Table of Contents

- 1. Brief Earnings Snapshots – Rocket Lab (RKLB) & DLocal (DLO)

- 2. Microsoft (MSFT) – Detailed Catch-Up Earnings Review

- 3. Cloudflare (NET) – Detailed Catch-Up Earnings Review

- 4. SoFi (SOFI) – Notes from CEO Anthony Noto’s Interview with KBW

- 5. PayPal (PYPL) – Brief Notes from Consumer GM Diego Scotti’s Interview with KBW

- 6. Cava (CAVA) & Starbucks (SBUX) – Tariffs & Shutdowns

- 7. Headlines

- 8. Macro

A lot of this week's content has already been sent:

- Sea Limited Earnings Review.

- On Holdings Earnings Review.

- Nu Holdings Earnings Review.

- My Current Portfolio & Performance vs. the S&P 500.

Other earnings reviews from this season:

- The Trade Desk Earnings Review.

- Lemonade & Duolingo Earnings Reviews.

- Palantir & Hims Earnings Reviews.

- Cava Earnings Review.

- DraftKings Earnings Review.

- Uber Earnings Review.

- Shopify & Coupang Earnings Reviews.

- Meta Earnings Review.

- Alphabet Earnings Review.

- Apple, ServiceNow & Starbucks Earnings Reviews.

- Amazon & Mercado Libre Earnings Reviews.

- PayPal Earnings Review.

- Tesla Earnings Review.

- SoFi Earnings Review.

- Netflix Earnings Review.

- Taiwan Semi Earnings Review.

1. Brief Earnings Snapshots – Rocket Lab (RKLB) & DLocal (DLO)

Neither of these names are part of the coverage network. I got some requests to put together one-pagers for the Discord room, so thought I’d share those here as well.

a. Rocket Labs

Results:

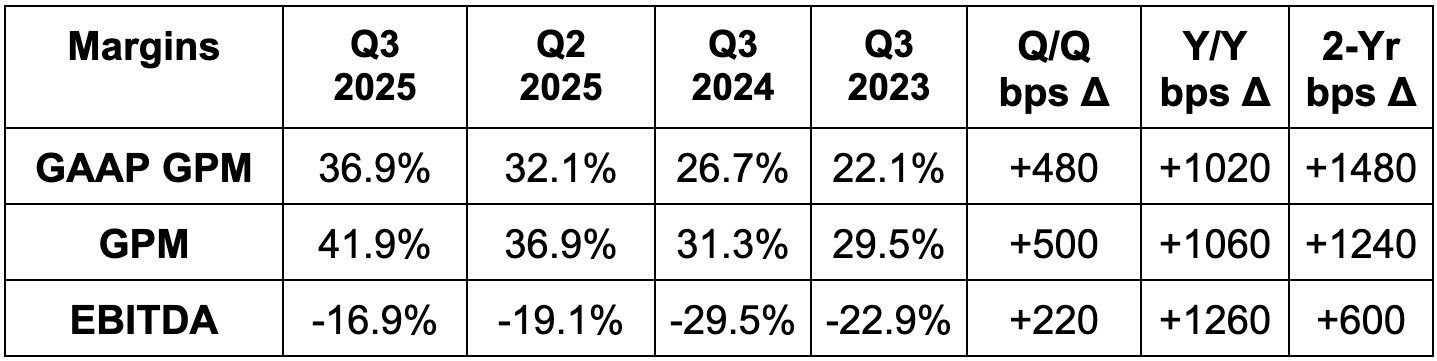

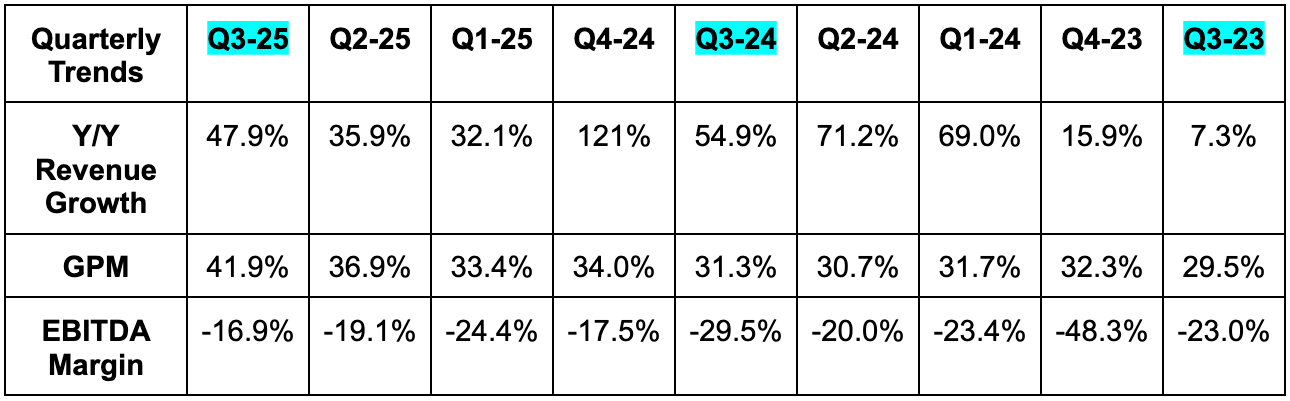

- Beat revenue estimates by 2.2% & beat guidance by 3.4%.

- Beat 40% GPM estimates & identical guidance by 190 basis points (bps; 1 basis point = 0.01%) each.

- Missed -$24M EBITDA estimates by $2.3M & missed guidance by -$4.3M.

- The large GAAP EPS beat was due to a $41M tax benefit.

Balance Sheet:

- Nearly $1B in cash & equivalents.

- $347M convertible notes.

- $68M debt.

- 6.2% Y/Y diluted share count growth.

Q4 Guidance & Valuation:

- Beat Q4 revenue estimates by 1.5%.

- Missed -$12M EBITDA estimates by $14M.

- Missed -$26M EBIT estimates by $7M.

- Met -$0.05 EPS estimates.

