“Our robust growth and leverage enable us to step-up investments in new technologies and geographies. Our platform and innovation offer strong momentum heading into fiscal year 2023 and we firmly believe CrowdStrike’s best days are ahead.” — CFO Burt Podbere

1. Demand

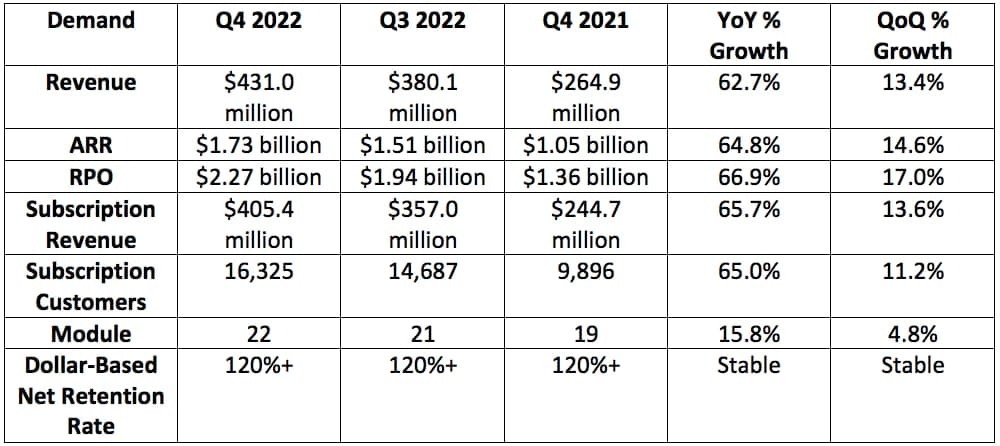

CrowdStrike guided to $409.5 million in revenue for the quarter and analysts were expecting $412.4 million. CrowdStrike posted $431.0 million in revenue, beating its expectations by 5.2% and analyst expectations by 4.5%. This represents CrowdStrike’s largest revenue beat over the last 3 quarters.

For 2021 as whole:

- Revenue grew 66% YoY.

- Subscription revenue grew 69% YoY.

- Dollar-based net retention was 123.9% vs. 125.0% YoY and 124.0% 2 years ago.

- Gross retention was at a “best in class” 98.1% vs. 98.0% YoY

- CrowdStrike’s revenue split continues to be 72% U.S. based and 28%. international.

Note that subscription customer growth would have been 64.7% YoY without a small, inorganic contribution from SecureCircle. The revenue contribution was immaterial.

2. Profitability

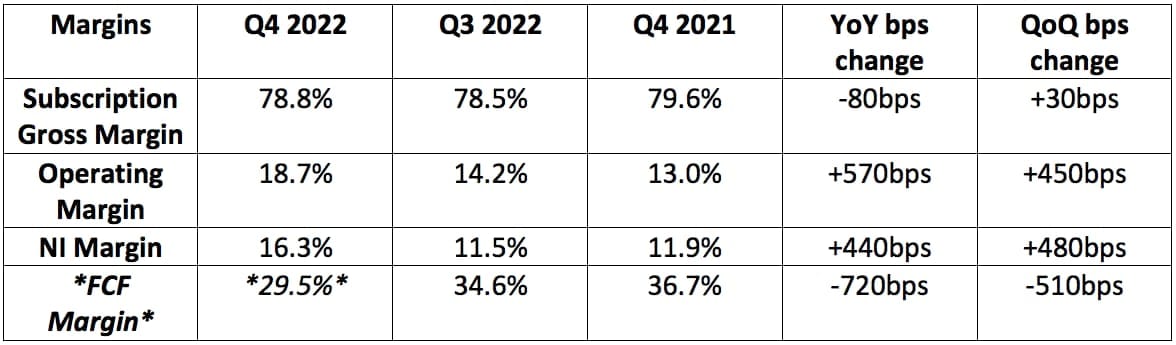

CrowdStrike guided to $57.4 million in non-GAAP operating income and posted $80.4 million, beatings expectations by 40.1%

CrowdStrike guided to $47.3 million in net income. CrowdStrike posted $70.4 million, beating expectations by 48.8%. CrowdStrike and analysts both expected $0.20 in earnings per share (EPS). CrowdStrike posted $0.30, beating expectations by $0.10 or 50%.

NOTE: FCF margin for the quarter was impacted by an IP transfer tax charge related to CrowdStrike’s purchase of Humio. Without this headwind, FCF margin would have greatly expanded to 45.7%. $92.6 million in stock-based compensation (SBC) for the quarter aided this result. Without any SBC help, FCF margin would’ve still been 24.2% when subbing out the IP transfer tax.

For 2021 as a whole:

- Operating income grew 215% YoY.

- CrowdStrike posted its 2nd straight year of FCF margin over 30%.

CrowdStrike has $2 billion in cash and equivalents on its balance sheet vs. $1.91 billion sequentially. It has about $740 million in total long term debt.

CrowdStrike’s weighted diluted average shares outstanding was 238 million for Q4 2022 (calendar 2021). That will rise to 243 million next year for modest 2.1% shareholder dilution.