Today’s Piece is Powered by our Friends atLong Term Mindset:

1. SoFi (SOFI) -- Student Loans

As part of the new debt ceiling agreement, the Federal Student Loan Moratorium will (finally) come to an end. As always, we don’t care about the politics of this decision, but care deeply about the potential impact it could have on SoFi’s business. And the potential impact is exciting. I brainstormed and collaborated with @DataDInvesting on Twitter. He’s a very smart guy, a hard worker and a great writer. We’d recommend that you check him out when you get the chance.

There are two pieces of good news stemming from this development: Demand recovery and more balance sheet flexibility. Starting with demand, SoFi’s largest business segment heading into the moratorium was student lending. It was also by far its most profitable business. During the moratorium, volumes have been running anywhere between 10% and 20% of 2019 levels while private loan payments continued. The company will not immediately ramp volumes back up to 2019 numbers considering how far the federal funds rate has risen (higher rates = less refi demand). Still, it’s expecting a meaningful ramp to expeditiously recoup the majority of that business. How?

We have to remember that college students are initially underwritten with virtually no credit history and at the very beginning of their credit building journeys. As federal loans season, these borrowers routinely build income streams and establish a track record making them less risky customers. This frees private loan vendors like SoFi to profitably offer more compelling rates to borrowers as the risk erodes. That does become more challenging in today’s rate environment vs. 2019, but the firm still sees a large chunk of existing federal loan volume as ripe for refinancing at lofty contribution margins.

During the moratorium, SoFi was still paid on its existing loans, but federal loan borrowers with high interest debt had no incentive to refinance with SoFi. Why would they pay a lower interest rate today when they can just pay nothing at all. Most wouldn’t and so SoFi’s volumes plummeted.

It maintained growth despite this (incredible actually) as it seamlessly pivoted to personal lending and financial services. This powered brisk compounding and operating leverage despite this vitally important student segment being on pause. That pause is now over and so the refinancing incentive is back. Why does this matter? Let’s explore.

Income Statement Impact:

In SoFi’s recent student loan lawsuit, it estimated the revenue impact from the pause to be around $350 million over the last 10 quarters. That equates to an annual revenue impact of $140 million or 9% of its 2022 revenue. This was very high profit business for the company with the contribution margin likely in the 60% range. Let’s assume 55% just to be safe for $77 million in annual contribution profits. This conservative estimate would have equated to a 43% boost to the company’s 2022 contribution profit had the moratorium not been in place.

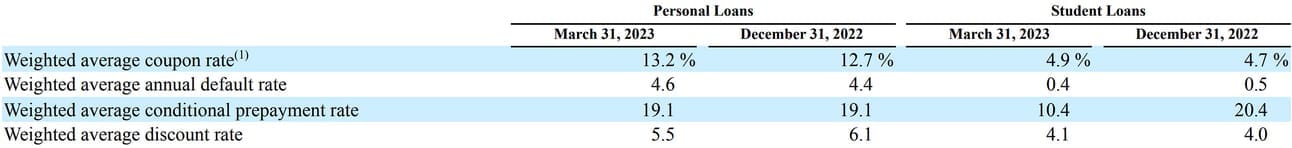

Let’s calculate the impact with an alternative approach. Over the last few quarters of normal student refi demand, about 60% of SoFi’s total loan volume was from that segment. It was doing around $100 million in quarterly lending revenue at that time. Personal loans carry higher gross and net yields (see image below) than do student loans, so we’ll safely assume this 60% volume proportion equates to a 40% revenue proportion (based on the limited public historical data we have available on SoFi). This gets us to $160 million in 2022 revenue and $88 million in annual contribution profits.

Method 2 does not consider the rising rate environment in while method 1 does. It’s hard to see student loans jumping back to 60% of its lending activity in the current interest rate environment and with how large the personal segment has gotten. HOWEVER, method 1 ignores SoFi’s bank charter impact and its ability to now hold loans on the balance sheet in a more profitable manner and over a longer time period than it could before. So? It’s quite easy to see a scenario where method 2 even looks a bit conservative over time as it harvests more interest income, originates more volume, taps into more capital market buyers and enjoys near future rate cuts to act as a refi demand accelerant. There’s vast pent-up demand for refinancing created by the moratorium; that pent-up demand can now finally begin to unwind.

