Sections 3-7 are for paid readers. They include full reviews of Apple and Starbucks earnings, Uber news and more.

A lot of this week’s content has already been sent. In case you missed it:

- Amazon & Mercado Libre Earnings Reviews.

- Meta Earnings Review.

- PayPal Earnings Review.

- Alphabet Earnings Review

- SoFi Earnings Review.

- Netflix, Tesla and Taiwan Semi Earnings Reviews were published earlier in the month.

Next week, earnings coverage will include Palantir, Hims, Shopify, Cava, DraftKings, Uber, Duolingo, Coupang, Robinhood, The Trade Desk etc.

Finally, I started a new position this week.

Now let's dig in.

1. Earnings Snapshots – Microsoft (MSFT) & Cloudflare (NET)

I will publish full reviews of both quarters sometime this month. There were not enough hours in the week to get to them, and next week is looking just as busy. For now:

a. Microsoft (MSFT)

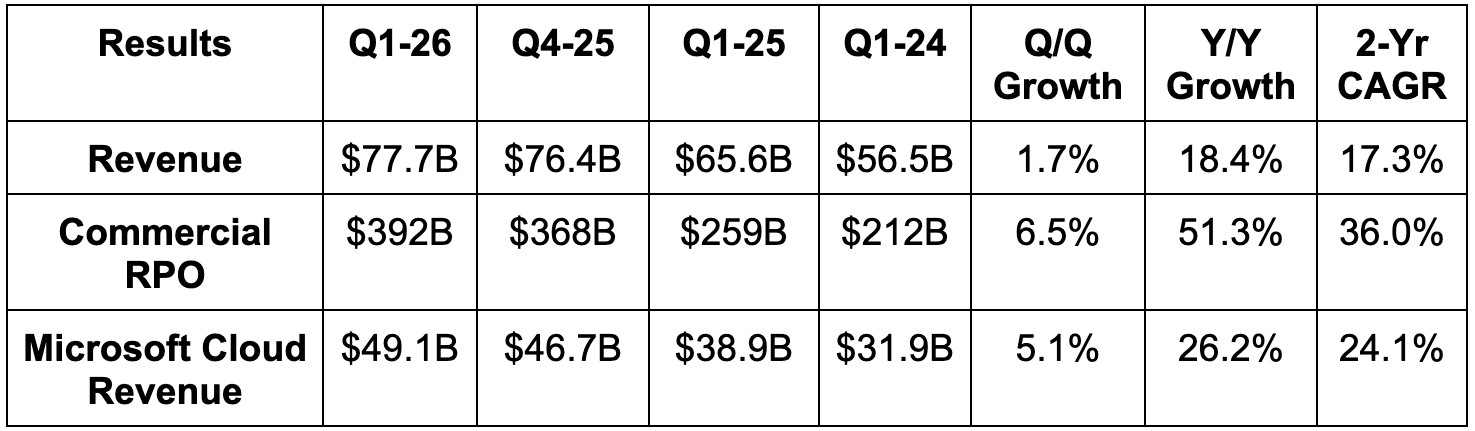

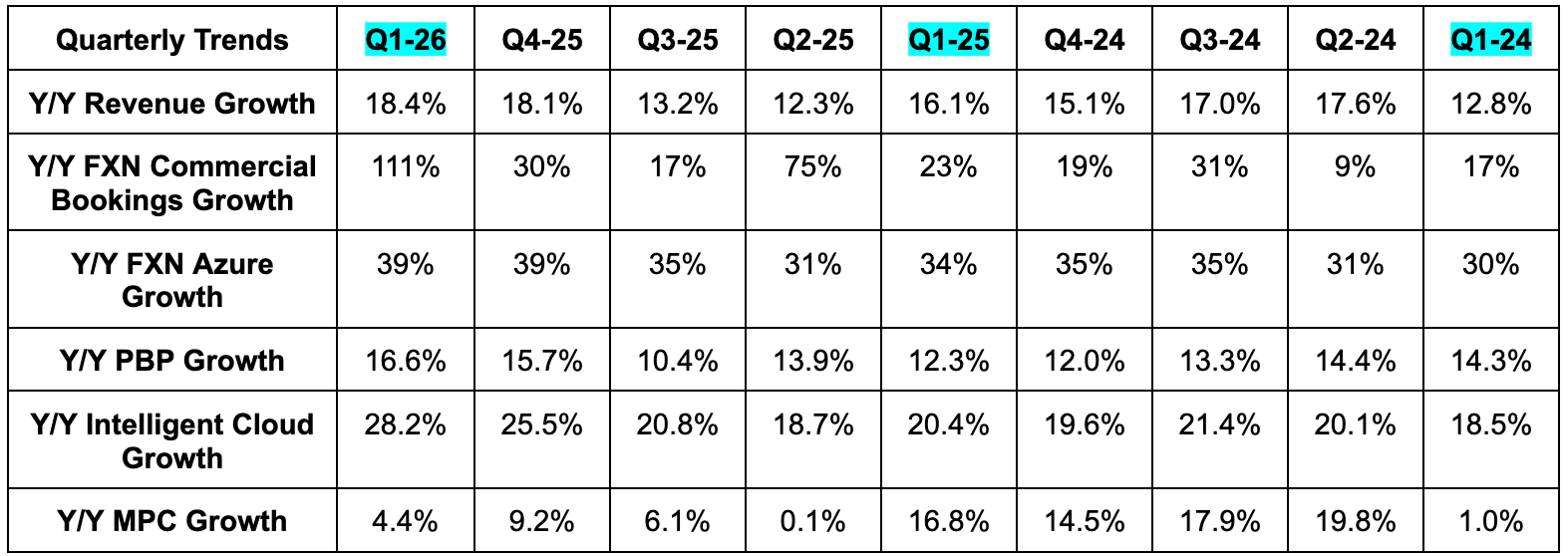

Demand:

- Beat revenue estimate by 2.8% & beat guide by 3.1%.

- Productivity and business revenue beat estimates by 1.8%.

- Intelligent cloud revenue beat estimates by 2.1%.

- More personal computing revenue beat estimates by 9%.

