Table of Contents

- 1. Earnings Round-Up — Lemonade, Robinhood & Coinb …

- 2. Meta Platforms (META) — Earnings Review

- 3. Microsoft (MSFT) – Earnings Review

1. Earnings Round-Up — Lemonade, Robinhood & Coinbase

Meta and Microsoft commanded most of my attention tonight and those are the two full reviews in this article. Still, I know there’s a lot of interest in these three companies, so I wanted to include very brief snapshots of each report tonight. While my reviews function as complete, detailed dives into reports, these snapshots offer 30,000 ft. views.

For Lemonade, I will include more detailed coverage, quantitative data and my views on the report in Saturday’s article. I don’t follow the other two names closely, but I also plan to cover Robinhood’s call in more detail Saturday if time permits. HOOD has implications for other names that I do focus on.

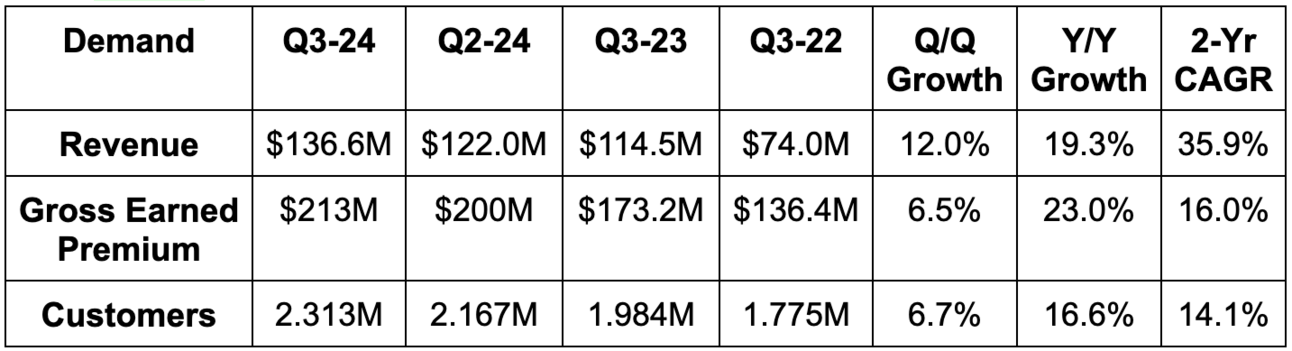

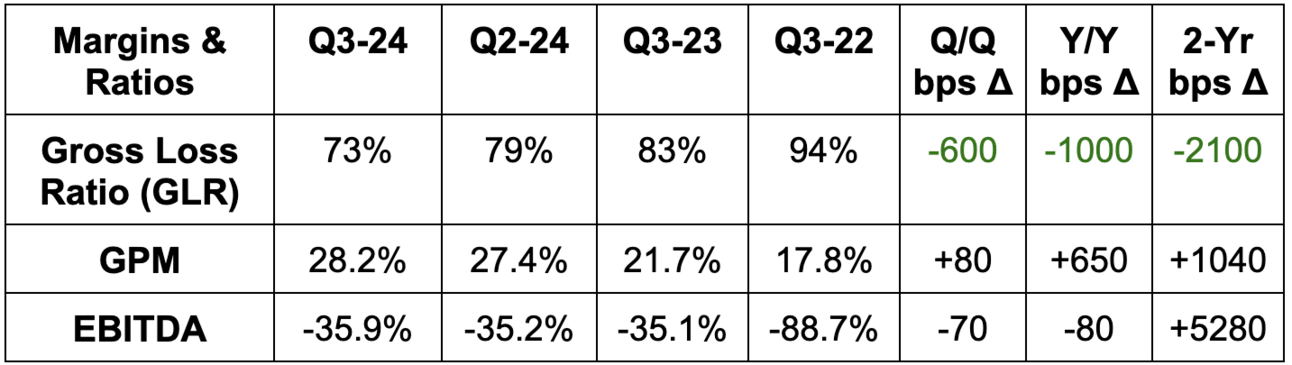

a. Lemonade (LMND)

Results:

- Beat gross earned premium (GEP) guidance by 1.9%.

- Beat in force premium (IFP) guidance by 1.4%

- Beat revenue estimates by 8% & beat guidance by 9.3%.

