Table of Contents

- 1. Quick Earnings Snapshots – Visa (V) & TransMedi …

- 2. AMD (AMD) – Earnings Summary

- 3. Alphabet – Detailed Earnings Review

1. Quick Earnings Snapshots – Visa (V) & TransMedics (TMDX)

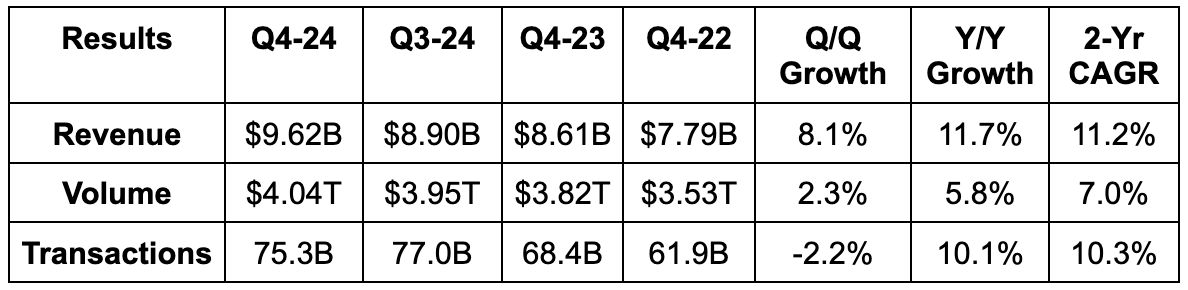

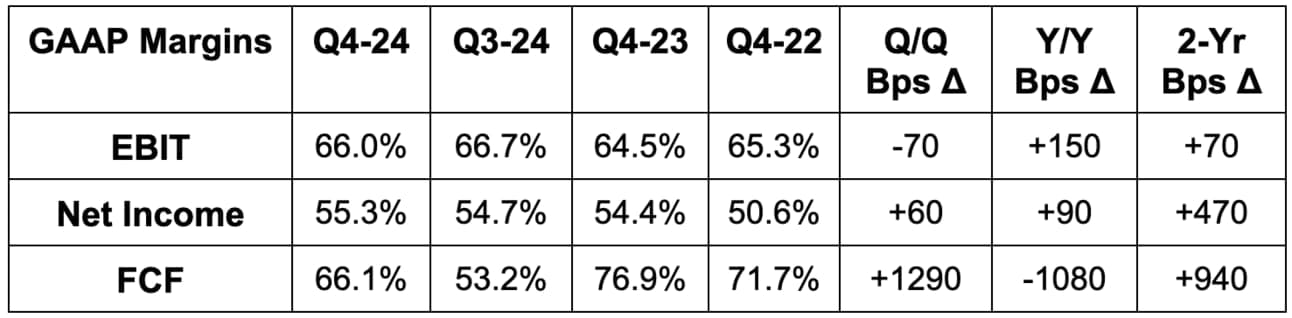

a. Visa

Results:

- Beat revenue estimates by 1.4% & met the high end of its growth guidance range.

- Beat EBIT estimates by 0.7%.

- Beat $2.58 EPS estimates by $0.13 & beat 12% growth guidance.

Balance Sheet:

- $17.7B in cash & equivalents.

- $20.8B in debt.

- Diluted share count fell 3% Y/Y.

Guidance & Valuation:

Because this was the end of Visa’s fiscal year, it offered brand new 2025 guidance for revenue and EPS. Both were in line with expectations. Considering the company represents trillions in annual spending, its take on the consumer matters a lot. Here’s how it feels about 2025:

“As we regularly say, we are not economic forecasters so we're assuming the macroeconomic environment stays generally where it is today. As such, we expect payment volume and processed transaction growth to remain strong and generally in line with full year 2024 levels.”

CFO Christopher Su

Visa trades for 26x forward earnings. Earnings are expected to grow by 13% this year and by 12% next year.

