As always, if you feel inspired to do so, please share this far and wide with any fellow investing nerds. That is how we grow.

Introduction:

While investors seem ready to pronounce Walt Disney a decaying organization… to that I say “not so fast.” I still see plenty of magic left in the Mouse House. The company’s roster of brands and intellectual property (IP) is elite, its parks are cash printing machines, and its new (old/new) team is now running things in a more rational manner. Any turnaround will take several quarters if not a couple of years to play out… but the recipe is there.

While there is plenty of risk associated with this investment case, the potential reward is compelling if Disney can simply get out of its own way and execute. Here, I’ll dissect the company, its prospects and risks. Let’s begin.

1. A Review to Disney’s Assets:

There’s a popular graphic that is passed around social media on the vast quantity of brands that consumer packaged goods giants own. The takeaway is relevant to Disney: Own companies that own great brands. The coinciding notoriety means organic word-of-mouth growth, higher consideration and purchasing intent, loyal customers and pricing power vs. substitutes. Well? Disney is the content firm that owns an enviable group of iconic brands.

Its digital entertainment assets perfectly complement Disney’s thriving cruise line and parks businesses spanning North America, Asia and Europe. These physical experiences enable the delivery of memorable and uniquely omni-channel customer engagement. Disney is far from the only enterprise with high quality entertainment brands. Where it stands out is in its global pairing of these brands with brick and mortar activities to deepen a fan’s company affinity and drive revenue. This means a higher lifetime value ceiling from a customer than for companies like Netflix. In my mind, media and parks go together like bread and butter, salt and pepper or Mickey and Minnie.

With this serving as the baseline, let’s turn to how Disney has mishandled its invaluable IP and why that opens the door for such a compelling potential investment.

2. (Re) Enter Iger

Messy Succession:

Bob Iger’s 2020 retirement was not as seamless as it could have been to say the least. Bob Chapek, his successor, struggled as the leader of this gigantic enterprise. Rather than remaining politically agnostic, he somehow managed to upset both sides of a heated, polarizing LGBTQ+ debate in Florida. Not only that, but he turned the Florida state government from an ally into an adversary through a lawsuit in connection with this same development. The relationship here doesn’t seem to be deteriorating further, but I’d love for Disney to drop the litigation and play nice. It’s not a matter of right wing or left wing but shareholder value optimization.

This may sound insensitive to some, but I don’t want the companies I own shares in poking their heads into highly controversial political issues. The best-case scenario is that you only upset 50% of your fans. I want them keeping their mouths shut, leaving the debate to societal dialogue, maintaining politicians on BOTH sides of the aisle as allies and focusing on running the business. Fundamental execution alone is hard enough.

The Chapek mistakes continued. He hiked park pricing in the middle of 2022 as inflation was severely cutting into discretionary spending even while service levels were deteriorating. He vastly over hired and built out significant fixed cost bloat as he thought pandemic trends were more durable than they proved to be. In fairness to him, Iger was a small part of that mistake and many companies fell for this trap as well. But it’s still worth noting. Chapek also fell victim to the secular decline Disney’s linear television business is facing as we evolve to a world of streaming. That wasn’t his fault, the but merely added to the negative sentiment surrounding the stock during his tenure.

All of these theatrics resulted in Disney’s board re-appointing Iger as the CEO in 2022. Rumors swirled that a main factor leading to Chapek’s early departure, in addition to those mentioned, was his focus leaning too heavily towards influencing culture vs. delivering for shareholders. The board seeing this as a weakness is another sign that Disney is ready to be a focused business once more. Iger seems fixated on running Disney like a lean, mean, financially thriving machine… and to that I say “thank you”.

Iger’s Path:

So what has he done early on that gets me excited? From a 30,000 foot view, he has expeditiously set and raised a $5.5 billion cost-cut target, embraced new revenue streams and repaired Disney’s approach to streaming, group interoperability and more.