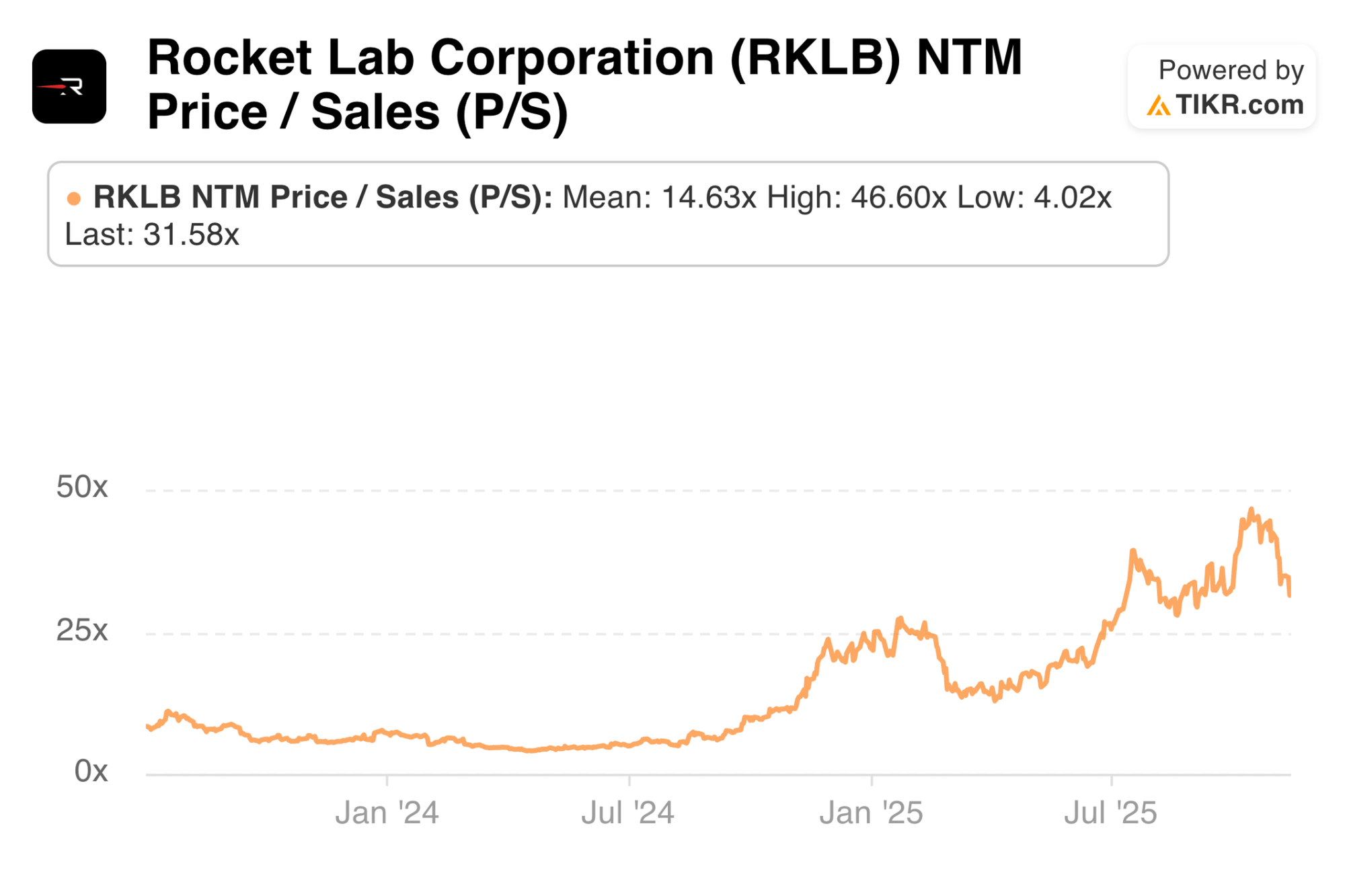

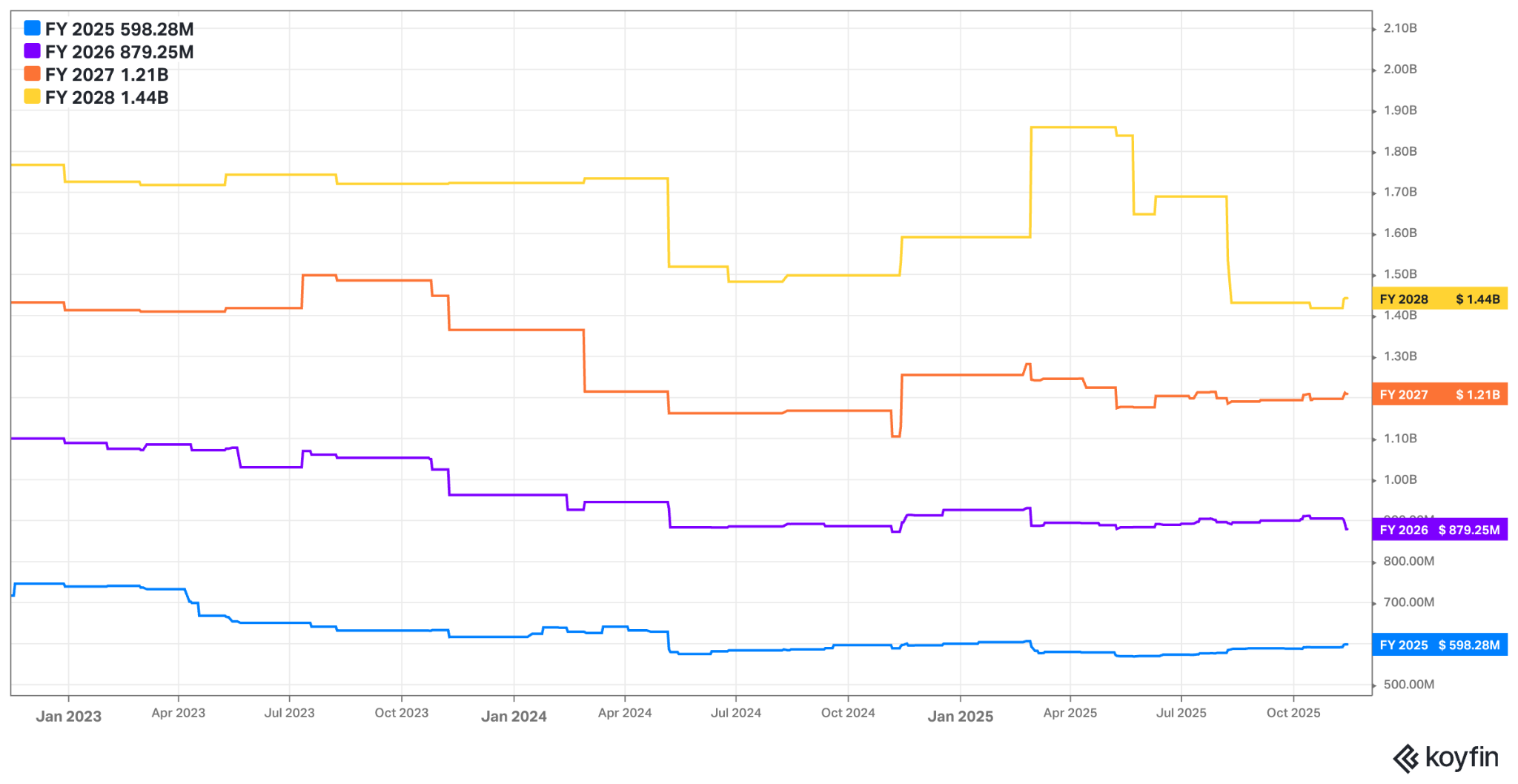

RKLB isn’t yet profitable. They trade for 32x forward sales and likely somewhere around 70x-75x forward gross profit. Sales are expected to grow by 37% this year, 47% next year and 37% the year after. They’re expected to deliver 2 points of GPM expansion over that period, so gross profit growth will be modestly faster.

b. DLocal (DLO)

