Welcome to the hundreds of new subscribers who have joined us this week. We’re delighted to have you and determined to provide as much value as possible.

Today’s Article is Powered by Savvy Trader:

1. Global E-Commerce Earnings

a) Sea Limited (SE) Q1 2023 Earnings

Results

- Revenue met estimates.

- GAAP gross margin (GPM) missed estimates by 80 basis points (bps).

- EBITDA beat estimates by about 30%.

- GAAP EBIT missed estimates by about 60%.

- Missed $0.41 GAAP EPS estimates by $0.25.

Balance Sheet

- $6.1 billion in cash and equivalents with another $1.5 billion in restricted cash. It also has $864 million in short term investments.

- $3.33 billion in convertible notes; $100 million in borrowings.

- Stock comp was 6.5% of sales vs. 6.2% last quarter and 4.7% of sales Y/Y.

Results context

Sea Limited’s focus has fully shifted from growth to profit. It’s trying to extract maximum value from its existing asset base to juice margins. That’s why it spent $400 million on sales & marketing vs. a little over $1 billion in the Y/Y period. It still grew at a 3-year clip of 62% vs. 73% last quarter, but growth will be muted going forward compared to pandemic periods.

E-Commerce

- FX neutral e-commerce revenue rose 42% Y/Y. Revenue growth was driven by transaction fees and advertising.

- E-commerce EBITDA margin was 9.9% vs. 9.2% last quarter and -49% Y/Y. The segment is very profitable in Asia and not profitable in newer markets like Brazil.

- Contribution loss per order in Brazil improved 77% Y/Y to a loss of $0.34.

- It added 50 new hubs in Brazil during the quarter and added new capabilities to service some returns on behalf of 3rd party sellers.

- In-house logistics investments led to delivery times falling 12 hours Y/Y on average.

- It’s using language learning models (LLMs) to enhance product recommendations which has already begun to raise conversion rates.

- The Shoppe affiliate program now has 4 million registered influencers with orders from this program in Indonesia tripling Y/Y.

Entertainment

- Digital entertainment EBITDA margin was 42.6% vs. 27.2% last quarter and 39.2% Y/Y.

- 491.6 million quarterly active users vs. 485.5 million Q/Q and 615.9 million Y/Y.

- 37.6 million paying users for a 7.7% payer to total ratio vs. 9% Q/Q and 10% Y/Y.

- Its hit game Free Fire is seeing “positive user trends and a new MAU peak over the last 8 months.” This positive trend continued into April.

- Its Arena of Valor game set new engagement records this quarter a full 6 years after launch.

“Our new game pipeline remains healthy and we will be launching new titles in the coming months.” -- Founder/CEO Forrest Li

Financial Services

- Digital financial service revenue rose 75% Y/Y and 8.6% Q/Q to reach $412.8 million.

- $2 billion in loan receivables is flat Q/Q. Credit loss allowance rose from $237 million to $281 million Q/Q. Non-performing loans over 90 days rate was flat Q/Q at 2%.

- Focused on adding new products like insurance to round out the utility of its digital wallet.

- Using AI models here to curb fraud rates.

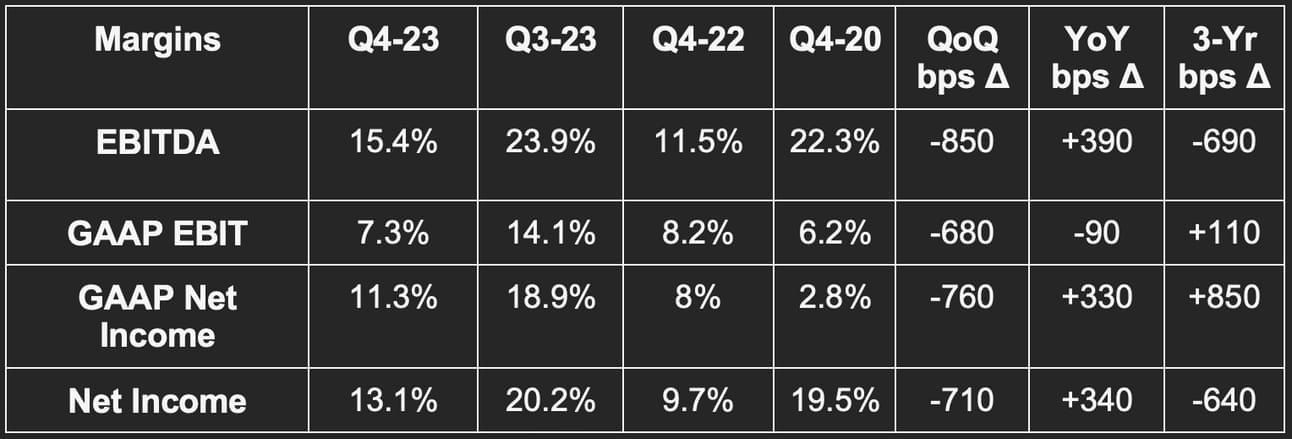

b) Alibaba (BABA) FY Q4 2023 Earnings

Results

- Revenue beat estimates by 1.3%.

