1. SoFi Technologies (SOFI) -- CFO Chris Lapointe Interview & Downgrades

a) CFO Interview

Student Loan Ramping:

In the 15 years leading up to the student loan pause, $575 billion in credit was issued at 6%-7% yields which SoFi is able to refinance at more favorable terms. Of that, $200 billion presides within the credit bands where SoFi operates. There will be two sources of refinancing demand acceleration as interest begins accruing in August and payments resume in October.

First, with the student loan repayment burden as pressing as ever, borrowers will be looking to extend the terms of their loans. Even if SoFi can’t provide a lower rate to these borrowers, Lapointe offered an example of extending a term from ten to twenty years. Even at a higher rate (7% instead of 6%) this led to monthly payments falling from $775 to $540. Many will be able to maintain or cut their rates and extend terms for larger savings. This loan demand should rapidly proliferate in today’s rate environment and doesn’t require future rate cuts for support. That said, rates will inevitably come back down.

The second source of demand would be aided by rate cuts. This will come from borrowers who SoFi can refinance at lower yields. It sees a large chunk of outstanding federal volume as presently ripe for doing so. As rates are cut some time in the next year, this source of demand will ramp further. Because refinancing costs a borrower nothing and is a quick application, Lapointe sees some borrowers refinancing multiple times as rates start to fall. Most won’t be waiting for more cuts to refinance just once at the optimal rate -- there’s no need.

The largest year of refinancing demand in the history of the market was $20 billion. That’s just 10% of the opportunity SoFi is pursuing today and offers a long potential runway of demand to enjoy. With its 60% market share of the refinancing sector (vs. 40% in 2019 as some players have vacated), the business is theirs for the taking.

To Hold or Sell Student Loans? That is the Question:

Lapointe offered some updates to the student loan business’s profit structure. As of last quarter, the segment’s weighted average coupon was 4.9%. In period refi originations this quarter have risen to a more robust 6.5% rate. Considering SoFi’s cost of capital of around 3.85% (call it 3.9% now with the APY hikes) and annual losses of 0.4%, SoFi is left with a roughly 2.4% return on asset (ROA) and a 20% return on equity (ROE) with its capital structure. A 20% ROE for low risk debt is good.

Of the student loans originated around 4.9%, most were issued when warehouse debt was cheaper, SoFi’s APY was lower and so its cost of capital was lower. Lapointe didn’t tell us what the whole book’s ROE was, but hinted at those lower coupon loans still being attractive holds. Student ROE of 20% is much lower than unsecured personal ROE over 40%, but SoFi has the leverage and capital ratios to retain all of the loans rather than sell any of them. That would juice return metrics, and that’s the plan.

Lapointe ended this segment by reminding us that 6.5% yielding debt with 40 bps of annual losses is also quite compelling for capital markets. That’s why capital market demand remains “strong” and available to SoFi if it needs to tap that liquidity (which it doesn’t). There is a lot of flexibility here and, as that remains the case, its sole objective will be to responsibly maximize shareholder returns.

Personal Loan Markings:

Like every other conference, SoFi was asked about its mark-to-market loan valuations as it doesn’t use traditional current expected credit loss (CECL) methods. Again, Lapointe told us exactly how overly conservative the assumptions baked into the markings truly are. They assume 4.6% personal loan annual loss rates while -- several quarters into putrid macro -- SoFi’s actual losses are less than half that. Its expectations are that “loss rates will continue to consistently outperform.” The marking methodology also writes down loan valuations more expediently and aggressively than alternative methods. For example, after a loan turns 30+ days delinquent, it writes down 70% of the valuation and incurs the costs on its financial statements for that quarter. It is not shady in its marking methodology… it is effectively (if not overly) prudent while even using an independent third party to value the credit.

SoFi’s macro assumptions also include 5% 2023 unemployment and a pessimistic 2.5% 2023 GDP contraction. The Federal Reserve, for context, expects unemployment of 4.1% this year and 1% GDP growth.

As another interesting note, leadership reminded us how balance sheet markings are closely tied to actual capital market demand. They assume SoFi can fetch a 4% gain on sale margin for personal loans vs. 6% apples to apples returns for holding. That 4% gain on sale is based on direct communication with loan buying customers and valuations are tightly tied to this reality. The noise surrounding SoFi’s lack of whole loan sales last quarter was unwarranted. Again, it’s all about ROE optimization thanks to its balance sheet flexibility. Today, that ROE optimization requires holding and forgoing capital market sales that are fully available to the firm. Bids on residuals are less compelling than balance sheet stashing.

