Today's earnings review is powered by Commonstock:

1. Demand

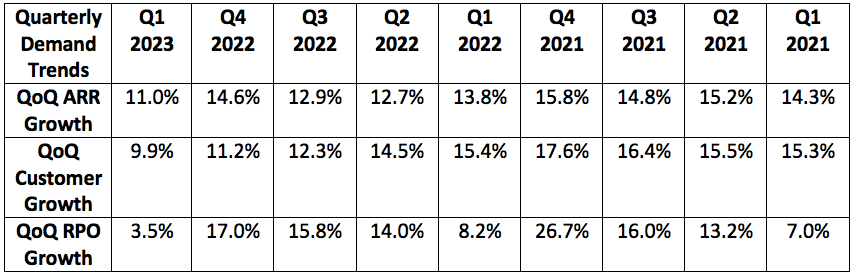

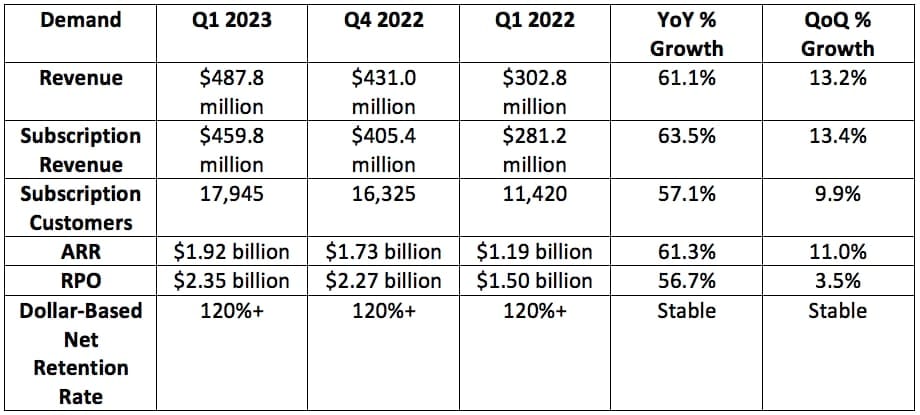

CrowdStrike guided to $462.1 million in revenue while analysts were looking for $464.4 million. CrowdStrike posted $487.8 million, beating its own expectations by 5.6% and analyst estimates by 5.0%.

Analysts were also looking for:

- $1.90 billion in ARR. CrowdStrike posted $1.92 billion, beating expectations by 1.1%.

- $2.58 billion in RPOs. CrowdStrike posted $2.35 billion, missing expectations by 8.9%. More on this later.

- 17,783 subscription customers. It reported 17,945 customers, beating expectations by 0.9%.

More context on demand:

- Last quarter, CFO Burt Podbere told us that sequential net new ARR growth as well as RPO growth would be challenged by multiple 8-figure deals closing in Q4 2022. That's why sequential RPO growth especially was so slow.

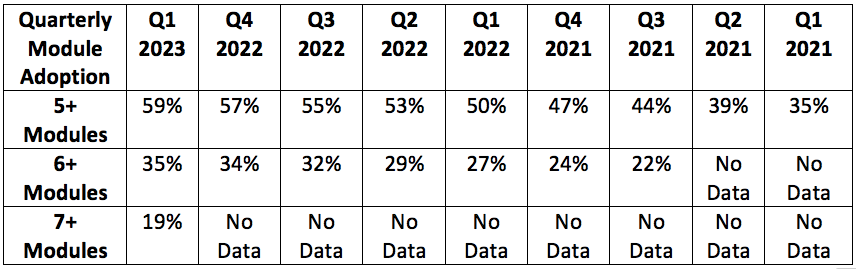

- CrowdStrike incurs the vast majority of its operating expenses when on-boarding the first module for a client.

- More module adoption from there is largely profit and so feeds incremental margin expansion.

- Now that CrowdStrike has over 70% of its client base with 4+ modules, it will no longer disclose this metric. Instead, it will disclose 5+ modules, 6+ modules and now 7+ modules to highlight the strong momentum it's seeing in terms of module up-selling. Investors had been told to expect this for a few quarters.