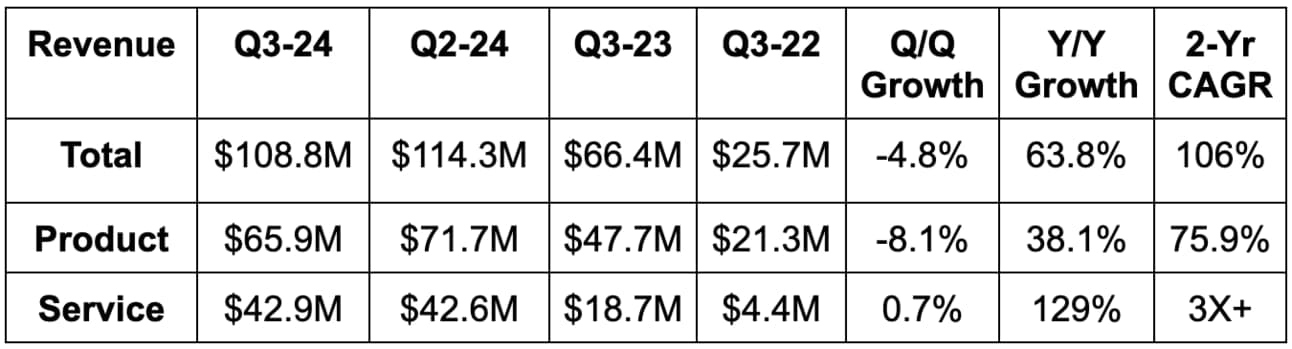

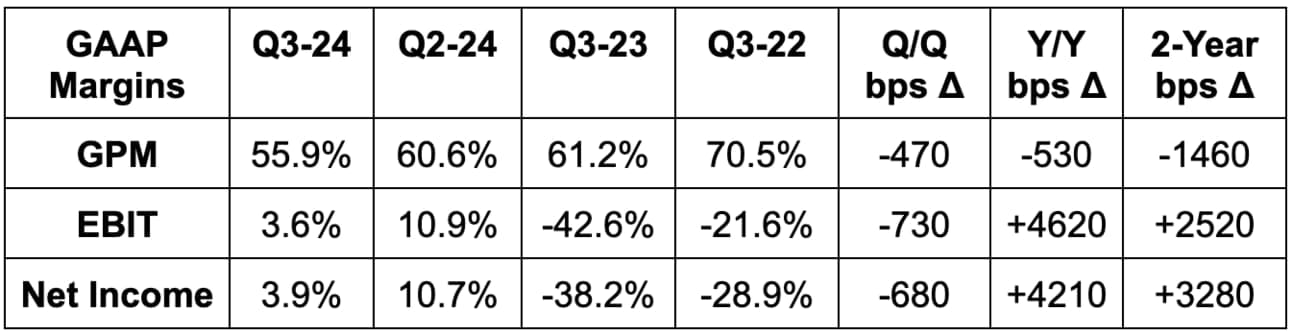

b. TransMedics (TMDX)

TMDX makes Organ Care Systems (OCS). With it, organs from donors can be preserved for longer periods of time and transported more easily to recipients. This is a new name in the coverage network that I plan to cover in more detail going forward. From my outsider perspective, this is the bear/bull debate:

Bears say margin pressure is structural, transplant availability creates a lack of visibility for forecasting and smaller competition can further erode pricing power and demand. It’s also expensive from a traditional valuation point of view (PEG ratio is more reasonable at roughly 1.3x).

Bulls say margin pressure is due to the build-out of aviation fleets to drive more competitive differentiation. That’s temporary. They point out that utilization rates of the fleet are still low and immature, which is leading to revenue headwinds. That’s also temporary. They’ll also point out that this is a share leader in a sector that should deliver strong growth for a long time. Finally, while margins are suffering today, they remain profitable and did maintain revenue guidance. I find the bull case more compelling, but I have a lot more work to do here.

"We maintain our conviction in our growth runway for 2025 and beyond. We remain well on track to reach our stated 2028 targets.”

Presser

Results:

- Missed revenue estimates by 5.4%.

- Missed $13 million EBIT estimates by about $9 million; Missed $0.31 EPS estimates by $0.19.

- Sharply missed 61.8% GPM estimates by 590 bps.

Balance Sheet:

- $330M in $ & equivalents.

- $59M in debt.

- Diluted shares +10% Y/Y; Basic shares +2.5%.

Guidance & Valuation:

TMDX reiterated $435 million revenue guidance, which missed by 2.3%.

TMDX trades for 70x earnings. EPS is explosively inflecting this year and expected to compound at a 50%+ clip over the following two years.

2. AMD (AMD) – Earnings Summary

If there’s one thing the semiconductor industry loves, it’s constantly changing the names of products with an alphabet soup of acronyms for us to juggle. Fun, fun. Those acronyms all fall into neat categories: chips, networking and connectivity, and software. It’s these ideas and AMD’s positioning within them that matter to investors. Not that they’ve memorized what an MI325 HBM3E chip stands for. That’s how we’ll frame this coverage, with an emphasis on data center results.

GPU: Graphics Processing Unit. This is an electronic circuit used to process information and data. The accelerated compute needed for GenAI apps and models pulls from next-gen GPUs. It thinks its “MI” series of GPUs (part of the “Instinct” product family) boasts best-in-class memory and bandwidth, which Nvidia would certainly disagree with. AMD also thinks its 2025 Instinct release will compete with Nvidia’s world-class Blackwell platform.

CPU: Central Processing Unit. This is a different type of electronic circuit that carries out assignments and data processing. CPUs fall in the general compute bucket. General compute CPUs are still optimal for static, step-series and instruction-based tasks. They’re also much cheaper than deploying next-gen GPUs when they can work for the specific use case. AMD’s new AI data center CPUs “extend leadership in performance per watt and dollar.” I

NPU: Neural Processing Unit: Used for AI-enabled personal computers (PCs).

TOPs: Tera Operations Per Second. This measures NPU performance, with more TOPs being better. AMD’s new Ryzen AI PC has 20% more TOPs than Microsoft’s best unit. To AMD, TOPs superiority is imperative for running Copilots and GenAI apps on PCs with optimal latency, hallucination rates and performance. It’s how the firm claims to be a “leader in AI inference on the PC side.”