“What’s embedded in the marks is what a buyer is willing to pay and you can assume they are baking in a level of conservatism accounting for a recession or harder times.” -- CFO Chris Lapointe

Annual Percent Yield (APY) Flexibility:

The benefit SoFi enjoys from the charter (allowing it to use deposits for funding) rose again last quarter. It sits at 210 basis points vs. around 150-190 in 2022. This gives it the flexibility to continue raising its APY which bolsters deposit growth and so loan liquidity. It thinks that its flexibility is unparalleled vs. non-banks and will let it maintain its APY at higher levels as rates are eventually cut to distance itself from alternatives.

Technology Segment:

Lapointe reiterated that tech segment margins are set to bottom from here while growth accelerates to 15%-20% by Q4 and speeds up more in 2024. It is “well on its way” in late stage conversations with a “dozen large financial institutions” which would all be very needle moving to revenue over time. We’ve heard this for a while but these “conversations” now seem to be wrapping up. The recent proof-of-concept with a top ten financial institution has been a “large win” for the firm and an accelerant to this potential demand.

Final Notes:

- Reiterated plans to add over $2 billion in deposits this quarter.

- Reiterated plans to be GAAP net income positive by Q4.

- Customer acquisition cost in its lending business fell 19% Y/Y last quarter thanks to financial service cross selling.

- Wyndham integration is going “well.” Home loan volumes are still expected to ramp in the second half of the year.

- Reiterated that stock compensation will fall below 10% of revenue by Q4. That’s a big piece of turning GAAP net income profitable.

b) Downgrades

This week, three different firms downgraded SoFi. The core theme of the decisions was valuation due to its recent near doubling in price (with upbeat views of the company’s longer term prospects). Concurrent with the downgrades, the price targets were actually raised. This is valid: There has been a great deal of multiple expansion in just 30 days with the stock racing aggressively higher.

We saw claims of “market manipulation” and “shady dealings” from some across the web and we wanted to address these claims and why they’re erroneous. As a reminder, SoFi is a top three holding in my portfolio, and I see no merit in an argument that analysts were doing anything but acting rationally. This is normal. This is healthy. This is entirely fine.

Companies do not go up in a straight line and multiples cannot just endlessly expand. Especially without negative real interest rates, fundamentals and valuation will always matter. Long term alpha is driven by rate of profit compounding; profit cannot explosively compound overnight and so share price cannot permanently soar higher while the business stays the same. So? It was clearly time for this stock to take a breather and to digest some of the explosive gains we’ve seen.

From an analyst perspective, this also makes perfect sense. Piper Sandler for example had a $6.5 price target as of last week with an outperform rating on the firm. It either needed to figure out a way to argue the firm was somehow 50% more valuable than it recently thought it was or more gradually tweak the target and downgrade the stock. Analysts are simply playing catch up. They need new data and a new reason to raise targets beyond where SoFi sits today. Considering the consistent commentary we’ve gotten on how well Q2 is going for the firm, that reason could come when it reports earnings later in the summer. We’ll see.

2. Revolve Group (RVLV) -- Plans

I don’t talk about Revolve much vs. other, more popular holdings. I’m prepping to meaningfully add to my stake in the coming quarters and I wanted to explain the timing and why Revolve.

A Weird Time Period:

Revolve caters to a young, “aspirational” consumer shopping for expensive clothing and accessories from established and up and coming brands. Furthermore, it drives a great deal of traffic, buzz and revenue from live events that it hosts all year along. These events coincide with things like Cochella and New York Fashion week. Finally, it’s clothing is worn to “look and feel your best” meaning it’s mainly for going out use cases. When you combine these things together we are left with the following trends:

- 2020 and early 2021 was a very challenging period for the firm as socializing ground to a halt, its live events paused, and the drive to “look and feel your best” greatly diminished. Growth mightily slowed.

- In late 2021 and the first half of 2022, comps got extremely easy while cash sloshed around in pockets, socializing and live events resumed and Revolve continued consistently taking market share. This resulted in the 20% annual growth company expanding revenues by well over 50% for most of this period.

- In late 2022 and the first half of 2023, comps became abnormally difficult via rapid growth the year before. Beyond that, macro turned sour, liquidity dried up, consumer confidence eroded and economic growth slowed. The world shifted from buying goods to services and also traded down across categories to preserve more finite budgets. Revolve, like everyone else, was also caught with excess inventory when demand trends abruptly shifted. As a result of this all, Revolve’s growth ground to a halt and income statement margins contracted. Its cash flows have been exceedingly strong recently, but that’s mainly the result of inventory liquidation from the prior glut.

