Sections e, f & g are for paid subscribers. They include detailed data and commentary on the balance sheet, guidance, valuation, shareholder letter and conference call, as well as my take on the quarter.

If you'd like to read those sections and full reviews on 40+ companies this season (and so much more), you can access 25% annual discounts and upgrade below.

a. Key Points

- Brazilian charges unexpectedly weighed on profitability.

- Advertising progress is palpable.

- Expanding potential content types with a Spotify partnership.

- The new home page is exceeding expectations.

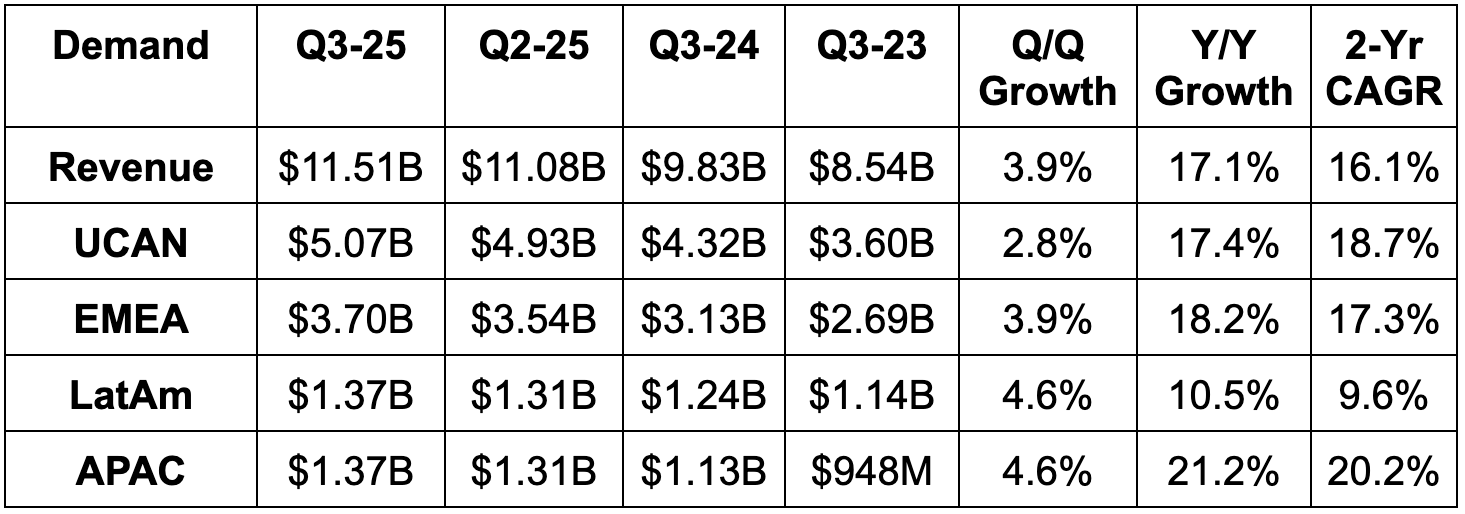

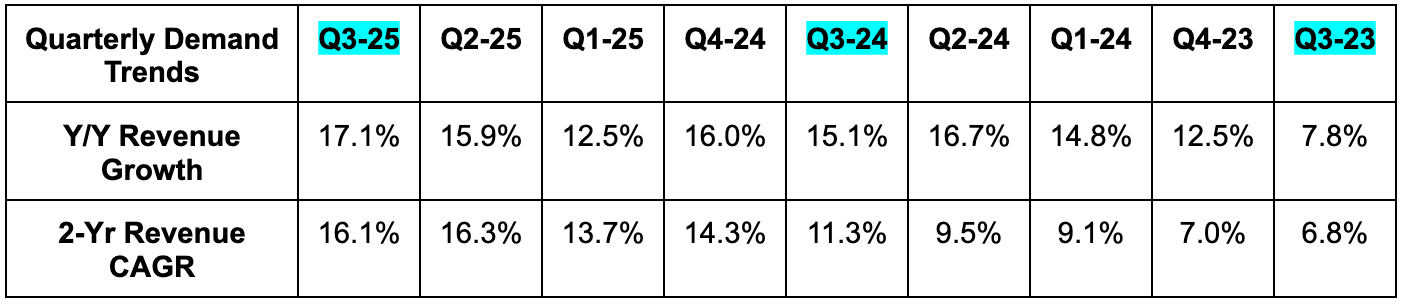

b. Demand

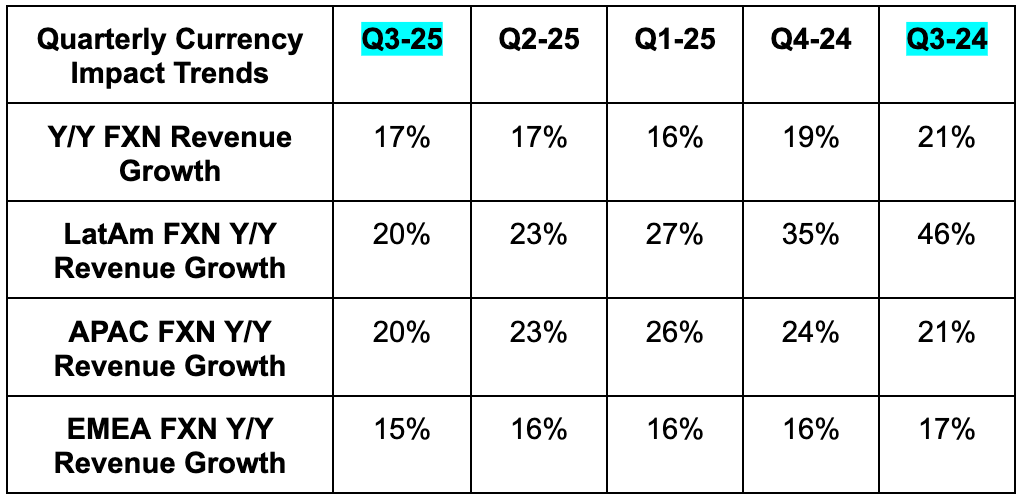

Netflix slightly missed revenue estimates & slightly missed guidance. It posted 17% foreign exchange neutral (FXN) growth, which means the miss was driven by unfavorable currency movements – rather than anything related to core operations. As expected, view hours growth accelerated during