1. Upstart (UPST) — Investor Conferences, Auto Progress & KBRA Data

a) Co-Founder/CEO Dave Girouard Interviews with JMP Securities and Morgan Stanley

On the differentiation of Upstart’s Lending Model:

“Some either can’t conceive that we can make a smarter credit decision [than FICO and some human-created rules] or think everybody must be doing this. The truth is neither of those things are accurate. It is neither impossible nor easy… the types of teams that can build these models don’t exist in most of the lending industry… the disbelief puts our company in a place where we have a belief adoption curve. We’re proving it month by month.”

“We want to be the first stop for credit access because the consumer trusts us to offer the best rate, best process, best everything. We have to make that a little bit truer every single day.”

On the partner philosophy and partners dropping FICO minimums:

“We have an enormous number of knobs and dials that we can implement to manage partner risk… you can think of our system as having a first pass — which is the partner’s rules — and then a second which is our risk system… we do that because it’s important to meet highly regulated and conservative banks where they are. They have all sorts of reasons not to want to just jump into the future… once they’re on the platform, they start to see how it performs. They start to see that minimum credit score and other rules are unnecessary and not actually predicting risk. The rules actually exclude a bunch of people they could successfully and responsibly lend to.”

On re-thinking Macro:

“Banking and lending tries to watch the tea leaves to react to the changing state of the economy. Ultimately, our system we believe is much more adept at reacting quickly and doing the right things… now 2022 has all these other variables and the bottom line is that there’s no such thing as everything is normal. I think what we’re doing over time is proving to our partners that this is the system you need to deal with a noisy, crazy background economy.”

As a reminder, Upstart has guided to rising default rates into 2022 as the consumer normalizes post-pandemic. According to Girouard, we are now “close to pre-COVID levels” in terms of defaults and he sees it now stabilizing at a rate similar to 2019. Girouard explicitly said this change has “not negatively impacted the business” as the loans have already been priced accordingly (as Kroll Bond Rating Agency (KBRA) data hints at below). Considering Upstart’s loan performance exceeded expectations for partners and investors pre-COVID, re-entering an environment more similar to that one should not impact its ability to continue executing.

“We feel good. We’re in a good position. Our system did the right things and now we’re largely beyond the stimulus impact… as a technology provider in a cyclical industry, it’s vitally important that we are helpful when things get volatile to allow lenders to continue making credit available when it’s needed the most.”

Upstart used the pandemic as a tryout to soar from the 4th largest in its space to 1st, by far. It shined through the hectic times.

On auto refi (older product) and auto purchasing (newer product):

“Last year, we said auto is our next thing. We focused on it and had confidence that the market opportunity is enterable. We came into this year able to say, yep it’s happening. We know the drill for improving the models and scaling up while improving conversion rates and all of that… in the case of auto, we simply offer a better product.”

On Prodigy (acquired by Upstart) giving it the dealer-facing software it needed for auto purchasing:

“We view the auto purchase opportunity as much larger than Refi. With the auto purchase product, we have the same smarter credit and automation built in, but we also have proprietary distribution…. We work a lot with LendingTree and Credit Karma for personal loans. In those cases, they’re the first thing the consumer sees. Now, we are in the car dealership so we are LendingTree, Credit Karma and Upstart all rolled in one. We feel confident that this has the potential to be our largest business by far in a few years… We’re well on our way to being in 15,000 to 20,000 (it’s in a few hundred today) large independent and franchised dealerships. We feel very confident we will continue growing our presence quickly.”

“It is fair to say when we put that $1.5 billion auto origination number out there, we feel very comfortable. Refi has achieved liftoff and hopefully later this year we’ll say the same thing about the auto purchase product.”

Girouard eluded to more dealer integration work left to be done but referred to this as “not remotely risky.”

Until recently, it was not providing its own auto purchase credit offers — now it is:

“In the dealerships where we’re testing our own credit offers, we’re becoming increasingly confident as we start to see that our offers will compete really well across a lot of the spectrum… lenders also are realizing there’s no reason not to work through our system. As usual, we have the same value proposition of approving more people at lower loss rates…. Upstart Auto Retail has no enemies… all 3rd parties can win here.

