Today’s piece is powered by Savvy Trader:

Welcome to the 342 new readers who have joined us this week. We’re delighted to have you all as subscribers and determined to provide as much value & objectivity as possible.

1. Shopify (SHOP) -- Arming the Rebels & the Generals

Shopify was born as a company to “arm the rebels” and “lower the barrier to entrepreneurship.” With this image has come a label that its commerce platform only serves smaller merchants. That’s simply inaccurate. I wanted to address this confusion that I see constantly pop up on Twitter.

Since 2019, Shopify has been hard at work on improving its offering for Fortune 2000 brands. It added a business to business (B2B) and wholesale selling channel which fully integrates into all other consumer-facing Shopify selling vectors. Most B2B software competitors force clients to run separate stacks in parallel which makes inventory management, price customization and store configurability quite manual and difficult. Shopify allows for all channels to be run through one dashboard with lower total cost of ownership and better interoperability within segments.

Furthermore, in 2022 it added key Enterprise Resource Planning (ERP) partners in Accenture, Deloitte and EY to train and educate their workforces on selling Shopify’s suite. Most large enterprises prefer embarking on large platform transitions through ERPs and now Shopify offers far more flexibility here.

But wait… there’s more!

Shopify’s new headless commerce stack (headless means full separation of front and back ends) and its new Online Store vastly enhance its offering for large businesses. How?

- Turns each store page into a drag and droppable block to power full (no-code) customization. Think of a Shopify store page like lego blocks.

- Many of the largest brands want fully customized stores built for them. Shopify isn’t willing to build from scratch for individual merchants, and this is how it offers that same level of customization without needing to do so.

- Allows apps to be added in a no-code manner to any piece of a store to emulate complete control of the user interface & experience without forcing Shopify to build from scratch.

- Expedites front-end updates by separating them from the back end while using Application Programming Interface (API) calls to connect front and back-ends in a far less cumbersome, more expedient & configurable manner.

- This bridge offers the best of both worlds → lighter weight software for faster performance but still with a real-time data channel to ensure things like inventory & promotional activity are always accurately displayed.

- Uncaps API call limits to also uncap the possibilities for customization. Merchants no longer need to choose between which desired customization features to deploy. They can have it all.

You can take my word for it, or you can simply observe all of the major bellwether brands Shopify works for today:

2. CrowdStrike (CRWD) -- New Hires & an Interesting Initiation

a) New Hires

CrowdStrike hired Daniel Bernard as its new Chief Business Officer and Raj Rajamani as its new Chief Product Officer of Data, Identity Cloud & Endpoint (DICE). Interestingly, both new executives came from SentinelOne. Bernard was the Chief Marketing Officer there while Rajamani was the Chief Product Officer. In terms of prestige, Bernard’s new title at CrowdStrike is similar to his at SentinelOne. For Rajamani however, he’s now the CPO of a segment of CrowdStrike (and reports to the CPO, not CEO George Kurtz) while he was the head CPO at SentinelOne. It appears that he was willing to take a title downgrade to work for CrowdStrike vs. one of its key competitors. A small fact that speaks well for CrowdStrike among those actually embedded in that community.

This news also signals more focus on the small-medium business (SMB) segment of the market as that’s the SentinelOne bread & butter. Specifically, Bernard will lead CrowdStrike’s SMB go-to-market strategy. These hires, along with rising competitive SMB win rates for CrowdStrike last quarter plus the new Falcon Go package tailored to smaller customers, show CrowdStrike’s invigorated emphasis here is working.

b) Initiation

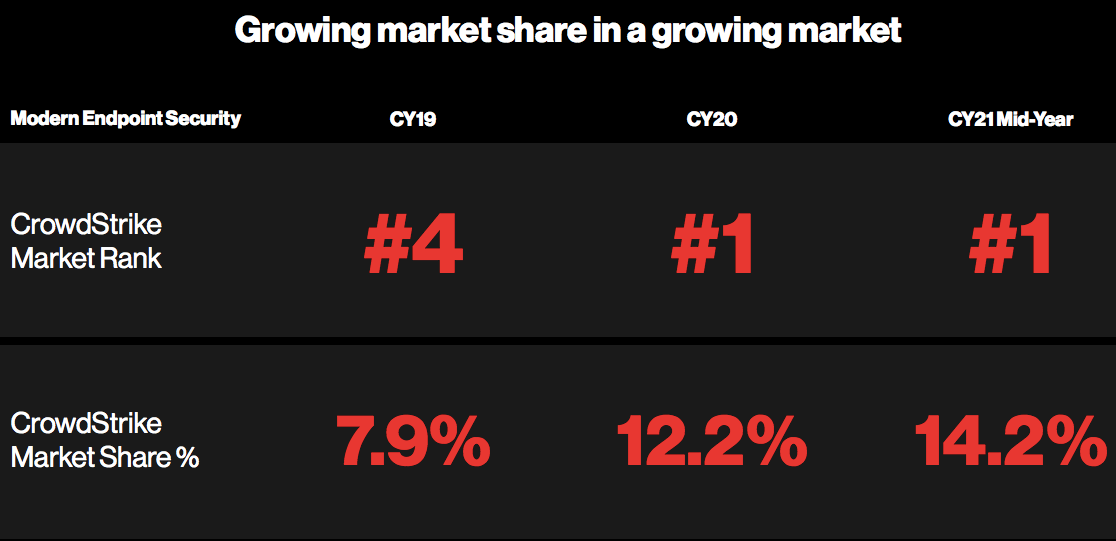

BMO Capital Markets initiated CrowdStrike at overweight. The news isn’t as interesting as the reasoning: The firm sees CrowdStrike effectively competing with Microsoft for endpoint market share. Considering CrowdStrike’s market share has nearly doubled over the last few years to overtake Microsoft as top dog in the space, this isn’t surprising, but is still nice to hear.

