This was too long to send via email in its entirety. For the full piece, click here.

1. Progyny (PGNY) — Earnings Review

“When we issued our guidance to you in November, we were experiencing increased utilization as September, October and November all had strong utilization growth month-over-month. When Omicron emerged in December, overall member activity slowed sharply enough to have an impact on our results that was beyond our predictions.” — CEO Peter Anevski

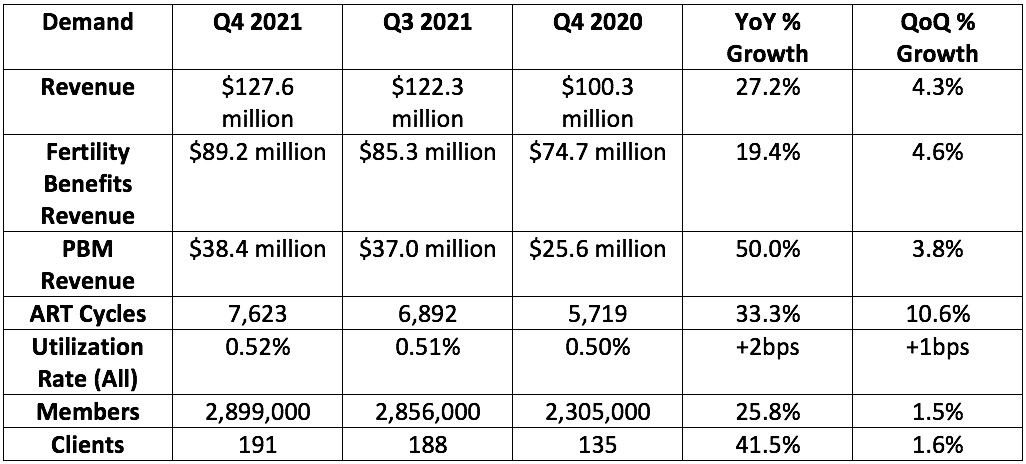

a. Demand

Progyny guided to $137.4 million in revenue for the quarter and analysts were expecting $134.9 million. Progyny reported $127.6 million in revenue, missing its expectations by 7.2% and analyst estimates by 4.4%.

Progyny always anticipates a slight utilization dip from November to December as offices close for holidays and people go on vacation. The decline this year was twice the impact they’ve come to expect which resulted in a revenue hit of $9 million for the quarter. Without this event, Progyny was gearing up to slightly beat analyst revenue expectations.

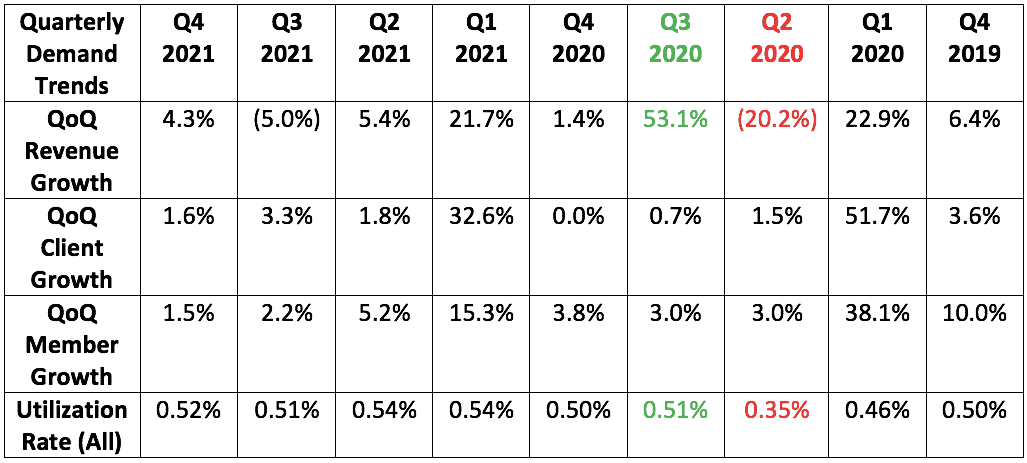

In Q2 of 2020, Society for Assisted Reproductive Technology (SART) suspended all new fertility treatment cycles. These resumed in Q3 2020 which is why there’s such an abrupt reduction and subsequent recovery in revenue and utilization in Q2 2020 (red) vs. Q3 2020 (green). It was heartening to me to see utilization recover so quickly.