Along those lines, we’ve seen some estimates citing the incremental revenue impact being closer to $320 million with $176 million in contribution profit (or roughly double what we are assuming). This lofty estimate scrapes assumptions from 2019 when macro was far easier than it is now and when gain on sale margins were likely more appealing. Yes, it can hold loans for longer at higher net yields with the charter, but we still find $320 to be aggressive. For that reason paired with general uncertainty, we prefer taking a more conservative (ok, pessimistic) approach (margin of safety is a wonderful thing).

Regardless of what the exact incremental dollar amounts will be from this development, it is clear that the impact will be quite positive and material to SoFi. We’re excited to see the data flow in as payments start back up in the second half of the year and federal borrowers are pushed to seek more favorable rates (especially in today’s macro backdrop). Some could argue that borrowers will wait for rates to fall more before seeking a refinance. That will be true in the occasional instance, but two counter arguments there. First, the typical borrower is not paying attention to the fed funds rate and its projected near-term path. They just want a cheaper loan. Secondly, refi applications with SoFi are inexpensive and easy to complete. Borrowers can just refinance over and over again if the rate becomes even more compelling or they can elect a variable rate refi. Given that, there is no incentive to wait. The time value of money tells us they’ll be driven to secure savings as soon as possible.

Cross-Selling:

As a company born to refinance student loans, SoFi’s brand association still presides heavily within that product vertical. Some consumers who were shopping for a loan in Q4 2019 simply don’t know how many products SoFi has added to its bundle over the past 3 years.

As these shoppers return to the market, a large chunk of them will do so through SoFi. These consumers entering the ecosystem for the first time in 3 years will be amazed at how much the financial offerings have expanded. Many who’ve had a positive SoFi experience (i.e. seeing their student loan payments drop like a rock) will surely be motivated to use and purchase additional SoFi products. This cross-selling revenue would incur virtually zero added customer acquisition cost and would feed its margin profile further.

Balance Sheet Impact:

As revenues and profits from the segment ramp, SoFi will have a few options on what to do with the newly originated loans on its balance sheet.

Hold the Balance Sheet Stable in Size and Make-up:

First, it can keep the balance sheet and student loan position at the same size and make-up that it is today. The recovering demand will free SoFi to recycle the existing student loans more expediently on its balance sheet and to replace them with newer, higher coupon student loans to harvest more interest and servicing income. For context, its student loan average coupon has risen by more than 10% over the last 12 months while default rates have improved. High credit quality and coupons rising faster than benchmark yields is a perfect combination… and it continues to boost its coupon faster than rates rise. This inherently makes newer originations more profitable and capital market demand stable. SoFi’s credit recipe is exactly what most capital market buyers seek and is how SoFi has found consistent demand across credit cycles.

All of this can happen while it leans on its banking charter to enjoy lower cost of funding and higher net yields associated with holding.

We were somewhat concerned about the demand for SoFi student loans originated with a fed funds rate at 0% and if these loans carried attractive enough net yields to motivate capital market demand. That concern ignored a key reality: Through this entire moratorium, SoFi has been consistently selling off student loans into capital markets (as private student loan payments continued). The loans it currently holds are predominately newer originations with a lower proportion of pre-pandemic volume. Pre-charter, it was selling at about the rate of origination but has since elected to hold a larger proportion of less seasoned loans with higher coupons. There is not some massive base of student credit sitting on its balance sheet from a 0% fed funds era -- and so unrealized losses on sales should be minuscule while new capital market demand should be stable.

Furthermore, its hedging program to remove downside rate risk means it really doesn’t need favorable capital market terms for these deals to make sense. Cash flows have already been “locked in.” It likely will get favorable terms as it has consistently found in the past for some of the loans. It may, however, have a tough time netting typical gain-on-sale margins with its remaining 2021 originations. Again, with the hedging program that’s completely fine.