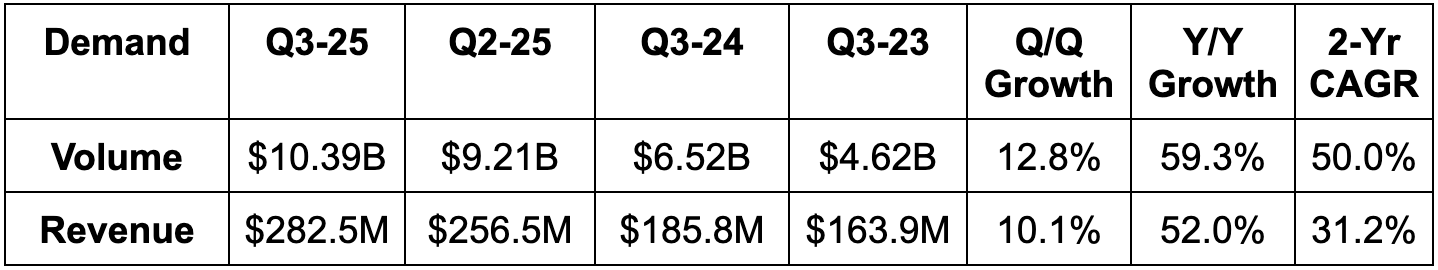

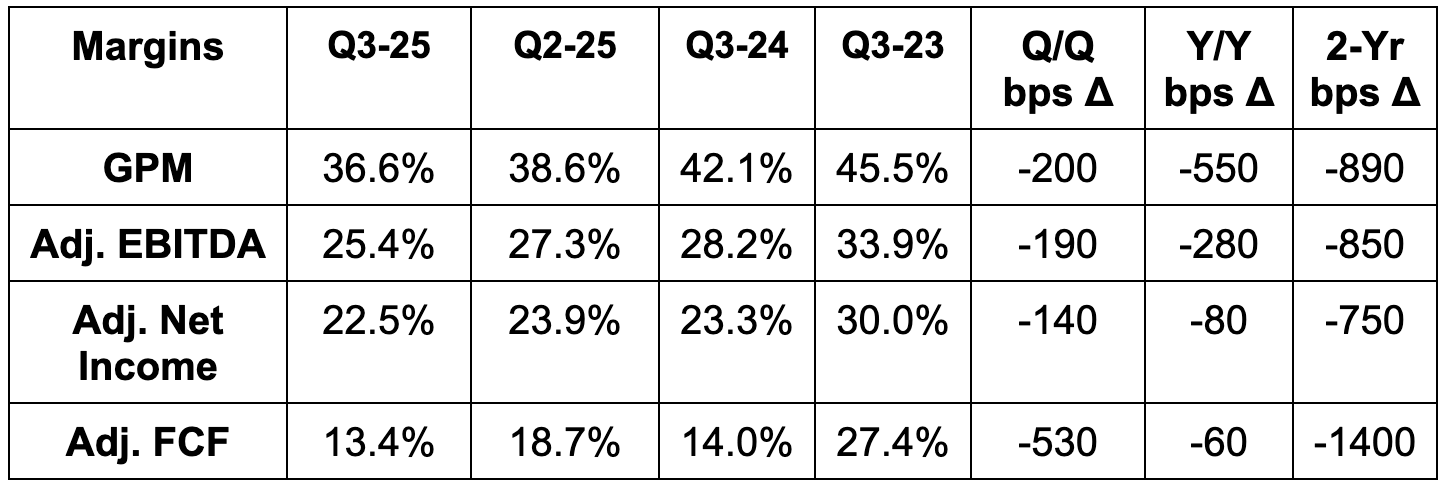

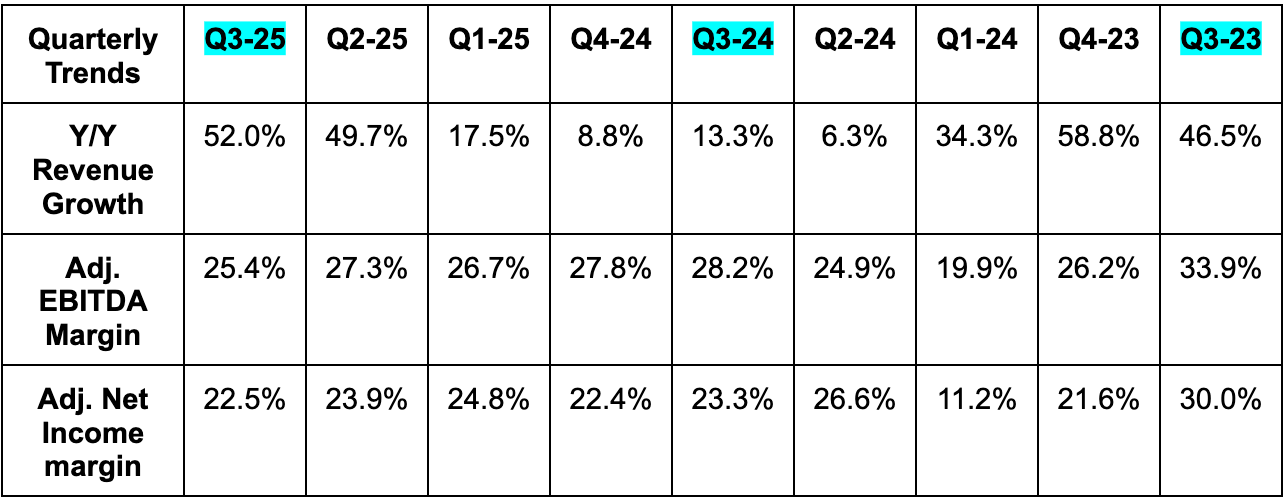

Results:

- Beat revenue estimates by 7.8%.

- Missed 39.2% GPM estimates by 260 bps. Beat EBITDA estimates by 4.3%.

- Beat FCF estimates by 11%. Met $0.17 EPS estimates.

Balance Sheet:

- $605M in cash & equivalents.

- No debt.

- 2% Y/Y share dilution.

Guidance & Valuation:

- Raised annual TPV growth guidance from 45% to 50%+.

- Raised 35% revenue growth guidance to ~40%, beating 37% estimates.

- Reiterated 32.5% gross profit growth guide, missing 33% estimates.

- Reiterated 45% EBITDA growth guide, meeting expectations.