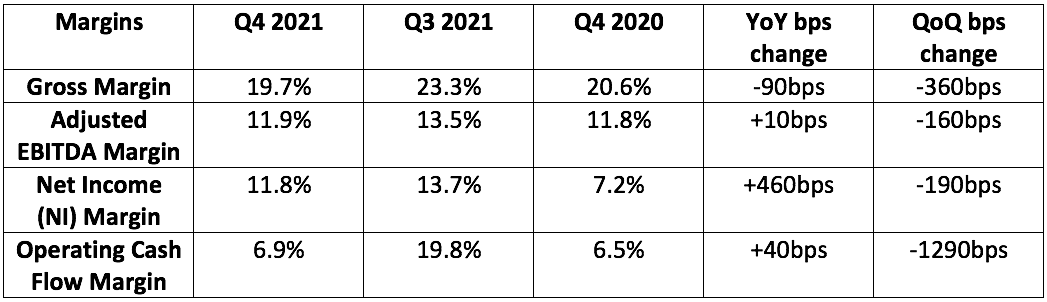

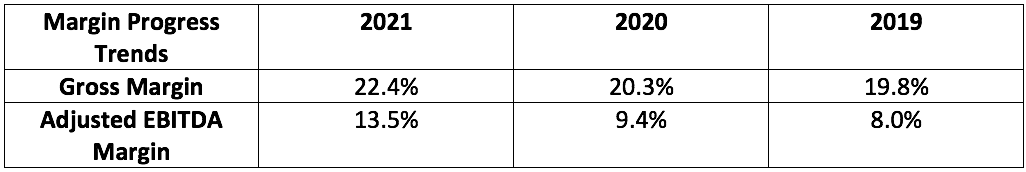

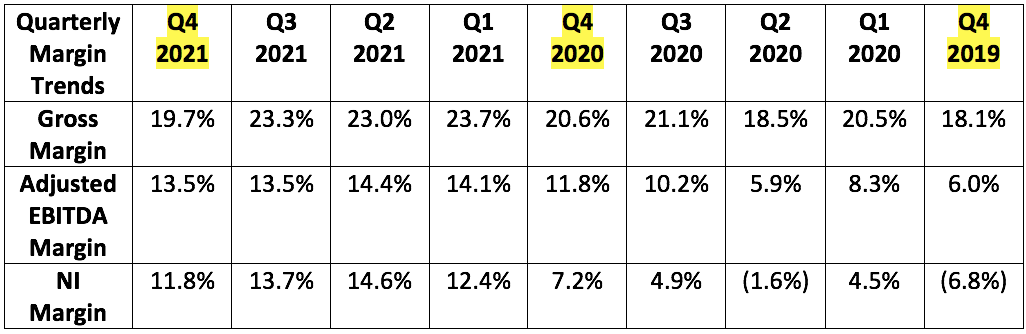

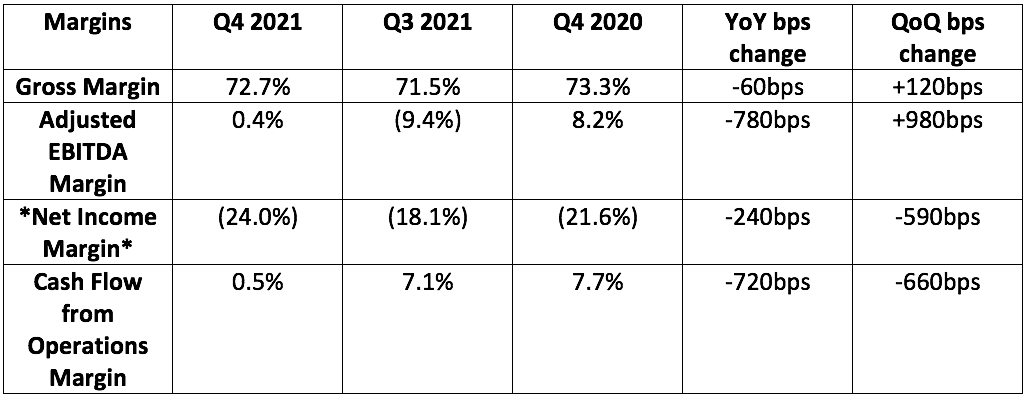

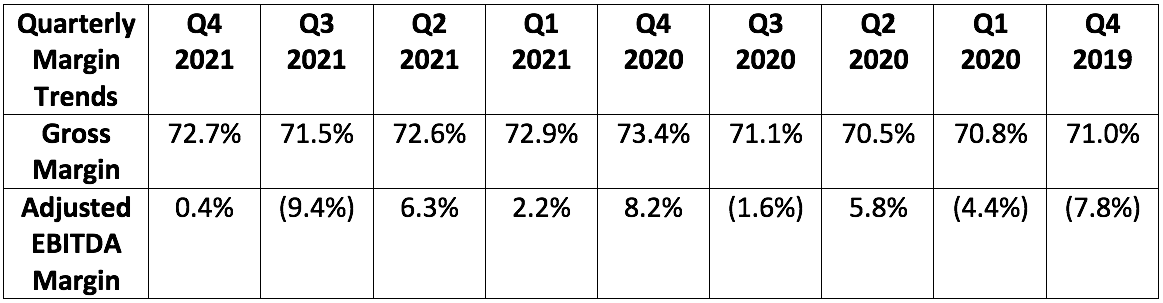

b. Profitability

Progyny guided to earnings per share (EPS) of $0.02. Progyny earned $0.15 per share, beating expectations by $0.13. This beat was related to tax allowance benefits that Progyny will continue to enjoy in 2022. With 2021 earnings of $0.66 per share, Progyny’s trailing earnings multiple is 65X.

Progyny guided to adjusted EBITDA of $17.55 million. It generated $15.1 million, missing expectations by 14.0%. Like the revenue miss, this was attributed to Omicron.

Gross margin compression is entirely stock-based compensation related. Without stock-based comp charges in Q4 2021 and Q4 2020, gross margin would have expanded to 23.4% from 21.7% YoY. Without this benefit, gross margin would have expanded to 24.2 from 21.2% YoY for 2021 vs. 2020 as a whole.

Other Important notes on margins:

- Q4 2020 net income margin removes a larger, one-time tax benefit Progyny enjoyed to make the comparison apples to apples.

- Operating cash flow margin fell this year as expected and as a result of contract revisions with pharmacy partners. This changed the timing of its payments.

- This tweak allowed them to “leverage the strength of the balance sheet to lengthen rebates receivable to capture more margin and profitability.”

- Progyny discloses adjusted EBITDA margin on new, incremental business. This incremental margin was 22.4% for 2021 vs. 16.7% in 2020.

