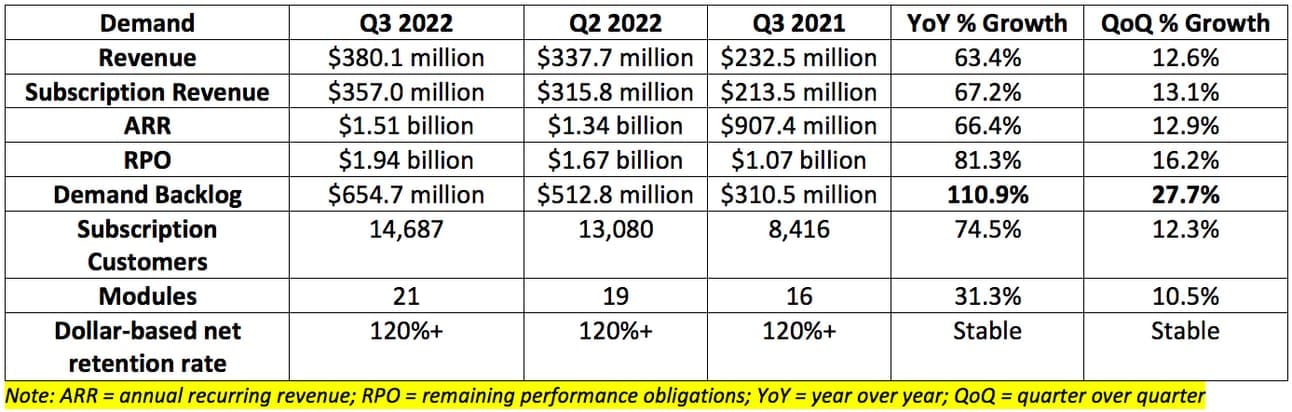

A. Demand

On results:

CrowdStrike guided to a revenue range of $358-$365.3 million for this quarter. Analysts were expecting $364.2 million in sales for the period. The company posted $380.1 million beating its own midpoint by 5.1% and analyst estimates by 4.4%.

QoQ growth acceleration (last quarter vs. this quarter):

- Sequential revenue growth accelerated from 11.5% to 12.6%..

- Sequential demand backlog growth accelerated from 14.1% to 27.7%.

- Sequential remaining performance obligation (RPO) growth accelerated from 13.6% to 16.2%.

Lofty RPO and demand backlog growth both hint at more rapid expansion to come. These are both purely forward-looking demand metrics.

Note that year over year comparisons are measuring current times vs. a period in which work-from-home greatly accelerated endpoint security needs (CrowdStrike’s main niche). CrowdStrike’s strong results are despite this comparison headwind.

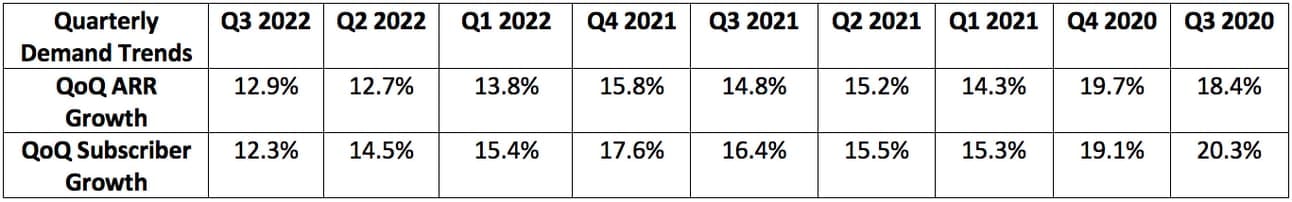

On key sequential trends:

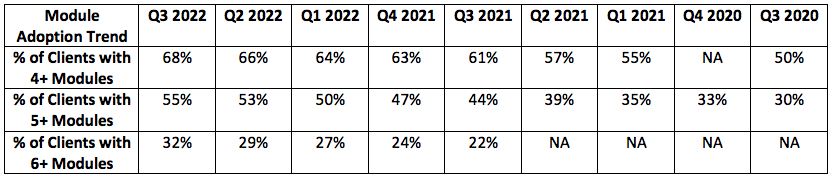

Module adoption costs CrowdStrike virtually nothing in added operating costs after the first module has been on-boarded. This means the trend of strong module adoption depicted below is a clear sign of more margin expansion to come. CFO Burt Podbere has told us numerous times in the past that CrowdStrike will continue to debut 1-2 new modules every year.

For some reason CrowdStrike did not disclose its % of clients with 4+ modules in Q4 2020 then began doing so again the following quarter.

Last quarter, Burt Podbere told us that CrowdStrike would soon begin disclosing users with 7+ modules which offers more evidence of strong continued adoption. The company didn’t even disclose users with 6+ modules until fiscal Q3 2021 because the number wasn’t material enough to report.

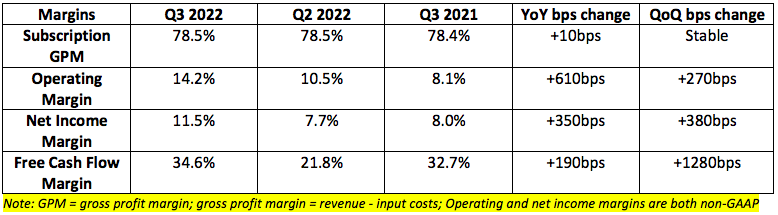

B. Margins

CrowdStrike was expected to earn $0.11 per share for the quarter. It earned $0.17 per share beating expectations by $0.06.

CrowdStrike also guided to the following:

- $29.4 - $34.7 million in non-GAAP operating income. It posted $50.7 million beating the highpoint of its guidance by 46.1%.

- $19.7 - $25.0 million in non-GAAP net income. It posted $41.1 million beating the highpoint of its guidance by 64.4%.

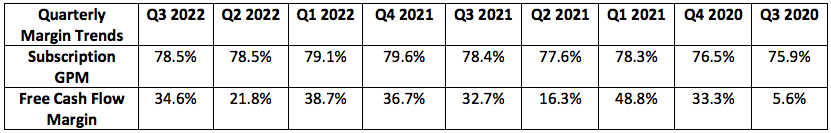

Q3 is a seasonally stronger period for cash flow generation vs. Q2. This is due to performance obligations and accounts receivable translating more commonly into free cash in the period vs. Q2.

As a reminder, CrowdStrike’s target subscription GPM range is 77%-82% — a range that it has now been in for nearly 2 years:

C. 2021 Guidance Updates

Analysts were looking for roughly $400 million for next quarter’s revenue guide. CrowdStrike guided to $406.5-$412.4 million representing a beat at the midpoint of 2.4%.