- Beat -$56M EBITDA estimates by $7M & beat guidance by $8M.

Guidance & Valuation:

- Q4 revenue guidance met estimates.

- Q4 EBITDA guidance missed -$21M estimates by $6M.

- Considering the historically bad hurricane that swept through the state recently, this was actually better than I expected.

- Raised annual revenue & GEP guides due to large Q3 beats.

Lemonade expects to be EBITDA positive in 2026. Wildly speculative investment. High risk/high potential reward.

Balance Sheet:

- $979M in cash & equivalents.

- No debt.

- Turned operating cash flow positive this quarter. Reiterated path to positive FCF.

- Liquidity will remain a strength following expected hurricane-related losses.

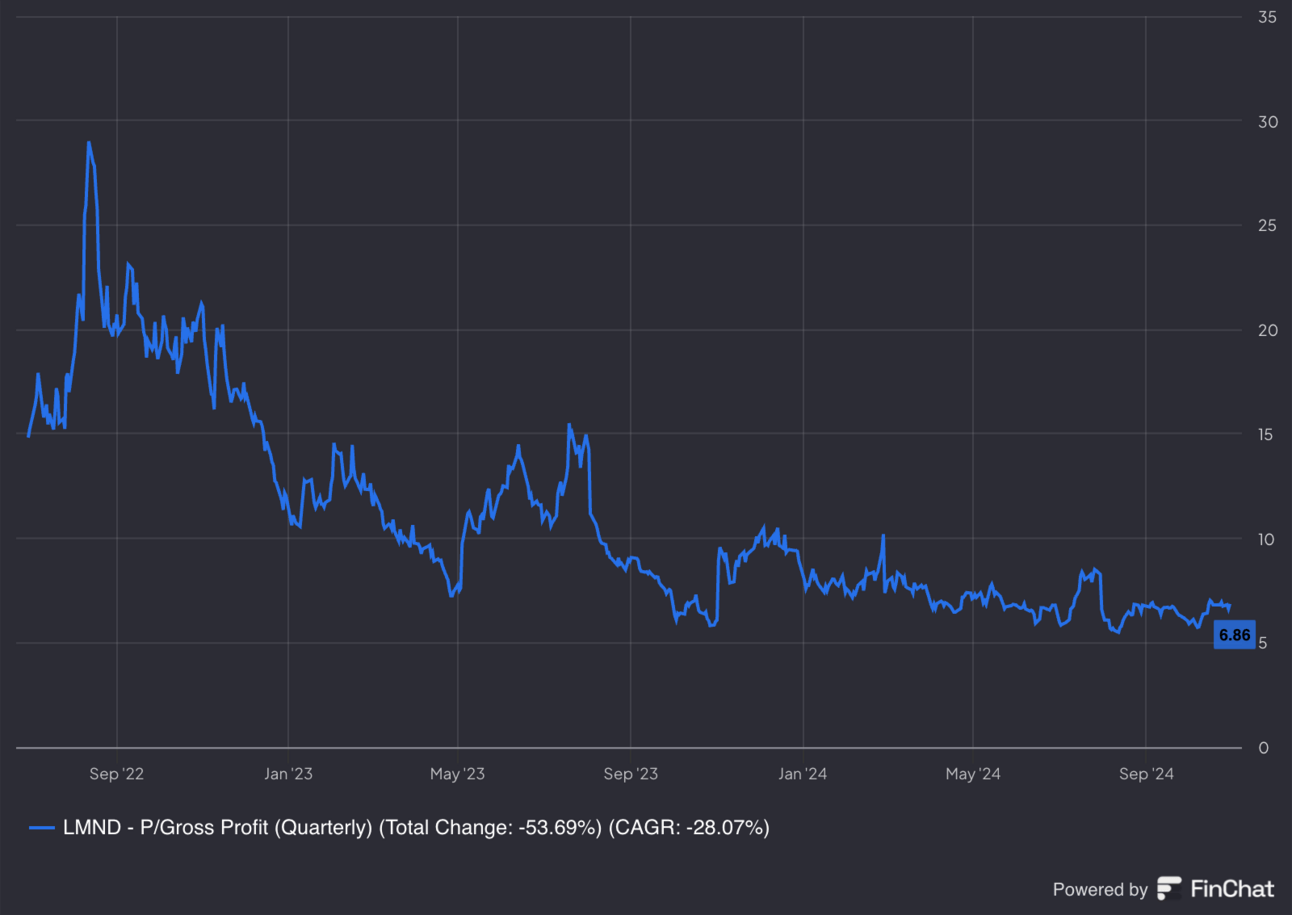

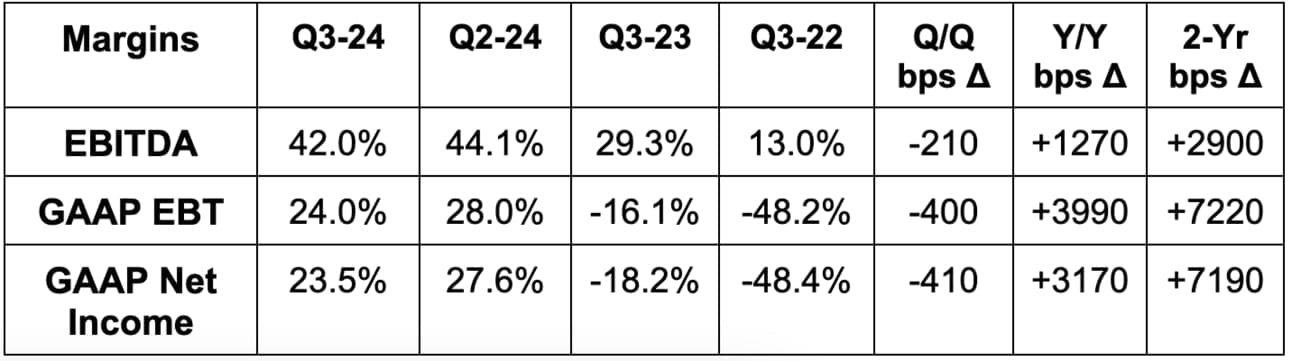

b. Coinbase (COIN)

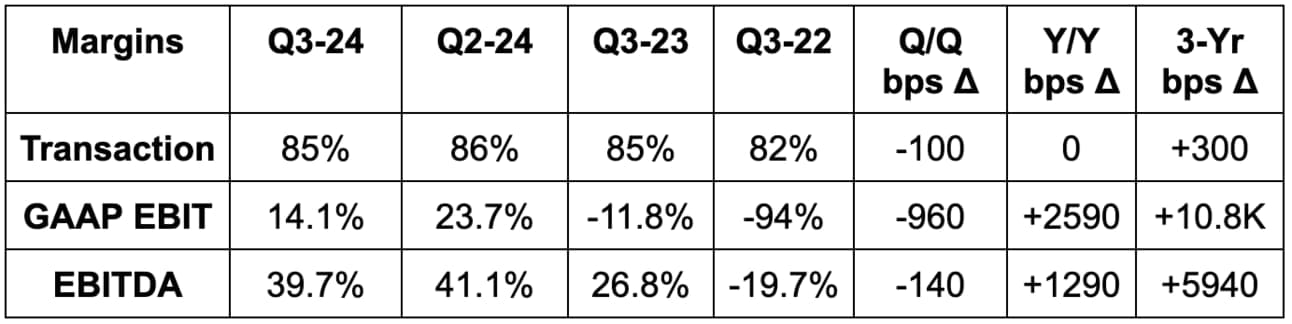

Results:

- Missed revenue estimates by 9.6%; missed subscription revenue guidance by 1.6%.

- Beat EBITDA estimates by 2%.

- Beat GAAP EBIT estimates by 13.8%.

- Missed $0.68 GAAP EPS estimates by $0.40.

Guidance & Valuation:

- $542.5 million in subscription and support revenue.

Balance Sheet:

- $7.7B in cash & equivalents.

- $4.2B in total debt.

- Basic share count rose 5% Y/Y.

- Diluted share count rose 13% Y/Y.

