Almost everything was sent during the week. In case you missed it:

- Trade Desk, Duolingo & DraftKings earnings reviews

- Uber & Shopify earnings reviews

- Lemonade, Hims & Coupang Earnings Reviews

- Mercado Libre & Palantir Earnings Reviews

- Updated Portfolio & Performance vs. the S&P 500

Table of Contents

- 1. Earnings Snapshots

- 2. The Trade Desk (TTD) – Analyst Notes & a Leader …

- 3. Zscaler (ZS) – Fortinet Earnings

- 4. AMD (AMD) – Earnings Review

- 5. Headlines

- 6. Macro

1. Earnings Snapshots

a. Datadog (DDOG)

I plan to publish a full Datadog review next week.

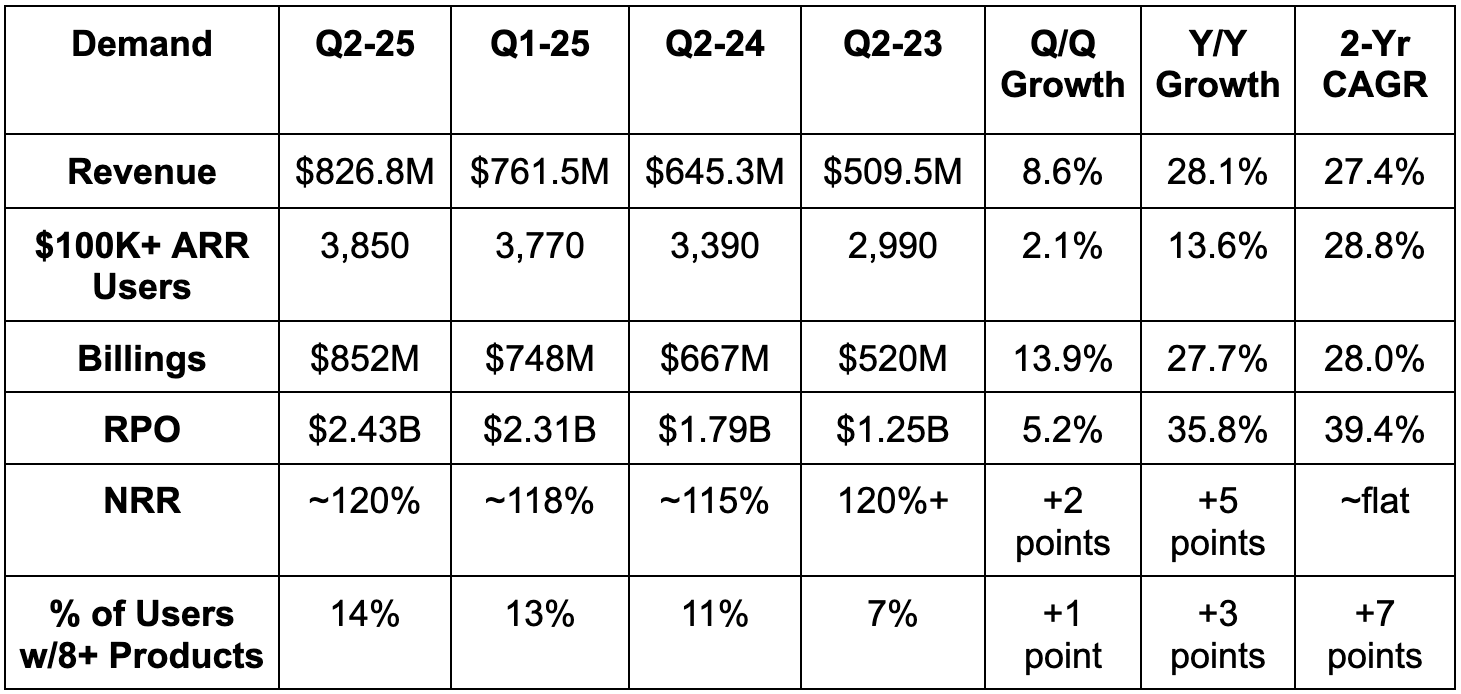

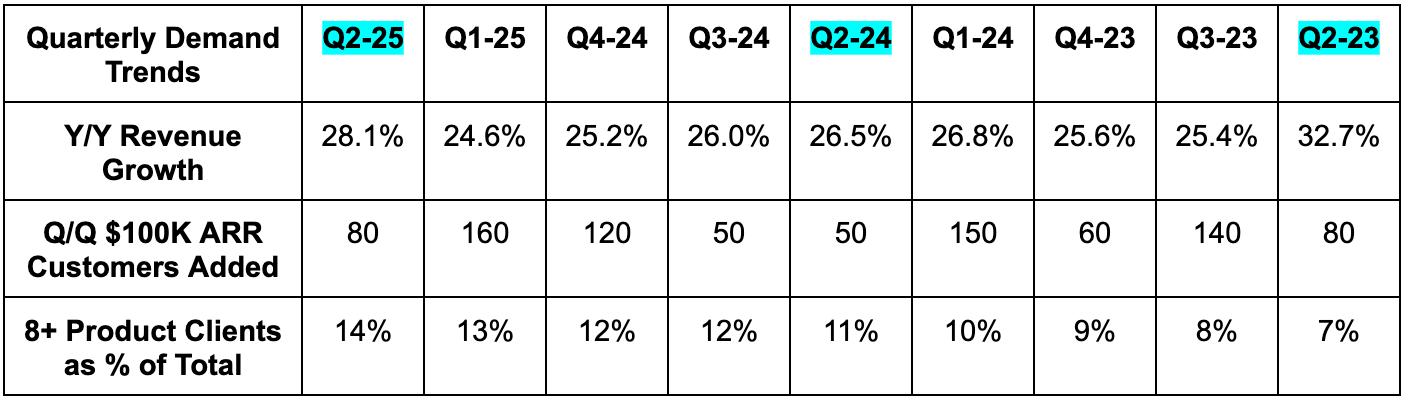

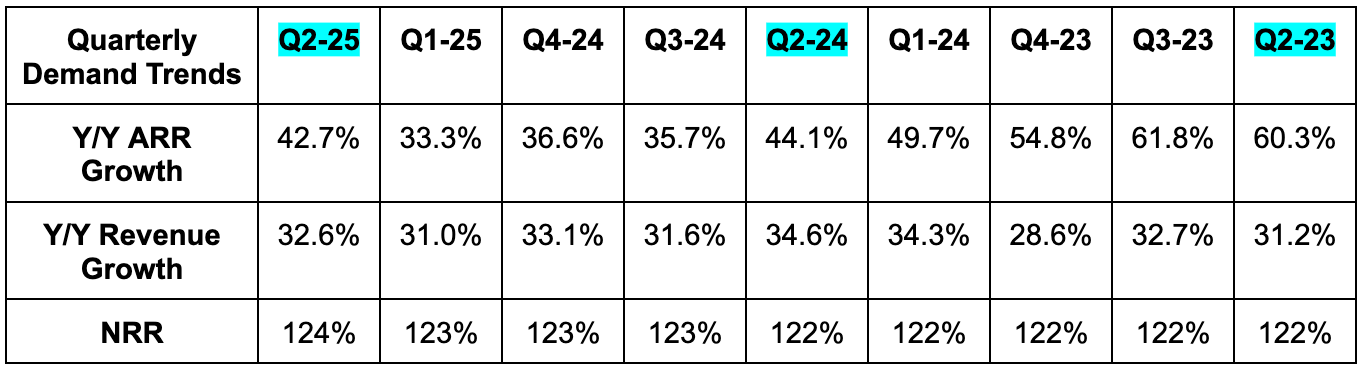

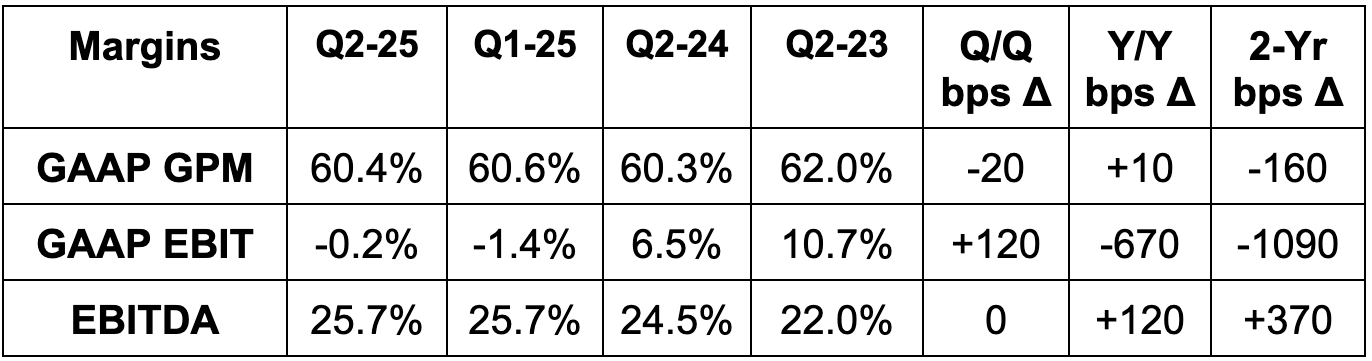

Demand:

- Beat revenue estimate by 4.5% & beat guidance by 4.8%.

