Table of Contents:

- GitLab – Brief Earnings Snapshot

- Lululemon – Detailed Earnings Review

- Salesforce – Detailed Earnings Review

- Broadcom – Detailed Earnings Review

- PayPal – CFO Interview

- Shopify – CFO Interview

- DraftKings – CEO Interview

- Starbucks – Promising News

- Alphabet – Anti-Trust Win

- Amazon – AWS Growth

- Duolingo – Alternative Data

- Headlines & Macro

Earnings Reviews from this Season:

- Zscaler earnings review

- Nu & Airbnb earnings reviews

- Cava & On Running earnings reviews

- Datadog & Sea Limited earnings reviews (sections 1 & 2)

- Palo Alto & Spotify earnings reviews (sections 1 & 2)

- AMD earnings review (section 4)

- Trade Desk, Duolingo & DraftKings earnings reviews

- Uber & Shopify earnings reviews

- Lemonade, Hims & Coupang earnings reviews

- Mercado Libre & Palantir earnings reviews

- Amazon & Microsoft earnings reviews

- Meta & Robinhood earnings reviews

- SoFi & PayPal earnings reviews

- Alphabet & Tesla earnings reviews

- Chipotle earnings review.

- ServiceNow earnings review

- Netflix & Taiwan Semi earnings reviews

- Starbucks & Apple earnings reviews

& my current portfolio/performance.