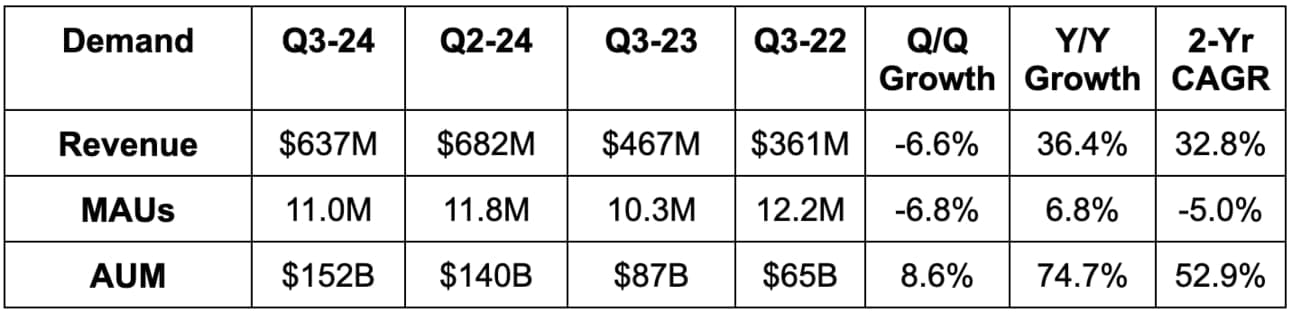

c. Robinhood (HOOD)

Results:

- Missed revenue estimates by 3.5%. All buckets besides “other” missed.

- Missed EBITDA estimates by 3.1%.

- Slightly missed $0.18 GAAP EPS estimates by $0.01.

- Met net funded accounts estimate.

- Slightly beat assets under custody estimates.

- Robinhood Gold subscribers rose 65% Y/Y vs. 61% Y/Y last quarter.

