1. The Trade Desk (TTD) -- Q1 2023 Earnings Review

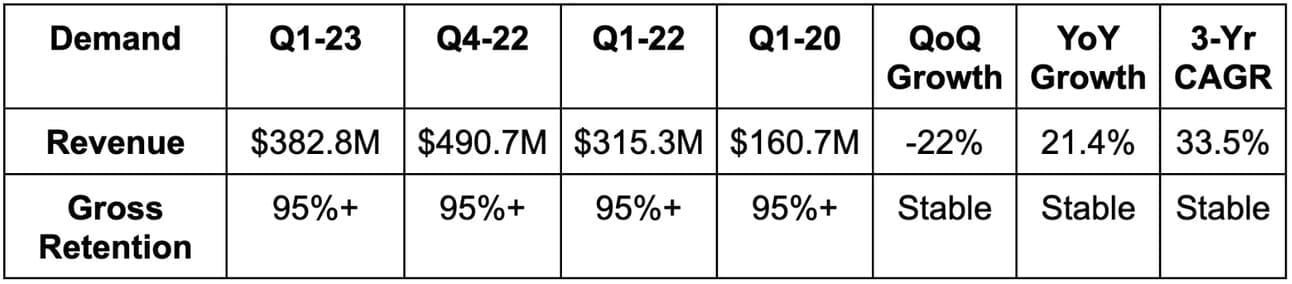

a. Demand

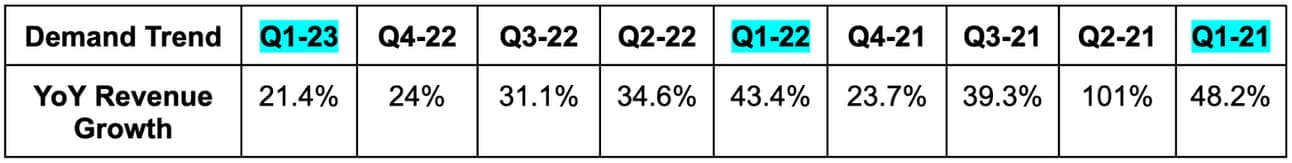

More Demand Context:

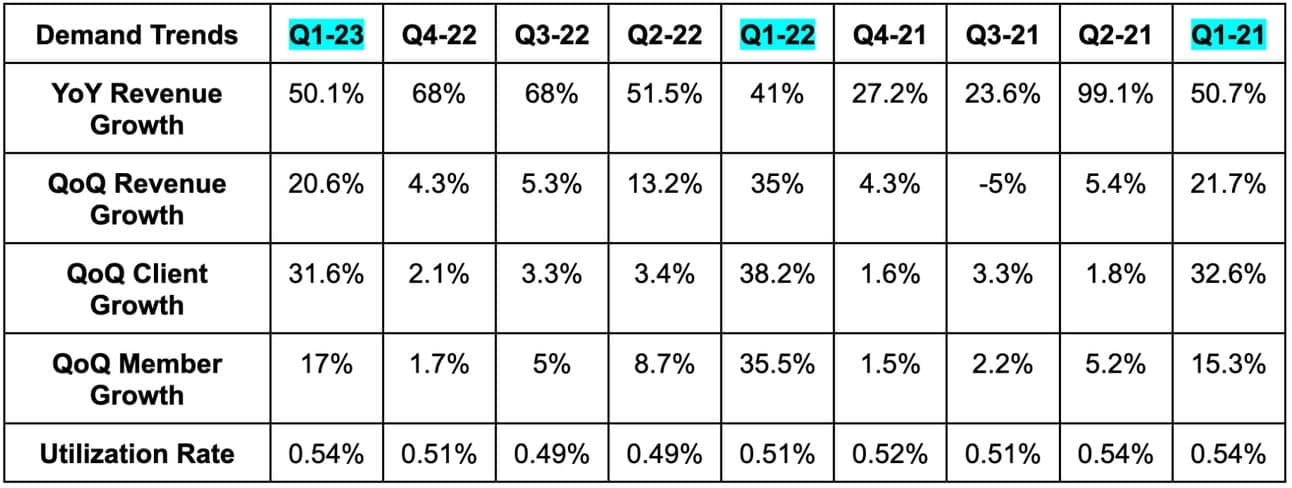

- Easy comps in Q1 2021 and Q1 2022 turned into tough comps this quarter. Revenue growth would have been closer to 23% ex-2022 political spend.