Upstart Auto Retail refers to the company’s car dealer product. Not refinancing auto loans through Upstart.com or a lending partner. It’s the end-to-end, on and off premise software that dealers use to power the car buying experience. Upstart then uses its auto lending partners to fund the loans.

On the asset-backed securitization (ABS) market slowing and the impact on Upstart:

“The majority of our institutional buyers don’t securitize, so the market has no impact on them. The rest only securitize if it’s really productive to do so. Otherwise, they happily hold the loans and appreciate the yield they get from them. There’s only a small fraction that could have a lower appetite without the ABS outlet but that’s not all that material to us… In 2021, the ABS market was extraordinary. You had loans bought at par and sold within a month or 2 at 108% of par…. we expect that because ABS markets have cooled down, a lower fraction of 2022 loans from our platform will end up in ABS markets.”

Considering investor worries over Affirm cancelling a debt offering related to an ABS transaction of its own, hearing this from Girouard was both unsurprising and comforting to me.

b) Auto Progress

Upstart launched a mobile-first version of its Upstart Auto Retail platform alongside some new features like custom filters to search for cars. Considering 66% of dealer traffic through the Upstart Auto platform comes from mobile devices, this is key to further removing platform and venue friction while conveniently and actionably meeting the user wherever they’d like. It’s this ability to freely move from on-line to in-store and back that is something many other competing digital products lack. Upstart “bridges these two worlds with a consistent customer experience from start to finish.”

This on-line to in-store toggling capability readily offers salespeople with more timely insight into what a customer is actually looking for to speed time to close. Dealers can pick and choose exactly how they want their purchase flow to be organized so that they can do things like hide steps that have been completed (thanks to a new save and finish later feature). Furthermore, the new product equips Upstart’s dealers with the ability to create a more granular, personalized, targeted buyer experience to raise conversion.

The platform’s broad integrations with brick and mortar dealerships are designed to give buyers the ultimate flexibility within selecting which part of the buying process happens where.

As part of the launch, Volkswagen was announced as the newest of 6 global car manufacturers to support Upstart Auto Retail. Just one day later, Upstart announced that Volkswagen selected the platform as a “preferred digital retail provider.”

“When we started working with Upstart Auto Retail, they were an up-and-coming startup in the digital retail space. We chose them because other platforms simply did not meet our needs. Having worked with them now for so long, it has been nothing but a success story.” — Owner of Volkswagen Platinum Josh Lever

The software costs $599 per month per dealer rooftop.

c) KBRA Data

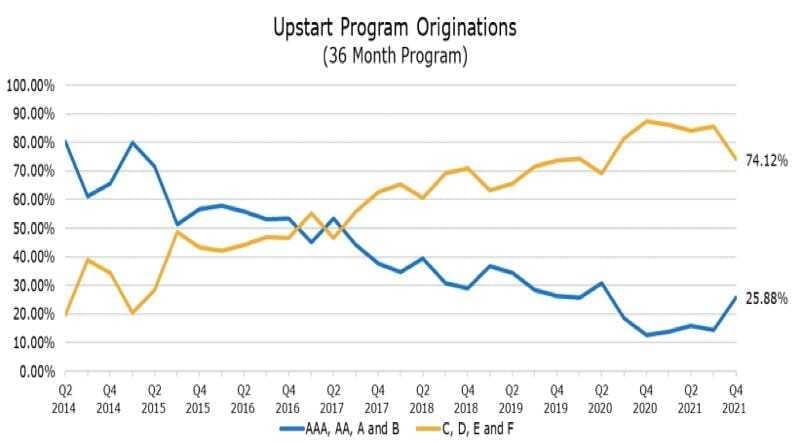

KBRA published new data on Upstart’s 2nd 2022 pass-through transaction. It’s interesting to note that Upstart’s credit mix shift towards lower-graded loans seems to have leveled off:

Still, that mix shift took place throughout 2021 (and before as well) which is why average interest coupon for the latest pass-through transaction is higher (4%) compared to older pass-throughs. This leaves room for more defaults and higher trigger rates — rising credit enhancements within the deal also boost that cushion further.

