Table of Contents

In case you missed it, my detailed Nvidia earnings review.

Other Reviews to read this season:

- Sea Limited Earnings Review.

- On Holdings Earnings Review.

- Nu Holdings Earnings Review.

- The Trade Desk Earnings Review.

- Lemonade & Duolingo Earnings Reviews.

- Palantir & Hims Earnings Reviews.

- Cava Earnings Review.

- DraftKings Earnings Review.

- Microsoft & Cloudflare Earnings Reviews.

- Uber Earnings Review.

- Shopify & Coupang Earnings Reviews.

- Meta Earnings Review.

- Alphabet Earnings Review.

- Apple, ServiceNow & Starbucks Earnings Reviews.

- Amazon & Mercado Libre Earnings Reviews.

- PayPal Earnings Review.

- Tesla Earnings Review.

- SoFi Earnings Review.

- Netflix Earnings Review.

- Taiwan Semi Earnings Review.

Finally, I exited one holding and started a new position in another company during the week.

1. Datadog (DDOG) – Q3 2025 Earnings Review

a. Datadog 101

Core Product Niche:

This is a dominant player in the data observability space. Observability simply refers to monitoring an entire digital ecosystem to track issues, vulnerabilities and performance. Other players within this area include the hyper-scalers, Splunk, Elastic, CrowdStrike (through M&A) and many more. Datadog splits its observability niche into various buckets.

Bucket #1 – Infrastructure monitoring: provides a holistic view of assets like servers and networks to automate insight collection. Knowledge is power, and so this organized surveillance has a way of expediting the uncovering and fixing of issues. It helps optimize usage of compute and eliminate hardware performance bottlenecks. Optimization routinely means lower total cost of ownership for DDOG customers.

Bucket #2 – Log management: collects and manages logs or “timestamped records of events.” This also facilitates faster issue remediation and performance optimization. This product routinely complements infrastructure-based monitoring with its event-based support for things like customer service interactions.

- Flex Logs: A cost-effective means to store and retain large batches of logs by separating storage and query usage. Separation makes compliance & storage more efficient, while augmenting data scalability and query breadth. Conversely, flex log querying is slow. That makes this better for lower priority data and where latency is not a crippling bottleneck. They recently added “Flex Frozen” logs with 7 years of storage.

Bucket #3 – Application Performance Monitoring (APM): Tracks app performance and uncovers/prioritizes performance issues to be remediated. The firm is rounding out developer tools to help them customize existing DDOG apps and models with their own data and work. It recently added a “Latency Investigator” to automate forensic investigations and expedite root cause analysis and “Proactive App Recommendations” to turn insights into actionable plans.

Bucket #4 – Digital Experience Monitoring: This is exactly what it sounds like. This product includes real-time user monitoring (RUM) to track precise, observed interactions, and Datadog Synthetics, which provides a simulation of expected observed interactions. Here, Datadog delivers detailed churn analysis, engagement metrics, feature testing, user journey reports etc. It also recently introduced mobile app testing. Users can now conduct this testing right from their actual mobile phones. Finally, this segment features product analytics that allow clients to directly trace application behavior such as feature adoption, engagement and retention to see how tweaking an experience directly impacts the overall business. This includes split testing capabilities to experiment before deploying changes. It helps turn RUM and Datadog Synthetics work into tangible business insights.

These four product categories, which frequently work together, form its “unified platform.”

Other Product Categories – Security:

Because Datadog already handles network viability, security is a very relevant growth adjacency. Here are some important security products to know:

- Cloud Infrastructure Entitlement Management (CIEM) sets strict, minimum access identity controls, cutting risk of identity attacks in the cloud.

- Security Information and Event Management (SIEM) product enables “long-term data log visualization for security investigations.” It’s helpful for broad threat management use cases. This can be done without dedicated staff, making cloud migration and usage easier.

- Application security and code security offerings cater to use cases across the development, security and operations (DevSecOps) lifecycle. Datadog has been a large player in the Ops section (and increasingly Sec too). Code security is moving into the Dev section more meaningfully, or moving “further left” towards developers.