Looking Ahead:

So what do we expect the rest of 2023 and beyond to look like for Revolve? The second quarter will likely be ugly again when it reports in July. That could set the stage for a great purchase opportunity. We’ve already gotten April and May sales data showing Y/Y declines in the “mid-single digit percent range.” June is when comps start to get much easier, but macro headwinds should continue to dampen growth this month as well. For this reason, I’m not racing to add the shares that I want to add this year. I did add a bit recently, but I’m leaving a great deal of room and flexibility to keep accumulating as we approach that report.

Looking at Q3 and beyond, things will likely start to look much healthier and more normal. The inventory re-balancing it’s conducting will be finished this month and gross margins should briskly expand as a result. We’ll start to see that play out in Q3. The team has consistently reiterated that margins are set to bottom and is fully confident in growth re-ramping back towards 20% as Y/Y comps ease and macro headwinds begin to fade.

There could be more margin upside ahead as well. The global company is finally ready to expand its fulfillment footprint. While it was using a single West Coast facility, it has since added a distribution center on the East Coast and is prepping to add international capacity as well. This will cut down miles to fulfill which is especially important for Revolve. Why? Its goal is to “turn your home into a dressing room” to emulate the strengths of department store shopping. This entails free, seamless returns and rapid shipment windows. Returns are a big part of its model and that won’t change. If Revolve can store returned inventory in the U.K. for example to re-fulfill there vs. shipping it back to California and then again to the U.K., processes become more efficient and costs fall. This will raise the long-term margin ceiling of the firm. It’s also investing in sharpening its existing AI models to enhance product matching and ideally lower return rates.

Once inventory is re-balanced, Revolve will lean back into owned-brand sales and growth. It has shied away from doing so as offering owned brands comes with less ordering and inventory flexibility than 3rd party. Owned-brands inherently come with better margins vs. its 3rd party business. Another margin tailwind to look forward to.

Growth drivers for this firm remain abundant. It’s still tiny compared to the legacy department stores that it disrupts and displaces. It has recently expanded into the beauty category along with other apparel segments to expand wallet share and is finding early success. Its Men’s category is still close to 0% of sales, but it just hired new talent to grow that important opportunity as well. With the loyalty it has built with young women and the reality that they do a lot of the shopping for men, this could find rapid traction. It also continues to see its other website (FWRD.com) thrive with brisk multi-year compounding. The team is now ramping cross-marketing efforts on the two sites and combining loyalty programs as well to drive growth. Just a mid-single digit % of Revolve customers shop on FWRD. That proportion rises every quarter with a long way to go. Hiring Kendall Jenner as FWRD’s creative director turbo-charged that site’s awareness and remains an exciting development. Finally, partnerships in India and Mexico are fostering rapid growth in those newer markets. While North America remains untapped, potential abroad is even less mature.

The Team, The Team, The Team:

One of the best parts of this investment is the rock-solid leadership team. The co-founders built the firm from the ground up with very little capital. They did so with a tech background enabling them to build their own vertical tech stack and save on 3rd party fees. The co-founders own nearly 50% of the company and pay out well under 1% of revenues in stock-based compensation. They deeply respect the value of the equity because that value is what powers their own net worth. Management and shareholder interests are fully aligned.

That alignment is likely why Revolve has been profitable throughout its decades of existence -- which is quite the rarity in its e-commerce fashion niche. Its balance sheet is pristine with no debt and its cash pile sits at a robust $280 million or 23% of its total market capitalization. That allows it to continue playing offense and to increase its market share across this entire cycle. Those share gains should become more noticeable as e-commerce growth recovers in the second half of 2023.

Valuation:

The aforementioned headwinds to current results will lead to flat revenue growth in 2023 and about a 25% decline in EBITDA and net income. Free cash flow will spike higher, but that’s again due to inventory reductions. This is why I’m not in a hurry to add today.

Looking ahead to profit growth in 2024 and beyond is where things get very compelling. From 2023-2025, EBIT is set to compound at 51% with GAAP net income compounding at a rate of 46%. These profit estimates rely on 16% revenue growth compounding over that period. I view that as overly conservative based on historical compounded growth and leadership commentary (which has always been candid). Faster revenue growth would mean faster profit growth, but that upside is not necessary for this to work thanks to the currently modest valuation. The firm trades for 25x 2023 earnings which, based on rate of profit compounding, leaves it at a forward PEG ratio (using 2-year net income CAGR) near 0.5. Yes please.

As the 2nd quarter draws to a close and we enter the second half of the year, I expect to accumulate more shares here.

