Table of Contents

- Rest in peace, Charlie Munger:

- 1. ZScaler (ZS) — Earnings Review

- 2. Salesforce (CRM) — Earnings Review

- 3. Snowflake (SNOW) – Earnings Review

- 4. Earnings Roundup – Workday (WDAY); Intuit (INTU …

- 5. Disney (DIS) – Signal vs. Noise, Activists & a …

- 6. Uber (UBER) – New York City, The UK & S&P 500

- 7. Amazon (AMZN) – Bullish Notes

- 8. Holiday Weekend Results – PayPal (PYPL); Lulule …

- 9. Nanox (NNOX) – “Earnings” Review

- 10. Macro

- 11. Portfolio

Rest in peace, Charlie Munger:

Rest in peace, legend. The investing world lost an icon this week in Charlie Munger. He lived a hell of a 99 year life, and is someone who I admire, look up to and constantly learn from. Most of you probably know him as Warren Buffett’s right-hand man. I prefer to think of him as his partner who steered Buffett’s success more than he gets credit for. He changed Buffett’s mindset from being a pure bargain hunter to balancing deal-hunting with the pursuit of high quality business models. He shared abundant wisdom at shareholder meetings and thoroughly entertained with his opinions on everything from Apple to Crypto. His view that reputation is our most important asset motivates my full transparency and intolerance of any shady behavior. He was, is and always will be a legend. RIP.

1. ZScaler (ZS) — Earnings Review

Zscaler is a next-generation, predominantly cloud-based network security company. It competes with firms like Palo Alto and Cloudflare.