Hold the Balance Sheet Stable in Size and Change the Make-up:

In SoFi’s mission of ROE optimization, it could also elect to replace a chunk of its $5 billion in student loans with a larger proportion of personal loans. These personal loans boast superior net interest margins when held vs. student loans (see chart above). Unlike the student product, SoFi can easily continue profitably tapping into 6% warehouse debt to fund personal credit thanks to the 13%+ coupon rate that it fetches (vs. 5%-10% for SoFi’s variable & fixed student products). This is possible, but we’d argue it would have already been doing this if it didn’t want to hold as many student loans via the stable capital market demand.

More Aggressively Grow the Balance Sheet:

Alternatively, it could also elect to grow the balance sheet and simply hold as much as it responsibly can. With its nearly $20 billion in funding capacity and $16 billion in loans, there is still room for the balance sheet to grow at today’s capital structure. This wiggle room exists while rapid deposit growth feeds it more cheap cost of capital to fuel originations. How big can the balance sheet responsibly get right now with SoFi’s current business? That answer is quite subjective, but its excess liquidity and conservative leverage ratios both clearly point to it not being near maximum today. While student loans are lower net yield than personal, they’re still profitable to hold, still very low delinquency and still bolster SoFi’s equity return ratios.

Reality Will Be a Combination:

What will SoFi do? In our view, it will likely be a combination of these paths. The balance sheet will inevitably continue to grow. At the same time, it would be silly not to accept robust gain on sale margins while recycling seasoned loans with higher coupons as rates remain elevated.

The effect will likely be gradual balance sheet growth, but still frequent capital market activity to ensure that growth is as optimal (safe & profitable). Capital market usage will also obviously rely on macro and residual demand. When loan re-purchase demand is weak (as it is now), SoFi will skew towards a holding bias. As demand recovers over time (like in 2020-2021), that bias will erode. In SoFi’s path to becoming a top ten banking institution over the next 5 years, the balance sheet will have to exponentially grow. As my colleague at @DataDInvesting points out, this expansion will require a near term inflection of GAAP net income to maintain conservative tier 1 capital ratios and flexibility. Fortunately, that’s coming. And in its path to realizing that top 10 goal while delivering attractive return metrics, it will need to grow responsibly. Balance.

2. Salesforce (CRM) -- Q1 2024 Earnings Review

a) Results

- Beat revenue estimates by 1% & beat guidance by 1%.

- Beat Current Remaining Performance Obligation (cRPO) guidance by 0.8%.

- Missed $0.27 GAAP EPS estimates by $0.07 & missed $0.25 guidance by $0.05.

- Beat EBIT estimates by 8.6%.

- Beat $1.61 EPS estimates & its identical guide by $0.08.

b) Full Year Guidance Updates

- Reiterated revenue guidance which barely missed estimates.

- Raised GAAP EBIT guide by 5.4%. Raised its GAAP EBIT margin assumption from 10.8% to 11.4%.

- Raised EBIT guide by 3.7% & beat EBIT estimates by 3.4% and raised its EBIT margin assumption from 27% to 28%.

- Raised OCF guide by 0.8% & missed OCF estimates by 0.9%.

- Raised FCF growth guide by 100 bps to 16.5% Y/Y growth.

- Raised $2.60 GAAP EPS guide by $0.08 & beat GAAP EPS estimates by $0.07.

- Raised $7.13 EPS guide by $0.29 & beat EPS estimates by $0.25. $7.13 would represent lofty 36% Y/Y EPS growth.

Reiterated plans to reach a 30% non-GAAP EBIT margin by Q1 of next year.

Next quarter guidance was slightly ahead on revenue & comfortably ahead on profit.

c) Balance Sheet

- Share count fell 1% Y/Y via $2.1 billion in buybacks. Buybacks - stock comp = $1.36 billion for the quarter. This is its 3rd straight quarter of share count shrinkage. Salesforce continues to expect to offset all dilution with buybacks and committed to stock comp falling below 9% of sales this year. It was 8.4% of sales this quarter.

