In case you missed it:

25% earnings season discounts for annual plans are live. Subscribe to access:

- 40+ detailed earnings reviews every season.

- My portfolio/performance.

- Consistently thorough analysis of news and events.

- A Discord room to collaborate with seasoned investors and ask me questions.

This is where serious investors come for signal over hype, data-driven opinion and level-headed insight. Subscribe here.

Table of Contents

1. Meta (META) – Earnings Review

a. Key Points

- 20%+ multi-year revenue compounding at massive scale.

- AI again drove its content recommendation and ad matching improvements.

- They will spend aggressively in 2026 and margins will fall Y/Y.

- 2026 revenue guidance represents its fastest rate of growth since the pandemic.

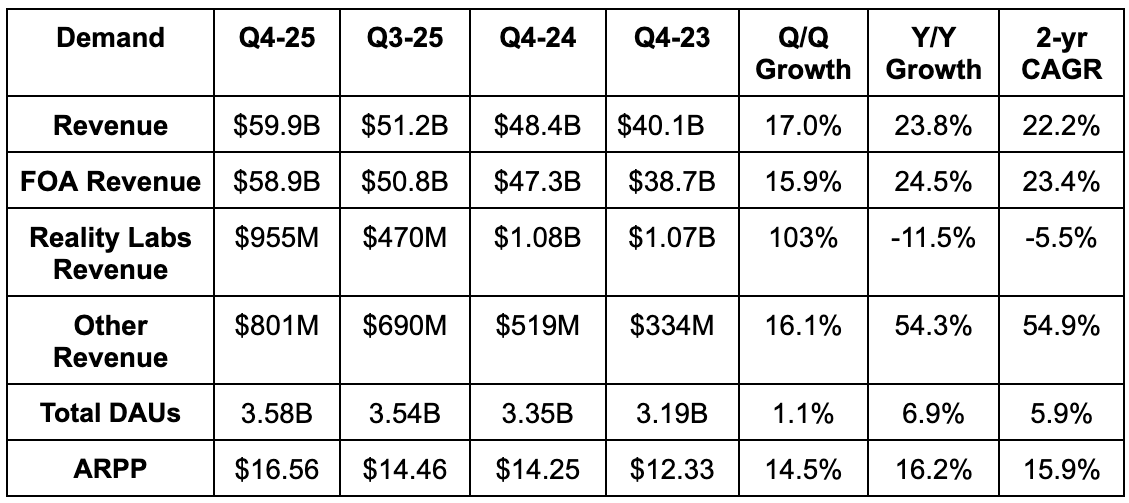

b. Demand

- Beat revenue estimates by 2.6% & beat guidance by 4.2%.

- Family of Apps (FOA) revenue beat estimates by 2.6%.

- Facebook Reality Labs (FRL) slightly missed estimates.

- There was a 1-point currency tailwind, which was as expected.

- Beat 3.56B daily active user (DAU) estimates by 20M.

- Meta has more than 2B DAUs across each of Facebook and WhatsApp. It’s nearing that mark with Instagram as well.