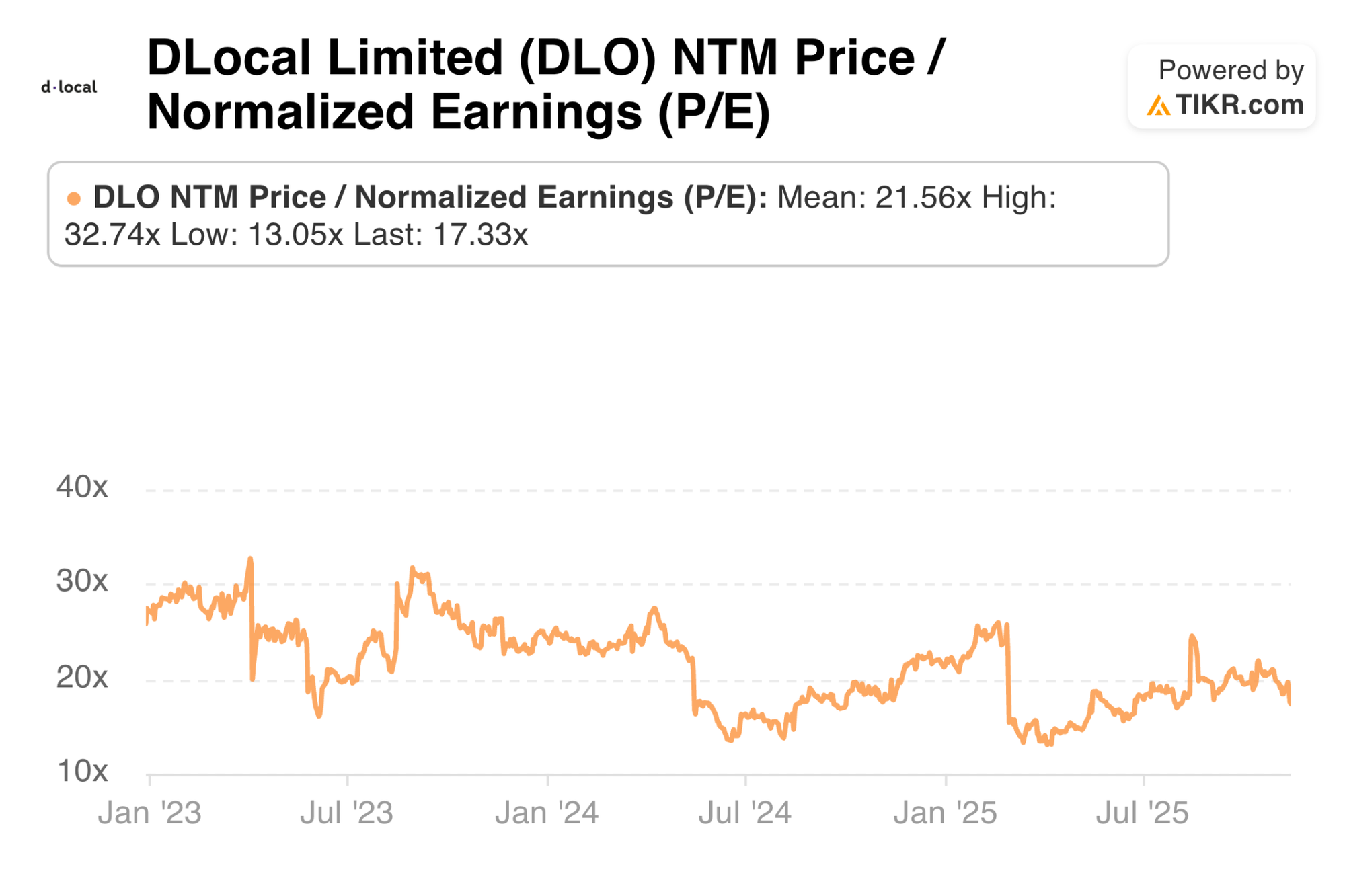

DLO trades for 17x forward EPS. EPS is expected to grow by 33% this year, 23% next year and 24% the year after.

2. Microsoft (MSFT) – Detailed Catch-Up Earnings Review

a. Key Points

- Azure remains capacity constrained with supply equilibrium taking longer than expected to reach.

- CapEx growth continues to be tied to near-term revenue opportunities.

- Impressive Y/Y EBIT margin expansion as depreciation ramps.

- Fabric and Foundry are thriving.

b. Demand

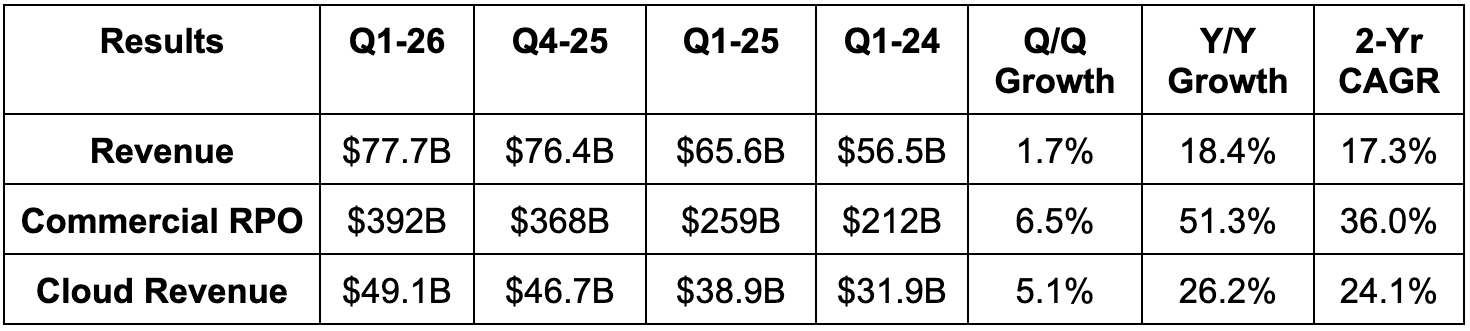

- Beat revenue estimates by 2.8% & beat guidance by 3.1%.

- Productivity and business revenue beat estimates by 1.8%.

- Microsoft commercial cloud revenue has a modest revenue recognition timing benefit.

- Intelligent cloud revenue beat estimates by 2.1%.

- The “pace of cloud migrations is acceleration,” per CEO Satya Nadella.

- More personal computing revenue beat estimates by 9%.

- Constant currency (CC) revenue growth was 17% Y/Y, which beat 14% CC growth estimates.

- Beat commercial cloud revenue estimates by 1%.