- Video is around 45% of revenue, mobile is around 35% of revenue; display is around 10% of revenue and audio makes up the remaining 5%.

- Travel as a vertical was a standout for the company. Spend there nearly tripled YoY.

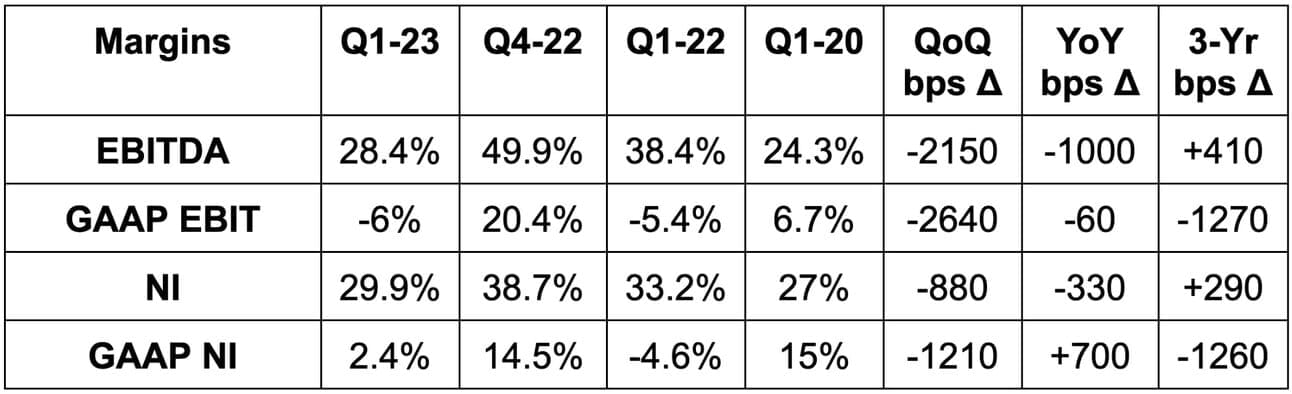

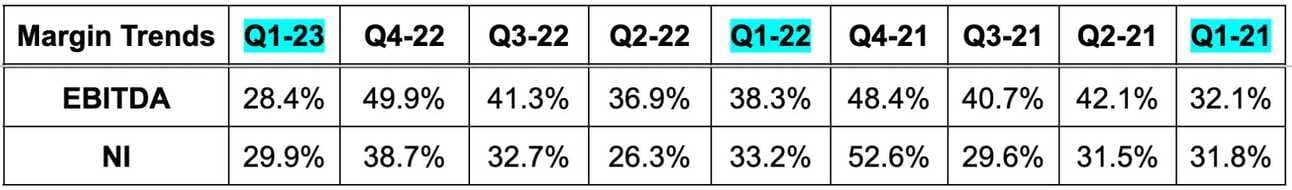

b. Profitability

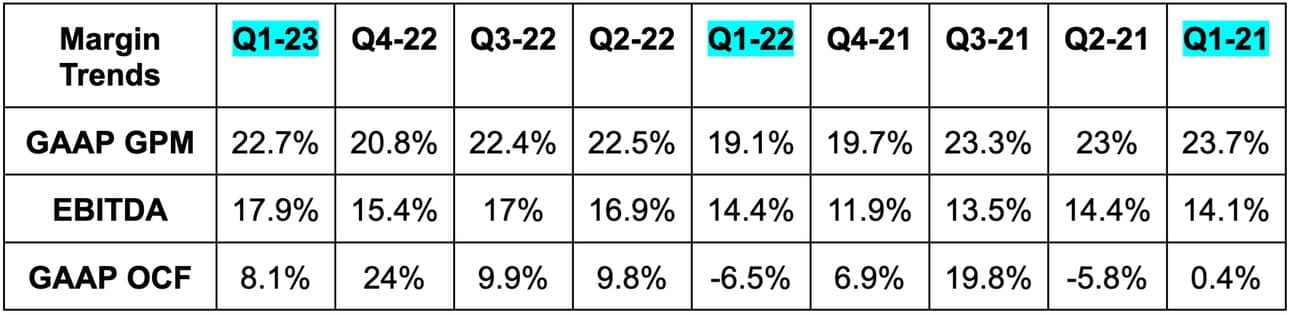

More Margin Context:

- Free Cash flow generation is compounding at a rate over 100%.