- It also has some data loss prevention scanning to flag, monitor and protect sensitive data. This supports every other security product. Most recently, it added agentless environment scanning (no security agent installation needed) to match with its agent-based product.

- They’ve retrofitted these data scanners for large language models (LLMs) and agents.

Other Product Categories – AI:

Toto is the name of its large language model (LLM) and Bits AI is its suite of agentic tools. This includes the Bits AI Agents for software development, security and data analytics that all automate manual work within their respective categories. It also includes the site reliability engineer (SRE) agents (in limited access). These fully handle alert response, triaging and remediation, while offering fixes to and actionably resolving code bugs. It streamlines work within DDOG’s core product pillars to extract more productivity gains. It also added dedicated security agents to investigate, propose remediation plans and fix vulnerabilities in apps and source code. Developers can implement these fixes right from their mobile devices.

Its Model Context Protocol (MCP) ensures autonomous agents can fetch the data they need from a wide array of sources across the web. This helps broaden available context to expedite root cause analysis of various issues. Early integration partners include Cursor, OpenAI and Anthropic. With Cursor and OpenAI specifically, the new integrations allow DDOG products to be used within the integrated developer environments (IDEs) of each form. It’s available for some customers, but not yet fully released. It can summarize incidents and conversationally field questions. It’s also rolling out autonomous investigations to remove the manual work from uncovering issues with infrastructure, large language models, apps, usage patterns etc.

And unsurprisingly, it also tweaked and configured its core products to cater to LLM observability. New offerings for this asset class include prompt injection protection and data poisoning prevention. The first guards against hackers inundating models with poor data to lower output quality; the second insulates companies from adversaries attempting to actually manipulate training data.

Other Product Categories – Incident Management:

Finally, Datadog offers an incident management suite. This includes Datadog On-Call, which alerts (or pages) engineers about various issues and Incident Management to actually orchestrate remediation and learn from what went wrong. It seamlessly integrates DDOG’s holistic observability suite to not only provide an end-to-end, bird’s-eye-view of operations, but to also actionably and quickly fix issues as they appear.

b. Key Points

- Large outperformance was broad in nature.

- Renewed its large OpenAI contract.

- 15 AI-native customers are now contributing $1M+ in ARR.

- The security is meaningfully accelerating.