1. GitLab (GTLB) Brief Earnings Snapshot

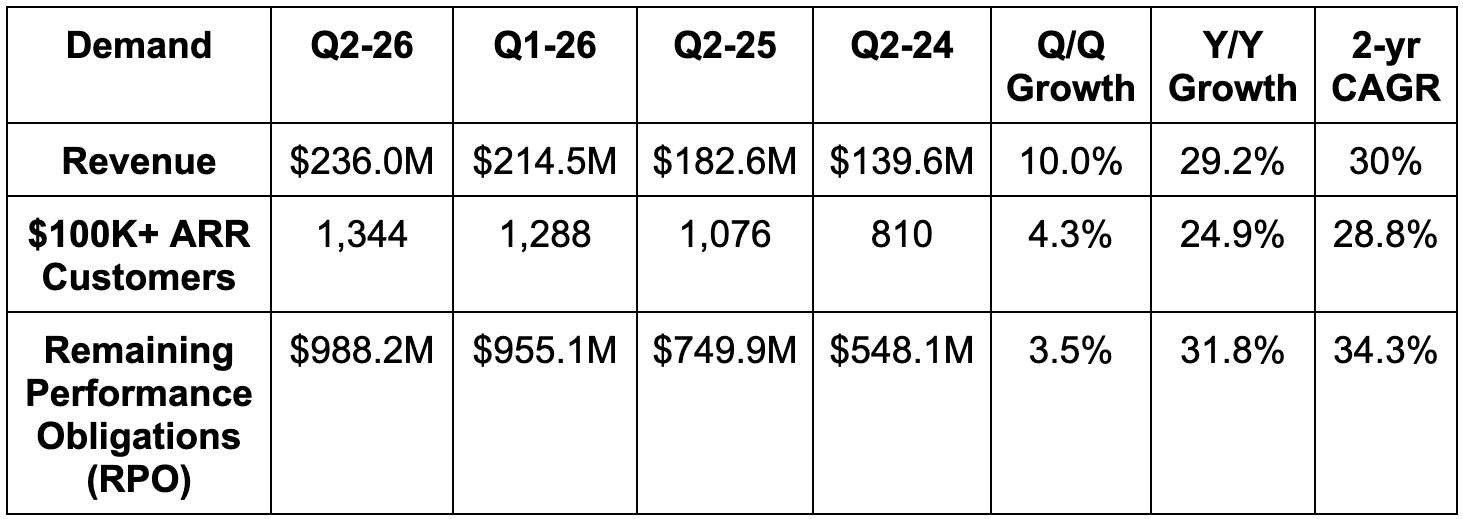

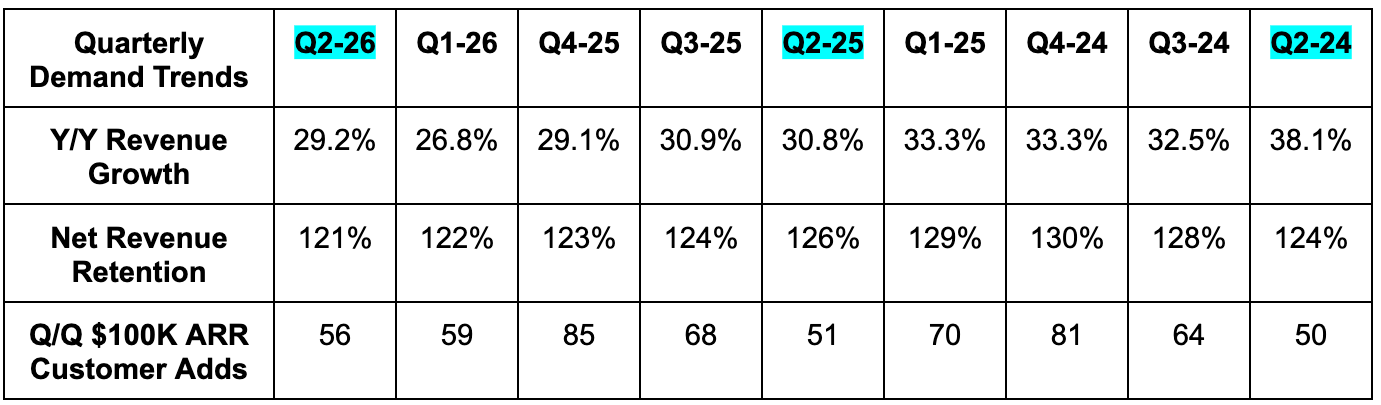

a. Demand

- Beat revenue estimates by 3.8% & beat guidance by 4.2%.

- Missed billings estimates by 0.6%.

- Slightly missed remaining performance obligation (RPO) estimates by 0.4%.

- Met net revenue retention estimates.

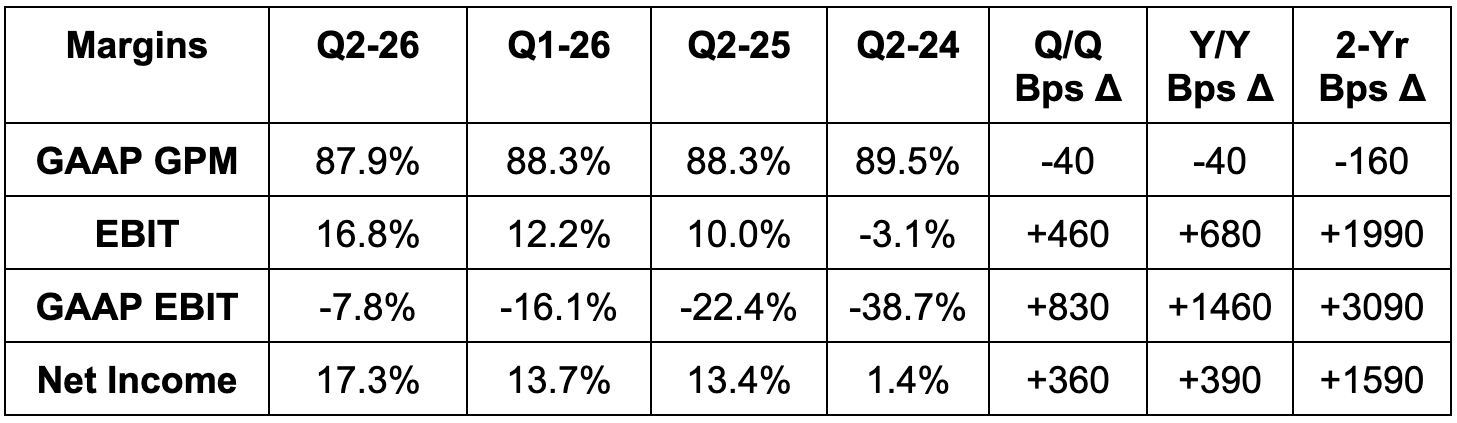

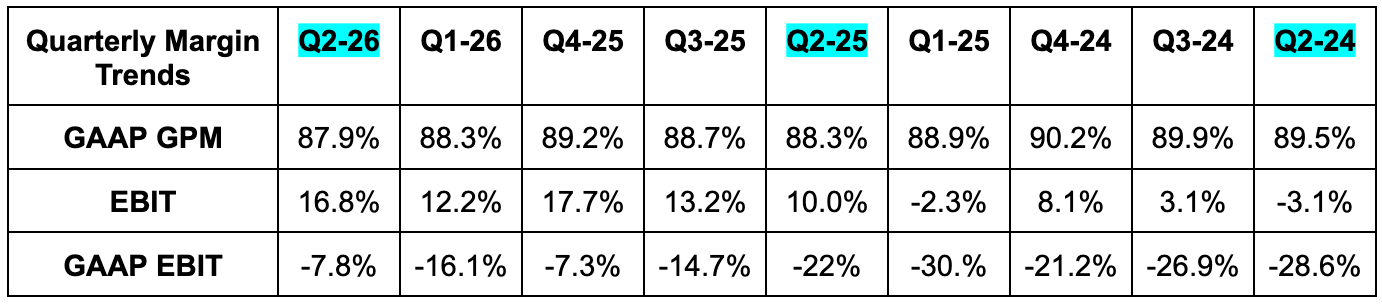

b. Profits & Margins

- Beat $24M EBIT estimates by $16M & beat guidance by $16.5M.

