Sections 4-14 are for paid subscribers. If you'd like to read about SoFi credit market information, Rubrik's Agent Cloud Release, a brief Lemonade vs. Root comparison, Trade Desk competition news and more, upgrade below. Next week, we will be publishing more than 10 earnings reviews on SoFi, Meta, Apple, Starbucks, Microsoft, PayPal, and more.

In case you missed it:

- Tesla Earnings Review.

- Netflix Earnings Review.

- Taiwan Semi Earnings Review.

- My Current Portfolio & Performance vs. the S&P 500.

1. Intel (INTC) – Brief Earnings Snapshot

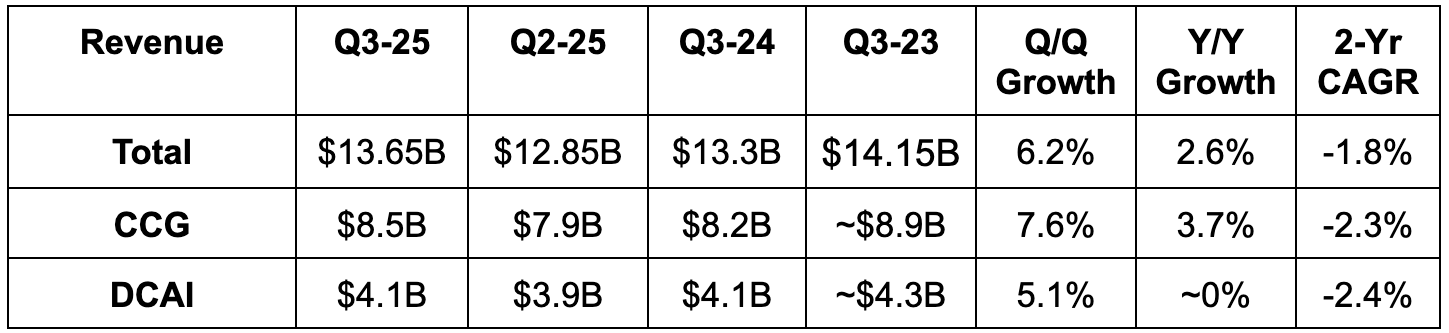

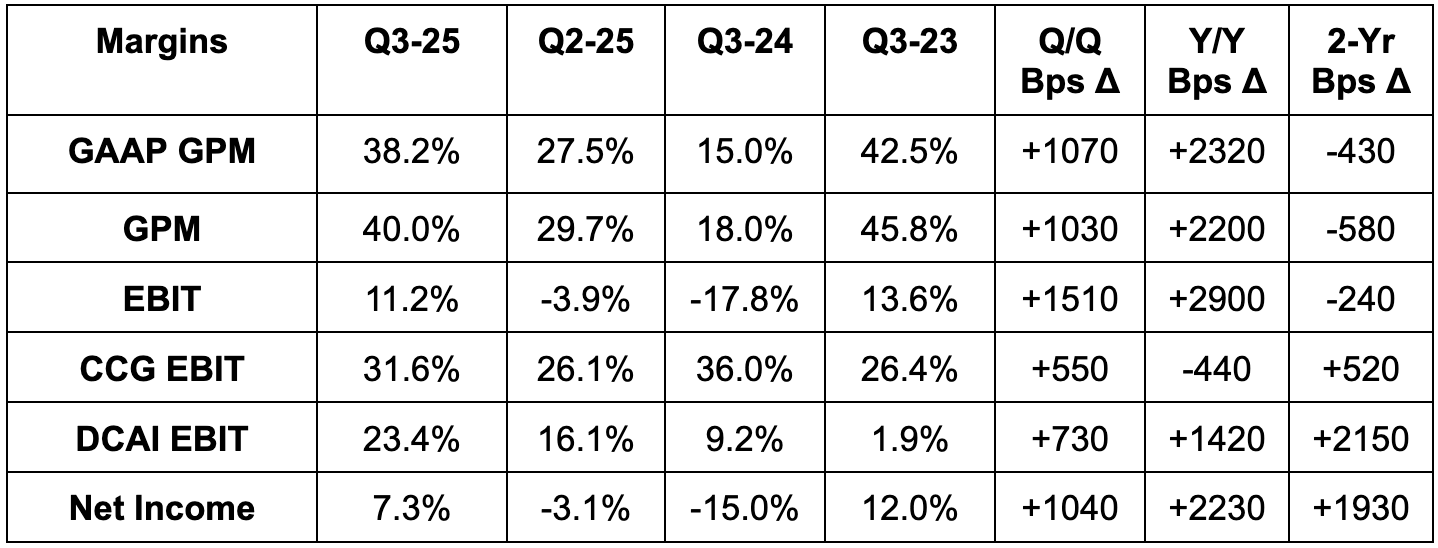

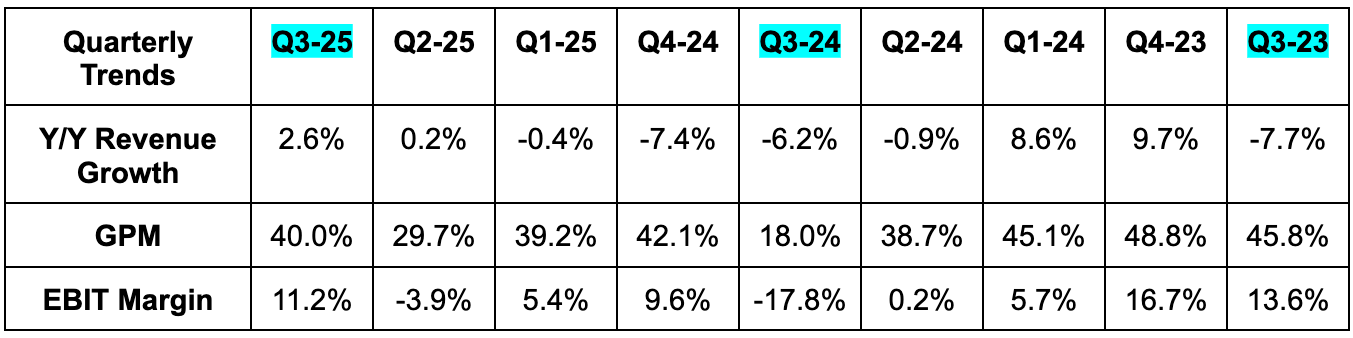

a. Results

- Beat revenue estimate by 3.8% & beat guidance by 4.2%.

- Beat Client Compute Group (CCG) revenue estimate by 4.7%.

- Beat Data Center & AI (DCAI) revenue estimate by 3.8%.

- Beat 36% GPM estimate & identical guidance by 400 bps.

- Beat $0.01 EPS estimate by $0.22 & beat guidance by $0.23.

b. Balance Sheet

- $30.9B in cash & equivalents.

- $11.5B inventory vs. $12.1B Y/Y.

- $44B in debt.

- 5.6% Y/Y share count dilution.

