1. Progyny 2nd Quarter Earnings Review

a. Demand

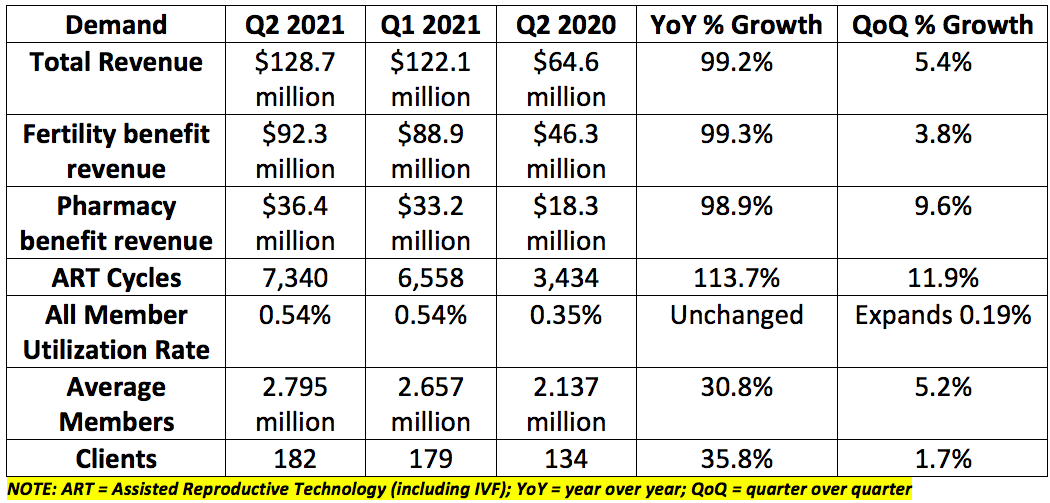

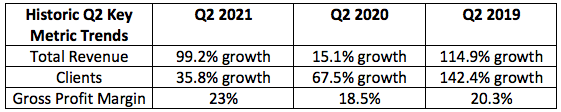

Progyny — a fertility benefits manager — guided to $126-$131 million in revenue for the quarter. It posted $128.7 million representing 99.2% growth and essentially in-line results.

CDC and Society for Assisted Reproductive Technology fertility report findings:

- Since 2016 Progyny has boosted live birth rates by 14% while the national mean has stagnated. Stagnating national averages demonstrate how difficult it is to match Progyny’s value.

- Progyny’s program yields a 16% higher pregnancy rate vs. the national mean.

- Progyny’s program yields a 25% higher live birth rate vs. the national mean.

- Progyny’s program yield a 26% lower miscarriage rate vs. the national mean.

Remember some treatments cost over $10,000 a piece. Less treatment is a massive economic advantage to complement the outcome advantage.

Additionally, (not included in the CDC-published report) Progyny’s program continued to generate improved employee productivity and workforce satisfaction.

b. Profitability

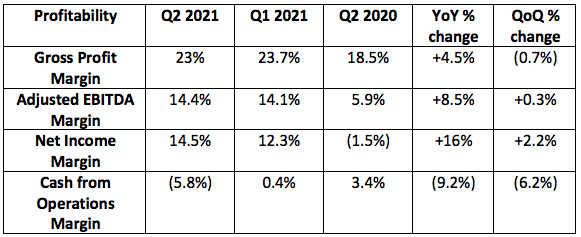

Progyny earned $0.19 per share beating expectations by 111%. The $0.19 metric includes a $0.07 tax benefit. Without the benefit, Progyny would have beaten expectations by 33.3%.

Progyny guided to $17.5-$19 million in adjusted EBITDA. The company posted $18.4 million in adjusted EBITDA, in line with guidance.

Cash flow from operations margin was uniquely hurt by the timing of payments received from pharmacy program partners. This is expected to normalize going forward and is what led to the near doubling in accounts receivable year over year.

Adjusted EBITDA margin on new, incremental revenue was 22.9% pointing to continued expansion here going forward.

c. Selling Season Notes

New client demand has returned to pre-pandemic levels.

“Commitments received is the most we’ve ever seen at this point in the selling season and beyond our expectations.” — CFO Peter Anevski

A large number of existing customers — including some of Progyny’s largest — have already committed to service expansions for 2022. The company proclaimed it has already reached its goal for annual up-selling revenue.