- Beat $0.16 EPS estimates by $0.08 & beat guidance by $0.075.

c. Balance Sheet

- $1.16B in cash & equivalents.

- No debt.

- Basic share count rose by 3.9% Y/Y. Diluted share count actually fell a bit Y/Y.

d. Guidance & Valuation

- Reiterated annual revenue guide, which slightly missed estimates.

- Raised annual EBIT guidance by 13.4%, which beat estimates by 12.2%.

- Raised annual $0.745 EPS guidance by $0.085, which beat estimates by $0.07.

- Q3 was a bit light for revenue and EBIT.

GitLab trades for 52x EPS. EPS is expected to compound at a 15% clip over the next two years following a couple years of triple-digit growth.

2. Lululemon (LULU) Detailed Earnings Review

a. Key Points

- Management fixes aren’t working.

- Excuses are recurring and mounting.

- Tariff headwinds are ramping.

b. Demand

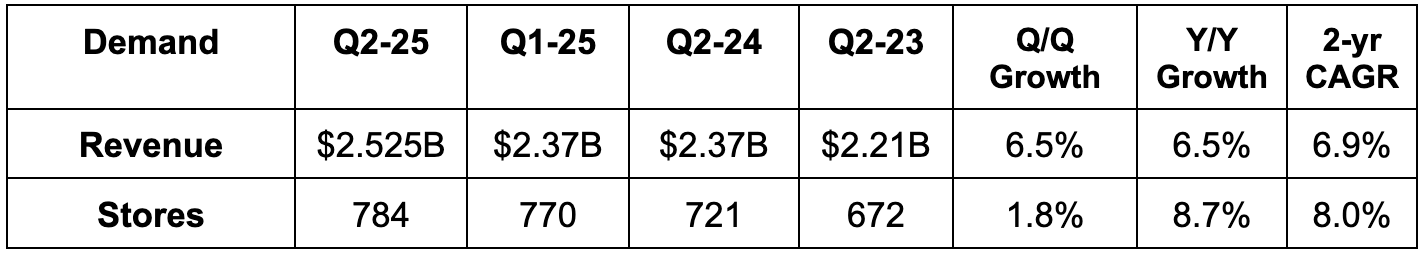

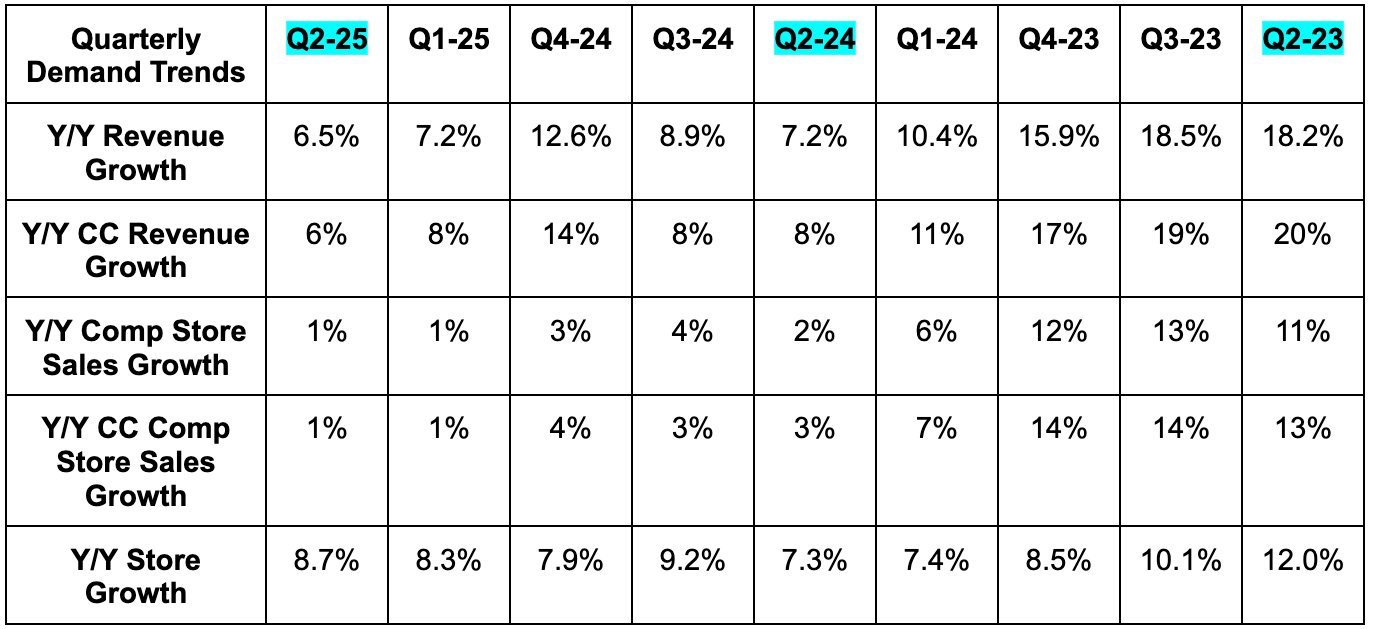

- Missed revenue estimates by 0.5% & missed guidance by 0.9%.

