Table of Contents

In case you missed it:

a. Key Points

- The Warner Brothers deal is progressing nicely.

- Ad momentum is great.

- Margins continue to expand.

- Mixed engagement trends.

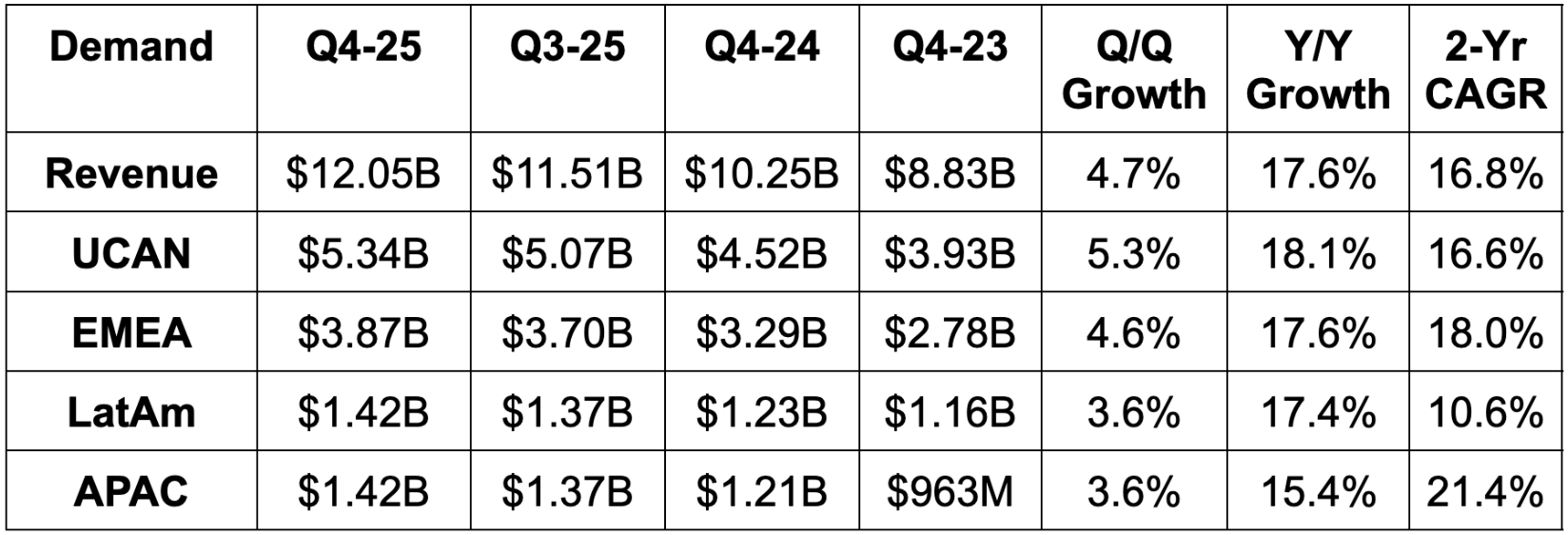

b. Demand

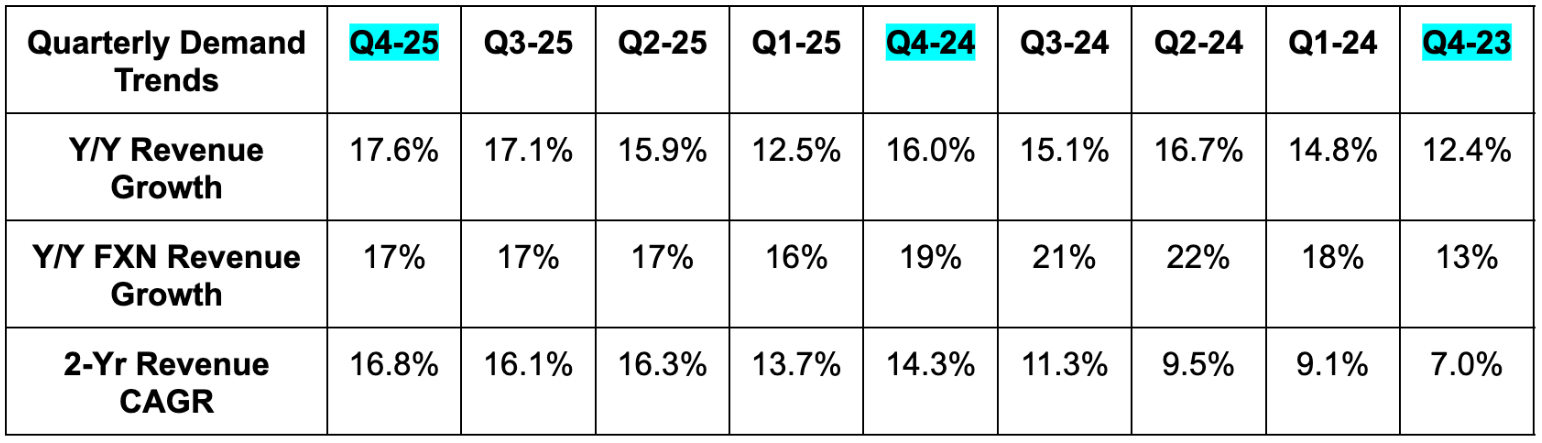

- Beat revenue estimates by 0.7% & beat guidance by 0.8%.

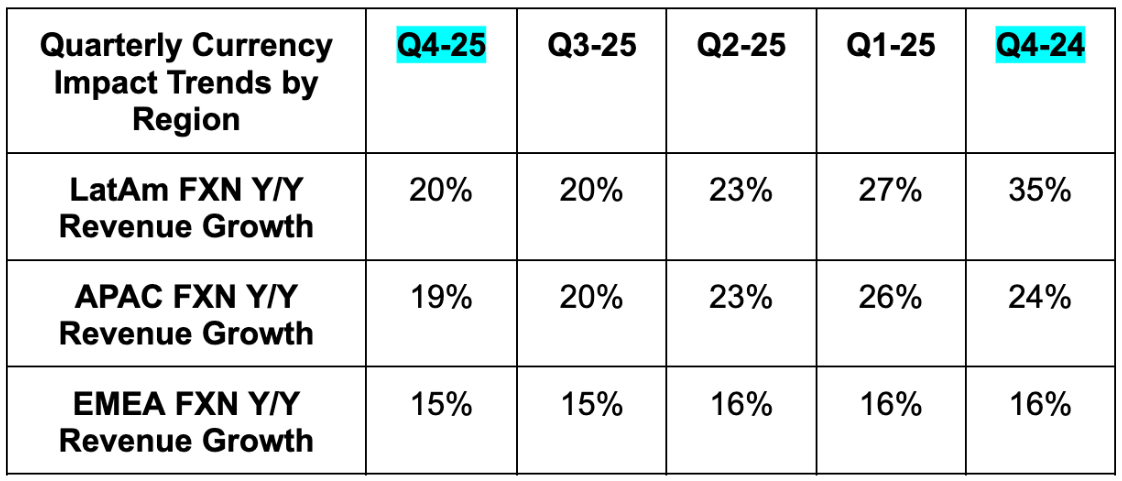

- The beat was despite foreign exchange (FX) headwinds that were worse than expected. FX neutral (FXN) growth was 16% Y/Y vs. 16% guidance.

- Demand was driven by a blend of member expansion, price hikes and triple-digit advertising growth.

- Netflix reached 325 million members “during the quarter.” Candidly, the vagueness on timing is unnecessarily annoying to me. We don’t know which day they hit that benchmark. If we assume it happened at the end of the quarter, members rose by about 7.5% Y/Y. If it happened sooner, growth was faster.

