Today’s Article is Powered by Savvy Trader:

1. Duolingo (DUOL) -- Q2 2023 Earnings Review

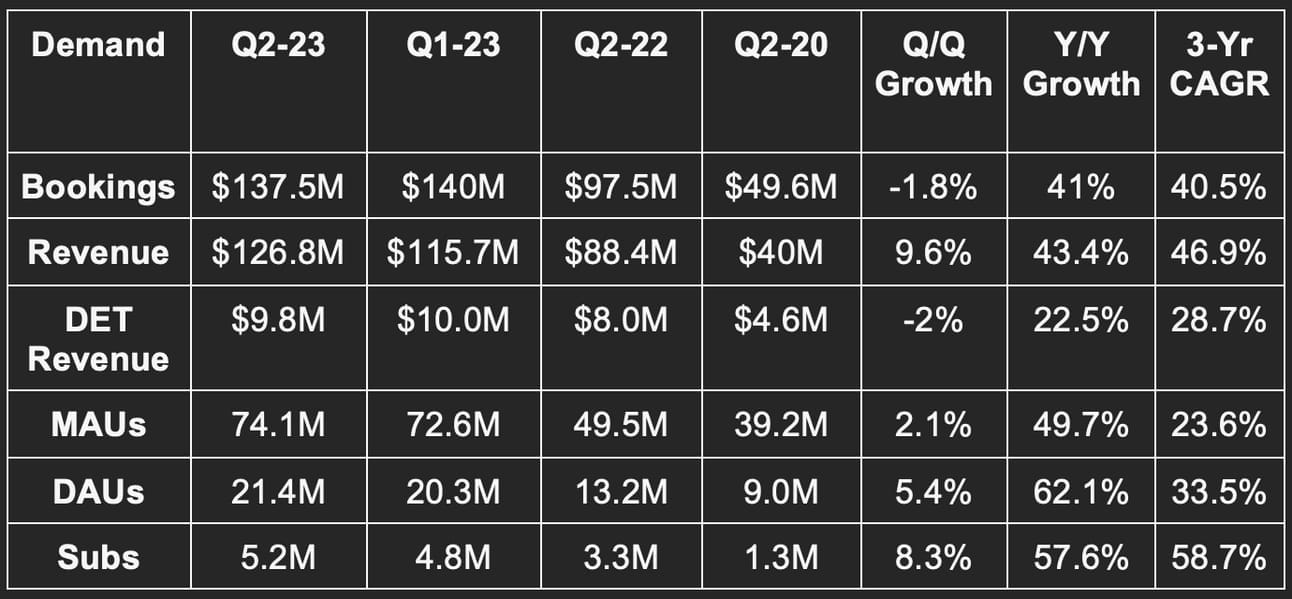

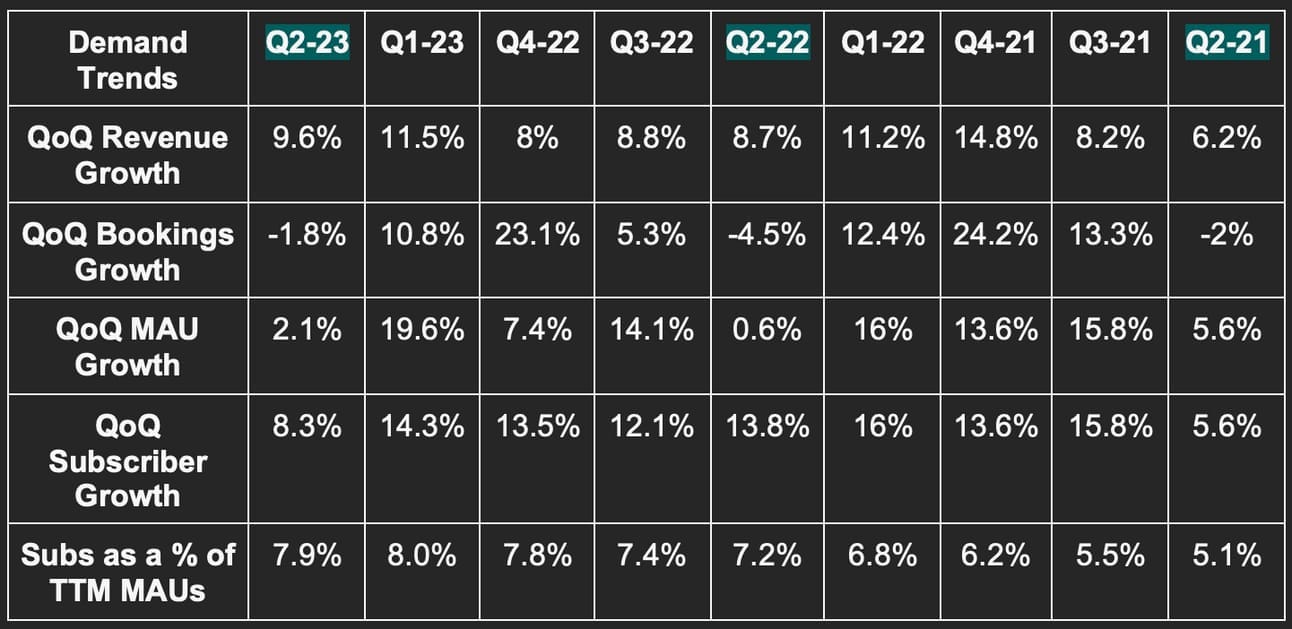

a) Demand

- Beat bookings guidance by 6.2%.

- Beat revenue estimates by 2.5% & beat guidance by 2.6%.

Demand Context:

- Advertising revenue rose 16.4% Y/Y to reach $13.1 million. Rapid growth is being driven by subscriptions and Duolingo English Test to a much lesser extent.

- Other revenue (which is made of in-app purchases on virtual goods) more than doubled Y/Y to reach $8.8 million. Impressive, and soon will be quite material to overall results.

- Subscriptions = 75% of revenue vs. 76% Y/Y.

- 46.9% 3-yr revenue CAGR vs. 60.3% Q/Q & 64.8% 2 quarters ago.

- DAUs as a percent of MAUs set a new record of 29%.

Someone reached out to us claiming a Q/Q bookings decline from Q1 to Q2 was a reason to be bearish. They simply needed to revisit historical financials to know they were wrong. This happens every year and is related to marketing spend timing as well as consistent seasonality. Nothing to see here.

b) Profitability

- Beat EBITDA estimates by 48.2% & beat guidance by 48.2%.

- Beat GAAP EBIT estimates by 46.7%

- Beat -$.20 GAAP EPS estimates by $0.28; Interest income helped this turn positive for the quarter. Regardless, margin expansion would have been rapid. And furthermore, the hefty interest income is a luxury that a cash-rich, debt-free firm like this one has earned.

c) Balance Sheet

- $608M in cash & equivalents.

- No debt.

Share count rose by 5% Y/Y as IPO-related awards continue to dilute shareholders. This is the ONLY negative to pick at amid a sea of positives. Share count growth has slowed and needs to slow further as it’s expected to. A buyback here would be tempting, but the reinvestment opportunities remain extremely compelling. It can likely do both. Between all outstanding options, there is a potential for 17% additional total dilution. This 17% will vest over the coming years. Vitally, it reiterated 2% share dilution for 2023 with that modest pace of growth expected to continue thereafter (not assuming any buyback program).