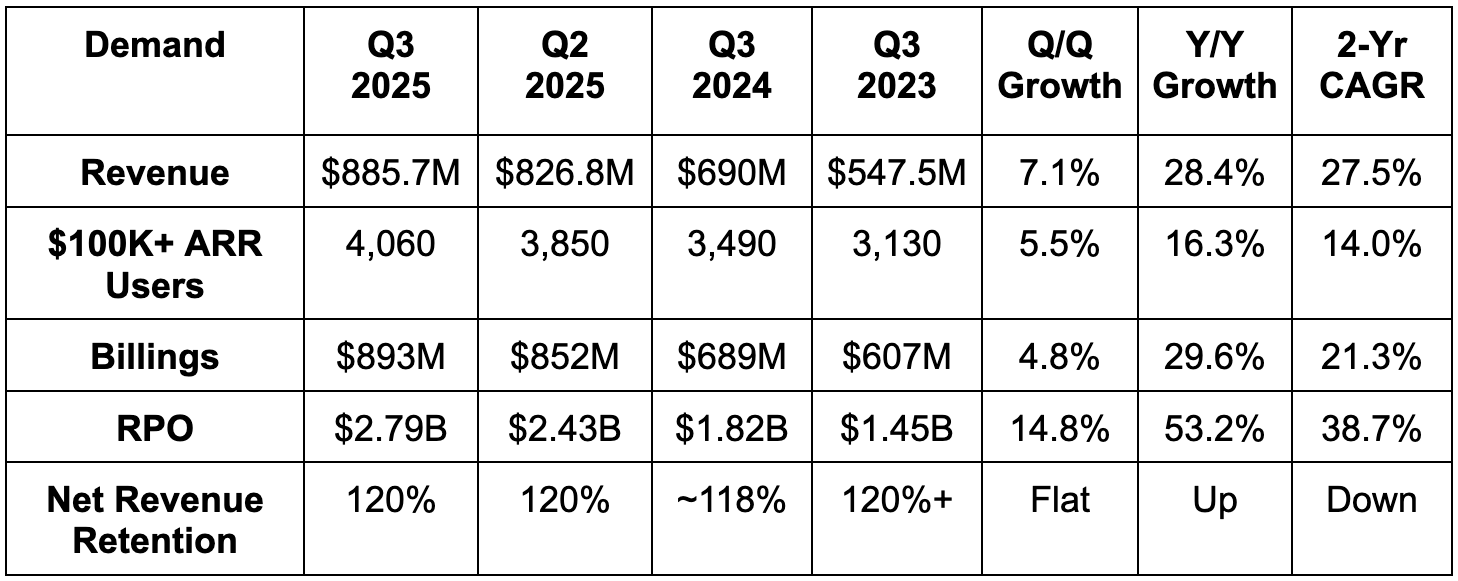

c. Demand

- Datadog revenue beat estimates by 3.9% & beat guidance by 4.1%.

- Beat billings estimates by 2.2%

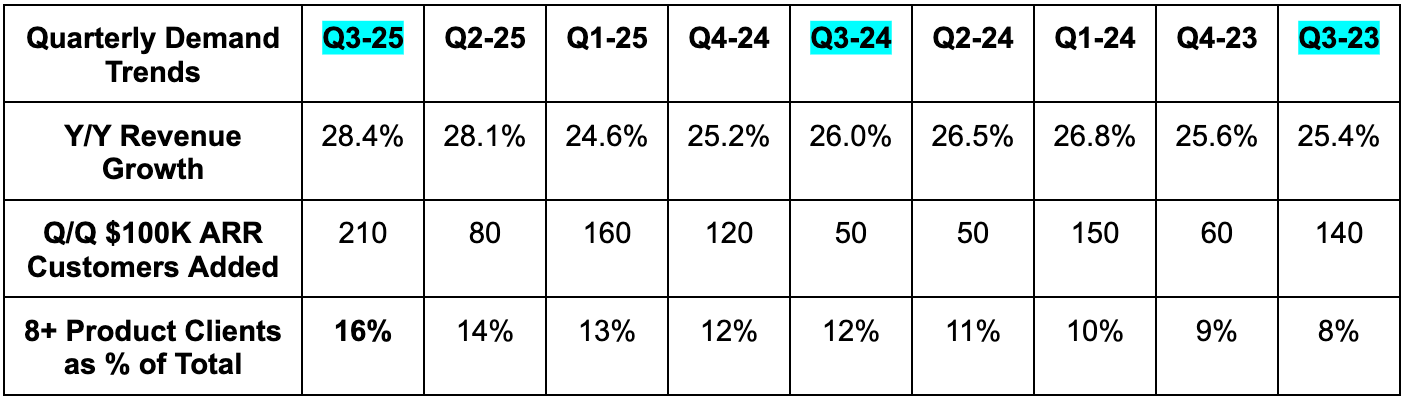

- It was nice to see a 2-point Q/Q rise in the % of clients using 8+ products. That hasn’t happened in over 2 years.

- Beat remaining performance obligation (RPO) estimates by 9%.

