Table of Contents

- 1. Big Bank Earnings

- 2. Software Selloff & AI Disruption Risks

- 3. Alphabet (GOOGL) – Siri

- 4. Cava (CAVA) – Leadership

- 5. Coupang (CPNG) – Ongoing Breach News

- 6. Lemonade (LMND) – Customer Milestone

- 7. DraftKings (DKNG) – Going Global, an Upgrade & Outcome Noise

- 8. Meta (META) – Various News

- 9. Duolingo (DUOL) – Leadership

- 10. SoFi (SOFI) – Clarity Act & More

- 11. Headlines

- 12. Macro

In case you missed it, I published a Taiwan Semi earnings review during the week and an updated view of my portfolio and performance (exited a core position).

1. Big Bank Earnings

Important Credit Lingo:

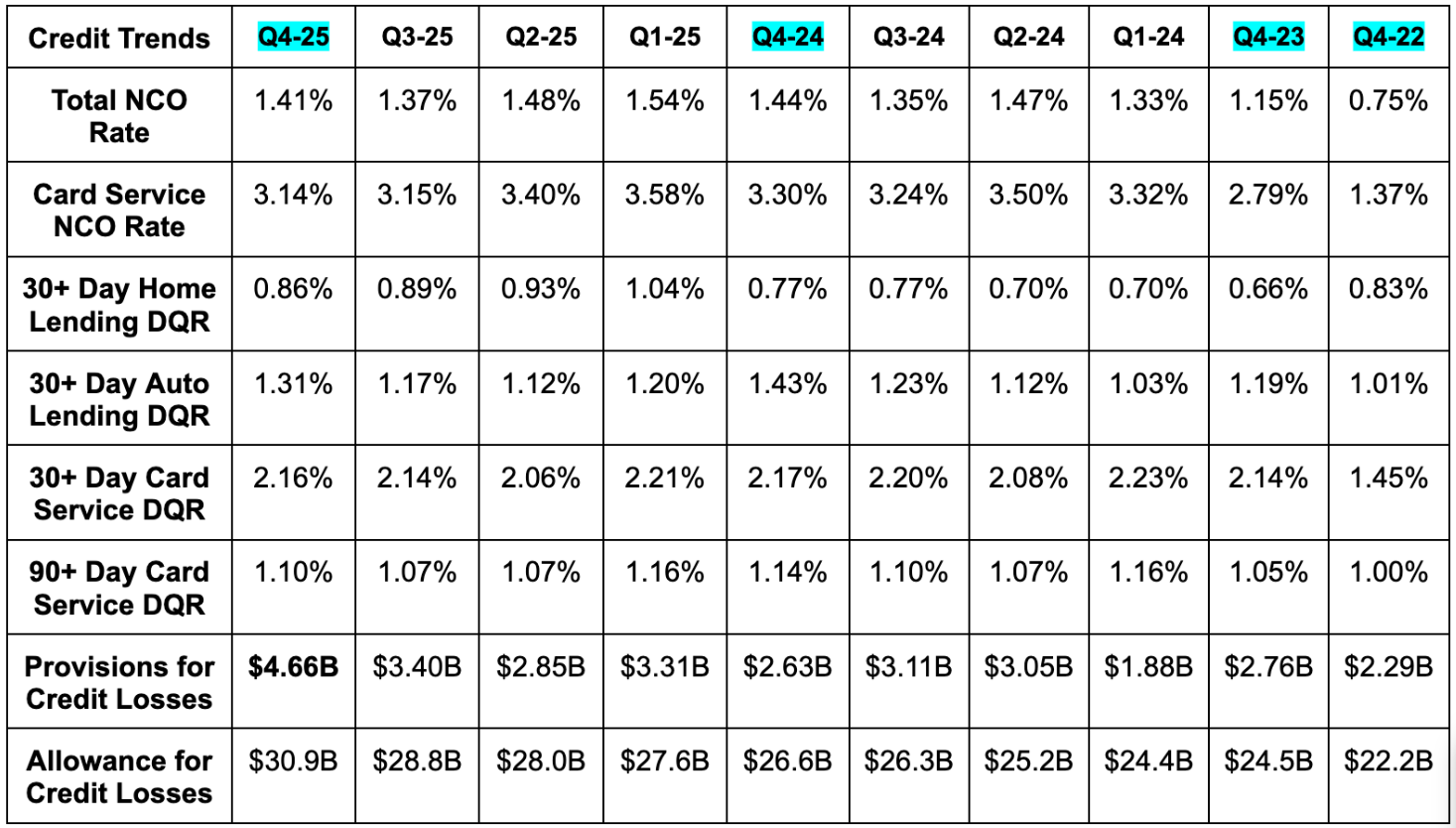

- “Provisions” are a company's funds set aside to cover their best estimate of future credit losses based on observed economic conditions. This is the leading indicator for credit health.

- Provisions are usually based on the current expected credit loss (CECL) framework.

- Delinquencies are loans that are past due by a certain number of days (30-90 day and 90+ day are common). This will lag provisions and lead charge-offs.

- A non-performing loan (NPL) rate measures the portion of outstanding credit more than 90 days delinquent or past due.

- Net charge-offs are loans that a creditor decides won’t be repaid and will instead become losses. Net charge-off (NCO) rate is the percentage of loans classified as uncollectible. This is the lagging credit indicator.

- Reserve levels refer to the amount of funds set aside to cover potential losses for the overall portfolio. Reserves and Provisions are correlated.

- Higher expected delinquencies and NCOs contribute to reserve building.

- If a company decides future losses could rise, they will raise Provisions. If they’re right, delinquencies will eventually rise. If that credit isn’t repaid, charge-offs (losses) will eventually rise.

a. JP Morgan

Results:

