Table of Contents:

- Alphabet – Gemini Enterprise & Search

- PayPal – BNPL & Ads

- Amazon – Quick Suite

- AI Trade Thoughts

- DraftKings – CEO Interview

- Mercado Libre – Macro & Products

- SoFi – Brokerage Progress Report & Revisions

- APP – Investigation

- Headlines

- Macro

My latest portfolio & performance vs. the S&P 500 can be found here. Earnings season coverage gets rolling next week with big banks.

1. Alphabet (GOOGL) – Gemini Enterprise & Search

a. Gemini Enterprise

Google launched a product called Gemini Enterprise this week. The release builds on Alphabet’s positioning as another highly capable full-stack AI player. It has world-class models… world-class distribution… wonderfully efficient chips and data centers... elite research talent… AND an army of organized, customizable agents poised to extract more automation-inspired efficiency across an entire enterprise. And intuitively, as another way to leverage its broader product suite, these agents will be powered by Gemini and equipped with conversational querying for simple access.

The value creation will reach every facet of a company's day-to-day operations to make sure their AI investments are creating enough value and time savings to power real ROI. The suite includes a "workbench," which seamlessly builds complex agentic workflows in a no-code manner and a large library of agent templates for companies not working to build their own. All of this will be under one roof, ensuring superior interoperability, broad integration flexibility for customers. It also provides rapid product improvement informed by a larger sum of relevant data than others. Remember when these guys were falling behind? Me neither.

As we talk about a lot, there are 3 layers of the AI opportunity -- infrastructure, models and apps/agents. Alphabet's TPU/GPU hybrid infrastructure (they say) is the most efficient and productive on the planet. Their Gemini models rank at the top of leaderboards with a new batch coming soon. They have 6 existing apps with 2B+ active users. This is how they can use these great assets to ensure they're a central piece of the app/agent layer. Monetization within that layer has really only been reached by a few companies such as Palantir, Microsoft and ServiceNow. This will pin Alphabet in more direct competition with the agent-based products that those companies are selling. Gemini Enterprise is the search giant's most direct attempt yet to monetize this 3rd layer… and it’s hard to think Alphabet won't take its fair share here too. As a reminder, they were the late entrant in cloud computing and have built that into a fantastic business. I don't think the later debut will prevent it from winning yet again.

This will be offered for as low as $21/user/month for Gemini Business Plan subscribers.

