Most of this week’s content was already sent. My Nvidia (NVDA) & SentinelOne (S) Earnings Review can be found here; my Zscaler (ZS) Earnings Review can be found here; my updated portfolio & performance vs. the S&P 500 can be found here; 37 (told you I was a nerd) more earnings reviews from this season can be found here.

Table of Contents

- 1. Brief Earnings Snapshots – Salesforce (CRM), Ma …

- 2. PayPal (PYPL) – CEO Alex Chriss Interviews with …

- 3. Meta Platforms (META) – Miscellaneous

- 4. SentinelOne (S) – More Sector Information

- 5. Headlines

- 6. Macro

Next week’s articles will include CrowdStrike & Broadcom earnings reviews, a Lululemon snapshot, conference coverage & more.

1. Brief Earnings Snapshots – Salesforce (CRM), Marvell (MRVL), Okta (OKTA) & Dell (DELL)

a. Salesforce (CRM)

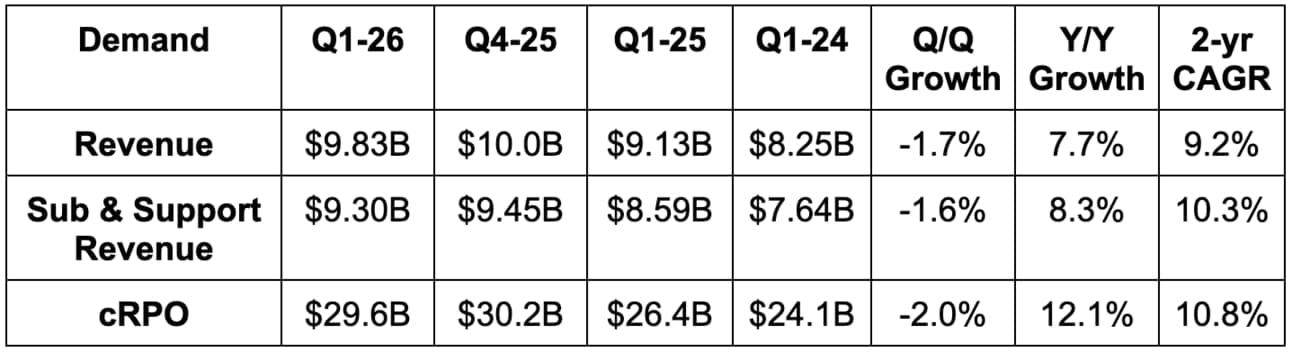

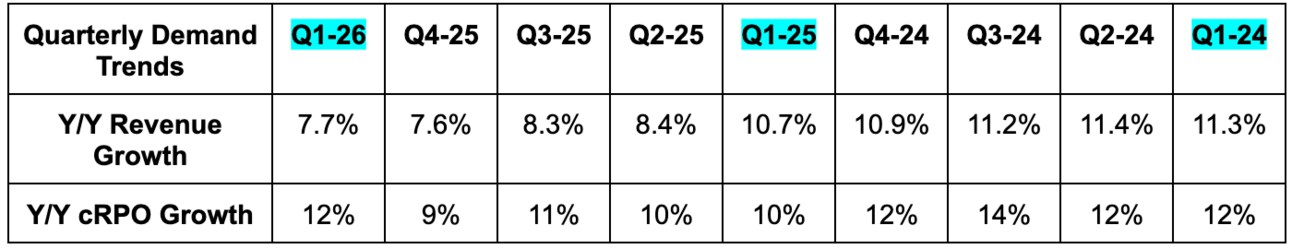

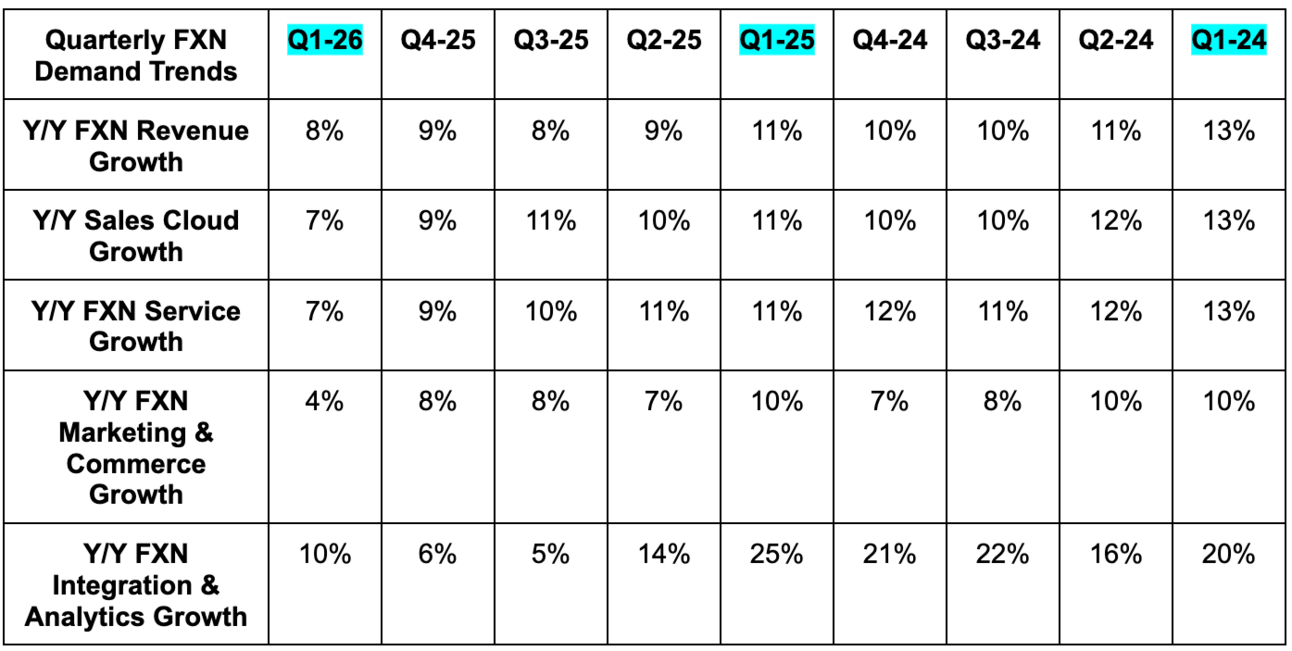

Demand:

- Beat revenue estimate by 0.8% & beat guidance by 1.0%.

- Beat 7% foreign exchange neutral (FXN) growth guidance with 8% FXN growth.

- Beat subscription & support revenue estimate by 0.8%

- Beat current remaining performance obligation (cRPO) estimate by 1.9% and beat 10% FXN cRPO growth guidance with 11% FXB growth.