- Beat commercial cloud estimate by 1%;

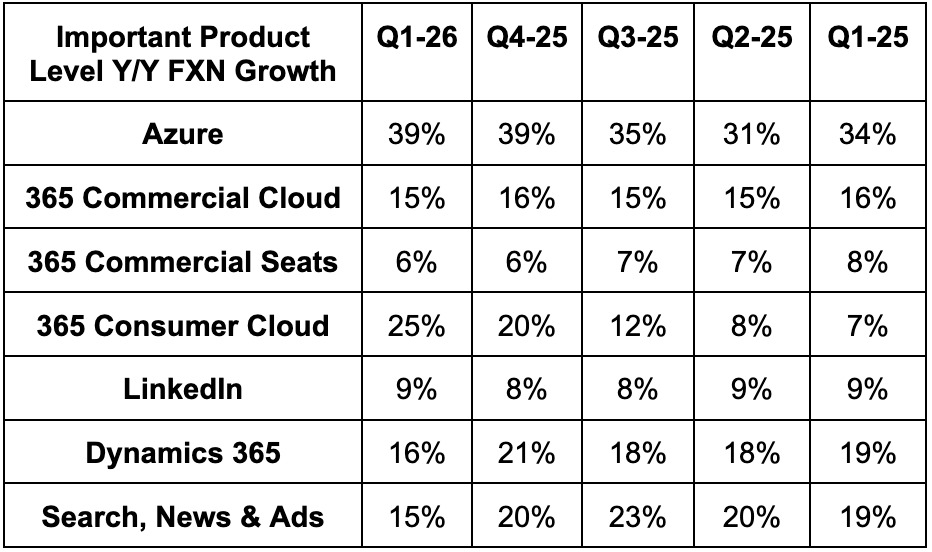

- 39% constant currency (CC) Azure growth beat 37% growth estimates.

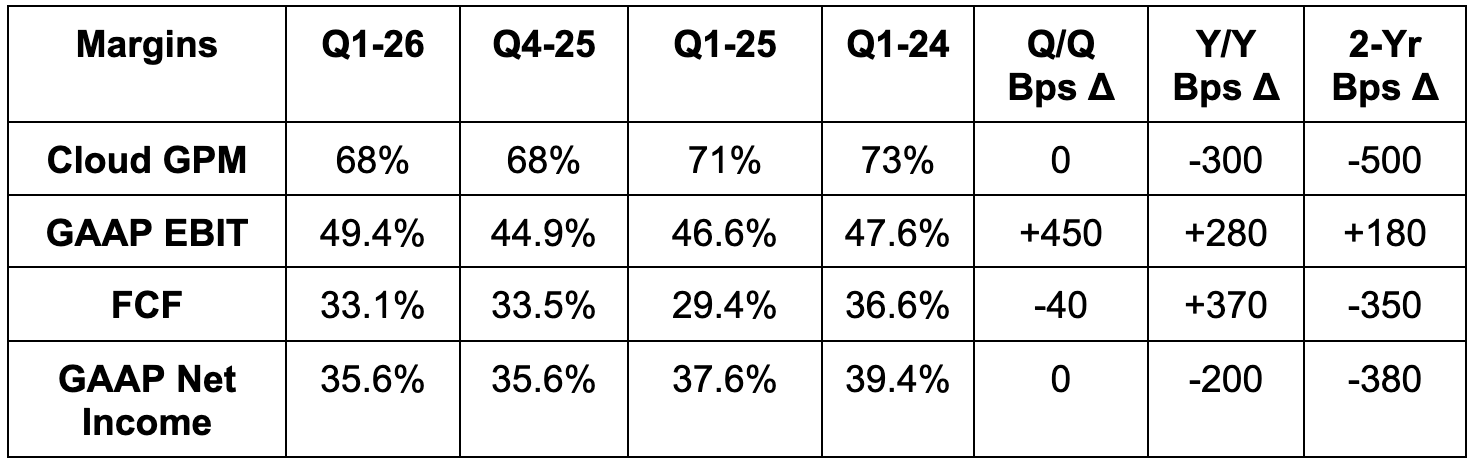

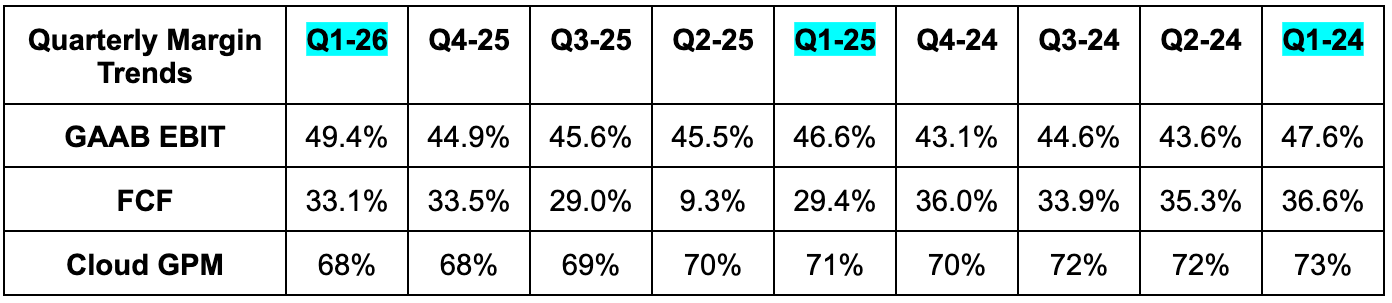

Profits & Margins:

- Beat 67% cloud GPM estimates and beat 67% cloud GPM guidance.

- Beat EBIT estimates by 8.3%.

- Beat $3.68 EPS estimates by $0.45.

- Beat $3.68 GAAP EP estimates by $0.04.

- Beat FCF estimates by 37%. It spent $35B in CapEx vs. guidance of “over $30B.”

Balance Sheet:

- $102B in cash & equivalents.

- $11.5B in Long-term investments.

- $43B in debt.

- Slight Y/Y diluted share count decline.

Guidance & Valuation:

Roughly met Q2 revenue and EBIT estimates (both missed by less than 0.1%).

