Next week, we’ll send reviews on Nvidia, CrowdStrike, SentinelOne and MongoDB.

In case you missed it from this earnings season:

- Nu & Airbnb earnings reviews

- Cava & On Running earnings reviews

- Datadog & Sea Limited Earnings Reviews (sections 1 & 2)

- AMD Earnings Review (section 4).

- Trade Desk, Duolingo & DraftKings earnings reviews

- Uber & Shopify earnings reviews

- Lemonade, Hims & Coupang Earnings Reviews

- Mercado Libre & Palantir Earnings Reviews

- Amazon & Microsoft Earnings Reviews

- Meta & Robinhood Earnings Reviews

- SoFi & PayPal Earnings Reviews

- Alphabet & Tesla Earnings Reviews.

- Chipotle Earnings Review.

- ServiceNow Earnings Review.

- Netflix & Taiwan Semi Earnings Reviews.

- Starbucks & Apple Earnings Reviews.

& my current portfolio/performance.

Table of Contents:

- Spotify – Earnings Review

- Palo Alto – Earnings Review

- Meta – Noisy Week

- SoFi – New Product

- Alphabet – Chrome, Gemini, ChatGPT & Waymo

- Duolingo – Social Media & Analyst Notes

- Mercado Libre – Argentina

- Headlines

- Macro

1. Spotify (SPOT) – Catch-Up Earnings Review

a. Key Points

- Spending more money on product innovation. That and higher payroll taxes held back profits.

- Strong quarter for user growth.

- Newer content categories are all performing well.

- AI DJ grew engagement by 2x Y/Y.

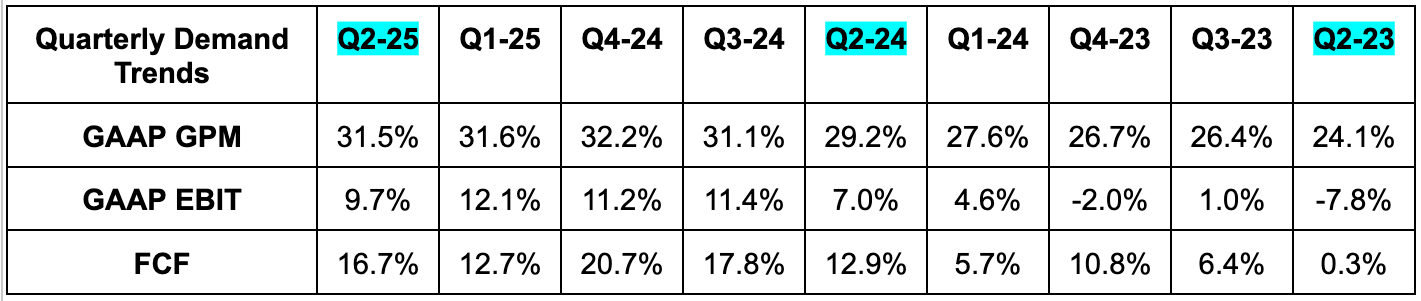

b. Demand

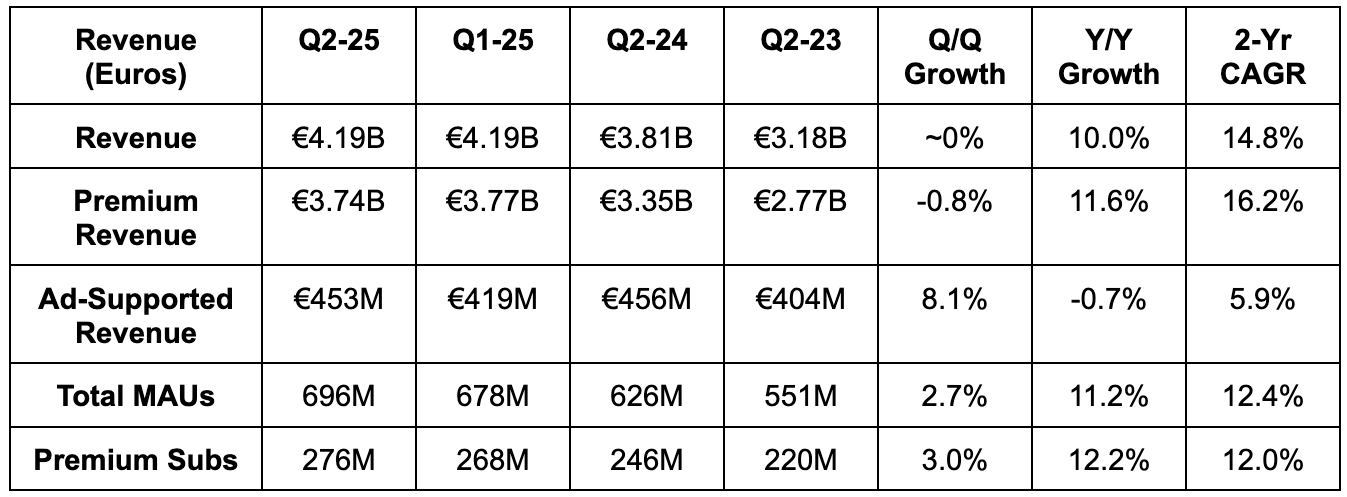

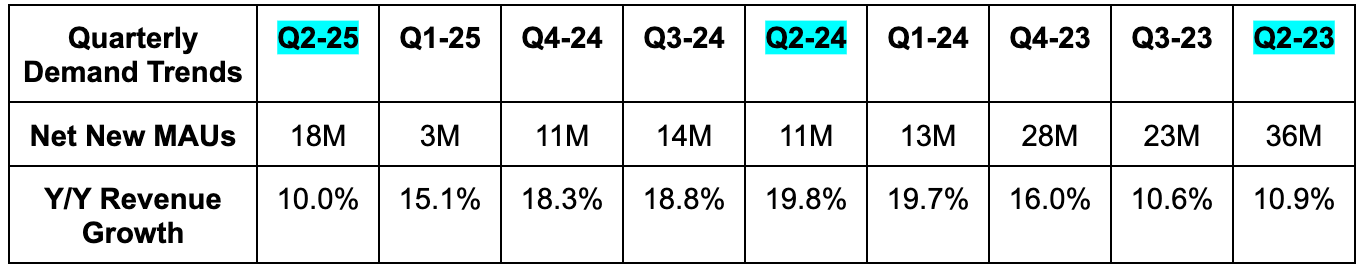

- Missed revenue estimates by 2% & missed guidance by 2.6%.

- The miss was related to FX headwinds that were €104M larger than expected. Without this item, revenue would have been slightly ahead of estimates and roughly in line with guidance.

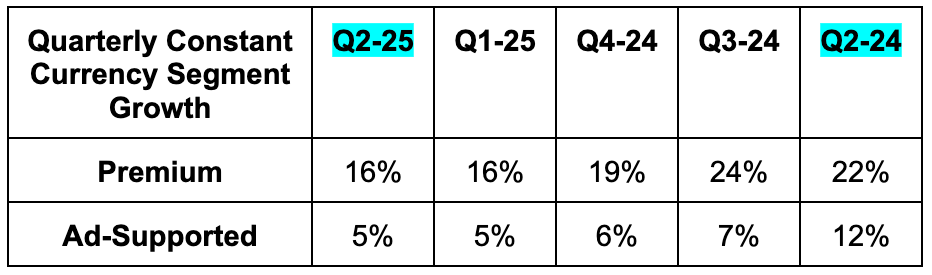

- Constant currency (CC) revenue growth was 15% Y/Y.