Q3 vs. the first half of the year. This is reassuring, as it coincided with the content slate beefing up and shows customers responded positively to that added material.

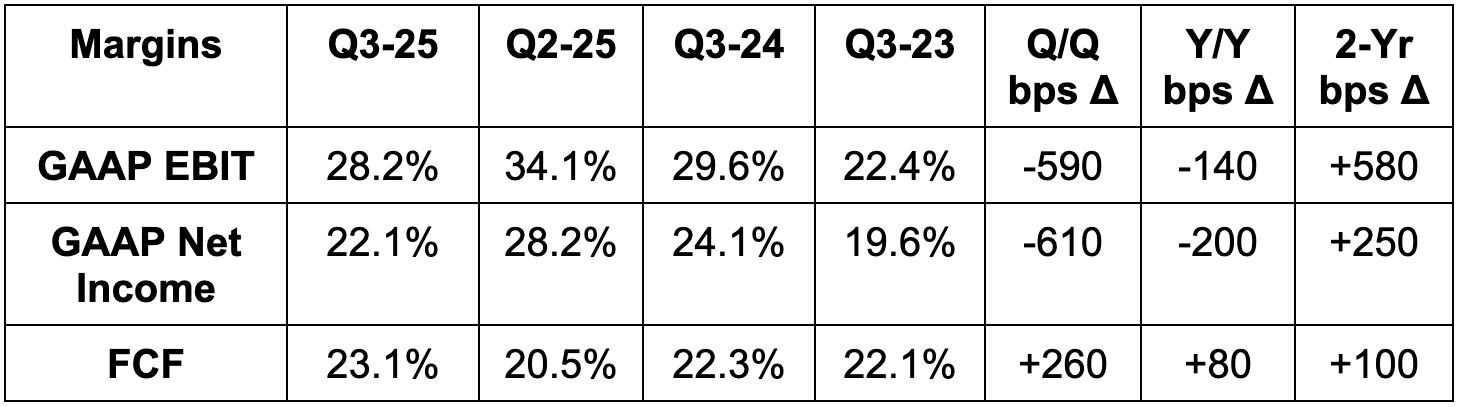

c. Profits & Margins

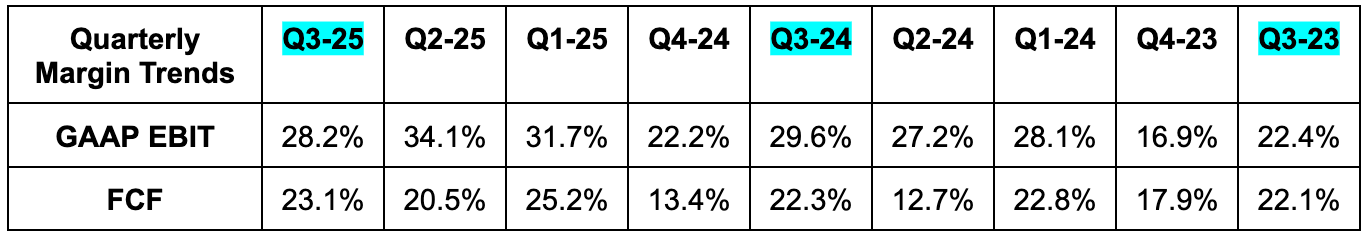

Netflix incurred a $619M charge in Brazil due to a “gross tax on outbound payments.” The nation’s supreme court unexpectedly ruled this tax included Netflix’s operations, reversing a previous decision by lower courts. $619M covers nearly 3 years of back charges, which is why the number will not be remotely as large in the future. The expense lowered EBIT margin margin by a full 500 basis points (bps; 1 basis point = 0.01%).

- Missed EBIT estimates by 10.5% & missed guidance by 10.4%.

- Missed $6.94 EPS estimates by $1.07 & missed guidance by $1.

- Beat FCF estimates by 11%.

d. Balance Sheet

- $9.3B in cash & equivalents.

- $14.5B in debt.

- Share count fell by 1% Y/Y. $10.1B left in buybacks (about 2% of the market cap).