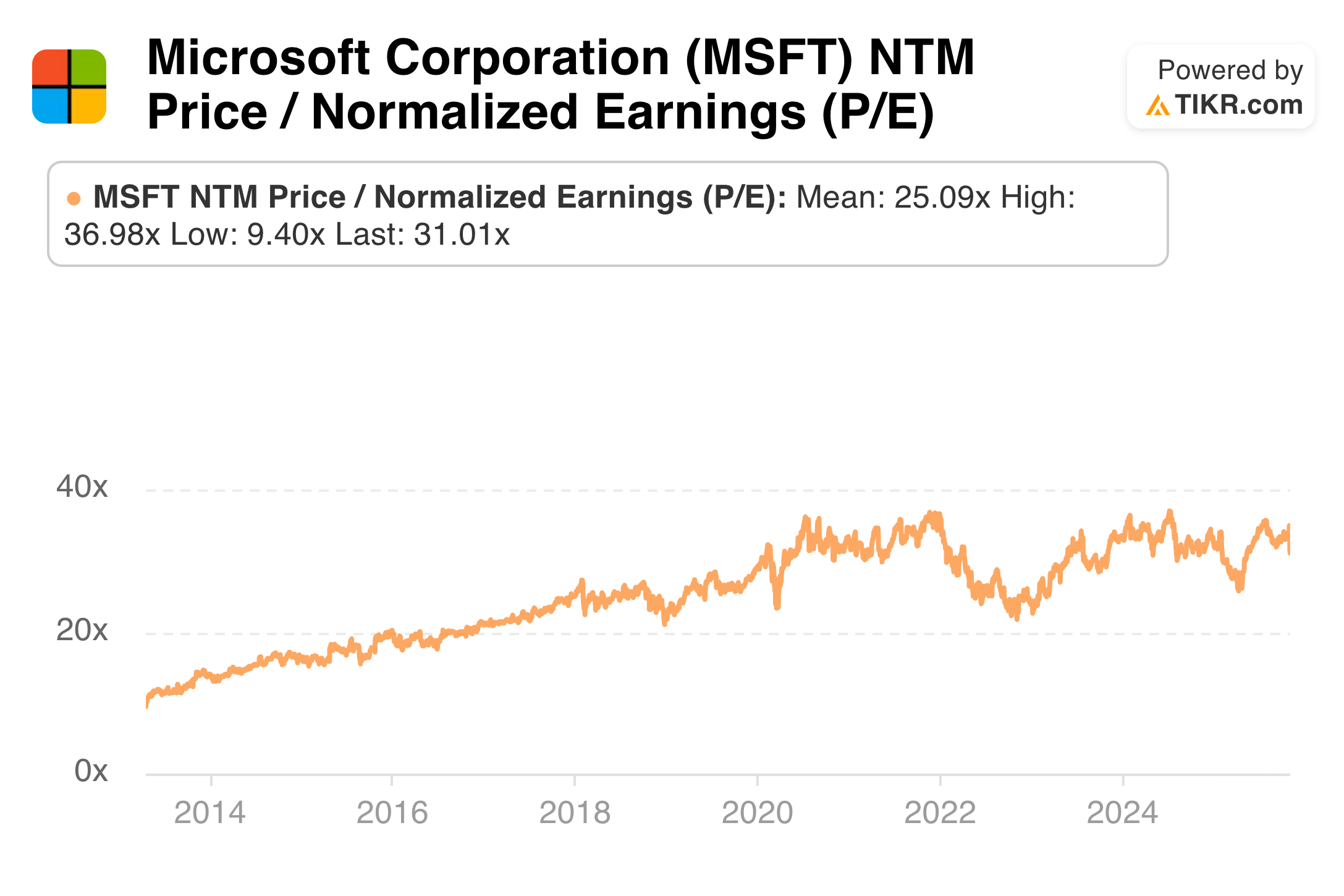

Microsoft trades for 31x forward EPS. EPS is expected to compound at a 17% clip over the next 3 years.

b. Cloudflare

Demand:

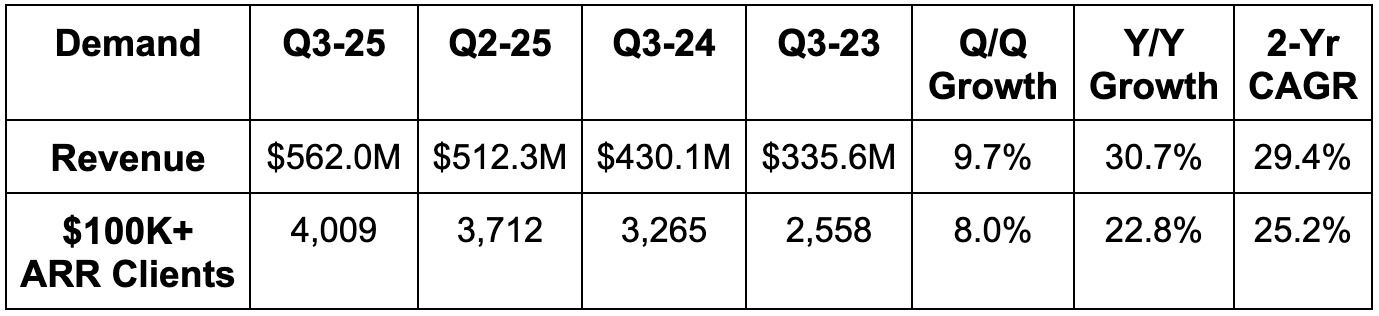

- Beat revenue estimate by 3.1% & beat guide by 3.3%.

- Its 29.4% 2-yr revenue compounded annual growth rate (CAGR) compares to 28.9% Q/Q & 28.5% 2 quarters ago.

- Beat $100K ARR client estimate by 63 clients or 1.6%.

