1. Progyny (PGNY) — Earnings Review

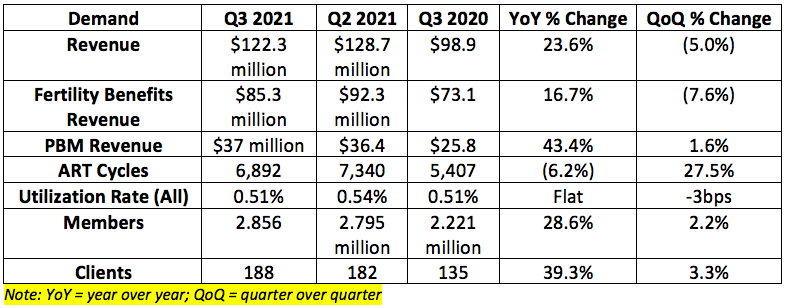

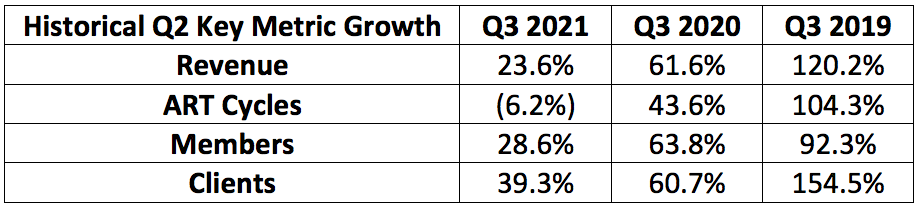

a. Demand

Progyny guided to $121-$130 million in sales for the quarter. It posted $122.3 million in sales missing the midpoint expectation by 2.6% and coming in at the low end of its guidance range.

Like most healthcare service companies, the largest step-up in sequential growth will be between the fourth and first quarters. This is when new clients from the selling season become live.

It’s important to note that revenue growth is expected to briskly accelerate next quarter and in 2022. As the company told us last quarter, utilization rates across the fertility industry dipped to 88% of normal levels before recovering to 90%. Utilization rate continued to improve throughout the 3rd quarter but not to the high end of its utilization rate forecast of 95% of normal levels. Importantly, utilization kept improving into the 4th quarter.

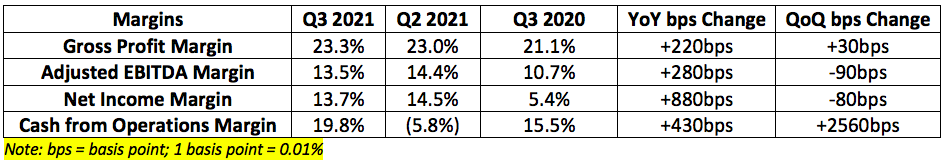

b. Profitability

Progyny was expected to generate roughly $0.05 per share. Without a one-time tax benefit helping its earnings this quarter, Progyny still generated roughly $0.09 per share beating expectations by $0.04. With this benefit it beat expectations by $0.12.

Progyny guided to $14-$16.5 million in adjusted EBITDA. It posted $16.5 million — at the high end of its guide.

The second quarter is a seasonally weak period for the company’s cash flow margins as it spends to support new customers but waits until the following year to collect fees from those new customers. That’s why the sequential boost in cash from operations was so dramatic.

Gross profit margin expansion was due solely to scaling the business. This should continue.

Adjusted EBITDA margin on incremental revenue was 27.5% during the quarter vs. 22.9% sequentially and 22.6% for 2020 as a whole. This offers direct evidence of a long runway for continue margin expansion as the newest business is the most profitable for Progyny — 27.5% represents a 1400 basis point expansion opportunity.

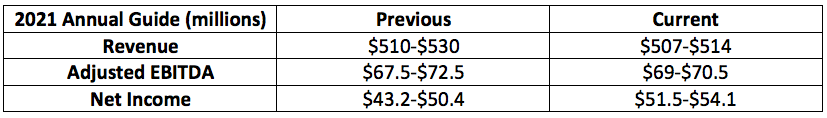

c. Guidance

The company expects $133.9-$140.9 million in next quarter revenue. Analysts had been expecting $141.6 million.

Progyny’s revenue guide represents 48% growth at the midpoint for 2021. Encouragingly, it expects revenue growth to accelerate in 2022 to 50%. That would bring us to north of $770 million in sales which is roughly in line with analyst forecasts. Incoming CEO Peter Anevski told us that this guide assumes the current slightly-depressed utilization rate continues — this rate did not rebound as quickly as it needed to for Progyny to maintain or raise its guide. It does not assume any further improvement meaning any improvement could place upward pressure on that guidance.

d. Notes from Outgoing CEO David Schlanger

On leadership changes:

David Schlanger will step down as CEO next year and stay on as the chairman of the board. Current President and COO Peter Anevski — who has been with the company since Schlanger began his tenure — will assume the CEO position. The 2 have worked together for over 2 decades with WebMD and Progyny.