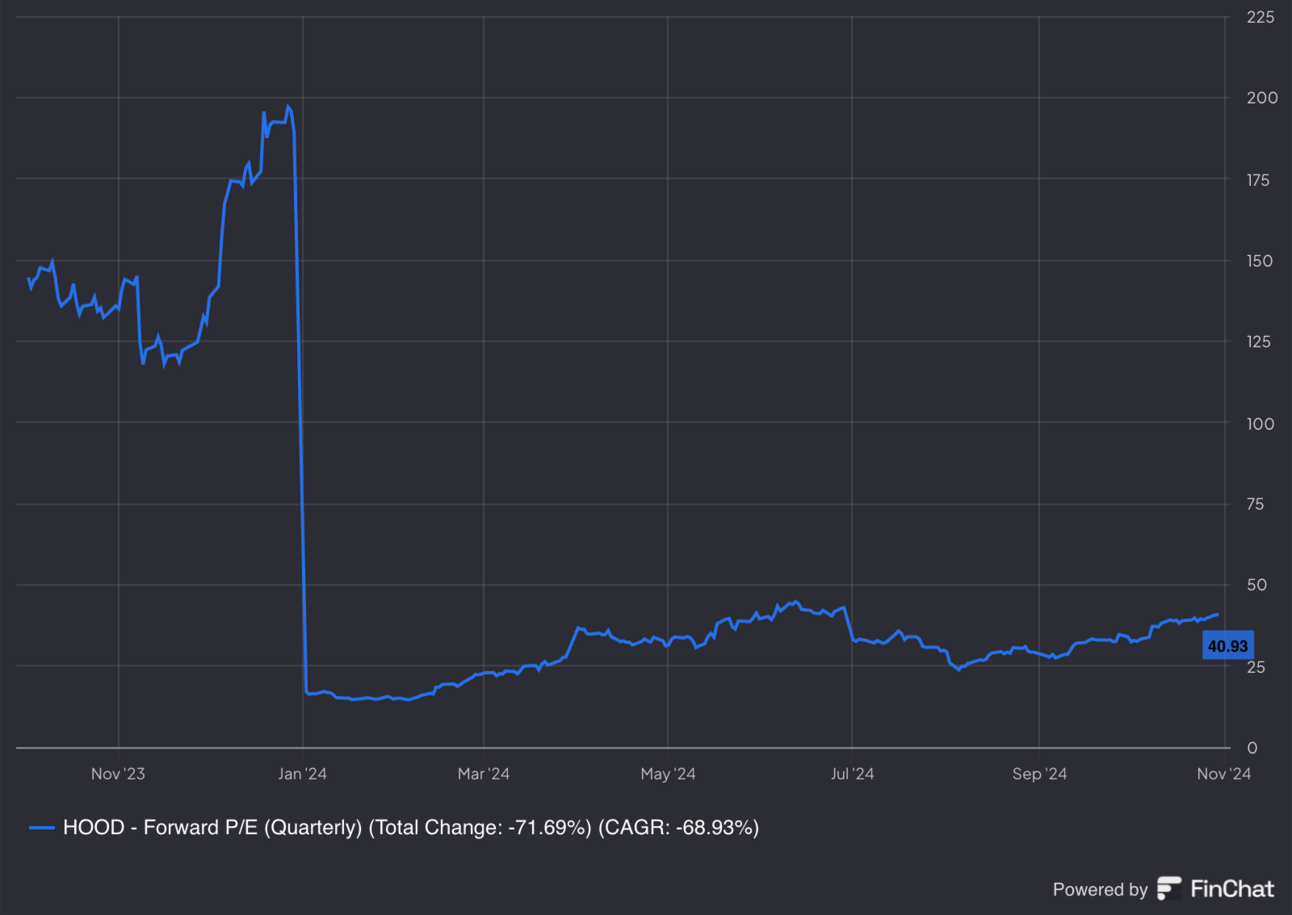

Valuation:

EPS is expected to double this year and fall by 3% next year.

Balance Sheet:

- $4.6B in cash & equivalents.

- No debt.

- Diluted share count rose 1% Y/Y; basic share count fell 1.2% Y/Y.

- $39B in trailing 12-month net deposits vs. $33B Q/Q & $24B 2 quarters ago.

2. Meta Platforms (META) — Earnings Review

Recent Content to Read:

- AMD, Alphabet and Visa Earnings Coverage.

- SoFi & PayPal Earnings Coverage.

- Tesla & Service Now Earnings Coverage.

- Netflix and Taiwan Semi Earnings Coverage.

- SoFi Deep Dive.

- Nu Deep Dive.

- Zscaler Investment Case (shorter deep dive).

- Starbucks Investment Case.

- Cava and SweetGreen Deep Dives.

Amazon & Apple coming tomorrow. Dozens more reports coming this season.