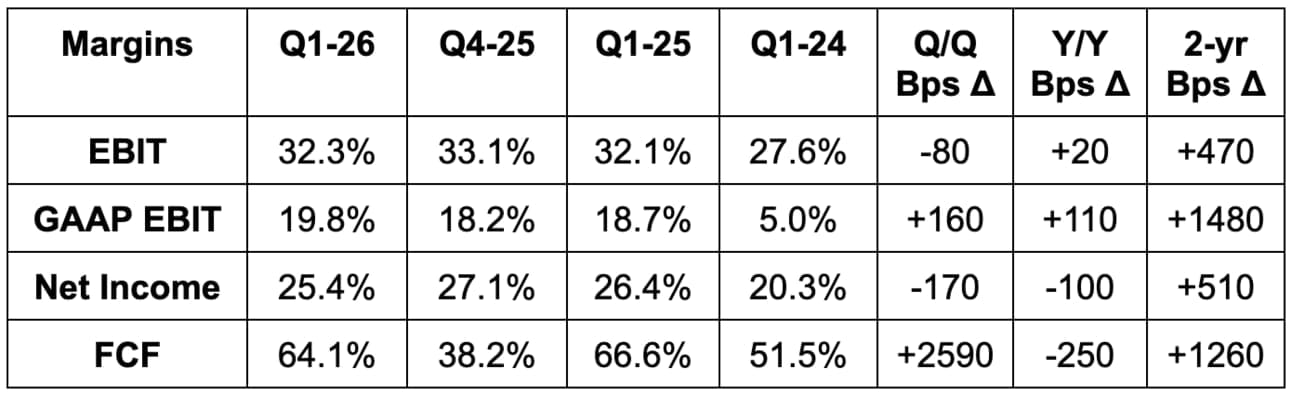

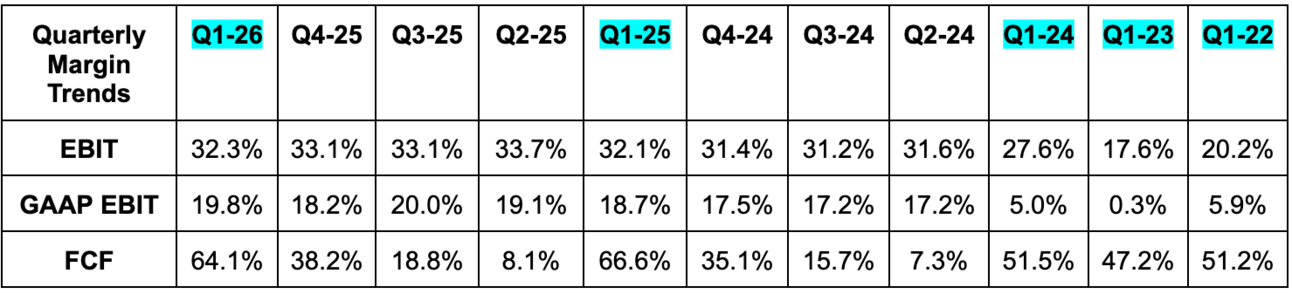

Profits & Margins:

- Slightly missed EBIT estimate.

- Beat $1.50 GAAP EPS guidance by $0.09.

- Beat $2.55 EPS estimate by $0.03 & beat guidance by $0.04.

- Beat free cash flow (FCF) estimate by 7%.

Balance Sheet:

- $17.4B in cash & equivalents.

- $4.94B in investments.

- $8.44B in total debt.

- Diluted share count fell by 1.5% Y/Y.

Guidance & Valuation:

- Raised annual revenue guidance by 1.1%, which beat estimates by 0.9%.

- Raised annual FXN revenue growth guidance from 7.5% to 8.0%.

- Reiterated 9% annual FXN subscription & support revenue growth guidance.

- Raised annual EBIT guidance by 1.1%, which beat estimates by 0.6%.

- Reiterated 34% EBIT margin guidance, with the EBIT dollar beat related to revenue outperformance.

- Reiterated 21.6% GAAP EBIT margin guidance, with GAAP EBIT dollar guidance rising by roughly 1%.

- Raised $11.16 annual EPS guidance by $0.19, which beat estimates by $0.14.

- Raised $6.99 annual GAAP EPS guidance by $0.19.

- Reiterated 10.5% annual operating cash flow (OCF) growth guidance.

