1. Taiwan Semiconductor (TSM or TSMC) – Earnings Review

Taiwan Semi builds chipsets for other companies like Nvidia, AMD and Qualcomm. It does so in its highly expensive, highly complex chip fabrication plants. These are called “fabs” for short and arguably provide one of the deepest moats in public markets.

Needed Definitions:

- Fab means a factory.

- Nanometer (NM) describes the chip technology. Smaller NM is more advanced, as it uses smaller transistors. This means TSM can pack more transistors into a single chip while making those chips more energy efficient and cost-effective.

- “Advanced Technology” revenue is revenue from 3nm (N3), N5 & N7 technology. Anything under 7nm is “advanced.”

- Wafer refers to the raw materials (like silicon) that are used to manufacture chips. Wafers are used to build integrated circuits (ICs), with the transistors within these ICs guiding and facilitating functions. Nvidia’s Blackwell and Hopper chips are considered ICs.

- Chip-on-wafer-on-substrate (CoWoS) is a packaging process that combines chips into a single unit.

a. Demand

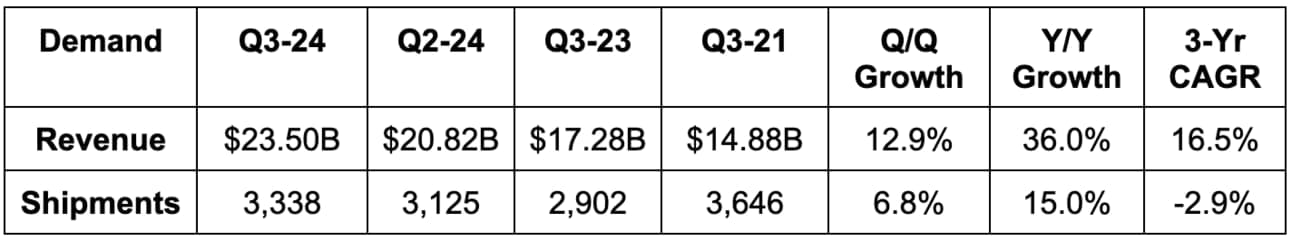

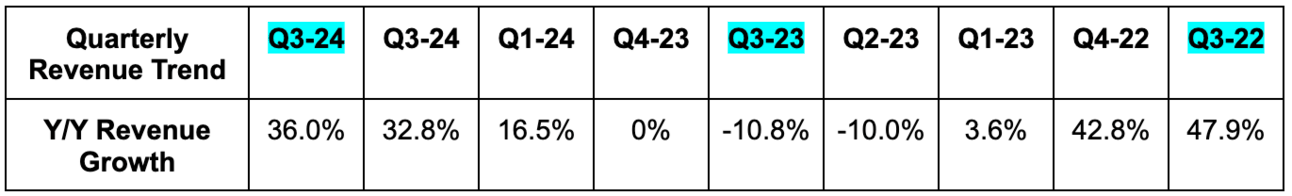

Taiwan Semi beat revenue estimates by 1% & beat revenue guidance by 3.1%. Its 16.5% 3-year revenue compounded annual growth rate (CAGR) compares to 9.8% last quarter and 13.5% two quarters ago.