- Growth was strongest in Latin America.

- Premium revenue growth remains strong in its most mature markets, pointing to plenty of runway remaining.

- Ad revenue missed estimates by 5%.

- Premium revenue missed estimates by 1.3%.

- Beat Monthly Active Users (MAUs) estimates by 1% and beat guidance by 1% as well.

- Added 18M net new MAUs vs. 11M expected and added its second most Q2 MAUs in company history.

- Beat premium subscriber guidance by 1.1%.

- Added 8M net new subscribers vs. 5M expected.

- Europe is its first region to cross 100M subscribers.

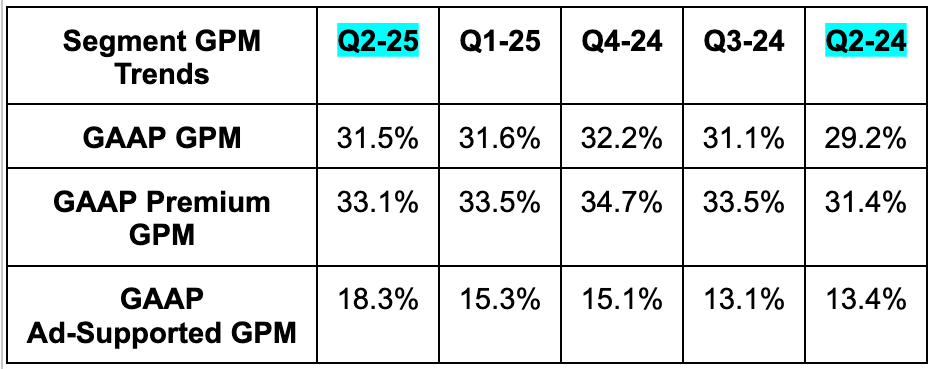

c. Profits & Margins

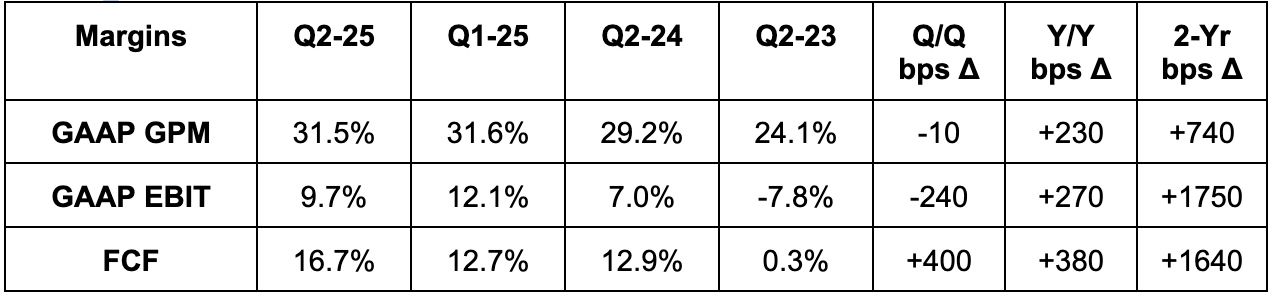

- Gross profit margin met 31.5% estimates & identical guidance.

- Missed EBIT estimates by €89M or 18.1% & missed guidance by 25%.

- Social charges (payroll taxes) were Still, you’d think analyst estimates would have moved to reflect that.

- Beat FCF estimates by 14%.

Premium segment GPM expansion was driven by revenue growth outpacing music related cost growth, as well as audiobook efficiency gains. These tailwinds were partially offset by incremental costs related to the Spotify Partner Program (SPP). As a reminder, SPP lets podcasters tap into ad revenue sharing like creators on YouTube and X can. Ad-supported margin expansion was driven by podcasting and music gains.

The EBIT miss included payroll taxes that were €98M larger than expected due to its rising share price. They call these “social charges.” Without this headwind, which should have been at least partially baked into analyst estimates, it would have beaten EBIT estimates by 1.8% and missed its guidance by 6.5%. The remainder of the miss was driven by some modest tax headwinds and also “lighter ad sales.” More on that later. With all of these charges, OpEx rose by 8% Y/Y. Excluding the social charges and some FX headwinds, OpEx rose by 5% Y/Y due to more marketing and headcount growth.

d. Balance Sheet

- €8.4B in cash & equivalents.

- €1.93B in convertible senior notes.

- Some of these mature in March.

- Share count fell slightly Y/Y. Added $1B to its existing buyback program. It has $1.9B in remaining buyback capacity.

e. Guidance & Valuation

- Revenue guidance missed estimates by 6.4%.

- This €286M miss includes a €200M foreign exchange (FX) headwind.

- 31.1% gross profit margin guidance missed 31.5% estimates by 40 basis points (bps; 1 basis point = 0.01%).

- They continue to see material GPM expansion in the years ahead.

- EBIT guidance missed estimates by 15%.

- MAU and premium subscriber guidance both slightly beat estimates.

- They think they are well on their way to 1B+ subscribers over the long haul.

- CC average revenue per user growth is expected to be around 0% Y/Y.

SPOT trades for 40x forward FCF and 60x forward EPS. FCF is expected to grow by 12% this year, 30% next year and 27% the year after. EPS is expected to grow by 15% this year, 86% next year and 32% the year after that.

GPM guidance includes a 40 basis point (bps; 1 basis point = 0.01%) headwind from regulatory charges.

The EBIT guidance miss was explained as near-term expense growth and timing. This is also modestly impacting input costs (more content) and therefore GPM. Spotify sees great opportunities to expand content breadth, introduce new products, bolster subscription tiering and enhance lifetime value. This requires some temporary spending growth to support the future rollouts, and it sounds like that’s the source of this shortfall. The team has effectively managed costs and delivered a margin explosion while keeping the growth engine humming. They’ve demonstrated strong capital allocation skills and, in my mind, have earned the right to invest. The company still expects to deliver Y/Y margin expansion this year, but this guidance led to EBIT estimates falling by about 6% for 2025 and falling by a few percent for 2026.

f. Call & Release

Advertising Softness:

It’s worth noting that a shift away from owned-content (and massive associated contracts) towards licensed podcasts held back growth a tad; rolling out SPP and the ad-revenue sharing did too. Without these two items that cut overall impressions and revenue kept per impression, growth would have been around 10%-12% Y/Y. Despite that, leadership bluntly told investors that they’re disappointed in the ad business’s performance. Ek thinks they’re moving too slowly, and the teams are being reorganized to accelerate pace of progress. This is why their head of advertising left for DoorDash (they pushed him out).

Spotify doesn’t need to change the go-to-market approach or any strategic objective within this arm of the business. They simply need to execute better. Spotify has a massive and engaged audience that advertisers yearn for, and it’s determined to more meaningfully unlock that potential.