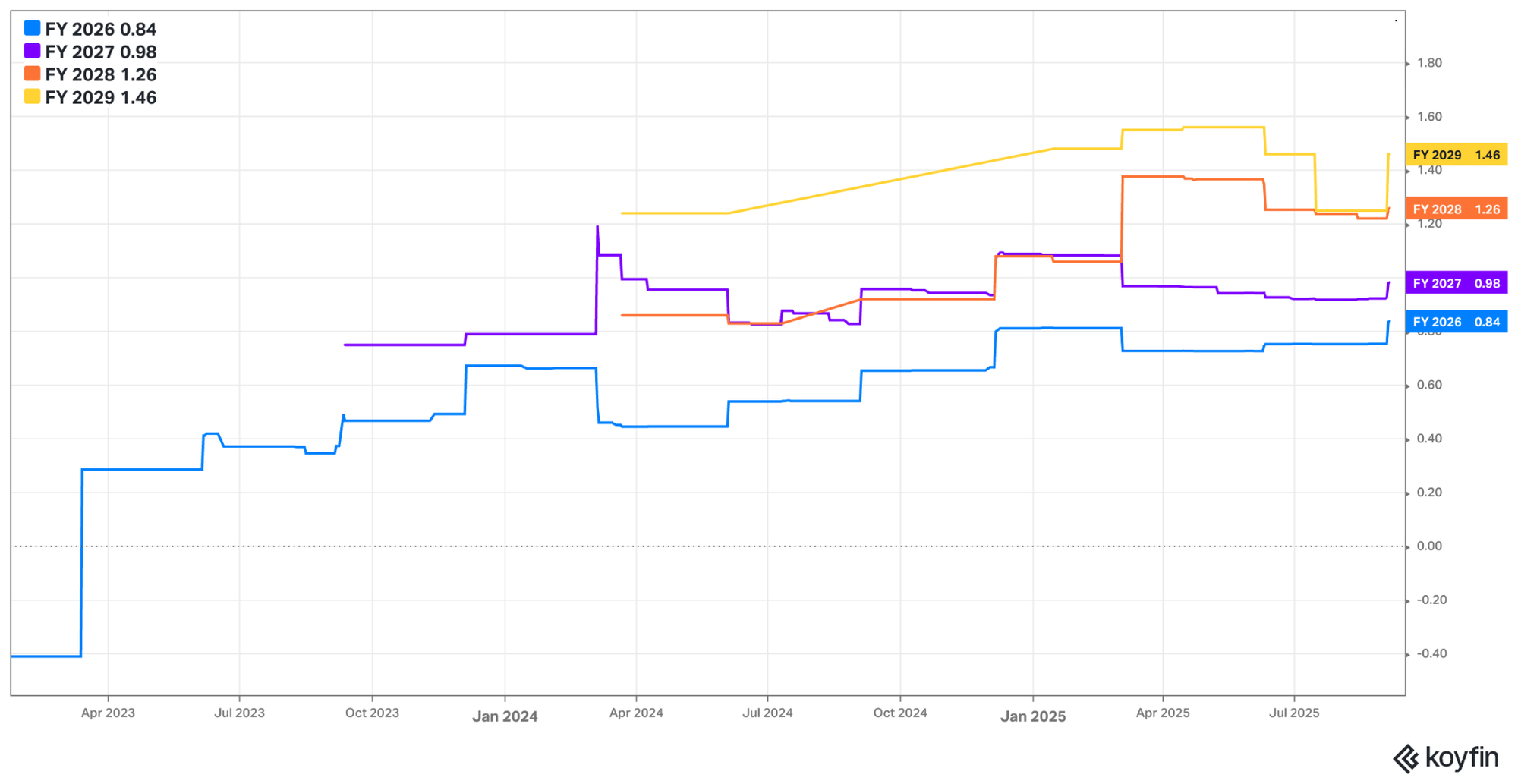

- Its 6.9% 2-yr revenue compounded annual growth rate (CAGR) vs. 8.9% Q/Q & 14.2% 2 quarters ago.

- Comparable store sales (comp sales) rose by 1% Y/Y, which missed 3% growth estimates.

