Welcome to the hundreds of new readers who have joined us this week. We’re delighted to have you.

1. Lululemon (LULU) – Q2 2023 Earnings Review

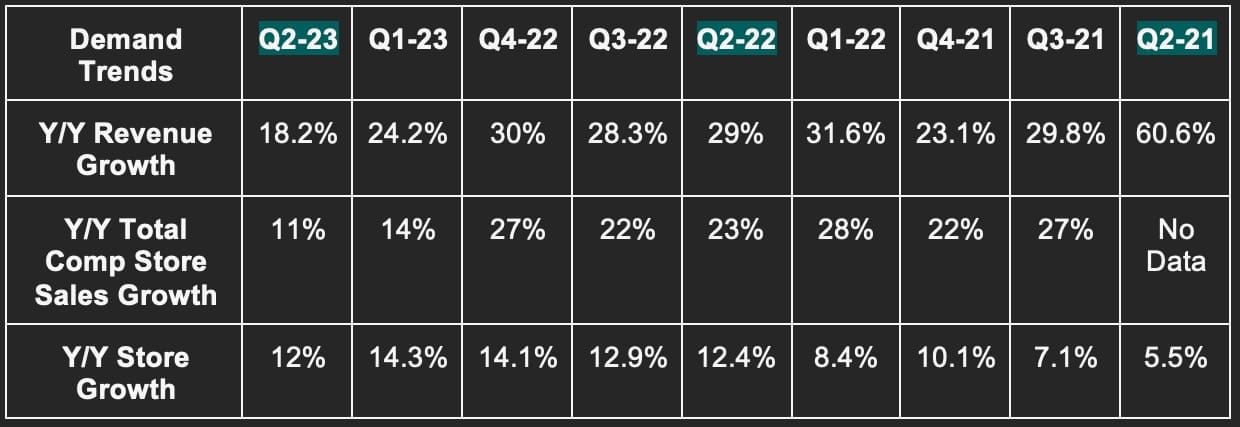

a. Demand

Lululemon beat revenue estimates by 1.8% & beat guidance by 2.6%.

Demand Context:

- Still very easy 3-yr comps due to the pandemic. This is why 3 year CAGR is so far ahead of the firm’s long term target of 15% annual growth. That should normalize as comps finish normalizing.

- Direct to consumer (DTC) sales = 40% of total vs. 42% Y/Y.