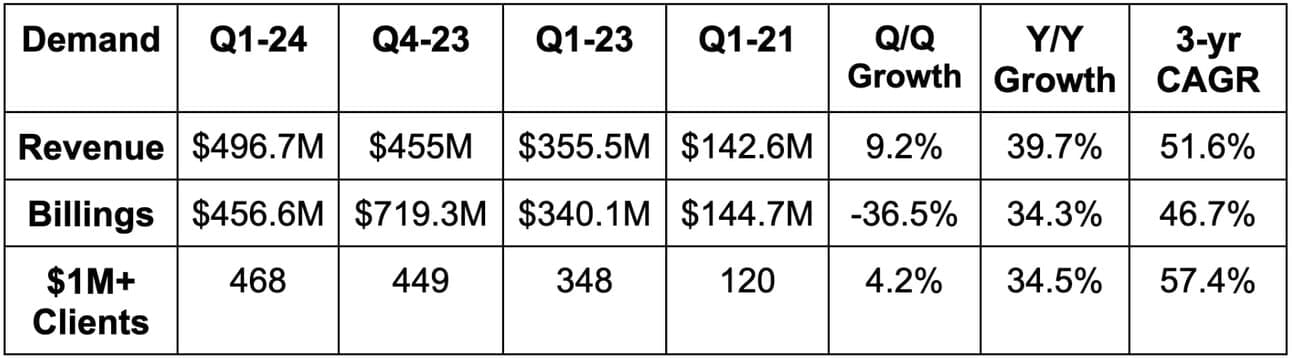

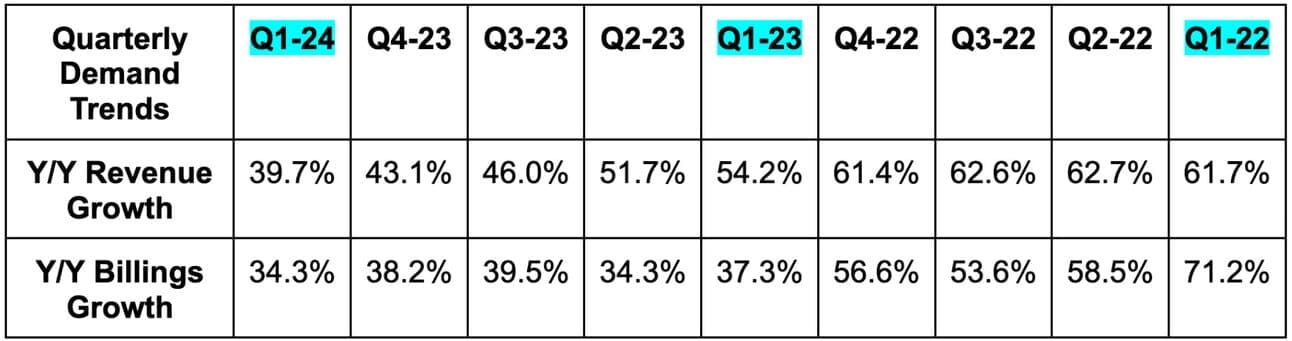

a. Demand

Zscaler beat revenue estimates by a comfortable 4.9% and beat its own guidance by 5.0%. Its 51.6% 3-year revenue compounded annual growth rate (CAGR) compares to 53.5% as of last quarter and 55.9% 2 quarters ago.

Billings were roughly in line with consensus, but about 2.4% below the buy side hedge fund surveys that I had access to.

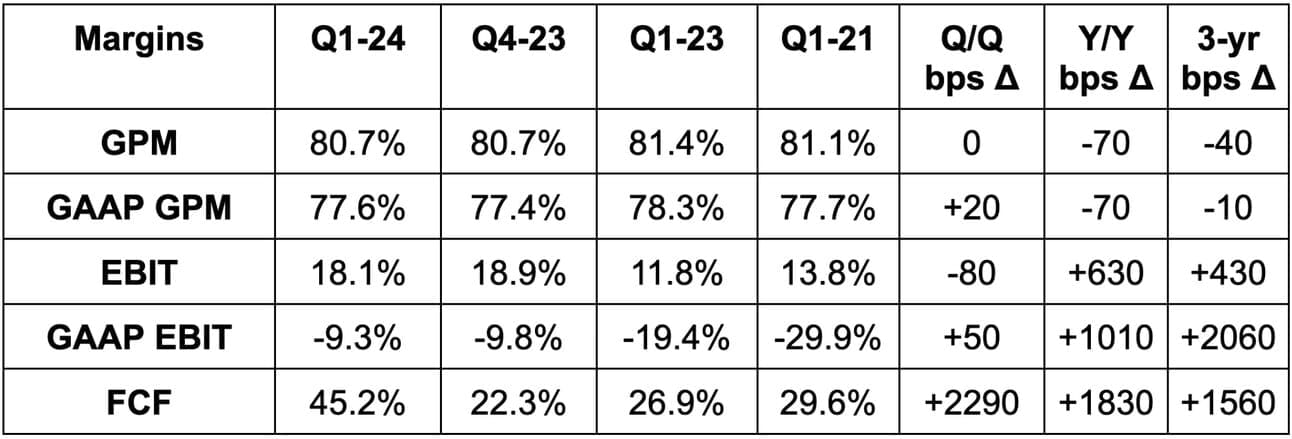

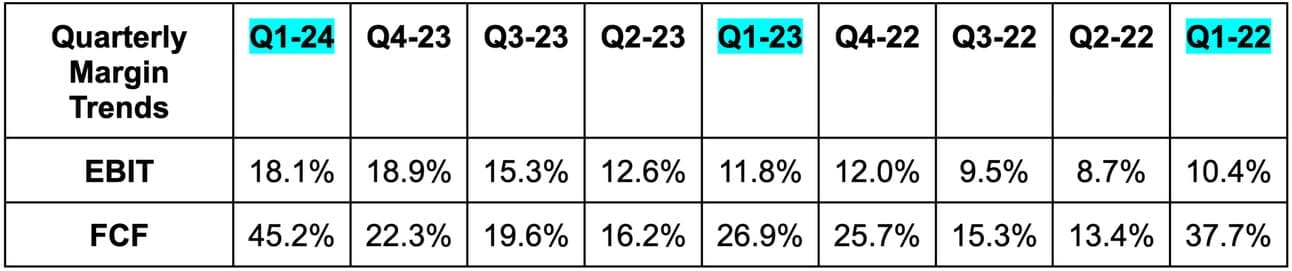

b. Margins

- Beat EBIT estimates by 25.6% & beat its EBIT guidance by 26.3%.

