Table of Contents

In case you missed it:

- Palantir & Hims Earnings Reviews.

- Uber Earnings Review.

- Shopify & Coupang Earnings Reviews.

- Meta Earnings Review.

- Alphabet Earnings Review.

- Apple, ServiceNow & Starbucks Earnings Reviews.

- Amazon & Mercado Libre Earnings Reviews.

- PayPal Earnings Review.

- Tesla Earnings Review.

- SoFi Earnings Review.

- Netflix Earnings Review.

- Taiwan Semi Earnings Review.

- My current portfolio & performance vs. the S&P 500.

a. Cava 101

Cava is a quick-service restaurant chain that sells Mediterranean food, with a focus on strong value, quality ingredients and a warm, in-store ambiance.

My Cava Deep Dive can be found here.

b. Key Points

- Underwhelming results.

- Poor macro and tough Y/Y comps.

- New stores performed quite well.

- 16%+ store growth for 2026.

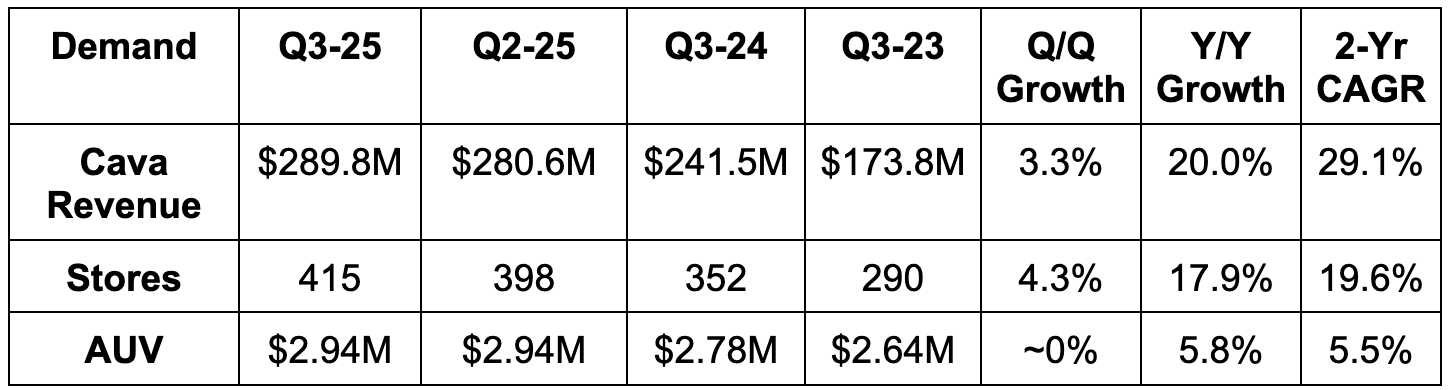

c. Demand

- Missed revenue estimates by 0.8%.

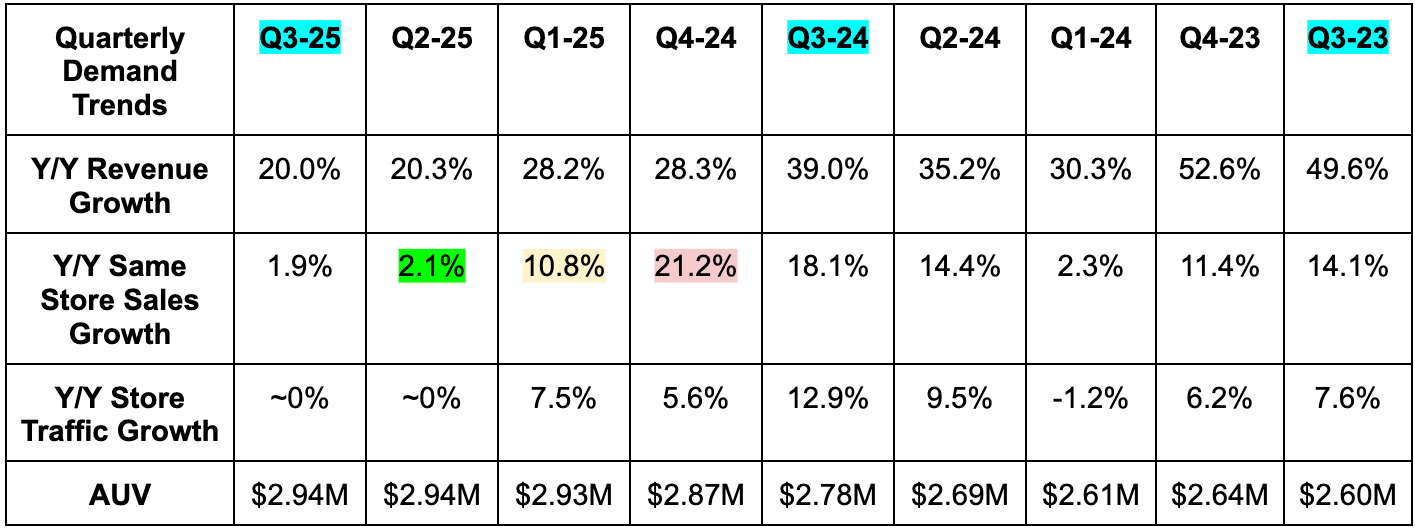

- Traffic rose by 0% Y/Y vs. 0% last quarter and 7.5% 2 quarters ago.