d) 2023 Guidance

- Raised 2023 bookings guidance by 2.8%. The company now expects 33.5% Y/Y growth here.

- Raised 2023 revenue guidance by 1.7%.

- Raised 2023 EBITDA guidance by 28%. It raised EBITDA margin guidance by a full 300 bps.

The quarter and guidance led to a 2023 EPS estimate boost from $1.37 to $1.85, a 22% boost to EBITDA estimates and a 1.6% boost to revenue estimates. Strong.

e) Call & Letter Highlights

Mainly Organic Growth, But Also a Marketing King:

The vast majority of Duolingo’s user growth continues to come from organic word of mouth. This is fully expected to be the case going forward as its spend on paid user acquisition remains miniscule. It has obsessed over product first since inception to build the most engaging and impactful app possible. That’s how it thought it could best and most sustainably grow… and it was dead right.

When DUOL does lean into marketing, it does so in a creative and uniquely effective manner. It calls this approach “Social-First Marketing.” The idea is to infuse its brand into pop culture events like the Barbie Movie premier (which Duo attended). It was even referenced in the hit film as an “inbound request” (!) from the makers. It also utilizes social media heavily to generate virality at very low cost (just the social media team’s salary) user growth. It never tries to directly sell the app with campaigns, but rather builds buzz (or hoots). Fans and users routinely use this content for inspiration which merely amplifies the impact. All in all, social impressions for Duolingo are up 150% Y/Y and that’s a large source of its outperformance.

DUOL has gleaned key insights from this engaged marketing approach in important growth markets like China. For example, China loves Lily (one of its characters) while the rest of the world loves the Duo Owl mascot the most. So? It’s shifting marketing content to emphasize Lily in the PRC.

Engagement also remains strong with retention stable despite rapid growth as well as growing instances of long user streaks.