- CrowdStrike’s gross retention rate “reached an all-time high” which implies it was above the 98.1% result that it reported last year.

- CrowdStrike did get a pandemic boost via workforces becoming more distributed and remote which required broader endpoint protection.

- This elite 60%+ growth is on top of that material boost.

- International growth of 71% outpaced domestic growth of 59% as CrowdStrike begins to realize returns on its global investments. A fortress balance sheet allows for these investments to comfortably take place.

2. Profitability

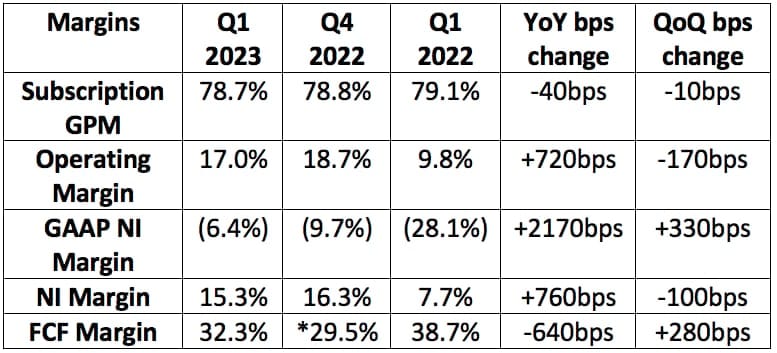

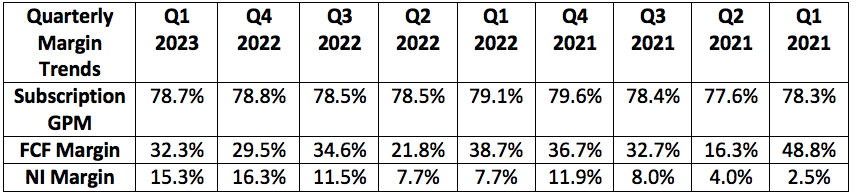

CrowdStrike guided to $0.23 in earnings per share (EPS) with analysts looking for the same. Its net income guidance of $54.3 million also implied an 11.8% margin. CrowdStrike posted $0.31 in EPS, beating expectations by 34.7%. It also posted a 15.3% net income margin which beat expectations by 350 bps. This is evidence that the incremental growth it delivered in the quarter flowed down the income statement quite nicely -- it was efficient, profitable growth.

CrowdStrike also guided to $64.1 million in non-GAAP operating income with analysts expecting $65.1 million. It generated $83 million, beating its expectations by 29.4% and analyst estimates by 27.4%.

Analysts were also looking for a 76.8% gross margin. It's unclear to me if this was subscription gross margin guidance (where CrowdStrike focuses) or overall gross margin guidance. If it's for subscription gross margin, the result beat expectations by 190 basis points (bps). If it's for overall gross margin, it missed by 10 bps.

More margin context:

- The gap between GAAP and non-GAAP NI margins is powered by stock based compensation. Q4 2022 FCF margin was also held back by an IP transfer tax charge via the Humio M&A. It would have been 45.7% without this help.

- The low point of the mostly positive report was stock-based compensation of $102.4 million vs. expectations of $85 million. Still, Stock based compensation expense growth is expected to slow this year with the firm’s fully diluted share count poised to grow by roughly 1.2% in calendar 2022. Previously, CrowdStrike thought this growth would be 2.0% for the year.

- Cash flow margins were impacted by capital expenditures more than doubling YoY to support rapid growth in products and geographies.

CrowdStrike has $2.15 billion in cash and equivalents on its balance sheet vs. $2 billion last quarter.

Commonstock is a friendly community of passionate investors who believe that transparency can elevate discussion and performance. This platform strikes the perfect balance between collaborative debate and uplifting camaraderie. I like to think of it as a more focused, verifiable, productive and kind version of FinTwit -- without all of the noise.

There's a reason why I have linked my portfolio to the service (and no others) and am a daily active user.

Come join us to see what all of the hype is about. Sign up is free and you'll be glad you did.