- Beat $0.49 earnings per share (EPS) estimates by $0.18 & beat its same EPS guidance by $0.18 as well.

- Beat free cash flow (FCF) estimates by 68.0%.

- GAAP & non-GAAP gross profit margins (GPMs) were both comfortably ahead of consensus estimates.

c. Balance Sheet

- $2.32 billion in cash & equivalents.

- $1.1 billion in convertible senior notes. No traditional debt.

- Share count rose by 2.9% Y/Y.

d. Fiscal Year 2024 Guidance

- Raised revenue guidance by 1.8% which beat estimates by 1.6%.

- Reiterated billings guidance which missed estimates by 0.5%-1% depending on which data source we use.

- Raised EBIT guidance by 8.2% which beat estimates by 7.6%.

- Raised $2.23 EPS guidance by $0.23 which beat estimates by $0.22.

- Reiterated low 20% FCF margin for the full year.

Next quarter guidance was similarly ahead of expectations across the board. It does not guide to billings on a quarterly basis.

e. Call & Release Highlights

Zscaler & Zero Trust 101:

ZScaler’s Zero Trust Exchange is its latest and greatest cloud security platform. It blazes a trail between users (remote and in-office), apps and devices across eligible networks. Zero Trust is exactly what it sounds like: never trusting a device or end user. The exchange constantly vets and verifies all endpoints and users as they move within a company’s perimeter. It does not allow bad actors to breach a vulnerable infrastructure or freely move about it thereafter without any subsequent verification. ZScaler assigns risk scores for requests to assess needed levels of verification.

This approach replaces an antiquated network security philosophy that every device and user within a perimeter automatically getting unconditional access. So? Zero Trust is safer AND allows remote workforces to responsibly work from anywhere. Zero Trust is rapidly replacing firewalls and virtual private networks (VPNs) to reduce security risk and enhance productivity. As all strong software platform plays do, Zscaler’s Zero Trust infrastructure also cuts costs by diminishing the need for on-premise security apps and through vendor consolidation.

I know readers are most familiar with endpoint security and CrowdStrike based on what I’ve most closely covered. While Zscaler and CrowdStrike do compete in some areas, they partner more frequently and even offer joint products.

More Sector Definitions:

- Secure Access Service Edge (SASE) provides access to software for users regardless of where they’re working.

- Virtual Private Cloud (VPC): These are subsections of public cloud environments. They offer users more autonomy with their network and apps. They also allow for secure connections between cloud and self-hosted (on-premise) environments with no public network exposure. This is especially key for highly regulated industries.

- Virtual Desktop Infrastructure (VDI): Allows software to be accessed on remote devices. Zscaler’s Zero Trust Exchange ensures this is done safely and securely.

- Firewall is a legacy form of network security that uses a fixed set of rules to authorize outbound and inbound traffic.

Zscaler Product Definitions (which exist under the Zero Trust Exchange Platform):

- Zscaler Internet Access (ZIA) protects internet connections. It’s the middleman between a user and a network which ensures proper authorization & access.

- Zscaler Private Access (ZPA) offers remote access to internal apps. This is an upgraded VPN by “connecting directly to the required resources without public exposure” per Zscaler filings.

- Zscaler Digital Experience (ZDX) ensures high quality and always on performance of loud apps. It sifts through networks to identify sources holding back performance to be remediated.

- Risk360 flags vulnerabilities and offers end-to-end risk quantification with intuitive next steps for remediation.

- Risk360 has already closed more than 10 deals.

- Breach Predictor is a newer Zscaler product. It uses GenAI models to “anticipate potential breach scenarios.” It eliminates those scenarios before they even surface.

Strong Demand:

Zscaler enjoyed a record quarter for $1 million+ customers. Its pipeline reached new records and its net revenue retention rate remained at a strong 120%. As a clear sign of the platform and vendor consolidation approach working, roughly 50% of its new client wins purchased ZIA, ZPA and ZDX. Similarly to CrowdStrike this week, outperformance despite no improvement in macro. The firm continues to overcome elevated deal scrutiny and sales cycle elongation. Importantly, while those headwinds aren’t abating, they are also not getting worse. Whether it’s due to growing attack instances, new SEC disclosure requirements, the Biden Administrations Zero Trust executive order, or a combination, demand remains resilient.