Schlanger will now focus on the areas of the business where he feels he can have the greatest impact on Progyny’s future: developing new markets, products and relationships. He’ll continue to be a “sounding board” for Anevski as well.

Michael Sturmer will be the new Progyny President. Sturmer previously was the Chief Growth and Strategy Officer and SVP of Health Services at Livongo. Sturmer was a driving force behind the successful selling season this year.

“I believe this is an opportune time to implement this transition given that we are now concluding the most successful selling season in our history.” – Schlanger

While leadership transitions can be worrisome when the outgoing CEO has been so successful, it’s comforting to see all of the roles being filled internally by company veterans.

On the selling season:

Progyny received commitments from 85+ clients with an estimated 1.2 million covered lives for the selling season to get to 265 clients and 4 million covered lives. This would mean at least 45.2% growth and 42.0% growth respectively. This represents briskly accelerating growth between 2021 and 2022 as Progyny takes advantage of a full normal selling season under its belt post-pandemic. These marks exceeded extremely high expectations for the company. Most new clients will be live in Q1 with the rest live by Q2 of 2022.

Progyny maintained its “near 100%” client retention for the 5th consecutive year.

33% of existing clients increased their benefits coverage for next year — upsell activity exceeded all expectations.

e. Notes from Future CEO Peter Anevski

“To put our latest selling season into perspective, we added more new clients in one year as we had when we went public 2 years ago.” — Incoming CEO Pete Anevski

On the selling season:

Average covered lives per client of roughly 14,000 recovered off of the 2020 dip to levels in line with pre-pandemic periods. They also signed new clients with over 100,000 covered lives.

92% of new clients are going with the pharmacy benefit — Progyny believes it can get this number to 100%. The 92% metric is vs. 84% in 2020 and 73% in 2018 when it went public. Cross-selling is gaining more and more momentum.

48% of Progyny’s new clients this year previously had no existing fertility benefit (creating new TAM) vs. usual levels of around 35%-40% as fertility benefit adoption among large employers grows.

The 2022 selling season pipeline is larger than the 2021 pipeline was at this time last year.

Anevski on new product launches:

“We are continuing to explore the possibility of broadening our portfolio of services or adding new markets where we believe expansion makes sense.”

f. Notes from CFO Mark Livingston

The sequential assisted reproductive treatment (Art) cycle decline was due to the temporary blip in utilization. Female utilization remained strong, but the proportion of lower-priced fertility services was higher during the period due to (again temporary) lower IVF utilization. People returned to fertility treatment pursuits, but the first step of this return is lower-value consultations for Progyny with IVFs and other more costly procedures taking place thereafter. This has largely normalized into the 4th quarter.

4th quarter margins are seasonally weak for Progyny as it on-boards new employees to service new clients that will go live in the following quarters.

g. My Take

The slight top line miss and the second straight 2021 revenue guide down is not good. Utilization rate recovering more slowly for the sector than some thought was to blame for this but that rate continued to improve into this quarter.

Everything else in the quarter was fantastic. Selling season went extremely well, margins continue to rapidly improve and the 2022 revenue guide calls for strong, accelerating growth. This was not perfect, but it was good enough and keeps my long term thesis entirely intact.

Click here for my Progyny deep dive.

2. REVOLVE Group (RVLV) — Earnings Review

a. Demand

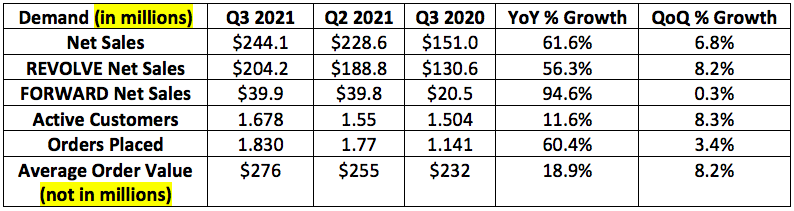

REVOLVE was expected to generate $214.4 in quarterly sales. It posted $244.1 million beating expectations by 13.8%.

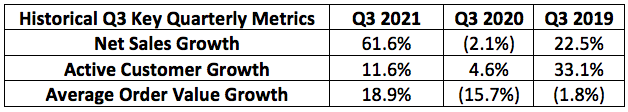

$244.1 million represents 58% growth vs. the most recent pre-pandemic period which accelerated from 41% sequentially. The company has been able to maintain a 26% 2-year compounded annual growth rate (CAGR) through the heat of the pandemic. The strength was led by domestic sales growth of 65% with international growing by 49%.

As a reminder, the pandemic was a severe headwind for this e-commerce company specifically for the following 2 reasons:

- The company predominately sells dresses and clothing people wear when going out or to the workplace.

