Sections d, e, f & g are for paid readers. They get into 2026 guidance, valuation, CapEx, the balance sheet, conference call notes and my take.

In case you missed it:

- PayPal Earnings Review.

- Tesla Earnings Review.

- SoFi Earnings Review.

- Netflix Earnings Review.

- Taiwan Semi Earnings Review.

- My current portfolio & performance vs. the S&P 500.

a. Key Points

- Another raise to 2026 spend guidance.

- Strong advertising performance gains are powering great pricing power.

- Large non-cash tax charge weighed heavily (and noisily) on net income.

- AI is materially helping their current growth.

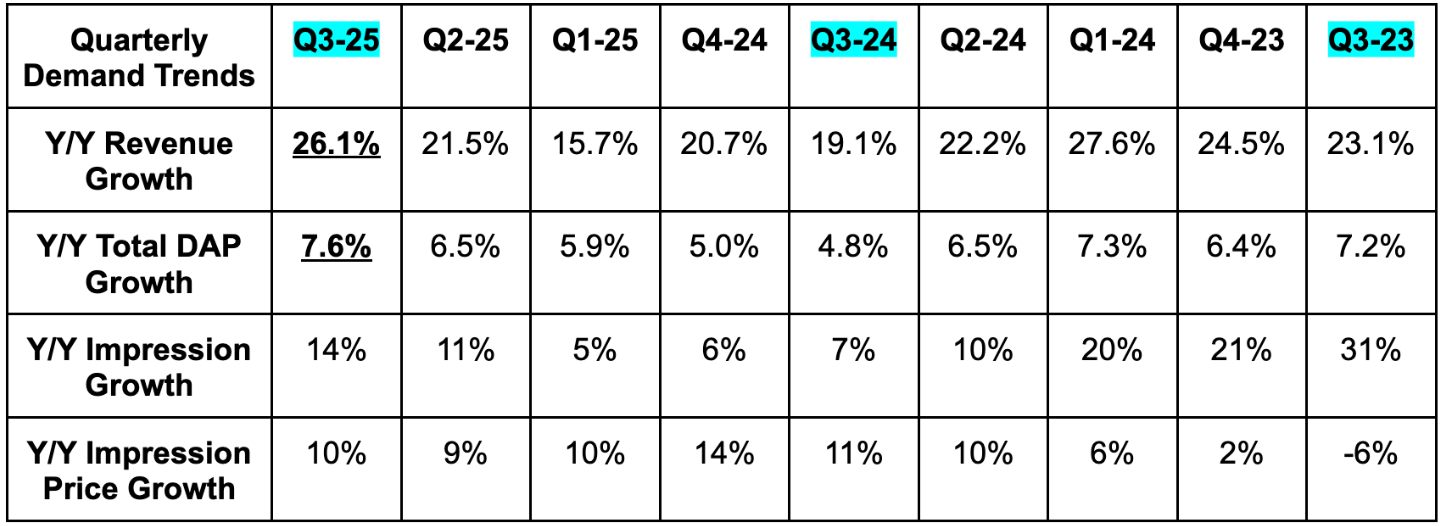

b. Demand

- Beat revenue estimates by 3.2% & beat guidance by 4.5%.

- Y/Y constant currency (CC) growth was 16%. The FX tailwind was in line with guidance. This outperformance did not come from favorable currency movements.

- Beat Family of Apps (FOA) revenue estimates by 3.5%.

- Beat other revenue (WhatsApp Business Messaging + Meta Verified) estimates by 16%.

- Beat Facebook Reality Labs (FRL) estimates by 48%.

- Growth for FRL benefited from a Quest ordering pull-forward from retail partners. It thinks some revenue for this segment shifted from Q4 to Q3. Still, other parts of this bucket like smartglasses contributed to the growth as well. They see smartglasses growth remaining very strong in Q4.

- Beat daily user/people (DAP) estimates by 1.7%.

- DAP growth was positive across all apps, including Facebook.

- As announced during the quarter, Instagram now has 3B DAPs.

- Beat 11% Y/Y ad impression growth estimates with 14% Y/Y growth.

- Met 10% Y/Y price per ad impression growth estimates.

- Price growth was impacted by strong growth in ad surfaces (WhatsApp & Threads) and geographies that don’t monetize as well as other areas.

- Price growth was driven by ad performance improvements.