Savvy Trader is the only place where readers can view my current, complete holdings. It allows me to seamlessly re-create my portfolio, alert subscribers of transactions with real-time SMS and email notifications, include context-rich comments explaining why each transaction took place AND track my performance vs. benchmarks. Simply put: It elevates my transparency in a way that’s wildly convenient for me and you. What’s not to like?

Interested in building your own portfolio? You can do so for free here. Creators can charge a fee for subscriber access or offer it for free like I do. This is objectively a value-creating product, and I’m sure you’ll agree.

There’s a reason why my up-to-date portfolio is only visible through this link.

3. PayPal (PYPL) -- Branded Checkout Share

SMBC Nikko Securities (based in Japan) expressed some caution this week in its downgrade of PayPal from neutral to underperform. The firm argued that at a minimum, the pace of PayPal branded checkout share gains was slowing and could even be stagnating. It further stated that PayPal’s focus on margin expansion and earnings growth could stifle its pace of innovation causing it to lag its peers. Here’s what I think:

PayPal branded share gains do not need to rapidly rise for this investment to work. It already has dominant share & dominant availability among merchants within e-commerce. Branded PayPal checkout is the mature cash cow feeding the rest of the company’s growth projects (Venmo and Braintree) and its buyback. As long as that checkout share is stable, like this research note suggests it could be, that cash cow will be stable. Furthermore, we are just weeks removed from a very upbeat upgrade for PayPal on the basis that its branded checkout share trends among the largest merchants in the world had turned positive once more.

If PayPal does cede material share of branded checkout due to failure to innovate, that could make the aforementioned cash cow more vulnerable and would force me to re-evaluate my holding. So far, its results and all but guaranteed strong Q4 2022 + 2023 guidance make me think that’s not happening.

Additionally, PayPal is among the most profitable, liquid & highly regarded brands in the world of fintech. It has readily used M&A to plug innovation gaps with purchases like Honey, Braintree, Hyperwallet and more. Its M&A track record is about as strong as it gets in terms of shareholder value creation. With fintech multiples greatly slashed in the last year, it could affordably plug more holes if it saw a need. Management has hinted at getting more interested in M&A very recently as those multiples have come down. It has nearly $11 billion in current liquidity on the balance sheet; there aren’t many disruptors in the space that it can’t afford to buy should it so choose.

4. Meta Platforms (META) -- User Data, AI Investments & More

Deutsche Bank research published some data this week on social media app usage in the United States. Daily usage rates for Facebook & Instagram both rose 400 bps to 82% and 78% respectively from June to December 2022. These gains were identical to TikTok’s. In terms of daily time spent market share among social media apps, Meta fared relatively well. Its share between Facebook and Instagram was 27% for December vs. 28% in June. TikTok fell from 18% to 16% as its average minutes spent fell more sharply than any other competitor.

While FinTwit had already pronounced TikTok victorious in a brisk Meta Platforms death… to that I say not so fast. The Family of Apps is more than holding its own and even taking relative engagement share vs. its 2 largest competitors -- YouTube and TikTok.

Reels is slowly winning the world’s attention while its monetization rates improve… Younger generation app engagement remains stronger than competitors according to its Group Director Sophie Neary this week… TikTok public sector bans are happening at a rapid clip… AI investments are bearing fruit with Morgan Stanley the latest institution to point that out on Wednesday… Year over year comps are easing as we lap the impact of IDFA and the pandemic pull-forward… WhatsApp marketing and enterprise tools are finally gaining steam. This is a perfect storm of Meta tailwinds and, I believe, the time to be leaning into Meta stock (which I own). That’s why I added this week and have been consistently adding for months. Time will tell if I’m right.

5. Match Group (MTCH) -- Monetizing Power Users

Hinge’s new subscription model will be $60 per month vs. its currently most expensive plan of $35 per month. Perks of the more expensive plan will include better, more frequent placement to boost matches and more tailored profile recommendations. Tinder is also now fielding interest in a $500 per month subscription package. (For that price tag, maybe the package comes with a love potion or something along those lines).

When Bernard Kim was appointed the new CEO of Match Group, one of his key objectives described to investors was better-monetizing power users. He thought a small cohort of “highly motivated daters” had far more price elasticity than Match was taking advantage of. Well? This will be one of the ways -- in addition to a more compelling a la carte offering -- that Kim will try to extract value from that customer cohort. With Tinder growth slowing and Match entering a more mature phase of its user growth (outside of Hinge and a few other apps), revenue per user will become an increasingly important piece of this investment. We’ll see what kind of traction these packages can garner.

6. Olo (OLO) -- New Client

Olo landed Rachel’s Kitchen and its 8 locations as the firm’s newest customer. Rachel’s is starting with 4 modules immediately (vs. less than 3 overall on average for Olo customers) including the company’s newest product: Olo pay.

7. Upstart (UPST) -- Auto Lending

Upstart announced two application extensions for its Auto Retail Platform: Digital Financing & Online Searches. With these two products now available in a fully digital format, Upstart can offer dealers across the country an end-to-end digital car buying application process. While that sounds like table stakes (because it is in other sectors), it’s actually something that does not exist today without several manual controls and paperwork frustrating customers, lowering conversion & fostering time delays.

Expected benefits of the Digital Finance Product:

- “Frictionless signing & contracting” with next day funding.

- Higher approval rates (based on continuously sharpening its underwriting models and introducing its AI underwriting algorithm purpose-built for auto).

- No learning curve for dealers; Integrates right into their current workflows.