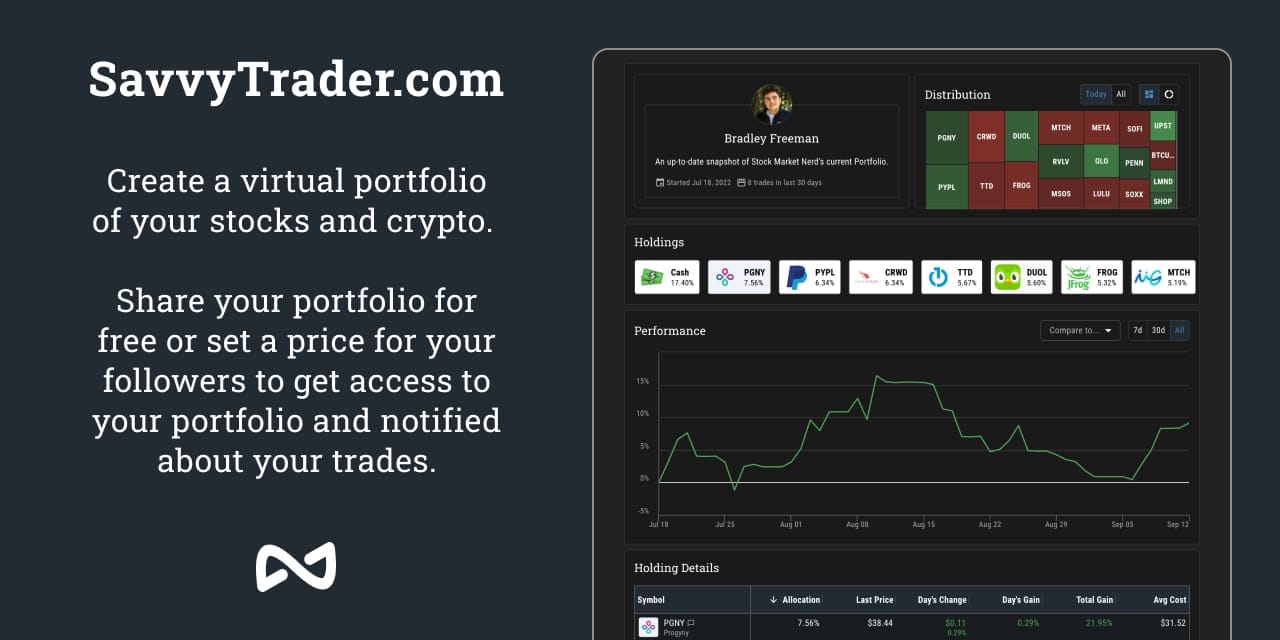

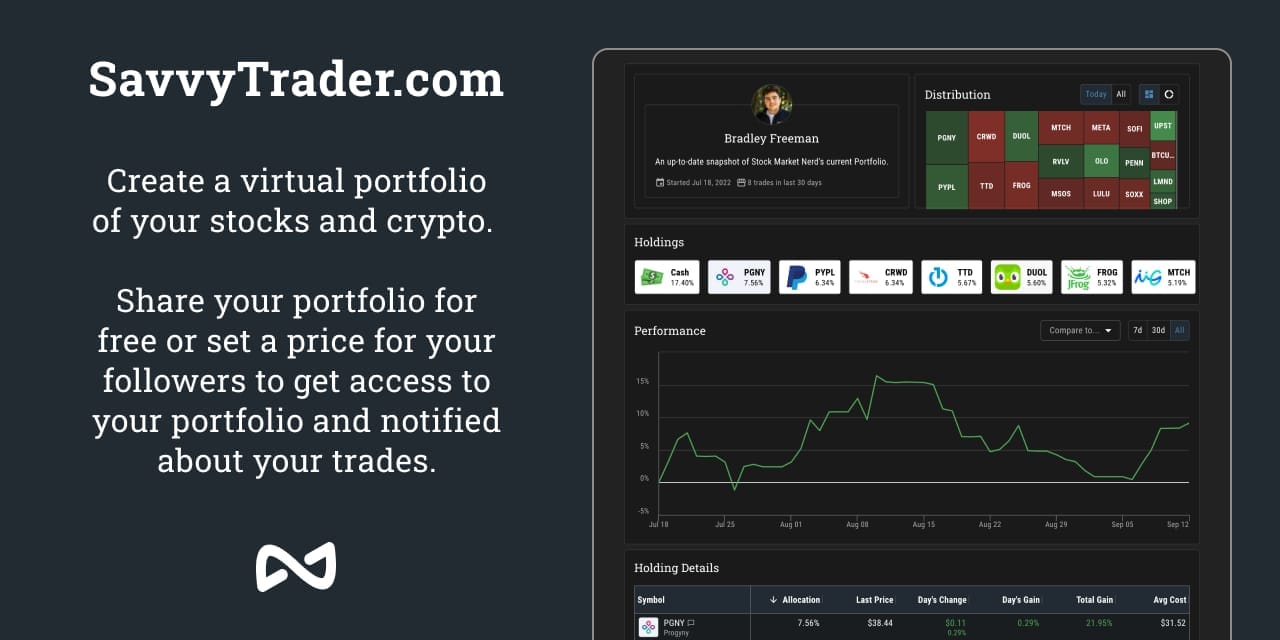

This piece is powered by my friends at Savvy Trader:

Welcome to the 323 new readers who have joined us this week. We’re thrilled to have each & every one of you & determined to provide as much free value as possible.