Cost cuts will consist of $2.5 billion from selling, general and administrative (SG&A) reductions and $3 billion in non-sports content savings. The SG&A cuts, including layoffs and team reorganization, are already beginning to feed its non-GAAP EBIT recovery (not GAAP yet as changes have led to large restructuring charges). The content savings won’t begin meaningfully kicking in until next year. The longer-term nature of multi-year film contracts make immediate benefit realization less feasible. That also means the cost-cutting initiatives should bolster profits for the next few years rather than just the next couple quarters.

Most importantly, he set out to “place creativity back at the center of Disney” and to empower creators to make what they want with no pre-set agenda. Vitally, this change coincided with him reconnecting these artists to Disney’s distribution and marketing teams for greater cost-to-value matching. More on this later.

A Little History & The Team:

Iger first joined ABC about 50 years ago and proceeded to climb all the way up to head that broadcast network 15 years later. When Disney bought ABC in 1995, Iger remained on as segment chairman for another 5 years. From there he was promoted to Disney’s COO and eventually CEO in 2005 as the culmination of a “save Disney” board campaign. That movement was based on the old CEO’s egregious compensation practices, organizational mismanagement and his disconnect from the firm’s creatives. These issues should sound somewhat familiar… and if Iger fixed them once, Iger can fix them again. The mending, however, will be a long process which is likely why he just extended his contract with the board for another 5 years.

Iger’s history with Disney consists of a culture of internally grooming future leaders. For example, its current CFO Kevin Lansberry has been with the company for 2 decades. Lansberry recently replaced Christine McCarthy in an interim role with McCarthy stepping down to attend to a “family medical” issue. I wish her the best.

McCarthy isn’t the only recent c-suite departure. Chief Information Officer Diane Jurgens recently announced plans to leave the company after just 3 years. For needed context, she was a Chapek hire (enough said). While c-suite churn is never ideal, it’s understandable when companies are being shaken up as aggressively as Disney is. Rebecca Campbell also retired this year after 26 years with the company. She led Disney’s international content branch and is 51 years old.

3. Disney Media -- Linear

Disney Media is one of three newly formed Disney segments along with ESPN and Disney Parks and Experiences (DPEP). The branch encompasses all streaming, linear and broadcasting assets aside from ESPN’s live sports. Let’s start with the black eye of the portfolio which is linear television including ESPN.

3a. Linear’s Struggles:

It’s no secret that cord cutting is in full swing. Linear TV is the business being displaced as this unfolds which hurts Disney assets such as FX and ABC. With ABC being the top news broadcast provider for the last 4 years, this matters dearly to the business. Specifically, linear EBIT has consistently fallen throughout 2023 when eliminating the effect of timing-related cost savings in Q1. Eyeballs are slowly moving away from cable partners and channel affiliates while advertising dollars follow suit. A poor macro backdrop further adds to that headache.

This past quarter saw linear revenue fall 7% Y/Y. EBIT declines were even sharper due to sports content rights timing. These negative patterns have been consistent with no end in sight.

Encouragingly, leadership talked up “signs of improvement” (ie reduced decline rate) in August. Still, that improvement is being driven by live sports. For context, ratings remained healthy at ESPN last quarter which saw 10% Y/Y growth in linear and addressable advertising revenue. ESPN is a standout as passionate fans flock to the channel to watch their favorite leagues and as Disney successfully passes on rate hikes to distribution partners.

Linear advertising demand for scripted entertainment remains challenged and cord cutting/diminishing viewership should make that weakness structural. Streaming will have to pick up the slack, but it’s not scaled or mature enough to do so just yet. That’s what I view as the main Disney predicament driving negative investor sentiment today. This is temporary and solvable… but not in the very near term.