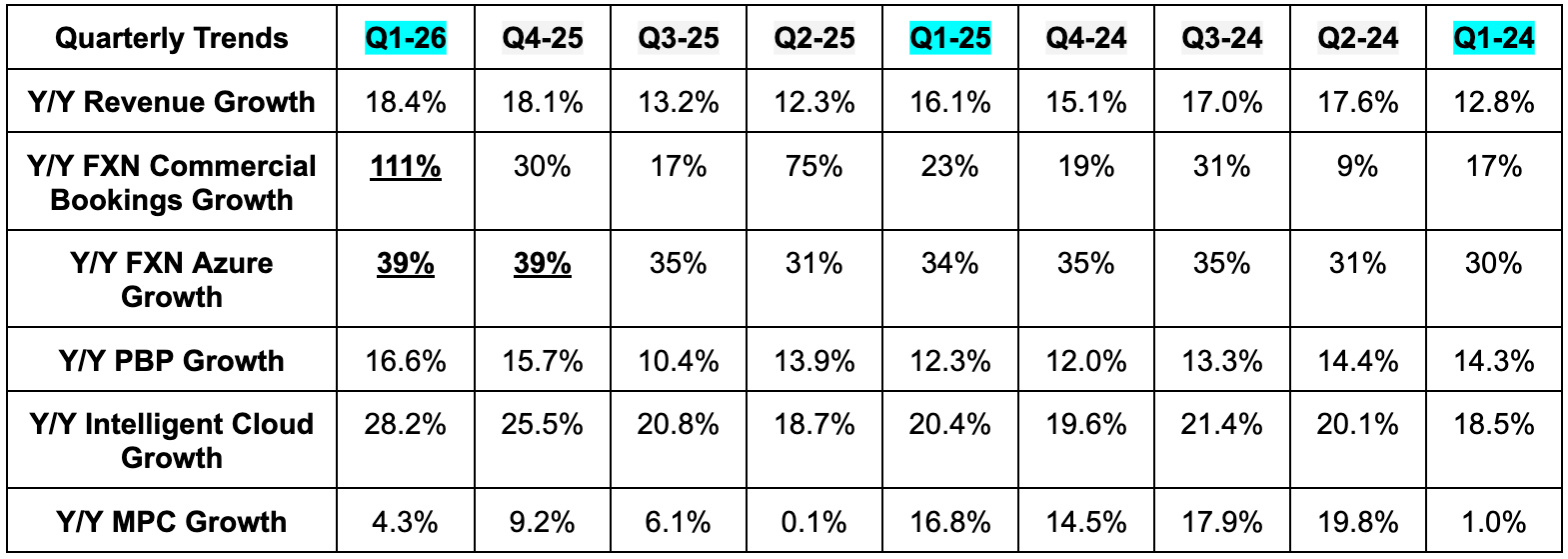

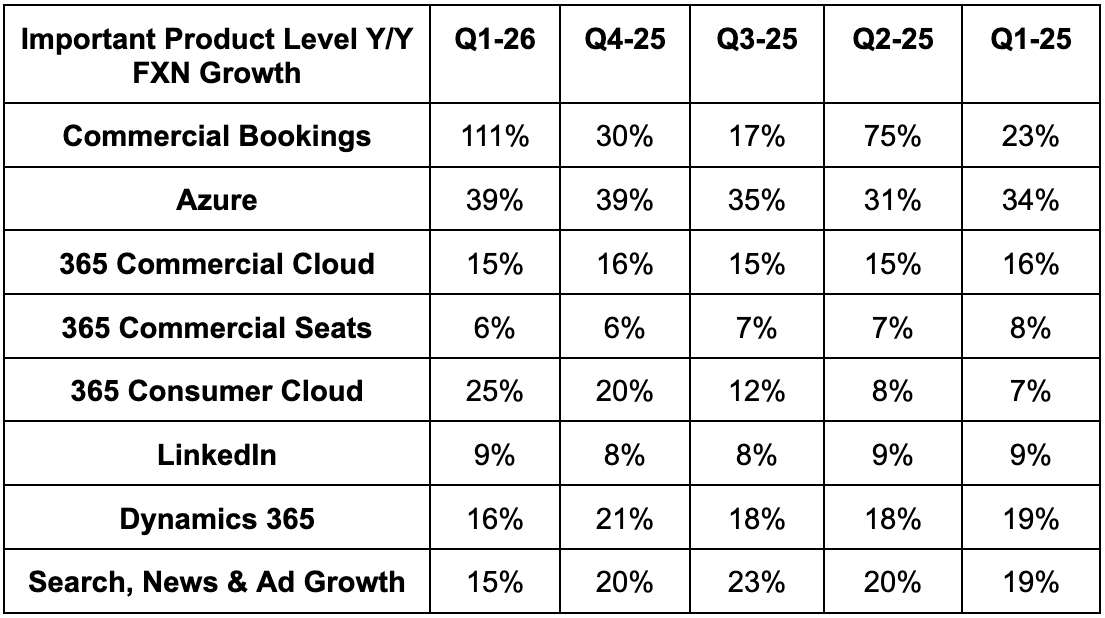

- 39% constant currency (CC) Azure growth beat 37% growth estimates and 37% growth guidance. Some buy-side targets were looking for 40% Y/Y growth.

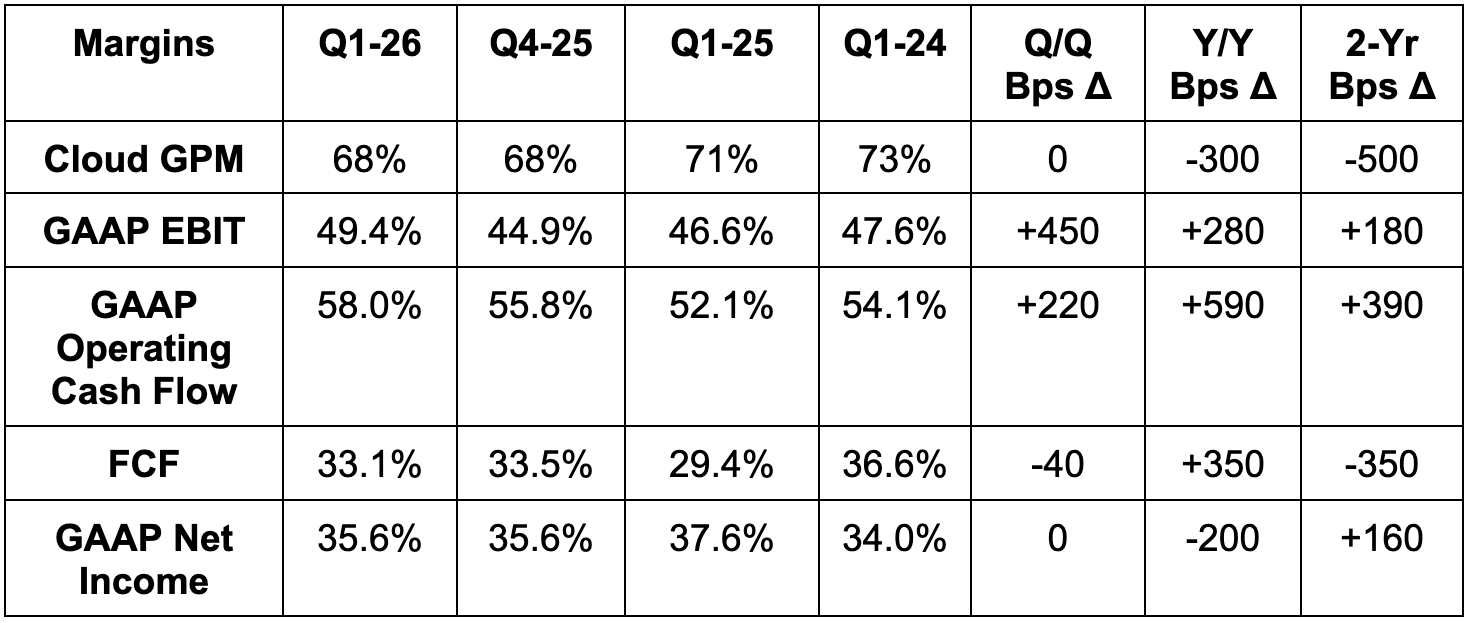

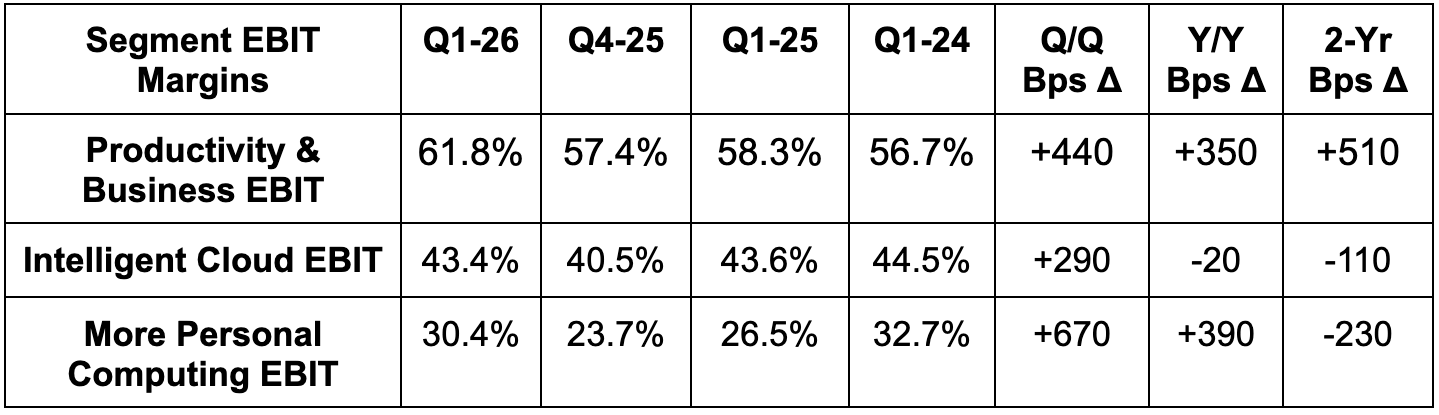

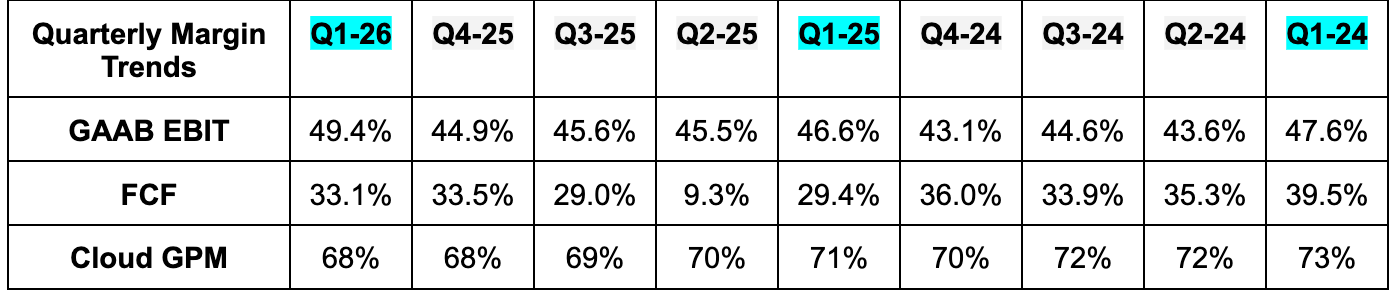

c. Profits & Margins

- Beat 67% cloud GPM estimates and beat 67% cloud GPM guidance.