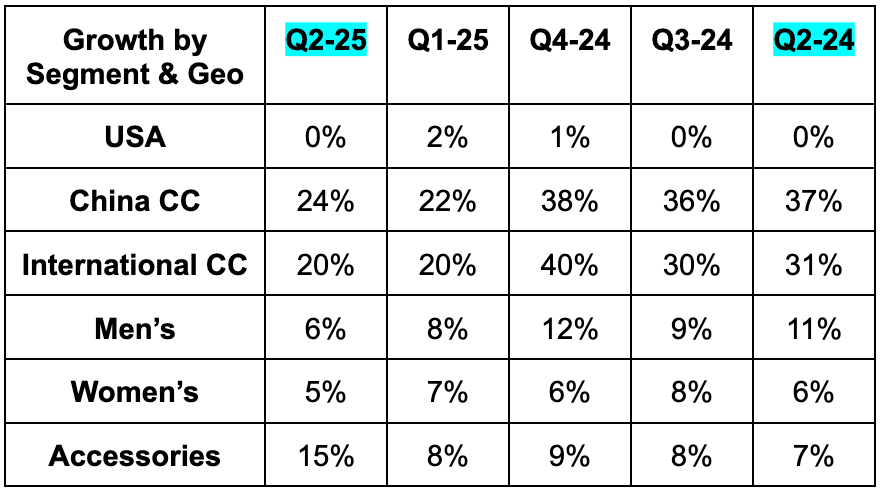

- Americas comp sales growth was -4% Y/Y vs. -1% expected. Growth was -3% Y/Y on a constant currency (CC) basis.

- China comp sales growth was 17% Y/Y vs. 13% expected. A rare bright spot in this report. CC growth was 16% Y/Y.

- Rest of World comp sales growth was 12% vs. 13% expected. CC growth was 9% Y/Y.

- International comp sales growth was 22% overall and 20% CC.

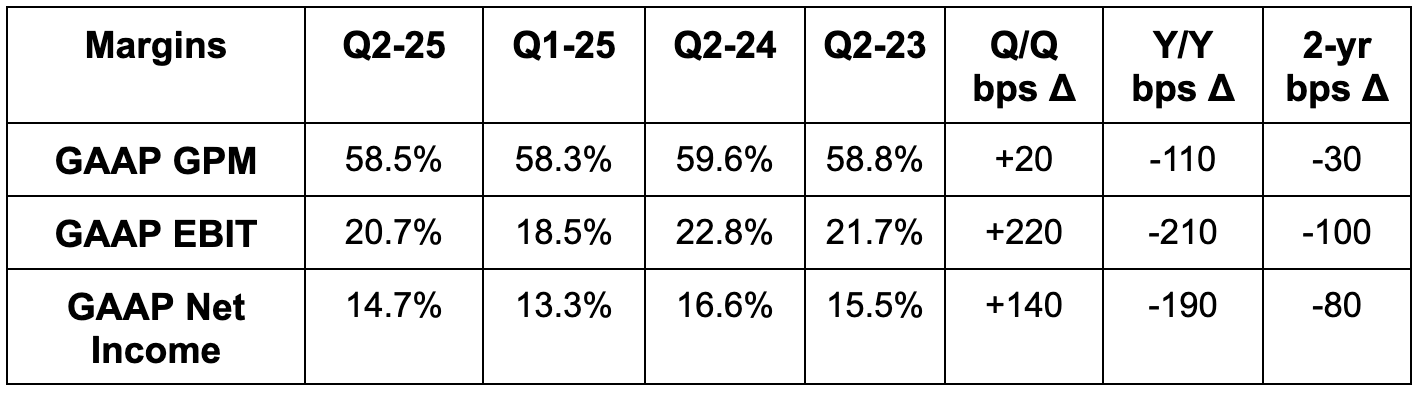

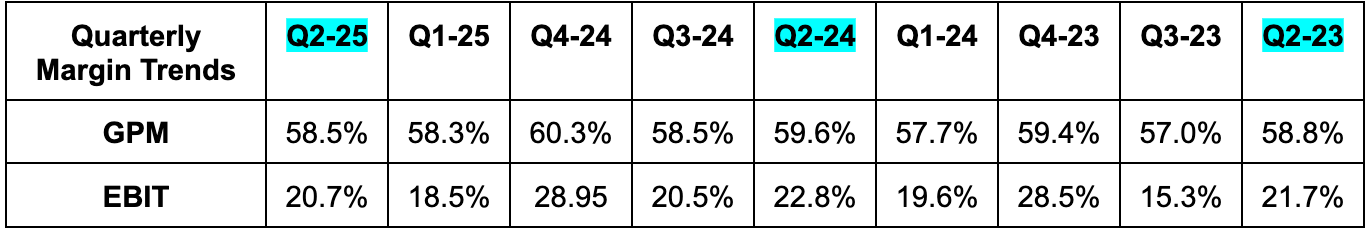

c. Profits

- Beat 57.6% GPM estimate by 90 basis points (bps; 1 basis point = 0.01%) and beat guidance by 110 bps.

- Markdowns rose by 60 bps Y/Y vs. the 30 bps it guided to.

- Upside was driven by lower-than-expected tariff headwinds, a reversal in a stock-comp expense and some ocean freight deflation.

- Beat EBIT estimates by 9.6%.

- Sales, general and administrative (SG&A) was 37.7% of revenue vs. 36.8% Y/Y. This was 90 bps better than expected, mainly due to stock compensation expense reversals.