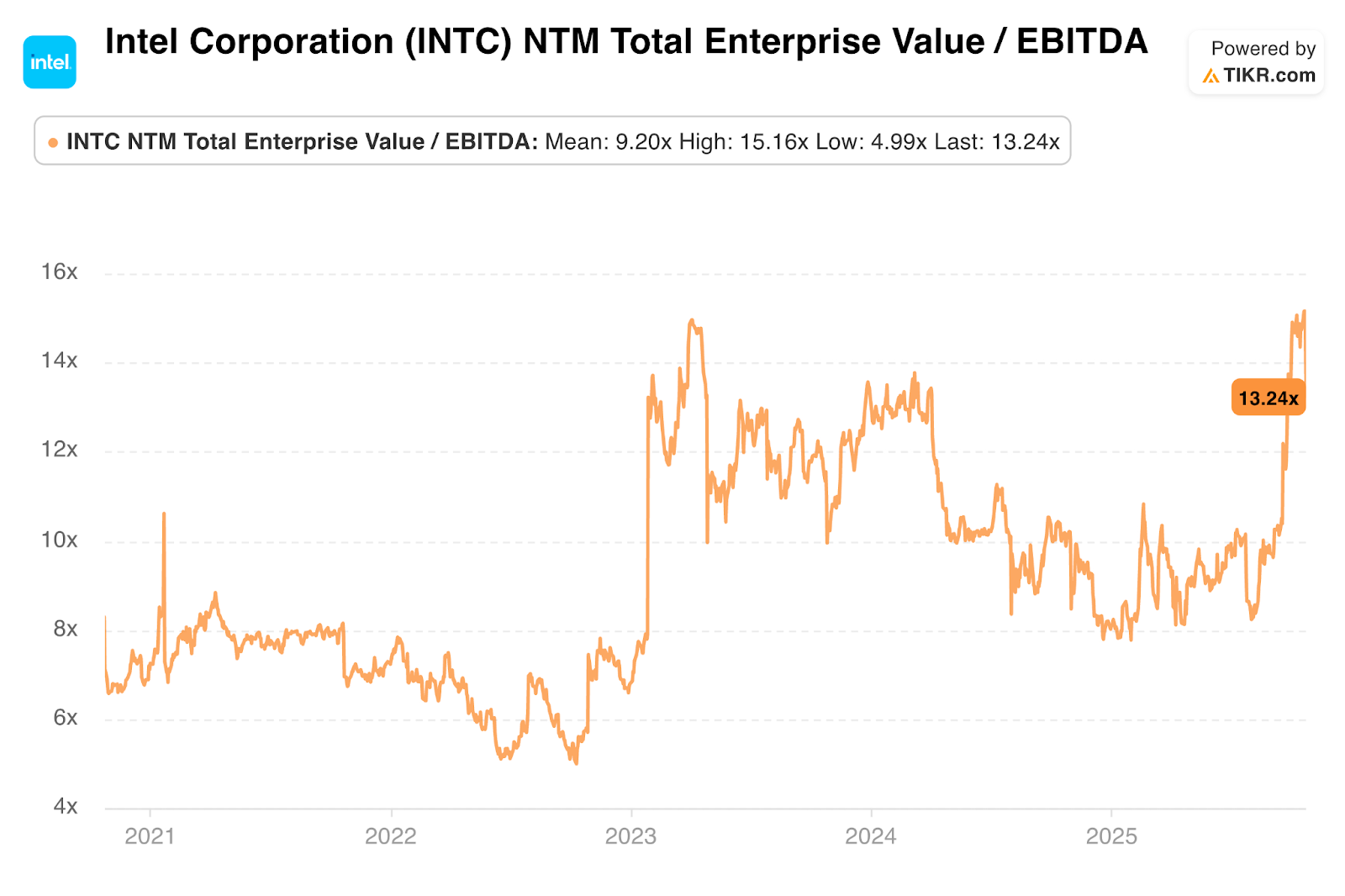

c. Guidance & Valuation

- Revenue guidance missed estimates by 1%.

- 36.5% GPM guidance missed estimates by 50 bps.

- $0.08 EPS guidance missed estimates by $0.02.

- -$0.14 GAAP EPS guidance missed estimates by $0.02.

2. Alphabet (GOOGL) – Various News

a. Anthropic

Anthropic and Google agreed to a new cloud deal. It includes up to 1 million Google AI chips (Tensor Processing Units; TPUs) deployed and over a gigawatt of compute by 2026. In total, it’s worth “tens of billions.” There are going to be many more cloud deals from this AI darling. I expect most of them to go to Alphabet and Amazon – the two providers with large equity stakes. Anthropic will not use a single vendor. That would be ill-advised. Multi-cloud adoption inherently creates a layer of resilience that modern companies flock to. So while I think this is a positive for Google, I don't think it's super surprising. We all saw Anthropic’s $23B revenue guide for next year. That will require a lot more capacity from Google and Amazon coming online. These deals are all but inevitable, and I don’t see one of them going to Google over Amazon as a negative for AWS. They will both continue to get their fair share of Anthropic workload demand. That's why they each spent so much money acquiring a stake (and boosting it thereafter).

b. Browser

This past week, as already announced and expected, OpenAI released their web browser. This, in my mind, should be treated as noise. I worry a lot more about OpenAI taking search market share than browser-level market share. Meanwhile, Gemini, AI Overviews and even core search market share trends all look very good for Google.

c. CapEx Guide