- Nearly $14B in cash & equivalents.

- $9.4B in debt ($181M current).

d) Call & Release Highlights

Demand Context:

- Revenue rose 13% Y/Y on an FX neutral basis.

- The revenue beat was credited to its core business.

- Slack revenue rose 20% Y/Y; Tableau revenue rose 12% Y/Y; MuleSoft revenue rose 26% Y/Y.

- The Data Cloud is now its fastest growing cloud ever.

- Revenue in the Americas was a notable weak spot as its large book of tech and financial service business remained hampered by Macro. Latin America, Brazil, Italy and Switzerland were notable geographic bright spots.

- 8 of its industry specific clouds grew ARR over 50%.

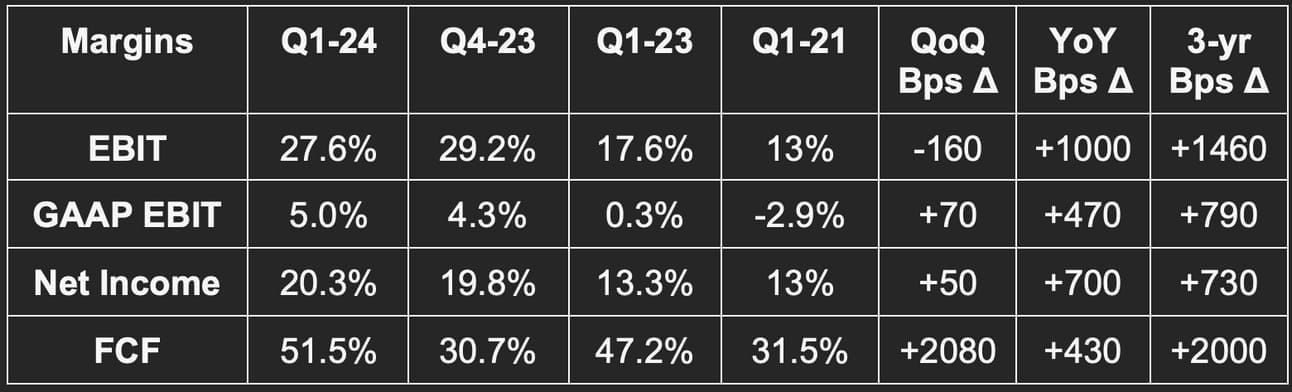

Margin Context:

- Sales & marketing as a % of revenue fell by a full 600 bps Y/Y.

- A restructuring charge hit GAAP EBIT by 860 bps.

On Restructuring & Cost Cutting:

Last quarter, Salesforce embarked on an operational overhaul of its business to identify excess resources and inefficiencies within operations. The margin expansion seen this quarter was credited to these actions. It continues to “scrutinize every dollar of investment and transform every corner of the company.” During the quarter, it removed complexity to accelerate and improve its go-to-market strategy.

Its restructuring will be 2-phased. Phase one is now largely complete while phase two will be implemented shortly once Bain has finished its consulting overview of the business. While R&D spend will remain a main focus, S&M and G&A cost buckets should provide meaningful leverage going forward.

Macro:

Demand for longer term, larger deals continues to be soft as added deal scrutiny and elongated sales cycles persist. That was most noticeable with smaller clients and is reflected in the forward guide via a 100 bps growth headwind from less professional service demand as. For this reason, cRPO was a bit lower than what some analysts had modeled but this was related to shorter term deals being signed amid poor macro. CrowdStrike, Okta and countless other software names told a similar story. This is why annual revenue guidance was not raised despite the strong performance.