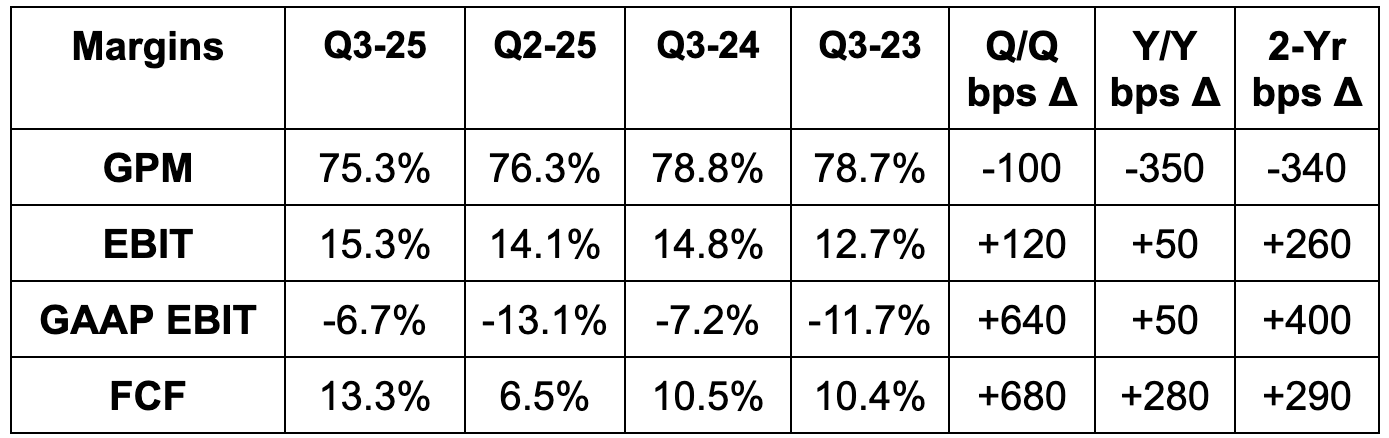

Profits:

- Beat EBIT estimates by 12.6% & beat guidance by 13.8%.

- Beat $.24 EPS estimates by $0.03 & beat guidance by $.04.

- Beat FCF estimates by 14%.

Balance Sheet:

- $4B in cash & equivalents.

- $1.97B in convertible senior notes.

- 2% Y/Y share count dilution.

Guidance & Valuation:

- Raised Q4 revenue guidance by 1.7%, which beat estimates by 1.4%.

- Raised Q4 EBIT guidance by 2%, which beat estimates by 2.2%.

- Raised Q4 $0.255 EPS guidance by $0.015, which beat estimates by $0.01.

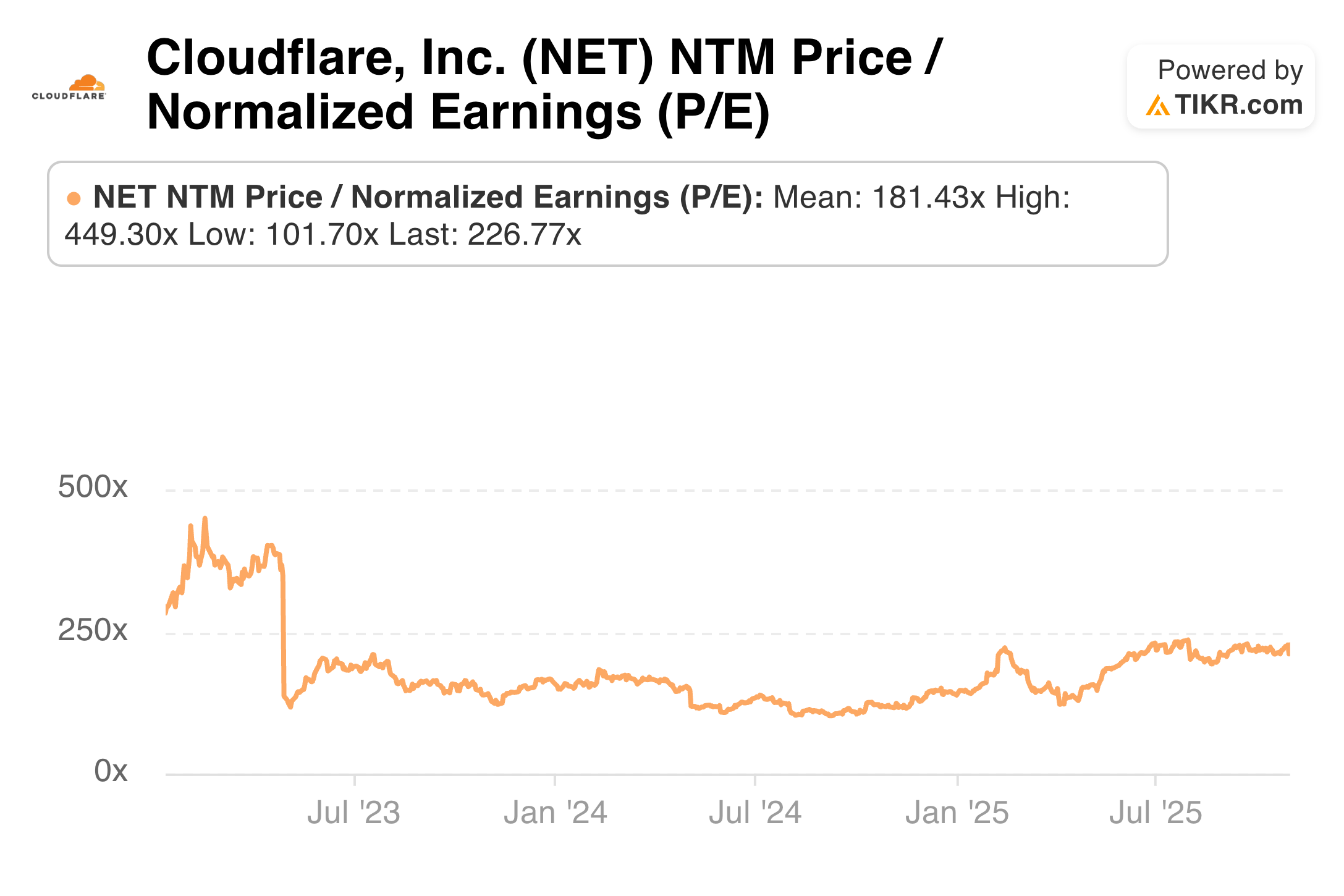

NET trades for 227x forward EPS. EPS is expected to grow by 22% this year and 28% next year.

2. ServiceNow (NOW) – Q3 2025 Earnings Review

a. ServiceNow 101

I plan to create a 101 archive that I can link to in the future so that people familiar with the company can conveniently skip this section. I will say that the 101 sections do change a bit from quarter to quarter as news evolves, but they’re largely the same.