Inbound requests to replace firewall-based SASE continue to briskly rise as Zero Trust is increasingly known as the superior option.

Deal Highlights:

- Leading software firms shifted to Zero Trust Exchange after firewall-based SASE failed miserably and expanded the attack surface too widely. Zero Trust shrunk the attack surface by blazing a more direct and secure connection between apps and networks. The client went with ZIA, ZPA and ZDX.

- Expanded with a Fortune 500 travel and hospitality service provider, which doubled their annual data protection spend.

- Won a Fortune 200 financial service firm. It used ZScaler’s full product suite to safely migrate to the cloud and shed half of its data center requirements. It was able to do this despite operating in one of the most tightly regulated sectors. It expects to enjoy a 500% return on investment.

Scaling:

Zscaler is enhancing go-to-market efforts. This move is to cater to strong demand and rising adoption of and interest in its full platform. It hired Mike Rich as its new Chief Revenue Officer and President of Global Sales. Dali Rajic, who had been handling some of these duties, will now be fully focused on his other role as COO. Rich was most recently the President for Americas at ServiceNow. Joyce Kim was named its new Chief Marketing Officer. She previously led marketing teams at Microsoft, Arm and Twilio.

Public Sector:

The firm delivered 90% Y/Y growth within the public sector. It now has 12 of the 15 cabinet level agencies as customers. These types of clients usually start small and offer significant expansion opportunities if products work well over time. For example, it expanded ZIA and ZPA deployment from 25,000 users to 100,000 users for one of these agencies while cross-selling ZDX to all 100,000 of these users.

Billings and Free Cash Flow:

Total billings fell a bit more sharply than expected Q/Q due to a $20 million “upfront billing on a multi-year deal” last quarter. The billings pull-forward last quarter meant outperforming cash collections this quarter and propped up its free cash flow margin. The firm continues to expect a low 20% FCF margin for the year.

Generative AI:

Zscaler is enjoying a 20% average spend uplift with clients opting for its newer GenAI products. 95% of organizations are now using GenAI in some capacity while 48% of them think it’s a threat. This puts Zscaler in an ideal position for future up-selling.

Final Notes:

- 1/3 of its customers are using its newer cloud workload protection tool. It added real-time cloud resource discovery as a new tool for this offering.

- Gross margin was helped by extending the useful life of some cloud infrastructure from 4 to 5 years. Google and Meta did the exact same thing. Nothing shady here.

f. Take

This quarter resembled the strong results from other vendor consolidators and platform plays in software. They’re winning through better efficacy and efficiency with lower cost. That’s what Zscaler provides within the realm of network security. This quarter is simply more evidence. Some will pick at the mere reiteration of billings guidance. If I were a shareholder, as long as it doesn’t become a trend, I’d take that as a sole negative 10/10 times.