Margins:

Duolingo pushed some Q2 marketing spend to the second half of the year. Without this help, EBITDA margin would have been 15% and ~only~ expanded by 1020 bps Y/Y. This was Duolingo’s first quarter with incremental EBITDA margins above its target range of 30%-35%

Revenue per Subscriber:

Revenue per subscriber fell by 7% Y/Y. This is solely driven by foreign exchange (FX) headwinds and also pricing changes in some geographies Q3 of last year. Average revenue per user (ARPU) will turn flat sequentially in Q4 and resume positive growth thereafter.

Duolingo Max (More Expensive Subscription Tier) & Generative AI:

Duolingo continues to aggressively split test the planned Duolingo Max subscription tier. Current pricing is 2x that of the existing tier but is fluid at the moment and that could change. It’s working hard on “Roleplay” (conversational practice) to add more complex dialogue while adding new tools like “In-Lesson Coaches” with Generative AI to help learners. All in all, “the reception has been very good so far” per Luis.

Beyond the new subscription tier, Duolingo is actively building Generative AI into its content processes to expedite and enhance pace of lesson creation.

TAM:

A big concern for Duolingo is how large the language learning market truly is. Well? Really Big. It’s large and Duolingo has a vast digital market share lead. Specifically, the industry is $50 billion in size. But there are three interesting additions here:

- 80% of Duolingo users are brand new to language learning. It’s directly growing the market.

- It sees user growth above its 25%-30% range pre-IPO for the foreseeable future and a long-term slowing towards that range. 25%+ user growth is still excellent and expansion will be faster than that for the next several quarters if not years.

- Most of the TAM is for complex English learning. Duolingo does not have all of the content it needs to support these advanced learners. It will launch a large content update later this year that it thinks will close this gap and unlock a majority piece of the TAM.

Math App:

“We’re very happy with progress so far. The app’s growth looks a lot like early Duolingo.” – Co-Founder/CEO Luis von Ahn

f) Takeaway

Another flawless quarter from Duolingo. What else is new? While forward multiples are stretched, the estimates forming those multiples are woefully low in our view. So? We’re fine with capital appreciation as we don’t think actual forward multiples are remotely close to where the sell side thinks they are. This company is killing it. Rapid growth, rapid operating leverage, successful expansion into new products and an ideally organic source of growth. Such an easy company to own. Go owl go.

2. Upstart (UPST) -- Q2 2023 Earnings Review

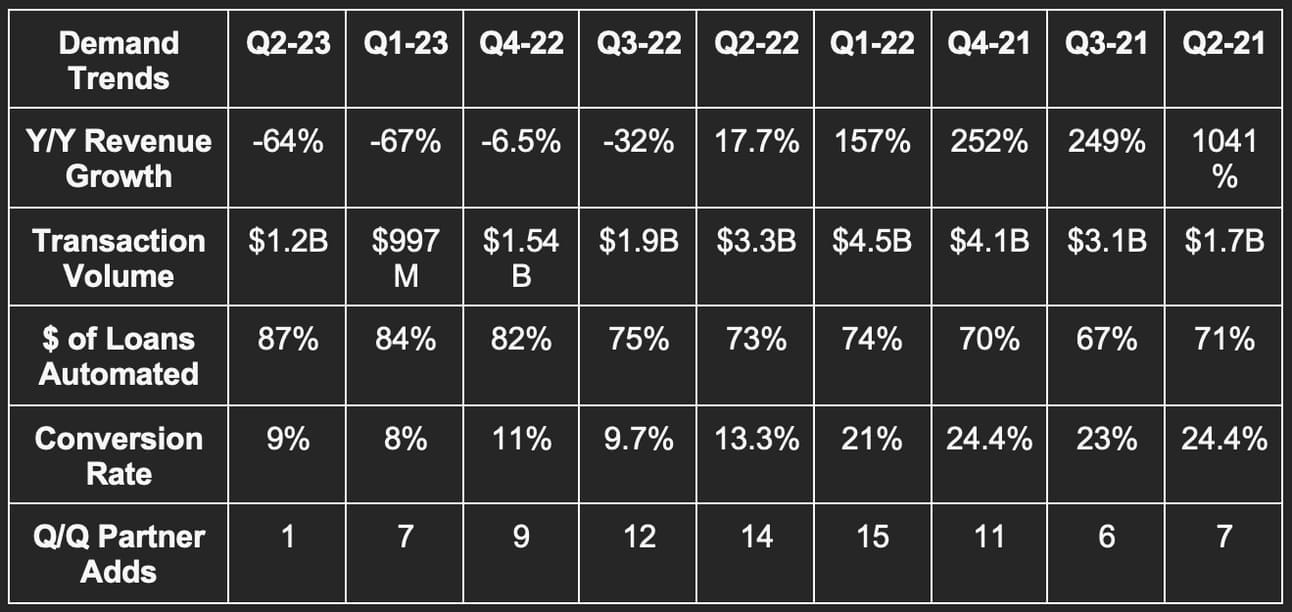

a. Demand

- Beat revenue estimates by 0.4% & beat guidance by 0.6%.

