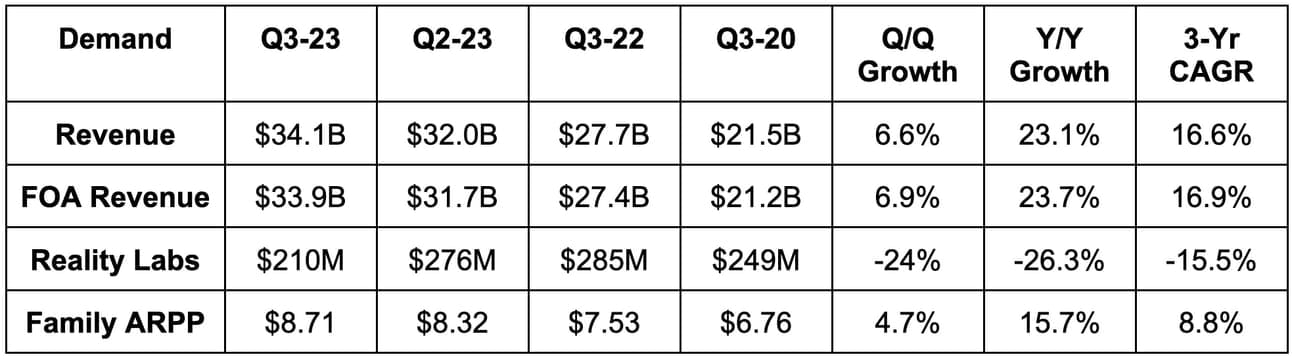

1. Demand

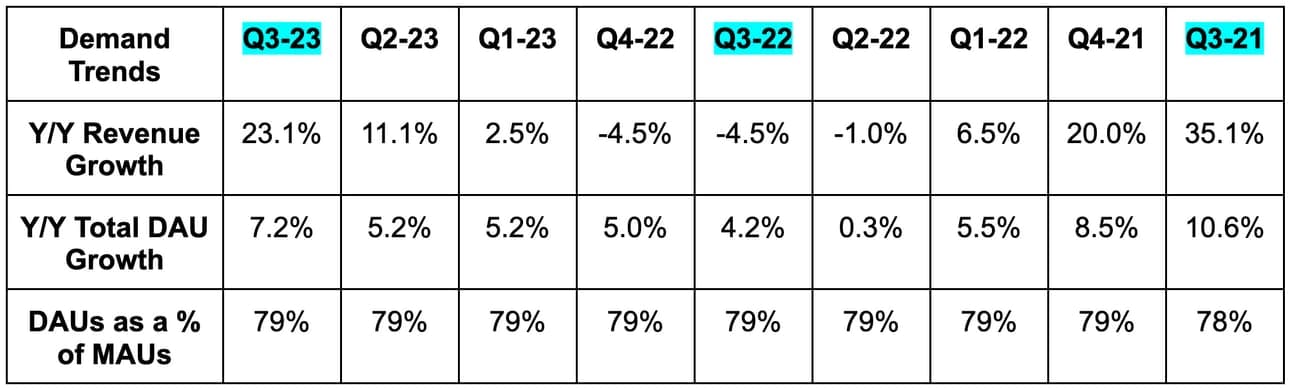

Meta beat sell side revenue estimates by 1.9% & beat its guidance by 2.7%. Its 16.6% 3-year revenue compounded annual growth rate (CAGR) compares to 19.6% Q/Q and 17.3% 2 quarters ago.

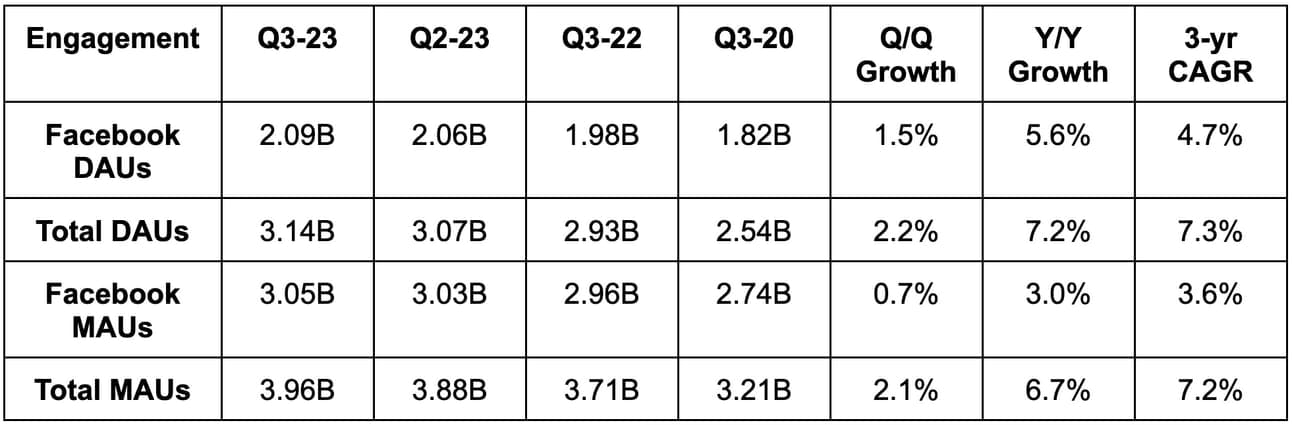

User growth beat across the board. Total daily active users (DAUs) beat estimates by 1.7%, total monthly active users (MAUs) beat estimates by 2.1%, Facebook DAUs beat estimates by 0.9% and Facebook MAUs beat estimates by 0.1%.