- Beat billings estimate by 4.6%.

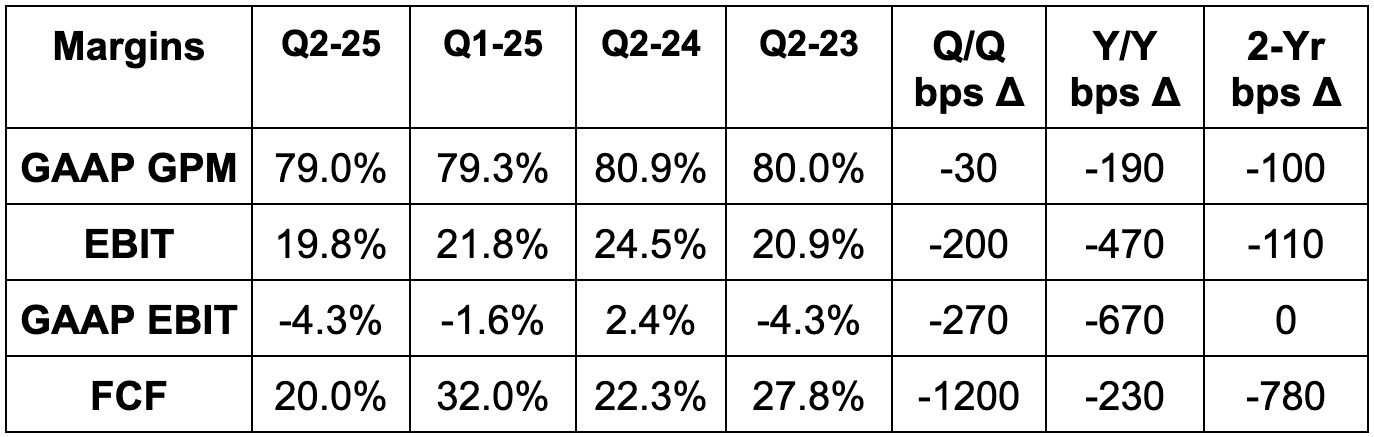

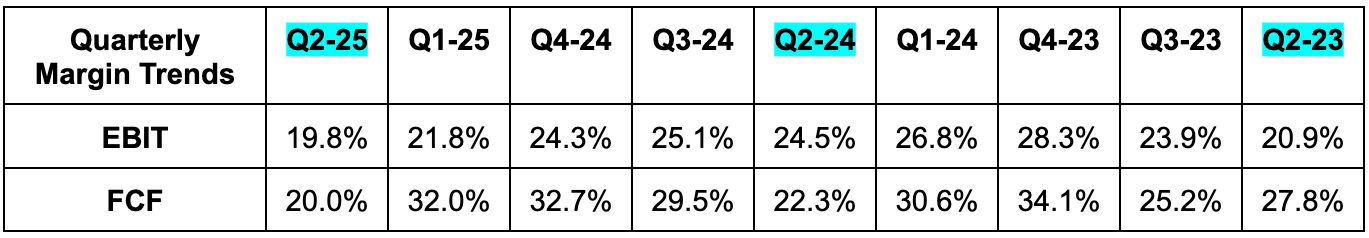

Profits & Margins:

- Beat EBIT estimates by 7.7% & beat EBIT guidance by 9.3%.

- Beat $0.41 EPS estimates & identical guidance by $0.04 each.

Balance Sheet:

- Nearly $4B in cash & equivalents.

- $981M in convertible senior notes.

- No traditional debt.

- Share count rose by 0.5% Y/Y.

Guidance & Valuation:

- Raised annual revenue guidance by 2.9%, which beat estimates by 2.4%.

- Q3 guidance was ahead by 3.5%.

- Raised annual EBIT guidance by 8.5%, which beat estimates by 6.3%.

- Q3 guidance was ahead by 11%.

- Raised annual $1.69 EPS guidance by $0.13, which beat estimates by $0.11.

- Q3 guidance was ahead of $0.41 estimates by $0.04.