- Beat fee revenue guidance by 11%.

Demand Context:

Conversion rate is being slammed by soaring interest rates and diminished funding supply appetite. Some borrowers are being priced out of credit while others are more frequently declining more expensive offers.

b. Margins

- Beat contribution margin estimate by 670bps.

- Beat $0.5M EBITDA estimate by $4.5M & beat guidance by $5M.

- Beat GAAP EBIT, GAAP EPS & EPS estimates comfortably.

Margin Context:

- Contribution margin is elevated mainly because nobody is willing to fund their loans and because it greatly reduced its marketing spend in light of this reality.

- A new record for loans fully automated also helped contribution margin. This was a positive source of the strength. This factor is encouraging and points to Upstart’s ability to leverage more volume from its fixed cost base when the environment improves.

- Operating expenses fell 35% Y/Y.

- Upstart took another $7 million out of its fixed cost base during the quarter with $17 million in permanent savings identified year to date.

c. Guidance

- Missed revenue estimate by 10%.

- This includes -$10 million in net interest income via continued fair value markdowns of the loans on its balance sheet.

- Sharply missed EBITDA estimates by over 60% or about $4 million.

- Missed -$0.38 GAAP EPS estimates by $0.07.

- A small adjusted net loss vs. expectations of modest adjusted net income.

- A 65% contribution margin.

A large portion (over 50%) of Upstart’s balance sheet credit is from older loans issued for research & development purposes (mainly within Auto). Charge-offs on these loans are soaring while loss rates spike higher. That will likely lead to more fair value markdowns in the coming quarters. Note that while the balance sheet loan reduction is encouraging, the cause is not encouraging and contributed to the decline. In fairness to them, loan sales did help too.

“When we are finally clear of the environmental turmoil around us, we are convinced that our business will be as formidable as ever.” -- Co-Founder/CEO Dave Girouard

d. Balance Sheet

- $443 million in cash vs. $790 million Y/Y (and it’s no longer profitable and won’t be next quarter either).

- $930 million in debt.

- $837 million in loans at fair value vs. $623 million Y/Y. The rise Y/Y is not ideal, but this position did fall from $1.01 billion Q/Q. The 17% sequential decline in loan balance was a 14% decline when excluding the impact of fair value markdowns. Ideally, this balance would be much smaller, but the team is making a “rational economic decision in the current environment” and using its own balance sheet to plug gaps on compelling credit. We vividly remember Upstart in its S1 flexing an ability to sell 98% of its origination volume. My how times have changed.

- The company reiterated its funding supply of $500 million per quarter from committed partners. It told us that it signed on new committed capital partners but will not raise that $500 million rate.

e. Call & Release Highlights

Committed Capital:

Upstart added another committed capital partner after Q2 ended with more conversations ongoing. With this committed funding, it closed on a securitization deal in July at credit spreads better than the Y/Y period. To be candid, spreads couldn’t have gotten much worse than last year. Interestingly, the $200 million ABS deal came from its balance sheet in a move that will help to alleviate liquidity fragility next quarter. That’s a positive. It said it did this to “reset market understanding of how recent vintages should perform” and to try to build capital market confidence that it has righted its mistakes.

More balance sheet relief is needed but may not be coming as quickly as we’d hoped. Why? All in all, it used about $800 million in committed capital this quarter between securitizing old originations and funding new credit. As part of this secured capital, it had to risk share on $40 million of its own funding. It views this $40 million investment as worth about $52 million today. The entire point of the committed capital arrangements was to diminish balance sheet pressure and fragility. If it needs to allocate capital every time this funding is accepted, that will materially dilute the benefit. The originations from this committed capital are performing as expected.

Macro:

The company that thought it was uniquely immune to macro and credit cycles in 2021 continues to mightily struggle with the less favorable part of this current cycle. Macro headwinds and a much higher benchmark Fed Funds rate are resulting in Upstart pricing its 36% APR limit and so declining borrowers. Borrowers below the 36% limit are more commonly rejecting offers due to more expensive rates. When combining that with an extremely minuscule partner and capital market appetite for its credit, we’re left with this quarter’s (and this year’s) challenged results. Borrower demand remains sky high. It’s just not able to presently take advantage of this demand. This is unfortunate considering that competition like Pagaya had the funding sources in place to keep growing this quarter.