- Beat $2.85 EPS estimates by $0.25 & beat guidance by $0.225.

- EPS fell from $3.15 to $3.10 Y/Y. A few pennies of this decline came from a higher tax rate (30.5% vs. 29.6% Y/Y).

d. Balance Sheet

- $1.16B in cash & equivalents.

- Inventory +21% Y/Y. Inventory is 2% larger than expected. Not great when this is one of the only things coming in above expectations.

- $393M credit revolver.

e. Guidance & Valuation

Lululemon lowered annual revenue guidance by 2.7%, with the new target missing estimates by 2.5%. New revenue growth guidance represents 3% Y/Y growth excluding the extra week. They now think U.S. revenue will fall by 1.5% Y/Y in 2025 vs. prior expectations calling for modest growth. It also now sees 22.5% Y/Y China growth vs. 27.5% previously. This is due to some macro weakness in their large cities. It continues to forecast 20% Y/Y Rest of World revenue growth. A lot more on this revenue disappointment later. It also lowered annual EPS guidance by $1.81 (or 13.4%) to $12.87, which missed estimates by $1.74. This new guide represents a 12% Y/Y EPS decline for 2025. A lot more on this right now. Guidance now includes a larger tariff impact of $240M in gross profit or 220 bps for GPM vs. 40 bps previously. All in all, they see GPM falling by 300 bps Y/Y vs. 110 bps previously.

Virtually that entire change (170/180 of the bps) is related to most of its shipments from Canada to the USA being eligible for de minimis tariff exemptions. Other weakness is due to a 50 bps markdown headwind vs. 15 bps previously guided to. Not great. Beyond input costs, guidance includes 35 additional bps of SG&A deleveraging, due to lower sales growth assumptions, investments and FX headwinds. All in all, it now expects operating margin to fall by nearly 4 points Y/Y.

- The $240M gross profit impact for 2025 is expected to rise to $320M in 2026 as they struggle to compensate for the headwinds.

- They don’t expect to be that aggressive with price hikes in light of tariffs. Price hikes so far have been modest and sparingly done.

- They expect 20% Y/Y dollar inventory growth next quarter and 10%-12% unit inventory growth. The gap continues to be related to tariffs and foreign exchange.