- Operating expense growth of 41% YoY was due to continued platform investments and also the return of in-person events/travel.

c. Balance Sheet

- $1.3 billion in cash & equivalents.

- $0 debt.

- Paid out $113 million in stock compensation which is still being inflated by temporary founder awards (for hitting performance targets). It bought back $259 million in stock to more offset this dilution.

d. Guidance

- Beat revenue estimates by “at least” 1.5%.

- Beat EBITDA estimates by 1.2%.

- The Trade Desk will continue to hire in 2023 at half the pace it did in 2022. It sees the talent market as far more favorable today than it has been since pre-pandemic. This, more cash taxes and the return of in-person events is expected to lead to operating expenses growing YoY in 2023.

The team hinted at operating leverage in the second half of the year and into 2024 but did not offer concrete guidance there.

e. Call & Release Highlights

Success:

The company again vastly outgrew digital advertising and took more market share. Companies amid uncertain macro are embracing better precision, more efficient reach and more relevant targeting. That is exactly what this scale leader within programmatic advertising delivers. And its commitment to only serving the buy-side merges this added accuracy with a lack of conflict of interest.

While some advertisers are somewhat timid amid poor macro, dollars continue to shift faster and faster to the firm’s channels and platform. This is why it continues to readily sign joint business plans with massive agencies worth well over $1 billion in spend. And that’s why it keeps taking share every single quarter.

Channel standouts this quarter were the same as they have been in recent periods: Connected TV (CTV) and retail media. It signed a new retail media partnership with Macy’s to join Home Depot, Walmart, Kroger, Meijer, Target, Gojek and many others. It spoke about Fair Price (largest grocer in Singapore) cutting customer acquisition cost by 33% with this platform at twice the scale. Good combination.

For CTV, streamers are increasingly embracing ad supported formats to fund their competitive content spend. To maximize value per impression within this newer approach, they must embrace open bidding and efficient price discovery. The Trade Desk offers that need with more scale (so more bids) than anyone else can.

Finally, the firm talked about this year’s up-front process so far. As a reminder, up-fronts mean purchasing large blocks of impressions well in advance -- with little visibility and data. The firm is thriving in an environment where uncertainty is extreme because it frees purchases to be done on an impression basis rather than millions at a time and far in advance. While that’s true, it still wants a piece of the upfront market while the shift to programmatic continues. So? The Trade Desk created a product to make this process more biddable and granular to help advertisers evolve.

- Advertisers at up-front events are now routinely requesting that publishers allow them to use The Trade Desk for purchasing. That’s powerful.

Unified ID (UID) 2.0 — The Trade Desk’s open internet identifier to replace 3rd party cookies and upgrade it to a fully omni-channel, always on customer view:

- NBC Universal added a UID2 integration along with Paramount and Rave (70 million users).

- The Trade Desk launched its TV Quality Index (TVQI) this quarter. This allows advertisers to understand consumer ad response, relevance and optimal return areas. It directly plugs into UID2 to accomplish this. Two large clients including Sinyi (largest real estate firm in Taiwan) used this newer tool to lift awareness and brand favorability by over 15% each. Sinya also enjoyed 2x the ad performance vs. its previous marketing strategy.

- 75% of its inventory is now UID2 tagged -- 3 months ahead of schedule.

- UID2’s better ID tagging is routinely fetching impression premiums vs. non-tagged inventory. Advertisers are happy to pay up for better targeting. Publishers get better rates. Win/win.

Generative AI:

- Jeff Green sees The Trade Desk as being in a “leading position” for generative AI. This is because investing in the compute power and tech is expensive. It requires balance sheet health and stable profits. The Trade Desk has that. This opinion also comes from The Trade Desk being born as an AI-supported company. It’s not a new thing for this firm.

- Its Koa platform has been using AI models for impression recommendations and campaign management for 5 years.

- Like others, The Trade Desk expects AI to improve its developer efficiency and to create new use cases like virtual assistants to “shorten the programmatic learning curve.” That last piece is expected to make the company a better vendor for smaller firms with more finite budgets and teams.

- It will launch its new AI-powered platform in June.