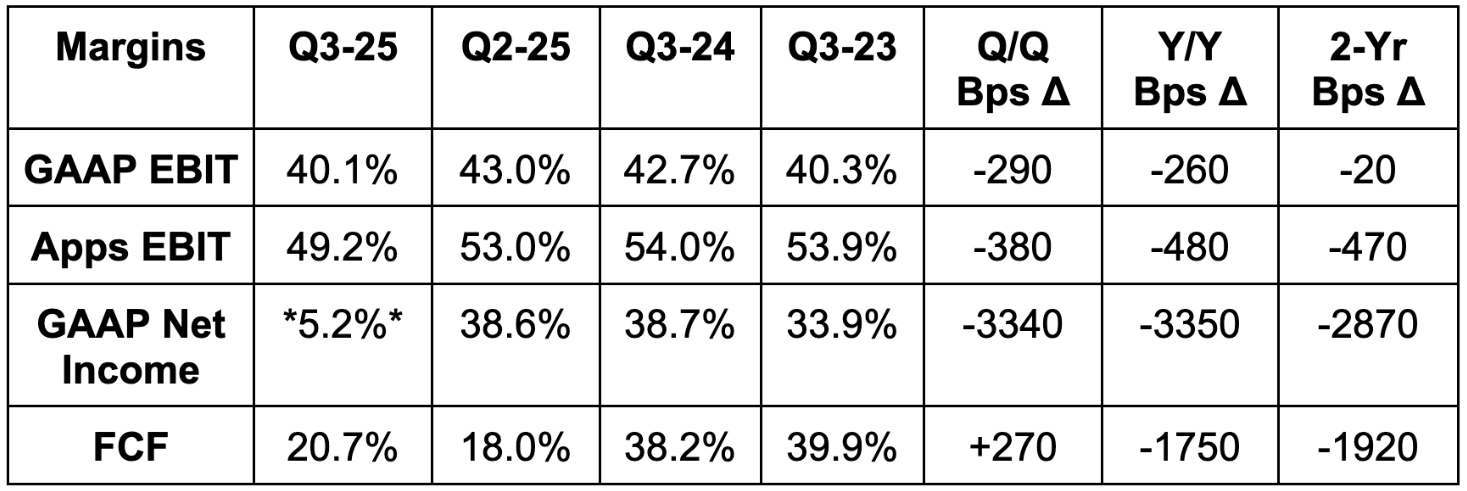

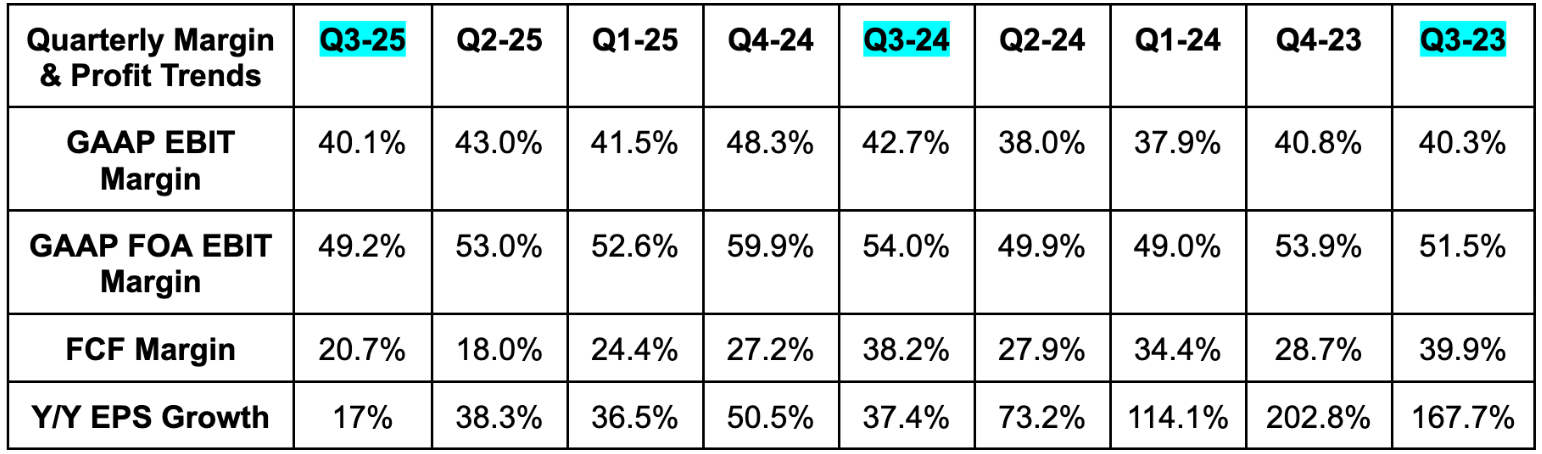

c. Profits & Margins

- Beat EBIT estimates by 5.3%.

- EBIT rose 34% Y/Y.

- Operating expenses (OpEx) rose 32% Y/Y.

- Headcount rose by 8% Y/Y.

- Met FCF estimates. This is despite $19.4B in CapEx vs. $18.6B in CapEx expected.

The Big Beautiful Bill (BBB) implementation led to Meta writing down the value of some deferred tax assets. This led to a $16B non-cash charge, which heavily impacted EPS and led to a massive and noisy “miss.” Excluding this charge, EPS would have been $7.25 vs. $6.71 expected for 17% Y/Y growth. EPS is irrelevant for this quarter. The EPS growth chart below excludes this item.