1. SoFi Technologies (SOFI) – Crypto and Student Loans

a) Crypto

4 members of the Senate Banking Committee this week requested information from SoFi pertaining to its cryptocurrency practices. Following a string of liquidations and high profile chapter 11s in the digital currency space (which the letter explicitly cited as a reason for the concern), this is not all that surprising. It’s also not concerning to me for the following reasons:

- Since Anthony Noto was named CEO in 2018, there has been 0 regulatory drama for this firm. Considering it listed as a SPAC during the height of that craze, this matters. That’s why the company was able to secure a bank charter (January 2021) amid all of the regulatory and bureaucratic headaches. Noto runs a tight ship.

- The company immediately responded to this inquiry telling investors it has played entirely by the rules here.

- TOTAL brokerage fees equate to less than 1% of SoFi’s revenue. Crypto brokerage fees are just one small piece of that tiny revenue contributor.

- SoFi has never had any relation to FTX or other bad actors in the space. Coinbase is its crypto custodian.

I think this will turn out to be irrelevant noise.

“We maintain consistent, constructive dialogue with each of our regulators… We look forward to sharing the requested information with the Senators in a timely fashion.” — SoFi Response

b) Student Loans

Once again, the Biden Administration has announced an extension of the “pandemic era” student loan moratorium through June 2023. The President wants the Supreme Court to review his loan forgiveness policy that was blocked by lower federal courts and this was his move to force that action.

SoFi had been gearing up to finally have all of its business segments enjoying a normal exogenous backdrop in 2023 for the first time in 4 years. It was prepping for a large ramp in December student loan refinance demand in anticipation of the moratorium ending. Now, that will not be the case.

This is undeniably an annoying headwind, but it’s not all gloom and doom for us SoFi shareholders. Why? Two years ago, when the moratorium was first implemented, student loan refi was an astronomically more important part for SoFi’s success than it is today. It didn’t have rapidly proliferating personal loan or technology platform businesses to weather the initial blow. And REGARDLESS, it still met its original 2021 guidance despite this unforeseen obstacle, it still grew rapidly, and it still expanded key margins.

Today, overcoming the same headwind will be easier for the company simply because its operations are more diversified across product categories than in 2020. That’s why Noto was able to confidently tell us this month that SoFi would continue to grow revenue over 35% YoY with a 30%+ incremental EBITDA margin in 2023 even if the moratorium stayed in place. He considered the expiration an if, not a guarantee and had his team preparing for a world of continued extensions. Prepare for the worst, expect the best.

I expect SoFi’s 2023 results to show little evidence of student loan pain, and I expect student loans to turn back on at some point for yet another lucrative growth lever to pull. Student loan refi demand isn’t gone, it’s just trapped in a can being frustratingly kicked down the road. I’ll likely wait for this news to be digested by markets for a few more days, and then add to my stake.

It may sound like I’m cheerleading to some when I shouldn’t be. In response to that, I’d just like to reiterate how remarkably consistent and strong SoFi’s fundamental performance has been since going public: That is why I remain so bullish. If that continues, the stock price will eventually take care of itself. If fundamental performance deteriorates, I’ll be open, candid and prompt about it… as always.

2. Shopify (SHOP) – Black Friday Stats

Shopify released data this morning covering how Black Friday went for its merchant base. Results were quite strong:

- Generated $3.36B in sales -- up 17% YoY & 19% constant currency

- Peak sales volume reached $3.5M per minute vs. $3.1M YoY.

- Cowen reported that Shopify’s peak sales volume only reached $2.1M per minute this year -- so this correction from Shopify was appreciated and encouraging.

- Shopify’s point of sale product saw 27% YoY volume growth.

- Average cart price rose slightly YoY — behind the rate of inflation.

- 15% of orders were cross border.

Adobe reported just ~4% YoY growth in online Black Friday sales & we’ve gotten several reports pointing to underwhelming brick & mortar sales as well. Considering these factors, the performance was reason for optimism.

It’s also good to see the company find more brick & mortar traction as it pushes deeper into that large piece of global commerce. Physical shopping has clearly come back with a vengeance (Walmart search volume re-surpassed Amazon’s yesterday for evidence), and it’s good to know Shopify continues to command a sizable chunk of that opportunity.

Savvy Trader is the only place where readers can view my current, complete holdings. It allows me to seamlessly re-create my portfolio, alert subscribers of transactions with real-time SMS and email notifications, include context-rich comments explaining why each transaction took place AND track my performance vs. benchmarks. Simply put: It elevates my transparency in a way that’s wildly convenient for me and you. What’s not to like?

Interested in building your own portfolio? You can do so for free here. Creators can charge a fee for subscriber access or offer it for free like I do. This is objectively a value-creating product, and I’m sure you’ll agree.

There’s a reason why my up-to-date portfolio is only visible through this link.

3. Lululemon Athletica (LULU) – Black Friday Channel Checks

According to Bloomberg News channel checks, Lululemon stores saw notably strong traffic during Black Friday with long lines and big crowds. The company -- as per usual -- conducted far less discounting than most of its peers, so it’s good to hear it still had comparatively strong store attendance.