- Progyny expects to continue to consistently and meaningfully expand gross and EBITDA margins in the years to come.

- Progyny’s growth provides natural leverage in contract negotiations and operations of scale that are naturally boosting its margins.

The company has $159.7 million in cash on hand and is debt free.

The 4th quarter is Progyny’s seasonally weakest period for margins. This is due to it adding the people and assets needed to support new clients before these clients go live the following year.

Note that as this is a healthcare services company and so sequential growth is not super relevant. It’s all about selling season success and the growth step-up Progyny enjoys between Q4 and the first half of the next year. For this reason, it makes most sense to focus on Q4 growth rates from 2021, 2020 and 2019 rather than all of its most recent quarters.

c. Guidance

2022:

- Progyny guided to $752.5 million in 2022 revenue at the midpoint. This missed analyst expectations of $757 million by 0.6%.

- Progyny guided to $116 million in adjusted EBITDA. This beat analyst expectations of $111.3 million by 4.2%. It expects adjusted EBITDA on incremental revenue of “more than 19.0%.”

- Progyny guided to $0.03 in EPS. Analysts were expecting closer to $0.60.

- This projection doesn’t include discreet income tax benefits or benefits related to stock based compensation. Progyny will likely continue to benefit from those items in 2022 which will continue to boost its EPS performance. This is why EBITDA outperformed while EPS “underperformed.”