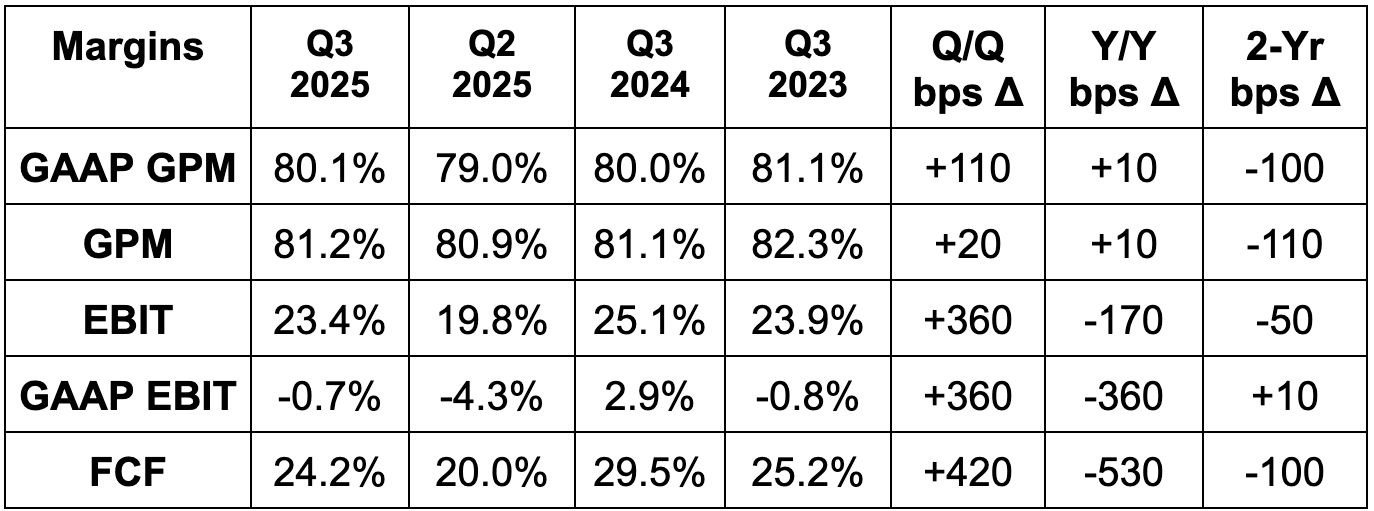

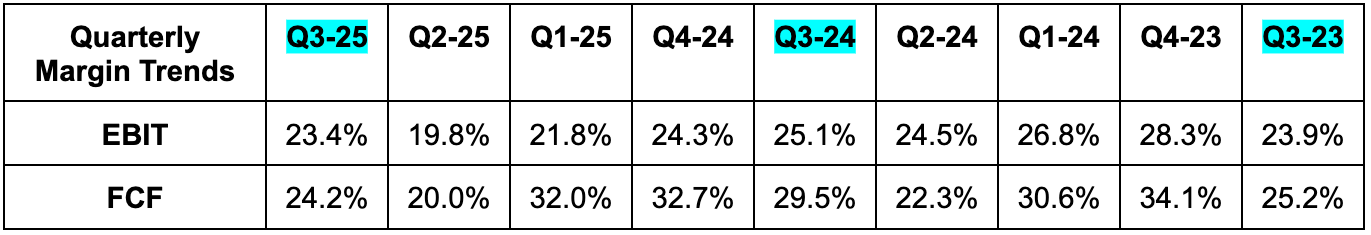

d. Profits & Margins

- Slightly beat GPM estimates.

- Beat EBIT estimates by 15.6% and beat guidance by 16.3%.

- Beat $0.46 EPS estimates by $0.09 and beat guidance by $0.10.

- Beat FCF estimates by 14.6%.

Gross margin was helped by engineering and cloud cost efficiencies. OpEx rose by 32% Y/Y to outpace revenue growth as they keep aggressively investing in long-term growth. These investments come in the forms of both product and sales.

e. Balance Sheet

- $4.1B in cash & equivalents.

- $982M in convertible senior notes.

- No traditional debt

- 1.2% Y/Y diluted share count growth.

f. Guidance & Valuation

- Raised Q4 revenue guidance by 4.1%, which beat estimates by 3.1%.

- They feel “good about Q4 pipeline.”

- Raised Q4 EBIT guidance by 21%, which beat estimates by 19%.