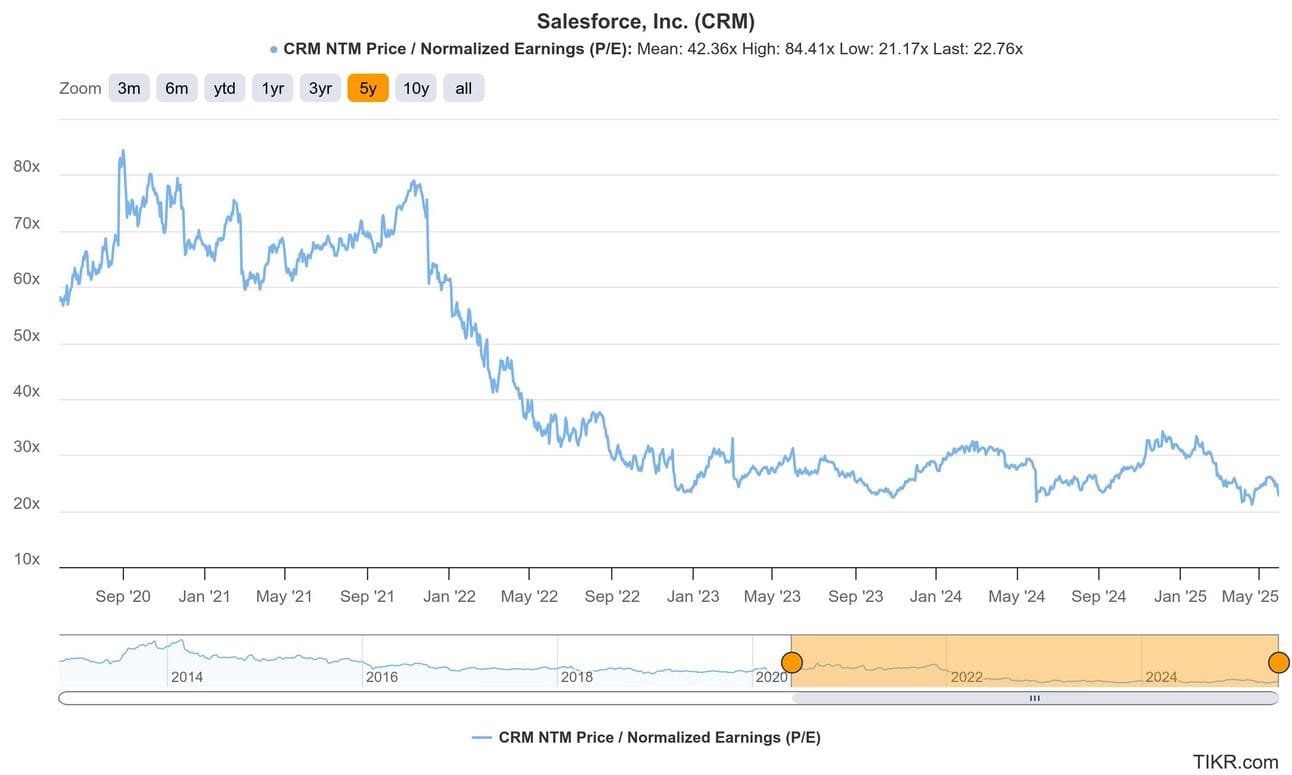

CRM trades for 23x forward EPS. EPS is expected to grow by 11% this year and by 12% next year.

Quick Highlights:

Salesforce is buying Informatica for $8 billion. As Founder/CEO Marc Benioff told shareholders, this combines Salesforce’s Customer Resource Management (CRM) engine with Informatica’s Master Data Management (MDM) and Extract, Transform, Load (ETL) capabilities. MDM handles consistent, accurate and properly-gated sharing of a firm’s data. It uses GenAI to automate anomaly detection within these new assets, accelerate data tagging, streamline data ingestion and offer predictive insights to join the plethora of tools Salesforce already offers in that arena. Informatica’s GenAI engine is called CLAIRE AI. ETL facilitates the transport of data from disparate systems into large, aggregated ecosystems… such as Salesforce’s data cloud.

Informatica should make migrating more of a company’s lucrative information to this enterprise software giant easier. As every software company will tell you, affordable access to large amounts of high-fidelity and relevant data is how AI apps become valuable. It’s how Salesforce will equip its commerce, marketing, service and every other cloud with actionable agentic workflows to vastly bolster utility (and potential monetization). The rationale for both purchases was to make Salesforce a more convenient and seamless end-to-end data vendor… which also makes it a better partner for embracing the AI revolution.

- Data cloud and its AI suite were both in 60% of its largest 100 deals. This combination rose 120% Y/Y to cross $1 billion in ARR. Growth last quarter was also 120% Y/Y and it added more than $100M in net new ARR this quarter.

- 50% of data cloud bookings were from current customers, showing the up-sell opportunity for this tool.

Agentforce is CRM’s AI-powered platform for agentic AI apps. Agentforce functions as a full-service, out-of-the-box suite to turbocharge client GenAI adoption by making the embrace of this technology easier. It brings together all of Salesforce’s work in Data Cloud, Einstein AI (suite of AI tools for outcome prediction, chatbot building and more) and Customer360 (aggregated customer information to optimize interactions) to create an end-to-end platform that actually drives value. This is a giant piece of Salesforce’s end-to-end AI services, which it calls “ADAM” (Apps + Data + Agents + Metadata). Many companies offer help in pieces of some of these areas. Salesforce covers it all.

Agentforce has already crossed 4,000 paid deals vs. 3,000 Q/Q and $100M in ARR. This is the fastest product ramp to that ARR milestone in company history. Finnair is automating 80% of customer service interactions with it, while Falabella is using Agentforce and WhatsApp to automate 83% of its customer service work. And internally, Agentforce is reducing some CRM hiring needs worth about $50M in annualized savings. Just like CrowdStrike, Zscaler and pretty much everyone else, Salesforce is offering a flex style for buying this product, which lets customers use up commitments at their desired pace. Finally., FedRAMP High Authorization should be coming soon for Agentforce, allowing it to be sold to customers like the Department of Defense.