3b. A Subtle Silver Lining:

While this backdrop is far from ideal, it’s not all bad news. Not only is Disney well positioned to benefit from the linear transition to streaming, but it’s also still enjoying unique value from the legacy distribution method as well. Abbott Elementary, for example, is a popular ABC show with an average audience age of 60 years old. Abbott delivered compelling traffic and advertising revenue via the linear outlet, but the value creation was far from finished. Disney added Abbott Elementary to Hulu (streaming) where it has become one of the service’s top sources of watch hours. To make this added traffic even more attractive, the average watch age on Hulu has been 30 years old, illustrating how incremental these avenues can be. Simpsons and Family Guy, two highly popular Fox shows, are also two of the best performers on Disney’s streaming properties.

“It’s clear to us that the exclusivity we assumed would be so valuable for subs wasn’t as valuable as we thought. Content can exist on linear and streaming due to different audiences.” -- CEO Bob Iger

3c. Charter Showdown:

The contract renewal battle between Charter and Disney is a clear sign of how the linear video landscape has changed. Disney pulled ESPN and the rest of its channels off of Charter’s Spectrum on the eve of college football season. You could you feel the outrage on social media from passionate fans and it’s this passion that led to an expeditious resolution after about a week.

The structure of this new deal further hammers home the power and draw of ESPN (and streaming too). So what’s in the new 10 year deal? While complete financial terms were not shared, Charter will supposedly pay Disney $2.2 billion in content access fees. Interestingly, it will drop 8 of Disney’s 27 stations including less popular channels like Freeform, while accepting Disney’s price increases on the remaining 19.

The most notable piece of this newer deal, however, is how it morphs together the worlds of linear and streaming. Charter customers will gain access to the ad tiers of Disney+ and ESPN+ via a new wholesale agreement. The price of these services will be baked into the Spectrum bundle’s overall consumer fees.

Furthermore, Spectrum customers will have access to ESPN’s planned streaming service whenever that goes live (which is inevitable). This ensures Spectrum continues to hold rights to that coveted content as the streaming revolution marches on.

This is somewhat perfect for Disney as it secures more cash flow and leeway going forward. Why? Disney has long relied on Charter and Comcast as centralized distribution partners for its linear TV assets. They aggregated the traffic. That outlet potentially vanishes in the world of streaming, but as part of this deal, Spectrum will continue to serve as a distributor to its nearly 15 million customers. That will mean more immediate traction and ad reach for the services and was the sticking point for Spectrum making the other concessions Disney wanted. It really was all about maintaining access to great content as that content moves off of linear.

Finally, this allows Disney to keep linear TV as a cash cow (a deteriorating cash cow but still a cash cow) for the next decade. That gives it far more flexibility and control over setting the pace of its eventual full shift to streaming. It can make this shift from more of a point of comfort rather than need thanks to this deal getting done. Laura Martin, one of my favorite media analysts, calls this a “win, win” and I’d have to agree.

4. Disney Media -- Streaming

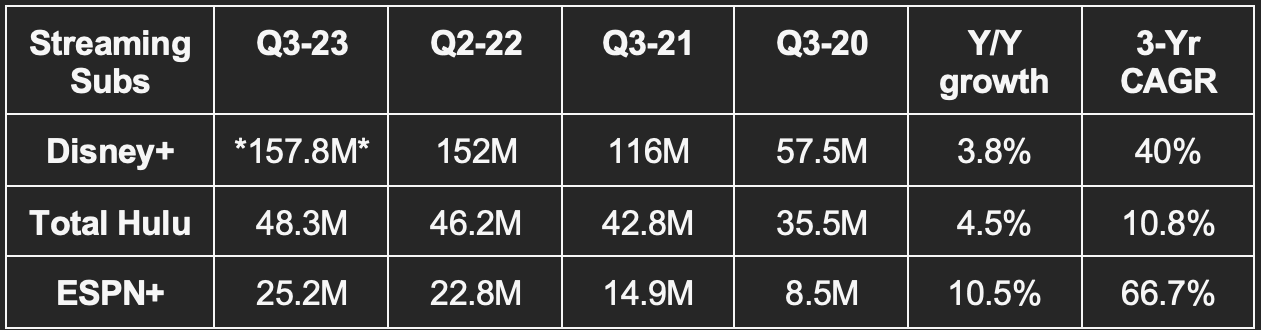

Disney’s streaming assets consist of Disney+, ESPN+ and Hulu. Streaming and Direct-to-Consumer (DTC) are considered synonymous and used interchangeably throughout the section.