For every single capital market transaction, KBRA’s current base case loss projection is equal to or below its initial expectation (a good thing).

2. PayPal Holdings (PYPL) — Two Investor Conferences

a) CEO Dan Schulman Interviews with Morgan Stanley

On Russia:

PayPal halted servicing Russian cross-border transactions in light of the war in Ukraine. This was both to take a moral stand and also to ensure safety for the few employees it has in both countries. It does not have a domestic business in Russia and total cross-border transactions from Russia equated to roughly 0.5% of total revenue last year.

On digital wallets at checkout and innovation:

“Clearly, digital wallets are taking share. There are far fewer people entering their credit cards for transactions and we’re seeing all forms of digital wallets take quite a bit of checkout share.”

Considering PayPal’s digital wallet boasts roughly triple the merchant acceptance rate of its next closest competition — Apple Pay — this will be a secular tailwind for PayPal to enjoy for not months, but years to come.

Mote notes on the 6-month-old digital wallet:

- It has already been adopted by 50% of PayPal’s active consumers.

- Digital Wallet users produce 2X the lifetime value (LTV) vs. checkout-only customers.

- Every time PayPal customers add an additional digital wallet service, its LTV rises by 25%

- There are many, many new product launches in the works.

- Users of the crypto services are 25% less likely to churn.

Checkout upgrades highlighted:

- PayPal lowered checkout latency by several seconds in 2021.

- It now proactively updates expired cards so “you never have a transaction turned down due to expiration.” This raised authorization by 0.01-0.02%.

- The organization worked to make a larger part of the PayPal order flow native to its application… “so you don’t have to bounce from merchant to PayPal and back as one-click checkout makes that much quicker.”

On Buy Now, Pay Later (BNPL):

“We could have bought a BNPL player for $10+ billion but we opted to do it organically. Exiting Q4, depending on what metric you look at, we’re either the number 2, 3 or 4 player in countries globally where we offer BNPL.”

It did buy Paidy in Japan for roughly $2.7 billion but that was to expand into the country and for its deep integrations with Japanese convenience stores more so than to get its BNPL assets.

PayPal believes its value proposition in BNPL is “best in class” as it charges no added merchant fees and fosters a 21% spike in their sales volume which is 90% incremental margin. This is why I find it imperative for BNPL to be a tool and not the main value creator: PayPal is merely using BNPL to feed the Total Payment Volume (TPV) and checkout share of its core business — it does not need to overcharge merchants for these services as it generates the needed variable profit elsewhere.

“BNPL is a really good service… it’s not an end in and of itself. It’s not a company by itself.”

More BNPL notes:

- PayPal enjoys a double digit percentage rise in checkout share when its BNPL option is presented upstream during the shopping and discovery processes.

- The product is fully integrated into PayPal’s digital wallet.

- Its max payment is $1500 for BNPL which it’s looking to uncap.

“We’ve been doing credit inside PayPal for 10 years. We know when to responsibly lend and when not to… As best we can tell, we have the lowest BNPL loss rates in the industry. When you have 400 million consumers, it gives you another big advantage via familiarity. When you know the consumer, your approval rates are 90%+, when you don’t, the rate is 75%+. Using PayPal BNPL gives them a much better consumer experience than anyone else.”

On the brand:

“There are a couple of studies that have us as the #2 most trusted brand in the world. 54% of consumers will shop more at a merchant if PayPal is present.”

Braintree:

“Braintree is growing at leaps and bounds. We brought on some of the world’s largest merchants like DoorDash and Live Nation. If you look at Uber and Airbnb, we are either the primary or exclusive provider for the full stack.”

“Braintree is the only full stack processing platform where you can fully integrate in both PayPal and Venmo. If you think about one of the big advantages here, the competitors to Braintree supply just 1 side of our 2-sided network for full stack processing. We provide a full set of services and the ability to tap into our consumer bases.”