Platform-level adoption also remains strong, with around 80% of its deals including 6+ clouds. MuleSoft (app integration product) was in 50% of its $1M+ deals and Tableau (data visualization) was in 70% of them. Its industry-specific clouds were in 50% of its 100 largest deals vs. 75% Q/Q. Cross-selling means point solution displacement and vendor consolidation, which fosters better efficiency, product efficacy and retention. I think this is part of why Salesforce hasn’t seen any macro deterioration from trade wars.

Pretty good quarter, in my opinion. I’d love to see organic growth reaccelerate and it looks like that’s going to happen, considering forward guidance, easier comps and the firm’s tendency to beat its targets.

b. Marvell Technology (MRVL)

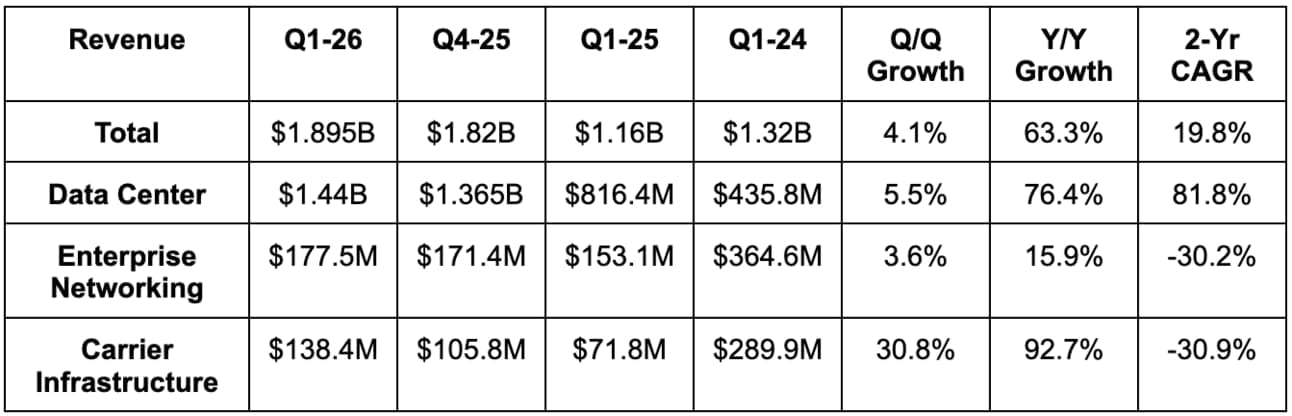

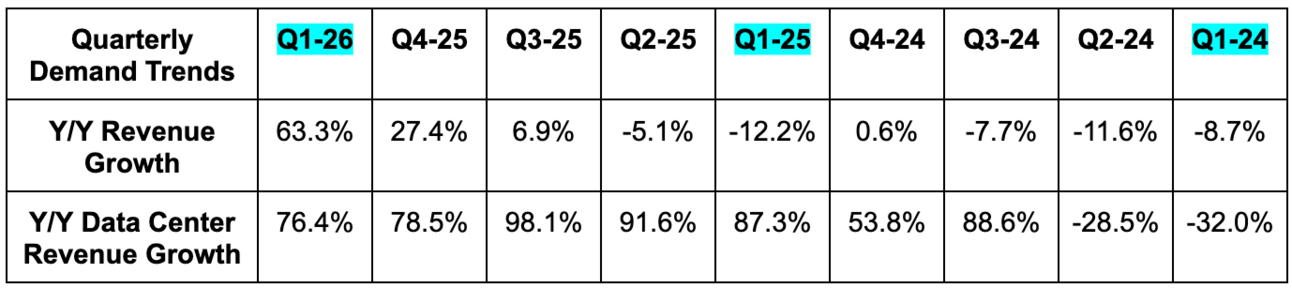

Demand:

- Marvel beat revenue estimates by 0.8% & beat guidance by 1.1%.

- Data center revenue met estimates.

- Enterprise networking revenue missed estimates by 5.2%.

