Table of Contents

- 1. Taiwan Semi (TSM) – Earnings Review

- 2. The Trade Desk (TTD) – Come to Papa & Leadershi …

- 3. Uber Technologies (UBER) – Drizzly

- 4. PayPal (PYPL) – CEO Interview & an Event

- 5. Amazon (AMZN) – Encouraging Datapoint, Sports & …

- 6. SoFi Technologies (SOFI) & Discovery Financial …

- 7. Meta Platforms (META) – Zuck AI Announcements

- 8. Super Micro Computer (SMCI) – Notable Pre-annou …

- 9. Disney (DIS) – ESPN Bet & Blackwells

- 10. Duolingo (DUOL) – Downgrade

- 11. Progyny (PGNY) – New Partner

- 12. Macro

- 13. Portfolio

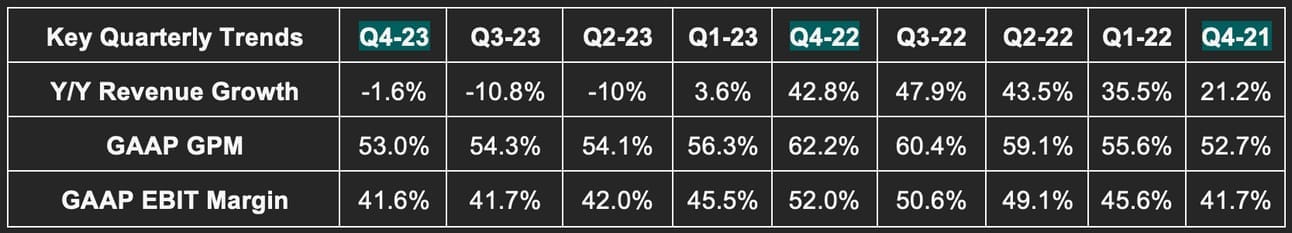

1. Taiwan Semi (TSM) – Earnings Review

Taiwan Semi builds chipsets for other companies like Nvidia and Qualcomm. It does so in its highly expensive, highly complex chip fabrication plants. These are called “fabs” for short.

Needed Definitions:

- Fab means a factory

- Nanometer (NM) describes the chip technology. Smaller NM is more advanced as it uses smaller transistors. Its newest 3 NM technology also includes an upgraded transistor technology to bolster the capacity. This means TSM can add more transistors to a single chip while making those chips more energy efficient and cost-effective.

- “Advanced Technology” Revenue = revenue from 3nm, 5nm & 7nm technology.

- Wafer refers to the raw materials (like silicon) that are used to manufacture chips and manipulate the materials with desired tasks.

a. Results

- TSM beat revenue estimates by 0.3% & beat its guidance by 2.2% at the midpoint. Its 15.7% 3-year revenue compounded annual growth rate (CAGR) compares to 12.3% as of last quarter & 14.7% 2 quarters ago.

- Met GAAP gross profit margin (GPM) estimates & beat its 52.5% GAAP GPM guidance by 50 basis points. (bps = basis point; 1 bps = 0.01%)

- Beat 41% GAAP EBIT margin estimates by 60 bps & beat its guidance by 80 bps.

- Beat $1.39 GAAP earnings per share (EPS) estimates by $0.05. It trades for about 18x next 12-month earnings.

b. Guidance

Next Quarter:

- Beat revenue estimate by 0.9%.

- Beat 39.4% GAAP EBIT margin estimate by 160 bps.

- Beat 51.3% GAAP GPM estimate by 170 bps.

- Dividend growth will be roughly 17% Y/Y next quarter & will continue growing from there.

2024:

- It also expects CapEx of $30 billion for the full year vs. $30.4 billion in 2023.

- Guided to mid 20% Y/Y revenue growth, which compares very nicely to consensus looking for 21.3% Y/Y growth.

c. Balance Sheet

- $54.3 billion in cash, equivalents & marketable securities.

- $30 billion in bonds payable.

- Inventory rose 13.6% Y/Y. Still, days of inventory fell 11 days Y/Y due to strong 3NM demand.

- Dividends rose 2.3% Y/Y in 2023 vs. 2022.