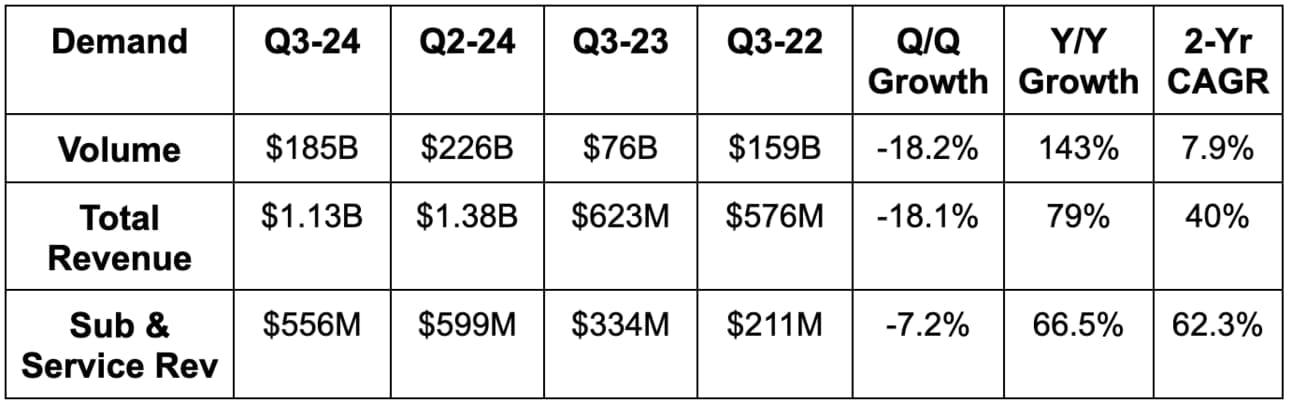

a. Demand

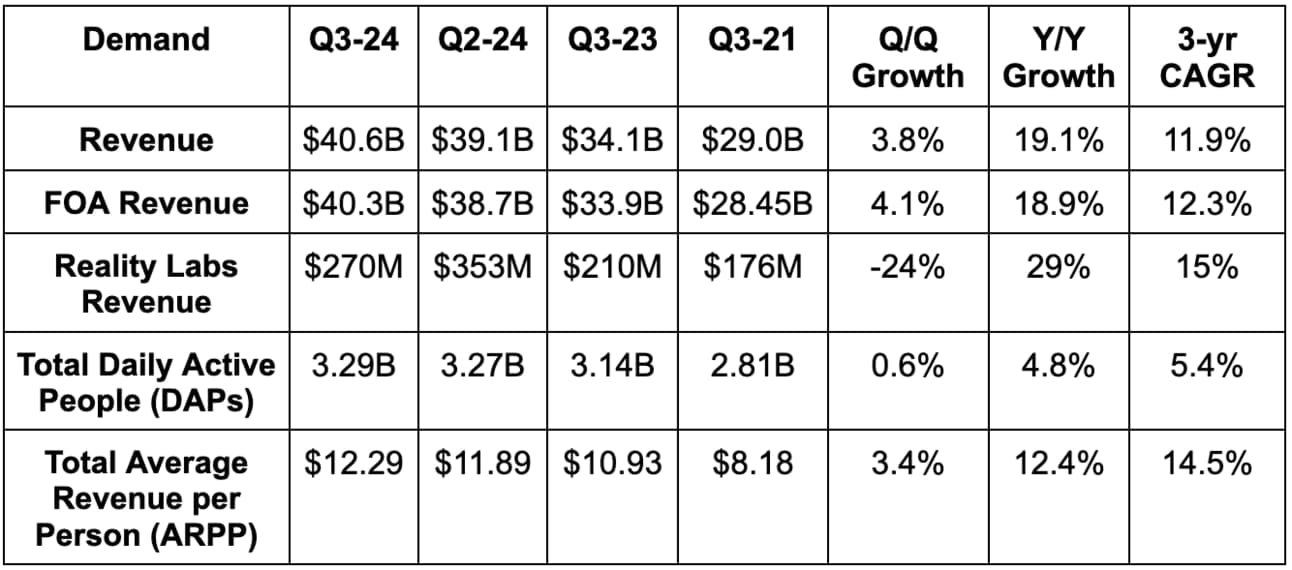

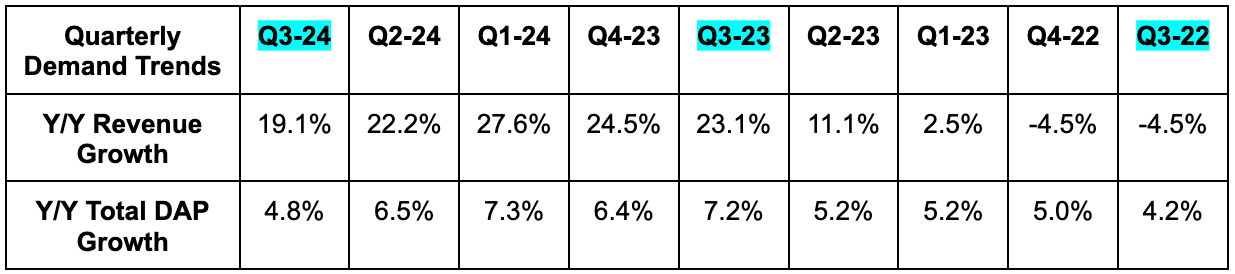

- Beat revenue estimates by 0.7% & beat guidance by 2.1%.

- Beat family of app (FOA) revenue estimates by 1.0%; missed $312 million Reality Labs revenue estimates by $42 million.

- Price per ad impression rose 11% Y/Y. This was the best result in over two years as it monetizes Reels more effectively. Total impressions rose 11% Y/Y.

- Beat Total Daily Active People (DAP) estimates by 1.2%.

- By advertiser geography, ad revenue rose by:

- 21% Y/Y in the USA & Europe

- 17% Y/Y in Rest of World.

- 15% in Asia Pacific. It is lapping strong Shein and Temu seller demand from last year just like Alphabet is.