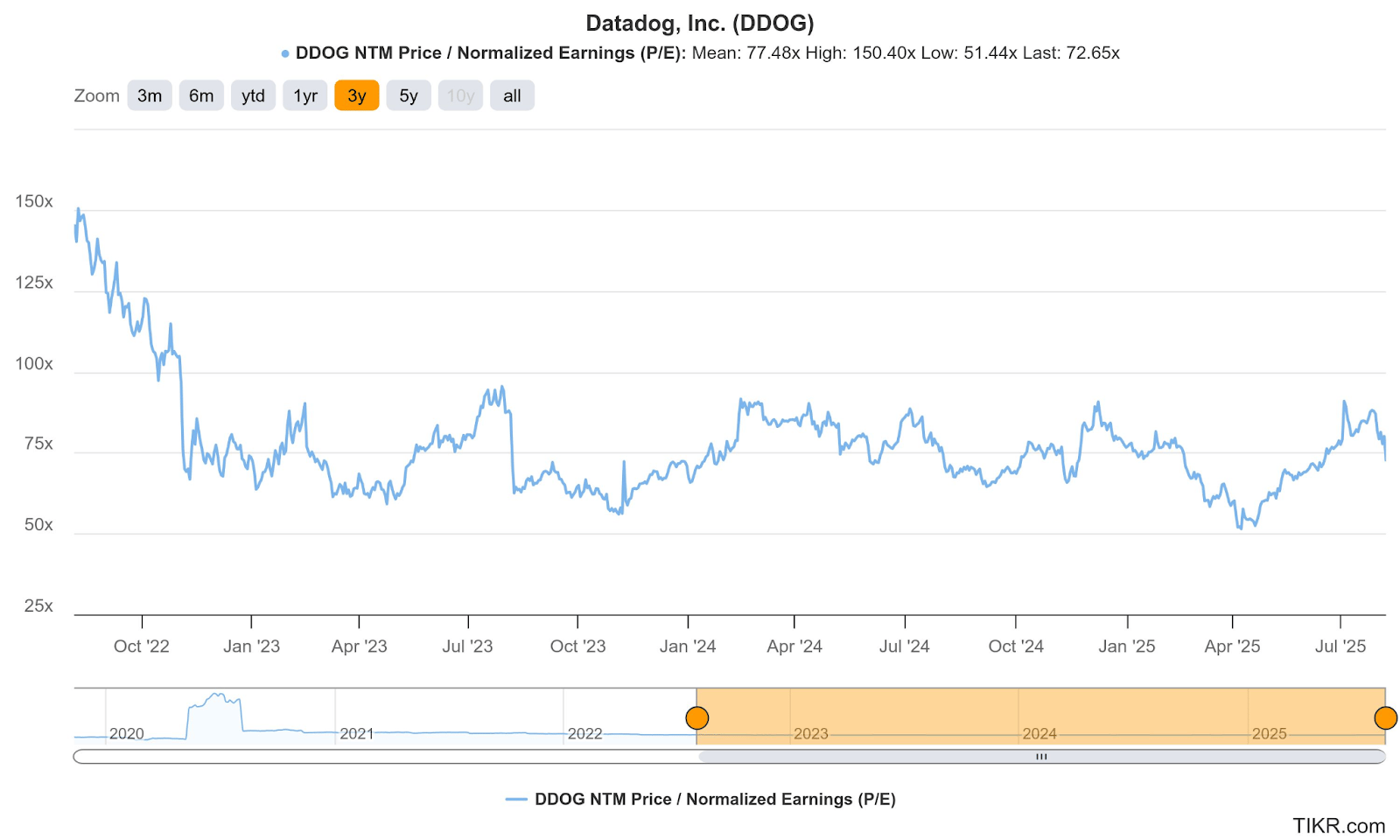

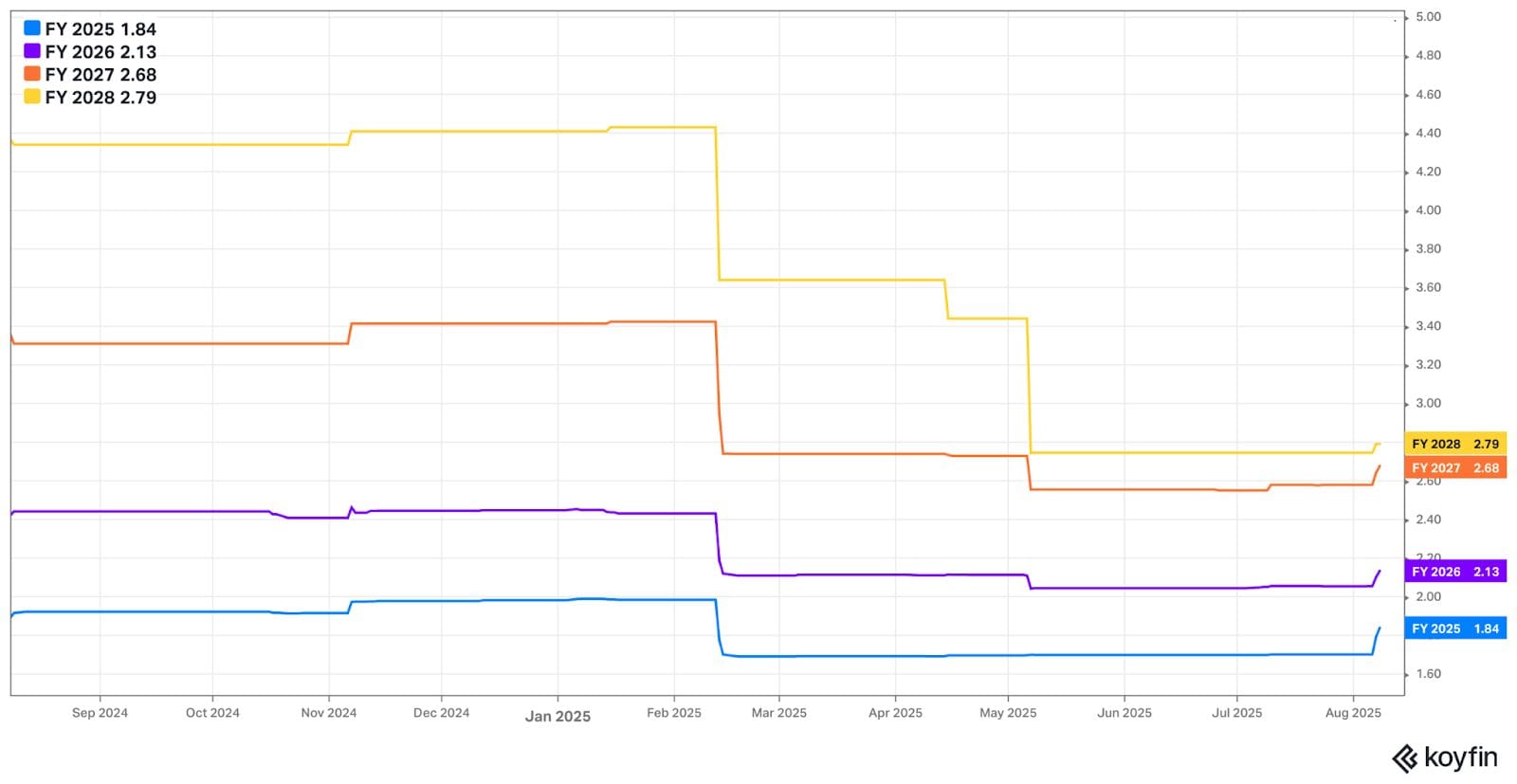

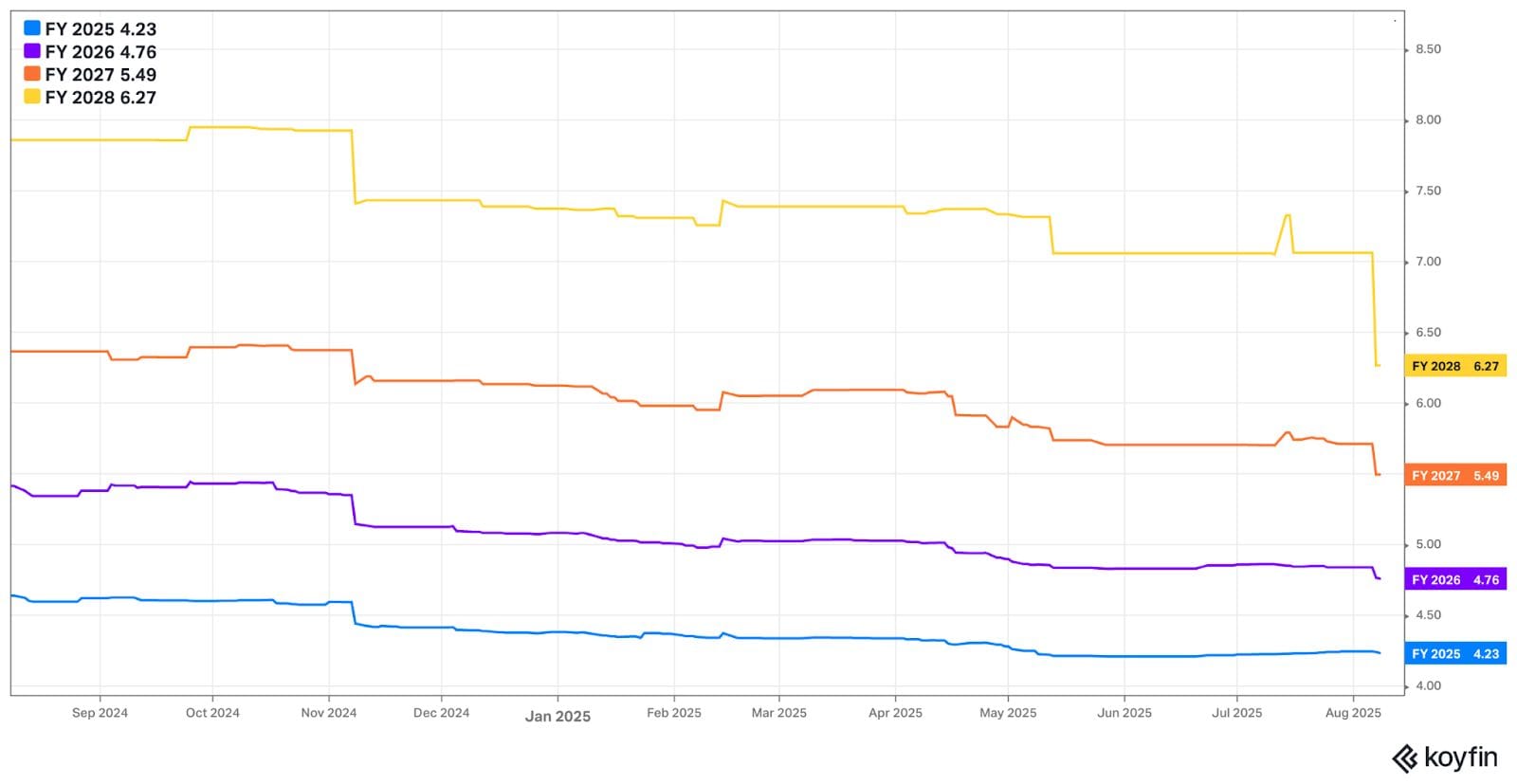

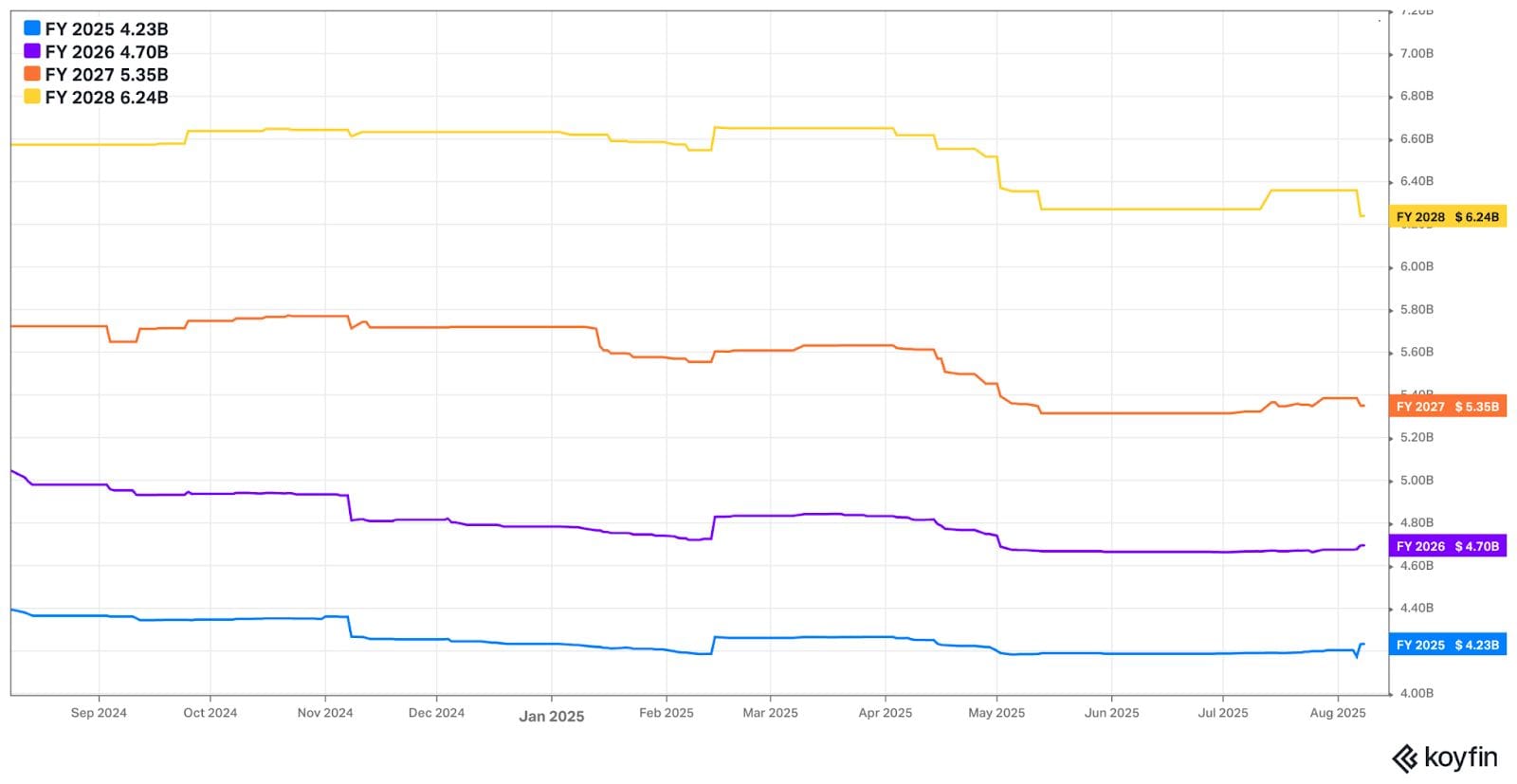

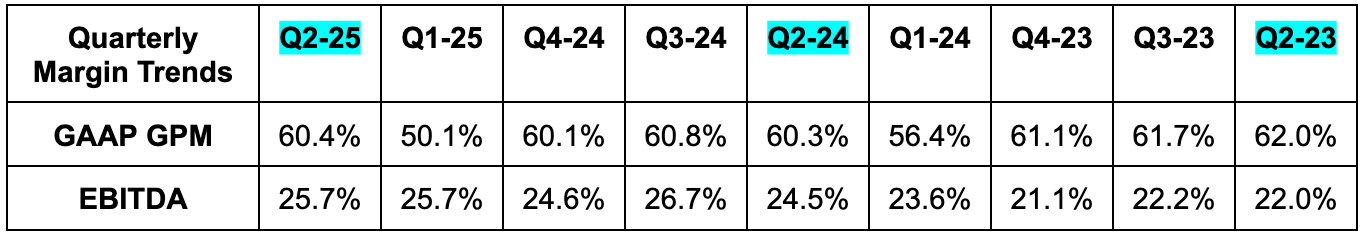

DDOG trades for 73x forward EPS. EPS is expected to grow by 2% this year, before resuming 23% compounding over the next two years. It also trades for 50x forward FCF. FCF is expected to grow by 7% this year