b. Search Data

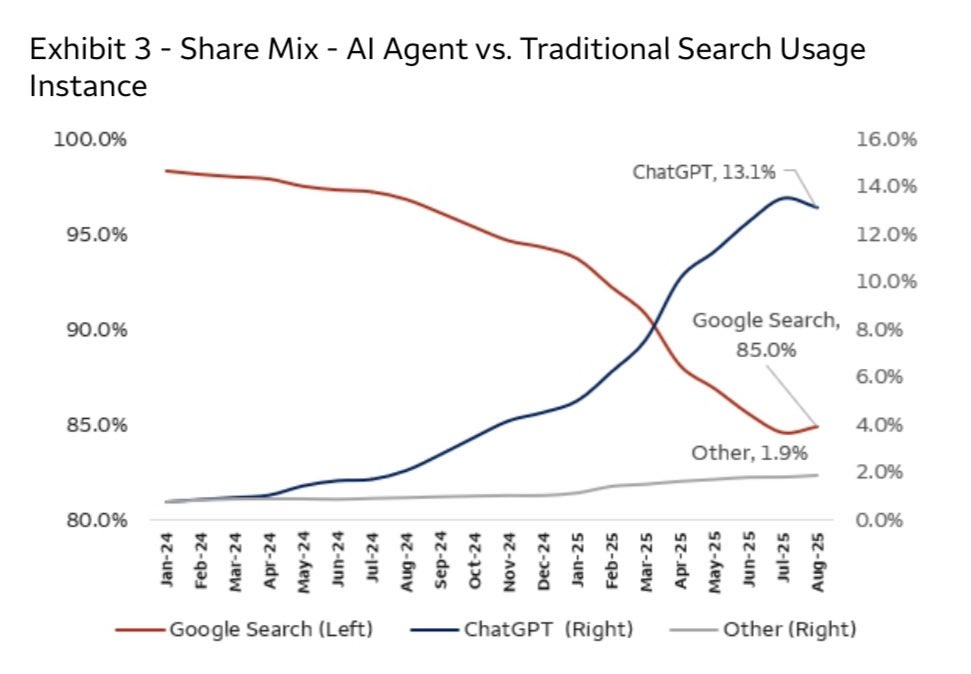

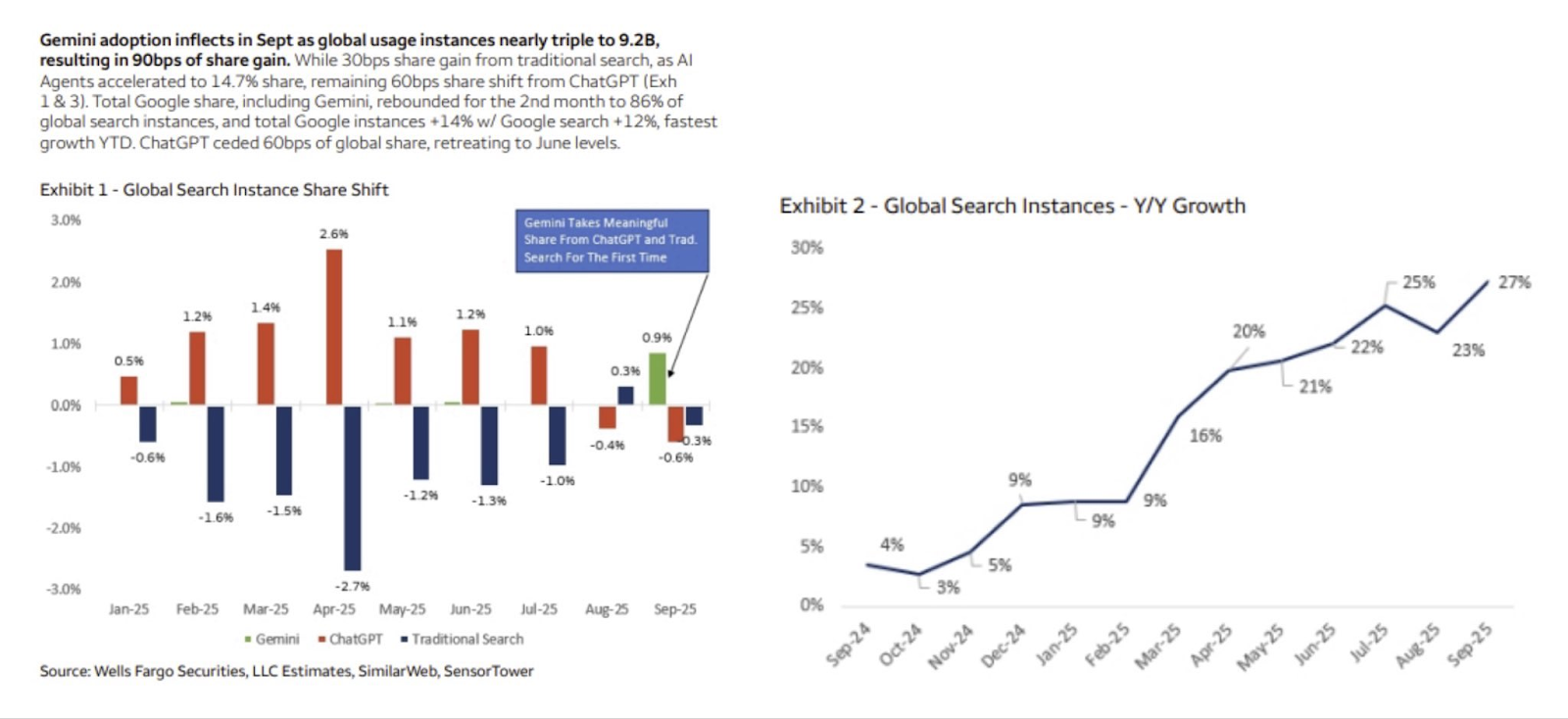

Wells Fargo published some new search data that bodes well for both traditional Google Search and Gemini. The chart is not well put together, but the data in it is very useful. As you can see below, traditional search market share (which includes AI overviews but not Gemini) rose in July and August after falling consistently for more than a year. That share looks to have come from ChatGPT. In the other image, you can see Gemini beginning to take meaningful market share for the first time in September. Good news on both fronts.

Alphabet recently cut the number of search results that LLMs using Google data can get from 100 to 10. These chatbots rely heavily on Google data to power their own offerings, and Alphabet just 10Xed the revenue it can potentially get with the exact same search API usage from competitors.

2. PayPal (PYPL) – Buy Now, Pay Later (BNPL) & Ads

a. BNPL

PayPal is running a 5% cash-back BNPL promotion through the end of the holiday season. I’m a fan of this. BNPL is becoming extremely popular for younger consumers as they shy away from traditional credit cards. It’s also a higher margin product for PayPal vs. credit cards. Building consumer BNPL habits can make the 5% promo a durable source of structural transaction-related operating leverage.

And not only is BNPL good for transaction margin, it’s great for customer frequency, lifetime value and retention. BNPL users spend more on PayPal and lean on it more heavily for their financial lives. With PayPal’s vast product suite and larger customer data profiles than competitors, they can season their models better, know their customer better, and create more lucrative overall relationships with more resilient credit health.

The product is already doing quite well for PayPal as they have integrated it earlier on in merchant shopping flows. All of these advantages (along with a ubiquitous brand) make it clear why they’re leaning into this strength. I expect this to be a modest accelerant for user growth, especially considering the omni-channel nature of the relationship. They’ve also added pay monthly options to their in-store experience as they gear up for a busy season.

PayPal BNPL (especially with upstream presentment) amplifies conversion rates and revenue for merchants too… not just for PayPal. That makes this payments firm a more strategic vendor beyond a transactional button, which they’re trying very hard to do.

b. Ads

PayPal debuted the PayPal Ads Manager this week. The product greatly helps smaller businesses monetize their lucrative ad impressions. PayPal organizes that supply, plugs it into the firm’s vast base of advertising demand and matches merchant supply with the most valuable suitor for both parties. This maximizes cost per impression for its merchants and return on ad spend for its advertisers. Win, Win. They are the value-creating conduit in this situation. It’s wonderful what happens when a company like PayPal can connect high-intent shoppers to brands the company knows these shoppers will be interested in. Just another reason why PayPal’s vast customer data profiles on the consumer and merchant sides are so incredibly valuable. They’re finally taking advantage.

Ads Manager is similar to Amazon’s and Google’s and also somewhat similar to Trade Desk’s retail media product. It’s different from Trade Desk in that it focuses more on publishers (sell-side vs. buy-side) and on smaller customers rather than gigantic ones. Merchants can onboard in minutes and do not pay any upfront fees for access to this offering. Like previous ad offerings from the company, businesses simply compensate PayPal as they make money from automated impression placements. PayPal does all of the work for them, and offers complementary reporting and measurement products so an organization can act accordingly. This should be a popular offering for its small business customers, and a high-margin source of PayPal revenue.