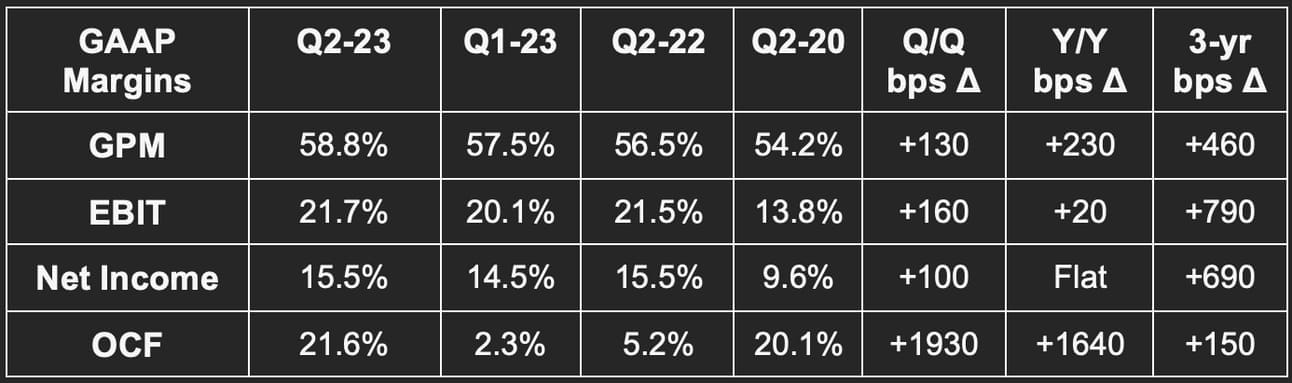

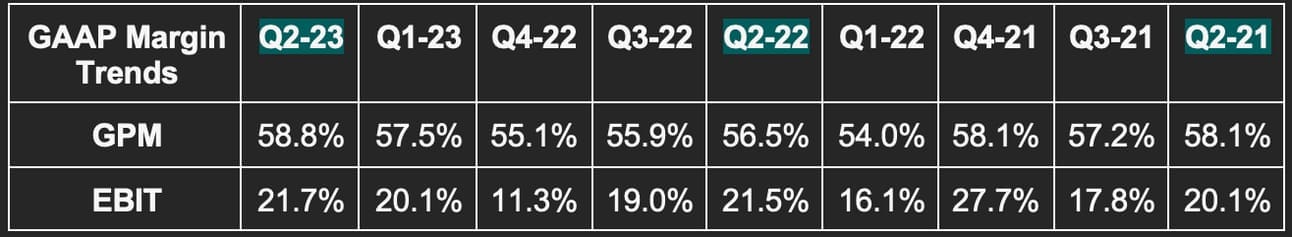

b. Margins

- Beat $2.54 GAAP EPS estimates by $0.15 & beat guidance by $0.19.

- Beat GAAP EBIT estimates by 4.5%.

- Beat 58.6% GAAP GPM estimates by 20 basis points (bps).

Margin Context:

Lulu has generated $331 million in year-to-date free cash flow vs. $327 million all of last year. This is NOT coming from inventory reductions as inventory rose Y/Y and Q/Q. That’s why gross margin continues to expand. You would be hard-pressed to find another player in this space delivering this kind of strength today.

c. Guidance

- Raised revenue guidance by 0.7% & beat estimates by 0.4%.

- Raised $11.84 GAAP EPS guidance by $0.26 & beat estimates by $0.19. The new EPS guide represents 20.2% Y/Y growth.

- Next Q guide was slightly ahead across the board.

- Now sees 200 bps of GPM expansion Y/Y vs. 190 basis points last quarter. Air freight relief is the source of the improvement here.

- It continues to see 40 basis points of Y/Y EBIT margin leverage for 2023. It’s allocating the pocketed input costs to more growth initiatives within OpEx which is why this wasn’t raised alongside gross margin.

“We remain aware of the uncertainties that exist in the current macro environment and consistent with our approach over the last several years, we continue to be prudent and plan the business for multiple scenarios.” -- CFO Meghan Frank

Next quarter guidance was slightly ahead on demand and profit as well. It sees low double digit inventory growth next quarter. Importantly, it also maintained its long-term targets calling for roughly 15% annual revenue compounding and modest operating leverage through 2026.

d. Balance Sheet

- $1.1B in cash & equivalents.

- $400 million in available credit revolver capacity.

- Inventory rose 13.5% Y/Y and 5% Q/Q. Again, strong free cash flow is not related to inventory liquidation.

- Shares fell slightly Y/Y via buybacks.

e. Call & Release Highlights

Thriving:

Lululemon has been a notable standout within a challenged consumer discretionary space in 2023. That narrative continued this quarter with more market share gains (1.3 points of incremental share per Circana data) and pretty much every single product seeing outperforming strength. Women’s, Men’s and Accessories grew by 16%, 15% and 44% Y/Y respectively. Broad-based momentum actually accelerated into Q3 with growth in every major geography including the U.S. accelerating Q/Q thus far. With U.S. revenue growth of 11% Y/Y this quarter vs. 52% internationally, that acceleration note was fantastic to hear.

Core franchises are killing it with its Women’s Softstreme category now “emerging as another core franchise.” ABC pants for Men are still killing it. Makes sense… Those pants rock. The Everywhere Belt Bag continued brisk growth following a strong debut. Its 2 newest men’s collections are exceeding expectations. Everything Lulu sells is selling well… new and old.

Innovation:

- Will launch Men’s Footwear next year.

- Its new Steady State category for Men uses the exact same fabric as its Scuba franchise. This meant wonderfully affordable innovation which has been met with an extremely positive guess reaction. Just one of many examples of Lulu leveraging fabric innovation for multiple categories and revenue buckets. More revenue generated by already incurred fixed costs is always a wonderful thing.

Going Global:

- The store opening in Bangkok was “among the strongest ever” for Lulu in Asia-Pacific (APAC).

- Store remodeling in Australia is working well.