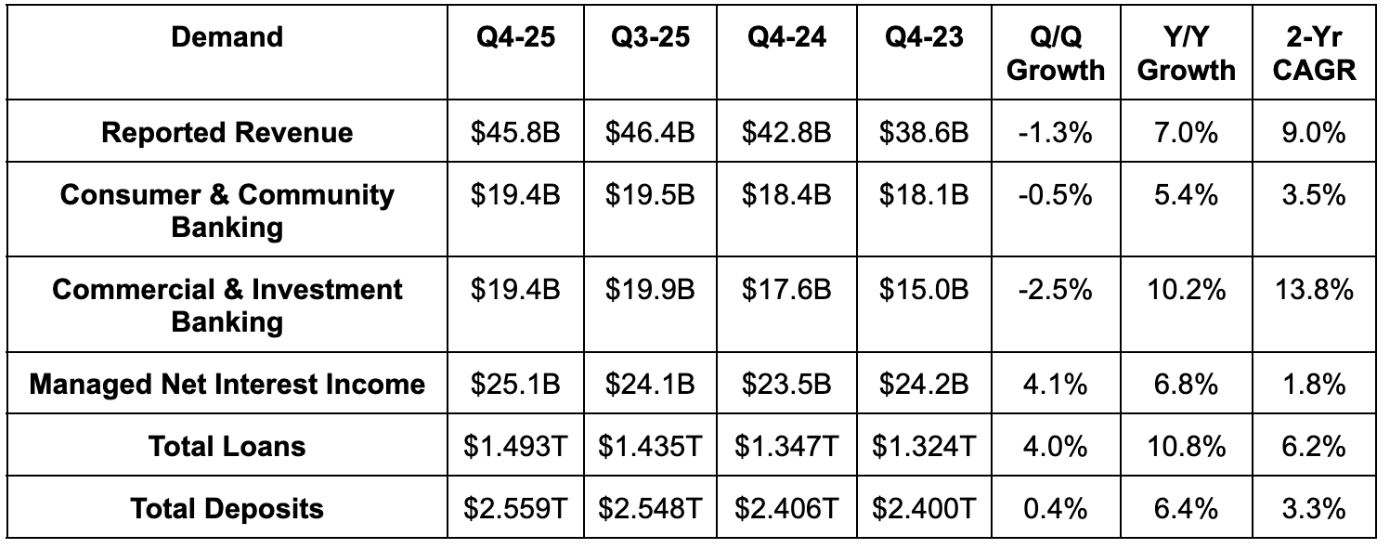

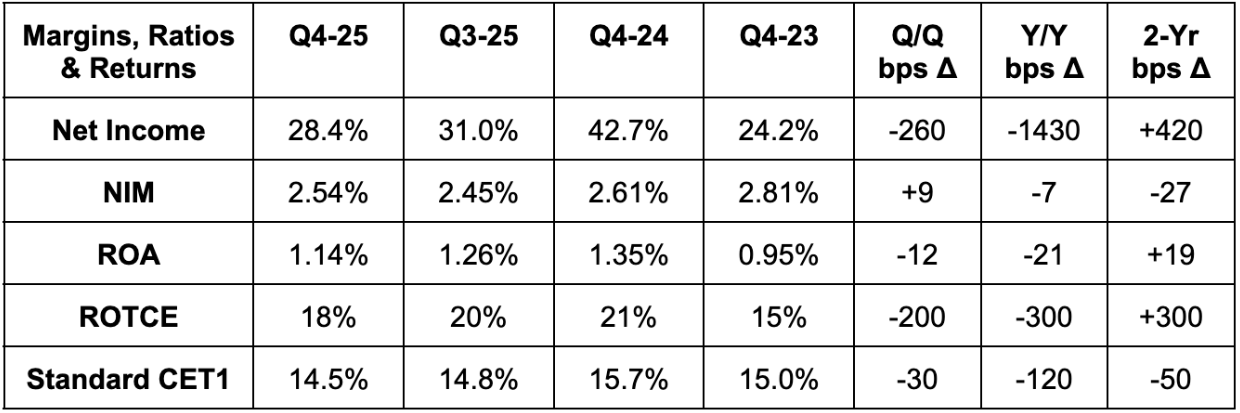

Revenue missed estimates by 0.9%. It also missed $4.91 EPS estimates by $0.28 and exactly met 2.54% net interest margin (NIM) expectations. Finally, it missed 1.20% return on asset (ROA) estimates by 6 basis points.