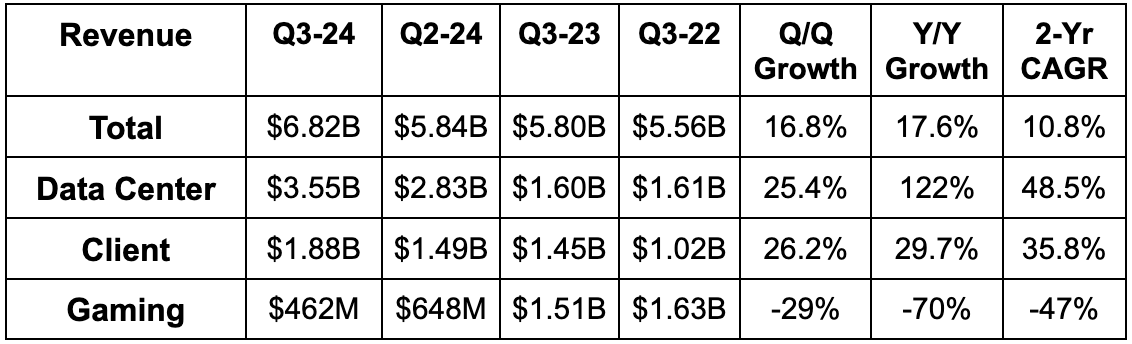

a. Results

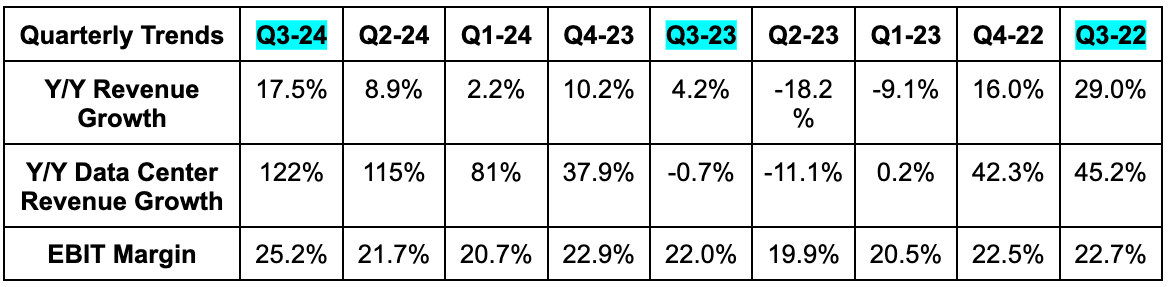

- Beat revenue estimates by 1.8% & beat guidance by 1.5%.

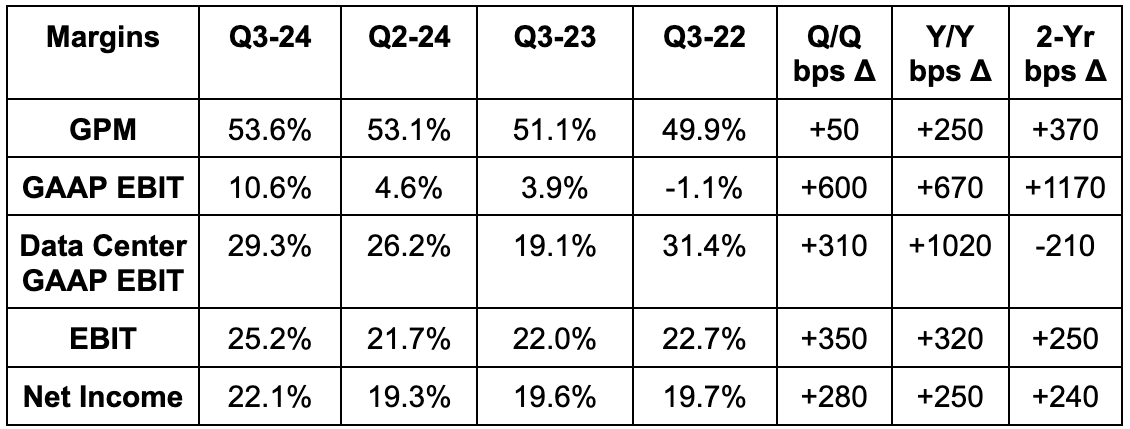

- Slightly beat gross profit margin (GPM) estimates & slightly beat identical guidance. Data center outperformance led to GPM expansion.

- Beat EBIT estimates by 2.1%.

- Met $0.92 EPS estimate.

- Xilinx M&A continues to hit overall GAAP margins.

b. Balance Sheet

- $4.5B in cash & equivalents.

- $1.7B in debt.

- $5.4B in inventory vs. $4.4B year-to-date.

c. Guidance & Valuation

Next quarter revenue guidance missed by 0.7% while its 54.0% GPM estimate slightly missed 54.2% estimates. EBIT estimates for Q4 missed by 7%. AMD trades for 38x forward earnings. Earnings are expected to grow by 28% this year and by 60% next year.