b. Profits & Margins

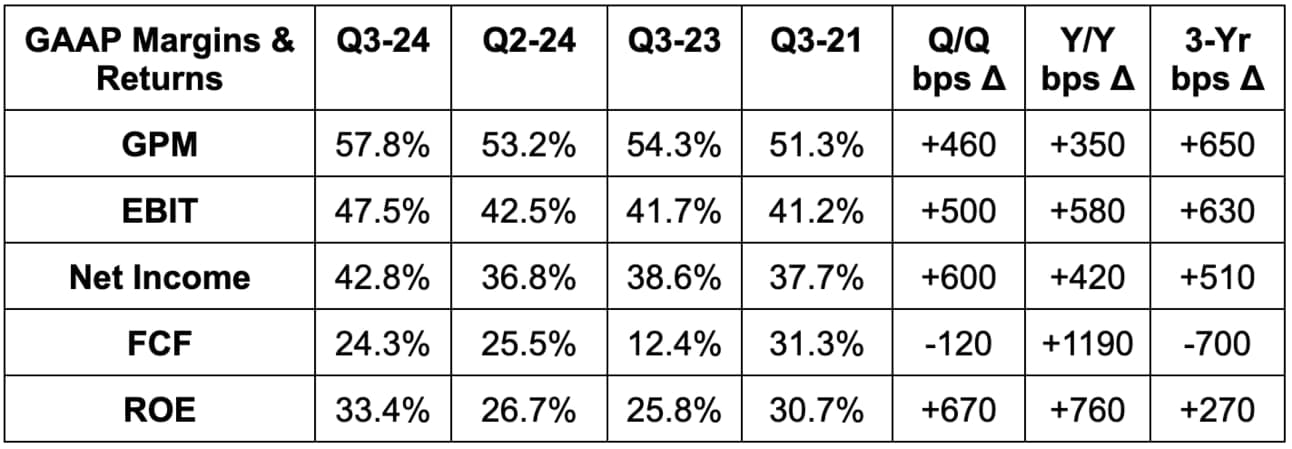

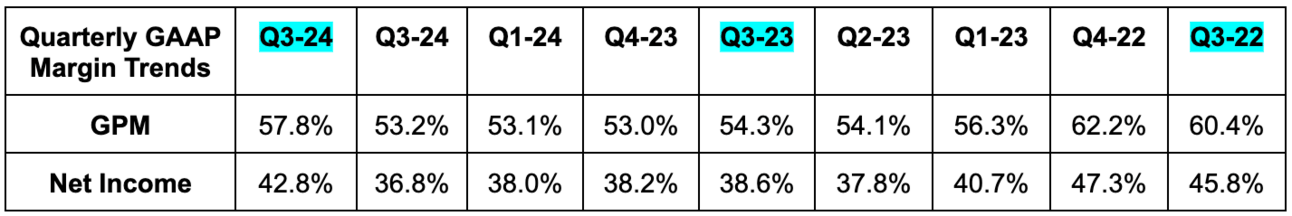

- Beat 54.7% gross profit margin (GPM) estimates by 310 basis points (bps; 1 basis point = 0.01%) & beat GPM guidance by 330 bps.

- Beat EBIT estimates by 9.4% and beat EBIT margin guidance by 400 bps.

- Beat $0.36 GAAP EPS estimates by $0.03, which represents about an 8.3% net income beat.

- Beat 31% return on equity (ROE) estimates by 240 bps.

c. Balance Sheet

- $69 billion in cash & equivalents.

- Inventory rose 12% Y/Y. Inventory Turnover days were 87 vs. 83 Q/Q and 96 Y/Y. This rose Q/Q due to a “pre-build” of N3 and N5 wafers.

- $30.5 billion in bonds payable.

- Share count was roughly flat Y/Y.

- Dividend payments rose by 30% Y/Y.

d. Guidance & Valuation

For the full year, TSM sees “close to 30%” Y/Y revenue growth. This is a raise vs. “slightly better than mid-20%” growth guidance offered last quarter. It also changed annual CapEx guidance from $31 billion to “slightly higher” than $30 billion.

- Q4 revenue guidance beat by a robust 6%. That’s excellent for a company this large.

- Q4 GPM guidance beat 54.7% estimates by a handsome 330 bps.

- Q4 EBIT guidance beat estimates by 14%.