- Accounts receivable fell 4 days Y/Y to 31 days.

d. Call & Release Highlights

Demand & Macro Context:

A strong ramping of 3NM tech was credited with the demand outperformance this quarter. It was a “tough year for the industry” per the team. Weakening macro, high inflation and soaring cost of capital all “prolonged the global semiconductor inventory adjustment cycle.” Still, its tech leadership powered its outperformance of -8.7% Y/Y growth vs. -13% for its overall sector. Furthermore, based on the 2024 guide, it sees growth sharply recovering in the quarters ahead as it’s “well positioned to capture AI and high performance compute growth opportunities” with its advanced technology. Its mid 20% 2024 revenue growth guide compares to overall industry growth of 10% and 20% Y/Y for its foundry category.

Inventory levels across the industry are now, finally getting back to “healthier levels.” The company is confident that its “business has bottomed out Y/Y.” All in all, leadership reiterated its 15%-20% annual revenue growth target first offered in January 2022.

Margins:

The gross margin decline for the year (contracted 520 bps for all of 2023 Y/Y) was as expected. It’s based on 3NM volume ramping to a point of margin maturity. That takes time. For now, it’s a continued gross margin headwind while becoming a larger portion of its overall revenue.

TSM also continues to invest heavily in R&D to “extend its tech leadership.” It always invests ahead of expected demand opportunities and does not shy away from doing so if end markets weaken for a few quarters. It takes the extremely long term view, which is needed when its fab plant expansion takes several years to deliver. It decided to keep the pedal to the metal here in 2023 despite weakening demand. This led to EBIT margin falling 690 bps Y/Y for 2023.

For 2024, better capacity utilization will help margins as demand recovers. Its continued investments in 3 nanometer will hurt gross margin by 300-400 bps for the year. Furthermore, it’s working on converting some N5 capacity to N3 capacity to support the multi-year demand ramp. This will mean heightened margin pressure in 2024 by another 100-200 bps. It will mean lower costs thereafter. Over the long haul, ex-volatile foreign exchange, it remains confident in a 53%+ gross margin.

New 3NM Tech & N2:

Taiwan Semi continues to iterate on its 3NM node. Its N3E, N3X and N3P chips are all in the works and began volume production this quarter. These offer higher performance and different use cases for its end customers. All are key pieces in its expectation of 200%+ Y/Y revenue growth within its 3NM revenue bucket.

For its newest 2NM node, “consumer interest and engagement” compared to N3 is “much higher.” The first iteration of its 2NM technology will begin volume production next year. To cater to high performance computing use cases, it will offer a chip with a backside power rail solution by 2026. Traditionally, power is transferred to transistors from the front of the chip. By moving it to the back, energy efficiency and heat management are both improved. TSM is always innovating.

AI:

“A surge in AI-related demand in 2023 supports our already strong conviction that the structural demand for energy-efficient computing will accelerate in an intelligent and connected world. TSMC is a key enabler of AI applications. No matter which approach is taken, AI technology is evolving to use more complex AI models as the amount of computation required for training and inference is increasing.” – TSM Leadership

Global Factory Footprint:

- In Japan, it expects its 12-28 nanometer tech facility to open in February and begin volume production in Q4 2024.

- In Arizona, it remains in “close contact with the U.S. government on incentives and tax credit support.” It’s making “strong progress” with Arizona labor groups and is now installing equipment at its first planned fab in the states. Volume production is expected to begin in early 2025.

- In Germany, it continues to work towards a new factory in Dresden for auto and industrial end markets.

- In Taiwan, it’s greatly expanding 3NM capacity to meet demand.