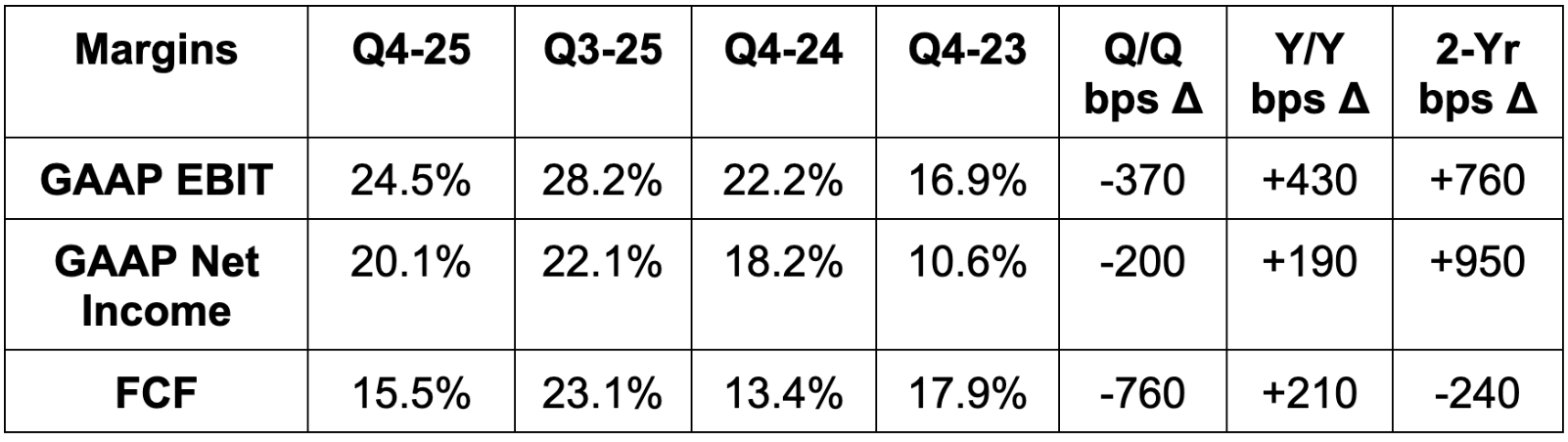

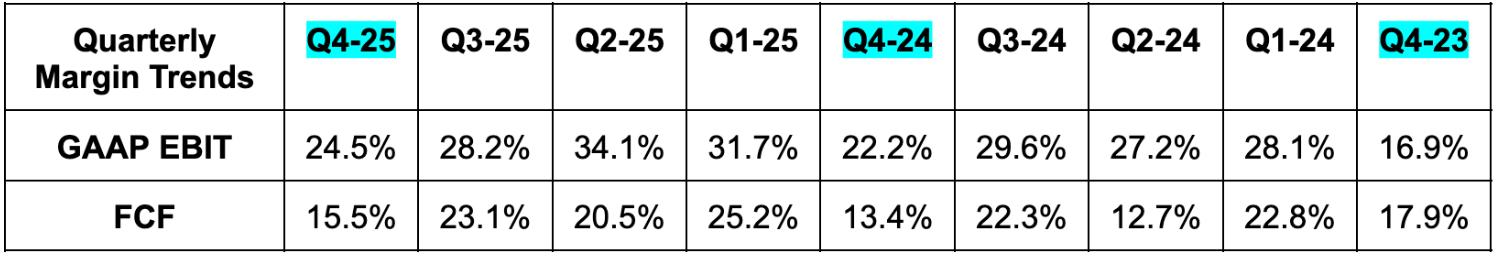

c. Profits & Margins

- Beat EBIT estimates by 1.7% & beat guidance by 3.4%.

- Full year EBIT margin rose from 26.7% to 29.5% in 2025. Very good.

- Beat $0.55 EPS estimates by $0.01 & beat guidance by $0.015.

- There was $60M in unexpected incremental interest expense from a bridge loan it took out to help with the Warner Brothers deal. This lowered EPS by $0.01.

- EPS rose by 31% Y/Y.

- Beat free cash flow (FCF) estimates by 30%. This was related to the $700M tax charge in Brazil discussed last quarter moving from Q4 2025 to 2026.

- This same item hit the income statement last quarter and lowered both EBIT and net income margins by 5 points each. That’s why the degree of Q/Q income statement margin contraction is better than typical seasonality.