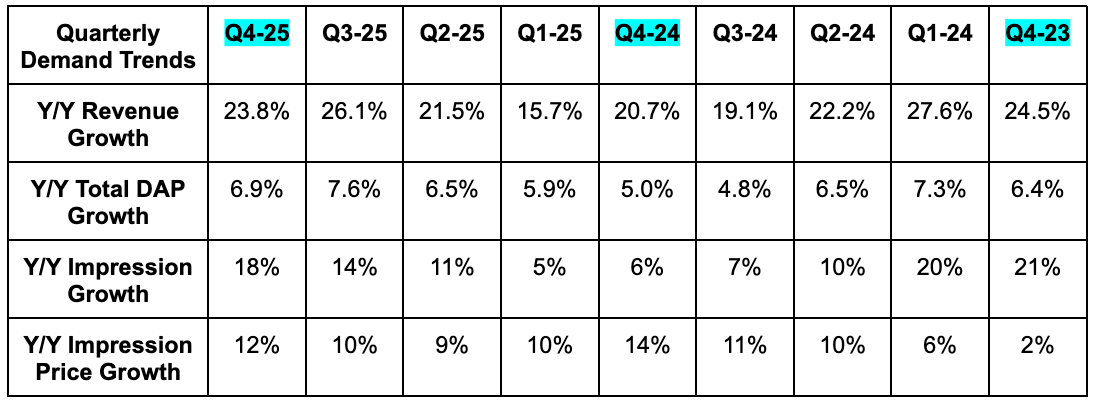

- Beat 12% Y/Y ad impression growth estimates with 18% Y/Y growth. Impression growth was driven mostly by engagement gains, rather than showing users more ads.

- Missed 9% Y/Y ad pricing growth estimates with 6% Y/Y growth.

- Pricing growth was driven by better ad performance.

Other revenue beat $719M estimates by 11%. I know this bucket is puny compared to the mighty Family of Apps (FOA) business, but it is quickly emerging as a material growth accelerant. The bucket includes paid messaging ads on WhatsApp, which is why growth is so rapid and why I’m so interested in tracking it. WhatsApp is still so early in its monetization journey, resembling an Instagram of 10 years ago in terms of headway left to enjoy and boasting a larger user base. Between this, its smartglasses and its apps business that’s still somehow rapidly expanding, Meta is sharply outgrowing every single other Mag 7 company. It's even outgrowing CrowdStrike as of this quarter.

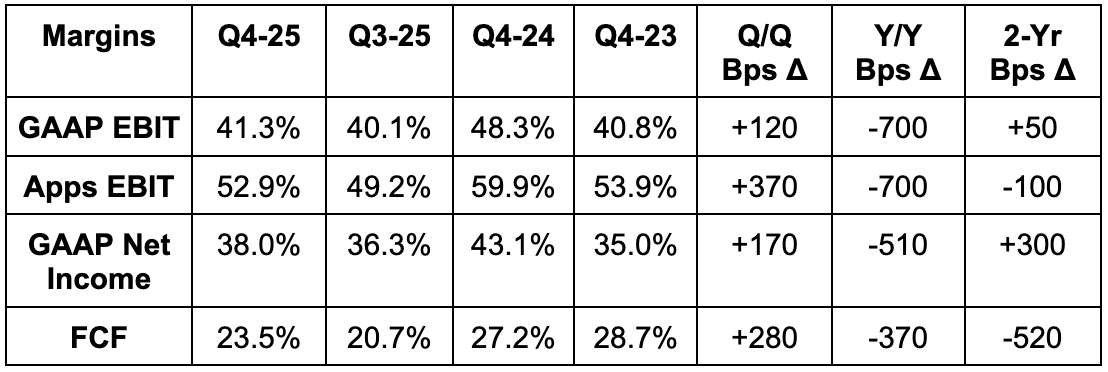

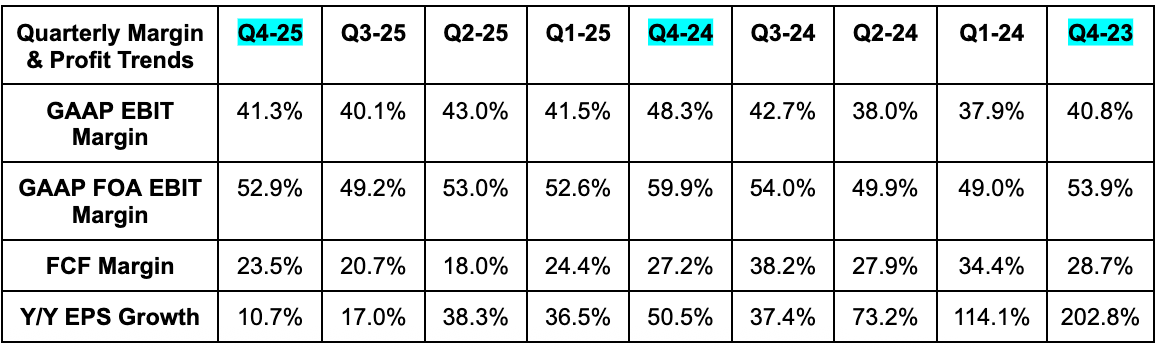

c. Profits & Margins

- Beat EBIT estimates by 3.5%.