- EBITDA beat estimates by 5.1%.

- GAAP EBIT beat estimates by 21.9%.

- Beat $1.35 EPS estimates by $0.21: nearly doubled GAAP EPS estimates.

For the full year, revenue rose 2%, net income rose 17% and non-GAAP net income rose 4%. Note that China is now exiting its latest pandemic lockdowns and Alibaba has an established brick and mortar presence there.

Balance Sheet

- $28 billion in cash and equivalents with another $47.5 billion in short term investments.

- $14 billion in senior notes.

- $7.5 billion in long term debt; $1.1 billion in current debt.

- $1.9B in buybacks during the quarter with $19.4B left on program.

Restructuring

Alibaba is considering and executing several initiatives to reorganize the firm’s structure and unlock shareholder value. It will spin off its cloud group via a special stock dividend in the coming quarters which will function as an independent public company. The board of directors is also exploring an IPO of its logistics group called Cainiao and an IPO of Freshippo (grocery delivery). It formed a new capital management committee to explore more possibilities.

China Commerce

- Debuted a new interface for its shopping app Taobao. The aims of this upgrade are to infuse more media content to boost engagement, to become more price competitive and to get better at high frequency everyday deliveries.

- Taobao and TMall gross merchandise value (GMV) fell by about 5% Y/Y. That decline improved throughout the quarter and turned positive in March.

- Local consumer service order growth was over 20% Y/Y for the quarter.

International Commerce & Logistics

- AliExpress (cross-border) enjoyed double digit order growth. It debuted a new product called “Choice” which is really just a program to bolster selection and fulfillment service.

- 72% of its logistics revenue was from external customers vs. 69% Y/Y.

- Named the first Chinese logistics company to partner with the United Nations on its World Food Program.

Cloud

Revenue fell 3% Y/Y and 2% Y/Y ex-intercompany eliminations. The decline was blamed on cloud project delays due to the pandemic, content distribution demand normalization and a large customer churning from the platform.

Alibaba Cloud debuted its latest LLM which it plans to infuse across its entire business. The segment is also cutting pricing by up to 50% for its core products to bolster adoption and is debuting a more price conscious product bundle as well.

2. North American Commerce Earnings

a) The Home Depot (HD) Q1 2023 Earnings

Results

- Missed revenue estimates by 2.7%.

- Roughly met EBIT estimates and beat EBIT margin estimates by 50 bps.

- Beat $3.80 GAAP EPS estimates by $0.02.

- Met GAAP GPM estimates.

Balance Sheet

- $1.26 billion in cash and equivalents vs. $2.84 billion Y/Y.

- $25.4 billion in inventory is roughly flat Y/Y and rose slightly Q/Q.

- $40.9 billion in long term debt; $1.3 billion in current debt.

- Repurchased $2.9 billion stock vs. $2.3 billion Y/Y.

- Quarterly dividend payment rose 8% Y/Y.

- Inventory turns fell from 4.4x to 3.9x Y/Y (higher = better here)

Guidance

The company lowered its Y/Y comparable sales and revenue growth guidance from 0% to negative 3.5% for 2023. It also lowered its EBIT margin guidance by 25 bps and now expects EPS to fall 10% Y/Y vs. previously expected a mid-single digit decline.

“We are confident in continued share gains.” -- Press Release

Results Context

“Over the past 3 years, we grew our business by 43%. After this period of unprecedented growth, we expect the demand to moderate in fiscal 2023, which our first quarter results reflect… This is a year of moderation for the sector.” -- CEO Edward Decker

- U.S. comp sales fell 4.6% Y/Y. In February they fell 2.8% Y/Y; in March they fell 7.5% Y/Y and in April they fell 3.7% Y/Y.

- Overall comp sales fell 4.5% Y/Y.

- EPS of $3.82 compares to $4.09 Y/Y.

- The company’s external surveys show professional backlogs are elevated vs. historical norms but diminished Y/Y.