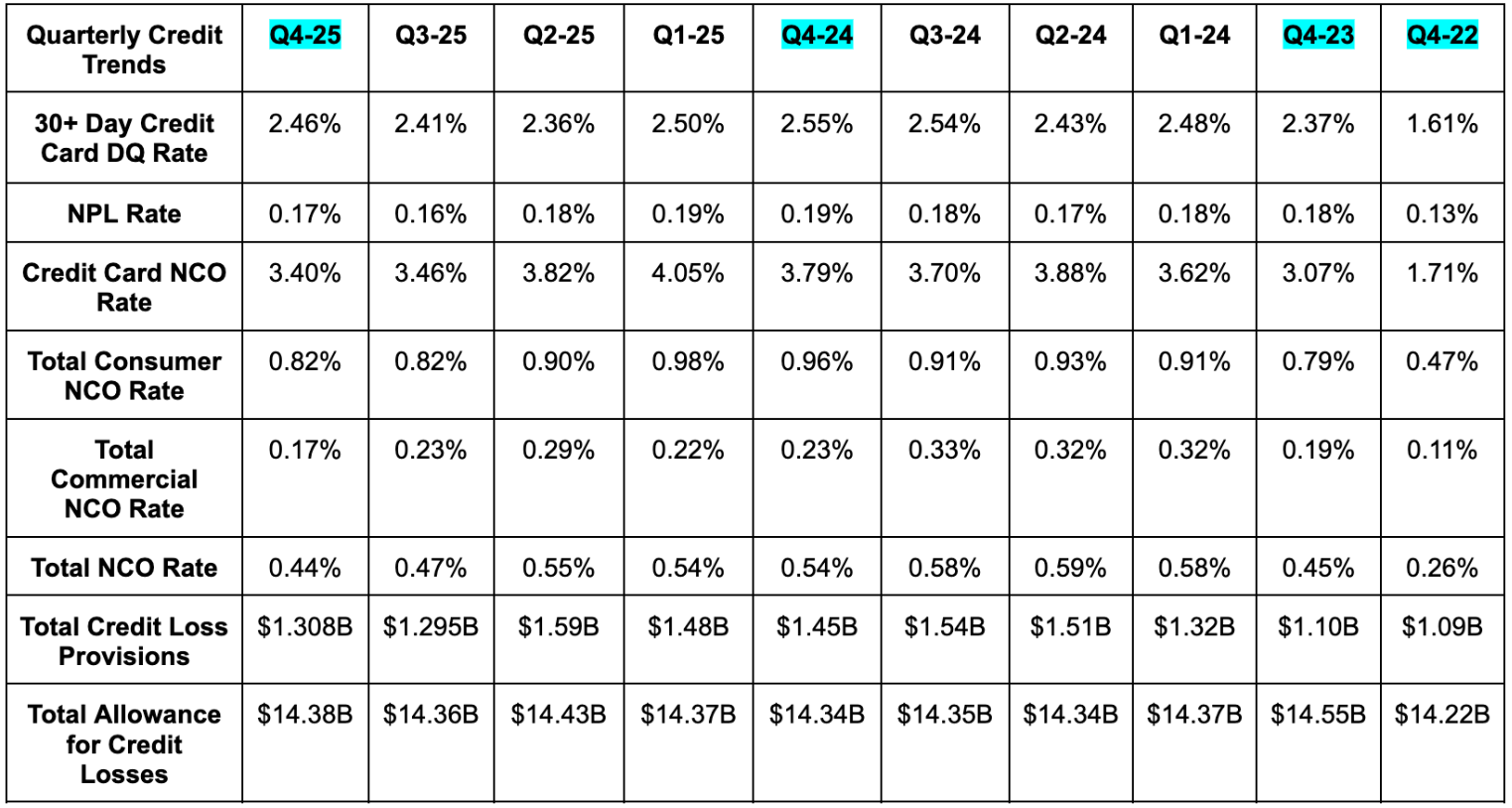

Credit Data:

Outlook & Call Commentary:

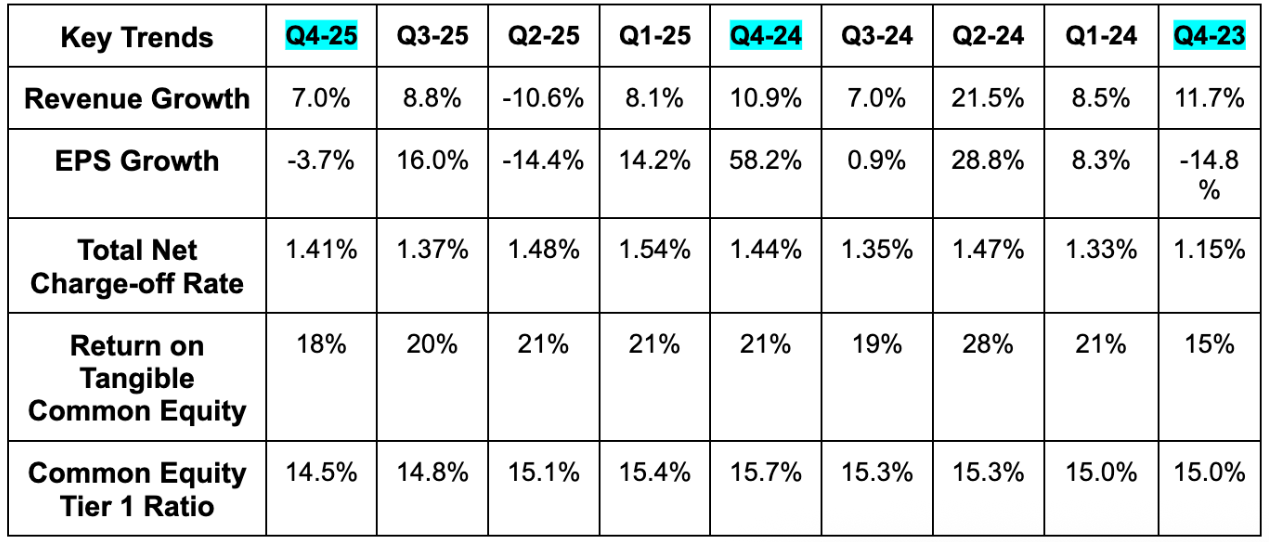

The charge-off rates look pretty good. Things are mostly stable on a sequential basis and improved Y/Y (which excludes seasonality). The same is true for delinquency rate data (typically a meaningful Q3 to Q4 step-up in auto delinquencies). So with that in mind, and based on the positive economic commentary below, why did provisions sharply spike higher? What are they seeing? In a word, Apple. The company had to add $2.2B in front-loaded provisions to add the Apple Card portfolio to its balance sheet. Portfolio growth also led to provisioning growth. Excluding that Apple item, which is entirely based on accounting regulation and not concern over Apple Card repayment trends, provision levels look great.