Iger has come back to Disney with the following streaming playbook:

- Cut costs to push Disney+ to positive EBIT by FY 2024 & Focus on the Core

- Rationalize organizational structure.

- Price to value.

- Create Globally Relevant Content.

- & Hello Licensing.

4a. Cut Costs & Focus on the Core

Let’s start with cost cutting and the push for positive streaming EBIT by the end of FY 2024. Per Iger, Disney has gotten far too aggressive on content quantity and general entertainment (outside of core brands and IP). Because Disney+ was born during a time when investors solely cared about subscriber growth, that’s what Disney prioritized. As a result, it flooded Disney+ and Hulu with large volumes of low-quality, low-rated content to try to minimize churn. In reality, it had been thinking about this segment incorrectly. Eyeballs want world-class entertainment.

Now, Disney is actively shedding un-compelling titles and is focused on quality as part of its aim to drive $3 billion in content cost savings. It doesn’t see these cuts having any impact on churn or subscriber growth to date. While that’s encouraging, it’s also a byproduct of how bloated and misaligned its budget had truly become. Frustrating, but totally fixable (really, isn’t that what we are looking for as an investment opportunity?).

This change is why it stopped guiding to quarterly subscribers: Priorities evolved in favor of what Iger calls “aggressive content curation.” Bloomberg also recently reported that it’s cutting internal subscriber targets for 2024 that were set over a year ago. Considering the abrupt shift in philosophy, this was inevitable.

Near Term Impact of Focusing on the Core:

Disney is now shuttering some new projects, ending struggling shows, removing low value licensing agreements and becoming “highly picky” on which general entertainment content it chooses to keep. Overall, Iger and his team are obsessively reviewing every cost line item to ensure streaming is becoming as efficient as it can be. This drive for productivity lead to the combination of its product and program marketing teams as well which fostered modest cost savings. This all created a $2.65 billion restructuring charge this past quarter with severance adding $210 million to that one-off hit. Conversely, it has also led to streaming losses improving by $1 billion since Iger took over with further improvements expected going forward.

For the year, most subscriber churn has been powered by Disney+ Hotstar’s decision not to renew India Cricket rights (wouldn’t outbid Paramount). In India specifically, the service’s subscriber count most recently fell from 52.9 million to 40.4 million Q/Q. But it was only a subscriber hit. Hotstar subs come with much lower revenue per user vs. core Disney+ ($0.59 vs. $6.58) and contribute immaterial revenue and EBIT to its overall streaming results. Not chasing the rights was the correct decision and shows Iger is serious about belt tightening. Overall core subscribers (which excludes Hotstar) continue to gradually rise Y/Y with international additions offsetting minimal losses in North America.

It’s important to note that Disney fully expects streaming subscriber growth to continue for the long haul. The team has simply placed added emphasis on guaranteeing the unit economics as growth continues. It sees ramping core subscriber growth as we wrap up fiscal 2023 and head into 2024. The confidence stems from easier comps, a strong content slate and partners like Sony adding to the library’s appeal.

Tighter Global Focus:

Like countless other firms have done over the last 2 years, Disney will focus on only its highest value international markets for streaming. It will pull back on local content spend and completely exit some geographies with perhaps some licensing agreements to more efficiently maintain revenue. It will focus on only the countries where it sees a high probability of success. It’s safe to assume this will be North America, Western Europe and parts of Asia Pacific.