- Carrier Infrastructure revenue beat estimates by 18%.

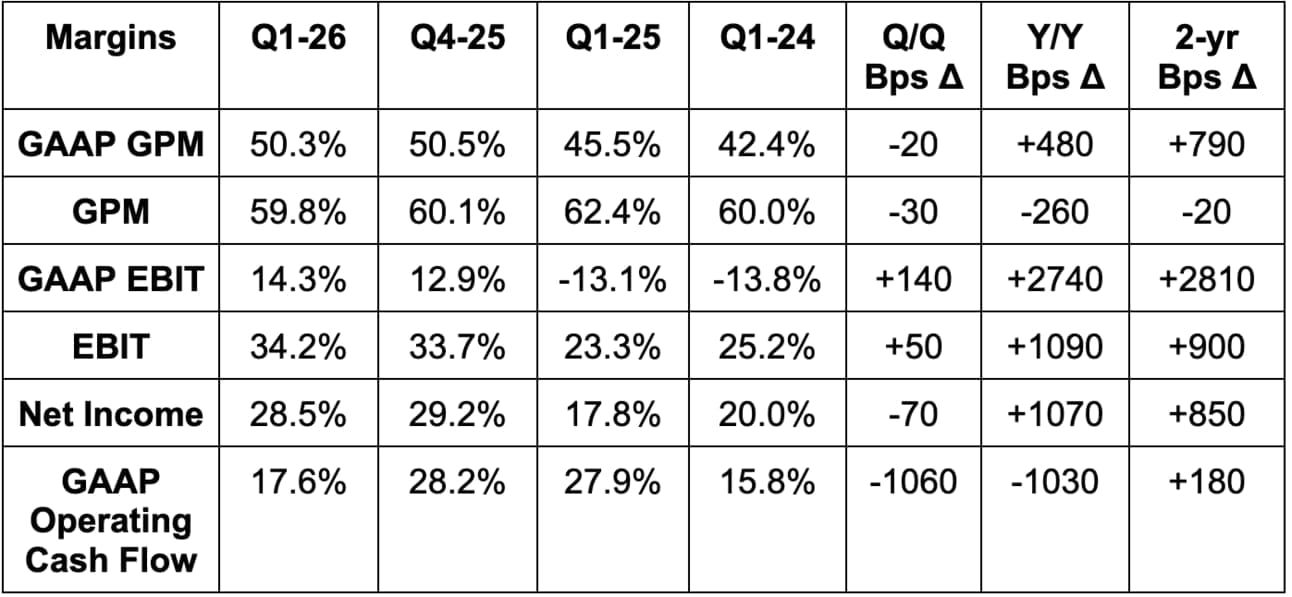

Profits & Margins:

- Missed 60% GPM estimate & missed identical guidance by 20 bps each.

- Missed 50.5% GAAP GPM guidance by 20 bps.

- Beat EBIT estimate by 1.8% & beat guidance by 2.1%.

- Beat $0.19 GAAP EPS estimate & identical guidance by $0.01 each.

- Beat $0.61 EPS estimate & identical guidance by $0.01 each.

- Missed FCF estimates by 41% (very lumpy on a quarterly basis).

Balance Sheet:

- $886M in cash & equivalents.

- Inventory rose 29.6% Y/Y.

- $4.23B in total debt.

- Diluted share count fell slightly Y/Y.

Q2 Guidance & Valuation:

- Revenue guidance beat estimates by 1%.

- 59.5% GPM guidance missed estimates by 10 bps.

- EBIT guidance beat estimates by 1.6%.

- $0.67 EPS guidance met estimates; $0.21 GAAP EPS guidance missed estimates by $0.02.