- Its National Fitness Day event in China was well attended and fulfilled core brand awareness objectives. China revenue rose 61% Y/Y.

The significant savings Lulu is enjoying within air freight is allowing it to further accelerate global brand building and marketing investments. Considering its unaided brand awareness is 25% in the USA, just over 10% in Australia and the U.K. and under 10% everywhere else, there’s a long runway to grow the Lulu brand. This brand building over the last year or so has directly translated into international revenue as a percent of total crossing over 20%. CEO Calvin McDonald sees this approaching 50% over time.

While it will always focus on grassroots marketing, it’s now ready to accelerate its global campaign and large live event cadence.

In Europe, the soft launch with popular e-commerce vendor Zalando this summer went well. That relationship gives it great traffic access in that newer market while maintaining DTC margins for the most part. This is not wholesale revenue.

Final Notes:

- Lululemon’s Essentials membership program crossed 12 million this quarter. It launched less than a year ago.

- The outperforming sales growth was the main source of 14% Y/Y inventory growth vs. the 20% growth leadership guided to last quarter.

f. Takeaway

Again, 2023 has been a challenging year for consumer discretionary as a category. Based on Lulu’s results, the weakness has not been noticeable as it continues to overcome any and all headwinds. This part of the cycle SHOULD HAVE been very tough for the company, but I suppose it didn’t get the memo. This was a very strong quarter with nothing for me to pick at in the least. Great brand. Great team. Great company. Enough said.

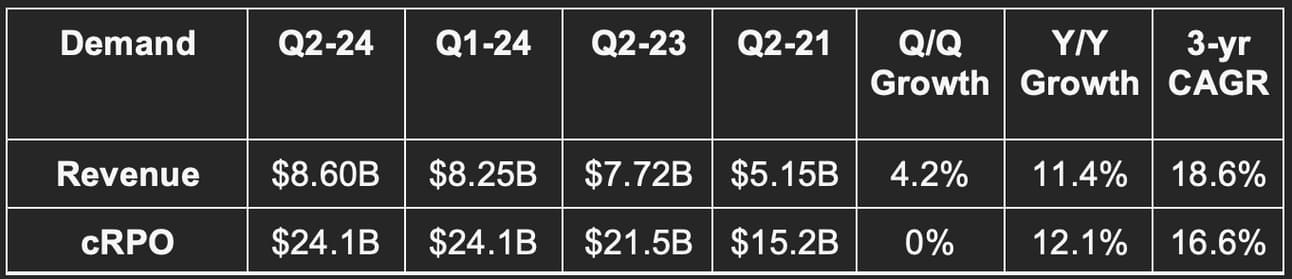

2. Salesforce (CRM) – FY Q2 2024 Earnings Review

a. Results

- Beat revenue estimate by 0.8% & beat guide by 1%.

- Beat current RPO (CRPO) guide by 1.9%.

- Beat $0.80 GAAP EPS estimate & same guide by $0.48.

- Beat $1.90 EPS estimate & same guide by $0.22.

- Roughly doubled free cash flow (FCF) estimate.

b. Fiscal Year 2024 Guidance Updates

- Raised revenue guide by 0.4% & beat estimate by 0.2%.

- Raised EBIT guide by 7.6% & beat estimate by 7.1%.

- Raised GAAP EBIT guide by 10.8%.

- Raised $2.68 GAAP EPS guide by $0.83 & beat estimate by $0.81. This includes a $1.11 restructuring charge.

- Raised $7.42 EPS guidance by $0.63.

- Raised operating cash flow growth guidance from 16.5% Y/Y to 22.5% Y/Y.

Next quarter guidance was also ahead across the board.

c. Balance Sheet

- $12.3 billion in cash & equivalents.

- $9.4 billion in total debt with $1 billion due within 12 months.

- Share count fell by about 1.5% Y/Y via continued buybacks. It has $11.9 billion left on its current $20 billion buyback program. Stock comp is expected to be 8% of revenue this year.

d. Call & Release Highlights

Generative AI:

Einstein is Salesforce’s AI tool to augment the Salesforce CRM platform. It automates data sifting and insight gleaning to reveal valuable patterns to guide decisions. It also comes with language tools to translate and analyze text to uncover sentiment among other things. These tools existed before the generative AI wave, but now they’re getting an upgrade thanks to it. Einstein GPT allows Salesforce clients to plug into language models (including OpenAI’s, Anthropic’s and Cohere’s) to make workflows more productive, intuitive, conversational and automated. It features a low code tool set to reduce the barrier for non-experts to build applications and also boasts expert-level tools to build more complex models and use cases.

