In case you missed it:

- Netflix (NFLX) Earnings Review

- Taiwan Semi (TSMC) Earnings Review

- My Current Portfolio & Performance vs. the S&P 500

Next week, earnings season ramps up. I will be publishing reviews on SoFi, Meta, Tesla, ServiceNow, Apple and probably Microsoft.

My Axon Deep Dive will also be published next weekend.

Table of Contents

1. Intel (INTC) – Earnings Snapshot

a. Results

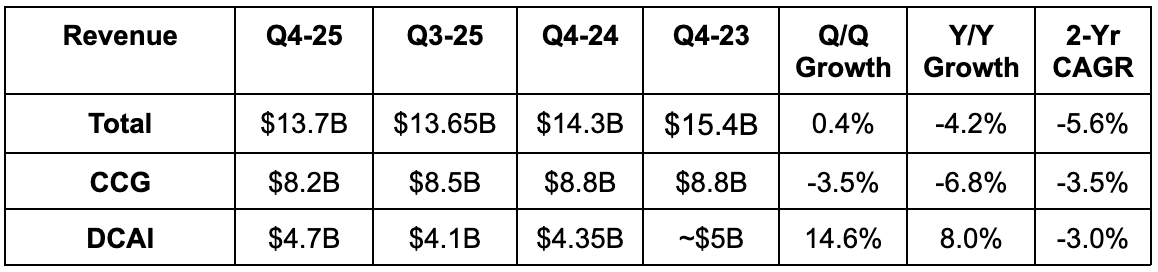

- Beat revenue estimates by 2%.

- Client computing group (CCG) revenue beat estimates by 1%.

- Data Center AI (DCAI) revenue beat estimates by 20%.

- Foundry revenue met estimates and rose by 4% Y/Y.

- Intel voiced frustration with supply shortages and leaving some demand on the table during the quarter.

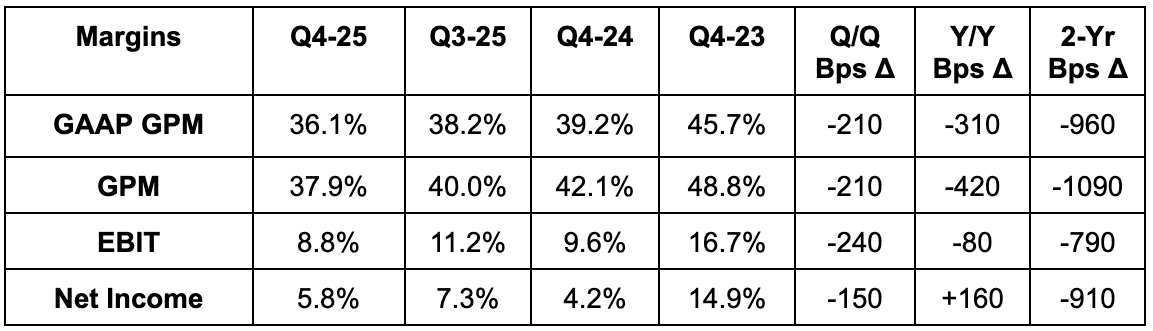

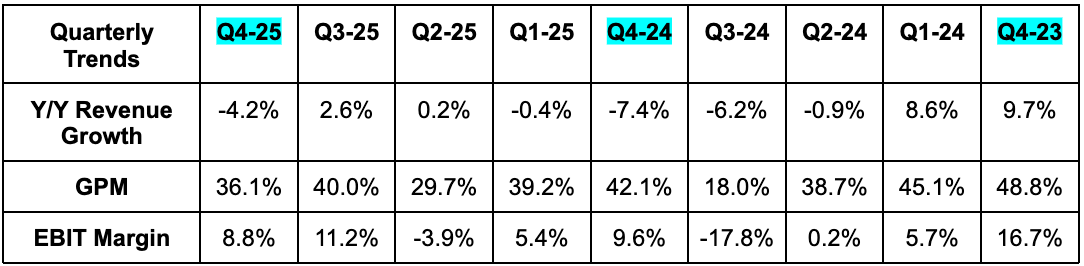

- Beat 36.4% GPM estimates by 150 basis points (bps).

- Beat $0.07 EPS estimates by $0.08.

- Beat $840M EBIT estimates by about $360M or 43%.

- CCG segment EBIT margin was 27.0% vs. 31.6% Q/Q and 36.4% Y/Y.

- DCAI segment EBIT margin was 26.4% vs. 23.4% Q/Q and 8.6% Y/Y.

- Foundry EBIT margin was -56% vs. -52% Y/Y as they aggressively front-load hefty investments to set the stage for future segment growth.

b. Balance Sheet

- $37.3B in cash & equivalents.

- Inventory fell 5% Y/Y.

- $46.5B in total debt.

- 12.4% Y/Y share count growth.

c. Guidance & Valuation

For next quarter, revenue guidance missed by 3%, $0 EPS guidance missed by $0.05 and 34.5% GPM guidance missed by about 2 points.