There are some early signs of progress. Growth was fastest within its new, automated Spotify Ad Exchange (SAX), where advertisers rose by 40% Y/Y. As a reminder, this is a dedicated supply-side platform. It entailed an overhaul of Spotify’s advertising tech stack and greatly enhanced its capabilities. Specifically, the platform unlocks granular user identification and targeting so advertisers know where and how to spend. And it makes these impressions fully biddable to allow superior targeting and identification, fostering favorable price discovery and optimal cost per impression. Over time, this should help compensate for the underwhelming ad pricing environment SPOT has cited for over a year now. Just like in streaming, programmatic, biddable advertising is how publishers like Spotify can fund hefty content spend while delivering strong margins. And it’s how that can happen while advertisers still enjoy stronger ad returns – thanks to the upgraded efficacy SAX delivers. So again… this part of the ad business is going pretty well. They just want it to be going even better and want SAX to more quickly expand as a percent of total segment revenue.

- SAX added a Magnite integration to tap into the demand-side platforms that this sell-side player partners with.

Increasingly Diverse Content Types & Subscription Tiering:

Audiobooks are a great example of where Spotify is expanding content categories and deepening overall engagement and retention. This quarter, it expanded premium audiobook subscription options to 4 new markets in Europe. It also launched a new audiobook plan (Audiobooks+) that offers 15 more listening hours per month for users in 13 countries. As part of this, it also launched Audiobooks+ for Family and Duo plans (first premium audiobook plans for these types of subscriptions). All in all, audiobook premium traffic continues to steadily rise, with 35% Y/Y growth in the important U.S., U.K. and Australian markets.

Aside from audiobooks, customers who watch video podcasts are growing consumption 20x faster than solely audio users. Video podcast views are up 65% Y/Y as well.

We did not get much of an update on the planned superfan music subscriptions. This will likely include exclusive artist events and other perks like that. Spotify has an extremely high quality bar for product delivery (as it should). It does not think this product is ready to be released, but it’s making great progress.

AI & Product Innovation:

- AI DJ is a personalized music curation with an agentic host.

- AI Playlist allows users to conversationally tell Spotify what they like and what they’re in the mood for to automatically generate relevant playlists.

Spotify continues to bolster engagement through AI-inspired personalization. AI DJ streams are up 45% Y/Y and engagement is up 100% Y/Y, as Spotify added it to 60 new markets and users gravitated towards the offering. The conversational nature of telling it what to play is resonating, and sessions only get more relevant and accurate with time. That’s why engagement growth is well beyond stream growth.

AI Playlist entered 40 new markets this quarter. Its ability to use explicitly stated musical preferences in addition to user history is upleveling output quality. And, like AI DJ, it merely gets better with more data and time.

- Adding new ways to pre-save new music and discovery content.

- Product improvements are driving improvements in free-to-paid conversion rates.

- AI is materially improving internal efficiency for Spotify, like so many other firms.

Apple & Epic Games Ruling:

As a reminder, a court ruling between Epic Games and Apple forced the mega-cap to allow payment steering, or enabling app owners to direct customers to different checkout options. This is helping unlock considerably more a la carte purchasing optionality with Spotify gaining more flexibility in payment options and workflows. Per leadership, content leaders of the future will excel in premium subscriptions, ad-based growth and a la carte. SPOT kills it on the premium side, is working to improve the ad side and is excited to more meaningfully enter the a la carte side.

This ruling also allows Spotify to communicate with its customers in more direct and actionable ways. The enabling of call-to-action options for vendors like Spotify mean it can now alert subscribers when subscriptions lapse due to term expiration or a failed payment. That and enhanced payment optionality directly helped subscriber retention and conversion dynamics during the quarter.

Pricing Power:

Price hikes in France, Luxembourg, the Netherlands and Belgium were met with no material churn. Spotify continues to meticulously update pricing in various markets and for various tiers nearly every single quarter. That will likely continue. With its best-in-class engagement, it could easily be hiking prices more sharply and frequently. But? It fixates on “putting its subscribers on a pedestal” and taking elite care of them. It wants its price-to-value lead vs. the competition to perpetually grow, which requires slower pace of pricing growth.

g. Take

Not an amazing quarter but certainly not terrible either. Spotify has trained investors to expect great demand and profit outperformance for about 2 years now. This was a modest deviation from that positive theme – but for reasons I found acceptable. This great team has proven how capable they are of deploying capital, nurturing the growth engine and expanding margins. They’ve delivered a profit explosion while demand didn’t materially slow. That’s hard to do, and is a testament to how beloved and sticky this product is. They compete with several mega caps that have crushed countless smaller competitors… Yet David continues to flex its muscles vs. multiple Goliaths.

I get excited when this team identifies new growth opportunities, and support their decision to take advantage of those high-return prospects. It’s not about maximizing profit for a three-month period (even though Wall Street routinely makes us feel like that’s all that matters). It’s about optimizing long-term value creation, and doing so for Q3 requires getting aggressive with OpEx and accepting modestly lower near-term margins.

2. Palo Alto (PANW) – Earnings Review

a. Palo Alto 101

This is a recurring section in each quarterly PANW review. A lot of it is the same as last quarter, with a few updates on product news since then.

Palo Alto is a cybersecurity company competing across endpoint, cloud and network. It’s pushing to bundle next-gen products into larger deals to differentiate vs. firewall-based competitors like Fortinet and next-gen disruptors. This process of “platformization” will again be a key piece of this review.

Cortex Security Operations:

Cortex includes its endpoint and security information and event management (SIEM) products. SIEM aggregates needed context to make sure decision-making and work are more cohesive. Extended Security Information and Event Management (XSIAM) is the product umbrella to know. It brings together all endpoint use cases and SIEM to power Palo Alto’s Security Operations Center (SOC). The SOC is the central monitoring and protection engine of a company’s cybersecurity workflows. It is what units all needed data and context, providing companies a bird’s-eye view of their businesses, with a complementary data lake to ensure scalable ingestion of needed context. Companies can access their endpoint data, Strata data (couldn’t resist) and a host of 3rd parties in the ecosystem. More usable data means better outcomes.

More endpoint security products to know:

- XSOAR helps automate and guide best practices for incident response while ranking severity of threats. It relies on SIEM for its scaled, complete data ingestion to direct optimal workflows.

- Xpanse provides attack surface management.

- XDR infuses non-endpoint data sources into breach protection to extend coverage beyond strictly that endpoint. Adding more data without sacrificing cost and latency performance is where SIEM shines.

In a somewhat confusing manner, PANW leadership will talk about Cortex endpoint platform-level wins and SOC wins interchangeably, despite the SOC not solely being endpoint products.

Cortex Cloud (was formerly called Prisma): The cloud security suite is now called Cortex Cloud. The change was made to more explicitly communicate how linked its cloud business is to both network and endpoint offerings. Like XSIAM and SASE are the platformization pillars in endpoint and network, in cloud it’s the Cloud Native Application Protection Platform (CNAPP). CNAPP includes:

- Cloud Security Posture Management (CSPM) organizes access compliance, provides overarching cloud ecosystem visibility, and proactively blocks misconfigurations.

- It has another product like this for applications specifically. It’s intuitively named Application Security Posture Management (ASPM).

- Data Security Posture Management (DSPM) tags, uncovers & protects data in the cloud. This works for structured data, as well as unstructured data, which is increasingly important in the age of GenAI.

- AI security posture management gives companies an overarching view of their AI assets and environments to flag vulnerabilities and preventatively resolve them.