before compounding at a 28% clip over the next two years. They’re in investment mode for 2025.

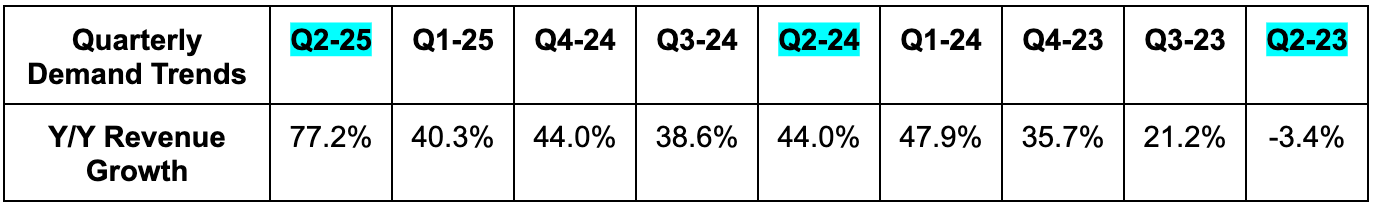

b. Airbnb (ABNB) – Earnings Snapshot

I also plan to publish an Airbnb review next week.

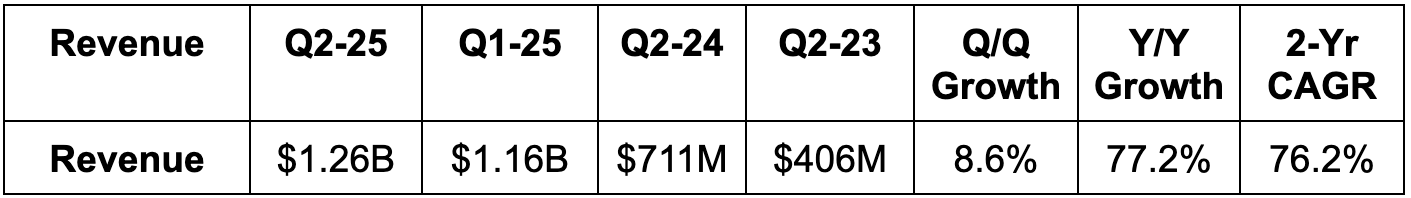

Demand:

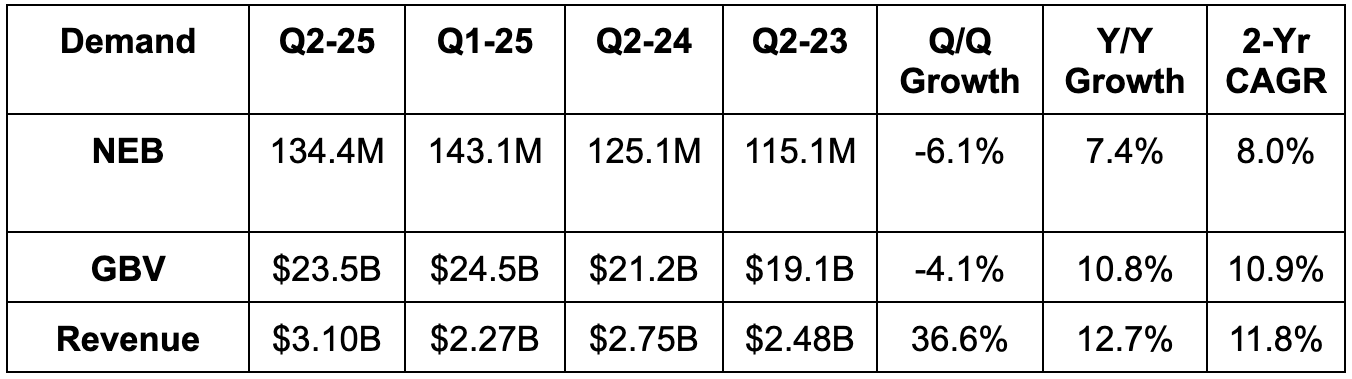

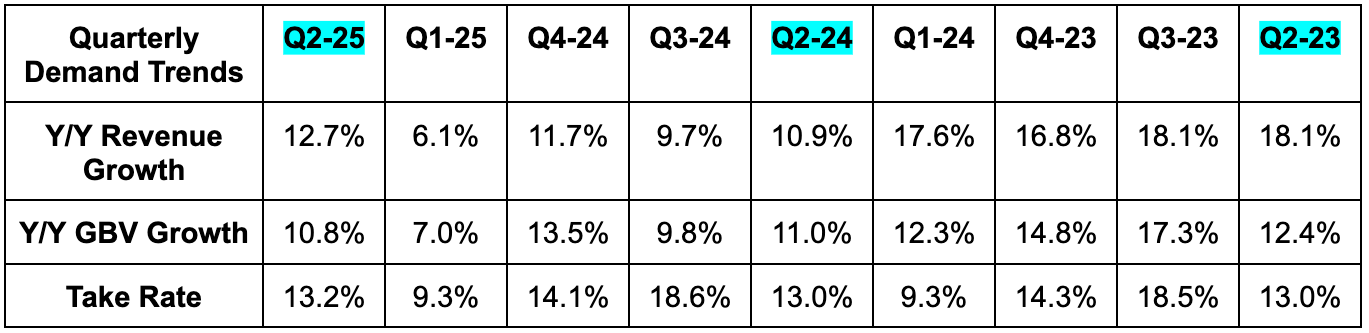

- Beat gross bookings value (GBV) estimates by 3%.