“We are well on our way to returning to the sequential growth trend in client and covered lives that we had been on before the pandemic.” — CEO David Schlanger

d. Guidance Updates & Rationale

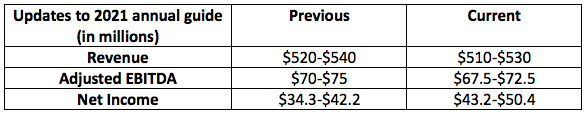

Progyny is ahead of schedule in terms of signing new companies. Still, utilization and appointment trends have recently been impacted (along with the sector). 90% of its members are going about normal treatment schedules but the remaining 10% have grown more hesitant due to a combination of the delta variant and pent-up summer vacation demand.

It expects to get back to 95% of normalized utilization by Q3 although allowed for utilization to stay at 90% in its guidance. Progyny believes this is a “short-term anomaly” and is already “seeing indications of member activity returning to levels that are closer to expectations in the last week.” This is why it adjusted its revenue guide down, despite the enterprise contract momentum.

d. Management Commentary

“The factors critical to our ongoing growth -- including industry-leading outcomes, high member satisfaction rates and high client retention rates — are all going extremely well.” — CEO David Schlanger

Its net promotor score (NPS) stands at its highest level ever which implies an NPS over +81.

The company expects to maintain a similar 48%-54% growth rate that it guided to for 2021 into 2022 as retention, up-selling and new client win trends all remain strong. This does not assume any “baby boom” for 2022.

e. My Take

The numbers were good, but the guide was underwhelming. Utilization rate is hurting them at the moment, but it’s encouraging for them to see trends already normalizing and referring to the dip as an “anomaly.”

This was not a perfect quarter. It was acceptable, however, especially considering Schlanger told us to expect a similar 48%-54% growth rate for 2022. That coupled with precipitously expanding gross profit and EBITDA margins makes me confident going forward despite the guidance miss. A below-average quarter, but my thesis is fully intact. I added to my position on Friday and will be looking to slowly add more to Progyny if it dips further.

2. REVOLVE 2nd Quarter Earnings Review

“2021 annual growth will likely end up far above our long term 20% target.” — Co-CEO Mike Karanikolas

a. Revenue

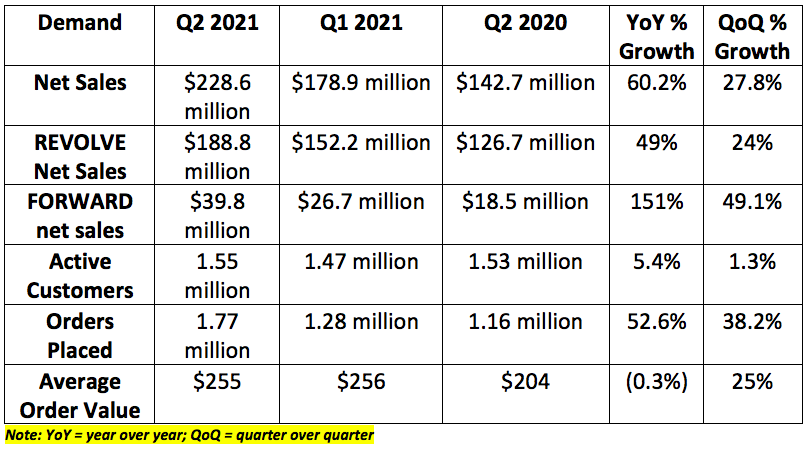

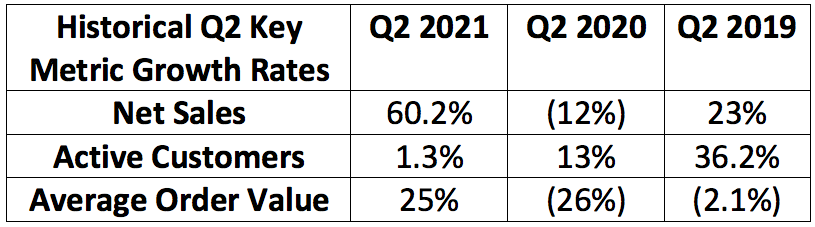

REVOLVE — an online retailer specializing in women’s clothing — was expected to generate $198.8 million in Q2 net sales. It posted $228.6 million in net sales beating expectations by 14.9%. Domestic sales grew 59% year over year (YoY) while international sales grew by 63% YoY.