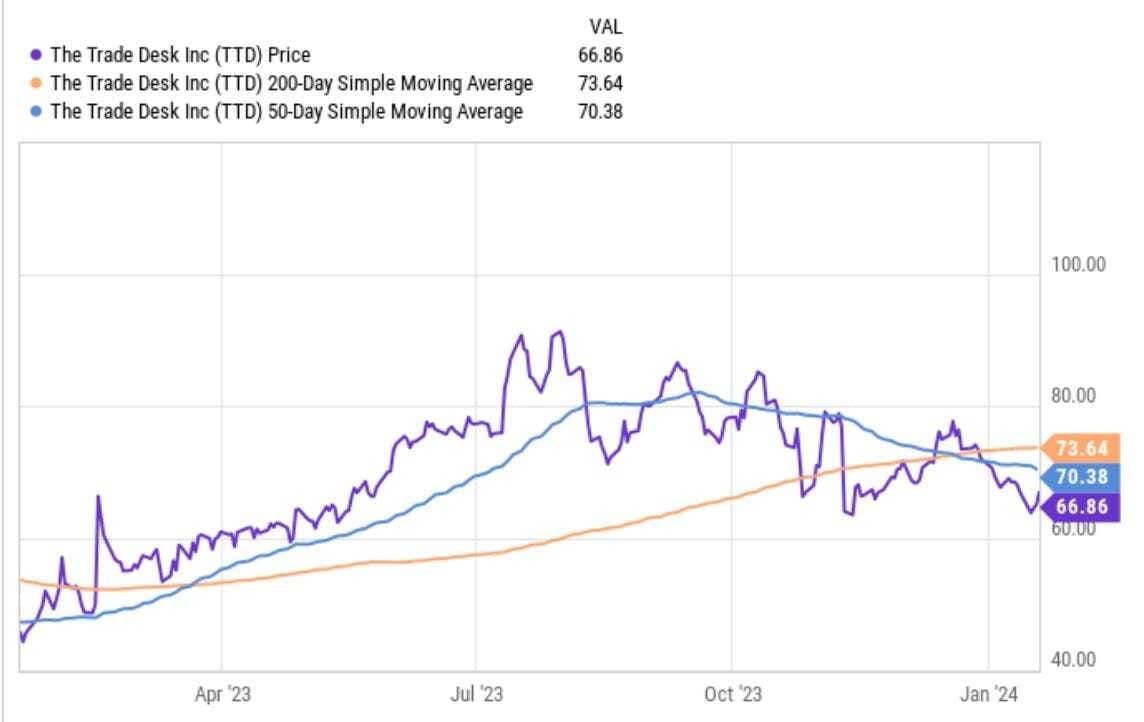

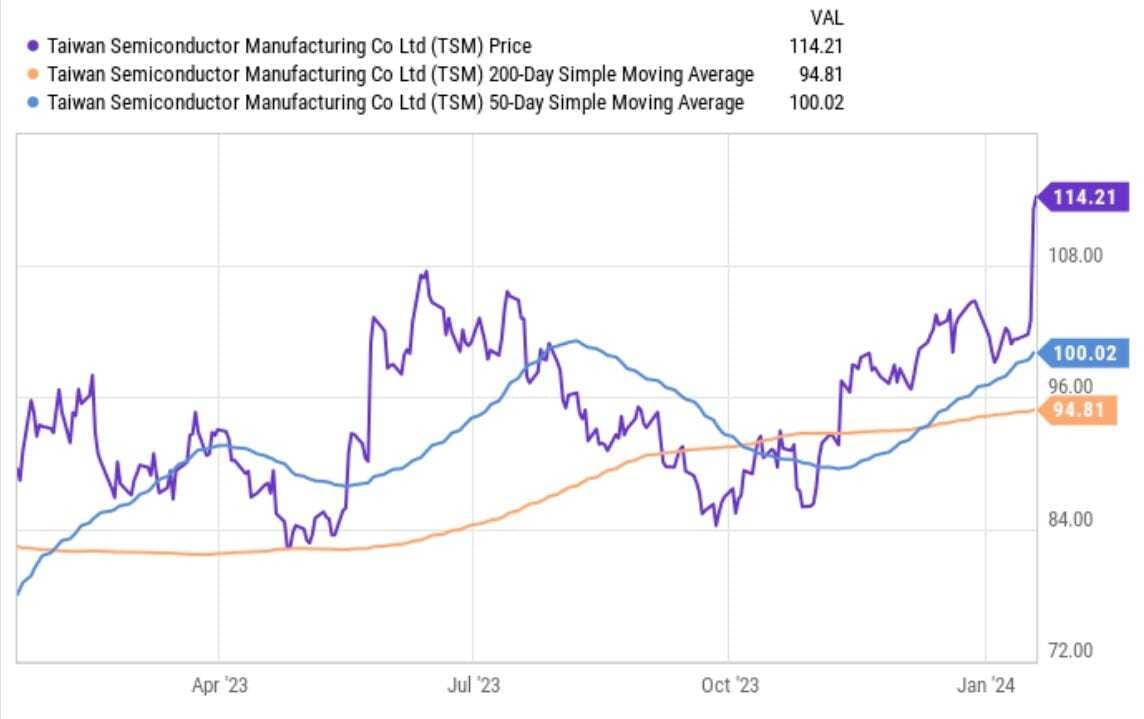

2. The Trade Desk (TTD) – Come to Papa & Leadership

a. Come to Papa

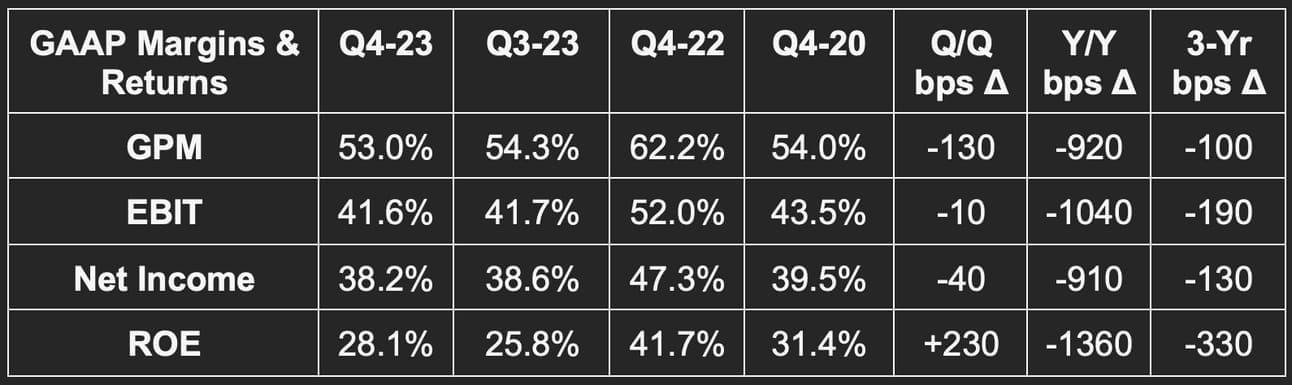

At the beginning of the year, I placed The Trade Desk in my fundamentally elite but very expensive holding category. At that time, it was trading for around 135x next 12 month operating income. It was also trading for an EBIT multiple/3-year EBIT CAGR of 1.99x. This made it the 6th most expensive growth and technology name in my broad coverage network. Since then, the shares have cooled off quite a bit. The EBIT multiple is now closer to 100x, and likely below that considering the company consistently surpasses profit estimates. The 1.99x EBIT growth multiple has also fallen below 1.50x, which is now below average within its bucket of companies.

I’ve trimmed 6 times in the last 12 months. None of these trims had anything to do with the quality of the firm’s performance, but were solely based on an aggressively steep multiple. The company is simply an elite executor, Jeff Green is a fantastic CEO and its niche is highly compelling. The stock just got way ahead of itself, so I lightened up. The price tag has now waned to a point where I’ve added to my stake for the first time in over a year. I hope to continue doing so into more material multiple contraction. I think there’s a chance that Q4 looks less impressive than its quarters normally do before performance improves in 2024. That could give me the chance to keep re-building the position.

The Trade Desk boasts a tangible edge in its ability to double average ad placement efficacy for its buyers. This means it outperforms during poor advertising demand times like in 2022 as buyers scrutinize every dollar spent even more and flock to the highest return relationships. The Trade Desk is the partner to deliver unmatched returns in the open