3. Adobe (ADBE) -- Earnings Review

a) Results

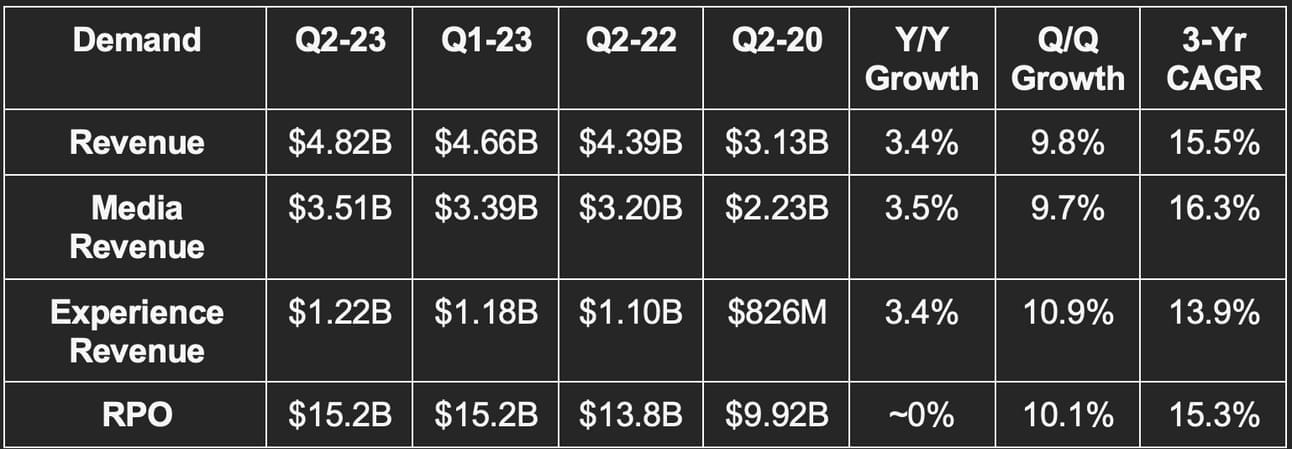

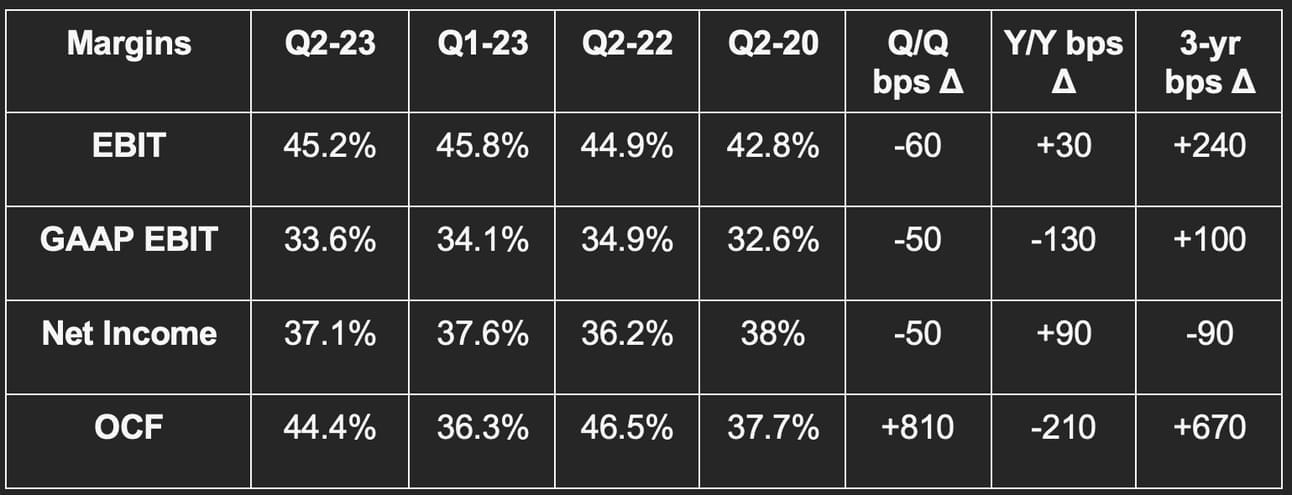

- Beat revenue estimate by 1.1% & beat guide by 1.1%.

- Digital experience revenue was in line with guidance.

- Digital media revenue beat guidance by 1.4%.

- Beat EBIT estimate by 2.3%.

- Beat operating cash flow (OCF) estimate by 6%.

- Beat $2.72 GAAP EPS estimate by $0.10 & beat guide by $0.14.

- Beat $3.79 EPS estimate by $0.12 & beat guide by $0.13.

Beat digital media net new ARR guidance by 11.9%.