- Beat revenue estimates by 2.2% and beat guidance by 3.5%.

- Beat nights & experiences booked (NEB) estimates by 0.5%. NEB growth was expected to moderate from 8% Y/Y last quarter. It was a tenth of a point away from rounding up to 8%.

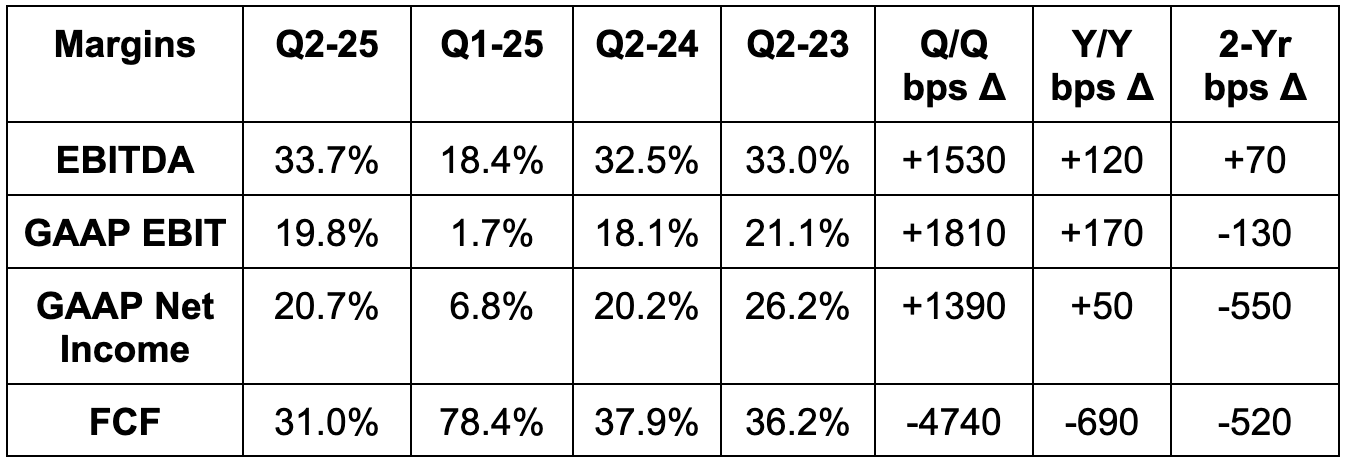

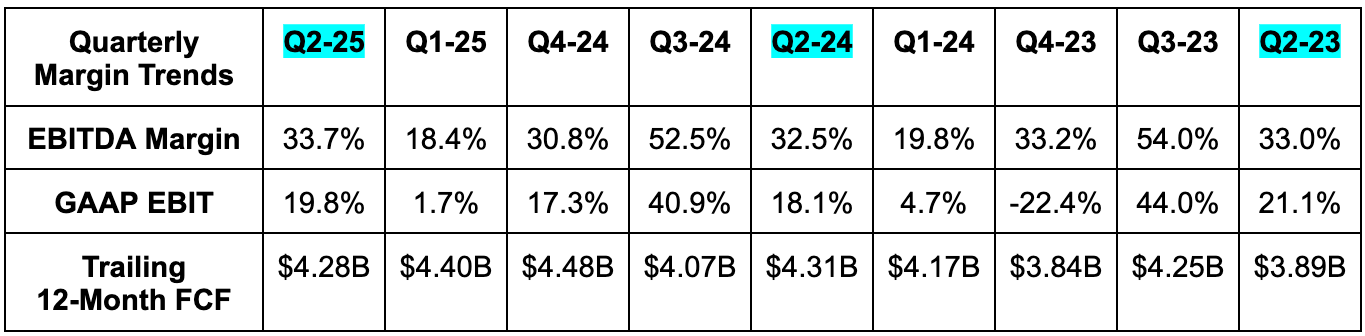

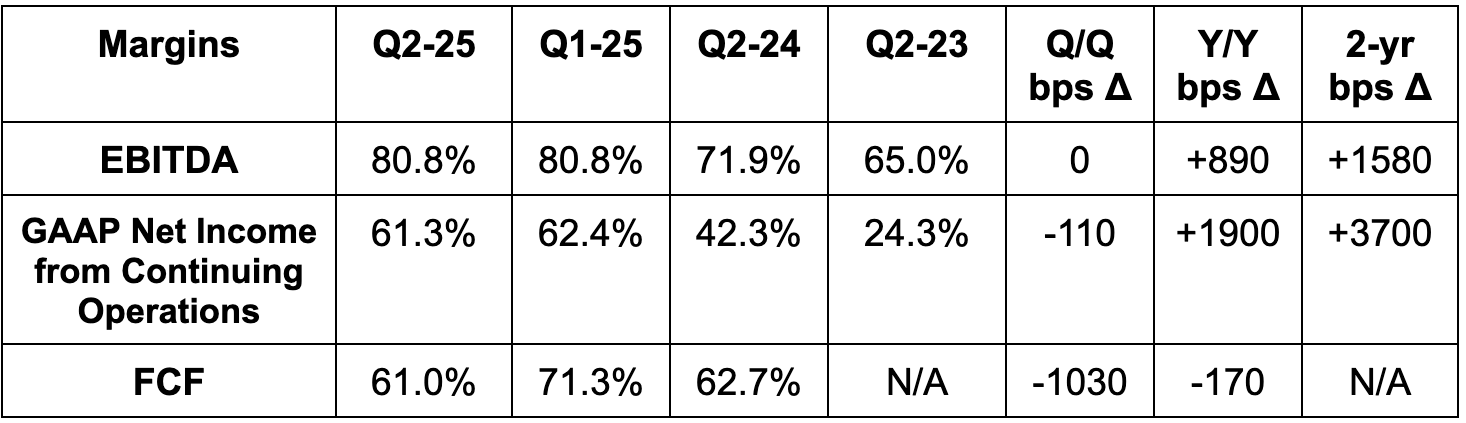

Profits & Margins:

- Beat EBITDA estimates by 7.5%.

- EBITDA margin expanded, which compares favorably to flat-to-down Y/Y EBITDA margin guidance.

- Beat FCF estimates by 4.2%.

- Beat $0.94 GAAP EPS estimates by $0.09.

Balance Sheet:

- $11.4B in cash & equivalents.

- $2B in total debt (which is current).

- Diluted share count fell by 3.1% Y/Y.

Guidance & Valuation:

Q3 revenue guidance was slightly better than expected. They also reiterated 34.5%+ EBITDA margin guidance for the year and called for $2B+ in Q3 EBITDA. This was at least 6.9% better than expected, although estimates just dipped from $2B to $1.88B right before the report.