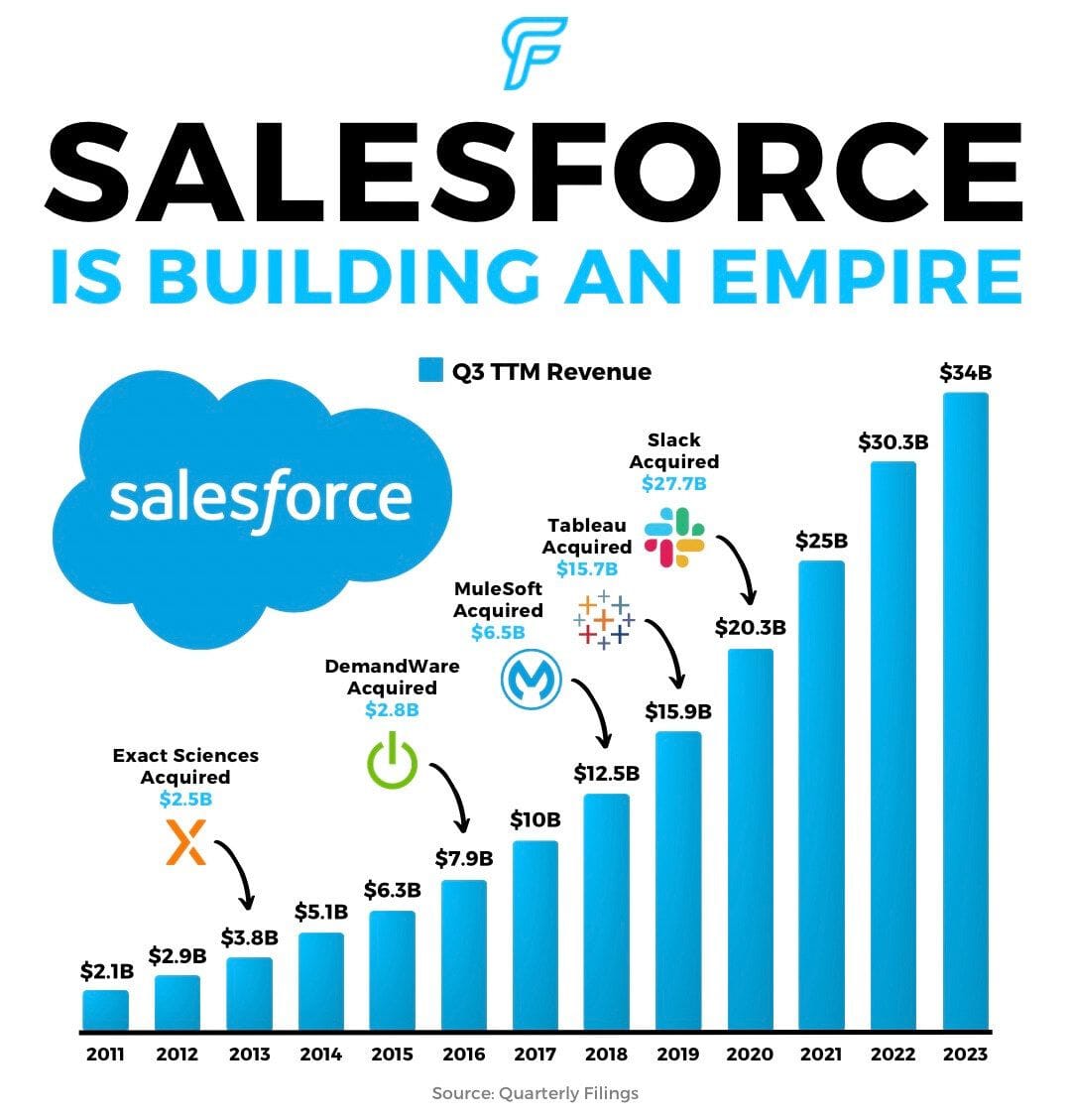

2. Salesforce (CRM) — Earnings Review

Salesforce is the 3rd largest enterprise software firm on the planet. It provides a broad suite of products to help clients optimize customer interactions, sales and marketing efficacy. The overarching niche is called customer resource management (CRM). Its products are delivered through dedicated cloud services (like the Service, Marketing and Sales Clouds) as well as other popular tools like Tableau (acquired in 2019).