On missed Q4 2021 estimates and underwhelming guidance for 2022:

“We clearly got a little ahead of ourselves in looking at what was happening early on in the pandemic. But if you look at the underlying strength of our business ex-eBay… we have really strong underlying growth… everything I see now points to core business strength. So far, the first quarter is shaping up about as we expected.”

On changing customer focus:

Schulman told us that while the focus has shifted away from quantity and to quality, they should return to 30 million+ annual account adds as we lap tough pandemic comps. PayPal’s 11% YoY growth (18% ex-eBay) in transactions per account was one the fastest rates it has posted in 3 years — a sign that the quality approach is working.

“The top of the funnel remains very strong… Are we running out of room to grow active users in our core markets? Absolutely not. We’re 1/3 penetrated in our core markets.”

“Low engaged customers using us 1 time per year leaving us has basically no material impact on revenue. It allows us to shed the costs associated with keeping that customer without impacting our future revenue potential.”

On China:

“We’re very focused on the opportunity in China now that we have our licensing there and now that we’ve finally got our infrastructure in place that is fully compliant and legal inside the country.”

On Crypto:

“We put out an easy-to-use crypto product to buy and sell and use with merchants as well. That was step 1 of a multi-part road map around digital assets.”

On Venmo:

“Venmo TPV is approaching 0.25 trillion growing at 44%. To put that in context, in 2017 PayPal was at TPV of $0.20 trillion growing at 25%... PayPal was a P2P service starting off… and then it went into every merchant (85% in the U.S.). Venmo is going to follow that same track.”

Venmo Pay on Amazon will launch in 2022.

On Walmart and presentment:

“2 years ago, we were buried in pages of checkout options at Walmart. We’ve worked with them on a number of different things post eBay operating agreement so now we’re front and center. As a result, checkout percentage is up substantially. The reason a company like Walmart will work with PayPal like this is because we drive incremental sales and our conversion rates are higher.”

This is why I am confident that the eBay operating agreement ending will be a net long term tailwind for PayPal. It’s free to participate in more intimate relationships with countless other merchants; it had previously been restricted from or entirely prevented from doing so. The eBay business abruptly halting has been a pain, but it’s now just 3% of PayPal’s TPV.

b) CFO John Rainey Interviews with Wolfe

On guidance and the stock price:

“It has been and likely will continue to be a more difficult environment to predict. We were conservative in assuming only 2 interest rate increases in our forecast for the year… given that we earn interest on customer balances, that is one area for potential upside. The other area of conservatism is credit loss rates returning to the mean because of the impact of stimulus. Neither are huge drivers of our business… I would not characterize our guide as overly conservative.”

“We are a show-me story. We clearly need to demonstrate that we can produce the results we talked about. I’m disappointed that we are in that positions… some of it is self-inflicted and we all recognize that. We are focused on generating results that get back to demonstrating the true value of our franchise and opportunity.”

On checkout:

“You can look at 3rd party independent survey after survey that would suggest the preferences for PayPal for checkout going head-to-head with the others… for conversion, completion, engagement and everything else, studies suggest we fare much better than others.”

“Moving further up into the payments flow is where the PayPal value proposition shines. They can have the one-click checkout with no information needed. It’s also where merchants see much higher conversion.”

On directly integrating Honey Rewards into PayPal and Venmo:

“We recognize that the capabilities we got with Honey can unlock many more relevant experiences for our consumers. We are in the early stages around what we’re doing with Honey… We’re seeing strong (7x) increases in discoverability and first-time usage of new features that we’ll build upon to create more utility in the digital wallet.”

It has used some of Honey’s shopper and discovery tools in the new digital wallet which are all working, but there’s much more to do here.

On the super-app journey:

PayPal’s high yield savings product is now in a live beta stage for 20% of its users. The investing products it has planned could be live by the end of the year or early next year. PayPal digital wallet users can now buy and sell crypto and use the balances for purchases at participating merchants.

“We want to provide this digital app where our users can access a suite of different services and then re-spend that money within the PayPal ecosystem.”