Q1 2022:

- Progyny guided to $167.5 million in Q1 2022 revenue. This beat analyst expectations of $164.1 million by 2.1%. This would represent roughly 37% growth. This range includes the impact of Omicron in January and assumes a more normal level of Utilization through March.

- Progyny guided to $24.0 million in adjusted EBITDA. This beat analyst expectations of $22.3 million by 7.6%.

- Progyny guided to a loss per share of $0.015. This missed analyst expectations of $0.14 by $0.155. This again is tax benefit related.

Progyny is assuming a normal level of utilization and mix in its 2022 guide and is NOT “writing in a little bit of the extra strength in February and March into the rest of the year.”

Why the larger revenue range?

“The larger overall revenue range is to factor in some level of less favorable mix or utilization or other unfavorable changes. It also factors in the larger portion of customers going live in Q2 and Q3 than they normally do. To the extent they decide to delay anything any further, that’s a risk assumed in the range we put out there.” — CFO Mark Livingston

d. Notes from CEO Pete Anevski

“Coming off of our most successful sales season ever, we are excited for the year ahead after successfully launching with the largest number of new clients and covered lives in our history. All of the macro trends that have been fueling our rapid growth remain intact” — CEO Peter Anevski

On 2022:

“We are cautiously optimistic that the pandemic may be coming to an end and the world hopefully will return to a more normal state. At this point, every indicator we monitor supports that we will have another successful selling season, driven by our superior solution, high levels of service and industry-leading clinical outcomes.” — CEO Peter Anevski

Utilization rates were strong in October and November, however the Omicron variant led to an activity hit in December and January. Importantly, the company has seen its member utilization and activity levels “rapidly” normalize in February which is why the company was able to maintain its ambitious full year guide.

“Based on the visibility we have into February and March as well as the limited visibility we have into April, member activity has rapidly recovered to normal levels. The Omicron impact on member utilization appears to be behind us.”

“One of the most important themes of the last 2 years is that most fertility patients have continued to be highly resilient in the pursuit of care even against the backdrop of the pandemic. Covid-19 disruptions for us have been short-lasting and have only impacted activity for a small portion of our members.”

Anevski reiterated Progyny’s plans to be at 265+ clients by July 2022 and 4 million+ covered lives thanks to the historically successful selling season being in the books. This still just represents 3% of Progyny’s target market despite its massive market share lead in the growing space. This doesn’t even include school systems, unions and other public employers.

“Our sales momentum from 2021 has continued into 2022. We are seeing meaningful increases across all metrics we use to monitor sales progress vs. early selling season progress one year ago at this time. This includes the active pipeline, new pipeline development year-to-date and year-to-date sales wins so far.”

On 2021:

Client retention remained “near 100%” for the 6th consecutive year.

Progyny’s NPS of +81 set a new record high while most of its competition remains around +0. Progyny was at +71 at the time of its IPO.

On product and geographic updates:

Progyny is making it a 2022 focus to provide increasing levels of fertility support to its male members. It will launch many new services and capabilities here specifically in the coming months to enhance up-selling.

“Male factor infertility is diagnosed equally as often as female factor infertility. While a Reproductive Endocrinologist is often able to effectively treat the couple regardless of what the underlying factor cause is, in some cases, a Reproductive Urologist may be beneficial for proper diagnosis and treatment of male issues.”

“Less than 20% of Urologists in the U.S. focus on reproductive health issues, and carriers may not have the subset of providers or coverage of these services in their network. This creates a gap which Progyny will attempt to address with this enhanced offering.”

Progyny will launch its fertility benefits solution in the Canadian market during 2022. It has been working tirelessly to build a network of Canadian Providers that it will manage in the same hands-on, data-driven way it does in the U.S.

“Although the Canadian Government provides universal healthcare to its citizens, comprehensive fertility coverage is not included in that program… Canadian employer supplemental coverage of fertility is even further behind where the U.S. was when we launched our benefit in 2016. As a result, most Canadians have no effective coverage today.”

e. Notes from CFO Mark Livingston

On margins:

“Gross margin increased meaningfully even as we invested to expand the functions and resources that we needed to support the on-boarding of our largest-ever cohort of new members in 2022.”