And for 2026, they see card services net charge-off rate remaining wonderfully resilient. This is expected to come in at 3.40% vs. 3.31% Y/Y and 3.34% two years ago. Great stability in their outlook, which is supported by the optimism in the call quotes below:

b. Bank of America

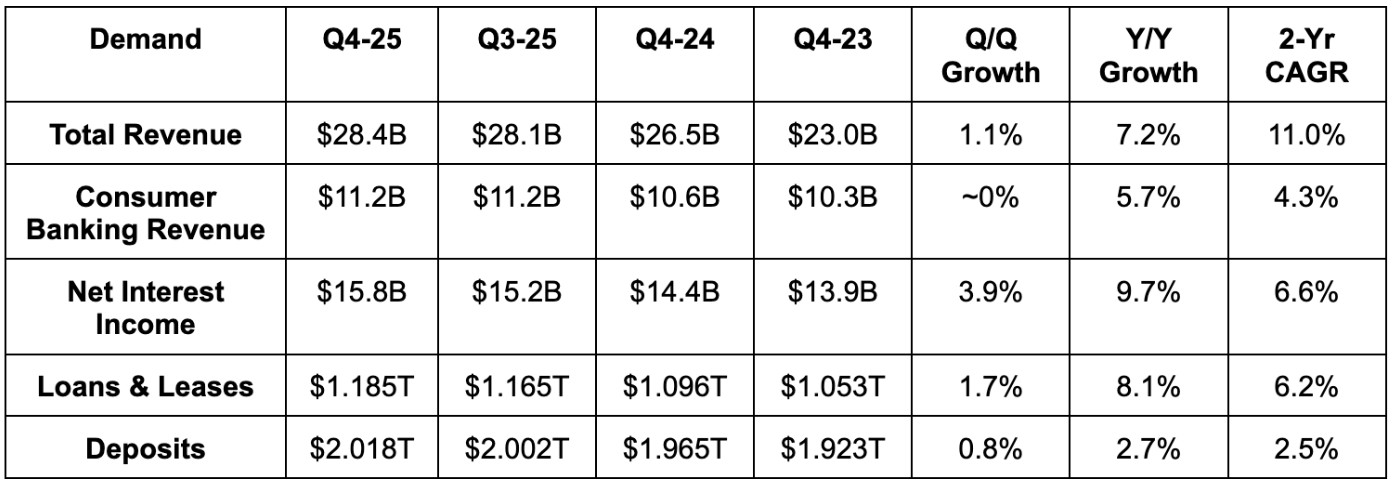

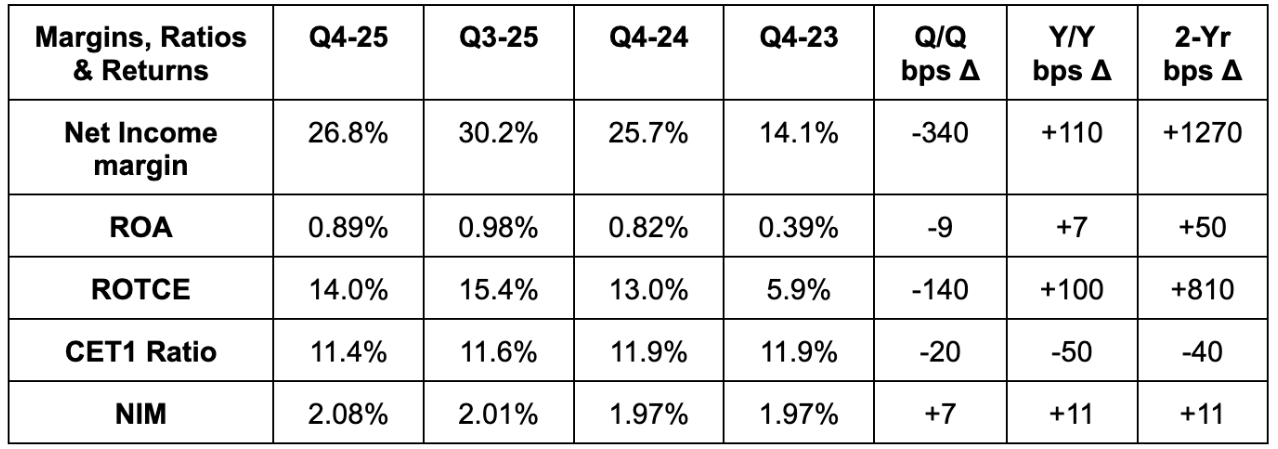

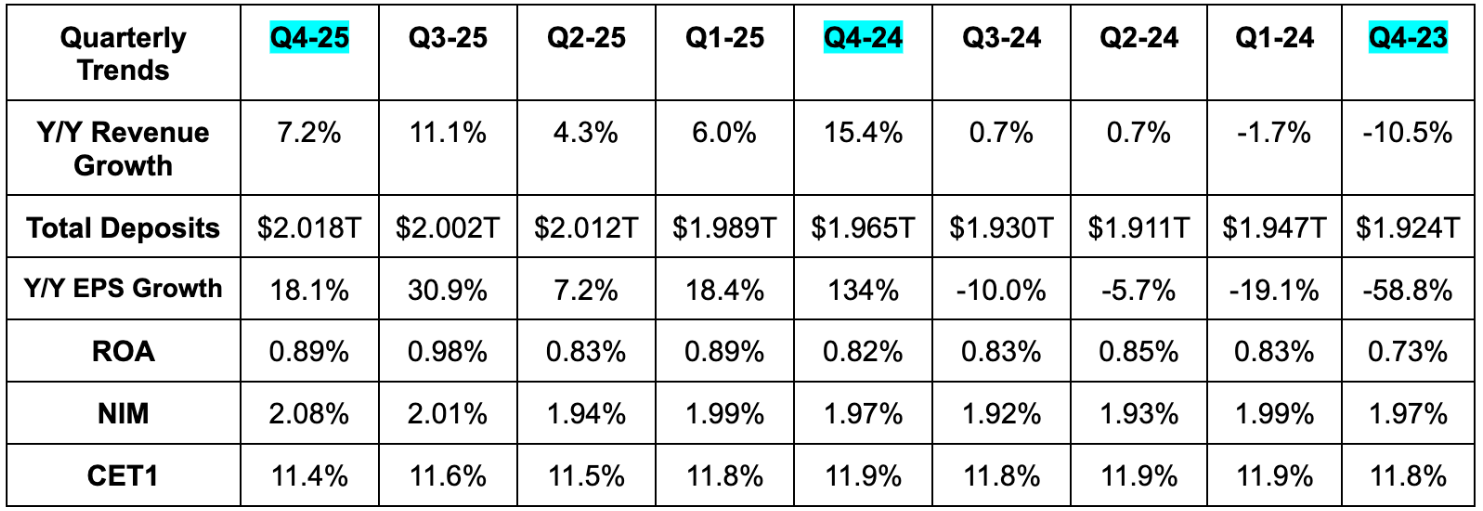

Results:

Bank of America beat revenue estimates by 2%, beat $0.96 EPS estimates by $0.02 and beat 2.00% net interest margin (NIM) estimates by 8 bps.

Credit Data:

Outlook & Call Commentary:

Just like JP Morgan, the data below looks quite resilient. Delinquency and NPL data looks solid on a sequential basis and a bit more solid on a Y/Y basis. NCO data looks good, and provisions (without JPM’s Apple headwind) were also good. There’s nothing at all alarming in this data or in the company commentary.

Moynihan responding to an analyst pushing back against their rosy 2026 outlook:

c. More Commentary from Around the Sector

The data and commentary were quite positive across the board. It’s easy and data-driven to feel optimistic about 2026 economic health, but we must stay laser-focused on unemployment trends to see if that rains on the parade. Not happening yet. Will keep obsessively monitoring. For now, the backdrop is constructive and supportive of strong 2026 growth.