- Cloud detection and response (CDR) proactively hunts and protects customers from cloud-based threats with run-time support.

- Cloud Workload Protection Platform (CWPP) is very similar to CDR, but for cloud workloads specifically, rather than identities, API calls etc.

- Cloud Discovery & Exposure Management (CDEM) “evaluates internet exposure risks and discovers unknown internet-exposed cloud assets.”

Cortex Cloud ties very closely to both Cortex and Strata. Products like CASB extend cloud security talents to network use cases and are a direct piece of its SASE network offering. Endpoint products like XDR rely heavily on cloud tools as well.

Strata: The network security suite is called Strata. This is where Palo Alto is supplanting legacy firewall vendors by offering (what it views as) superior, software-enabled firewalls alongside a suite of network security software (and some hardware-based firewalls too). It deploys software-defined wide area networks (SD-WANs) within firewall environments. SD-WANs serve as virtual network securers using a software-based approach to protection. Palo Alto protects networks using a “zero trust” architecture. Zero trust means a bad actor cannot penetrate the most vulnerable part of a digital ecosystem and move freely within it thereafter. Zero trust ensures consistent and complex validation of these permissions at every turn. It ends the game of “everyone within a firewall environment getting perpetual, unconditional access” and greatly limits the potential damage of network breaches. There are two pieces of the network bucket: modern hardware and software.

- In hardware, PANW provides “next-gen firewalls” with tools like contextual app inspection (more malleable access rules), intrusion prevention, URL filtering, data loss prevention (DLP) and more.

- Secure Access Service Edge (SASE) is the overarching software that ties its network platformization approach together and is built on the aforementioned zero trust foundation. SASE integrates tools that help prevent unauthorized access to data, abuse of networks (like phishing attacks to overwhelm networks with traffic) and broad visibility into health and performance of a network. It includes aforementioned SD-WANs, a Secure Web Gateway (SWG) and a Cloud Access Security Broker (CASB) to decide who gets access to which apps.

- Strata directly competes against Zscaler and Cloudflare.

Two more pieces of the SASE offering to know – Intersection of Network and Cloud Security (why the products are called “Prisma”):

Prisma Access Platform (PAP): You can call PAP a network or a cloud security tool, as the platform protects networks within cloud environments with aforementioned products like SWG and Zero Trust. PAP includes Prisma Access Browser (PAB). This encrypts and secures remote network connections and browser data across siloed, spread-out workforces.

Prisma AI Runtime Security (AIRS) “discovers AI ecosystems, assesses risk and protects against threats.” It’s an extension of its cloud runtime security tools specifically for AI assets. PANW uses this product internally to give it a full look at all AI assets, with seamless ability to scan and test them when need be. Posture management and configuration analysis products are quite common; effectively protecting cloud environments in actual runtime products like this one, CDR and CWPP (both defined above).

AI Access Security is another SASE product that “secures how internal employees use 3rd-party AI.” And speaking of AI, Palo Alto offers its “Precision AI” bundle. This offers AI-inspired upgrades to a plethora of existing tools and helps protect against AI-powered threats.

Now, onto the quarter…

b. Key Points

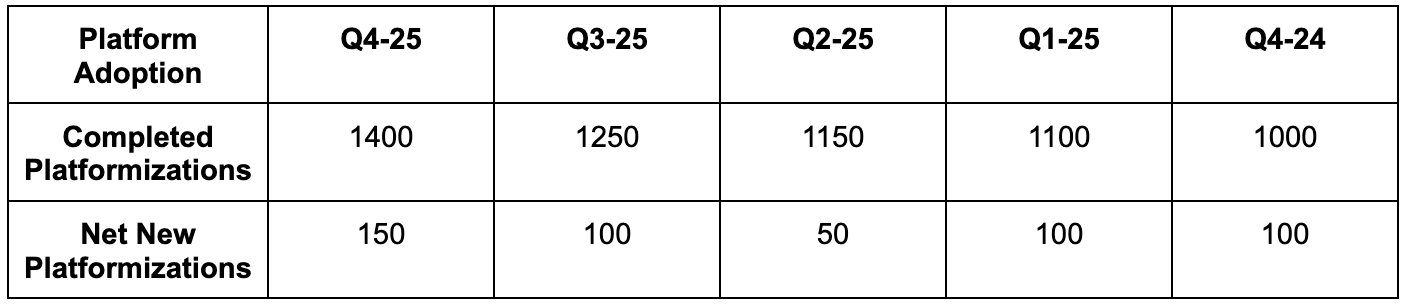

- Strong platform-level adoption.

- AI continues to be a business tailwind.

- Purchasing CyberArk to enter identity security.

- Confident in 40%+ FCF margins by fiscal year 2028.