4b. Rationalize Organizational Structure

Interestingly, part of the cost savings here will come from reorganizing teams in a more cohesive and streamlined manner. After Iger left in 2020, Disney was restructured in a way that siloed content, marketing and distribution teams. This led to severe budget bloating, mismatched costs, and some poor execution. The issue has been most noticeable for its film studios which I’ll cover later on. Iger has since re-unified these teams to ensure those making budgeting decisions are actually communicating with the people who have a better sense of content value. This will mean writers are held fully responsible for their creative success. That newfound accountability shows how Disney will be run more like a meritocracy and less like a children’s soccer league handing out participation trophies.

Its distribution teams have also rightfully pushed Disney to embrace omni-channel windowing. If it’s already incurring the costs, why not accrue maximum value? It’s now doing so.

The Magic Kingdom’s content differentiation comes from its unmatched library of loved brands and franchises. While it has had success with some general entertainment titles like Modern Family, that’s not where it excels. It’s now focused on what does makes it stand out: Core IP. The shifting content priorities will lead to Disney producing fewer titles with more emphasis on what has made the company iconic for a century.

4c. Flex the Pricing Power

As part of the subscriber arms race of 2020-2021, Disney priced its streaming services too generously. Part of this was its focus on general entertainment and part of it was just a strategic blunder (in hindsight). Like the content glut issue, it’s hard at work to alleviate this concern as its EBIT quest supplants subscriber growth as the top streaming priority.

It successfully passed on significant price hikes across its streaming assets in 2022. The churn was so minimal that it decided to hike prices this summer by another 27%. Disney+ is discovering that its streaming service may need to be a bit more niche than it originally expected… but that shift should mean incremental price elasticity of demand. Impressively, since launching the service at $6 a month in 2019, the price increases have compounded at a nearly 20% clip through 2023.

Another objective for the hikes is to drive more subscribers to Disney’s ad-supported tier. It rolled this plan out in early 2023 with Iger “very pleased” about the response. Specifically, 40% of its new subscribers last quarter opted into ads while Disney will debut the tier in Canada and Europe by the end of 2023. Ad-based plans deliver subscriber value beyond where Disney’s ad-free subscriptions had been priced. Hulu (Disney’s only profitable streaming service today) and Netflix have both explicitly demonstrated the same reality. It’s basically a no lose situation.

“The Disney+ ad tier continues to improve our ARPU.” -- Interim Disney CFO Kevin Lansberry

4d. Go Global

Disney is re-thinking global vs. local streaming distribution. Per Iger, Disney+ territory managers were becoming too… well… territorial. Disney was producing too much content at hefty price tags for specific markets without global appeal. Catering to the World instead of just the USA is another way to ensure dollars spent are as impactful as they can be. Yet another example of maximizing the value derived from incurred costs and behaving as a rational business. This is a key investment case theme.

Interestingly, Disney’s parks segment has always had this global focus. It has long welcomed visitors from across the world to share in globally relevant mining of its IP. Under Disney’s reinvigorated approach, it will emulate this philosophy within Disney Media. ESPN, Disney, Pixar, Fox, Lucasfilm and Hulu will ALL more strongly contemplate global relevance when looking at best use of funds.

4e. Hello Licensing?

When Disney+ debuted, it halted content licensing agreements with streaming competition to support its own product. As reviewed above, this thinking has been proven flawed. Interestingly, while Disney may be producing less content for itself, it may not be producing less content overall. As part of the Fox acquisition, the company secured a lot of creative talent. This creative talent will have less work to do given Disney’s new approach. Iger sees “likely opportunities” to allocate some of those extra hours to creating for other streamers and networks.

It will NOT license its core IP to the competition, but will more liberally license its general entertainment across the industry. This is another key sign to me that Disney is now singularly focused on maximizing shareholder value. Embracing licensing meshes well with its aim to get more aggressive on windowing content more frequently.

