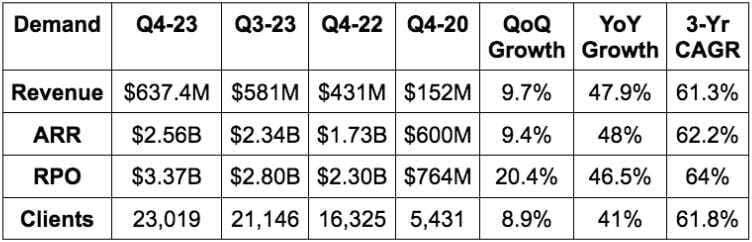

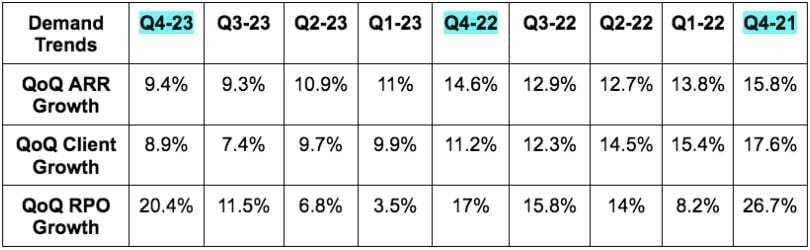

1. Demand

“CrowdStrike’s growing market share showcases customer recognition of Falcon platform’s tech leadership and advanced AI. We drive better outcomes, vendor consolidation and lower total cost of ownership.” -- Co-Founder/CEO George Kurtz

More Demand Context:

- The 61.3% 3-yr revenue CAGR compares to 66.8% last Q and 70.4% 2 Qs ago.

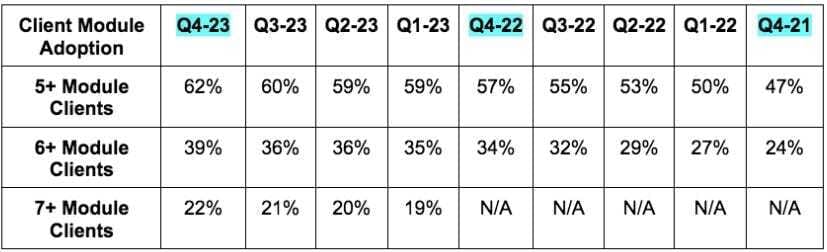

- CrowdStrike stopped disclosing customers with 4+, 5+ and 6+ modules after Q4 2022 and began disclosing 5+, 6+ and 7+ module customers instead. Why? Because too many of them had 4+ modules. Great problem. More module adoption is not only a revenue driver, but a margin expander as well as there is virtually no added OpEx to sell additional modules after the first.

- Customers with $1 million+ in ARR rose 57% YoY to reach 400. These customers use 10 modules on average.

- U.S. revenue for the quarter rose 44% YoY with international up 57% YoY.

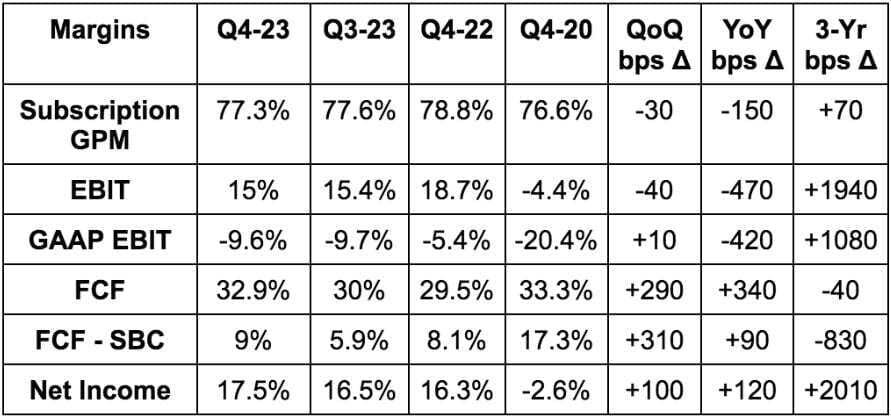

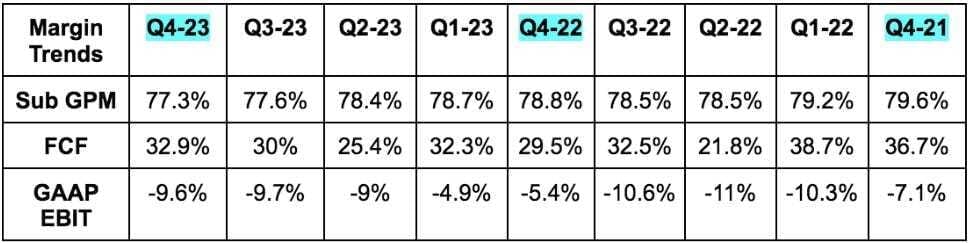

2. Profitability

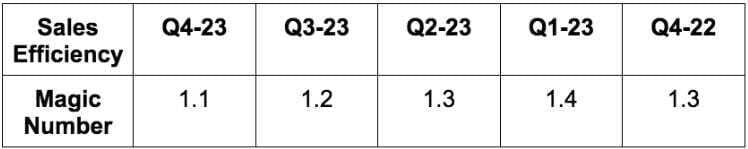

Magic number refers to net new subscription revenue multiplied by 4 and then divided by the company’s sales and marketing expense. Anything above 1.0 is a sign to CFO Burt Podbere to lean even more heavily into growth spend.

More Margin Context:

- The downward trend in gross margin is related to continued data center investments and a temporary M&A drag -- NOT discounting or tougher competition. CFO Burt Podbere reiterated CrowdStrike’s goal to reach an 82% subscription GPM by calendar 2024. I repeat: This is not related to tougher competition.

- Q4 2020 FCF margin was uniquely aided by abnormally strong collections.

- Operating income more than doubled in calendar 2022 as a whole while CrowdStrike reached its long term FCF margin target of 30%+ for the third straight year. Maybe it’s time to raise that target?

- FCF generation for calendar 2022 as a whole rose 53.2% YoY to reach $676.8 million. It should generate roughly $1 billion in FCF this year. Yes, this includes the stock comp add back which is a real expense. But FCF starts its calculation from net income. Net income is directly reduced by stock comp. It would not be able to have this kind of cash flow profile without strong income statement unit economics.

- Simply put: 5+5 = 10; 4+6 also = 10; 0+6 does not = 10.

3. Full Fiscal Year 2024 Guidance

CrowdStrike told us last quarter to expect low to mid 30% revenue growth for fiscal year 2024. It essentially reiterated that estimate along with its guide of low 30% ARR growth.

- Met revenue estimates of $2.99 billion representing 33.4% YoY growth. It always leaves room to raise as the year progresses and as things become more clear.

- According to some data sources, this revenue figure was about 1% ahead of estimates. My number comes from the Bloomberg Terminal.

- Beat EBIT estimates by 1.2%.

- Beat EPS estimates of $2.01 by $0.29.

First quarter guidance was slightly stronger than the full year guide. Notably subscription gross margin guidance of 100 bps of sequential expansion was much stronger than the 10-20 bps of expansion expected. Q1 being better than the full year is likely because CrowdStrike approaches uncertainty with extreme pessimism. It only offers more upbeat (and realistic) guidance as things become more clear. That’s one of the things I love about them. As it’s already March 7th, the clarity for Q1 is much higher than 2024 as a whole.

I expect the company to continue beating and raising throughout the year as it always does.