- AI engineering and infrastructure investments to support strong Azure demand weighed on GPM as expected.

- Beat EBIT estimates by 8.3%.

- Beat $3.68 EPS estimates by $0.45.

- Beat $3.68 GAAP EP estimates by $0.04.

- Beat FCF estimates by 37%. It spent $35B in CapEx vs. guidance of “over $30B.”

d. Balance Sheet

- $102B in cash & equivalents.

- $11.5B in long-term investments.

- $43B in debt.

- Slight Y/Y diluted share count decline.

- 10.7% Y/Y dividend growth.

e. Guidance & Valuation

Q2 guidance roughly met Q2 revenue and EBIT estimates (both missed by less than 0.1%). Revenue guidance assumes a 2-point FX headwind, while EBIT guidance implies flat Y/Y margins. OpenAI’s shift to a public benefit corp and their evolving partnership will continue to greatly impact their other income and expense line items. For this reason, their outlook will exclude this noise while it persists. Next, they now expect CapEx growth rate to be higher than FY 2025 vs. previous guidance saying it would be lower.

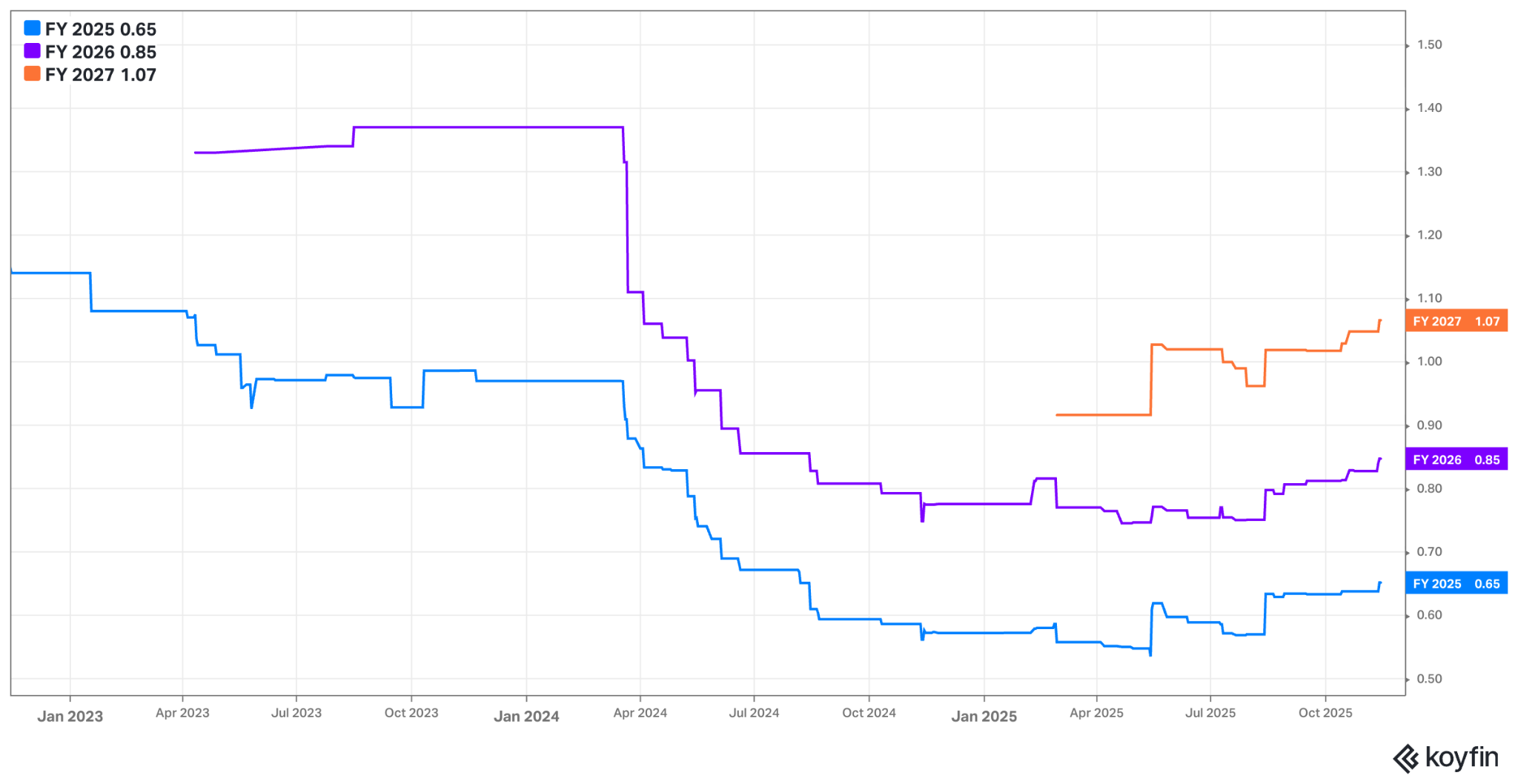

- Microsoft sees 37% Y/Y constant currency Azure growth vs. expectations that were closer to 38% Y/Y.

- They expect healthy commercial bookings growth next quarter.

- Microsoft cloud gross margin is expected to be 66% and fall Y/Y due to continued AI investments.