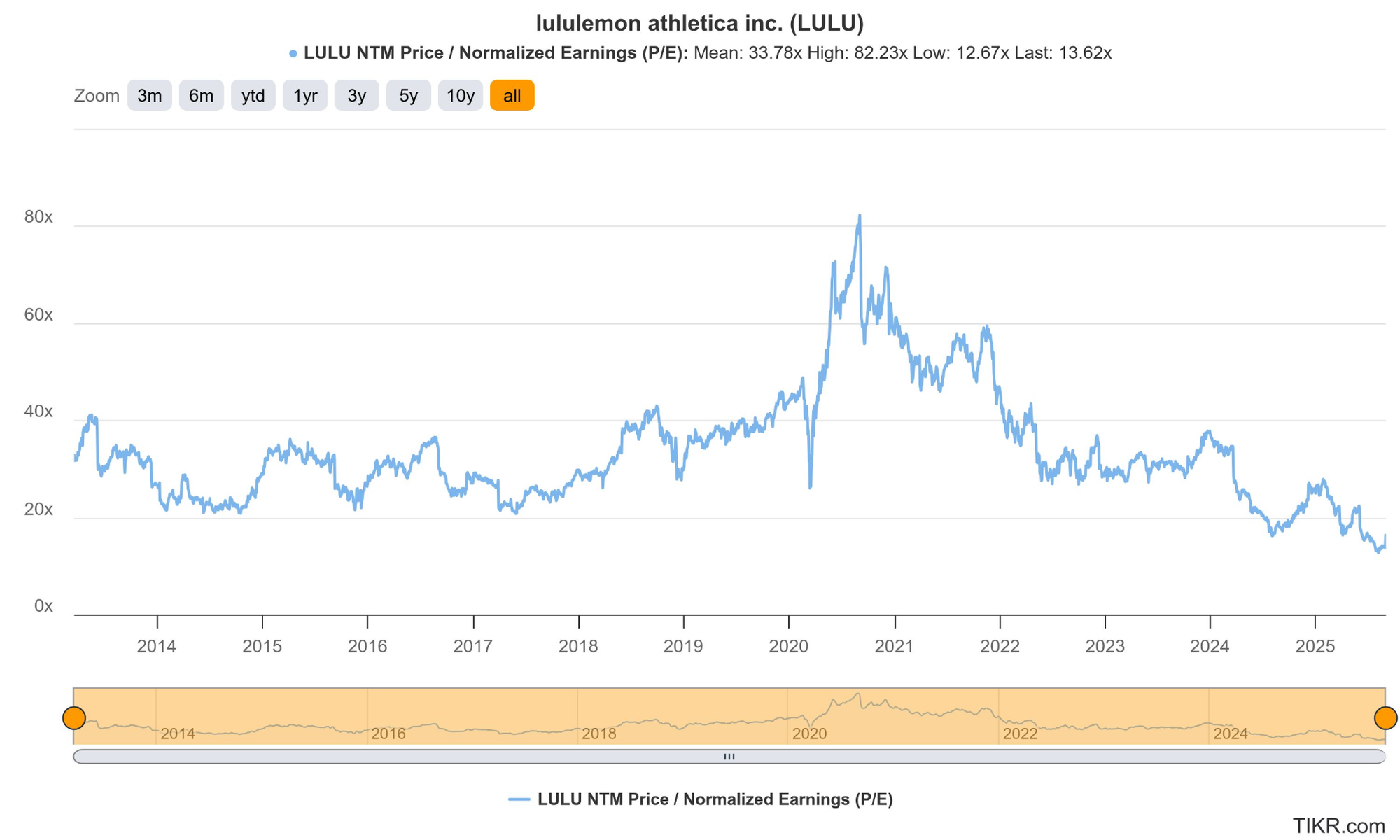

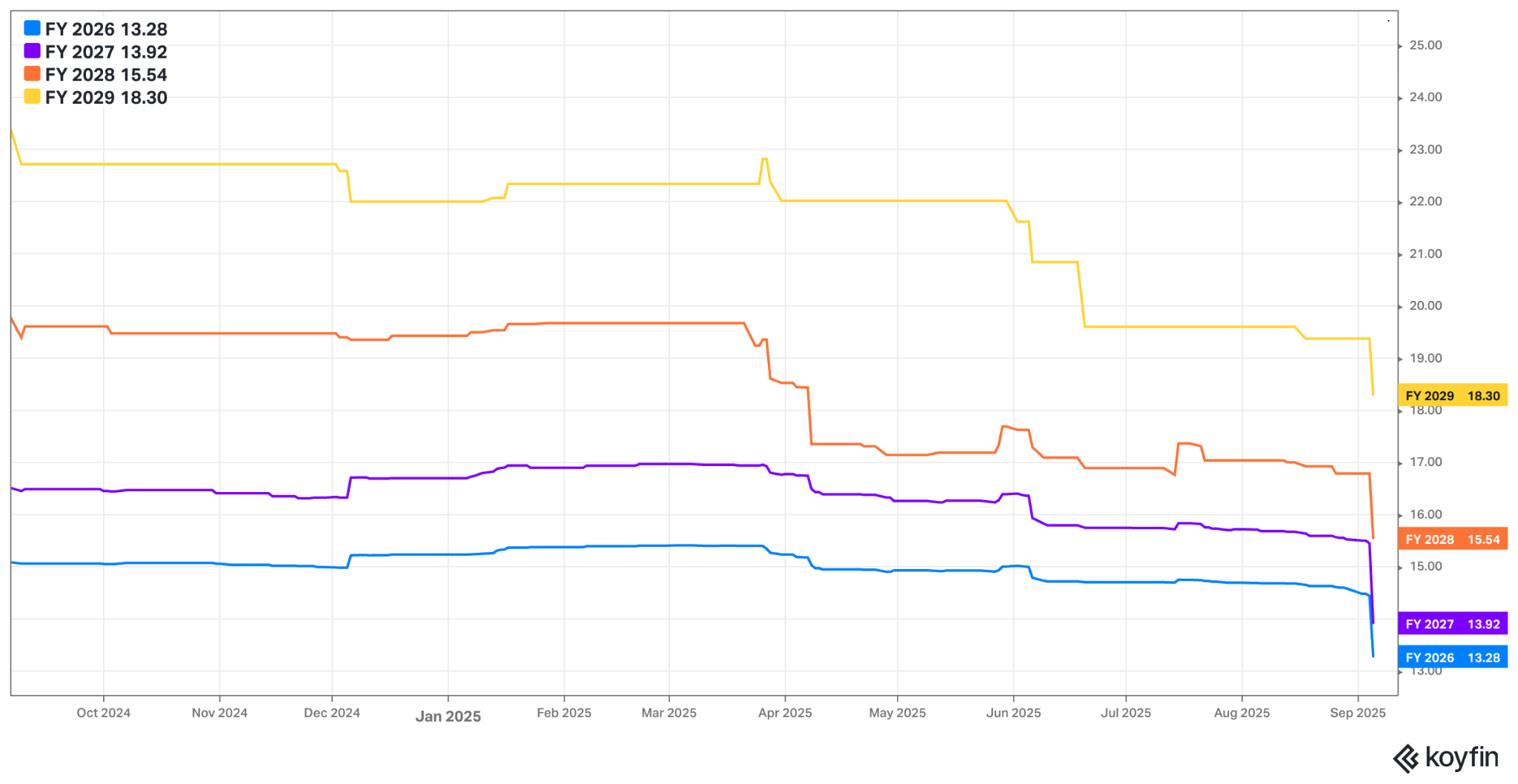

Lulu trades for 15x forward EPS (with vulnerable forward estimates). EPS is expected to fall by 9% this year and grow by 5% next year.