Product Niche:

ServiceNow is one of the largest enterprise software firms in the world. It infuses layers of automation into productivity-enriching software and infrastructure. For this reason, it calls itself the “leading digital workflow company.” All products and services are neatly tied into its unified platform layer called the “Now Platform.

In terms of product organization, ServiceNow splits work by technology workflows, customer resource management (CRM), industry and core business workflows and creator workflows:

- Technology workflows include Information Technology Operations Management (ITOM) and Information Technology Service Management (ITSM). The names of these products tell you exactly which types of workflows they’re meant to automate. This also includes IT asset management (ITAM), security operations and operational technology management.

- CRM, industry & core business workflows include customer service management, field service management, HR service, legal service and workplace service segments.

- Creator workflows include its app engine and Workflow Data Fabric. This is its data management tool.

Product Innovation:

ServiceNow has been hard at work on GenAI innovation to bolster automation capabilities. It seemingly launches a new platform every quarter, with exciting new ways to drive enterprise AI adoption. They focus on tighter partner integrations (like Microsoft Copilot), incremental AI-inspired automation, more open interdepartmental data sharing and agentic task completion. All of these releases also included its security and threat management products. NOW uses models that are trained on a company’s own data, which has been shown to accelerate incident response. Automated threat triaging helps as well.

For Developers:

ServiceNow offers the “workflow studio” as a way to create intricate workflows via a wonderfully easy, no-code or low-code drag-and-drop process. It’s a unified workspace to tap into all of the automation and workflow performance analytics tools ServiceNow provides, without requiring a talented developer to work. Various teams can easily access the studio to enable seamless collaboration and better work. StarCoder 2 provides developer access to large language models (LLMs) to automate code creation. Bring Your Own (BYO) GenAI model support allows for ultimate developer flexibility as they pick and choose which models serve them the best. And for more managed developer support, the NOW Assist Skill Kit helps developers deploy new GenAI prompts and workflows. ServiceNow has templates for pretty much all common needs, but it cannot possibly build models for every niche workflow. That’s where GenAI comes into play.

The NOW App Engine is ServiceNow’s platform for building apps. Creator Studio was just added to the NOW App engine to push its “low-code app leadership” to fully no-code building.

More AI Products to Know:

- NOW Assist AI is the firm’s GenAI assistant/companion app infused across most of its products.

- The AI Lighthouse Program expedites GenAI adoption through Nvidia and Accenture partnerships. NOW brings the apps; NVDA brings the hardware; Accenture brings the professional services.

- The RaptorDB Lighthouse Program: Its newest database that’s built to support the speed and needed scalability of GenAI use cases. It offers an extensive list of 1st and 3rd party data sources to utilize, with easy conversational querying to up-level data scientist productivity. This works across online transaction processing (OLTP) workloads and online analytical processing (OLAP) workloads, making it well-suited for high-frequency querying and more complex querying too.

- The AI Control Tower offers a holistic view or “command center” to maintain and optimize AI agents. It makes AI work triaging intuitive to show enterprises how to maximize return on investment and boost AI efficiency “from project inception to retirement.” This more clearly organizes and unlocks the value from NOW’s extensive data and partner access.

- Agentic workforce management is an update to AI agent orchestration, which brings easier human and agent collaboration.

- Autonomous IT minimizes manual work required to maintain assets. This helps with uptime optimization.

“Plus SKUs” are how ServiceNow bundles all of its GenAI work into subscription packages. It up-charges clients for access to these SKUs, as its approach to GenAI monetization has been more aggressive than most. These Plus SKUs do things like automate customer service, expedite issue resolution and provide more conversational fetching/querying of a firm’s data.

b. Key Points

- The AI revenue ramp is ahead of schedule.

- Strong margin outperformance.

- Rapid platform-level adoption.

- Outperforming new business quarter for the federal segment.

c. Demand

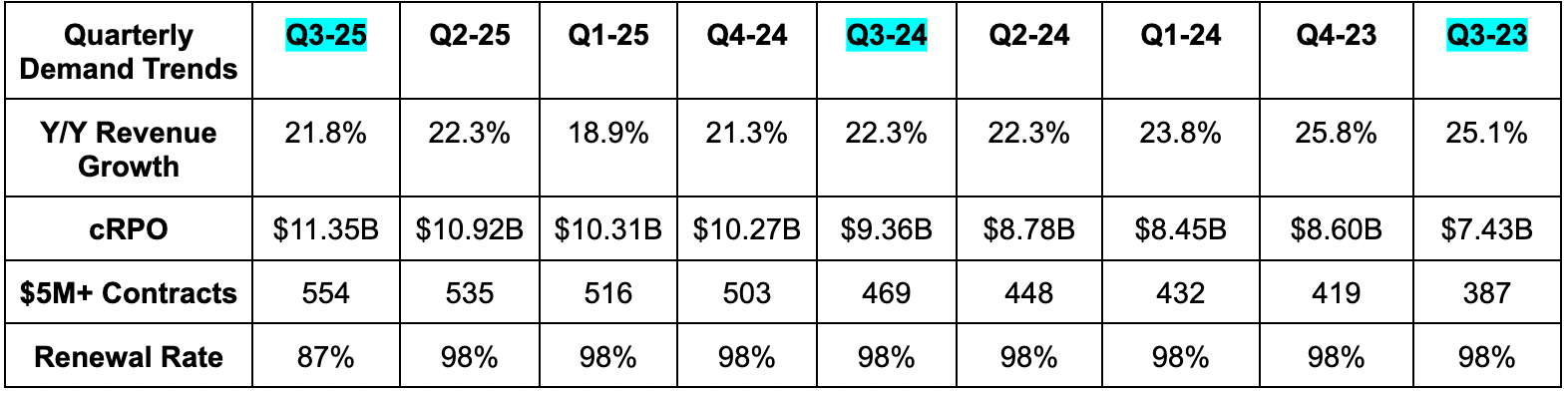

- Beat revenue estimate by 1.5%.

- 22% 2-year revenue compounded annual growth rate (CAGR) compares to 21.3% Q/Q & 23.5% 2 Qs ago.

- Beat subscription revenue estimate by 1% & beat guide by 1.1%.

- 20.5% constant currency (CC) subscription revenue growth beat 19.5% growth estimate & guide.

- 20.5% CC current remaining performance obligation (cRPO) growth beat 18% growth estimate & guide.