“In early November we issued a broad based grant of new equity to our workforce which increased the level on non-cash stock-based compensation and our operating expenses.”

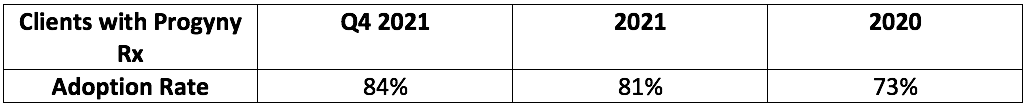

On Progyny Rx:

On treatment mix:

Utilization via consultation and diagnostic testing early on in treatment is worth less in revenue vs. advanced procedures later on in the treatment journey. Interruptions in this treatment journey (fostered by variants) negatively impacted its mix in Q4. This is why utilization rates are rather stable but revenue underwhelmed. Treatment mix in Q4 skewed to earlier on in the cycle than in previous comparable periods.

f. My Take

This was a fine but unspectacular quarter for Progyny. The variant seemed to weigh on its business but the 2022 guide hints at the pandemic’s impact being in the rear view. If management is wrong (which several analysts thought it may be based on the Q&A tone), that should mean falling short of the guidance the team has offered. Even if it does fall slightly short, I think there remains a lot to like with a 2022 EBITDA multiple of 28X and 40%+ growth expected going forward — in my view, there’s upside here if it can continue to execute. 2022 is a big year for this young fertility disruptor. I plan to continue accumulating more shares into any significant multiple compression.

Click here to read my Progyny Deep Dive.

2. Duolingo (DUOL) — Earnings Review

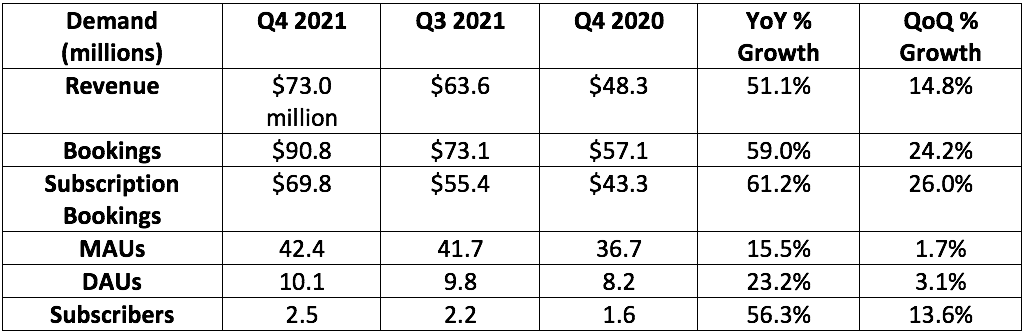

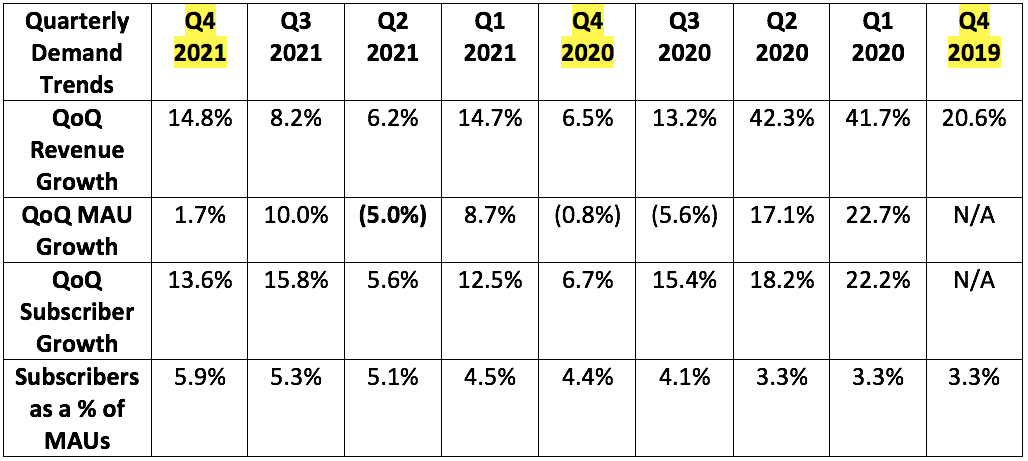

a. Demand

Duolingo guided to $68 million in revenue and analysts were looking for $68.85 million. Duolingo posted $73.0 million, beating its expectations by 7.4% and analyst expectations by 6.0%.