OpenPath:

OpenPath is TTD’s product allowing the demand side to plug directly into the supply side. The was born from players like Google opaquely siloing pieces of the supply chain and other vendors taking advantage of the confusion with excess fees and dishonest reporting. This is The Trade Desk’s response. OpenPath is NOT to replace the supply side. It is to let publishers on the supply side who want to perform their own supply side tasks like yield management to do so. Green was asked about Magnite’s new product called Clearline (which carries a similar philosophy). He thinks analysts are looking for drama for the sake of clicks while the two continue to co-exist. He’s not concerned.

Leadership:

CFO Laura Schenkein will replace Blake Grayson as TTD’s CFO next month. Schenkein has been with the team for 10 years and was most recently a finance team VP. That should make for a smooth transition. She previously worked as a VP at Barclays.

f. Take

This was an excellent quarter. More share gains, robust margins and a lengthy programmatic ad runway with leading open internet scale. The bar for execution is set extremely high based on the company’s valuation multiples… and deservedly so. We expect more drama-less execution despite numerous macro headwinds holding its competition back. The company just keeps executing.

2. Progyny (PGNY) -- Q1 2023 Earnings Review

“The year has begun with clear and positive momentum across all the key areas we look to including sales momentum early in the 2023 selling season.” -- CEO Peter Anevski

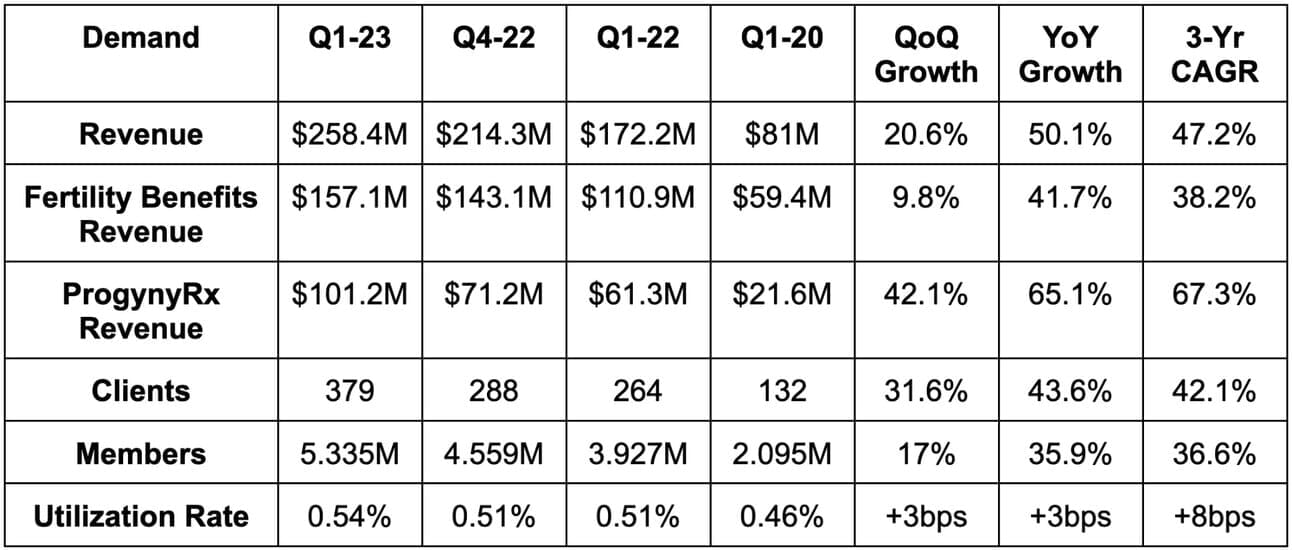

a. Demand

Progyny beat revenue estimates by 4.8% & beat its revenue guidance by 4.4%.

More Demand Context:

- Un-billed accounts receivable grew at a rate well below revenue. If you read our short report response in December… we told ya so.

- The pandemic made for easy 3-yr demand comps. New fertility treatments were temporarily halted in Q1 2020.

- Female Utilization rate improved from 0.45% to 0.48% YoY. This is despite rapid new client growth and these new clients always starting at utilization troughs.

- Progyny is now over 380 clients and 5.4 million members as of today.

- ProgynyRx attach rate reached 90% vs. 83% YoY. New clients boasted a 97% ProgynyRx attach rate.