- Half of this beat was thanks to early contract renewals pulled from Q4 to Q3.

- The falling retention rate was related to a "closure of a large U.S. Federal Agency” and would have been 98% excluding this.

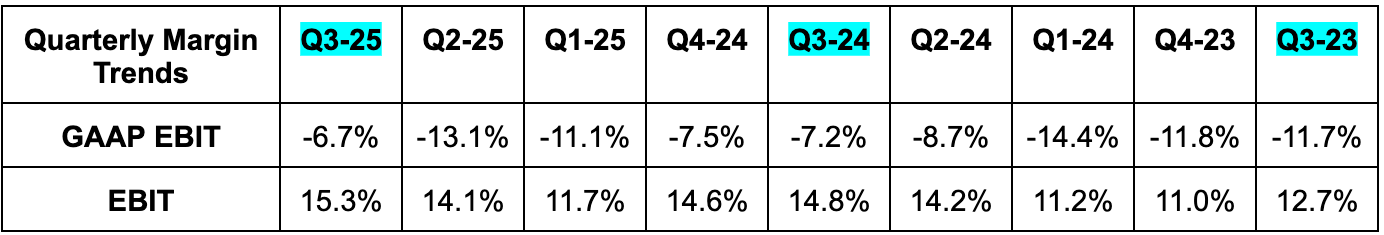

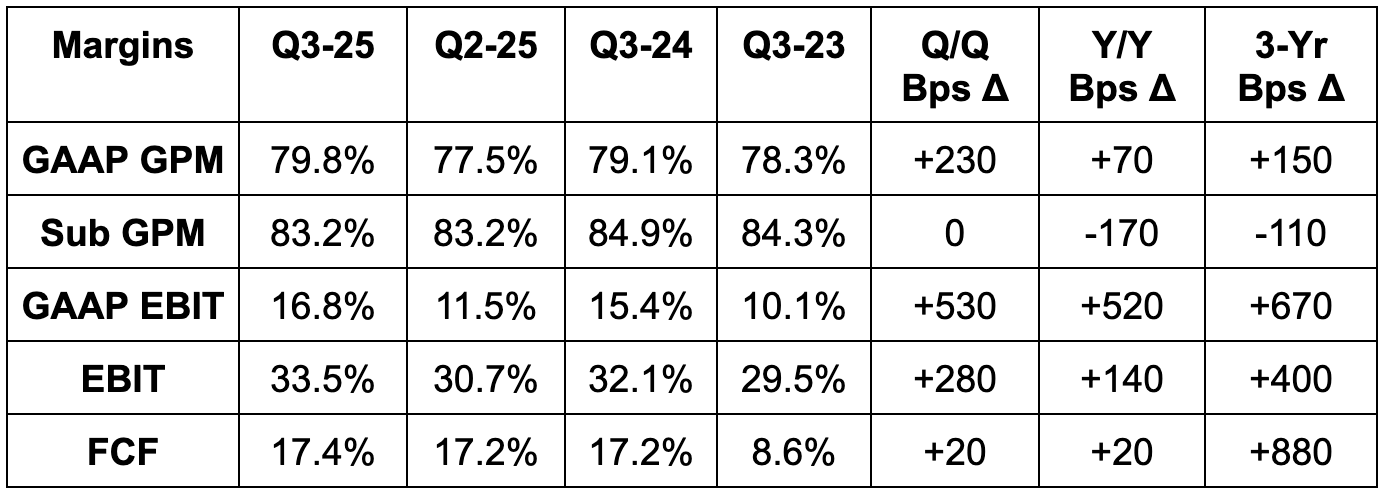

d. Profits & Margins

- Beat EBIT estimate by 8.5%.

- Beat 30.5% EBIT margin estimates by 300 basis points (bps; 1 basis point = 0.01%).

- A small portion of the margin outperformance was via expense timing.

- Beat $4.27 EPS estimate by $0.55.

- Missed FCF estimate by 5.9%.

e. Balance Sheet

- $5.4B cash & equivalents.

- $4.3B long-term investments.

- $1.5B long-term debt.

- Slight Y/Y share count growth. $2B left in buybacks under the current program.

- 5-1 stock split announced.

f. Guidance & Valuation

- Raised annual subscription revenue guidance by 0.4% or the amount of the Q3 beat plus a small Q4 guidance raise thanks to FX favorability.

- An added layer of prudence stemming from the government shutdown was baked into this guidance.

- Raised annual CC growth guide from 19.75% Y/Y to 20% Y/Y.

- Reiterated annual 83.5% subscription GPM guidance.

- Raised annual EBIT margin guidance 50 bps to 31%, which beat estimates by 40 bps.

- Raised annual 32% FCF margin guide to 34%, which beat 32.2% margin estimates.