“Making use of all platforms is the best way to monetize.” -- CEO Bob Iger

4f. Consolidating Streaming Apps & Build Advertising Reach

Disney is tweaking its streaming go-to-market to focus more on bundling. Its current marketing campaigns focus on the “Disney Bundle” of Disney+, ESPN+ and Hulu while it just released a Disney+ plan featuring a plethora of Hulu’s content. The unification approach is really is just the cable bundle 2.0. It worked well with Disney’s international bundling of Star into Disney+, and its intuitive to think the same benefit will be realized domestically.

Note: Disney owns 2/3 of Hulu while Comcast owns the rest. Disney has a 2024 option to buy the rest at a $27.5 billion valuation. No decision has been made, but CFO Kevin Lansberry told investors he has zero liquidity concerns if Disney decides it wants to other 1/3.

Bundling traction would create Disney value in a few key ways. The first is intuitive. Cross-selling directly drives higher retention. Even with the discounts offered to bundlers, that churn advantage means better lifetime value and more visible unit economics.

The next item pertains to advertising. Since Disney embraced streaming, it has been a leader among legacy media players in implementing new technology. It has a tight partnership with The Trade Desk on the buy side to extract maximum value from its inventory. With The Trade Desk, streaming ad buyers routinely pay hefty impression premiums because of the incremental targeting granularity (and returns) it provides. That’s the luxury of the always signed-in nature of streaming which linear or other channels like web advertising have never enjoyed. Now, Disney knows exactly who is watching what while The Trade Desk helps it know what those eyeballs want to be sold. So? Ad buyers receive more value and are willing to pay more to Disney.

When paired with this tech upgrade, streaming app unification will mean more data scale and a better view of consumer preferences than Disney has enjoyed in the past. Today, 40% of Disney’s total inventory is addressable/targetable. That proportion will keep rising to further enhance the value of Disney’s impressions. Addressable impressions boast more resilient demand than non-addressable counterparts and that bodes well for the future. Need proof? You’d be hard-pressed to find any weakness in The Trade Desk’s 2022-2023 results despite it presiding in the violently cyclical advertising sector. That’s because essentially 100% of its inventory is addressable/targetable and because streaming is such a large chunk of its revenue.

Rita Ferro (Disney’s President of Advertising) has been an instrumental part of Disney’s ad modernization. Aside from working with The Trade Desk, she facilitated the opening of Disney’s ad inventory to other demand side platforms (DSPs) and data agencies and freed advertisers to enjoy what they truly want: Minimum frequency with maximum returns. She has been vital in bringing Disney+ targeting up to par with Hulu’s capabilities. Interestingly, Hulu is already comfortably profitable for evidence of the Disney+ ad-tier potential.

Now, Rita and Disney are working to debut more of a self-service buying process to cater to smaller ad buyers. This will unlock economically rational growth from these smaller customers due to diminished Disney service requirements. Incremental layers of automation allow Disney to actually fulfill this demand without jeopardizing unit economics. Exciting development.

Finally, like Netflix, the company will crack down on account sharing with new user agreements by the end of calendar 2023. This is expected to drive profitable growth more noticeably in 2024. Iger won’t offer specific stats on this issue but does call it a significant opportunity.

4g. Streaming Can & Will Be a Great Business:

There’s a growing narrative on streaming being an awful business. Based on the fully addressable nature of ad impressions, Disney’s rapid progress towards breakeven EBIT, and Netflix’s solid EBIT profile, I reject this notion.

Disney turned linear up-front ad selling into a phenomenal business despite the lack of data driven targeting and measurement. Do you really think that as eyeballs finish shifting to streaming, the incremental addressability can’t turn into that same cash cow? It will take time, but streaming margins should be just fine. Netflix’s CFO agrees as he recently told investors that he fully expects run rate margins to approach linear TV.

The perceived margin risk will take a while to fade away as streaming rationalizes spend, scales and consolidates. Give it time as the rest of these cost and value improvements play out. Investor preferences can change on a whim… operational pivots for massive organizations take longer to bear fruit.