- Raised Q4 EPS guidance by $0.105, which beat estimates by $0.10.

- These Q4 raises are especially notable considering DataDog generally bakes in an extra degree of prudence into its forward guidance. Their revenue is based on consumption. Consumption is inherently more volatile than subscription-based revenue. It’s smart to guide prudently.

- They now expect CapEx to be 4% of revenue vs. 4.5% previously.

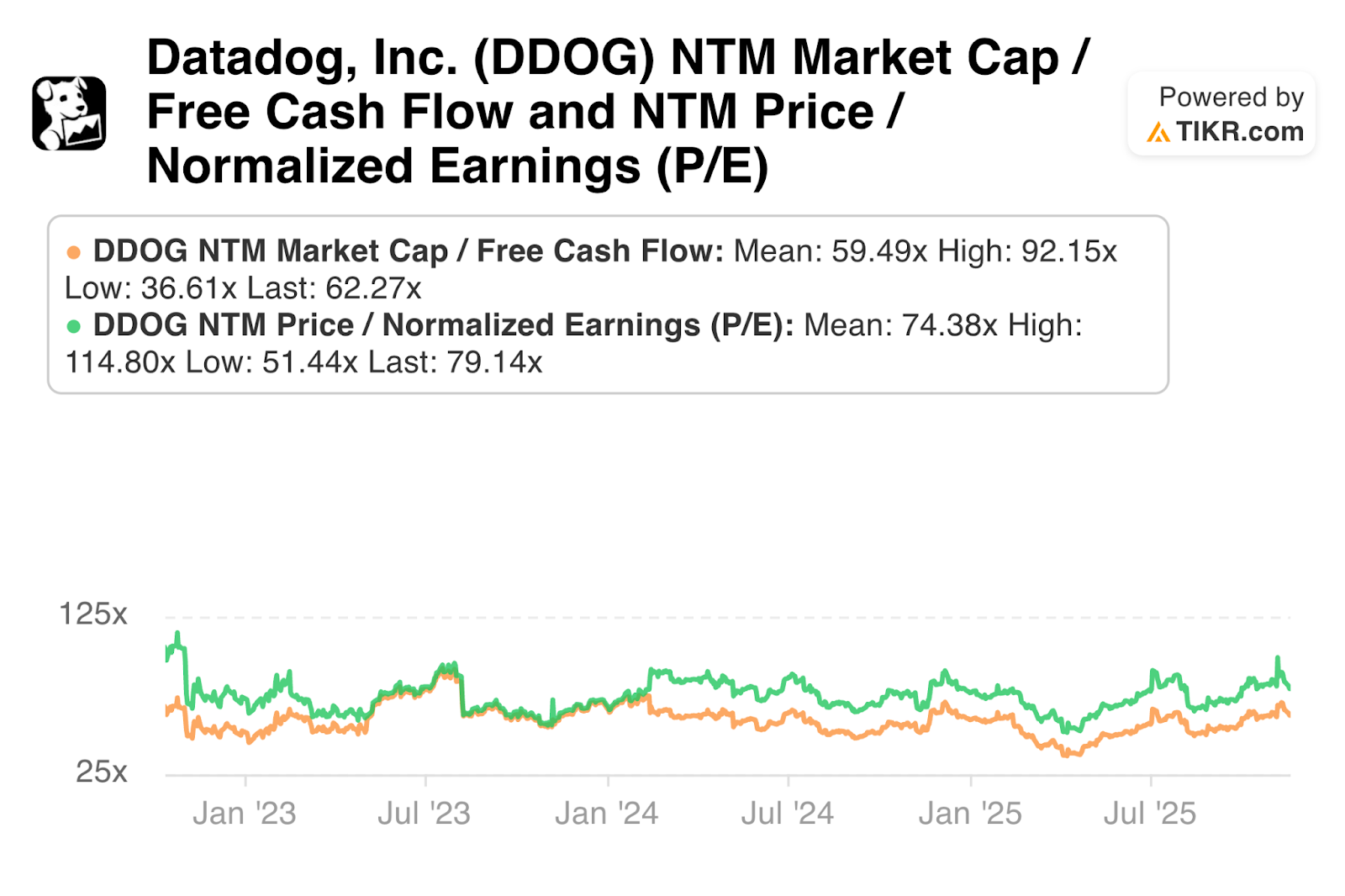

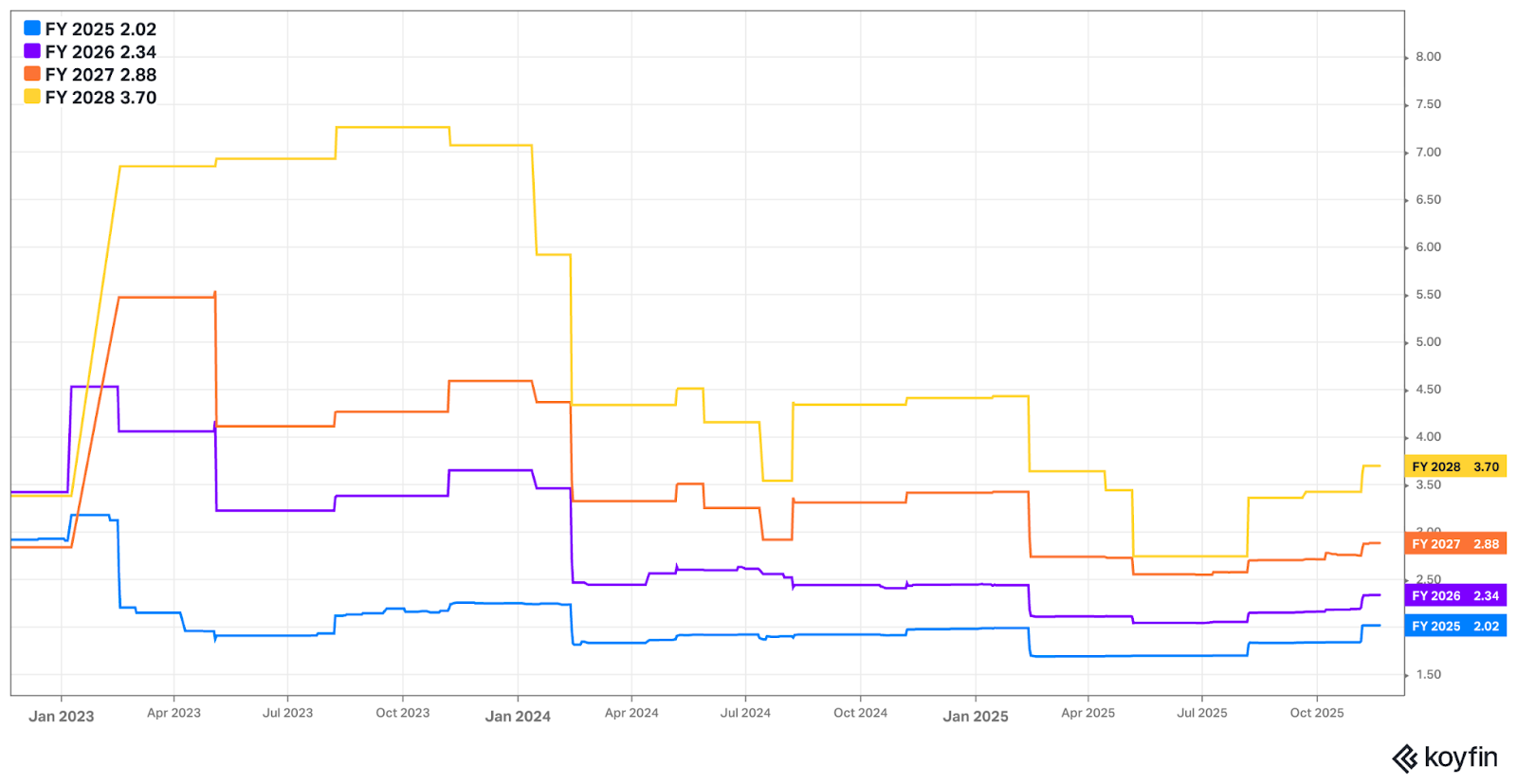

DDOG trades for 79x forward EPS and 62x forward FCF. EPS is expected to grow by 11% this year, 16% next year and 23% the year after. FCF is expected to grow by 14% this year, 24% next year and 29% the year after. They’re in the midst of an investment cycle right now.