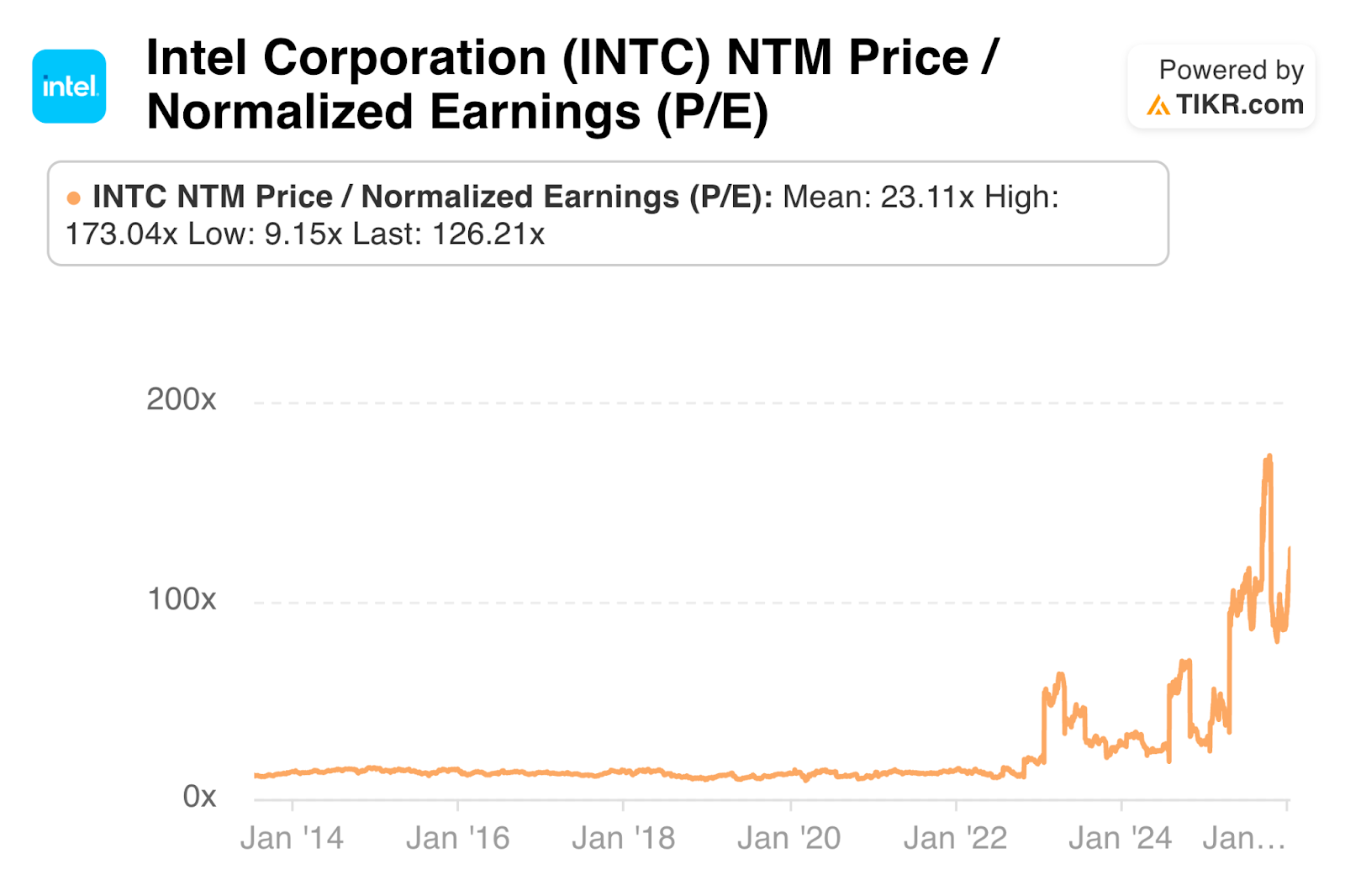

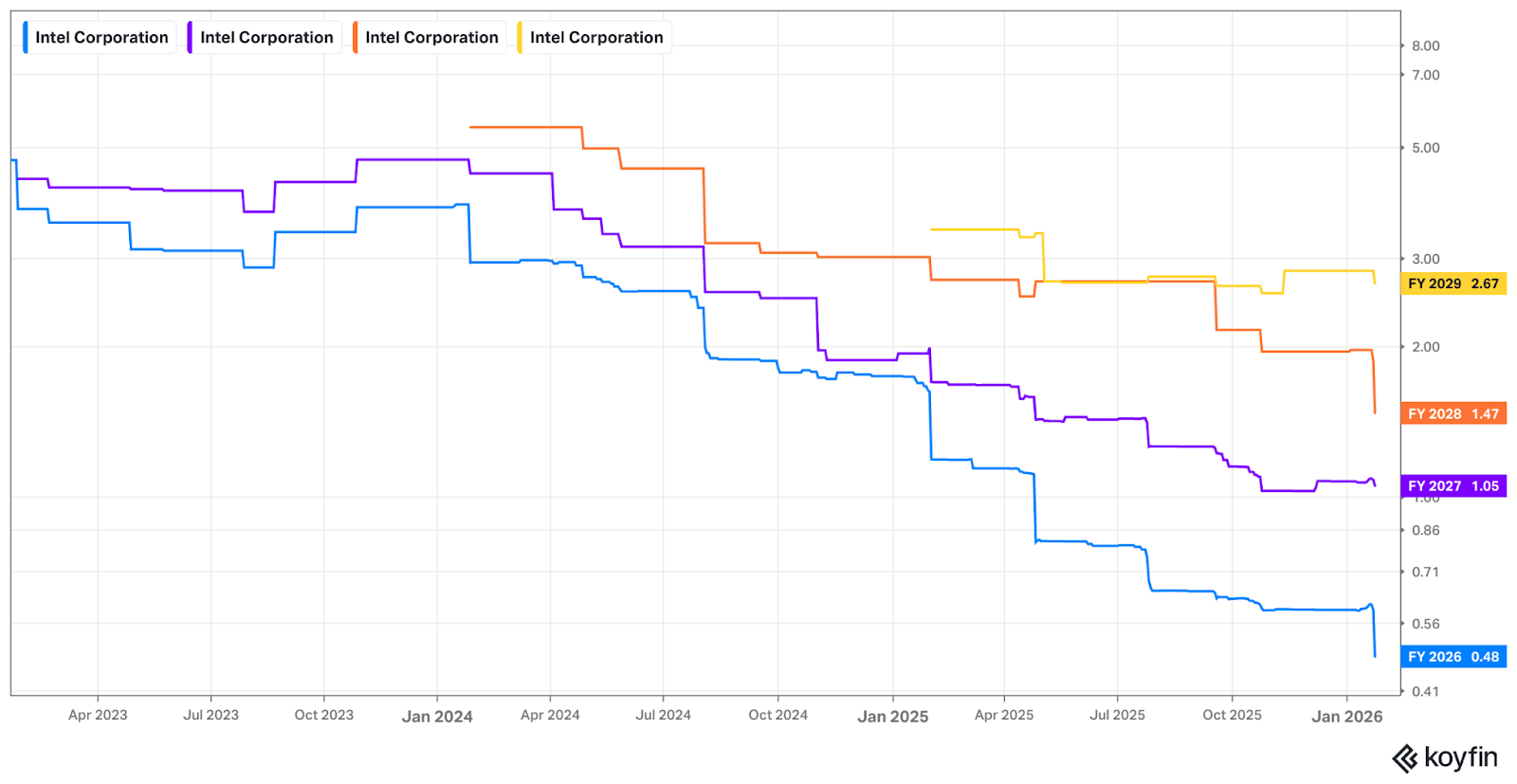

Intel trades for 126x forward EPS as they aggressively invest in their future and struggle to capture near-term demand. As of right now, EPS is expected to grow by 14% this year and by 119% next year.

Unless you are making a geopolitical-related bet, I don’t see why anyone goes with this over AMD for CPU exposure, this over AMD or Nvidia for high-performance chip exposure or this over Taiwan Semi for foundry exposure. Intel could turn back into a great and strategic company for U.S. national security and diversification away from sharp reliance on Taiwanese supply chains. The Foundry segment will just take several years to come to fruition, even with powerful allies like the U.S. government tilting the odds of success in their favor.

2. Nu (NU) – Customer Milestone

Nu is now the largest private sector financial institution in Brazil by customer count. They have over 112M customers there as of today vs. 110M Q/Q. For Q4 (ended on New Year’s) they probably added somewhere around 2M for the quarter. That compares to the few quarters before that being around ~2.5M adds. Not surprising to see this slowing and I fully expect that to keep happening in that country. The gradual nature of the slowing is what we want to see, as there’s no chance they can keep accelerating customer growth in Brazil specifically at this point. They already have over 60% of the adult population in the app. The Brazilian growth engine will be driven more by cross-selling & ARPU gains than customer growth going forward (with still solid customer growth).

Fortunately, they have miles & miles of runway there, as their gross profit market share is a small fraction of their customer market share. For context, they have 5% gross profit share despite having a 30% primary bank account share. That’s a 6x revenue opportunity just from their existing base as they match the suites of century-old incumbents and win customers thanks to their elite user interface and inherent cost advantages. Gross profit share looking like primary bank account and customer market share is a matter of when not if, in my opinion.

Their customer ARPU is tiny compared to large incumbents. That’s a byproduct of being behind incumbents in rolling out and scaling products like high-net-worth credit cards and more secured loan types. They’re quickly catching up and I expect the profit-to-customer market share gap to close and support more profitable compounding in that nation. And elsewhere, Nu’s customer growth is in its early stages.