internet. Returns are better, consistent identification of customers, reporting, and transparency are also just better. While all of this meant that it vastly outgrew the market in 2022 and “took more share in one year than ever,” the share gains were harshly masked by generally poor macro and ad purchasing appetite. Growing faster than the competition still meant growth slowing towards 20% Y/Y.

Now, with monetary policy easing, recessionary fears diminishing and commentary on bottoming demand from nearly every digital advertising staple over the last several months, I think the sector is becoming much more inviting. That’s happening while The Trade Desk stock has endured some sorely needed multiple compression. It will continue to take more market share like it has for over a decade. Those market share gains will be much more noticeable as sector growth accelerates; they should foster an acceleration beyond the current 20% growth currently expected for 2024. The cyclical industry is entering a more enjoyable part of this current cycle. That will prop up TTD’s growth as it continues to dominate within the two best secular growth stories in programmatic advertising: Retail Media and Connected TV. Fortune 500 retailers are lining up to partner with it. Every single streamer is embracing advertising.

b. Leadership

- The Trade Desk created a new role this week and appointed Tim Sims as Chief Commercial Officer.

- Jed Dederick is the company’s new Chief Revenue Officer. Tim Sims had been the firm’s Chief Revenue Officer before this.

- The firm’s Chief Strategy Officer, Sam Jacobson, was added to the firm’s board of directors.

“The Trade Desk has grown more rapidly and gained more market share in the last four years than at any point in our history, and these leadership appointments ensure that we are well positioned to continue on that high-growth trajectory.” – Co-Founder/CEO Jeff Green