This piece is powered by my friends at Savvy Trader:

Welcome to the 301 new readers who have joined us this week. We’re delighted to have you all as subscribers and permanently determined to provide as much value & objectivity as possible.

1. Airbnb (ABNB) -- New Position & News

a) Introduction

I started a 25% full position in Airbnb this week. I love the company, but still don’t love the multiple. So? I will selfishly hope for more multiple compression to build out my stake. But the research I’ve done on the name makes me interested enough in owning a small piece despite it seeming a bit too expensive today. I felt waiting entirely to dip my toe was getting too cute with the multiple now close enough to where I’d like it to be. Here, I’ll briefly explain my thinking. I will publish a deep dive on the company in 2023 that goes into far more detail.

I love investing in verbs. Venmo is my favorite part of the PayPal bull case and few other verbs carry as much meaning as “To Airbnb it” in today’s public markets. That’s why the company was still able to find healthy demand DESPITE turning off all marketing dollars during the pandemic.

The brand’s word of mouth virality is simply elite… and that matters to me a lot. It’s how a company finds seamless operating leverage while delivering robust demand and its how economies of scale can deliver the very best margin profiles over time. That’s what I expect here, and the signs of it getting to that point are already clear. Ex-stock comp free cash flow is already quite strong, and I see a lot more juice to squeeze out of its fixed cost base.

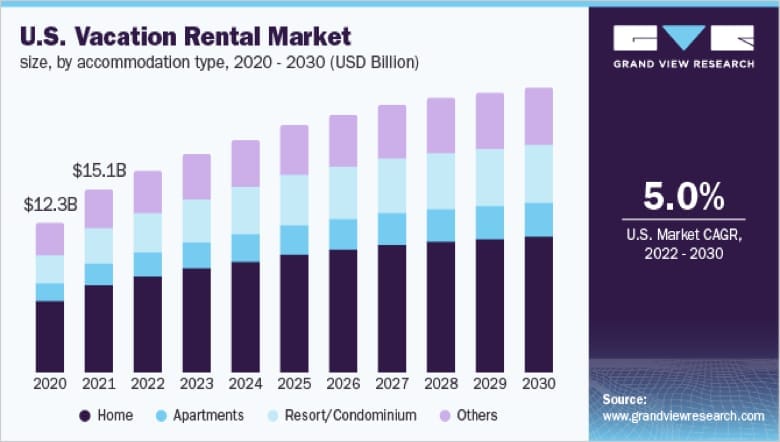

Furthermore, I view this company as the prime player in the longer term vacation/rental market. GenZ is far more nomadic and experience driven than previous generations have been, and Airbnb is the perfect service to allow these young spenders to find a special place anywhere… often for extended stays. And speaking of experiences, its expansion into enabling hosts to offer their talents in addition to their living quarters is a promising long term growth vector to explore.

More broadly speaking, Airbnb’s market is expected to continue outpacing overall GDP growth and its share gains (as seen from the dark purple bars below) speak to its ability to take advantage of that opportunity better than others can.

So what are the main risks I see today? First and foremost is local regulation amid common housing shortages. One way to combat these shortages is by blocking short term rentals like Airbnb. Although this is possible, it would take a large group of local municipalities to make the move to have a significant impact on the business -- and it would upset tax paying hosts in those affected cities. Furthermore, skyrocketing interest rates has made a large dent in housing demand which should ease this concern for the time being. I think special local taxes being implemented are more likely than the economic disruption a ban would cause.

But still, today, key international cities like Barcelona and Paris have strict limitations on Airbnb rentals. This will surely make international expansion less fruitful and it’s always possible that more cities or nations will follow suit.

Secondly is the founder. I see him as a strength and a risk. He’s smart, capable, driven… and a bit too optimistic at times. That means I have to take what he says with a large grain of salt which is obviously not ideal. Still, his track record speaks for itself and hard decisions he has made like price transparency and the aforementioned marketing pause amid Covid-19 have been the right ones in my view. He just needs to chill out a little.