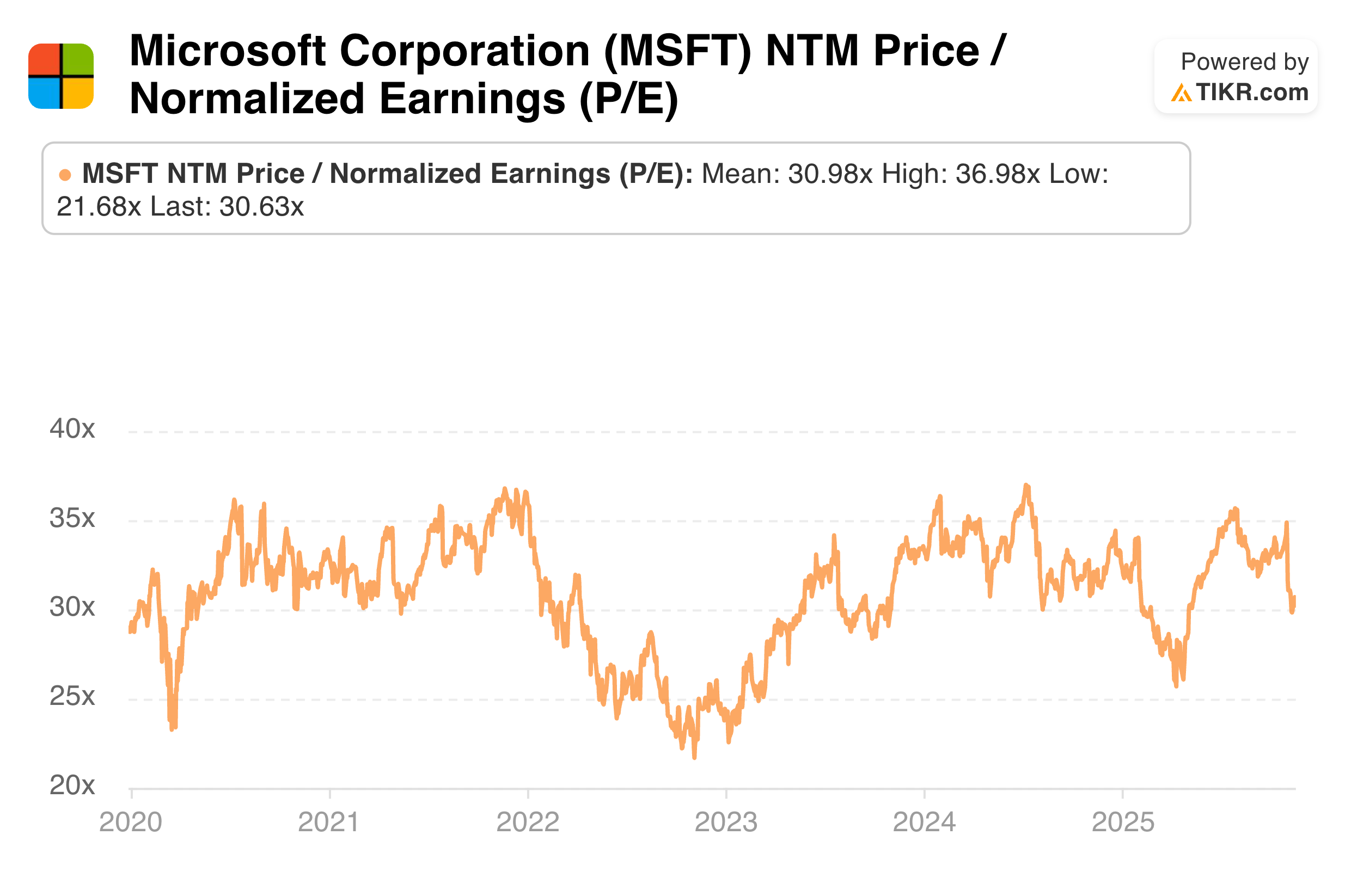

MSFT trades for 31x forward EPS. EPS is expected to grow by 16% this year and by 18% next year.

f. Call & Slide Deck

Bookings:

111% Y/Y commercial bookings growth overall was driven by OpenAI commitments, but does not include the new deal announced at the end of October. There’s likely another large spike coming when that new $250M contract is recognized. For commercial remaining performance obligations (RPO), duration (how long these deals will take to execute) is steady at two years. That means all the business Microsoft is building more capacity for will translate into actual revenue in a reasonable amount of time, lowering (not fully eliminating) the risk of ineffectively monetizing these large investments.

Leadership was asked about the various cloud deals going to hyperscalers other than Azure. Why are they not getting all of these contracts? Well… they don’t want them. Microsoft doesn’t want to be in the business of solely renting compute in giant clumps. They want holistic infrastructure contracts that include apps and services allowing the overall margin to be attractive and support investments. It also doesn’t want to get stuck with too much of one hardware generation and too much depreciation from that generation. They could have taken a lot of these compute deals, but didn’t feel the business was compelling.

Capacity & Depreciation:

AI capacity will grow by 80% this year with its data center footprint set to grow at a 41% compounded clip in each of the next two years. MSFT just opened a facility in Wisconsin that will scale to 2 gigawatts on its own and deployed the first Grace-Blackwell 300 clusters as well. This capacity growth is in direct response to tangible demand signals (as it has been). In terms of supply availability, they remain constrained despite the rapid capacity additions. Additionally, those constraints are now expected to last for at least another 3 quarters, vs. 1 more quarter based on its previous guidance. That bodes well for AI infrastructure cycle length.

With all of the debate surrounding useful lives of chips and depreciation schedules, I think it’s important to highlight the consistent work that goes into optimizing existing hardware performance. For Microsoft, their work ensures that a cluster of Hopper 100 chips is far more productive and efficient than when they first deployed it. Across every layer of the technology stack, there are dedicated teams and developers with the mission of extracting as much performance from these assets as possible. Whether Nvidia’s Cuda, AMD’s ROCm or Microsoft’s own software, there are systems in place to accelerate existing hardware performance that dwarf what we’ve seen in recent infrastructure CapEx cycles. For example, this work is how they’ve boosted token per GPU throughput for popular OpenAI models by 30% in the past quarter. That helps make aging chips valuable for longer.

Like Meta, Microsoft talked about significant compute usage optionality. They can allocate the CapEx to several different places if demand signals shift. And to ease overbuilding and depreciation schedule concerns further, leadership reminded us that these schedules are directly tied to multi-year compute contracts. They’re assigning longer useful lives because the assets are delivering revenue for longer and committed stretches of time. Sounds highly reasonable to me.

Sovereign AI:

In Germany, OpenAI, SAP and Microsoft are collaborating for new public sector infrastructure and services. They now have customers building sovereign AI products in 33 nations total.

AI – Azure AI Foundry:

As a reminder, Azure AI Foundry is MSFT’s cloud-native platform for experimenting with models and tools, creating complex AI agents and deploying them across enterprise work. Just like every hyperscaler, Microsoft says they offer the most model choice for developers to run training and inference through their platform. They have 11,000 in total on the 3rd-party side and are also enjoying solid 3x Y/Y download growth for their Phi Small Language Models (SLMs). Furthermore, its MAI text, voice and image models have proven popular within Foundry.

All in all, this has 80,000 total customers since launching last fiscal year and continues to boast 80% of the Fortune 500 as customers. That’s easier to accomplish when you already have ubiquitous cloud and productivity distribution across large enterprises, but it’s still a great result.

This quarter, Microsoft added an “Agent Framework” to help guide and fortify complex agent workflows, compliance and hygiene. These agent-building guardrails and processes perfectly plug into Azure AI Foundry Agent Service, which supports this development, powers agentic deployment and handles secure post-deployment management for these autonomous assets.

AI App Layer:

Microsoft now has 900M monthly active users across its AI apps and family of Copilots. As Satya put it, “Copilot is becoming the user interface for agentic AI experience.” It’s making interaction and engagement with highly complex and advanced algorithms feels conversational and seamless. And that’s really the only way these tools can be broadly used beyond a community of savvy, experienced developers. This first-party product family alone accounts for nearly 20% of all AI monthly actives on Azure. To build on this momentum, it released a more collaborative Teams Mode and debuted agents called Facilitator and Project Manager that help summarize meetings and build actionable workflows. Their Copilot for Microsoft 365 recently debuted “App Builder” as a purpose-built agent for track creation within 365 apps. They also introduced Agent Mode as a new way to turn a simple prompt into a word doc, Excel sheet or PowerPoint. Both launches are amplifying traction and pushing their Fortune 500 penetration rate over 90% for this specific product within the Copilot family.

Lloyds Banking Group is using it to save its labor force about 45 minutes of work per day while PwC has already saved millions in just 6 months. GitHub Copilot is automating “hundreds of thousands of lines of code suggestions” for AMD every month and enjoying record usage overall. It has 26M users and is powering overall GitHub growth that is “faster than any point in its history.” It will look to fuel that momentum with Agent HQ. This is a new agentic offering that manages, integrates and orchestrates work throughout all other GitHub Copilot agents with full access to all core GitHub tools to fuel autonomous work. This offers tight integrations with all other GitHub Copilot agents and 3P coding agents from Google, Anthropic, xAI and more.