These sales represent 41% growth vs. the comparable pre-pandemic period in 2019. Last quarter, REVOLVE grew sales by 30% vs. the comparable pre-pandemic period in 2019 meaning growth is meaningfully accelerating sequentially.

REVOLVE leans heavily on live music festivals to market its products. It also predominately sells clothes people wear for going out. As a result, the pandemic impacted the company in a uniquely negative way while it boosted most other e-commerce names. Normalization will greatly help REVOLVE as the growth in net sales this quarter indicates. Encouragingly, performance remained strong into July with YoY growth of over 40% and strong traffic/conversion trends continuing.

b. Profitability

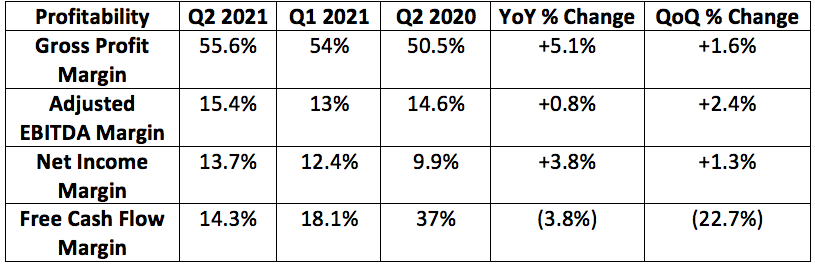

Revolve was expected to earn $0.21 per share. It earned $0.42 beating expectations by 100%. This was boosted by an effective tax rate of just 3.5% vs. 23% in the comparable period. Revolve expects this rate to be 25% in the future. Had it been 25% this quarter it would have earned $0.30 per share beating expectations by 43%.

Free cash flow margin decreased due to aggressively ramping inventory investments to support recovering demand. We are also lapping a period in which it greatly pulled back on spending. Inventory rose 18% sequentially to give an idea of how aggressively it’s pursuing growth.

Gross margin expansion was powered by a record high percentage of net sales at full-price. Operational efficiencies & more automation also contributed to margin expansion here.

c. Call Notes

“FORWARD” segment customers coming from REVOLVE “accelerated overnight” after the company launched its new FORWARD loyalty program fully integrated with its core REVOLVE segment. The results are “exceeding all of [management’s] expectations.” Still, just 5% of REVOLVE segment consumers shop on the FORWARD web site. There’s a long way to go here, but encouragingly cross-selling already contributes 10% of total FORWARD sales. The company will debut more FORWARD loyalty programs outside of the U.S. in the coming quarters.

REVOVLVE added a record number of new customers sequentially during the quarter to re-surpass its pre-pandemic levels. Revolve’s business remains just 3% penetrated in its core GenZ/Millennial female demographic.

Localization of marketing efforts contributed to rising returns on invested capital in Revolve’s international markets. It pursues influencers/celebrities with especially strong clout in a given geography to sell its products.

“We will be investing more than ever on some exciting marketing initiatives. This is the time to invest. Expect marketing spend to continue to sharply rise throughout the year.” — Mike Karanikolas

There continues to be 0 debt on the balance sheet with $220 million in cash to deploy. It’s time to be aggressive.

d. My Take

REVOLVE’s data driven inventory system enabled them to precipitously expand margins despite demand for its products collapsing during Covid-19. Now with demand returning, it’s time for the company to press the gas pedal on growth. The great results indicate that has already begun. REVOLVE is my 3rd largest holding and I am not looking to add to or trim my position at this time.

3. Penn National Gaming 2nd Quarter Earnings Review

a. Results

Penn National Gaming — a regional gaming company — posted Q2 revenues of $1.55 billion beating expectations by 6.8%. The company posted sales 17% above its comparable pre-pandemic period in 2019. Every company region besides the West has comfortably passed 2019 revenues with ease.

Penn National Gaming reported earnings per share (EPS) of $1.17 for the quarter beating expectations by 30% and up 165% from the comparable pre-pandemic period in 2019.