Duolingo guided to $80.5 million in quarterly bookings. It posted $90.8 million, beating its expectations by 12.8%. Strong bookings growth is an excellent hint at favorable forward looking demand — this is the result of more subscribers choosing annual plans in action.

The company did not see a material boost from the Omicron variant like it did with previous outbreaks. This outperformance was not pandemic-driven. Duolingo thinks it has returned to its long term growth trajectory — including 10-15% MAU growth going forward.

Notes:

- The pandemic accelerated its business in 2020 but the company appears to be through the toughest comps from that factor.

- This is the first time Duolingo has seen a sequential rise in Q4 MAUs in 3 years. It had guided to an MAU reduction for the quarter. Duolingo’s successful year-end campaign was given a lot of the credit for this encouraging reversion.

- Duolingo’s paid annual subscriber retention in 2021 rose “several percentage points” YoY.

- 85% of Duolingo’s subscribers are now on annual plans vs. 71% YoY and 80% last quarter. This greatly boosts lifetime value (LTV) and visibility.

- From an external marketing perspective, Duolingo’s once-a-year New Year’s discount yielded results “above expectations and drove a meaningful increase in new subscribers.”

Subscribers as a % of MAUs is Duolingo’s most important key performance indicator for revenue growth. Duolingo had been raising this metric by roughly 1% annually but was able to raise it by 1.5% in 2021. Von Ahn attributed this positive momentum to continued split (A/B) testing which its leading scale offers the data to accurately guide. This equips the company with a wildly efficient and informative trial and error mechanism to make the paid experience more appealing. Duolingo thinks its subscribers as a % of MAUs can eclipse the roughly 12% that dating apps enjoy on average — there’s a long way to go.

Additionally, evolving from a fixed price in each country to dynamic pricing by country is raising subscriber conversion.

“We have a long roadmap of tests that we believe will continue increasing the subscriber ratio in the years ahead.” — Co-Founder/CEO Luis Von Ahn

Its newly introduced family plan — allowing 6 members to access subscription features through one plan — should boost subscriber conversion further and the company is “encouraged by the early results.” So far, a low single digit % of subscribers are on this plan which has already been should to juice LTV. With elementary school products like Duolingo ABC and Duolingo Math on the horizon, family engagement in the core product will be a key driver of cross-selling.

b. Profitability

Duolingo guided to a loss of $5 million in adjusted EBITDA and analysts expected a loss of roughly $0.35 million. Duolingo earned $0.3 million, beating expectations.

Analysts expected Duolingo to lose $0.68 per share. It lost $0.46 per share, beating expectations by $0.22.

Duolingo generated $12.7 million in free cash flow in 2021. Note that this metric adjusts for IPO expenses and stock-based compensation associated with Duolingo’s public debut. The gap between net income margin and cash flow from operations margin is related to this and should close over time. We were told in recent calls that Duolingo planned to pursue growth over profitability in the near to mid-term future. The positive EBITDA surprise was in spite of this priority.

c. Guidance

2022:

- Analysts were looking for $321.3 million in 2022 sales. Duolingo guided to $337 million, beating expectations by 4.9%.

- Analysts were looking for a loss of $4.5 million in 2022 EBITDA. Duolingo guided to a loss of $3 million, beating expectations by 33.3%.

Q1 2022:

- Analysts were looking for $73.3 million in Q1 2022 sales. Duolingo guided to $77.0 million, beating expectations by 5.0%.

- Analysts were looking for a loss of $3.6 million in Q1 2022 EBITDA. Duolingo guided to a loss of $4.0 million, missing expectations by 11.1%.

d. Notes from Founder/CEO Luis Von Ahn

On growing users and subscribers:

90% of Duolingo’s user growth was via word of mouth in 2021. Duolingo generally enters individual markets with a few million in external marketing spend to get “the organic flywheel going.” It did this in places like India and Japan.

