1. CuriosityStream

“We continue to expect a robust second half of 2021 and we are as excited as ever about the long term growth prospects of the business.” — CEO Clint Stinchcomb

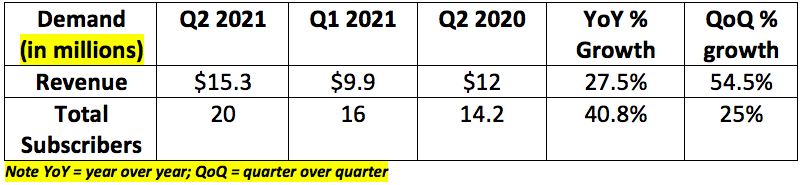

a. Demand

CuriosityStream does not guide to quarterly revenue, only annual. Analysts expected the company to generate $14.95 million in sales for the quarter. It posted $15.3 million thus beating those expectations by 2.3%.

CuriosityStream grew its direct subscribers by 56% year over year vs. 27% growth for Disney+ and (1%) growth for Netflix. Note that 56% year over year growth is comparing results vs. peak pandemic pain.

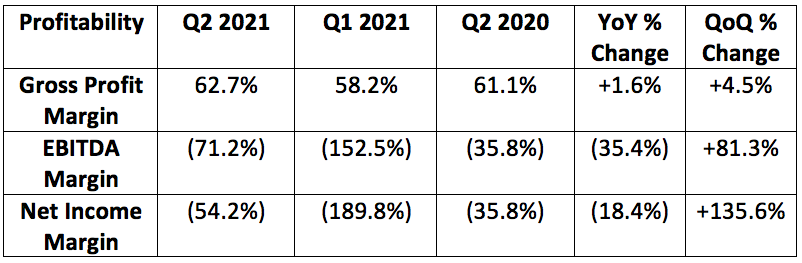

b. Profitability

Analysts expected the company to lose $0.18 per share for the quarter. It lost $0.19 per share thus missing expectations by 5.5%.

The firm has $120.8 million in cash and equivalents and burned $8.3 million during the 2nd quarter. This gives CuriosityStream 3.5 years of cash on hand at the current burn rate, but it expects to turn profitable within the next 2 years.

Gross margin is expected to fall to the low 40% range for the next 2 quarters. This is due to a large ramp in pre-sale revenues that are recognized as sales but cannot be recognized as gross profit during the same period. It has nothing to do with the underlying unit economics of the business.

Zooming out further, direct to consumer gross margins are expected to remain elevated in the years to come thanks to lower cost of content production in the factual space vs. scripted. For context, factual production costs as little as 5% of scripted content on an apples to apples basis.

c. Operational Highlights

The company maintained its guidance of at least $71 million in 2021 sales.

CFO Jason Eustace told investors the company’s 2021 revenue guide is now more than 90% committed vs. 90% committed last quarter and 80% committed 2 quarters ago.

“It’s our first full year as a public company and we want to demonstrate that we can hit our annual targets.” — Stinchcomb

CuriosityStream has officially launched the Curiosity Channel in German-speaking Europe as part of its new partnership with SPIEGEL TV and Autentic. SPIEGEL comes with millions of built-in subscribers and CuriositySteam has added hundreds of hours of German-dubbed programming for the launch. Germany is already a top 3 non-English-speaking market for the company. The company now has direct subscribers in 176 countries.

“Europe represents a vast DTC opportunity with hundreds of millions of affluent broadband subscribers. Unlike many traditional media companies, our international expansion opportunity is less hampered by fractured rights issues and is greatly enhanced by how well our content travels.” — Stinchcomb

The company’s Mars episode of its Secrets of the Solar System series was nominated for an Emmy in the category of Outstanding Science and Technology Documentary — a strong indicator as to the quality of the programming.

d. Management Commentary

CEO Clint Stinchcomb:

“We have successfully navigated the users who signed up during the pandemic better than anyone else in the industry. There was some concern about an uptick in churn impacting our business when lockdowns were lifted but we retained a higher percentage of users who signed up in Q2 2020 than any other streaming service. This is based on data from ANTENNA for the 13 months ending May 2021. — Stinchcomb

72% of subscribers who signed on during the height of the pandemic have been retained. Netflix is at 71%, Disney is at 55%, Hulu is at 52%, HBO Max 41% and Apple TV+ 17%.