- Beat $8.19 EPS estimates by $0.69. The beat was aided a bit by a 10% tax rate vs. its 13.5% tax rate guidance.

- EPS rose by 8% Y/Y.

- I excluded the large one-off tax charge from last quarter to avoid non-apples-to-apples Q/Q comps.

- Beat $12B FCF by $2B despite CapEx meeting $22B estimates.

OpEx rose by a whopping 40% Y/Y driven by higher infrastructure costs (including more depreciation from all the CapEx over the last few years). Higher employee compensation from its AI hiring spree, 6% overall headcount growth and legal fees all contributed as well

d. Balance Sheet

- $81B in cash & equivalents.

- $27.5B in investments.

- $58.7B in long-term debt.

- -1.4% Y/Y share count growth.

e. Guidance & Valuation

Meta’s Q1 revenue guidance beat estimates by 7%. This target represents 30% Y/Y growth and its fastest rate of expansion since the pandemic. It's benefiting a big 4-point currency tailwind, but 26% CC growth is still elite. Growth rates will slow during Q3 and Q4 as expected and due to much harder comps.

2026 expense forecasts were a doozy. OpEx guidance came in 9.6% ahead of expectations, while CapEx guidance was 13% larger than expected. While these are obviously huge cost numbers, I think they’re justified. The company has so many ways to productively use the assets that these CapEx dollars create. Flexibility is bountiful, which lowers risk of waste. Furthermore, as I’ll argue below, Meta is demonstrating excellent capital allocation skills that are fostering current growth and brightening future expectations as well.

They’re setting the stage for the core apps business to compound briskly for several years to come, knowing they can perfect the margin profile down the road as compute shortages end and these sticky improvements take hold. In terms of when these shortages might ease and cost pressure might wane, CFO Susan Li offered us a hint. She said the capacity coming online during Q3-Q4 this year would potentially resolve these compute constraints. A more favorable supply/demand dynamic would certainly be good for bargaining power for large customers like Meta.

Encouragingly, we were also told EBIT would grow Y/Y despite this vastly larger-than-expected OpEx guidance. Comforting guardrail. Sell-side analysts only expected 4% Y/Y EBIT dollar growth for 2026 before this report. If you told them before the print that OpEx guidance would be nearly 10% larger-than-expected, they would have likely been surprised to hear that the EBIT guidance was roughly in line with their expectations. To me, that’s simply a sign of how strong demand trends are right now. This incremental revenue is flowing steadily down the income statement as leverage builds.

Meta expects a 14.5% tax rate in 2026 vs. 30% Y/Y, which will mean EPS growth will be faster than pre-tax income (EBT) growth. Consensus growth estimates for EBIT and EBT are identical for 2026, which means there's no sharp change in interest expense intensity coming. That lets us assume EPS growth will be faster than EBIT growth. Analysts were expecting 3% EPS growth compared to the 4% EBIT growth. That should lead to upward EPS revisions for 2026.

Li also repeatedly said the business would generate cash flows to fund CapEx in 2026. To me, that’s saying operating cash flow guidance is at least $125B. Sell-side estimates were looking for $127B.