Einstein is Salesforce’s generative AI toolkit and its expansive data cloud is the vital complement to those products. As a reminder, the relevant injection of data into AI models is the only way to make these models useful and provides the “generative” learning experience to the software. The more data seasoning, the better. Salesforce has the unique ability to combine its “deeply integrated” data cloud into the rest of its clouds and apps. Its product breadth and vast customer base means this data cloud is wonderfully rich with insight while Einstein ensures that insight can be effectively gleaned and leveraged all from within the Customer 360 (its full suite of clouds) environment.

Having the data cloud, other operational clouds and Einstein in one place means greater efficiency as well. It means customers can access needed, curated data in real-time without costly, non-targeted external querying or the maintenance of siloed data lakes. Salesforce delivers a fully “integrated data architecture.”

“We're moving our customers from having islands of data to having a single source of truth for all of their data.” -- CEO Marc Benioff

Importantly, all of these generative AI tools are accessible in low or no code environments. Meaning that one does not need to be a computer scientist or a coding nerd in order to utilize them. Considering this, Salesforce sees its recipe within the generative AI wave as “democratizing access” to all of the model builders and services.

Along these same lines, Salesforce is adding another (5th) core objective to its operations in becoming the “leading AI customer resource manager.”

Growth by Product Bucket:

- 12% sales cloud growth vs. 13% Q/Q and 19% Y/Y.

- 12% service cloud growth vs. 13% Q/Q and 18% Y/Y.

- 11% Platform & Other growth vs. 12% Q/Q and 56% Y/Y.

- 10% Marketing & Commerce cloud growth s. 10% Q/Q and 22% Y/Y.

- 16% Data cloud growth vs. 20% Q/Q and 13% Y/Y.

Continued Customer Traction & Cross-Selling:

- 90% of the Fortune 100 uses Salesforce as of today and an average of 5 clouds.

- Data cloud was in 50% of its largest deals this quarter including expansion deals with KPMG and FedEx.

- PenFed is using Einstein to resolve 20% of service inquiries automatically with “incredible return on investment.”

- Half of its $1 million deals included MuleSoft. MuleSoft is its integration layer for apps and data sources

- 5 industry clouds enjoyed 50%+ annual recurring revenue (ARR) growth for the 3rd straight quarter.

- Customer wins included JP Morgan, Bayer and the Department of Veterans Affairs.

- 6 of its 10 largest deals involved 5 or more clouds.

- Over the last 5 years, $10 million+ customers have compounded at a 24.6% clip.

- 18.6% 3-yr revenue CAGR vs. 19.2% Q/Q and 20% 2 Qs ago.

Margins:

Salesforce reached its 30% EBIT margin target nearly a full year ahead of schedule. It does not expect that to be a one-off event, but a consistent trend with perhaps some expense timing-related volatility in the second half of the year.

Cash flow is being greatly held back by restructuring charges. GAAP EBIT and net income are being slightly held back by these charges.

Macro:

The buying environment remains “measured” while “compression of larger deals” continues and the sales cycle remains elongated. Macro headwinds were in full force this quarter and the company effectively baked those challenges into its guide and overcame them a bit better than expected as well. Revenue attrition remained stable at 8% to show the mission-critical nature of this platform.

Case Study:

Salesforce’s Einstein was added by an existing customer in Schneider Electric. With this product addition, it cut sales closure time by 30% and automated its entire order fulfillment flow.

Downstream:

Salesforce debuted “Salesforce Starter” as a bare bones product kit geared towards small and medium businesses. This reminds me of CrowdStrike’s Falcon Go bundle.

e. Takeaway

More wonderfully boring execution for a company that has listened to shareholders wanting fatter margins and found its groove this year. Its product suite obviously continues to resonate, its fat has been trimmed and its combination of buybacks and vast operating leverage should lead to rapid profit compounding for the foreseeable future. Great company… What else is new?