Table of Contents

a. Key Points

- Ugly headline numbers.

- Encouraging structural trends.

- Durable product advantages vs. prediction markets.

- Accelerating handle growth in October.

b. Demand

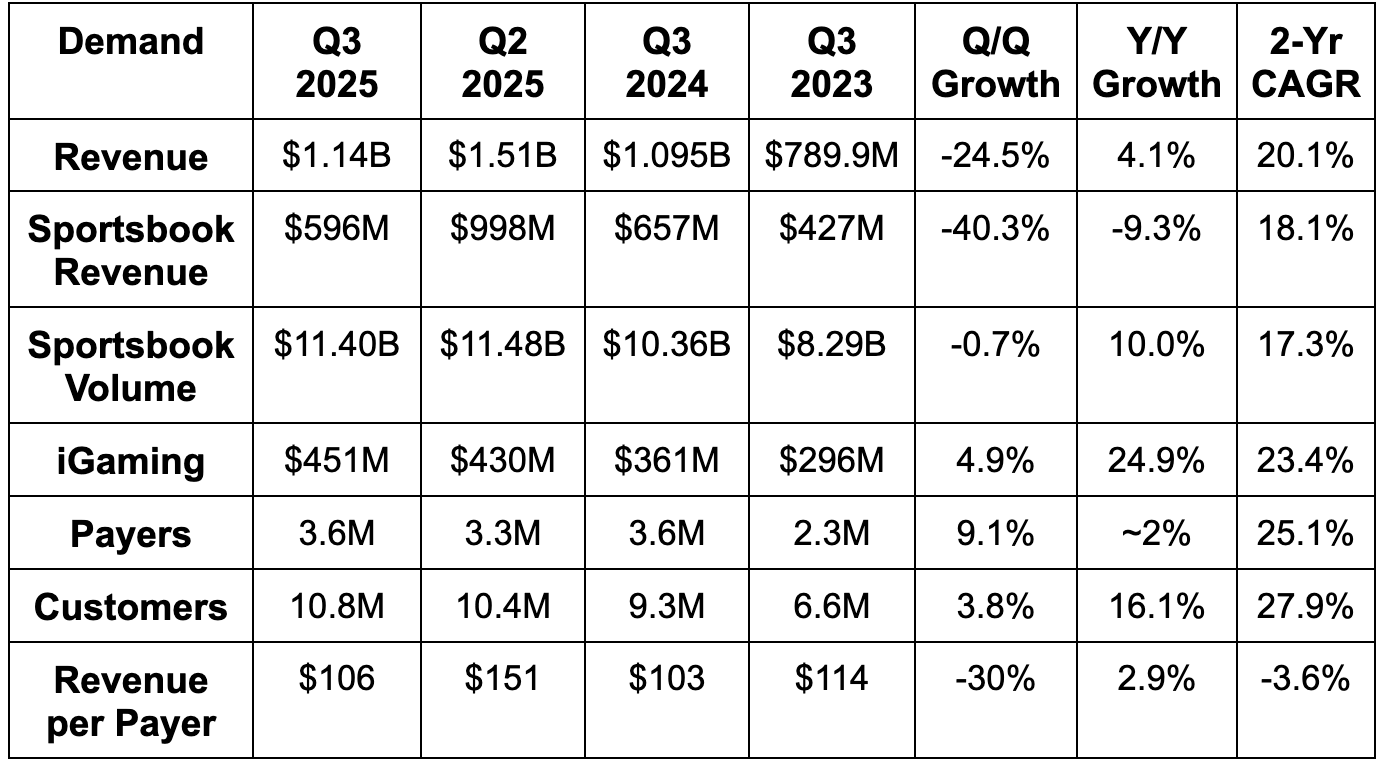

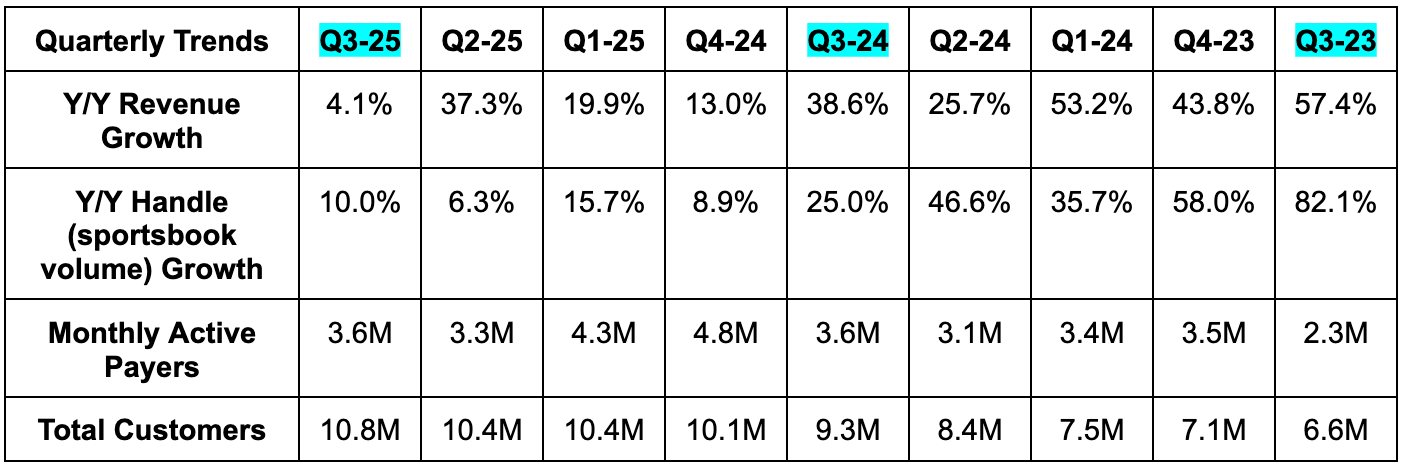

Missed revenue estimates by 5% due to sportsbook outcomes. iGaming revenue beat estimates by 4%. Note that Jackpocket M&A is a material revenue-per-payer headwind.