- Assisted Reproductive Treatment (ART) cycles rose 47.6% YoY.

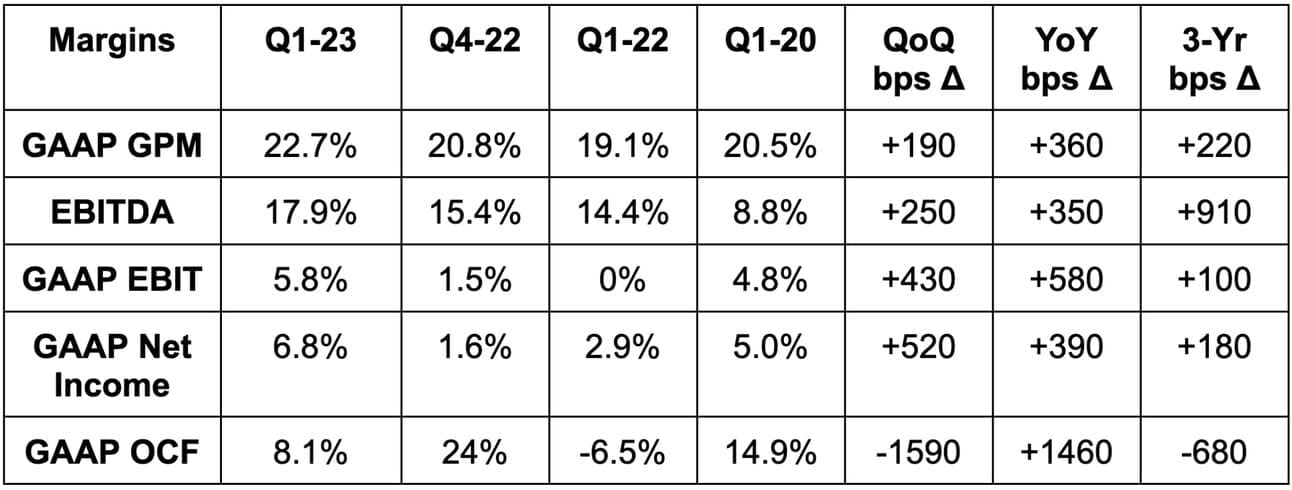

b. Profitability

- Beat EBITDA estimates by 9.3% & beat its EBITDA guidance by 8.3%.

- Beat $0.07 GAAP EPS estimates by $0.11 & beat its guide by $0.10. The $0.18 in EPS this quarter compares to $0.05 per share YoY. Importantly, this was NOT aided by income tax benefits which were $1.3 million this quarter vs. $5.1 million in the YoY period. This growth was powered by operating profitability.

- Progyny also beat cash flow and GAAP EBIT estimates, but these estimates were aggregated from just 2 analysts -- so not super valuable.

Margin context:

- Margin expansion was powered by cost base efficiency and economies of scale. General and administrative (G&A) as a % of revenue fell from 13.4% to 11.4% YoY as a result.

- Gross margin expansion was helped by a normalization in client onboarding timing. Last year, several clients launched in Q1 which led to it needing to invest ahead of the volume ramp. That hit margins. That impact was less pronounced this year.

c. Balance Sheet

- The balance sheet is pristine. It has $208 million in cash and equivalents with no debt.

- Stock based compensation was 11.9% of sales vs. 14.2% of sales YoY. This should continue to fall as Progyny distances itself from equity awards to executives for meeting performance targets.

- Bad debt expense was 2% of revenue vs. 1.3% YoY. Industry benchmarks of “good” for Progyny’s space is anything under 5%.

d. Guidance

Q2:

- Beat revenue estimates by 3.5%.

- Beat EBITDA estimates by 4.2%.

- Beat GAAP $0.08 EPS estimates by $0.015.

2023:

- Raised its revenue guide by 3.7% and beat estimates by 3.3%.

- Raised its EBITDA guide by 5.9% and beat estimates by 4.9%.

- Raised its previous $0.29 GAAP EPS guide by $0.16 and beat estimates by $0.17. This does not include any tax benefits that could come this year. This should keep being raised.

Progyny now expects incremental EBITDA margin (EBITDA margin on new revenue) of 20%+ for 2023. This compares to its previous guidance of 19.4% and paves the way for more margin expansion.