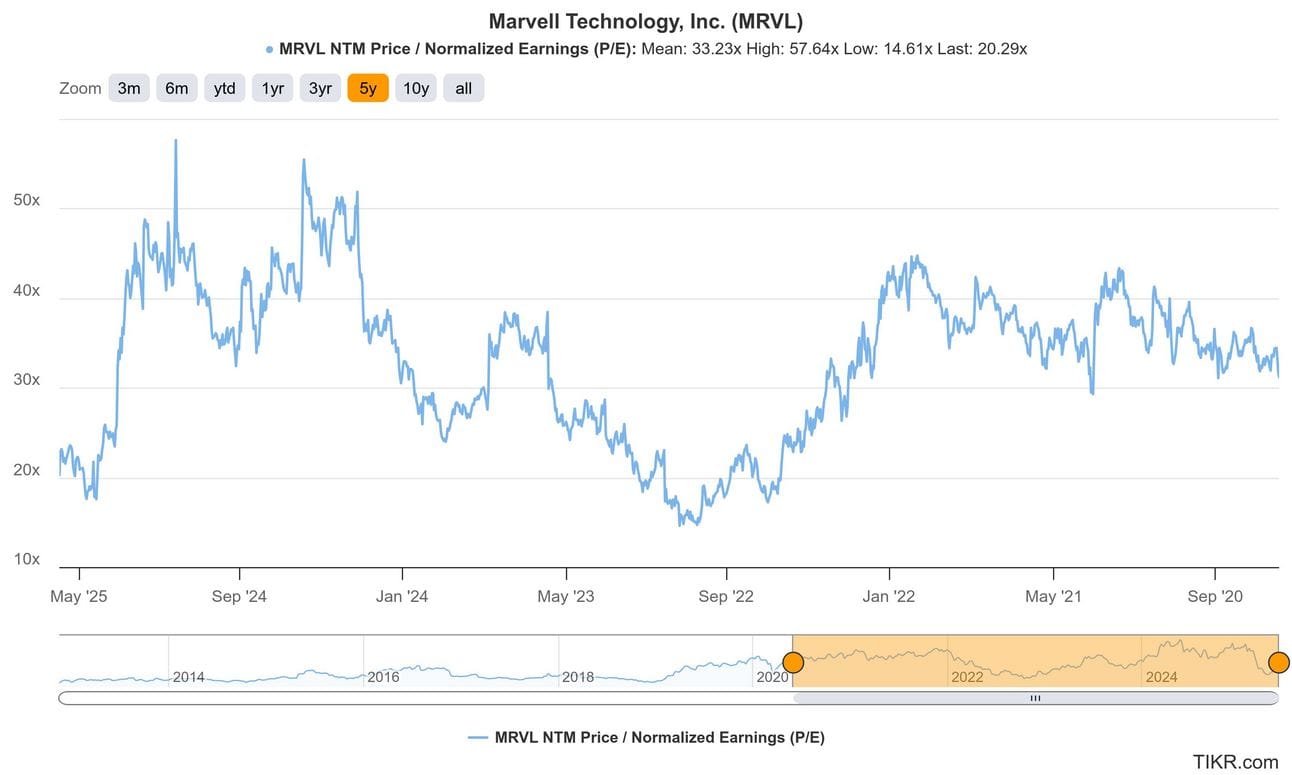

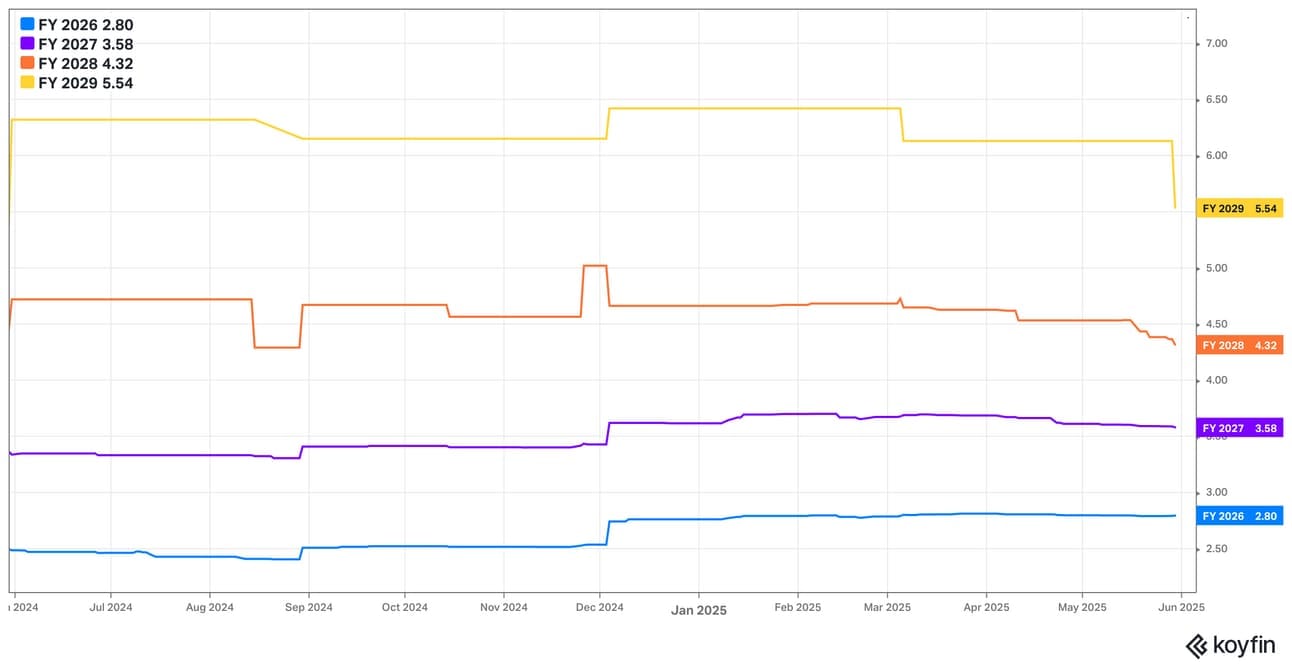

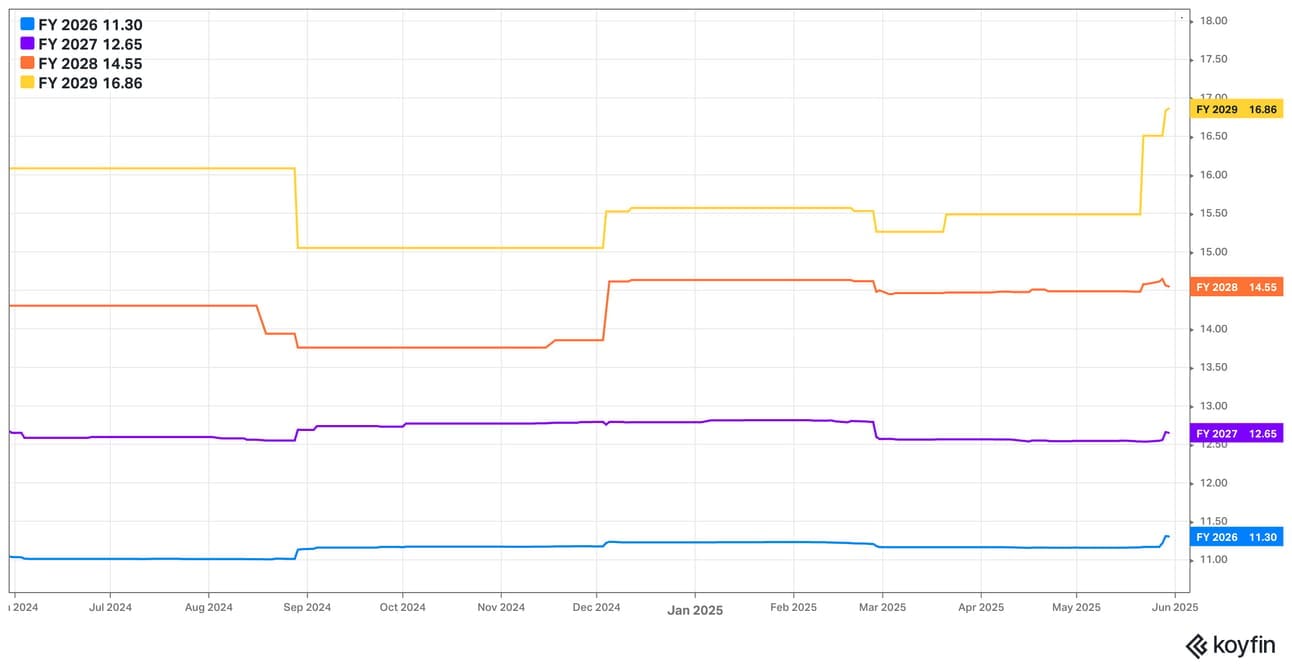

MRVL trades for 20x forward EPS. EPS is expected to grow by 78% this year and by 28% next year.