- Out of Home Depot’s 14 merchandise departments, 4 delivered positive Y/Y comps (building materials; hardware; plumbing; millwork)

Factors Blamed for Soft Results

The company blamed soft results and the guidance reduction on a few factors. Lumber disinflation was the main reason cited. That alone shaved 2.2% off of its comparable sales growth with more commodity disinflation hitting its growth by a bit over 1% incrementally. For context, framing lumber sold for $420 per 1,000 board ft. vs. $1,170 Y/Y. The benefits from an input cost standpoint were less noticeable than the hit to revenue as seen from the Y/Y margin declines.

Extreme weather in California was also partially blamed. The validity of this is evidenced by regions experiencing normal weather seeing more resilience vs. the Western U.S. This relative strength was more concentrated in smaller ticket items with large, discretionary purchases a notable weak spot. Large tickets over $1,000 in size shrank over 6% Y/Y across the book of business. Finally, consumer weakening beyond what Home Depot expected as of last quarter added pressure to its results. This pressure amplified as the quarter progressed.

Wage Investment Update

Home Depot announced a new billion-dollar investment in front line hourly workers last quarter. Early on, the investments are delivering on the firm’s goals. Application growth is healthy and it’s finding a more seamless ability to hire. March 2023 yielded the firm’s lowest employee attrition rate in “some time.” As an aside, this investment is why operating expenses slightly rose Y/Y.

Efficiency Investments

The firm tweaked order fulfillment operating procedures to allocate work more efficiently and to batch fulfillment orders to help employees be more productive. Its “Sidekick” app is helping to direct fulfillment employees to designated assignments to reduce down-time. Shelf availability customer service scores (internal metric) rose 3% as a result.