c. Demand

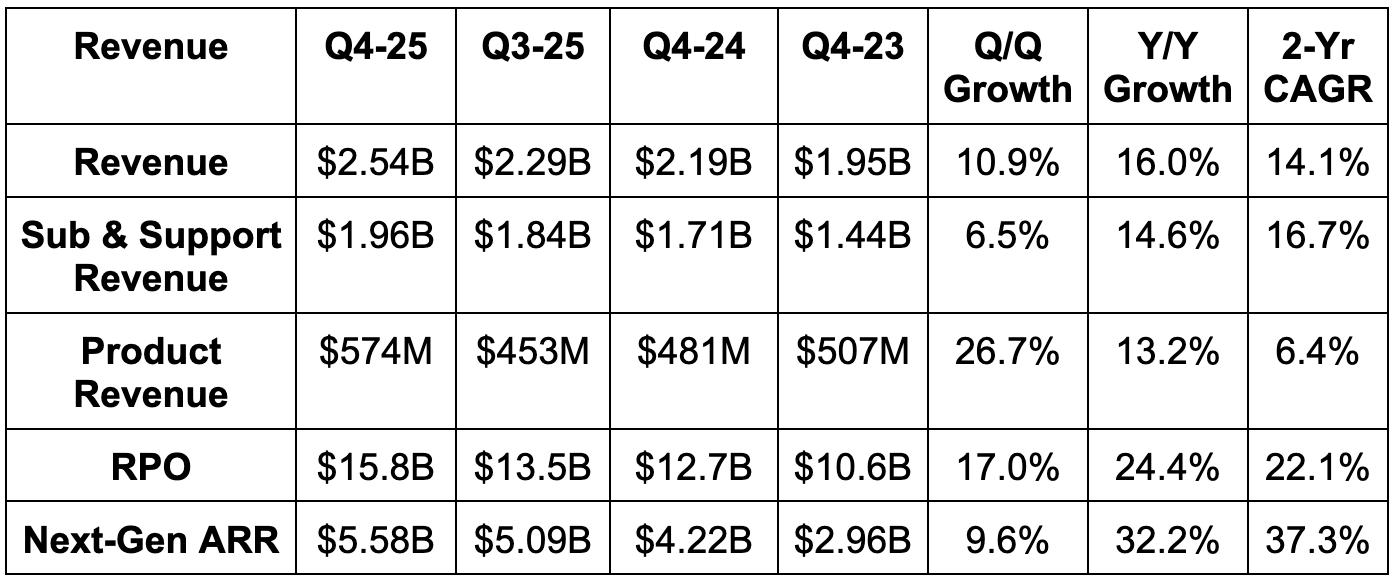

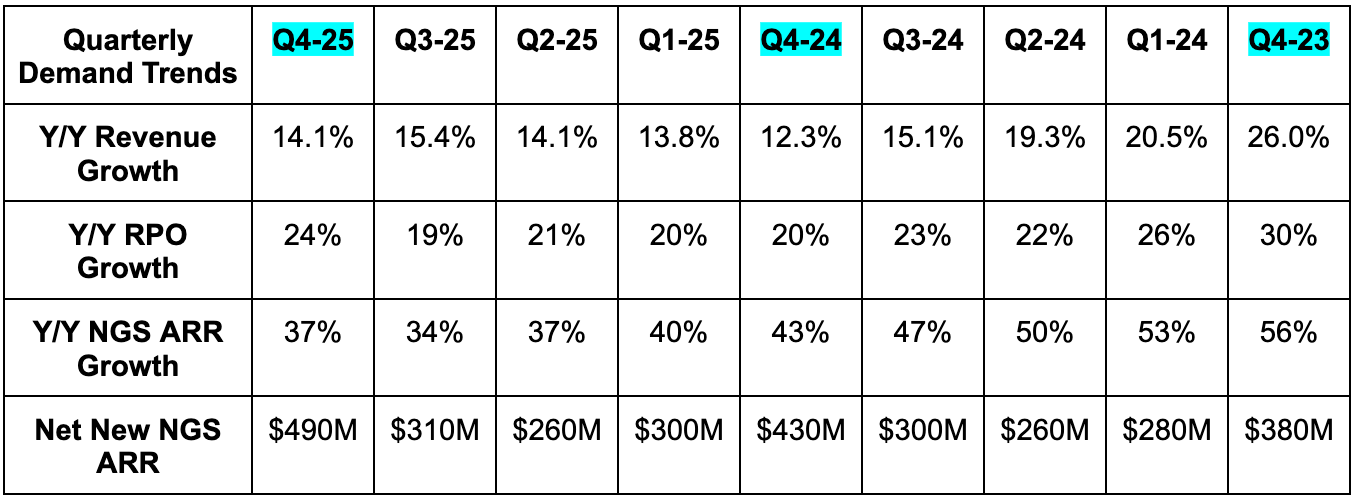

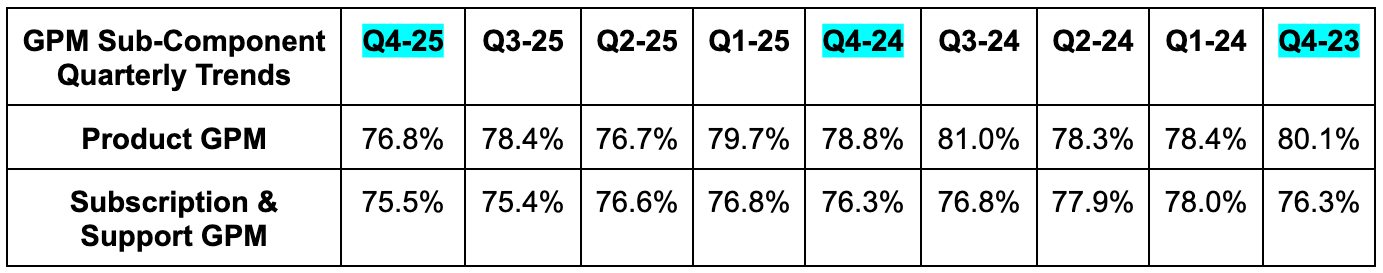

- Beat revenue estimates by 1.4% & beat guidance by 1.6%.

- Beat subscription & support revenue estimates by 0.6%.

- Subscription revenue rose by 17% Y/Y; support revenue rose by 11% Y/Y.

- Beat product revenue estimates by 4.1%.

- Slightly beat Next-Gen ARR estimates & slightly beat guidance.

- Beat Remaining Performance Obligation (RPO) estimates by 3.5% & beat guidance by 3.6%.

- Palo Alto is the first pure-play cybersecurity company to reach $10B in annualized revenue.

Macro was stable Q/Q. A brightening backdrop did not power the demand outperformance. More structural large deal flow momentum, especially in the public sector, as part of its ongoing push for platform-wide adoption (called “Platformization”).

Bookings and RPO growth meaningfully accelerated to their fastest clip in 10 quarters and 7 quarters, respectively. In terms of product highlights, as you may expect, SASE and XSIAM were the standouts. At the same time, the software portion of its firewall business continues to show impressive demand longevity. More on this later.

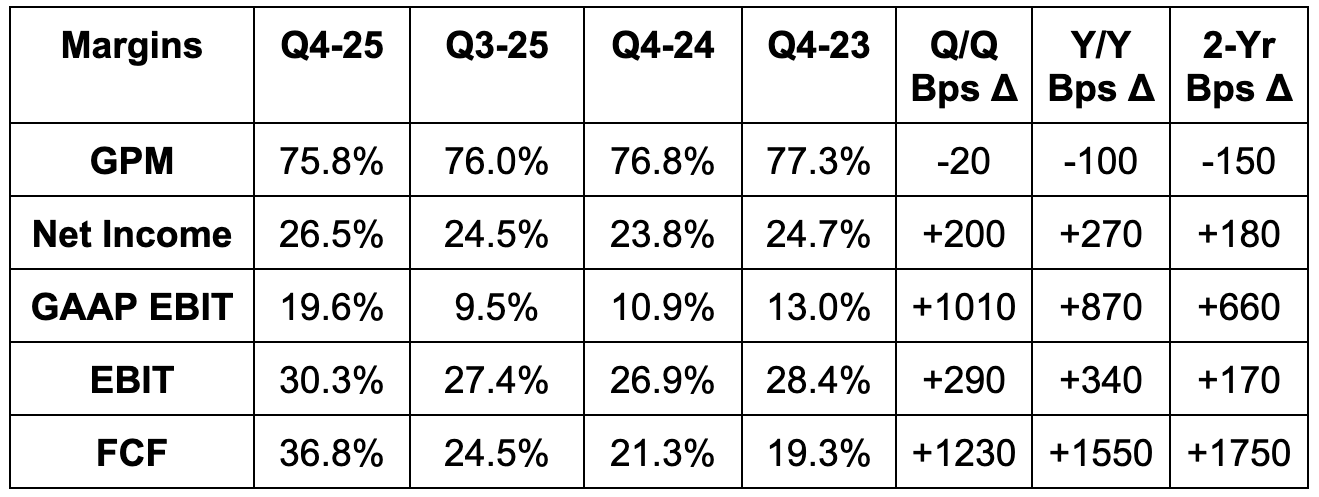

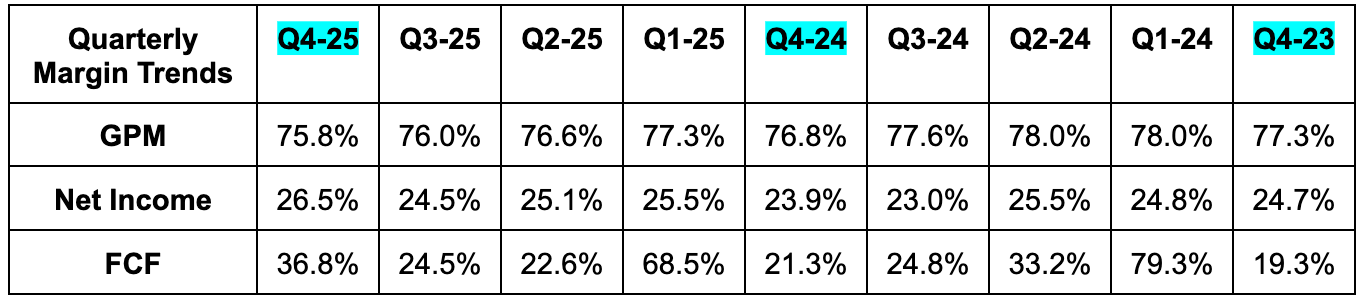

d. Profits & Margins

- Missed 76.7% gross profit margin (GPM) estimates by 90 basis points (bps; 1 basis point = 0.01%).