- Missed 2.7% same store sales (SSS) growth estimates with 1.9% growth.

d. Profits

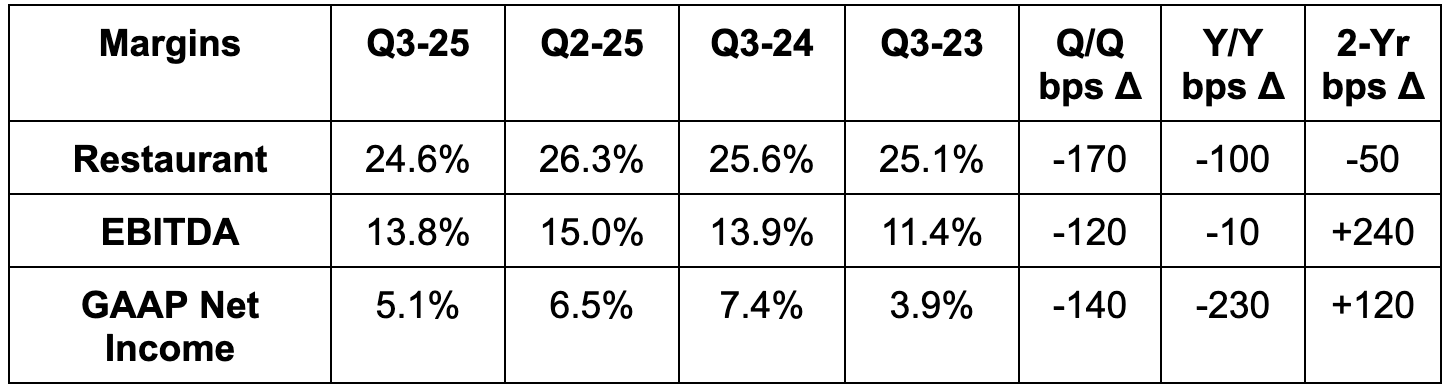

- Missed 25.5% restaurant-level margin (RLM) estimates by 90 bps.

- Met EBITDA estimates.

- Met $0.12 GAAP EPS estimates.

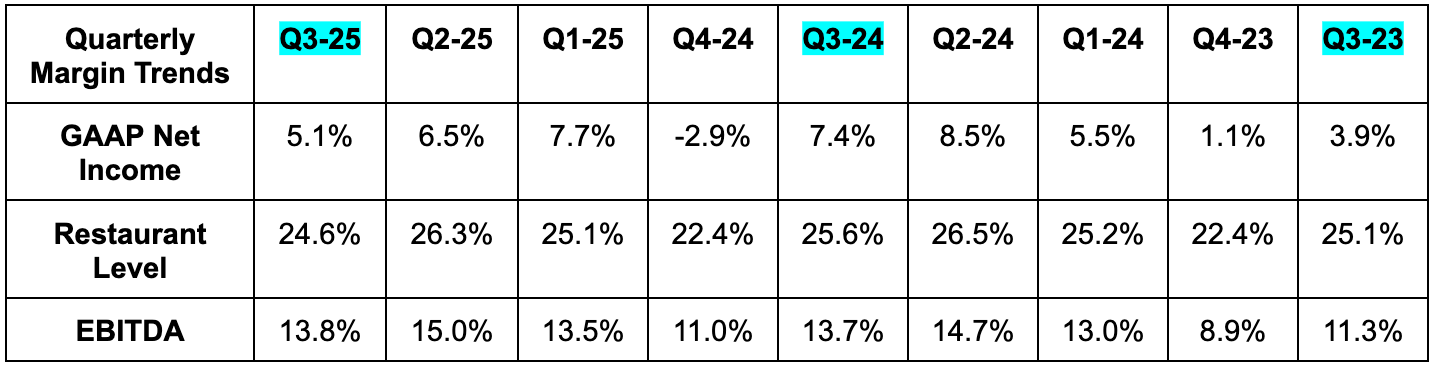

RLM was pressured by a few items. Food, beverage and packing (FBP) costs rose very slightly as a percent of revenue due to chicken shawarma. 2% wage inflation also led to labor rising from 25.4% of revenue to 25.5% Y/Y. Notably, other operating expenses rose 80 bps as a percent of revenue and drove most of the RLM decline. This is due to elevated maintenance and repair expenses, which they’re exploring how to curb. Mix-shift towards 3P delivery, insurance costs and tariffs all weighed on the metric as well. Taken together, these factors powered the 100 bps of Y/Y deleveraging. EBITDA margin was still able to stay flat thanks to 140 bps of Y/Y corporate G&A leverage. This was fostered by lower legal fees.

Net income fell Y/Y due to a 28.5% effective tax rate compared to zero taxes paid last year. Earnings before tax (EBT) rose by 15.4% Y/Y.

e. Balance Sheet

- $385M in cash & equivalents.

- Diluted shares fell slightly Y/Y.

- No debt.