Ad impression growth of 31% Y/Y beat 29.6% Y/Y growth estimates. -6% Y/Y price per impression growth beat -7% Y/Y estimates. More on this later.

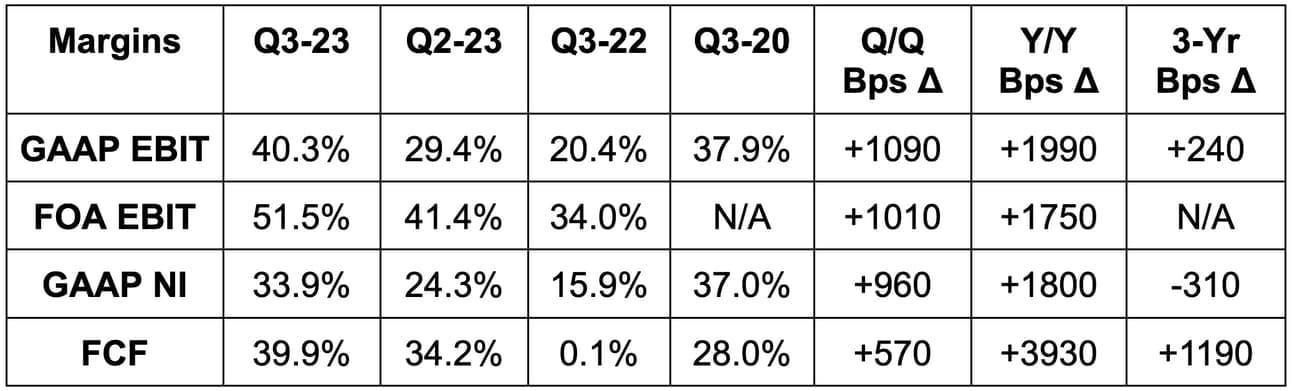

2. Margins

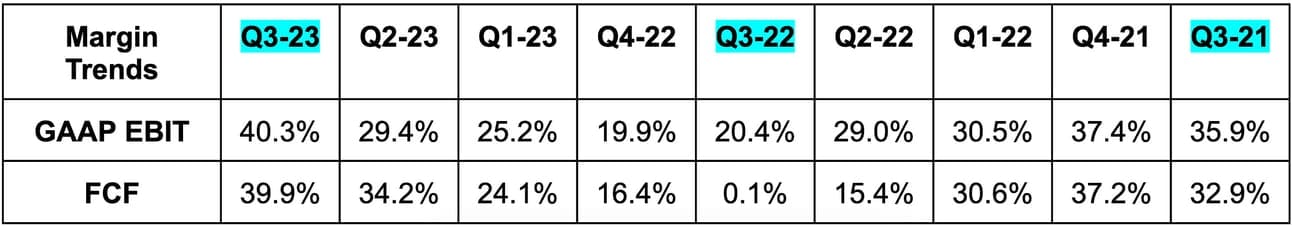

Meta beat EBIT estimates by 21%, beat $3.62 GAAP earnings per share (EPS) estimates by $0.77 and beat free cash flow (FCF) estimates by 83%.

3. Balance Sheet

- $60 billion in cash & equivalents.

- $18.3 billion in debt (all long term).

- Share count fell 4% Y/Y via continued aggressive buybacks. It has $37.2 billion left in buyback capacity.

4. Guidance

Meta’s Q1 2024 revenue estimate missed by 1.7%.

It lowered its 2023 operating expense (OpEx) guidance from $88.5 billion to $88 billion. It also lowered its 2023 capital expenditure (CapEx) guidance from $28.5 billion to $28 billion.

Its full year 2024 OpEx guide was 5.0% below consensus, while its CapEx guide was 5.3% below consensus. This should lead to upward 2024 profit revisions over the coming days. 2024 OpEx growth is expected to be around 9.7% Y/Y with CapEx growth expected to be around 16.1% Y/Y. Meta expects depreciation expense growth to accelerate in 2024 via higher CapEx in 2022 and 2023. It sees CapEx also ramping in 2024 to support data center and server investments for the large AI opportunity. As a reminder, it shifted to a new data center footprint which will make CapEx more efficient and project scaling more flexible over time. It will be a noticeable help to CapEx intensity in the coming years.

The company sees payroll growth resuming and thinks Reality Labs losses will grow in 2024 vs. 2023 as expected. It expects operating expenses overall to be boosted by the company maintaining a larger infrastructure footprint.