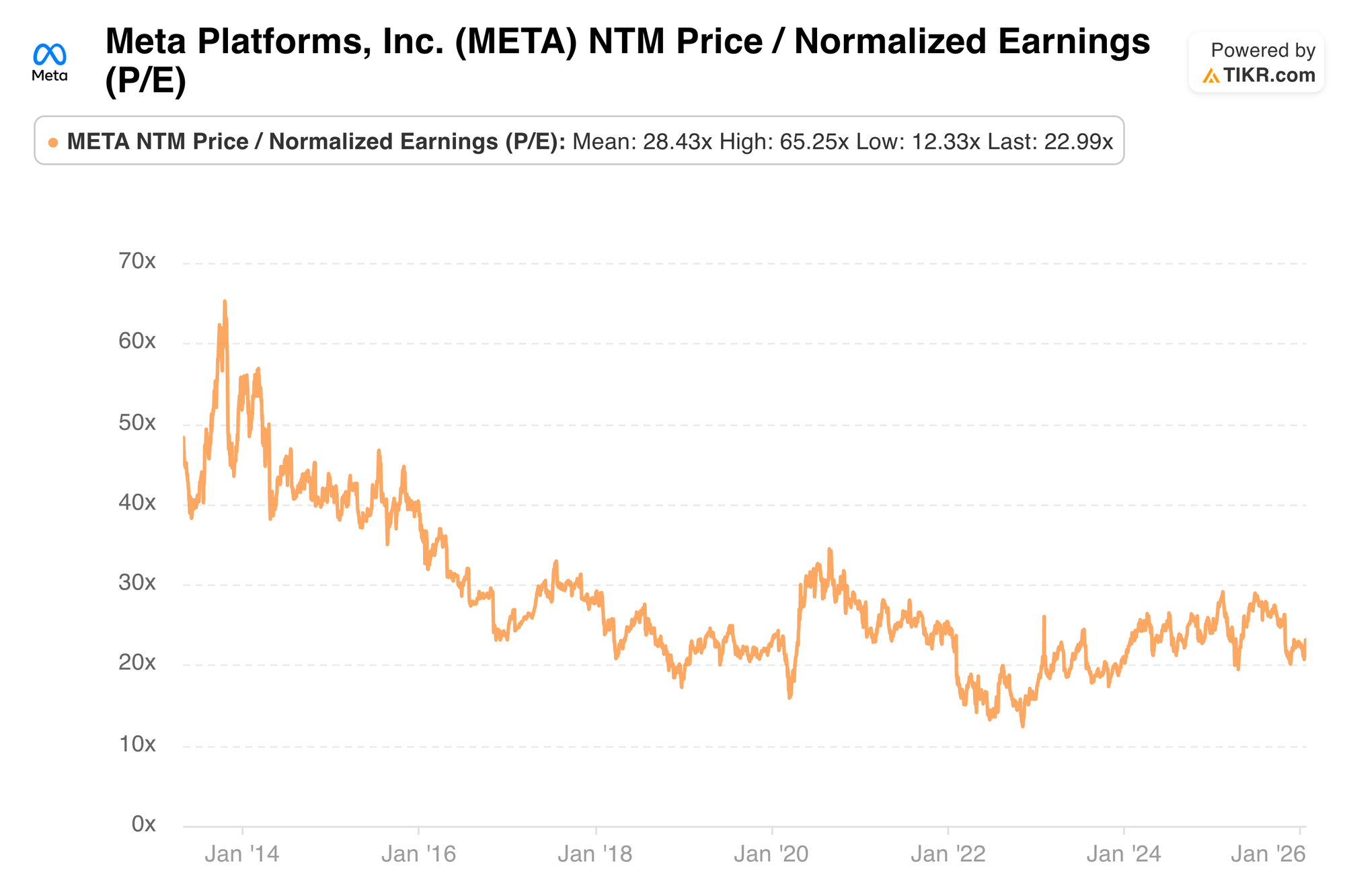

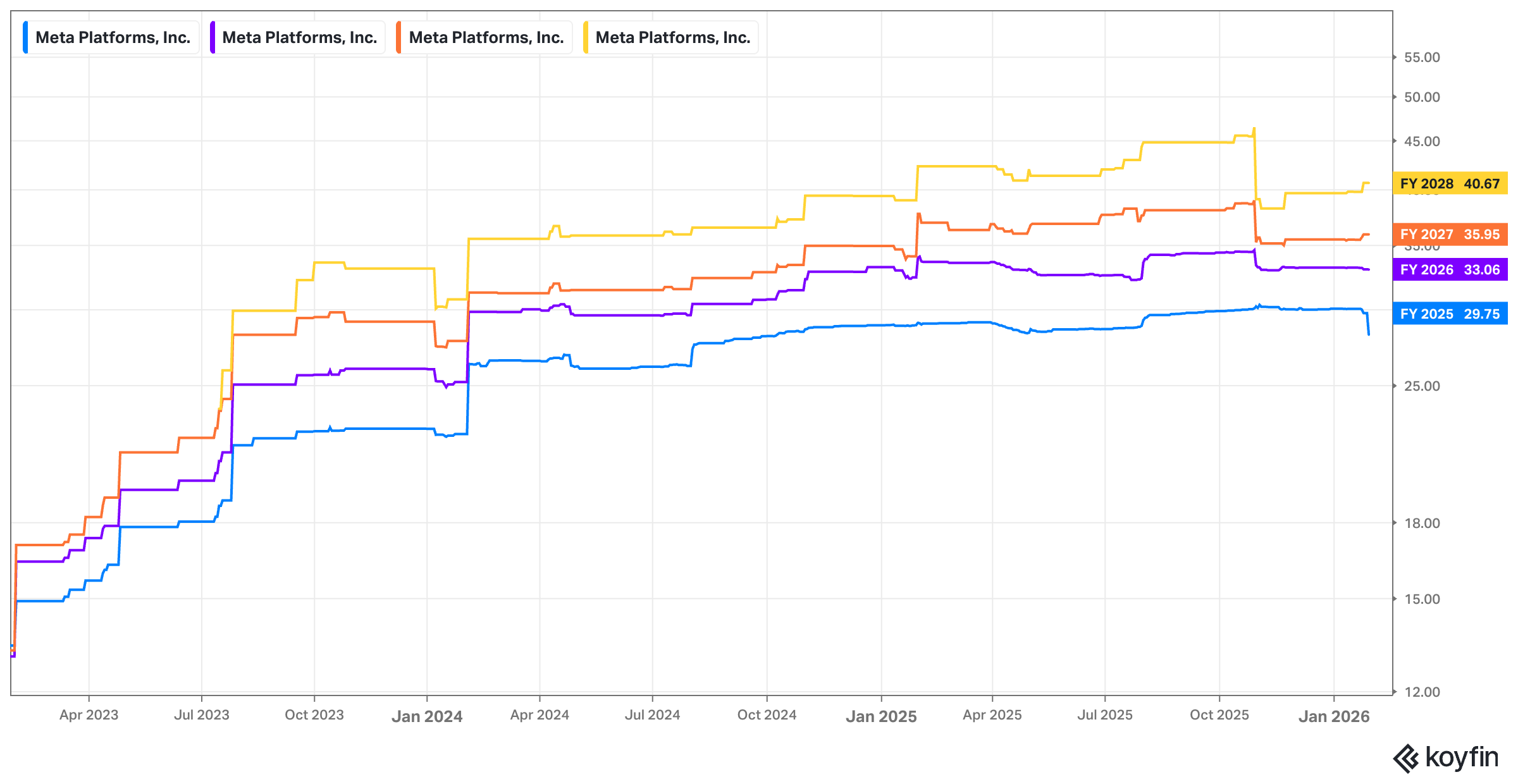

Meta trades for about 25x 2026 EPS. EPS is expected to grow by 3% this year and by 12% next year, following a 3-year period of compounding EPS at a 50% clip. Note that the chart below is a next 12-month p/e using Q4-25 to Q4-26. It hasn't been updated yet.