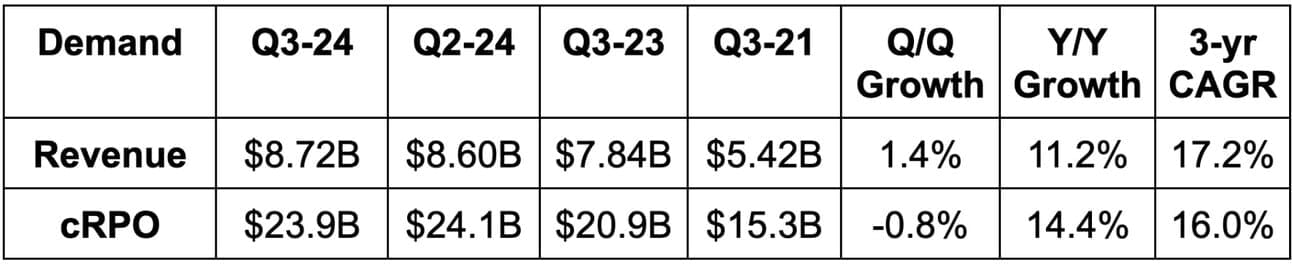

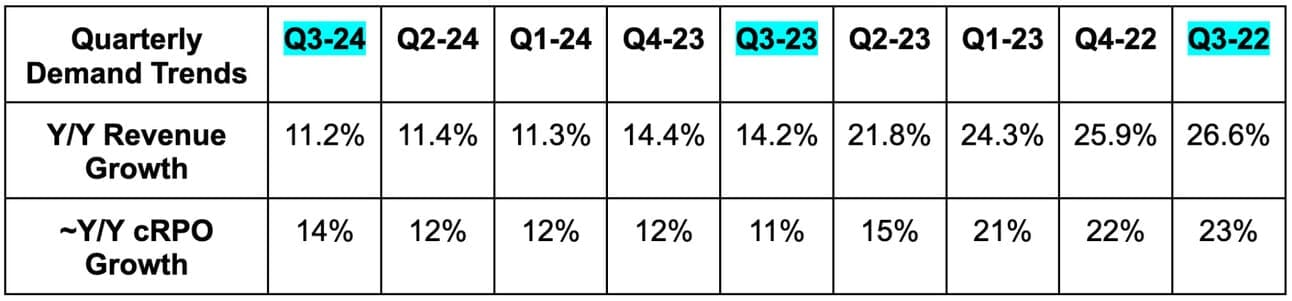

a. Demand

- Met revenue estimates & beat guidance by 0.1%. Its 17.2% 3-year compounded annual growth rate compares to 18.6% as of last quarter and 19.2% 2 quarters ago.

- Current Remaining Performance Obligation (cRPO) growth of 14% was well ahead of its 11% growth guidance.