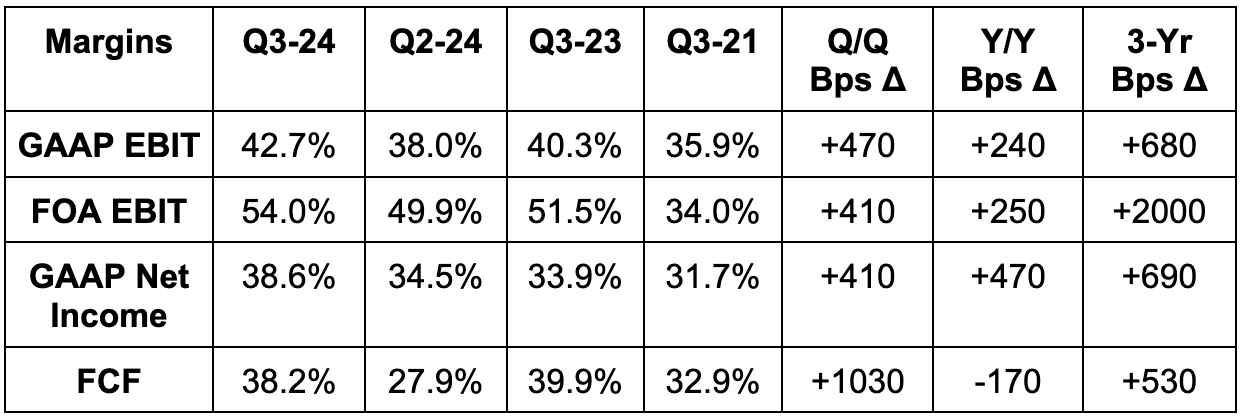

b. Profits & Margins

- Beat EBIT estimates by 7.1%; both segments beat EBIT expectations.

- Operating expenses (OpEx) rose by 14% Y/Y.

- R&D rose 21% Y/Y due to 9% Y/Y headcount growth and higher infrastructure costs.

- Sales & marketing & G&A both fell Y/Y due to lower restructuring and legal fees.

- Cost of revenue rose by 19% Y/Y to support continued GenAI infrastructure investments (it’s not just higher CapEx from this).

- Beat $5.25 EPS estimates by $0.78.

- Beat $11.5B free cash flow (FCF) estimates by $4B.

- Spent $9.2 billion on capital expenditures (CapEx) vs. $11.0 billion expected. This was related to some servers from a 3rd party arriving late. That pushed some CapEx from Q3 to Q4. This is why I love to focus on annualized FCF. It’s lumpy on a quarterly basis.

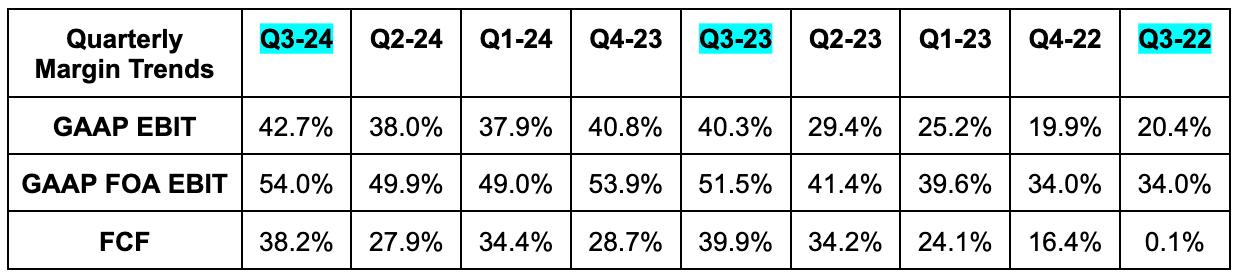

- The 54.0% FOA EBIT margin beat 52.3% margin estimates.

c. Balance Sheet

- $70.9B in cash & equivalents.

- $28.8B in debt. New $10.5 billion debt offering.

- Share count fell 1.6% Y/Y.

d. Guidance & Valuation

Q4 revenue guidance beat expectations by 0.6%. For the year, it slightly lowered its annual OpEx guidance, while slightly raising its CapEx guidance by a modest 1%. It continues to expect CapEx and associated depreciation growth in 2025 vs. 2024. It’s still working on a finalized 2025 CapEx budget. As a reminder, it has great flexibility to allocate these investments to different areas if need be. The dollars will not go to waste.