All of CuriosityStream’s renewals came at a higher rack rate vs. its Q2 2020 promotional pricing. This contributed to rising ARPU for the company (although no specific metric there).

“We believe our industry-low churn demonstrates the high value of our service as well as the success of our annual subscription strategy. We continue to think we have considerable pricing power. — Stinchcomb

The company’s rate of churn was flat year over year despite the uniquely positive demand shock CuriosityStream received and despite the heavy promotional activity it conducted in Q2 2020. This offers evidence for the meaningfully positive price elasticity Stinchcomb is talking about.

The company will release more new originals this year than at any point in its history.

Stinchcomb explicitly told investors that CuriosityStream has “strong interest and some strong commitments” from brand sponsors for the rest of the year. The company expects sponsorship deals to accelerate as the world opens up and in can conduct more in-person meetings.

2. CFO Jason Eustace

“As the world reopens and entertainment options increase, our subscriber growth continues unabated.” — Eustace

e. My Take

This was a strong report for the company. Facing extremely difficult year over year subscriber and revenue comparisons, CuriosityStream demonstrated little difficulty in driving more eyeballs to its platform.

Gross profit margin remains elevated, and new content continues to set new viewership records for the company. The factual streaming niche is working. Great quarter.

2. Duolingo

“Our goal is to become the industry standard when describing someone’s level of language proficiency. So instead of saying you’re an intermediate level speaker, you’ll say you’re a Duolingo 65 in Spanish.” — Co-Founder/CEO Luis Von Ahn

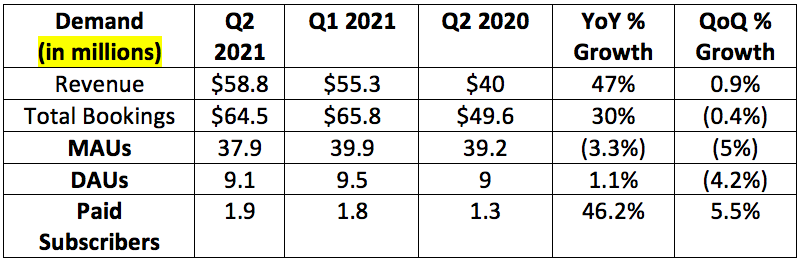

a. Demand

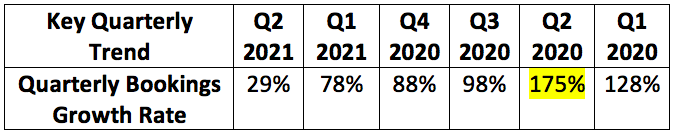

The company’s 2nd quarter bookings are generally similar to 1st quarter bookings. Last year, the company saw 35% sequential growth from Q1 2020 to Q2 2020 as a result of the pandemic. This made the Q2 2021 year over year comparison quite difficult. When adjusting for this impact growth rates accelerated in the quarter across the board.

Encouragingly, daily active users (DAUs) as a % of (monthly active users) MAUs for the quarter rose from 22.9% to 24% year over year. This is an explicit example of strong engagement even as lockdowns fade. Over 50% of these DAUs currently have a usage streak of longer than 7 days.

Visualizing the pandemic’s impact on Duolingo’s business:

b. Profitability

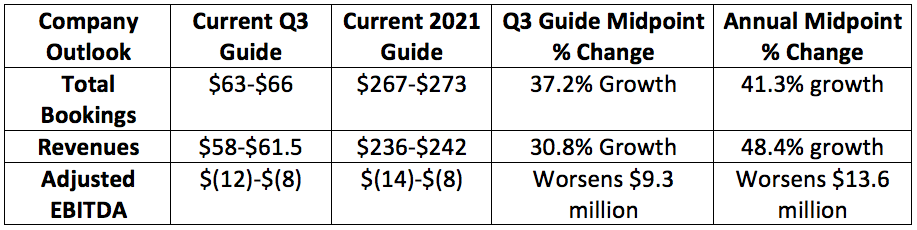

c. Third Quarter and Annual Guidance

d. Conference Call Commentary from CEO/Founder Luis Von Ahn

Ahn reiterated that language learning will be the first subject Duolingo covers, not the only. He also told investors Duolingo will be revealing more details on its family plan at “Duocon” on the 20th.