“Rather than spending our resources on short-term gains like performance marketing, we take the long view and continually improve our products and brand.”

Duolingo’s new TikTok account for its owl mascot (Duo) has 3 million followers and has racked up 500 million views with “basically zero marketing spend.” Its “Duolingo in Review” campaign, offering annual summaries of a learner’s year, drove “record” engagement and trended on Twitter.

Duolingo’s social and competitive feature additions continue to drive user growth and engagement. The % of daily users giving or receiving a “congratulatory message” grew from 1% to nearly 10% during the year and 25% of DAUs now follow 3+ other learners — which also directly boosts engagement.

On product enhancements to drive better learning:

- Duolingo upgraded roughly 3,000 lesson plans “to align more closely with language teaching standards.”

- Duolingo added 30,000 “immersion exercises” and audio lessons to bolster user conversational skills.

- Duolingo added smart-tips feedback (again using its scaled data engine) to give timely explanations when a student is struggling.

- Duolingo expanded into several non-Roman writing systems with brand new lessons.

- As languages like Japanese and Korean are “among the world’s fastest growing” — this was imperative.

- Duolingo launched unique, geography-specific voices for all of its popular characters.

- Duolingo will launch a new home screen in hopes to juice engagement further.

- Duolingo will add new in-class and mobile experiences for Duolingo for Schools. This is a dashboard aggregating all activity from students using the Duolingo app.

Duolingo’s internal research depicting that 5 Duolingo units is equivalent to taking 4 university semesters in half the time was peer-reviewed and published in the journal: Foreign Language Annals. Ahn reiterated that getting through 7 units is equivalent to 5 semesters and that most learners that get through 5 units are developing “level appropriate” speaking skills as well.

On the Duolingo English Test (DET):

Continued university adoption and student preference powered 63% YoY Duolingo English Test Growth. This implies revenue of roughly $24.5 million or 9.8% of total sales for a product that began monetizing in 2019.

The Irish Government announced acceptance for DET for new student visas. The company aims to expand DET beyond higher education and sees this as its first step in doing so.

“We are already the most downloaded language learning app globally and believe we can achieve similar success in testing and assessment… We’re just getting started… Duolingo aims to connect the DET proficiency scores to its app to “become the standard way people talk about fluency. Instead of a learner saying they’re intermediate, we want them to say they are a Duolingo 65.”

On new subject expansion:

The Duolingo ABC literacy product will launch on Android this year — the company is working on an overarching upgrade to this product at the moment. Its math product is still in the works and will launch by 2023. Duolingo will rollout premium versions of all of these products to drive further monetization in the coming years. As a reminder, Duolingo doesn’t monetize its products until they’ve reached effective scale and maturity. So, this was not the source of the guidance raise — it was the health of the core business.

“I’m biased, but the math app looks beautiful.

On strong culture:

67% of its new hires in 2021 were engineers or product managers — this led to GAAP research and development (R&D) as a % of revenue rising from 32% to 41% YoY. This is my favorite kind of company spend — especially for growth stories. Duolingo will continue to accelerate R&D spend and we have been told NOT to expect operating leverage in this cost line in 2022.

Duolingo’s employee attrition rate in 2021 was 6% — lower than industry averages.

e. My Take

This was a strong quarter in every sense of the imagination. While many seemed to think Duolingo was a pandemic flash in the pan, that does not appear to be the case. I continue to think this has promising potential to profitably and briskly compound over the coming years and this quarter was merely another data point supporting that opinion.

Click here to read my Duolingo Deep Dive.

3. GoodRx (GDRX) — Earnings Review

The company announced a $250 million share re-purchase program or roughly 6% of its shares. This is for the purposes of “limiting the dilution associated with employee equity compensation” and will be funded via cash or “funds available through various borrowing arrangements.” Unfortunately, that was the highlight of this poor quarterly performance:

a. Demand

GoodRx guided to $217 million in Q4 2021 revenue and analysts were expecting $217.5 million in revenue for the quarter. GoodRx posted $213.3 million, missing its expectations by 1.7% and analyst estimates by 1.9%.