- The company spends a large chunk of its marketing dollars on live events like music festivals and fashion shows.

Note that Average order value (AOV) is getting a boost from FORWARD’s proliferation — FORWARD is one of REVOLVE’s core, luxury owned-brands.

b. Profitability

The company’s profit guidance was as follows:

- Revolve was expected to earn $0.14 per share for the quarter. It earned $0.22 beating expectations by $0.08.

- The company was expected to generate $17.05 million in adjusted EBITDA. It earned $21.7 million beating expectations by 27.3%.

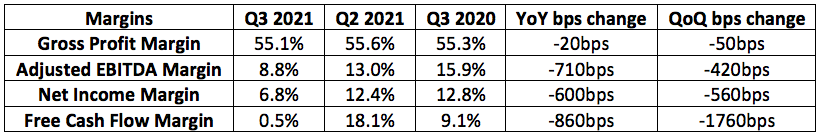

Margins were expected to compress this quarter as management previously highlighted that marketing spend would greatly accelerate and normalize during the period and going forward. For context, marketing spend was nearly 20% of sales this quarter which is 25% above its projected 2021 spend. It also more than doubled its inventory year over year which had been severely restricted and capped during the pandemic — this hit YoY cash flow and net income margins hard.

While these margins fell annually and sequentially, they still handsomely beat expectations with gross profit margin (GPM) previously supposed to be just 54% for the full year. Now it expects 54.5% GPM for 2021. FORWARD gross margin actually rose roughly 600 basis points year over year.

c. Balance Sheet

- $222 million in cash on hand

- $0 debt

- Wonderfully clean.

d. Co-CEO Mike Karanikolas Conference Call Notes

“We are thrilled with the early returns of our heavy marketing and brand-building investment initiatives.”

Karanikolas general notes:

- Traffic is well above pre-pandemic levels with higher conversion rates as well.

- A majority of newly added customers are buying from both REVOLVE and FORWARD.

- FORWARD segment growth is handsomely outpacing the luxury fashion segment as a whole.

- Cross-selling activity between REVOLVE and FWRD continues to grow “every month” yet the overlap remains in the “very low percentage” range pointing to a long runway. It was 5% as of last quarter yes that 5% already translated into 10% of FRWD’s total sales.

- The company is seeing 0 impact from Apple’s IDFA changes.

Karanikolas on supply chain issues:

Supply chain impacts like lower on-time delivery rates and rising freight costs have been prevalent but manageable. REVOLVE’s high-end goods paired with low discounting activity helps offset this issues. This is massive considering how many companies have blamed poor results on supply chain issues. Net promoter score (NPS) continued to rise during the year regardless of some delayed shipments.

e. Co-CEO Michael Mente Conference Call Notes

On Kendall Jenner’s Impact:

Kendall Jenner (new FORWARD creative director with nearly 200 million social media followers) hosted several events during New York’s fashion week. A video following her around New York for a look inside her day as the new creative director got 5 million views. She’s an icon… and now an icon working for REVOLVE.

The announcement to hire her led to a spike in FORWARD traffic that has not yet normalized with downloads of the app more than doubling year over year last month and social media followers 10Xing.

f. CFO Jesse Timmermans Conference Call Notes

“Strong top line trends continued through the month of October with the growth rate broadly in the range of our 3rd quarter growth rate.

Revolve now expects a 54.5% gross profit margin for 2021 vs. 54% last quarter and 53.5-54% 2 quarters ago.

The company continues to expect run rate growth of 20-25% and 14% EBITDA margins.

g. My Take

Fantastic quarter. The company is admirably managing supply chain issues better than most have been able to and is finding its recovering marketing spend met with exceedingly strong demand. Margins continue to remain elevated with its data-driven approach to inventory. I’ve said it before and I’ll say it again: hiring Jenner as the new creative director for FORWARD was nothing short of monumental for the company’s future. Great job, REVOLVE.

3. Penn National Gaming (PENN) — Earnings Review

“What really sets Penn Interactive (its online business) apart from the competition is our strategy to buy and build — whether it's brands, experiences, loyal customers, products, tech stack — versus the renting of eyeballs via aggressive traditional marketing tactics. We expect that this approach is the right long-term strategy and will result in a best-in-class margin profile and loyalty and retention.” — CEO Jay Snowden

a. Key Metrics

Expectations for Penn’s results were as follows:

- Penn was expected to generate $1.51 billion in sales. Results were in-line.

- Penn was expected to earn $0.89 per share and earned $0.52. This missed expectations by 41.6%.

EBITDA took a $30 million (or 0.85%) hit due to the Delta variant and Hurricane Ida. The company is seeing demand trends normalize into this quarter. That paired with recovering operational spend, M&A and Barstool product launches all led to the margin decreases. Margins largely improved vs. the pre-pandemic period.