f. Call & Release

More Weakness in the USA:

The profit revisions are almost entirely tariff-related and not something that I harshly blame on leadership. While you could argue a better team may have been able to claw back some of these expenses more quickly, they’re doing a reasonable job in doing so. The issue is the demand guidance and bad execution in the USA. Throughout 2024, we heard about a lack of newness in their inventory assortment. They needed to introduce fresh products with seasonal colors and patterns that guests would surely respond positively to. Newness was expected to be back to historical levels by this past spring. That’s what we were told. So what happened this quarter? A few things.

First, a lot of the new inventory didn’t move. Some of the new styles they introduced sold well, but a lot of the seasonal colors and patterns they thought were key to a demand recovery didn’t. They will need to clear out excess inventory throughout the end of the year, which is why markdown rate guidance worsened. I can’t help but think of other leadership teams in different parts of consumer discretionary like Cava. They don’t introduce a new menu item until it has been slowly, carefully tested and it’s painfully obvious that item will work. Is Lululemon not using a data-driven and evidence-based approach to their product line? This makes me think so.

Second, management believes that they’ve let some of their core franchises stick around for too long. Just like last year, they’re saying that the “newness” isn’t enough. They need many additional product launches to replace these fading product lines. Candidly, this sounds like Nike’s journey a few quarters ago when it sunsetted legacy franchises and ate a large revenue headwind as a result. Not great for a company considered a perennial double-digit grower and fundamental darling just a couple of years ago.

Thirdly, they didn’t have enough of the stuff that did work. We’ve been hearing things like that for over a year and it’s candidly getting very tiresome. The issues that forced me out of this great brand and investments a few quarters ago have not gotten any better. They’re dragging on.

Finally, they’re blaming fragile macro, a “challenging premium athletic wear market in the U.S.” and a “different competitive landscape.” The team was quick to say that no single company is materially impacting them, but it’s clear that competition is having some degree of impact. Still, most of this is just Lulu not executing.

The rare positives from this report include growth and market share gains in performance apparel, rising total guests (for all age groups), and higher guest retention rates. Conversion rates also didn’t worsen (but average order value did). And while these things are nice, they’re clearly not nearly enough to offset all of the softness. That’s mainly related to disappointing spending levels on the loungewear and social apparel sides of the business. That’s where fresh colors and patterns in the dated core franchises just aren’t working.

Lululemon is not early enough in its U.S. growth journey where it can simply rely on rapid store expansion to overcome some macro weakness and a lot more micro-level weakness. They’ve needed to do better for over a year. And unfortunately, momentum is not on their side. Traffic trends in this highly important market got progressively worse as the quarter dragged on.

USA Fixes?

Beyond yet another quarter of talking about fixing assortment and pushing back the timeline for resolving this issue, it has a few other fixes planned. They plan to accelerate the pace of new product testing and invest in more rapid inventory response to actual demand levels. Why this wasn’t already a priority in an age where data is king and not using it is flying without a net, I don’t know. Maybe the new Chief AI and Technology Officer can help them in this regard. McDonald is also excited about the work of Jonathan Cheung (Global Creative Director). He feels Cheung’s team is now in pace and that their product innovation will begin to bear material financial fruit next year. At that time, they expect product newness levels to rise from 23% of total to 35% of total. Again… I feel like I’ve been hearing the same things for over a year. Now they’ll surely fix it in 2026 instead of 2025. I will believe it when I see it.

International:

International results were actually fine. They added new stores in Italy and franchise-owned stores in Turkey and Belgium. Lulu also announced an exciting franchise store partnership to expand into India next year. The team sees a very long runway for unaided brand awareness and market share gains across the globe. It also thinks some of the fixes in the USA can be relevant for international markets.

g. Take

This quarter does nothing to make me want to re-enter the position I exited earlier in the year around $250/share. It makes me less interested – even at this admittedly dirt-cheap valuation. I almost expect guidance to be cut again this year and for estimates to keep falling. The forward multiples we are all looking at are likely not accurate and will end up being higher in reality.

This team no longer has a good feel for their business. They don’t seem to know what inventory will work and what won’t. They can’t move quickly enough when they actually determine what is selling. They haven’t inspired much confidence that yet another round of operational changes will be fruitful in 2026. We’re left with a strong brand that has completely lost its way and is showing zero signs of turning things around. Sure, there are some international bright spots… But if the USA is going to look this bad, that doesn’t really matter right now.

I do not think this is Alo or Vuori preventing Lulu’s success. Both are small fish in a giant industry and can grow much, much larger before having a major impact. Lululemon needs to look no further than a mirror to understand what is going wrong at that company. Apologies if this note is harsh… but so was the quarter. It’s time for a new leadership team.