In security, Copilot is helping drive 6.5x efficiency gains for some customer workflows, while its healthcare Copilot (Dragon) enjoyed 5x Y/Y patient encounter growth. On the consumer end, all Windows 11 PCs are now equipped with Copilot functionality. These laptops enable conversational agentic querying, simply jumpstarting multi-step tasks with words and watching Copilot take action for you with needed context. This helped generate 50% Q/Q growth in its consumer Copilot business.

On the 3rd-party side, Adobe, SAP, ServiceNow, Snowflake and other integrated software vendors are all building agents with Copilot for their customers. And for direct and custom client building, Copilot Studio traction remains great. As a reminder, Copilot Studio is the low-code agent-building platform, while AI Foundry is more developer-facing and enables deeper, more complex agentic task creation. Copilot routinely pulls from Foundry’s agents and tools as a simplified, streamlined interface for more basic work.

Strategic Importance of App Layer for Long-Term Positioning:

Under the new OpenAI deal, Azure exclusive IP and API rights last for another 5 years, while model and IP rights last for another 7 years. Achieving Artificial General Intelligence (AGI) would also lead to these rights expiring, but Nadella didn’t seem at all concerned by that. He does not think AGI “as defined in the contract is ever going to be achieved anytime soon.” From now until we do reach AGI, Microsoft is confident that building various apps, Copilots and other software will create a sticky, high-value ecosystem that extends well beyond building a great LLM. Nadella describes LLMs that approach AGI as “jagged intelligence” that needs agents and apps to “smooth out those jagged edges” and create manicured, frictionless use cases that create optimal value. It sees most of its long-term value in these apps and agents and sees that value fortifying its dominant ecosystem position in the years and decades ahead.

Fabric:

As a reminder, Microsoft Fabric is its overarching data analytics, engineering, warehousing, real-time analytics and business intelligence (Power BI) platform. Revenue grew by 60% Y/Y as it crossed 28,000 overall customers. Within Fabric and hyperscaler environments, Azure Structured Query Language (SQL) database grew by 75% Y/Y. Cosmos Database is its Not Only SQL (NoSQL) product that is perfect for unstructured, document-oriented data and effectively complements its relational SQL offerings, enjoying 50% Y/Y hyperscaler-related growth. These products are effectively removing data siloes and making customers of other clouds more eager to use their data in Azure and Fabric.

Other Products:

LinkedIn has 1.3B users, representing a 14% 2-year CAGR since they reached 1B in November 2023. A weak hiring market slowed down the talent solution portion of their services revenue.

Dynamics 365 (slew of business apps including customer relationship management (CRM)) took market share like Nadella says it does every quarter. The security business also “took share across all categories.”

g. Take

Another rock-solid quarter for Microsoft. Through all of the OpenAI contract noise, the company continues to execute, with cloud upside driven by its legacy server business rather than any AI-related deal. While I do find the concentration risk from OpenAI to be moderately concerning, there’s still plenty to be excited by. Foundry, Fabric and its Copilot family are all rapidly growing and Azure is leading the public cloud pack in terms of revenue growth. It's pushing back time needed to resolve supply constraints, which bodes well for the AI hardware growth runway. Additionally, despite ramping spend and depreciation, Microsoft is building out its fleet while still growing Y/Y operating margin.

As Max readers know, I prefer other enterprise software large cap exposure, but this is a world-class company with a great team performing at a high level.

3. Cloudflare (NET) – Detailed Catch-Up Earnings Review

a. Cloudflare 101

Basic Niche:

Cloudflare makes the internet fast and secure. They have a massive global Content Delivery Network (CDN) to move traffic closer to the end user, which cuts web latency. They actively assist clients in optimizing traffic, speed and consistency as well. NET doesn’t sell physical firewall hardware, but instead a virtual, cloud-native “Magic Firewall” to supplant these hardware needs. It offers web application firewalls (WAFs) for app-level security and Magic Firewall is for network-level security. Magic WAN is Magic Firewall’s partner in crime; it connects networks while Magic Firewall protects them.

Workers Platform & AI Tools:

Workers Platform is its server-less (so fully managed by Cloudflare) product suite for millions of developers to build, maintain, secure and deploy applications. This enables caching of content and apps across Cloudflare’s global network for faster delivery. Its newer Workers AI product allows developers to access models and GenAI tools (like sentiment analysis) to build and customize apps hosted by Cloudflare’s network. Workers AI pairs seamlessly with its “Vectorize.” Vectorize offers a style of data querying that allows for visualization of patterns.

Another key example of Cloudflare’s GenAI tools is its R2 product. This allows cloud workloads and data to freely move among public clouds with no tax. This is key in a multi-cloud world and is popular for model building and implementation. Models are voracious users of data and data is routinely hosted in many clouds. That's where R2 comes in handy.

- Cloudflare AI is its overarching suite of AI tools, which include the developer AI tools in Workers AI, among others.

- Hyperdrive is a notable product within Workers AI. This allows any legacy database to plug into NET’s global CDN. It makes NET an easier migration partner as it helps customers embrace next-gen databases, on-premise-to-cloud migrations and GenAI.

Zero Trust & More on Network Security:

Cloudflare also offers its Zero Trust Network Access (ZTNA) program. This directly competes with Zscaler and many others. Zero trust means that a user or device must be constantly verified (or never trusted). Cloudflare does this in a seamless manner, minimizing user friction. It considers device type, location, usage patterns (or signatures) and other contextual clues to better authorize permission requests. This way, it knows when to block those requests or when to require more information. It then deploys a minimal privilege approach to ensure only the necessary permissions are granted to workers. Nothing more, nothing less. Zero Trust ensures an adversary can’t breach the most vulnerable part of a tech stack and move freely throughout it thereafter.

Secure Access Service Edge (SASE) is a term for how Cloudflare conjoins web performance like SWG, Magic WAN with security use cases like data loss prevention (DLP), Magic Firewall, email security and broad threat intelligence capabilities. This drives vendor consolidation, controls costs and augments performance. Cloudflare One is its overarching product bundle subscription combining this suite.

Cloud Access Security Broker (CASB) is a security tool to provide firms with a bird's-eye view of application usage. This has both security and performance optimization implications. It hosts and secures client data and uncovers suspicious activity or deviations in typical usage patterns to flag threats. It plugs into NET’s Secure Web Gateway (SWG), which is essentially a digital security guard ensuring protection of a firm’s secure network and assets from the open internet. It ties closely to NET’s DLP and URL filtering tools.

It offers Distributed Denial of Service (DDoS) attack protection to augment its security and network capabilities. This form of hacking aims to inundate and overwhelm networks with traffic. This is delivered through a product called Magic Transit and boasts higher success rates, scalability and cost efficiency than alternatives. That recipe is a clichè for Cloudflare products. They think they’re one of one in terms of handling massive traffic spikes without ballooning costs or issues. While alternatives route separate networks for DDOS-specific functions, sacrificing interoperability, Cloudflare provides non-siloed service.

More on GenAI:

Browser Isolation is Net’s managed service for providing users with a purely secluded environment to search and scrape the web. This will be an increasingly important tool for its GenAI inference products that are now building steam. Inference is where Cloudflare expects to realize the bulk of GenAI’s financial value. Models are trained once and periodically updated with new data. After that, the value of those models lies in their ability to connect dots and drive insights (or inference). That’s where Cloudflare thrives. It offers a managed cloud platform to do all of that app and model work in a secure and compliant fashion.