“Our customers can contract for Professional Services in 2 ways, either on a time and materials basis, which is typically for smaller projects, or on a fixed fee basis. For purposes of cRPO, we only include projected business from fixed fee deals. One of the things that we are seeing right now is more customers are choosing to contract on a time and materials basis, which is not included in our cRPO.” -- CFO Amy Weaver

On AI:

With its tight OpenAI partnership, Salesforce debuted a slew of generative AI-infused product upgrades during the quarter. First is an upgrade to its Einstein offering called Einstein GPT. As a reminder, Einstein is Salesforce’s AI tool to augment the Salesforce CRM platform. It automates data sifting and insight gleaning to reveal valuable patterns to guide decisions. It also comes with language tools to translate and analyze text to uncover sentiment among other things. These tools existed before the generative AI wave, but now they’re getting an upgrade thanks to it. Einstein GPT allows Salesforce clients to plug into language models (including OpenAI’s) to make workflows more productive, intuitive, conversational and automated. It features a low code tool set to reduce the barrier for non-experts to build applications on top of. It also boasts expert-level tools to build more complex models and use cases.

If Einstein is peanut butter, its data cloud is jelly. To train models, companies rely on vast and organized databases which Salesforce provides. In CEO Marc Benioff’s words, it provides a “real time intelligent data lake to bring together all customer data in 1 place.” This aggregation translates to more frequent and direct feeding of data and insight to train models to enhance model efficacy.

While cool models and automation are both valuable and fun, trust and security is a prerequisite for motivating large clients to embrace generative AI. That’s where the salesforce trust layer comes into play. This layer effectively gates data and permissions to ensure proper access and authorizations. It automatically grounds company data to ensure open language learning models are not storing and using impermissible data. This ensures generative AI can be enjoyed without sacrificing authoritative posture and computer hygiene; more utility without more risk. The trust layer is also instrumental at solving for complex, dynamic global regulatory compliance like Europe’s GDPR.

More Salesforce Products being augmented with OpenAI’s and Anthropic’s (recent venture investment) language learning models:

- SlackGPT is leveraging the platform’s “treasure trove” of data to give every company and employee their own AI assistant. GPT models and Anthropic are now natively integrated into the tool.

- Tableau is its acquired data visualization platform to help build context-rich patterns and insights from a firm’s data. This allows firms to plug in spreadsheets and so much more to automate the intuitive, utility building organization of that information. TableauGPT morphs this process into a more conversational, lower code flow to lower the skill barrier for usage.

- It invested $250 million into a new AI venture fund to support startups.

- Within its own apps and developer ecosystem, generative AI is already boosting coder productivity by 20%-30% with Microsoft Copilot-type tools.

Customer Wins:

- Northwell Health added the Data Cloud to its Salesforce products to join the Health Cloud, Tableau and more.

- Landed Paramount, Lenovo, Vodafone, Discover, Alaska Air, Siemens, Spotify, NASA and the U.S. Department of Agriculture.

- MuleSoft (its integration layer for apps and data sources) is now #1 in integration market share per IDC for the first time.

Long-Term Mindset is a FREE weekly newsletter emailed each Wednesday. Each issue contains five pieces of timeless content to encourage you to think long-term. All issues can be read in less than 1 minute. There’s a reason why we are consistent readers and think you should be too. Subscribe here.

3. SentinelOne (S) -- Earnings Review

As a direct competitor to CrowdStrike in endpoint security, it’s interesting and relevant to compare these two companies to gauge how each is performing vs. one another. CrowdStrike seems to be pulling ahead of SentinelOne. Here’s a link to our CrowdStrike review published earlier in the week to compare.

a) Results

- Missed revenue estimates by 2.3% & missed guidance by 2.6%.

- Beat GPM estimates by 180 bps & beat guidance by 160 bps.

- Beat EBIT loss estimates by 9.4% & beat guidance by 9.6%.

- Met -$0.37 GAAP EPS estimates. Beat -$0.15 EPS estimates by $0.02.

b) Full Year Guidance Updates

- Lowered revenue guide by 6.4% & missed estimates by 6.7%.

- Raised EBIT guide by 6.4% & beat estimates by 6.8%.

- ARR growth in the mid 30% range vs. previous estimates of 47%. This is being impacted by an ARR recognition accounting change (discussed below). That plus general demand weakness was the source of the large revision lower.