g. Call Notes

Broad-Based Strength:

Everywhere you look, momentum was strong for Datadog. Momentum from AI customers accelerated and broadened. DDOG now has 15 AI customers spending $1M or more annually and 100 spending $100K+. That’s important. There has been considerable noise and concern surrounding its large business with OpenAI and fears of that giant displacing DDOG with internally built tools. DDOG showing its AI customers span well beyond OpenAI is good news for concentration risk. To diminish that risk even further (for now at least), OpenAI renewed their contract with DDOG in a 9-figure/year expansion. This deal entails much higher usage limits, which always means lower prices for customers (volume-based discounts). For that reason, it was especially encouraging to see GPM expand on a Q/Q and Y/Y basis regardless of the headwind. Several analysts were noticeably excited about that, and rightfully so. We don’t have an exact number in terms of percent of Datadog revenue from OpenAI, but estimates from sell-side firms like Guggenheim put that right around 5% of total vs. about 12% of total for the AI cohort as a whole.

The non-AI cohort was arguably even better. They saw an acceleration across small and large non-AI native enterprises, with Q/Q growth setting a 3-year high. Contributions from new and expanding customers were both very healthy, as retention rates remained stable and bookings from new customers doubled Y/Y thanks to rising deal values. These new customers generated 25% of DDOG’s total revenue growth this quarter vs. 20% sequentially.

There’s no single or temporary source of this success, as it’s encouragingly broad-based in nature. DDOG views it as a balanced mix of its product suite resonating, its incremental go-to-market investments bearing fruit and the demand environment remaining rather stable if not moderately positive. Those first two tailwinds should be structural in nature compared to fluctuating market conditions.

- Sales productivity was called “good” but it’s impacted by the rising number of new hires they have in the company.

- There are more go-to-market changes coming in 2026 that should bolster momentum further.

Wins:

Nothing illustrates momentum like some large customer wins:

- 7-figure/year deal with a telecom company in the EU for its largest deal ever in that region. The customer replaced expensive and ineffective tools with DDOG’s to lower overall costs by millions annually. They’re using 11 DDOG products in a contract that displaced 10 vendors. Nice platform-level win.

- 7-figure/year deal with a financial services company. They’re displacing 14 open-source tools and hyperscaler observability services with 11 Datadog products. These products include Bits AI limited release usage, On-Call and some security tools.

- 7-figure/year expansion deal with a Fortune 500 financial services company. They’re using 15 Datadog products across every pillar to replace the need to run 93 different cloud instances to power their jumbled open-source tools.

- 7-figure/year expansion deal with a Fortune 500 heavy equipment company. They’re replacing open-source log management tools for Flex logs and will add LLM Observability to cut overall costs as well.

- 7-figure/year deal for a customer that returned to Datadog thanks to the company’s improved product offering, breadth and execution.

- 7-figure/year expansion deal with an American carmaker. This company used up consumption commitments faster than expected and came back for more.

Digital Experience Monitoring:

This category is turning into a material financial driver for the business. It crossed $300M in ARR and delivered great momentum across all products, with especially strong growth enjoyed within the newer Product Analytics tool. This now has 1,000 total customers a few quarters into its amplified push into the segment. To help keep traction buzzing, for a second consecutive year, Datadog’s Digital Experience Monitoring was named the leader in Gartner’s Magic Quadrant.

