.

More Updates:

- Prime Video enjoyed 2M viewers per NASCAR race and delivered that activity’s youngest audience in over 10 years.

- Pharmacy grew 50% Y/Y.

g. Take

Decent quarter. I’d love to see Amazon be more aggressive at figuring out how to get AWS supply online faster. While AWS is a fantastic product with a great runway and strong competitive differentiation, it should be growing faster right now and that’s a tad frustrating. But… emphasis is on “a tad.” They have everything they need to accelerate this business going forward and that is what I expect.

When looking elsewhere, this business continues to impress. Revenue growth for all non-AWS segments was faster than it has been in over a year, while AMZN has now delivered 6 points of EBIT margin expansion in two years. They continue to take more market share and carve out massive pieces of arguably the two best structural growth stories on the planet (cloud and e-commerce). So while this wasn’t the best quarter Amazon has ever delivered, it was still a quarter that most other companies can only dream of and was still rock-solid. I view the EBIT guidance as overly prudent (just like last quarter) and think, barring a vast ramping in trade tensions, they will comfortably surpass that target next quarter.

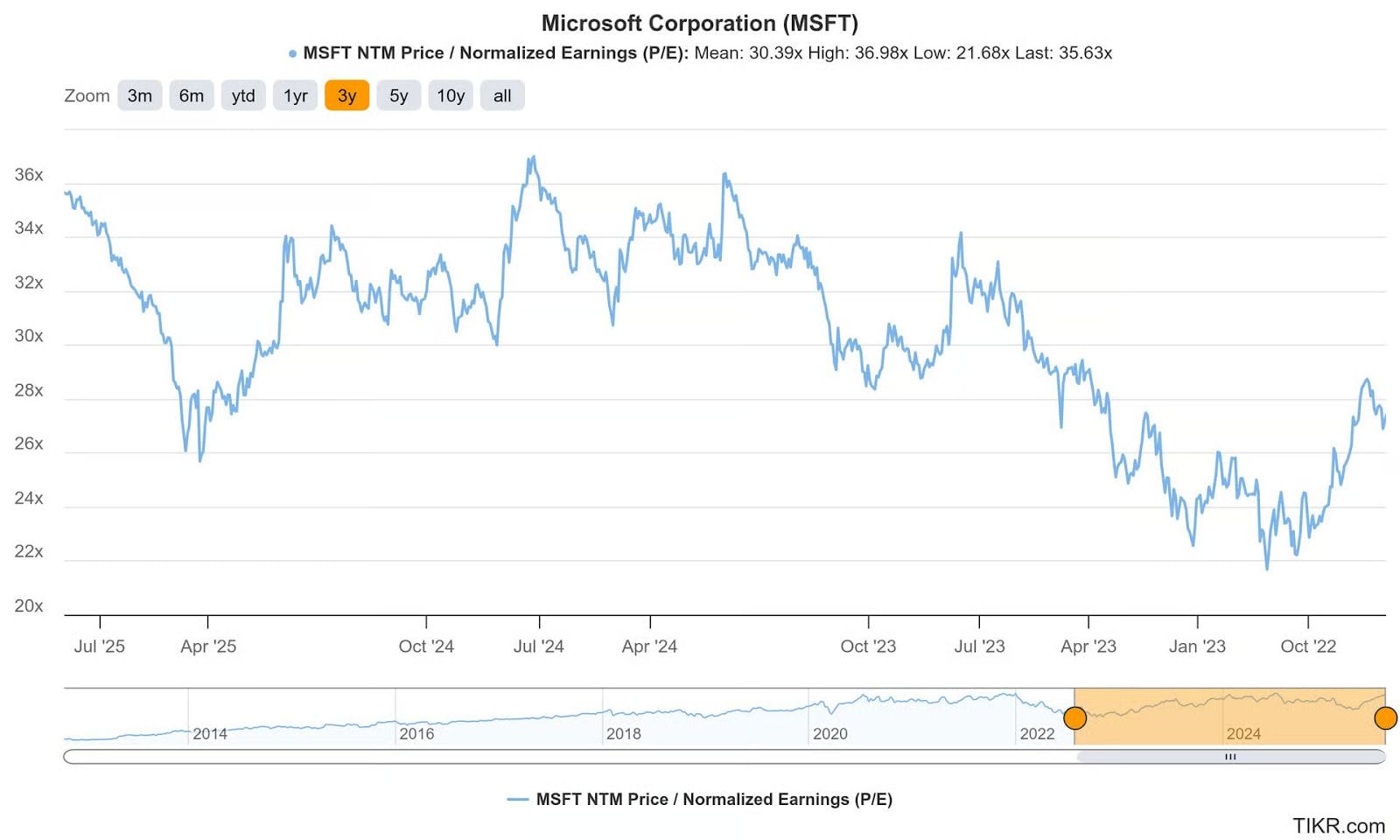

I have absolutely zero interest in selling any shares. I don’t anticipate enough stock price volatility for me to add, but that’s always possible. I’m eyeing the $190s to accumulate (about 30x forward EPS and a 2x PEG) and will keep you posted.