- Beat EBIT estimates by 6.8%. Beat FCF estimates by 1%.

- Operating margin for the year expanded by 150 bps.

- Beat $0.89 EPS estimates by $0.06 & beat guidance by $0.07.

- EPS rose by 27% Y/Y for the quarter and by 18% for the full fiscal year.

On product gross margin, PANW had a small inventory impairment charge that held things back a bit (I’m sure on the hardware firewall side of business). They’ve also worked hard to more their firewall manufacturing to the USA, which greatly insulates them from any tariff issues. As the firm works through these items, leadership thinks product GPM will move closer to 80% next year. Services gross margin expansion was via cloud cost efficiencies.

This was PANW’s first quarter with a 30%+ EBIT margin, and they remain confident in more leverage going forward. The higher EBIT margin ceiling is powering higher FCF margin potential too. Deferred payment evolution has been a hot topic for PANW for a few years now due to the feared impact on FCF margins. They’ve weathered it extremely well and continue to gain more future FCF visibility as the shift matures. With more visibility comes more confidence. More on this later.

e. Balance Sheet

- $2.9B in cash & equivalents.

- $5.6B long-term investments.

- Share count roughly flat Y/Y. No buybacks this quarter.

- Settled $383M in convertible notes in a mixture of cash and equity.

f. Guidance & Valuation

Guidance does not include CyberArk M&A, as it hasn’t closed.

- Annual RPO guidance beat estimates by 2.7%.

- Q1 guidance also beat estimates by 2.7%.

- They also see about 20% product revenue growth next quarter thanks to the software piece of that business.

- Annual revenue guidance beat estimates by 0.5%.

- Q1 guidance beat by a similar amount.

- The team remains very confident in raising current overall market share from its roughly 7% clip.

- Annual EBIT guidance beat estimates by 1.6%.

- Annual $3.80 EPS guidance beat estimates by $0.53 or $0.11 depending on the source.

- $0.89 Q1 EPS guidance beat estimates by $0.03.

- Annual 38.5% FCF margin guidance beat 37.5% margin estimates.

- They’re well on their way to their $15B+ ARR target.

- Following CyberArk integration and expected synergies, by fiscal year 2028, they think FCF margins will cross 40%.

Palo Alto trades for 49x forward EPS and 31x forward FCF. EPS is expected to grow by 13% in each of the next two years. FCF is expected to grow by 15% in each of the next two years.

g. Call & Presentation

M&A:

Throughout this piece, we’ll discuss PANW’s push to drive broader module selling, full embrace of each of its 3 product platforms and cross-selling those platforms. Trends look good, but it was still missing a large piece in its pursuit of end-to-end cybersecurity. That piece was identity security. Enter CyberArk with its $1.27B in ARR. Growth is currently being propped up by CYBR’s own recent M&A, but it looks like this can be a steady organic 20% grower. And that’s before plugging this smaller company into the massive roster of PANW customers yearning for more vendor consolidation. Post integration, PANW will be able to offer interoperable, single-vendor suites across network, cloud, endpoint and identity.

PANW didn’t see the Identity market as compelling until recently. It thinks the explosion in Agentic AI and multi-step tasks heightens the need for secure identity controls as those agents and their users race across the digital economy and scoop up needed context. CYBR ensures proper, minimum permissions to augment ID-based hygiene and protection with products like privileged access management (PAM). They think Agentic AI will coincide with an identity security demand explosion over the next 2 years, while PANW leadership is adamant that it can streamline costs and vastly bolster go-to-market in support of CYBR’s growth. Palo Alto has a detailed history of buying smaller growth companies within desired expansion markets. CYBR is not small. This is a blockbuster purchase, which is coming because leadership believes ID requires scaled data, experience and distribution for durable success. CEO Nikesh Arora thinks the leaders of future identity security will be the same firms that are leading today. This is certainly a current leader.

It plans to support the existing product roadmap, tie it into the other 3 product platforms and expand access to PAM to more use cases and customers – “rather than just a small set of IT administrators.” Execution is always critical when integrating a large purchase like this is. If the team can pull it off (and they’ve been great with M&A thus far), we do think this can turbo-charge CYBR’s own growth and further differentiate PANW vs. more mono-line product companies.

Platform-Wide Adoption (Platformization) Progress:

Like other enterprise software firms, PANW is all in on platform-wide adoption. That’s how you differentiate vs. point solutions, drive cross-selling, enhance retention, juice lifetime value and power financial success. And? Things are going well here.

A successful end to the fiscal year was credited to effective platformization momentum. The uniform silo-free nature of PANW’s platform is resonating across more and more product types. As that happens, deals are getting larger, longer-term and stickier. And fortunately, protection efficacy is getting stronger as PANW does a better job unleashing all of the data in its diverse data lake to season and augment each product it provides.

Looking ahead, they’re on track to finish 2500-3500 platformizations in the next 5 years and are exceedingly confident in this transition bearing considerable fruit (it already has). Net revenue retention for this cohort of customers is roughly 120%, with an elite 98%+ gross revenue retention rate.

Three deals were mentioned this quarter to hammer home the idea of this approach working:

- $50M NGS ARR deal with a global consulting firm. They purchased SASE, including its increasingly popular AI Access product, to greatly lower total cost of ownership thanks to fewer vendors and better outcomes.

- $15M NGS ARR deal with a European financial services firm. They platformized on Cortex with XSIAM, on network with SASE and purchased its Cortex Cloud platform as well. 3 platformizations for 1 customer.

- $12M NGS ARR deal across cloud, endpoint and network platforms. They’re now the standardized engine for this firm’s Security Operations Center (SOC) as well.

Network Security Suite:

The network security is by far the largest portion of NGS ARR at $3.9B, yet it’s still growing at a rapid 35% Y/Y clip. SASE is obviously a big contributor, as it frees companies to enjoy a highly scalable, public cloud native network offering. But when digging in, software firewalls and their ability to guard specific assets within a defined environment from outside adversaries are showing impressive durability. This is clearly a complementary offering for SASE, as those two product pillars successfully grow alongside each other.

Customers using hybrid cloud environments are understandably flocking to these virtual firewalls and they see that robust demand being a durable theme in the years ahead. As an aside, software firewalls are also why product revenue is now 56% software vs. 44% Y/Y and how product revenue rose by 19% Y/Y. They’ve meaningfully moved away from low-or-no-growth hardware firewalls, as that product line becomes increasingly archaic. Highly important for long-term growth. Relatedly, its firewalls operating system (PAN-OS) is enjoying step-for-step demand expansion alongside the firewalls. The company has a dominant 50% market share of this product type, and with optimistic sector demand expectations, it’s no wonder why they’re so upbeat about the software portion of the firewall operation.