- Note that CrowdStrike is expecting nearly identical ARR growth this year at far larger scale and with far better margins. I’m a biased CrowdStrike shareholder, but worth noting.

Importantly, this disappointment takes a more “prudent” forecasting approach and assumes further macro deterioration throughout the year. It assumes worsening pipeline conversion and worsening usage trends. This could turn out to be the kitchen sink quarter and needs to be for this investment to find its footing.

Next quarter guidance was weak across the board while it reiterated plans to reach breakeven EBIT by calendar 2024.

c) Balance Sheet

- Stock compensation rose from 40.3% of sales to 41.6% of sales Y/Y (and vs. 36.6% Q/Q). This is borderline egregious and needs to fall a lot more quickly than it’s falling.

- There are no liquidity concerns here despite the lack of cash flow. It has $700 million in cash & equivalents with another $400 million in long term investments. It can burn cash at this rate for several years and be fine and its margins also continue to improve to diminish the burn rate.

- Share count rose 6.9% Y/Y. Too high.

d) Call & Release Highlights

Demand Silver Linings:

- 88.9% 2-yr revenue CAGR vs. 105% Q/Q & 116% 2 Qs ago.

- Win rates remain “stable” with “no pricing pressures.” Over and over again it was asked about competition and was adamant that the competitive environment is stable.

- Gross retention remained “stable.”

- Net revenue retention is still at a lofty 125%+.

- Emerging modules represented 33% of its bookings as its cloud offering grew by triple digits Y/Y.

- It added a new Fortune 10 client and now has 5 of them. Impressive.

- 917 customers w/$100K+ in ARR vs. 905 Q/Q & 591 Y/Y.

Margin Context:

- R&D rose 20% Y/Y; S&M rose 64% Y/Y; G&A rose 48% Y/Y. Ideally for a growth company like this, R&D would be a heftier expense bucket with the other two being smaller.

- Scale and data usage efficiency drove the gross margin expansion.

- It talked up how its margins are expanding faster than the competition. That’s easy to do when your Y/Y FCF margin comp is -70% vs. 20%+ for these companies it’s comparing itself to.

ARR Recognition, Poor Macro and Execution:

SentinelOne changed its ARR calculation methodology during the quarter. For whatever reason, it was lumping usage and consumption-based revenue into the RECURRING revenue figure. Whoever made that decision should be immediately fired. It has now stripped that piece out of the number. During this review, it uncovered “historical recording inaccuracies” within ARR calculation that it has now fixed. Not good, Mr. CFO. All in all, these factors reduced ARR by $27 million or 5% of its total book of business. There was no impact to revenue or bookings from this change, but it did impact net revenue retention (NRR).

While Palo Alto, Fortinet and CrowdStrike all cited tough yet stable macro conditions, SentinelOne discussed these headwinds worsening significantly during the quarter. This is despite its somewhat bullish comments during the period at investor conferences. Budget scrutiny worsened, sales cycle elongated, lower usage from existing customers continued, deals shrank, pipeline conversion deteriorated and these factors (plus the accounting change) led to it revising its full year growth outlook down to 41% Y/Y. It’s also dealing with aforementioned softness in data usage trends as clients streamline their storage requirements to cut costs by “filtering out a lot of the data they don’t feel is as useful.” We heard something very similar from Snowflake within its usage-based model. The team also blamed disappointment on deal slippage (especially with larger deals), but if that were the main reason, the annual guide would not have been as severely affected.

Finally, leadership talked about poor execution on its inability to close a few large deals during the quarter. Loved the honesty here.

Cost Cutting:

It’s Meta’s year of efficiency… it’s Amazon’s year of efficiency… it’s SentinelOne’s year of efficiency… it’s everyone’s year of efficiency. Amid the soft selling and demand environment, SentinelOne is looking to trim its cost base. That action will include firing 5% of its staff and cutting variable costs wherever it can. It is fully committed to continued rapid operating leverage regardless of macro (good considering how far margins have to do). These moves will shave $40 million from its total costs. That $40 million in added net income would have made the company FCF positive this quarter (with a massive stock comp add back).