Most of this week’s content has already been published. In case you missed it:

- Alphabet Earnings Review

- Tesla Earnings Review

- Chipotle Earnings Review

- ServiceNow Earnings Review

- My Updated Portfolio & Performance with a New Holding

Next Week Is Going To Be Hectic:

- SoFi & PayPal Reviews Coming Tuesday.

- Starbucks & Meta Reviews Coming Wednesday.

- Amazon & Robinhood Reviews Coming Thursday.

- Spotify, Microsoft, Apple & Airbnb Reviews (Hopefully all) Coming Saturday. Airbnb may get pushed to the following week.

- Saturday coverage will also include quantitative data & consumer/macro commentary from Visa and Mastercard, as well as brief snapshots for Reddit & Roblox.

Table of Contents

- 1. MercadoLibre (MELI) – Argentina

- 2. Amazon (AMZN) – More False Alarms & India

- 3. SoFi (SOFI) – Miscellaneous

- 4. Duolingo (DUOL) – An Uninspiring Bear Case & A …

- 5. UBER (UBER) – AV Partner Network & the FTC

- 6. Shopify (SHOP) – Growth Levers

- 7. Headlines

- 8. Macro

1. MercadoLibre (MELI) – Argentina

Argentina represents a little over 20% of MELI’s total revenue and is arguably tied with Mexico for its second most important market. Considering this, economic weakening and rampant hyperinflation in that nation have hindered Meli’s financial performance. They’ve been able to effectively overcome this headwind, but they may not need to for much longer. MELI already posted its fastest rate of growth there in a year during Q4, and more tailwinds seem to be coming. According to that nation’s Secretary of Labor, Employment and Social Security, real paycheck levels set a 6-year high to start 2025. When pairing that with rapidly falling inflation levels (more progress still needed), the consumer there should be feeling relatively better. And that should be good for this e-commerce market share king.

2. Amazon (AMZN) – More False Alarms & India

This week, Wells Fargo and Cowen released notes talking about AWS pausing data center leases globally as demand for its infrastructure waned. These are reliable secondary sources… but I prefer primary sources whenever accessible. Luckily, Amazon’s VP of Global Data Centers took to LinkedIn to directly respond to these notes. He called demand levels strong and said “there haven’t been any recent fundamental changes to expansion plans.” He discussed Amazon constantly weighing various allocations of CapEx and capacity to isolate the best option, but overall investment levels aren’t changing or pausing. Thank you to that VP, Kevin Miller, for this timely response.

In other news, rumors are swirling about a trade deal between the USA and India being in its final stages. Additional rumors indicate that the USA is pushing hard to open that massive e-commerce market for both Amazon and Walmart (WMT). Currently, foreign e-commerce vendors in that nation are banned from selling products made by other companies they control. Amazon leaned on its own wholesale business to supply much of that marketplace. They cannot sell owned 1st-party inventory either and instead have to rely on local sellers to populate its selection. India is massive. India is business-friendly and USA-friendly. India has a rapidly growing middle class and a growing population overall. Gaining full access to this lucrative market would be a material win for both companies. We shall see what happens.

Raymond James downgraded Amazon to hold, but that was before comments made from the USA and China about cutting tariffs.

3. SoFi (SOFI) – Miscellaneous

SoFi added more private market access through a partnership with TemplumHQ. This will include access to Anthropic, which I think is quite material. Gaining access to SpaceX was needle-moving for top-of-funnel SoFi Invest growth, and Anthropic is arguably the most popular GenAI pure-play not named OpenAI.

SoFi officially introduced SmartStart, as a new student loan refinancing option. This allows consumers to make interest-only payments for 9 months, with no fees and the ability to effectively lower total payment due considerably.

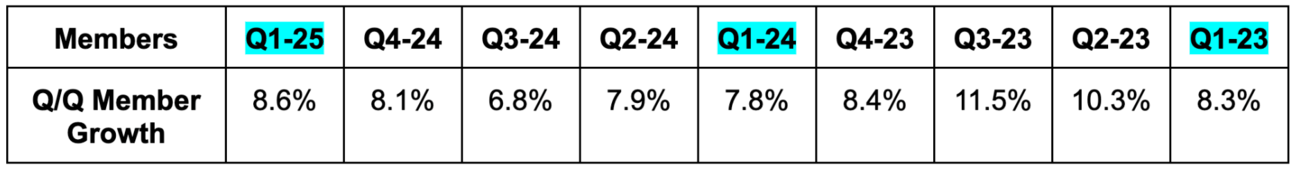

The nice part about SoFi’s immense retail attention is that there are always a ton of eyeballs on everything. Last week, it was folks digging up their source code that showed a crypto launch was imminent. This week, someone noticed a subtle 11 million member disclosure on a random page of their website. That’s a good number, as it potentially represents SoFi’s fastest Q/Q member growth in 18 months. But there’s a large caveat. This was discovered 24 days into calendar Q2. It’s unclear how much of the growth came during January-March and how much came so far in April. Regardless, this leaves SoFi with a great chance to still deliver its best growth in over a year.

Finally, Citizens JMP’s highly regarded analyst initiated SoFi with an outperform rating and a $17 price target. They’re optimistic about growth prospects and the multiple you have to currently pay to own those growth prospects. Smart firm.