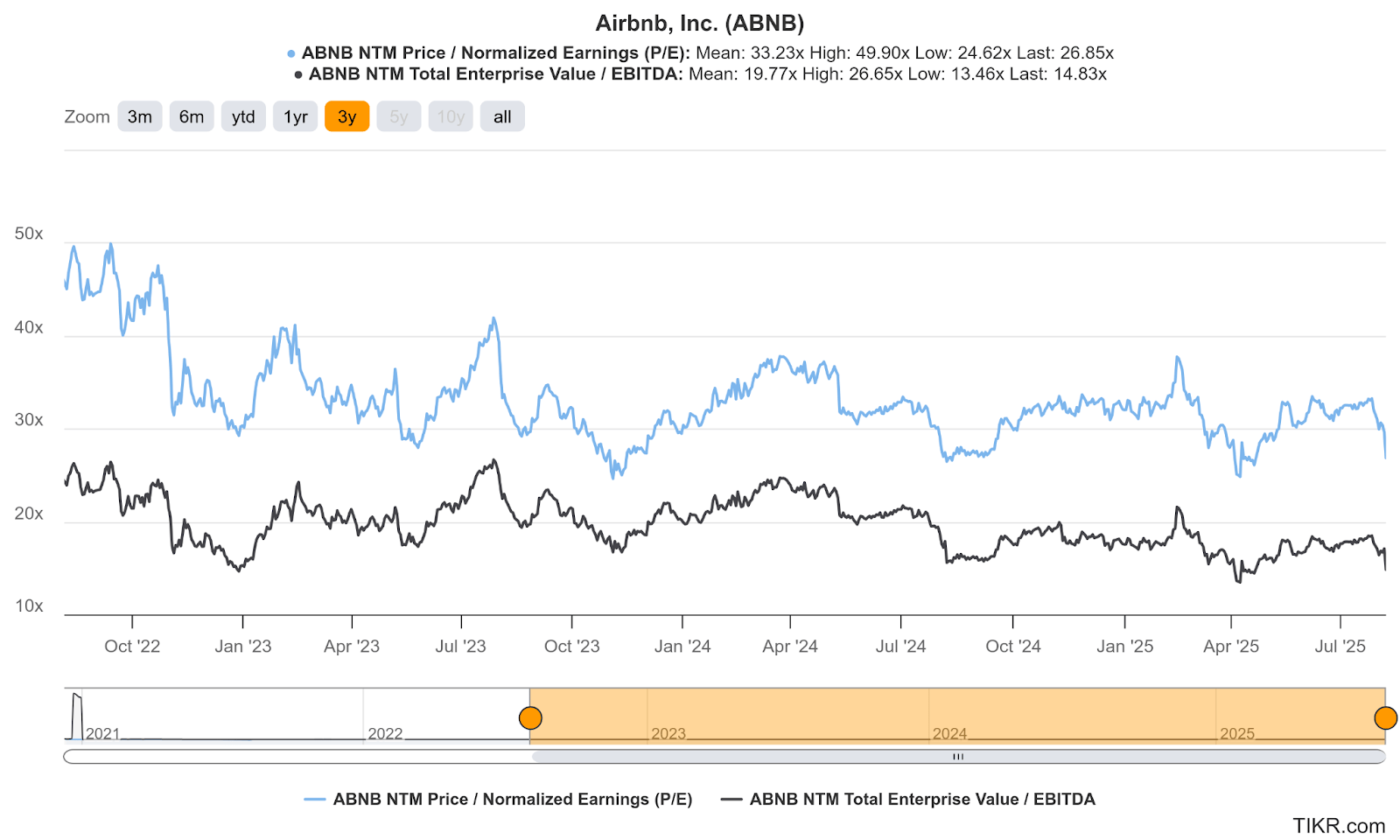

ABNB trades for 27x GAAP EPS and 15x EBITDA. GAAP EPS is expected to grow by 3% this year and 12% next year. EBITDA is expected to grow by 5% this year and by 11% next year.

c. AppLovin (APP)

Demand:

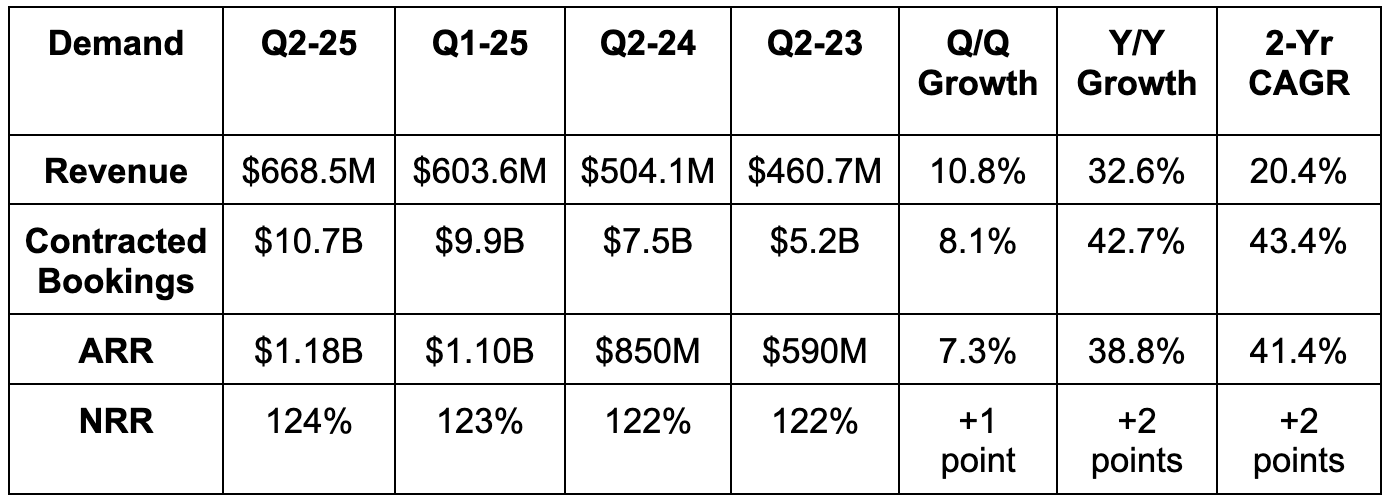

APP slightly beat revenue estimates & beat guidance by 4.6%.

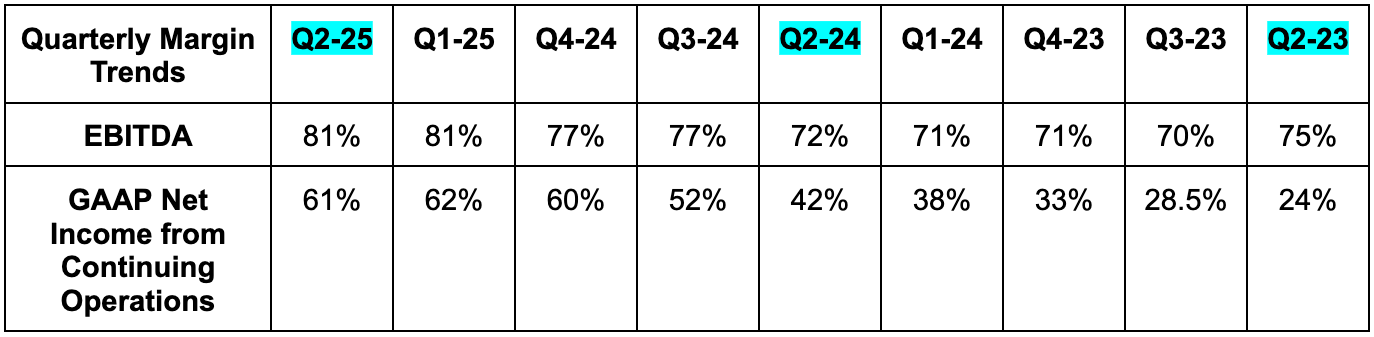

Profits & Margins:

App beat EBITDA estimates by 2% & beat guidance by 3.9%. Free cash flow missed estimates by about 5%. APP sold a business division recently and did not reconcile continuing operations numbers for Q2 2023 FCF. The comp is not apples-to-apples.

Balance Sheet:

- $1.20B in cash & equivalents.

- $3.5B in total debt.

- Diluted share count fell by 1.7% Y/Y.

Guidance & Valuation:

Revenue guidance was 2.3% ahead of expectations, while EBITDA guidance was 2.9% ahead of expectations.