Security:

Security ARR growth accelerated sequentially from around 45% Y/Y to 55% Y/Y. Really good. This success was facilitated by an acceleration in every single cloud security tool it offers, including Cloud SIEM, which is enjoying much more inclusion in larger deals.

AI Product Work:

Interest in its Bits AI agents was called strong, with thousands of customers now previewing its SRE agent and others within the overall suite. Early on, SRE customers are cutting mean-time-to-resolution (MTTR) for performance bottlenecks and security issues and automating the majority of investigations for analyst teams, cutting time and resources without sacrificing enterprise hygiene. Its Bits AI security agent is also getting “very positive feedback” for its vulnerability management, triaging, investigating and resolving. It’s quite early for all of these products, so the commentary on adoption was understandably vague.

Within AI Observability, it launched LLM experiments and playgrounds, which give developers a safe environment to build, iterate and test AI-powered apps and agents. This pushes them closer to initial source code generation or “further left” in the development, security and operations (DevSecOps) space (towards “Dev). For an idea of the interest in LLM Observability (within overall AI Observability), LLM spans (unit of AI operation) 4X’d in the last few months. That’s from a very small base, but this is the kind of growth we need to see from that small base to gain confidence in LLM Observability moving the needle in the future. AI Observability overall now has 5,000 customers sending DDOG data or using an integration, marking another quarter of adding 500 new clients sequentially. They think their 1,000+ AI integration menu is “unparalleled,” which means their ability to drive vendor and data interoperability is too. And that interoperability directly leads to more business, considering there’s a highly positive correlation between integrations used and revenue generated.

- They’re seeing MCP adoption translating to higher usage of other DDOG products.

- The Toto time-series forecasting model their research team created has been among the most popular downloads on Hugging Face in recent months.

More on AI Demand:

While it’s impressive that the AI cohort is already 12% of revenue, that’s really just those companies using existing DDOG tools. Its business is based on general compute CPU architecture, rather than the GPU-based architecture that powers Bits AI, AI Observability, Toto etc. DDOG’s observability niche is highly relevant for infrastructure, models, apps and agentic operations. They should absolutely be able to monetize the explosion in GPU-based assets stemming from AI, and that opportunity is still almost entirely in front of them. I’m surprised that hasn’t happened more meaningfully within its infrastructure monitoring business already, but they’re confident that the time will come.

Leadership was also asked about independent software vendors including observability in their overall AI product suites. Do they consider this a pressing competitive threat? The short answer is no. DDOG is an observability platform spanning all assets and workloads a customer needs to monitor and optimize. These customers, as leadership argued, do not want 15 different vendors and a web of disparate, clunky integrations to manage observability in frustrating siloes. They want one interface… one platform… one data repository… and one record of truth. That consolidates vendors, cuts costs and improves outcomes… just like it does for every other enterprise software platform. This is also why it’s encouraging to see the deals highlighted above that include 10+ DDOG products. More products will mean higher retention, increasingly loyal customers and higher lifetime value.

h. Take

Great quarter. The company’s go-to-market fixes are clearly working while their product traction is fantastic in security and good in AI (despite being very early there still). It was great to see them renew the OpenAI contract amid all of that noise as clearly using Datadog is a better option than that disruptor building their own tools. It's also great to see that occur while GPM still expanded on a Y/Y and Q/Q basis. That’s impressive and goes to show how effective they’ve been with trimming cloud and engineering costs. I thought the sharp Q/Q acceleration in security growth and the large roster of AI clients with $100K+ in ARR were both impressive items from a long list of highlights.

This is a great company. It’s a clear platform play in observability with ramping momentum across a few other product categories as well. I view this in the same high-quality light as companies such as Zscaler, Palantir, CrowdStrike and Cloudflare. But like most of those, I find the valuation to be too rich for the level of multi-year profit growth it's delivering. I don't consider risk/reward compelling enough to own this company, as I’d rather own shares of other world-class enterprise software names trading at lower multiples.

None of that changes how good the quarter was, how steady financial momentum is, how compelling the runway is and how pleased shareholders should specifically be with these numbers.