Table of Contents

- 1. Income Statement Comp Sheets

- 2. Nvidia (NVDA) – CES 2026 Keynote Highlights

- 3. AMD (AMD) – Lisa Su 2026 CES Keynote

- 4. CrowdStrike (CRWD) – M&A & Competitive Implications

- 5. SoFi (SOFI) – Noisy Week & More Capital Raise Info

- 6. Mercado Libre (MELI) – Venezuela

- 7. Meta (META) – Encouraging Progress & More

- 8. PayPal (PYPL) – Partnership & Quick Thoughts

- 9. Headlines

- 10. Macro

Earnings season gets started next week! I can't wait. I'll be publishing a Taiwan Semiconductor review and putting together a detailed overview of big bank credit data as a key gauge on the U.S. consumer.

For a view of my current portfolio & performance vs. the S&P 500, click here. I started a new position this week, added to a few existing holdings and trimmed my stakes in two.

1. Income Statement Comp Sheets

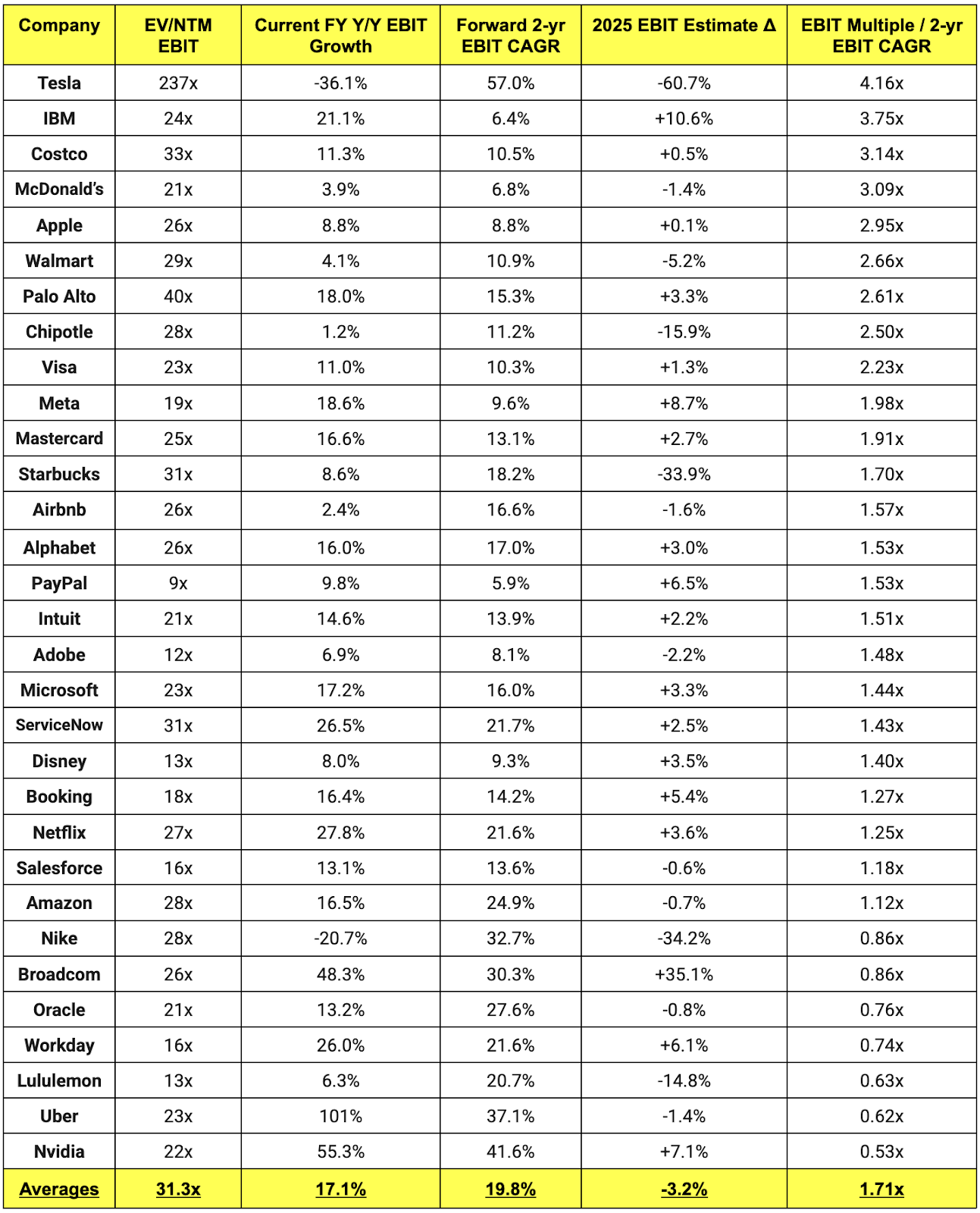

a. Mature Growth Cohort Valuation Comp Sheet

Caveats:

- Fiscal calendars don’t perfectly match.