We also must consider macro as a key risk for Airbnb. Vacations are discretionary purchases that are always cut before food or other basic necessities. Yes, economic weakness does motivate more hosts to list their own homes for a new income stream. Still, nightly rates, demand and lower investment property affordability all make poor macro an overall headwind for this business. Selfishly that is what has opened the door for me to start a position.

Airbnb is also still somewhat expensive. The company trades for about 30x forward earnings with about 15% revenue growth expected and margin expansion pausing until 2024. That’s about triple Expedia’s multiple and 50% higher than Booking.com. While Airbnb’s growth deserves a heftier valuation, this premium is quite generous and we’re still in a hawkish macro backdrop where pricey growth is automatically hated. Again, this is why I’m starting the position so small.

Airbnb is a safe 15% revenue compounder with obvious operating leverage ahead of it. The company has rapidly built an iconic brand despite several entrenched competitors fighting it at every turn. It has carved a deep niche with younger generations, and it has done so in a quite profitable manner. I find all of that admirable and compelling as an investment case.

b) Miscellaneous

- Airbnb eliminated 4,000 hosts from its database for breaking discrimination policies.

- Airbnb officially debuted a guest search option to view total price (including cleaning fees) on the site. This is an attempt to solve for guests upset with sticker shock post fees being added to the bill.

2. SoFi Technologies (SOFI) -- Insider Buying, BNPL, Galileo & APY

a) Insider Buying

Since August 2021, SoFi CEO Anthony Noto has purchased about $3.8 million in SoFi stock via 22 separate open market transactions. This week, Noto purchased another $5 million in company stock in one fell swoop. While executive buying is not a crystal ball for future returns, it IS a strong indication that insiders are optimistic. It’s curious to me that some can confidently argue otherwise, but I suppose they’re entitled to their opinion that contradicts endless historical research. But I digress.

Especially considering that Noto is ~only~ worth about $100 million, investing roughly 9% of his total net worth into SoFi stock over the past 18 months is surely notable. And it deserves even more context. Out of the $100 million in total net worth, a large chunk of that is tied to SoFi stock options that ONLY VEST IF SOFI SUCCEEDS. He is already overly exposed to the company’s execution. I guess he still wants more.

b) Buy Now, Pay Later (BNPL)

SoFi launched its own “Pay in 4” product using Galileo’s software as the backbone. The option can be selected at any merchant that accepts Mastercard for both online or in-store purchases. To start, this will be for transactions of $50-$500 dollars and will feature interest free payments. SoFi is Mastercard’s first Installments Program partner to go live.

- As part of this program, the BNPL offering will feature Mastercard’s fraud and liability protection programs.

- To use this feature, SoFi members will get a Mastercard branded virtual card upon acceptance that can be used for the transaction.

c) Galileo

Galileo launched “Direct Deposit Switch” in partnership with software provider Atomic. With this launch, Galileo’s clients can more seamlessly and expeditiously pay their constituents. Furthermore, it features automated tools for allocating a set amount of paychecks to investment accounts or for specific use cases like vacation funds. Atomic will help Galileo instantly approve and verify employee account funding requests like these.

With virtually all Americans receiving wages via direct deposit, enabling these dollars to be allocated to more places with more speed and automation matters a lot. Doing so in real-time with preferences easily and intuitively conveyable is simply icing on the cake. The added layer of convenience is expected to raise direct deposit adoption even further for Galileo clients which is especially appealing for credit-based customers relying on these dollars to fund loans.

As an aside, this also marks the debut of Technisys technology in the United States as it was a key piece of bringing the Galileo-powered offering to light.

“Clients leveraging payroll connectivity solutions, such as direct deposit switching, have seen as high as a 3-4X lift on direct deposit acquisition when benchmarked to other solutions.” -- Atomic Head of Markets Lindsay Davis

d) Savings Annual Percent Yield (APY)

SoFi raised its savings APY to 3.5% for direct deposit consumers. As a reminder, this 3.5% cost of deposits is lower than what SoFi had been paying on warehouse facilities. Rather than pocketing this savings via better loan book margins, SoFi is more focused on driving market share and demand growth. So expect the rate to continue rising to reel in more lucrative direct deposit customers.