Most of the company’s growth came from organic word-of-mouth during the quarter rather than external marketing campaigns just like in previous quarters. This is why half a billion downloads, close to 40 million MAUs and top of mind brand awareness is so vital.

“At Duolingo, instead of focusing on marketing, we are obsessed with our product.” — Ahn

Ahn discussed the that boost Covid-19 gave to its user engagement and confirmed the company expects to return to its user growth trajectory in the coming quarters.

“We are now back to growing at our normal rate.” — Ahn

e. My Take

Duolingo was among the largest beneficiaries of the Covid-19 outbreak and this quarter represented its toughest year over year comp ever. The company specifically called this out in its S1, so to see revenue growth remain at a lofty 47% rate is encouraging. The next few quarters will also come with difficult comps before we lap the pandemic lockdowns.

Monthly active users did fall slightly and daily active users only grew by 2% year over year, but it was nice to continue seeing lofty subscription growth despite this. I was also disappointed that it didn’t mention the impact of China banning its app on the business.

Tough quarters ahead paired with Duolingo trading for 24 times diluted price to 2021 sales could mean it may be a while for the stock to start to deliver meaningful returns. Still, strong forward looking guidance does hint at headwinds not hurting the company too much.

From an organization standpoint, I continue to believe Duolingo has a compellingly long growth runway to pursue thanks to its increasingly ubiquitous brand, efficacy and optionality. It’s massive word-of-mouth marketing channel enables this growth to come with elevated profit margins. It only began to monetize its products 4 years ago and is already poised to eclipse a quarter billion in annual sales.

My position is currently very small, and I would be a buyer on any significant weakness; I have no plans to do anything but accumulate shares.

3. GoodRx

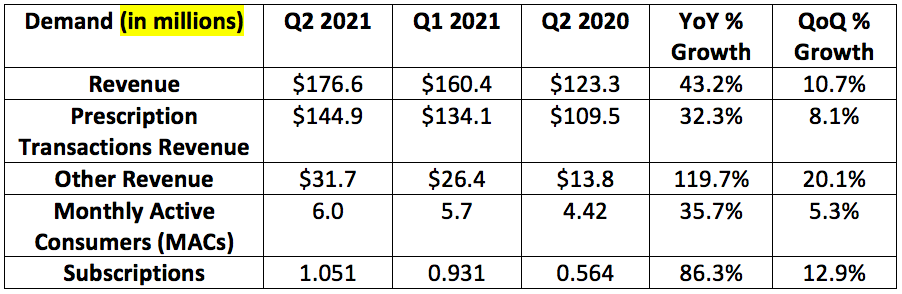

a. Demand

GoodRx internally guided to $172-$176 million in quarterly revenue. Analysts had expected $174.7 million. It posted $176.6 million beating the high point of its internal guide by 0.3% and analyst expectations by 0.7%.

This 43% year over year growth compares to 31% trailing 12-month growth.

Note that each subscription plan covers 1.5 Americans on average so the subscription footprint is roughly 1.57 million people in total.

GoodRx broke out subscription revenue from its other revenue segment for the first time this quarter. I added these 2 revenue lines together to make the comparison apples to apples.

Subscription revenue on its own grew 125% year over year to reach $14.3 million driven by an 86% rise in GoodRx Gold plans within its Kroger partnership. Other revenue now only includes its manufacturer benefits solutions revenue and telahealth. This segment rose 136% year over year to reach $17.4 million.

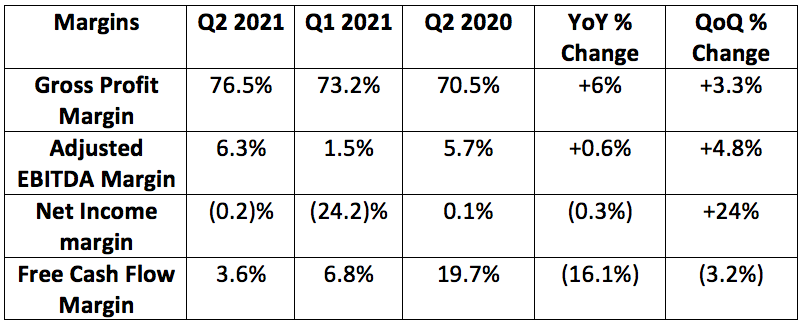

b. Profitability

GoodRx internally guided to a 30%-32% adjusted EBITDA margin. It posted a 30.9% margin essentially in line.