With all of that said, SASE is the most promising and highest-growth product in the network bundle. This important segment drove many of the large wins during the quarter, landed them a “record number of 8-figure deals,” and took more market share. It really feels like all of that share will go to a few big boys. This past fiscal year, it stole 70 SASE contracts from other existing vendors and added $200M in total contract value (TCV). ARR growth for this category also doubled overall company growth over the past 12 months, while customers rose by 18% Y/Y. PAB is arguably the star of the show within this categoric standout, as its Talon Security purchase now looks to be an obvious home run. And that makes sense in the world of Agentic AI. These agents need to race around to many different digital destinations to collect information. The one common denominator for all of these otherwise disparate web experiences is the actual browser. That’s the gateway to all of this information, so protecting that gateway is becoming even more important. That browser protection need is supporting PAB demand, as it doubled total seats sold Q/Q to 6 million.

- Prisma AIRS is off to a great start after fully launching this quarter.

- They’re taking market share in hardware firewalls, but that’s not a high growth segment and will not be in the future. Guidance continues to assume hardware growth is roughly 5% Y/Y for FY 2026.

Cortex, Cortex Cloud & The SOC

XSIAM, the star of the SOC show, saw customers rise 2x Y/Y to 400, while ARR per customer is over $1M. This is its fastest-scaling product launch ever. Thanks to its broad product offering, its large partner roster and the diverse data those two assets entail, its SOC is powering better interoperability, decisions & outcomes. Specifically, 60%+ of XSIAM customers enjoy Mean Time To Resolution (MTTR) under 10 minutes, which is excellent.

- Cortex + Cortex Cloud ARR rose 25% Y/Y.

- XDR $1M+ customers rose 30% Y/Y.

- Cortex Cloud achieved FedRAMP high authorization, unlocking more public sector demand.

To bolster the modules that can stem from XSIAM and its SOC, PANW extended its data lake. This data lake is what enables scalable ingestion of data (structured and unstructured), providing the required signal for all PANW products. This quarter, they leveraged this same asset to launch email security, with a new application product coming next year. All in all, from this batch of new products, TAM grew by $18B… simply by using assets that already existed. The new modules stemming from data lake diversification will simply grow the data this lake already enjoys, which should create even more opportunity for new product introduction. This spins a positive flywheel and should be quite helpful for margins, considering they’re not really building anything new… they’re using what’s already there in new ways. Efficient.

More on AI:

AI means far more data processing, rapid app creation, exponentially more compute and data per product and ferocious context scraping. All of that means a ton of incremental workloads, networks and soon-to-be identities for PANW to protect. That’s why AI-based traffic for PANW’s clients rose 890% Y/Y and why it already has $545M in AI ARR (+150% Y/Y). It’s another structural tailwind, with very little chance of being supplanted by companies such as OpenAI or Alphabet. That’s not something I worry about in security, while it is something I worry about in lower stakes areas like customer relationship management (CRM) and content creation.

To nurture traction, PANW just closed on its small acquisition of Protect AI. This, as the name indicates, offers products specifically for securing AI apps and models, which should boost its Prisma AIRS product. And speaking of AIRS, this landed PANW an 8-figure deal during the quarter just weeks after broadly launching.

As briefly mentioned, AI products are only as good as the data they are built on.. PANW’s broadest product suite means access to more data types, and it’s showing early signs of knowing exactly how to leverage that.

Final Note:

Nir Zuk (one of the co-founders) is retiring as CTO after more than 20 years with the company.

g. Take

Another great quarter from this rock-solid team. They’ve effectively stitched together M&A and formed a cohesive product suite better than most other enterprise software firms that have tried to do so before them. They have a broad product suite that is near best-in-class across the board. And with that added cross-selling capability, they don’t need to have the very best product everywhere to win. That’s why platformization is going as well as it is (great go-to-market helps a lot too). The opportunity remains massive and largely untapped, while PANW is demonstrating a clear ability to effectively cross-sell all 3 product pillars. While CyberArk creates new execution risk (big integration project), this team has earned the benefit of the doubt. I think they’ll successfully absorb this product and also think there’s every reason to believe this will be a 15%+ compounder for a long time.

3. Meta Platforms (META) – Noisy Week & More

This week, the New York Times came out with pieces on Meta downsizing AI teams, laying off some talent and restructuring once again. Wall Street Journal then came out saying Meta is freezing AI hiring. A few notes on this. First, as Zuck explicitly said on the earnings call, they want AI teams to be small and loaded with talent at the top. They think the teams weren’t optimally sized and strongly hinted at changing that to unleash tighter collaboration and faster innovation. If these authors read that earnings transcript, perhaps they wouldn’t have written about these things with such a surprised tone. Second, it’s natural and routine for teams to take a pause on hiring after adding talent as aggressively and rapidly as Meta did. It’s wise to get settled and organized, rather than just throwing endlessly more people at them to train. And finally, this was the shortest “hiring freeze” ever. Less than a day after the WSJ article, Meta hired another AI executive away from Apple.

- Debuted Meta AI Translations to automatically dub and lip sync short-form video content in other languages. That should vastly bolster reach for creators and help with overall engagement for Meta.

- Meta’s new smartglasses being unveiled at Meta Connect next month (can’t wait) will have their first wristband for hand controls.

4. SoFi (SOFI) – New Product

SoFi is introducing blockchain-based international money transfers in partnership with Lightspark. This will unlock cross-border transfers with lower transaction fees and faster delivery. This will plug a product gap SoFi had vs. others like Robinhood and create a new product advantage vs. the incumbent banks that it more directly competes with. Expect SoFi to rapidly rollout products in the world of crypto and blockchain amid the increasingly friendly regulatory backdrop. I’m excited about the relaunch of their crypto offering, as I’ve written about in the past, this can quickly ramp to 1%-2% of overall revenue in the coming year if they execute. And that’s just for the crypto brokerage offering. There are many more growth opportunities in tokenized loans and blockchain-based innovation as well. SoFi should (and will) be able to move faster than incumbent banks here. That would create real incremental product differentiation and support their growth trajectory.

5. Alphabet (GOOGL) – Chrome, Gemini, Cloud & Waymo

This was included in the Discord alerts tab for Max subs during the week.

As a reminder, there will be an antitrust ruling on Alphabet's business some time this month. Needham came out with a note saying they view a forced sale of Chrome (one of the main fears) as highly unlikely. The payments they make to Apple every year to be the default search engine could be deemed illegal. If that happens, Google Search probably loses some Safari-based market share. At the same time, Google would also pocket about $20B a year in cash to allocate elsewhere (like buying Wiz or making better chips). Not ideal, but a lot easier to stomach than a forced breakup. That's what we want to avoid. Full-stack AI relies on diverse access to data and scaled distribution to stand out from the pack. Chrome is one important piece of Google's fortress ecosystem. It's certainly not the only piece, but I'd much rather they stay together.