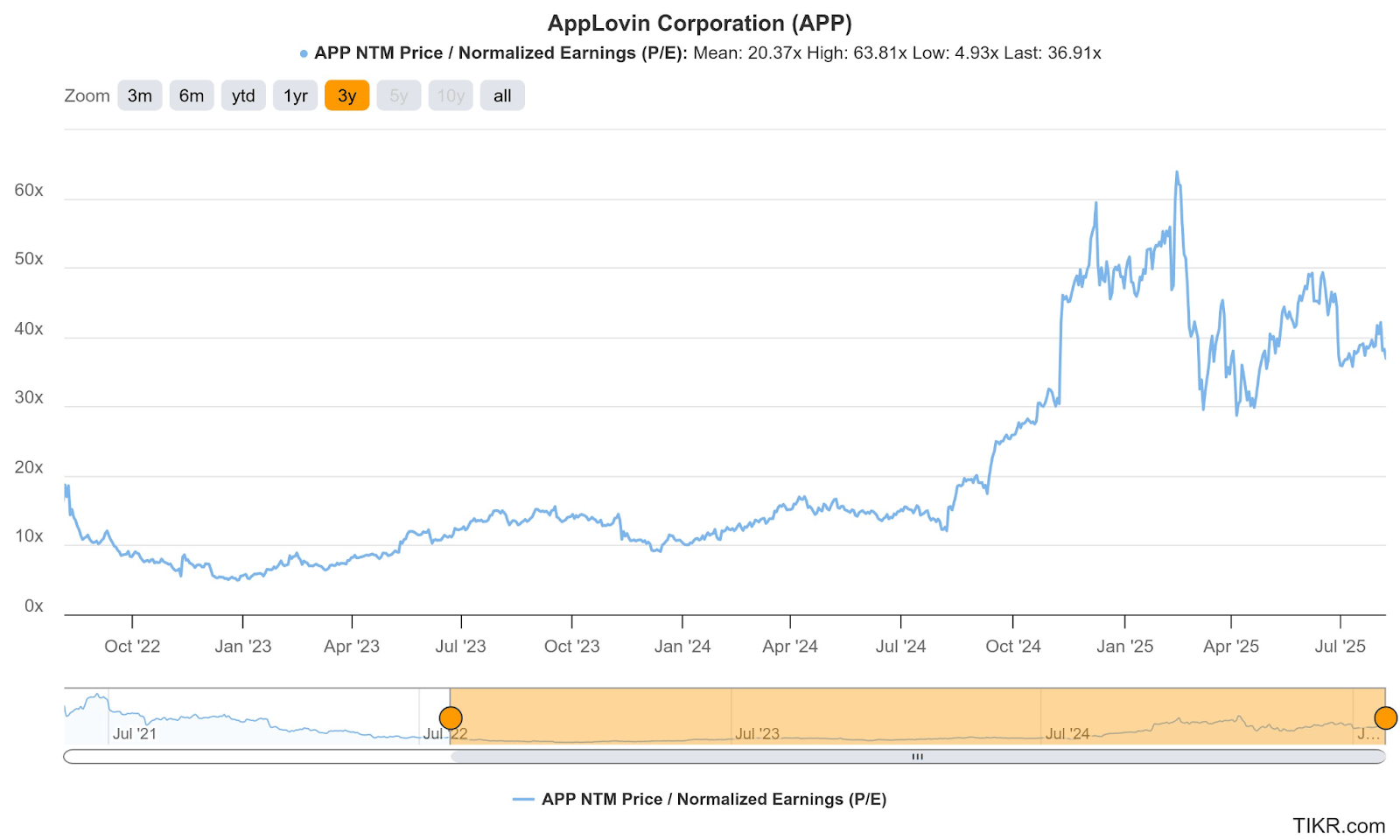

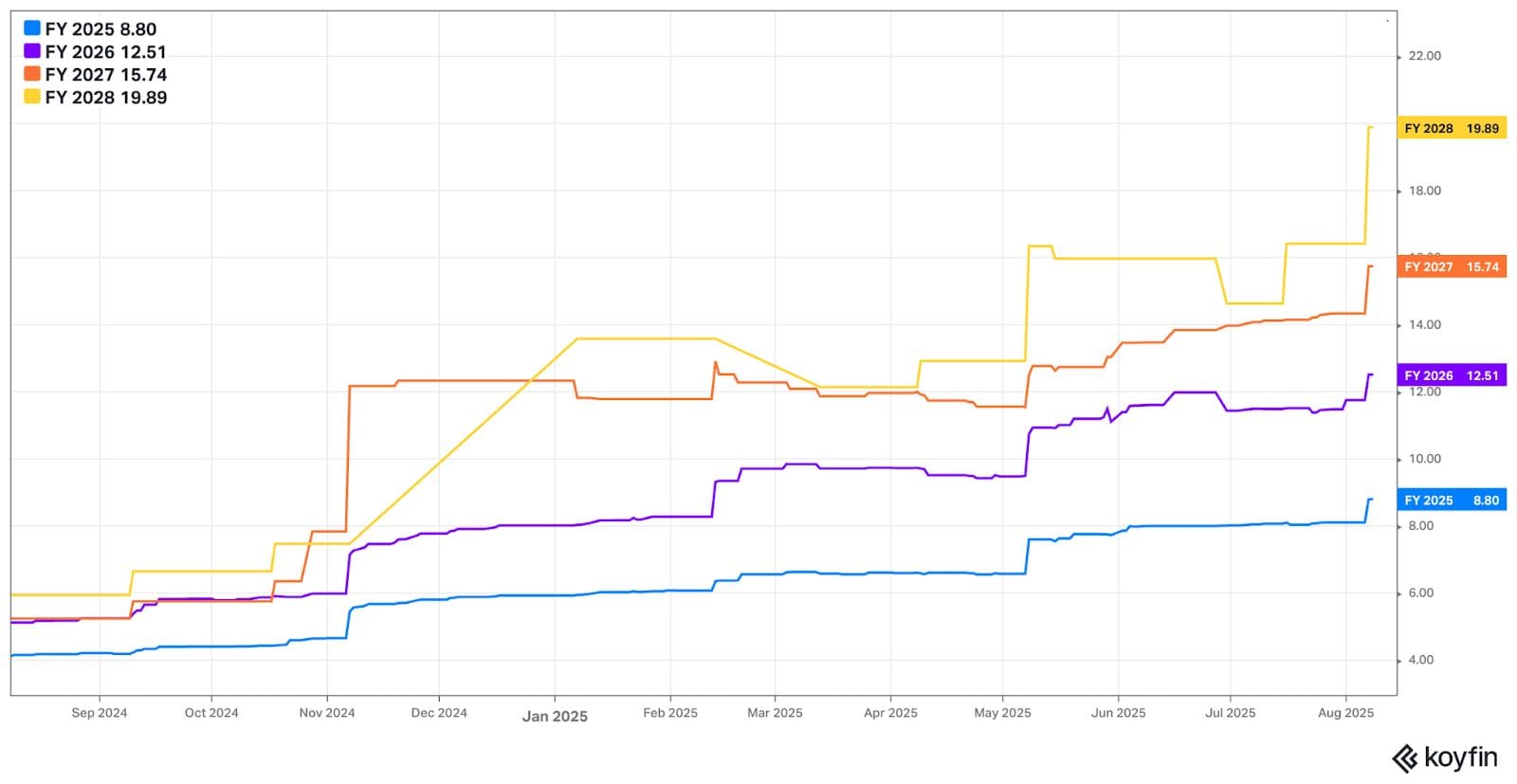

App trades for 37x forward EPS. EPS is expected to grow by 94% this year and by 42% next year.

d. Axon (AXON) – Earnings Snapshot

Demand:

Axon beat revenue estimates by 4.5% and beat annual recurring revenue estimates by 3.6%.

Profits & Margins:

Axon beat gross margin estimates by a point, beat EBITDA estimates by 7.5% and beat $1.47 EPS estimates. This included a $75M tax benefit. Performance awards for the leadership teams are greatly impacting GAAP margins.

Balance Sheet:

- $2.1B in cash & equivalents.

- About $2B in notes payable.

- Diluted share count rose by 6% Y/Y; basic share count rose by 3.4% Y/Y.