- Some firms only report GAAP EBIT without adjustments. Non-GAAP adjustments for this cohort of companies are a lot less aggressive than for the fast-growth cohort, so I just left things as is.

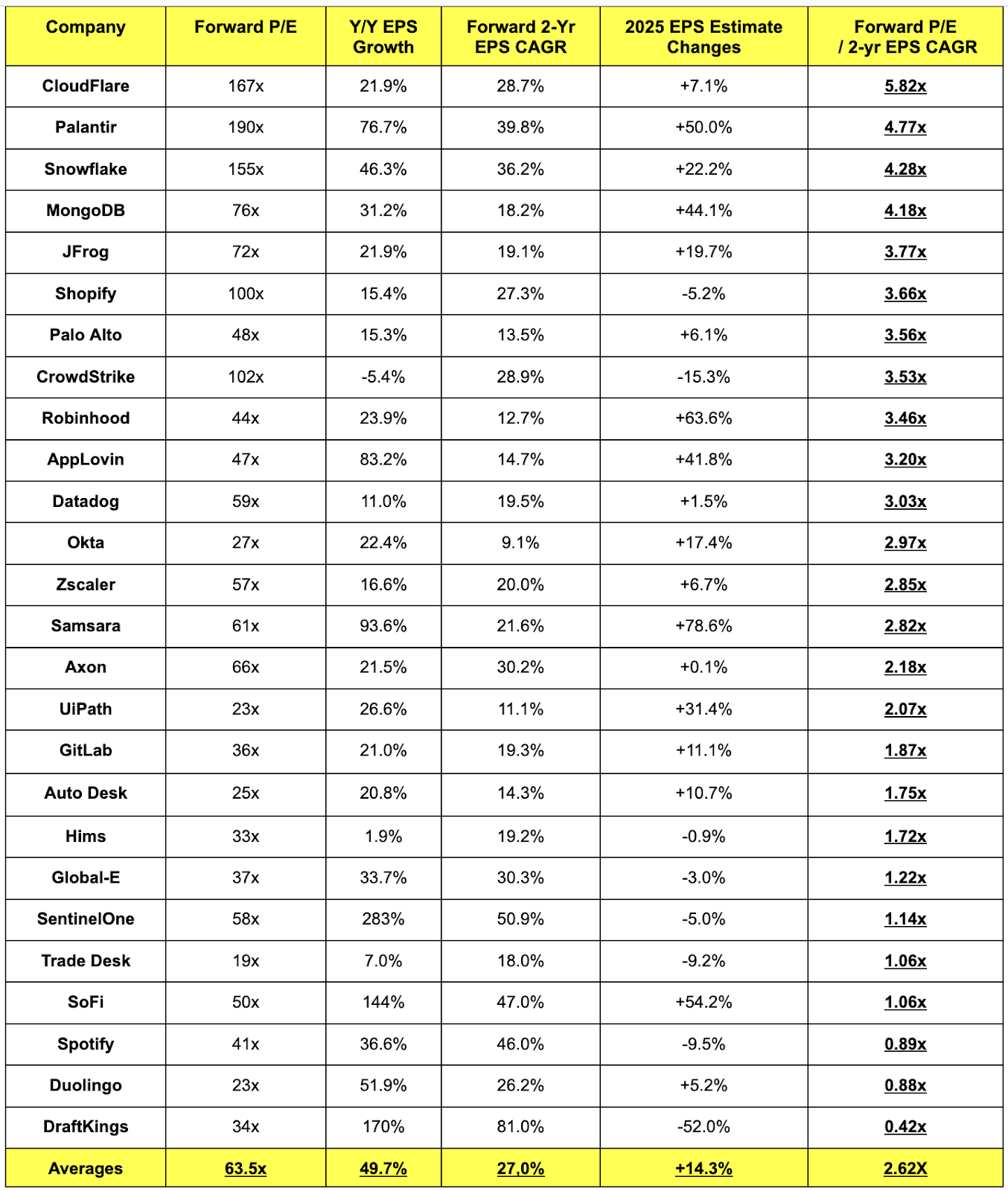

b. Fast Growth Cohort Valuation Comp Sheet

Caveats:

- Fiscal calendars don’t perfectly match.

- I used net income here instead of EBIT. This makes comps apples-to-apples for more firms (more make adjustments to net income than just EBIT). And for this group, non-GAAP adjustments are more aggressive and material. That means making sure they're similar on a company-by-company basis is more important. Furthermore, mark-to-market equity valuation changes that routinely impact net income for the other cohort only impact Axon in this group.

- I used pre-tax income for Axon. Net income is a bad metric for this name due to the unpredictable impact of share price swings on its payroll taxes and its equity portfolio. I raised the P/E by 5 turns to emulate taxation.