c. Profits

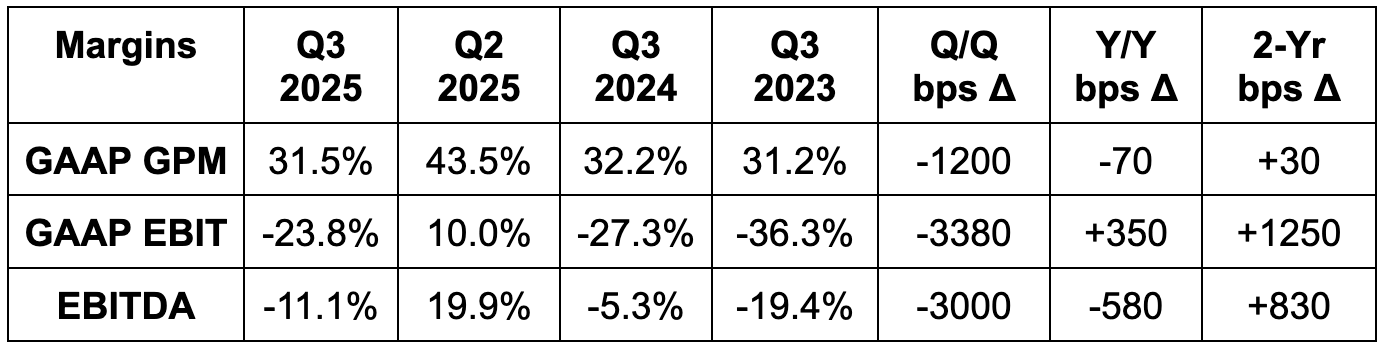

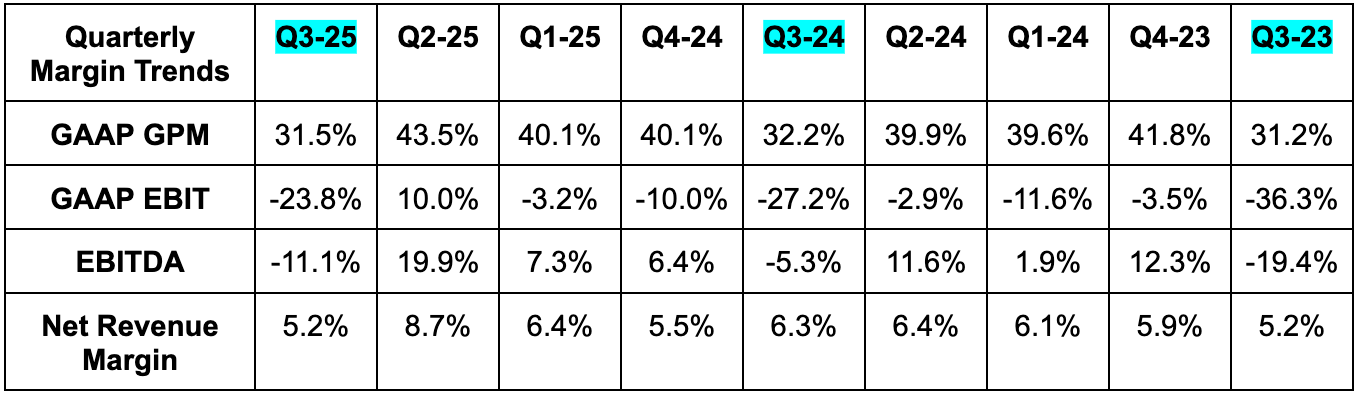

- Missed 37% GPM estimate by 6 points.

- Missed -$68M EBITDA estimate by $58M.

- Met -$0.26 EPS estimates.

- Bad outcomes directly impact every margin line.

d. Balance Sheet

- $1.12B cash & equivalents.

- $1.8B total debt.

- Stock comp dollars down 13% year-to-date.

- Raised $1B buyback to $2B. That’s nearly 15% of the market cap.

e. Guidance & Valuation

Analysts were anticipating a large reduction, but this was beyond expectations. No, this was not related to prediction market competition. It was due to a $300M friendly outcome headwind. They lowered by $300M solely because of this. This led to the large EBITDA cut too, while planned investments in its prediction market product launch meant the EBITDA cut was a bit amplified.

- Lowered annual revenue guidance by 4.8%, which missed by 3.1%.

- Lowered annual EBITDA guidance by 41%, which missed by 33%.

- No updates to annual GPM or FCF guides but I’m sure both were lowered internally based on the other misses.

It sounds like investment levels in mature sports betting states will fall Y/Y in 2026. That should provide more leverage, while they also expect to keep cutting overall promo rates. They have plans to invest more in AI, but a lot of that will entail efficiency gains that offset the profit headwind. 2026 investment focus areas will be on new states (hopefully some iGaming legalization wins) and prediction markets.

DKNG trades for about 20x forward EPS. EPS is expected to grow from $0.24 to $1.67 this year, by 83% the following year and by 50% the year after that. It has not been profitable for long enough to use anything but a sales multiple chart below. Estimates for 2025 will fall sharply due to the EBITDA revision (somewhere around $1), but I think any negative revisions for 2026 will be modest if there are any. Again, this miss is all luck-related.