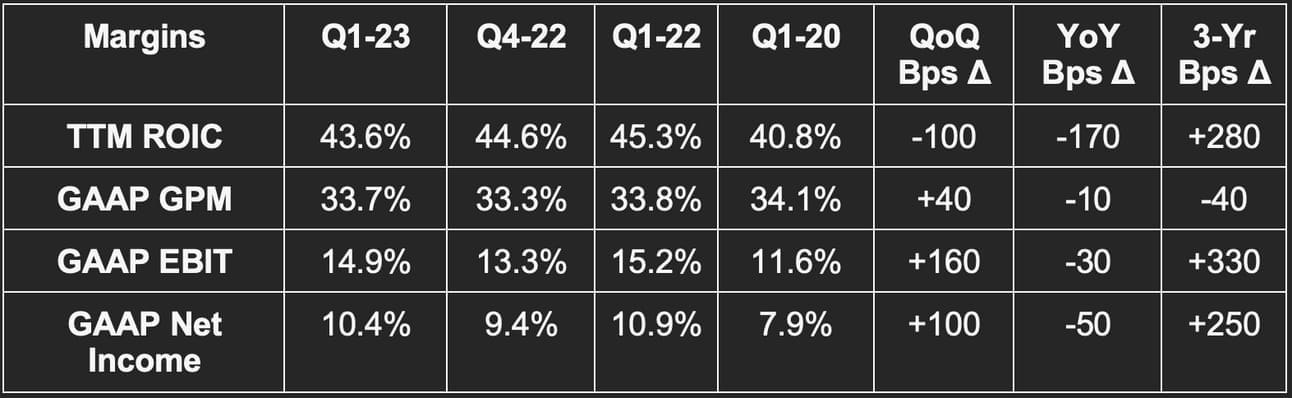

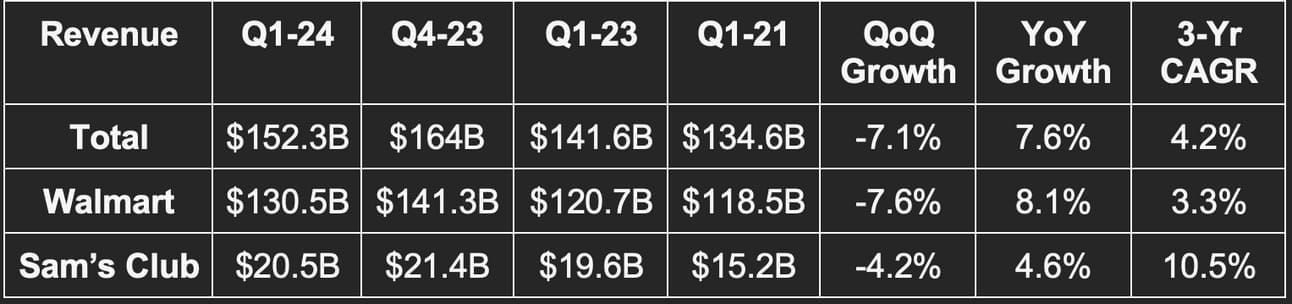

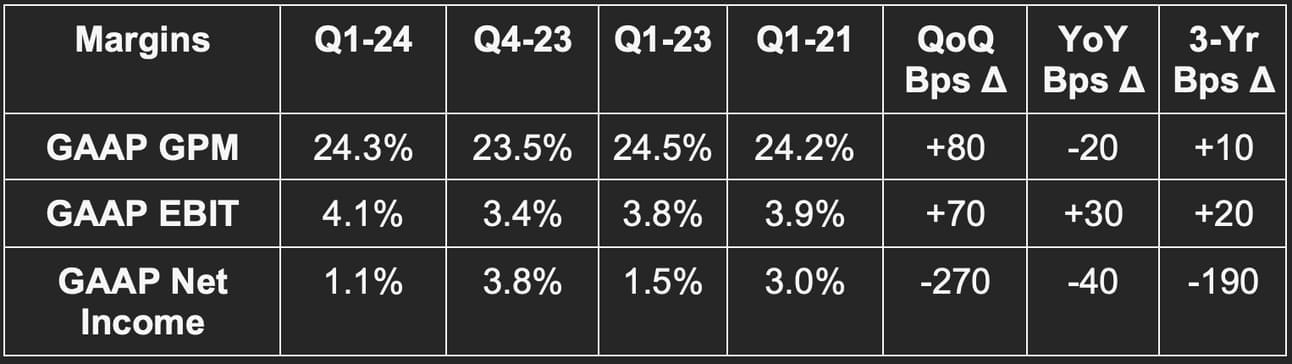

b) Walmart (WMT) FY Q1 2024 Earnings

Results

- Beat revenue estimates by 3.0%. Beat its 4.8% FX neutral growth guide by 290 basis points (bps).

- Walmart’s EBIT grew by 17.3% Y/Y vs. analyst estimates calling for 1.6% Y/Y growth. Its EBIT dollars were about 13% ahead of expectations.

- Beat $1.32 EPS estimates by $0.15 and beat its guide by $0.19.

- Sharply missed $1.32 GAAP EPS estimates by $0.70. This was due to equity investment valuation volatility which makes GAAP EPS a useless metric in many cases (like this one).

- Beat 23.8% GAAP gross margin estimates by 50 bps.

Trailing 12 month (TTM) return on assets was 4.5% vs. 5.5% Y/Y. TTM return on invested capital was 12.7% vs. 13.9% Y/Y. Both metrics were hit by “discrete charges” (opioid legal fees). Without this impact, ROA would have been 5.9% and ROIC would have been 14.1%. The company expects return metrics to positively inflect this year.

Balance Sheet

- $10.6 billion in cash & equivalents.

- Total debt of $49.5 billion.

- Bought back $686 million in stock vs. $2.41 billion in the Y/Y quarter.

- Dividend payments were flat Y/Y.

- Inventory rose slightly Q/Q and fell by 6.9% Y/Y.

“In terms of inventory, we're in good shape. In stock is improving and excess inventory keeps coming down. We see it in the numbers, and I'm seeing it on store and club visits.” -- CEO Doug McMillon

Fiscal Year 2024 Guidance

- Expects 3.5% FX neutral revenue growth vs. previous guidance of 2.8% growth.

- Expects 4.2% FX neutral EBIT growth vs. previous guidance of 3% FX neutral growth.

- Expects $6.15 in adjusted EPS vs. previous guidance of $6.02 and estimates calling for $6.14.

Its Q2 guidance was a bit light on revenue, EBIT and EPS.

Results Context

- Sales growth moderated throughout the quarter like for The Home Depot.

- eCommerce sales rose 26% overall and 27% in the U.S.

- Generated $200 million in free cash vs. -$7.3 billion Y/Y as it gets its inventory position in a much better spot.

- Advertising revenue rose 30% Y/Y.

- U.S. comparable sales rose 7.4% Y/Y while comparable sales in key international markets like Mexico, India and China rose well in excess of that metric. In China, economic reopening powered over 20% comparable store sales growth.

Macro Mix Shift

Walmart is seeing an aggressive shift from general merchandise to less discretionary grocery purchases as macro worsens. This revenue mix shift was larger in Q1 than the entire calendar 2022 period. That was the reasoning for the gross margin contraction Y/Y. Supply chain and freight costs were actually both gross margin tailwinds to offset this impact.