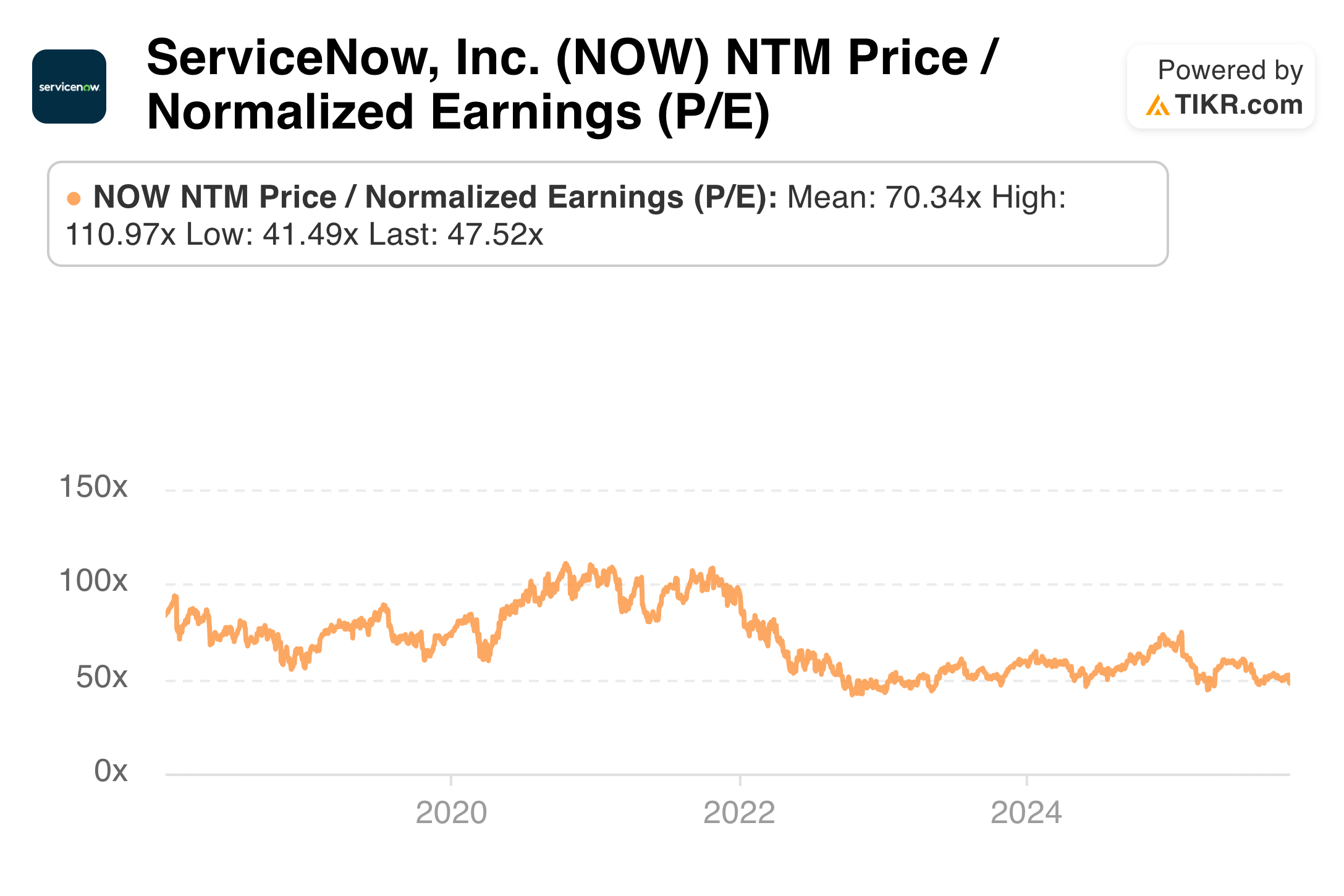

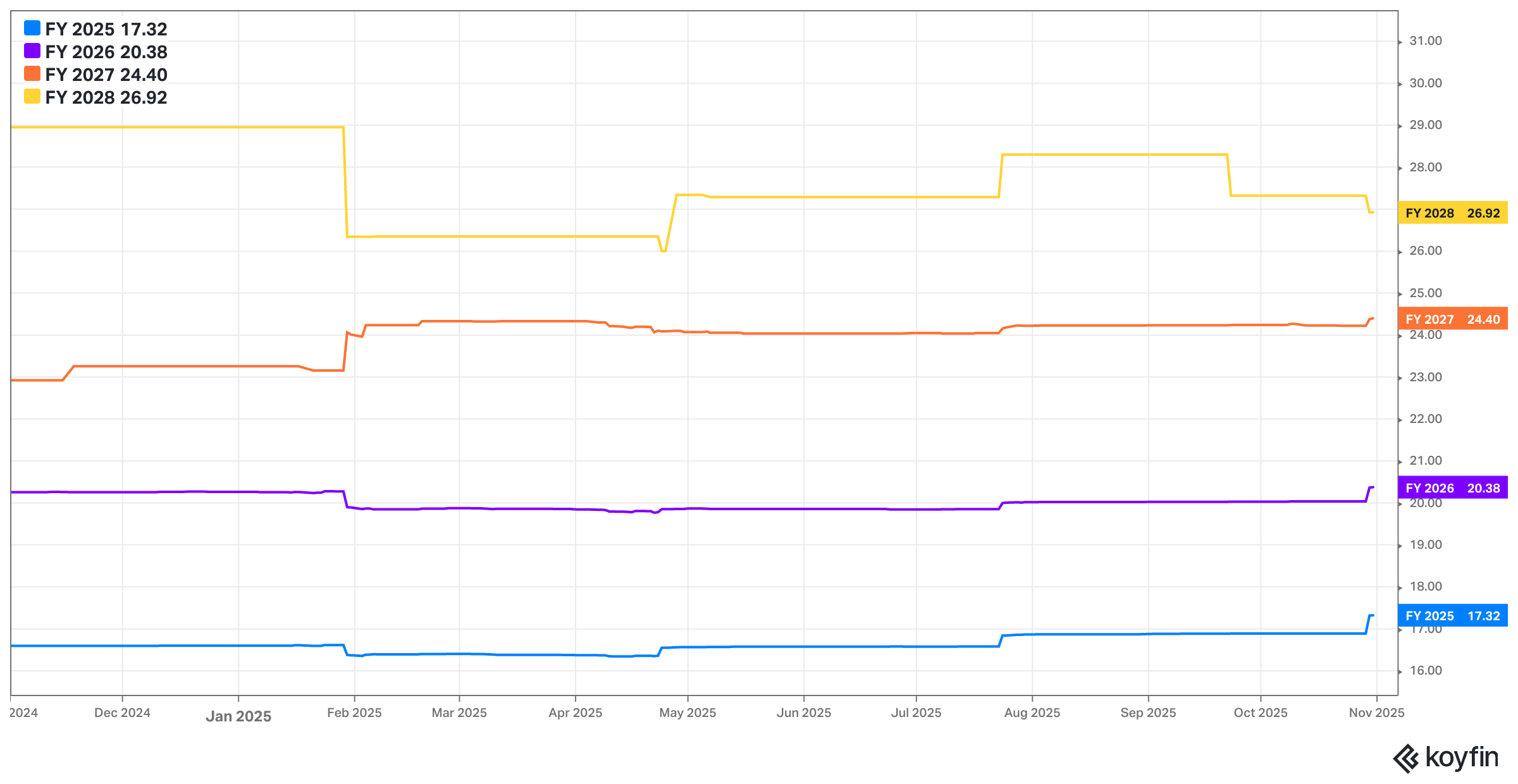

NOW trades for 47x forward EPS. EPS is expected to grow by 25% this year, 18% next year and 20% the year after.