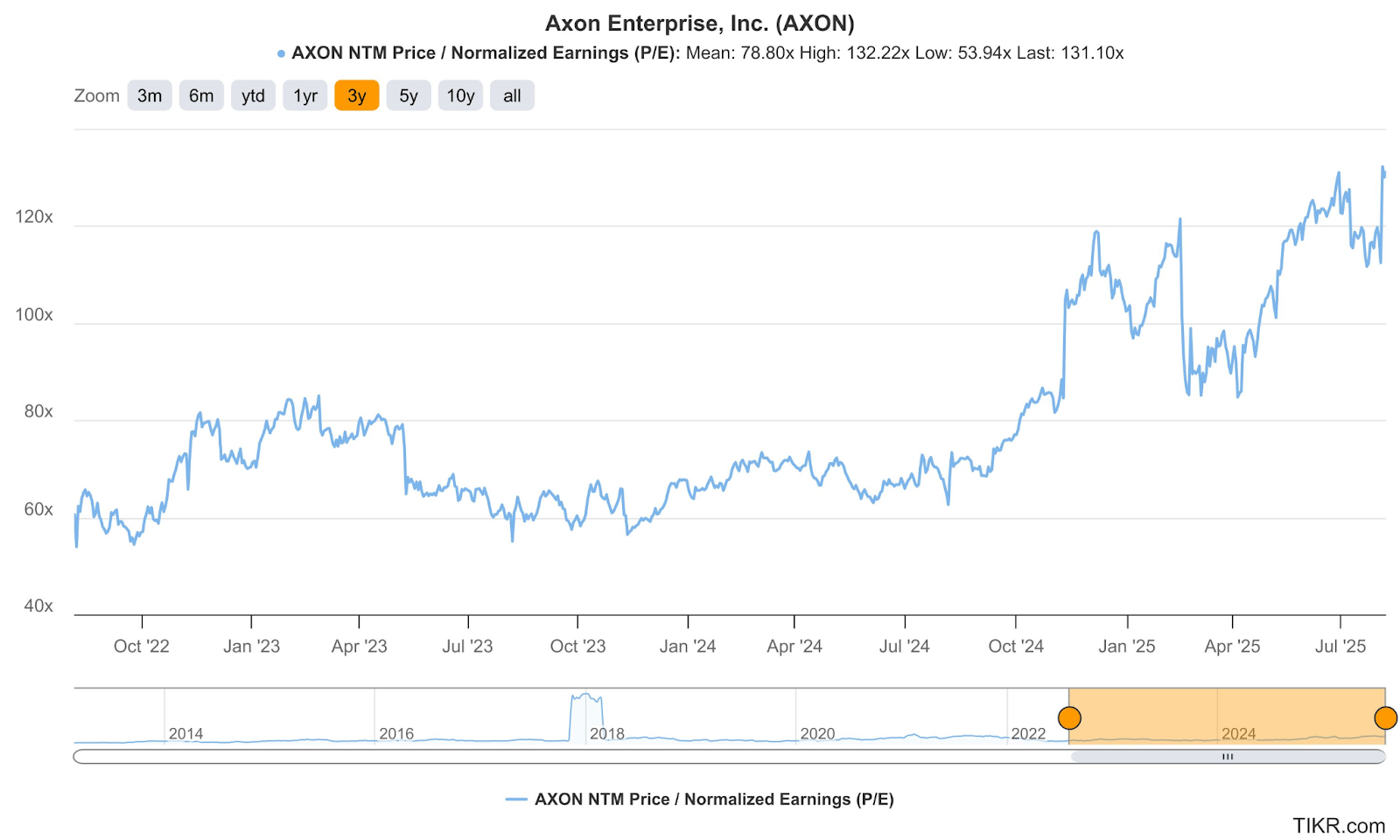

Guidance & Valuation:

Axon raised annual revenue guidance by 1.5%, which beat estimates by 1.1%. It also raised annual EBITDA guidance by 1%, which slightly missed estimates.

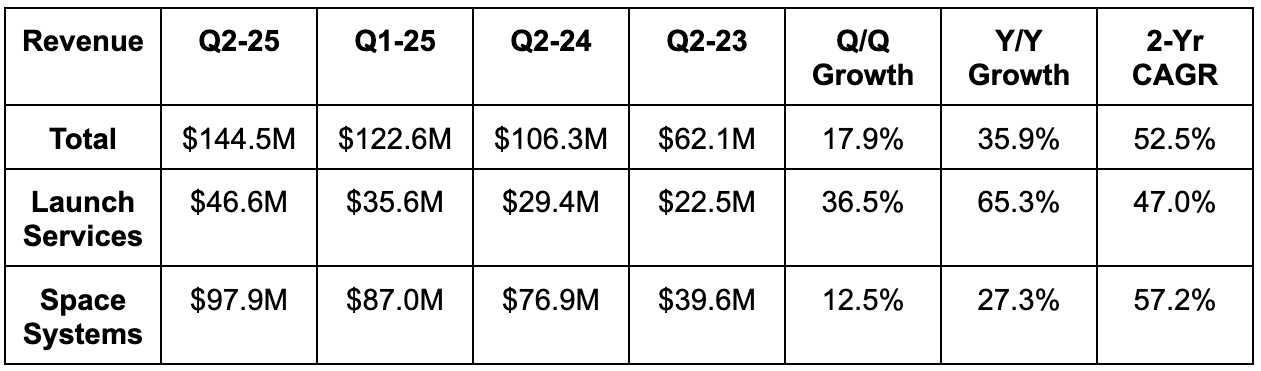

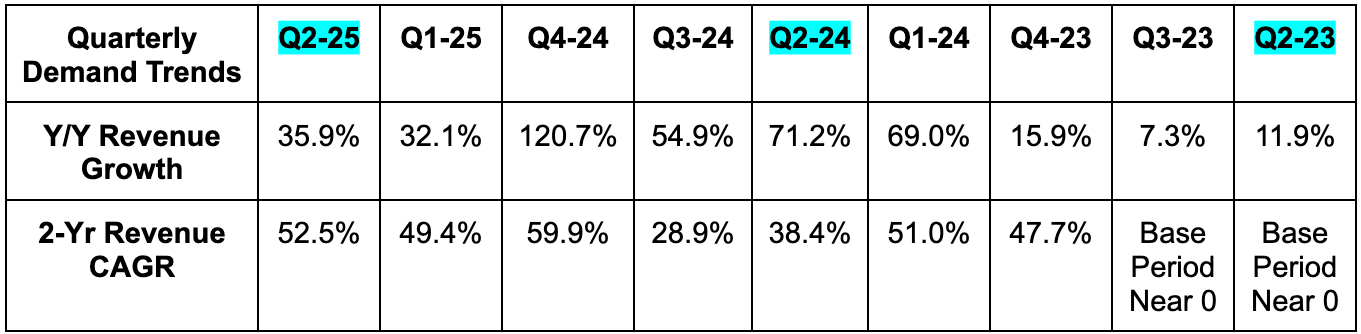

e. Rocket Labs (RKLB) – Earnings Snapshot

Demand:

Rocket Labs beat revenue estimates by 6.7% & beat guidance by 7%.

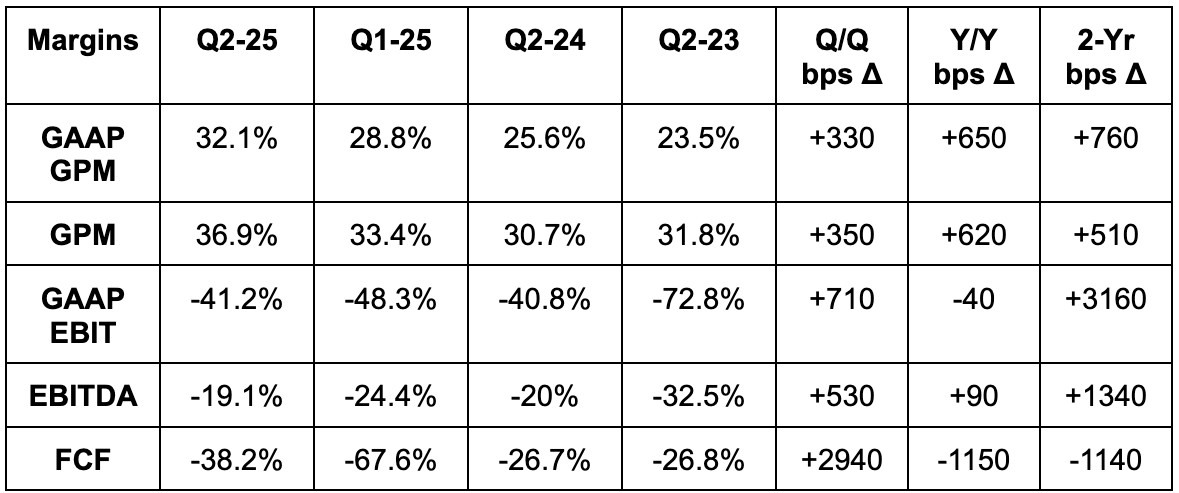

Profits & Margins:

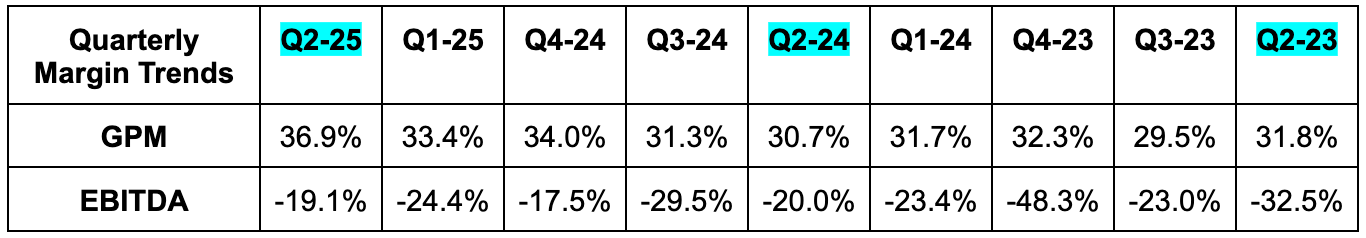

- Beat 31% GAAP GPM guidance by 110 bps.

- Beat 35% GPM guidance & identical estimates by 190 bps.

- Missed -$55.2M GAAP EBIT guidance by $4.4M.

- Beat EBITDA guidance by 4.9% & beat estimates by 11%.

- Met -$0.08 EPS estimates.

Balance Sheet:

- $564M in cash & equivalents.

- $56M in year-to-date CapEx.

- $347M in convertible senior notes.

- 4.2% Y/Y share dilution.

Guidance & Valuation:

- Revenue guidance slightly missed estimates.

- EBITDA guidance missed by 6%.

- GAAP EBIT guidance missed by 4.5%.