b. Margins

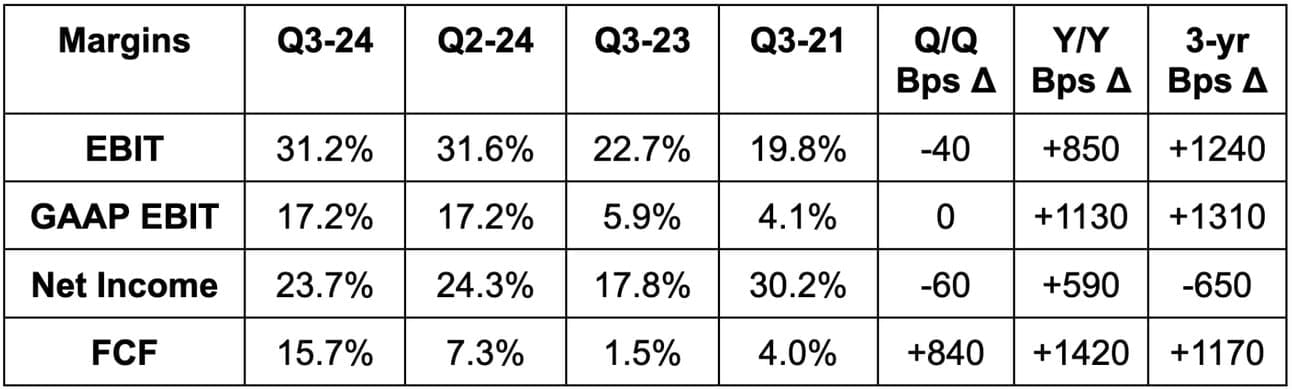

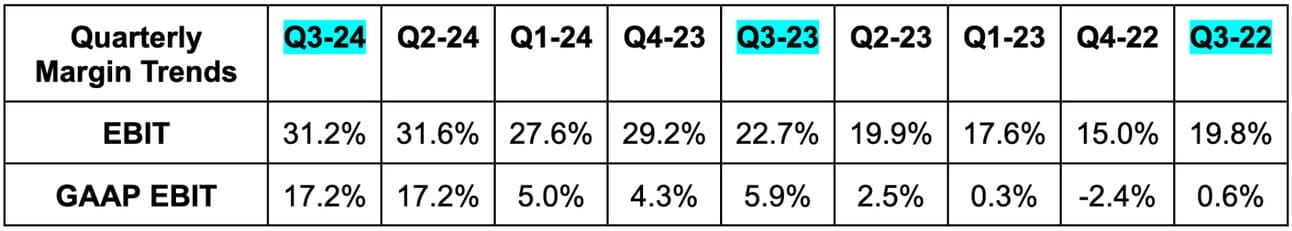

Margin expansion is the current Salesforce story. What had been a company focused on growth and M&A is now laser-focused on delivering operating leverage. It has effectively tightened its belt and seen margins explode higher. In testament to its new philosophy, it dissolved its M&A team to focus on organic execution. The margin explosion has been far more meaningful than the company or virtually any analyst expected.

- Beat EBIT estimates by 3.0%.

- EBIT is operating income.

- Beat free cash flow (FCF) estimates by 100%.

- Beat $1.04 GAAP earnings per share (EPS) estimates & beat its same guide by $0.21 each.

- Beat $2.06 EPS estimates & beat its same guide by $0.05 each.

c. Q4 Guidance

“We continue to assume a measured customer buying environment.” – CFO Amy Weaver

- Slightly missed Q4 revenue estimates.

- Beat $1.04 in Q4 GAAP EPS by $0.22 or 21.5%.

- Beat $2.18 in Q$ EPS by $0.07 or 3.2%.

Based on the Q3 beat and Q4 guidance, annual revenue guidance was reiterated. Profit guidance was raised across the board (most meaningfully for GAAP EPS). EBIT margin was raised from 30% to 30.5%. CEO Marc Benioff jokingly told CFO Amy Weaver on the call that she “better beat that.”

d. Balance Sheet

- $11.8 billion in cash & equivalents.

- $9.4 billion in debt ($1 billion is current).

- Share count fell by 2.5% Y/Y.

- Year to date buybacks of $5.93 billion vs. $1.68 billion Y/Y.

e. Call & Release Highlights

Key Products, Definitions & Progress (Salesforce 101):

Salesforce offers a variety of cloud services to its customers. These all enable digital management and optimization of a certain piece of a firm’s customer relationships. There’s a Sales Cloud which perfects consumer touch-points. There’s a Commerce and Marketing Cloud to build online storefronts and augment promotional activity. There’s a Service Cloud to handle customer issues and inquiries. This directly competes with firms like Shopify and Wix. There’s also a platform cloud which includes Slack.

Most recently, it debuted its Data Cloud. This is an aggregated client database to ingest, organize & glean insight from 1st party data. MuleSoft and Tableau are both key pieces of this Data Cloud. MuleSoft integrates apps and data to allow for management of these products and interfaces within Salesforce. Tableau is a data visualization tool to create automated progress reports and suggestions for leveraging findings. The Data Cloud competes with formidable players like Databricks and Snowflake and is currently its fastest growing cloud (aside from industry-specific products). Finally, as alluded to, it offers industry-specific clouds for sectors like healthcare. These are more customized to meet specific regulatory and operational needs. All of these clouds and products make up the firm’s subscription & support revenue which represents 93% of its total business. Professional services make up the rest.

Separately, Salesforce offers a product called Einstein. This is a full set of AI tools including outcome prediction, chat bots, image recognition, sales and sentiment analytics and more. It’s considered a general-purpose AI platform infused into various Salesforce products. Most recently, through an OpenAI partnership, it debuted Einstein GPT. Einstein existed before the GenAI wave but is now getting an upgrade thanks to it. Einstein GPT allows Salesforce clients to plug into language models (including OpenAI, Anthropic and Cohere) to make workflows more productive, intuitive, conversational and automated. It infuses familiar GenAI services across products like Slack and pretty much all others. It features a low code tool set to reduce the barrier for non-experts to build applications and boasts expert-level tools to build more complex apps. 17% of the Fortune 100 now uses Einstein GPT.