g. Call & Release

Zurich:

NOW unveiled its latest AI platform iteration this quarter called Zurich. The purpose of this release was to deepen NOW’s presence in agentic creation and accelerate large enterprise adoption of this technology. That acceleration will mean increased product demand and workloads and more NOW growth. The release also came with powerful new developer tools such as vibe coding agents alongside data and identity controls to match innovation with sound security. With Zurich, NOW uplevels its ability to provide valuable agents for customers not wanting to build their own, and tooling for customers that do. Relatedly, Zurich also boasts a large upgrade to its Workflow Data Fabric offering. This enhancement includes something called zero copy connectors, which are agents that can access whatever eligible data they need without data replication or storage. That greatly lowers costs associated with deploying these autonomous assets. And finally, Zurich takes a proactive step forward by actively recommending how customers can use or build other AI agents to automate certain manual tasks, cut costs and improve outcomes.

More on AI:

Now Assist is driving higher Pro Plus (subscription this is part of) attach rates. The product’s net new annual contract value (ACV) outpaced expectations and puts NOW on pace to beat its $500M annualized AI revenue goal for 2025. They’re also optimistic about surpassing their $1B in annualized AI revenue for next year. During the quarter, the GenAI assistant signed twelve $1M+ per year deals (including a $10M+ deal) and grew client agent consumption by 55x since May. The AI assistant’s exponential growth is a byproduct of the value it provides – like speeding up case resolution by 35% for Lenovo. Customers are quickly finding ways to deploy more complex and agentic workflows, which directly leads to more token consumption and product growth.

Its AI Control Tower is also performing very well. It quadrupled Q/Q deal volume. Small base, but still impressive. They think this product is helping them distance themselves from the competitive pack. The “single pane of agent glass” that it provides matters dearly. Companies are overwhelmed by the task of organizing, guardrailing and deploying agents without ballooning expenses, vulnerabilities or waste. This is what ServiceNow does for them with the Control Tower. They automate agent governance, and allow companies to focus on innovation, growth and improvement, knowing they’ll have security, support and order every step of the way. This is ServiceNow monetizing products that help make companies feel more comfortable with embracing AI agents, while it also has plenty of those agents to monetize these relationships further.

- NOW released a new enterprise AI interface called the AI Experience. This should make embracing this new technology more intuitive and seamless in another bid to expedite corporate adoption of AI technology.

- The company is onboarding new customers with “autonomous implementations” in as little as a few weeks with pre-built templates getting them to strong return on investment very quickly.

- Leadership mentioned bigger customers eliminating the AI experiments and projects that are leading to nothing but added expenses. These companies are looking to consolidate vendors and that benefits platforms such as this one.

- In the prepared remarks, the team featured its AI-powered configure, price and quote (CPQ) tool that it views as primed to disrupt the large CRM space. It’s helping customers automate lead and sales document generation and more.

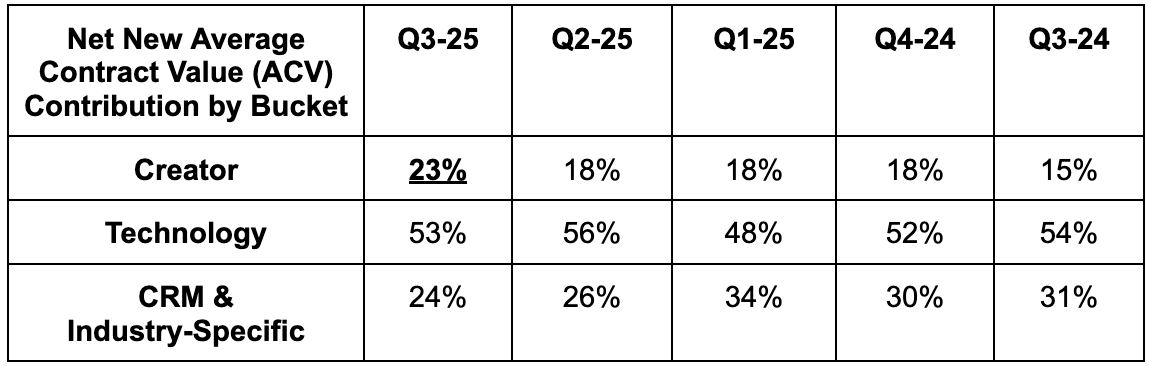

Platform-Level Adoption:

NOW continues to solidify itself as a dominant enterprise workflow platform. As we talk about constantly, that means vendor consolidation, better interoperability, better ServiceNow products, higher customer retention and loftier company margins. Cross-selling matters a lot. All 3 major workflow buckets were in at least 13 of its top 20 deals. $50M+ revenue customers rose 20%+ Y/Y and it signed 103 $1M/year+ contracts vs. just 89 last quarter. Furthermore, its budding risk and security segment became its 5th $1B+ per year business.

Federal:

Aside from losing a federal contract this quarter and enduring the small renewal rate hit, federal performance was strong. Material productivity and efficiency gains are cutting through the noise and allowing it to win in this part of the market. They surpassed internal net new ACV expectations and signed a new partnership with the U.S. General Services Administration (GSA) to “power AI first modernization for a new era of government.” It’s expected to simplify product onboarding and cut billions in costs for agencies via 30% efficiency improvements.

Investments, Partnerships & Accolades:

- New AI Institute in Florida. This includes a $1.8B investment and 850 new jobs.

- New AI skills program in Brazil.

- Invested in Zaelab to co-build new AI solutions for customer relationship management (CRM) and other areas.

- Invested $750M in Genesys, which specializes in AI agent orchestration.

- Partnered with Figma to add its designs to eligible ServiceNow agent input prompts.

- Bolstered their Nvidia partnership to collaborate on new reasoning models. NOW will also use NVDA’s AI Factory Reference Architectures to offer a wider array of agents.

- Partnered with FedEx to bring AI automation to supply chains.

- Gartner recognized NOW as a leader in Business Orchestration, AI Applications in ITSM, CRM Customer Engagement and Enterprise Low-Code Applications Platforms.

h. Take

Upgrade to read my take on the quarter, full reviews of Apple and Starbucks earnings and so much more.