There’s also an Alphabet rumor circulating of a $120B-$125B CapEx budget for 2026. That's a very big expense compared to a large $85B CapEx number this year. Alphabet doesn’t spend on AI CapEx unless they see near-term demand for more capacity – such as the new Anthropic cloud agreement. If this rumor is true, it indicates their belief that demand will remain massive for their cloud and AI services in 2026. That will weigh materially on FCF generation in the near-term, but I view this as money well spent. If they overbuild, there are so many other Google products that can easily use the compute and allow them to avoid waste. And over the long haul, I expect ownership of this scaled infrastructure to be convincingly additive to overall growth and profitability.

3. Uber (UBER) – Investment

Uber is participating in a $375M AVRide investment. Nebius (parent company) is also participating. Uber and AVRide have been close partners since last year, with a Dallas AV deployment planned for this year. They already have delivery robots in 3 cities as well. This will allow them to accelerate expansion and fleet buildouts while giving Uber steady access to another source of supply. The mobility giant did something similar with Lucid and I expect more of these deals. Uber can use its balance sheet to accelerate this industry’s maturation. And it can help a lot more players secure needed funding to get to the finish line. This not only gives Uber guaranteed access to more supply, but helps drive more competition. That’s great news for the demand aggregator in this equation.

Uber has told us they’re confident in monetizing these investments down the road when their capital is not so pressingly needed. For now, this is the right decision and doesn’t prevent them from rapidly buying back shares or expanding the product suite. That’s the beauty of massive cash flows.

- As planned, Uber and WeRide launched autonomous taxis in Saudi Arabia.

- Uber is offering a $4,000 driver credit to switch to EVs.