In other Alphabet and Apple news, Apple is considering Gemini to power its upgraded Siri product launching next year. There have been many rumors like this one -- so we'll see what happens. If this is legitimate, it would mean more reach for Gemini… more data… better model training… and faster model improvement for what is already the world leader. It would also mean a nice chunk of revenue to offset the potential headwind coming if Google can no longer pay to be Safari’s default search option.

In other Google news, Meta signed a 6-year, $10B cloud contract with Google Cloud. Between OpenAI, Salesforce, ServiceNow & the Oracle/Gemini model deal, this mega-cap is really starting to rack up some large wins. The Meta deal specifically should boost annualized Google Cloud revenue by around 3.5% (based on the most recent quarter.

Finally, Waymo secured the first autonomous driving testing permit in NYC. The U.S. leader continues to lead.

6. Duolingo (DUOL) – Social Media & Analyst Notes

Duolingo lost a few members of its social media group, including Zaria Parvez, who was considered the star of that team. Duolingo’s social media engine is the driving force behind its viral, organic growth. It’s how the word-of-mouth engine is amplified beyond traction from simply offering a great product. And while this is somewhat concerning, a $15B company isn’t fragile enough to crumble because one especially talented social media contributor left for another role. I do not think this company is close to that fragile, and am confident that their data-driven approach to social media engagement will continue to thrive.

Still, this is going to intensify the current noise surrounding this name. This comes as Duolingo has been forced to pull back from their edgy social media content in favor of more friendly remarks. As a reminder, that’s happening because of blowback against Founder/CEO Luis von Ahn’s AI pivoting comments a few months ago. That has led to falling engagement across their apps and the DAU miss discussed in the last earnings review. It’s worth noting that the “miss” still entailed 40% Y/Y growth and that they expect growth to be similar in Q3, but this was still a deviation from their uniform beat & raise trend.

Leadership has talked about trends already stabilizing and normalizing the edge content cadence in the coming weeks, and I expect trends to magically brighten as that happens. I expect this company to keep performing at a high level in the years to come, but also think all of the incessant noise surrounding the name is (unfairly) turning this into a battleground stock. Between the social media team departures, the AI-pivot user blowback and product innovation from perceived ChatGPT competition, there are a lot of doubters at the moment. I’d just mention they’re doubting a world-class team with an unmatched dataset, 30%+ top-line growth and consistently expanding margins trading at a mid-30s forward FCF multiple… but they’re entitled to doubt. I just don’t see things the way they do and remain confident in this holding. Keybanc does too, as they upgraded the name following a fading in the AI-blowback noise and brightening trends. Citibank also initiated it with a buy this week, due to its belief in long-term growth and that OpenAI risks are overblown.

7. MercadoLibre (MELI) – Argentina

This was included in the Discord room during the week.

MELI just launched their credit card in Argentina (Brazil launched 2021; Mexico launched 2023). That should be excellent for net interest income and juicing marketplace growth. Cardholders spend more on MELI in other nations -- this should be more of the same. And in a compelling positive flywheel fashion, that enhanced marketplace engagement will mean more repayment data to more effectively season underwriting models, grow originations and boost engagement more.

This news follows ramping fulfillment investments and growth spend in Argentina as macro keeps improving. This is MELI's highest margin ceiling country, arguably its least competitive market and has been a drag (hyperinflation) for a few years. It's now turning back into the highlight, and this will mean even more growth. The one thing to keep an eye on is the near-term FCF drag they will have from issuing new cards and front-loading provisions. That will be more modest than it was in Mexico and Brazil, as the percentage of the book that's new will be smaller (because Mexico and Brazil are already scaling). In my mind, that’s a concession to make in exchange for a higher revenue/profit ceiling down the road. Exciting launch.

8. Headlines & Analyst Notes

DraftKings was named the #1 iGaming product by Eilers & Krejcik for the 3rd straight report.

Wells Fargo expects solid CrowdStrike upside in its earnings report next week. They reiterated their buy rating.

Zscaler immediately deepened Red Canary’s (Managed Detection and Response) partnership with CrowdStrike following that deal closing.

As discussed in the Discord room during the week, Nu Brubank M&A rumors are heating up as the disruptor looks to maybe expand into Argentina. Good timing from a macro point of view. And a proven business model across 3 highly different LatAm economies.

China will not invade Taiwan with the current U.S. administration in office. That’s good news for sentiment with companies like Coupang and Sea Limited that compete in that market. It’s also great news for Taiwan Semiconductor’s actual operations, despite their steady expansion to U.S.-based manufacturing.

Citi double updated Nu from sell to buy. It’s growing increasingly confident in faster growth and stronger margins… my two favorite reasons for an upgrade. They now see net income coming in around 5% ahead of consensus estimates for 2025 and 6% for 2026.

Bank of America upgraded Snowflake on strong traffic channel checks and positive customer surveys.

9. Fed Chair Powell’s Jackson Hole Remarks & Macro Data

This was included in the Discord room during the week.

Labor Market:

The slowdown in payroll growth in July, as well as negative May and June revisions, were “larger than expected.” Fortunately, this has not coincided with a material rise in unemployment or a material worsening in wage growth. That’s has allowed the Fed to be more patient over the last few meetings.

Interestingly, that has a lot to do with slowing rates of immigration. So? While the pace of job demand growth is slowing, the pace of job supply growth is also slowing, which helps insulate true unemployment from this risk. Powell called the labor market “weirdly balanced.”

He also said this skews risks for this part of the dual mandate to the downside, and assured the public that they can “quickly” adjust policy if those risks materialize.

Inflation:

Tariffs are now boosting prices – as seen in this month’s producer price index (PPI). Housing disinflation trends remain solid, but goods inflation is again accelerating because of these policy changes. Interestingly, Powell sees the price impact as short-lived. That’s the first time he has explicitly said this, and markets were quite happy to hear it. The impact won’t suddenly vanish and will continue to ramp for a few months. But? They do not think it will be structural, and are encouraged by continued anchoring in long-term inflation expectations.

The risk here is that “short-lived” turns structural like “transitory” turned structural during the pandemic bubble. I don’t think that risk is all that pressing, considering tariffs should simply create a one-time step-up in pricing (over the course of a few months). They feel the same way. This is not remotely the same as pumping trillions into the economy and pausing loan repayments.

More notes:

- No change to 2% inflation target

- GDP growth slowing was blamed partially on a slowdown in consumer spending. This is being impacted by slower rates of immigration.

- Significant uncertainty about the impact of policy changes remains.

Policy Implications:

Between inflation challenges being moderate and likely short-lived and current employment dynamics, the shifting balance of risks may warrant adjusting the policy stance.” That led to rate cut probabilities for September jumping from 75% to 91%.

This meeting was about as dovish as Powell could have been. That should be good for risk asset valuations and capital market liquidity.

Consumer & Employment Data:

- Continuing Jobless Claims were 1.972M vs. 1.960M expected and 1.942M last month.

- Initial Jobless Claims were 235K vs. 226K expected and 224K last month.

- Existing Home Sales for July were 4.01M vs. 3.92M expected and 3.93M last month.

Output Data:

- The Philly Fed Manufacturing Index for August was -0.3 vs. 6.8 expected and 15.9 last month.

- The Manufacturing Purchasing Managers Index (PMI) for August was 53.3 vs. 49.7 expected and 49.8 last month.

- The Services PMI for August was 55.4 vs. 54.2 expected and 55.7 last month.