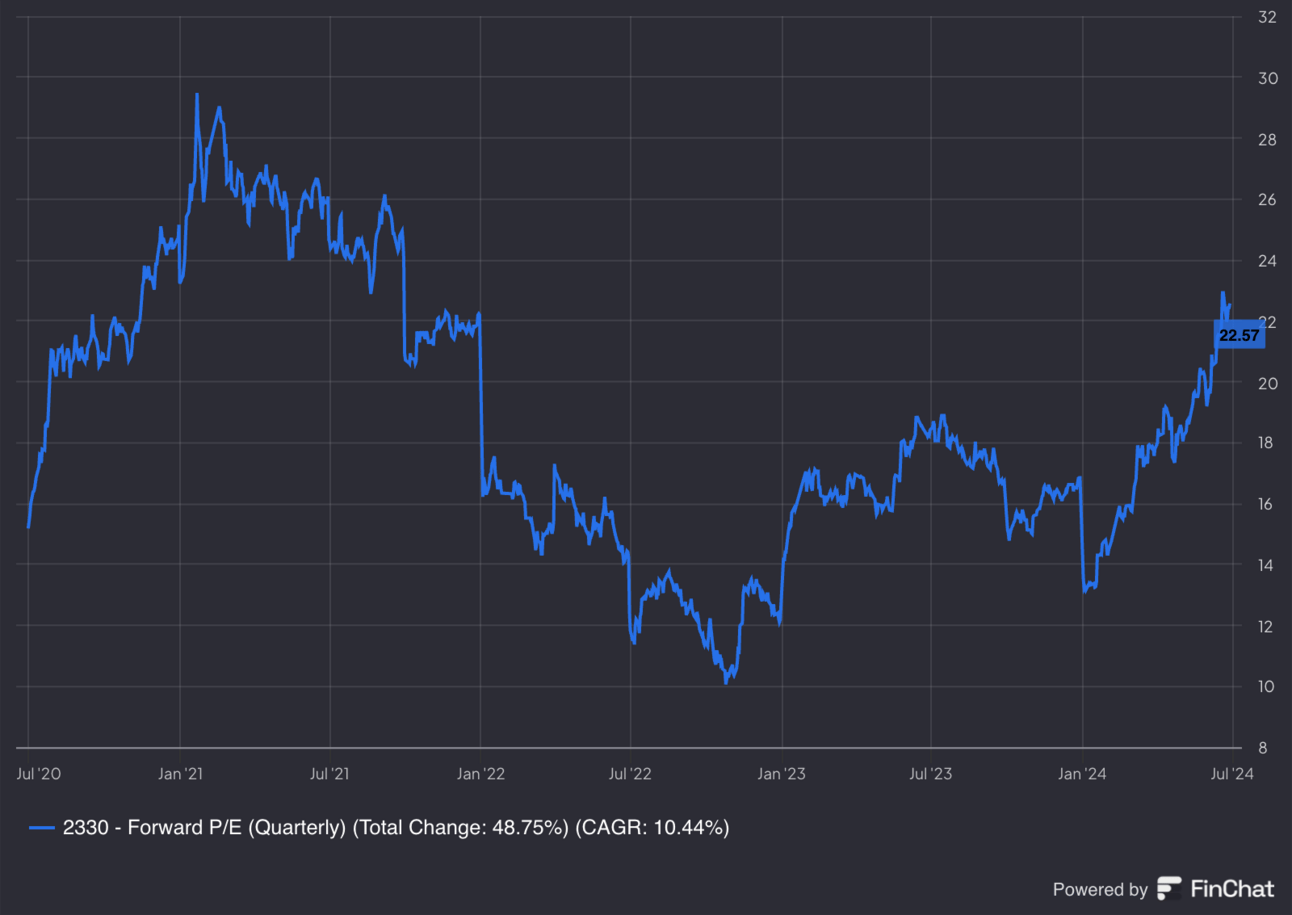

TSM trades for 23x forward earnings. EPS is expected to grow by 30% in each of the next two years.

e. Call & Release Highlights

Demand Context:

Advanced technology represented 69% of wafer revenue vs. 59% Y/Y. This was powered by 11% Q/Q growth within its high performance computing (HPC) bucket. HPC is now 51% of overall sales vs. 52% Q/Q and 42% Y/Y. Internet of Things (IoT) growth also materially boosted advanced technology results. Specifically, that bucket enjoyed 35% Q/Q expansion and a rise from 6% to 7% of total wafer revenue.

- Smartphone revenue rose 16% Q/Q to 34% of revenue vs. 33% Q/Q.

- Automotive revenue rose 6% Q/Q to 5% of revenue vs. 5% Q/Q.

- Digital Consumer Electronics (DCE) revenue fell Q/Q and shrank from 2% of revenue to 1%.

For non-AI demand, leadership called the environment stable. For AI specifically, it sees 2024 processor revenue contribution tripling to 15% of total. Nvidia’s boom is TSM’s boom too. When asked about durability of GenAI demand, leadership reminded us that it works with all of the companies making AI chips, frequently communicates with them, and sees demand remaining very strong. When asked about GenAI return on investment (ROI) for clients, CEO C.C. Wei offered tangible examples of the technology driving considerable efficiency and cost gain internally. Those improvements are transferable to other companies.

“We continue to observe extremely robust AI-related demand from our customers throughout the second half of 2024. This is leading to increasing overall capacity utilization rates for our leading-edge 3-nanometer and 5-nanometer process technologies. One key customer said the demand right now is insane and that it's just the beginning... it will continue for many years.”

CEO C.C. Wei

Margin & CapEx Context:

This was the most impressive piece of the report to me, and more context is needed. As a reminder, ramping up new nano-chip technology always leads to gross margin dilution. It takes time for economies of scale to eventually power margin parity between new products and older ones. Last quarter, TSM also told us that shifting some N5 production capacity to N3 would be a 100-200 bps GPM headwind for 2024. This change and new tech scaling perfectly coincided with electricity inflation in Taiwan. All of these GPM challenges were amplified by expansion to higher-cost regions for another 200-300 bps of GPM impact.

With all of this context, 350 bps of GPM expansion and the large beat were certainly notable highlights. Where did the outperformance come from? Per the team, higher capacity utilization (CEO quote above fares well for that continuing) and successful “cost improvement efforts” were the two primary sources. The headwinds described above have not improved at all, these positive items just overcame the obstacles. The strong Q4 GPM guide was due to the same factors.

On the CapEx side, budget allocations remain the same as TSM invests ahead of future demand. 75% of earmarked CapEx is for advanced process technologies and 15% is for specialty technologies. Complementary Metal-Oxide-Semiconductor (CMOS) is a type of specialty technology that TSM offers. It’s an IC used in logic processes to help assign functions.