Recent growth by cloud category:

- Sales Cloud revenue rose 10% Y/Y vs. 12% Y/Y last quarter and 13% Y/Y 2 quarters ago.

- Service Cloud revenue rose 11% Y/Y vs. 12% Y/Y last quarter and 13% Y/Y 2 quarters ago.

- Platform Cloud revenue rose 11% Y/Y vs. 11% Y/Y last quarter and 12% 2 quarters ago.

- Marketing & Commerce Cloud revenue rose 8% Y/Y vs. 10% Y/Y last quarter and 10% Y/Y 2 quarters ago.

- Data Cloud revenue rose 22% Y/Y vs. 16% Y/Y last quarter and 20% Y/Y 2 quarters ago.

Platform Play:

Consistent readers know… the theme of this software earnings season has been the platform play cream rising to the top and separating from the pack. Salesforce is squarely part of that cream. Its ability to drive better software value, automation, efficiency and lower cost is standing out. Just like it did for ServiceNow… just like it did for CrowdStrike… just like it did for Workday… just like it did for Zscaler… just like it did for Microsoft. Greater value and lower cost is the only formula that’s working in this heightened budget scrutiny environment. Salesforce delivers that formula.

Need some evidence besides the overarching results? It enjoyed 80% Y/Y growth in $1 million+ deals. Last year’s concern over full suite, large-scale deal demand has vanished with that demand “coming back.” 9 of its 10 largest deals in the quarter included 6 or more cloud products. 9 of its 13 industry-specific clouds saw annual recurring revenue over 50% Y/Y.

Its Unlimited Plus (UE+) plan combines a lot of its products into a single subscription. Traction there has been wonderful and is delivering a 70% boost to average client spend.

Productivity & Macro:

Salesforce’s Account Executive (AE) productivity soared 30% Y/Y. It has driven greater focus, enhanced go-to-market and located talent to optimize its selling process. Clearly that’s working. It has eliminated a large chunk of its manual quoting to remove steps to deal closure and is now enjoying the results in its soaring margin profile. Specifically, GAAP sales & marketing as a percent of revenue fell 600 bps Y/Y.

Macro headwinds remain as the “buying environment remains measured.”

The Data Cloud:

As we’ve explored numerous times, GenAI models insatiably consume data. Salesforce’s Data Cloud meshes seamlessly with GenAI. Models are worthless without effective data seasoning. Salesforce, like Snowflake, tears down data silos to unleash a firm’s COMPLETE database. It’s hard to overemphasize how big a piece of its GenAI strategy truly is. Benioff called it the “foundation of every AI transaction and large deal for the quarter.” It is simply paramount for the firm to maintain its proclaimed position as the leading AI CRM. And traction is building. 6 of its 10 largest deals from the quarter included the Data Cloud while $1 million+ wins doubled Q/Q. That’ll work.

“It's not like companies are going to run their AI off of Reddit or off of some kind of big public data set. They have to have their data set together to make AI work for them, and that is why the Data Cloud is so powerful for them.” – Founder/CEO Marc Benioff

Final Notes:

- Salesforce sees its “trust layer” as a key GenAI selling point. It separates and secures a customer’s data to eliminate impermissible access to it from model builders.

- Salesforce products are available for purchase on the AWS marketplace as part of a deepening partnership. The two announced deeper product and AI integrations during the quarter.

- It continues to selectively hire mainly within Data Cloud and AI roles.

f. Take

This was another rock-solid quarter. Since the firm’s pivot to focus on margin expansion, growth has not suffered materially, and profit growth has far surpassed estimates. The same has been true for only the highest quality firms in tech. This is a wonderfully boring company in the best of ways. Elite leadership, stable growth at massive scale and more execution. As margin expansion from the pivot draws to a close, Salesforce will need to keep finding demand to deliver compelling profit compounding. There’s good reason to believe that it can.

Well done.

Love this infographic?

My friend Carbon Finance sends out a weekly newsletter with simple, data-driven visuals that cover the most important headlines in investing.