Upstart’s macro index continues to deteriorate. Regardless of a strong labor market, savings rates are not rising as all earnings are being spent.

“In particular, until we see a definitive inflection and reversal in the trajectory of the macro index, we will continue to err on the side of being very conservative in our assessment and pricing of borrowers.” -- CFO Sanjay Datta

Parallel Timing Curve Calibration:

Upstart announced a patent pending risk algorithm process called “Parallel Timing Curve Calibration.” One of the bottlenecks of rapid credit risk model development is that you need to actually observe how the loans from that model perform overtime. Otherwise, it’s all theoretical with model quality lacking real-world, supporting evidence.

Upstart believes that this new model calibration technique will vastly boost the cadence of model introductions and enhancements. How? Now, new models will be able to pull from all existing credit to “predict how all outstanding platform loans will perform in the coming months.” This means a larger seasoning sample size and faster improvements.

Underwriting & more on Capital Markets:

Upstart continues to think that its risk models are “properly calibrated” and have been since late last year. It also sees new loan cohorts will deliver “at or above target returns.” As you can see from the image below, its realized returns on loans continue to re-approach target returns after about a year of underperformance. It will be interesting to see if this year of underperformance will be forgiven by fickle capital markets as macro improves. We’re uncertain. Hedge funds don’t easily forgive.

Furthermore, its credit bands remain better at predicting defaults than FICO-only models. It’s worth noting, however, that no other lender is only using FICO scores in their underwriting models today. There are more variables being used everywhere. I repeat: Everywhere. That is a very important caveat as it makes this comparison perhaps unfairly easy for the company:

“The ongoing supply of loans on offer in the secondary markets by sellers anxious for liquidity contributes to a challenging market dynamic. Loan books are being sold at bargain prices and creating no shortage of buying opportunities for investors. Our view is that it will take some time for the market to work its way through this surplus of cheap available yield.” -- CFO Sanjay Datta

Auto Loans:

- Added its second & third auto retail lending partners.

- Added 12 more states to its auto lending footprint to now cover 65% of the U.S. population today.

- It now has 61 dealerships offering Upstart Auto Loans vs. 39% Q/Q.

Small Dollar Loans:

Upstart added expected cash flow data to its small dollar underwriting and other credit products. This was frustrating to hear. Why? Because other lenders like SoFi have been using this variable for years and not claiming it to be a unique edge. It isn’t a unique edge.

Small dollar borrowers thus far have been purely incremental to its volumes. This is not cannibalizing core personal loan revenue. Good news.

Take Rate:

Upstart’s take rate is being boosted by a mix shift towards institutional funding via the committed capital and its bank partners being extremely timid with originations.

f. Takeaway

I’m quickly losing faith in this team. The company that used to claim relative macro immunity can make macro excuses all they want. It doesn’t play with investors that remember what was said a few quarters ago. While some of those excuses quite warranted, some of this fundamental weakness was self-inflicted. See Pagaya and its far more durable performance for evidence. Upstart was caught with its pants down in 2022 thinking it could rely on fast money hedge funds to supply capital for subprime credit through an inevitable credit cycle. Maybe it needed some financial service experience in the C-suite rather than a team full of ex-Googlers. Just maybe.

The company then proceeded to flip-flop on usage of its balance sheet to fund capital and has turned that balance from a strength to a weakness in less than a year. It has just been one disappointment after another. The guide shows zero signs of green shoots while we see those green shoots pop up for competitors. Perhaps capital markets have not forgotten the several months of underperforming vintages from Upstart in 2022. Add to that 1 sequential partner add (with these partners unwilling to fund credit) and my patience is wearing very thin.

So? All of this is to say that this business is now as low quality and speculative as anything else I own. I trimmed 50% of the holding (after selling 25% of it a few weeks ago and trimming all the way up in 2021) to make it 0.5% of the portfolio. It had been about 1.1% heading into the report. As of today, I have officially taken out my entire original investment between 2021-2022 trims and these two sales.

The upside associated with them figuring things out and delivering drama-free execution is immense. The probability of that coming to fruition is shrinking. Disappointing… again. Great companies overcome macro headwinds. While this model is as cyclical as things come, it still should have fared as well as other direct competition in its credit bucket. Weakness is understandable, this level of weakness is not. One more quarter of disappointment and I’m out.

I used the proceeds as a source of cash to start the Disney position. And speaking of Disney…